Data from the corporate income tax finalization declaration form is an important input for analyzing business performance, forecasting next year's tax expenses, and making financial and budget plans. Preparing and submitting the declaration on time helps businesses avoid late payment penalties and demonstrate compliance with tax laws.

In this article, Bizzi will update the latest corporate income tax declaration form, as well as guide how to make the declaration and important notes to avoid errors.

Corporate income tax finalization declaration and legal basis

Corporate income tax finalization declaration form synthesizes data from Business performance report, detailed accounting books, and at the same time reflect adjustments according to the Tax Law. The legal basis of the Corporate Income Tax Finalization Declaration Form (Form 03/TNDN and related forms) is clearly stipulated in the system of legal documents on tax.

What is a corporate income tax return?

The corporate income tax finalization declaration form is a mandatory report that businesses must submit to the tax authority after the end of the fiscal year, summarizing all valid income, expenses and corporate income tax temporarily paid during the year.

Purpose & role of corporate income tax settlement declaration form:

- Determine the actual corporate income tax payable for the year (or the amount refunded/deducted if overpaid).

- It is the legal basis for tax authorities to check, compare, and ensure that businesses properly and fully perform their final tax obligations.

Current corporate income tax finalization declaration forms

Below are the common corporate income tax (CIT) declaration forms in addition to Form 03/TNDN — with an overview of the purpose/use of each form:

Corporate income tax finalization declaration form 04/TNDN — “proportion-to-revenue method”

- Apply toEnterprises/organizations that cannot determine reasonable costs for production and business activities (for example: public service units, non-business organizations, business activities with revenue but cannot determine costs) and are allowed by law to calculate corporate income tax at a rate of % on revenue.

- Main content: Declare revenue by type (services, goods, other activities) with corresponding tax rates, then calculate the amount of tax payable.

- Use cases:

• When a business chooses to apply the direct method based on revenue instead of revenue - cost.

• When businesses cannot distinguish reasonable expenses to deduct, they should use a fixed rate based on revenue. - Note deadlines / regular declaration: Quarterly provisional payment, annual settlement declaration according to form 04/TNDN.

Corporate income tax finalization declaration form 05/TNDN — “income from capital transfer”

- Apply to: An organization (can be a business or an individual organization) that generates income from capital transfer (buying and selling shares, contributing capital, etc.)

- Main content: Determine taxable income from capital transfer, deductible expenses (if any), applicable tax rate, tax payable after deduction and reduction if applicable agreement.

- Use cases: When a business has a capital transfer transaction (for example: selling shares, transferring capital contributions).

- Special attention: If a foreign organization transfers capital in Vietnam, it must also use form 05/TNDN to declare tax on the income generated in Vietnam.

Corporate income tax finalization declaration form 06/TNDN — “transfer of capital associated with real estate / sale of the entire enterprise”

- Apply to: case of capital transfer attached to real estate, or the sale of the entire enterprise in the form of capital transfer in which the related assets include real estate.

- Main content: Record the capital transfer price, related costs (if determined), taxable income, applicable tax rate (usually 20 %) and tax payable.

- Outstanding features: This form is a “separation” method for capital + real estate cases, to handle corporate income tax separately for that transaction.

- Declare each time it occurs: not by general year (as real estate transactions are often special events).

Relevant additional appendices/forms (summarized)

In the form system attached to Circular 80/2021/TT-BTC (and appendices, amendments and supplements), in addition to the main forms such as 03, 04, 05, 06, there are also appendix/supporting forms like:

- Form 02/TNDN

- Form 03-2/TNDN (loss transfer appendix)

- Form 03-5/TNDN (appendix of income from real estate transfer)

Form 03-6/TNDN (report on the establishment and use of science and technology fund) - Form 03-8 and 03-8A/B/C (table of allocation of corporate income tax payable among establishments)

- Form 03-3A / 03-3B / 03-3C / 03-3D (appendix to corporate income tax incentives)

- … and other forms listed in the list of forms attached to the appendix of Circular 80/2021.

These appendices help to further detail elements such as carryforward losses, tax incentives, allocations between multiple entities, taxes paid abroad, etc.

Legal regulations and latest updates on corporate income tax finalization declaration (up to 2025)

Below are the official legal documents that are currently the basis or directly related to the corporate income tax (CIT) finalization declaration form, including laws, decrees and circulars, including the latest amended/supplemented documents up to 2025:

Law / amended law:

- Law on Corporate Income Tax 2008 (No. 14/2008/QH12) — This is the Corporate Income Tax Law that has been in effect since January 1, 2009.

- This Law has been amended and supplemented many times (for example, through the 2013 Law on Amendments and Supplements).

- The current consolidated text is Consolidated document 01/VBHN-VPQH 2023 Corporate Income Tax Law.

- Law on Corporate Income Tax 2025 (No. 67/2025/QH15) — The Law amending and replacing part or all of the current regulations will take effect from October 1, 2025.

- This Law introduces new points on taxable income, tax incentives, tax rates and does not allow offsetting of losses/profits between types of income in some cases.

Guiding Decree

- Decree 218/2013/ND-CP — detailed regulations and instructions for implementing the Law on Corporate Income Tax (provisions on taxpayers, taxable income, deductible expenses, determination of loss/profit, tax incentives, etc.).

- This Decree also abolishes old decrees such as Decree 124/2008 and Decree 122/2011.

- There are additional modifications, for example Decree 57/2021/ND-CP Supplementing a number of articles on corporate income tax incentives (point g, clause 2, Article 20 of Decree 218).

New guidance circular & amendments

- Circular 80/2021/TT-BTC — guiding the implementation of a number of articles of the Law on Tax Administration and Decree 126/2020/ND-CP (related to tax declaration, tax management, forms, electronic declaration).

- Sample 03/TNDN and the supplementary forms for final settlement declaration are issued with this Circular. Effective from January 1, 2022.

- Circular 80/2021 is also amended and supplemented by Circular 40/2025/TT-BTC (from July 1, 2025) on the division of tax management authority between local levels.

- Circular 40/2025/TT-BTC — Amending and supplementing a number of articles of the Circulars in the field of tax administration to define the authority between local authorities according to the 2-level model, effective from July 1, 2025.

- Including amendments to Circular 80/2021, Circular 86/2024 and other tax management Circulars.

- Previous Circulars guiding the implementation of corporate income tax (still cited or still indirectly effective)

- Circular 78/2014/TT-BTC — instructions for implementing Decree 218/2013/ND-CP.

- Circular 96/2015/TT-BTC — guidance on corporate income tax and amendments to previous Circulars (such as 78/2014, 119/2014, 151/2014)

- Joint Circular 12/2016/TTLT-BKHCN-BTC — guidance on the establishment and management of science and technology funds in enterprises (related to deductible expenses when calculating taxable income).

How to make corporate income tax declaration form 03/TNDN on HTKK software

Preparing corporate income tax finalization declaration (Form 03/TNDN) on HTKK software requires accountants not only to be proficient in operating the software but also to prepare complete and accurate input data.

How to make Declaration Form 03/TNDN on HTKK software

Preparing corporate income tax finalization declaration (Form 03/TNDN) on HTKK software requires accountants not only to be proficient in operating the software but also to prepare complete and accurate input data.

Steps to prepare input data

Before opening the HTKK software, accountants need to prepare data from financial reports and accounting books:

- Balance sheet: to determine the status of assets and capital sources.

- Business performance report (Form B02-DN): to get data on profit, revenue, and expenses.

- Detailed account book (expenses, revenue, provisional corporate income tax).

Key Points:

- Enterprises applying Circular 200/2014/TT-BTC will have a more detailed reporting structure than Circular 133/2016/TT-BTC for SMEs. Accountants need to pay attention when comparing data to avoid errors when entering into the accounting system.

3-step process for making declaration on HTKK

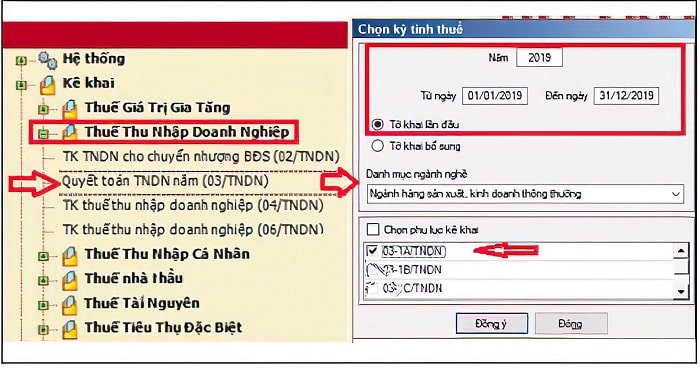

Step 1: Select the declaration form and tax period

- Open HTKK software, select "Corporate Income Tax" → "Corporate Income Tax Finalization Declaration (Form 03/TNDN)".

- Select tax period (by year).

- Select Appendix 03-1A/TNDN (required), may be accompanied by 03-2A/TNDN (loss carryover) or other appendices if necessary.

Step 2: Complete Appendix 03-1A/TNDN

- Fill in the data from the Income Statement into the Income Statement table.

- The system will automatically link the data with the main declaration.

Step 3: Fill in the main indicators on the declaration form 03/TNDN

- After completing the appendix, the software will automatically compile it into the main declaration.

- Accountants need to check, supplement and adjust specific indicators.

Important indicators to note when preparing corporate income tax finalization declaration

- Adjust to increase total profit ([B1]):

Including expenses that are not deductible when calculating tax (over-standard expenses, expenses without invoices and documents, invalid depreciation of fixed assets, etc.). This is a step that often leads to errors if not checked carefully. - Transfer loss ([C3]):

Use Appendix 03-2A/TNDN to declare the amount of losses carried forward from previous years. Note the principle: losses can be carried forward continuously for a maximum of 5 years, and cannot exceed the amount of profit generated in each year. - Difference between provisional and payable ([I]):

This is the indicator that determines the amount of corporate income tax that must be paid or deducted. This indicator is the basis for the tax authority to calculate late payment fees if the enterprise underpays.

Making Form 03/TNDN is not only an operation on the accounting system but also a process of comparing data between financial statements and books. Accountants need to clearly understand the data sources, regulations in Circular 200/133 and pay special attention to adjustment indicators to avoid errors.

Documents and deadline for submitting corporate income tax settlement

To fulfill corporate income tax (CIT) obligations, businesses need to clearly understand the components of the documents that must be submitted and the important time frames as prescribed by law.

What does the corporate income tax settlement file include?

A complete set of corporate income tax settlement documents usually includes:

- Corporate Income Tax Finalization Declaration Form No. 03/TNDN.

- Financial report year, including:

- B01-DN: Balance sheet.

- B02-DN: Report on production and business performance.

- B03-DN: Cash flow statement.

- B09-DN: Notes to financial statements.

- Appendices attached to the declaration (depending on the situation):

- Appendix 03-1A/TNDN: Results of production and business activities.

- Appendix 03-2A/TNDN: Loss transfer.

- Other appendices (if any: tax incentives, fund allocations, etc.).

Deadline for submitting declarations and special cases

- Deadline for submitting the general return: No later than the last day of the third month from the end of the calendar year or fiscal year (usually falls on March 31 of the following year).

- In case of enterprise dissolution or bankruptcy: Corporate income tax settlement dossier must be submitted together with the dossier for tax code termination, that is, before the tax authority issues a notice of tax code closure.

- In case of division, separation, consolidation or merger: The settlement dossier must be submitted within 45 days from the date of the decision of the competent authority on division, separation, consolidation or merger.

Why is there a difference in terms of time?

Because in cases of dissolution, bankruptcy or restructuring (division, separation, consolidation, merger), enterprises terminate or change their legal obligations related to corporate income tax. Therefore, the law stipulates an earlier deadline to ensure that tax authorities promptly inspect and handle tax obligations before the enterprise ceases operations or changes its legal entity.

In summary, businesses need to fully prepare corporate income tax settlement documents and closely monitor the payment deadline for each case to avoid administrative penalties or late payment fees.

Common errors and solutions when settling corporate income tax

To limit risks when settling corporate income tax (CIT), businesses need to clearly understand common errors and penalties for late payment or incorrect declaration.

Common errors when declaring corporate income tax settlement

- Missing loss transfer appendix (03-2A/TNDN)

- Many businesses forget or incorrectly declare this appendix, leading to losing the right to carry forward losses to the following years.

- Solution: Carefully review the business results report, compare accumulated loss figures with previous tax declarations to ensure correct declaration.

- Falsely declaring non-deductible expenses

- Một số khoản chi phí không hợp lệ theo quy định (không hóa đơn chứng từ, vượt định mức, chi liên quan cá nhân…) vẫn bị đưa vào chi phí được trừ.

- Solution: Refer to Article 4 of Circular 96/2015/TT-BTC to properly classify reasonable and valid expenses before making the declaration.

- No reconciliation of provisional data during the year

- Enterprises do not compare the amount of corporate income tax provisionally paid quarterly with the amount payable upon final settlement, which can easily lead to underpayment or overpayment.

- Solution: Make a detailed comparison table between the provisional declaration and the year-end settlement, and make timely adjustments.

- Error in financial report attached

- Mismatches between tax returns and financial statements raise suspicion and may lead to tax audits.

- Solution: Check the balance between financial statements and tax declarations, especially in terms of revenue, expenses and profits.

Regulations on penalties for late payment or incorrect declaration

According to Decree 125/2020/ND-CP, the penalties applied are as follows:

- Late submission of corporate income tax settlement documents:

- 1-5 days late: Warning (if there are mitigating circumstances).

- Late from 6-30 days: Fine from 2 - 5 million VND.

- Late from 31-60 days: Fine from 5 - 8 million VND.

- Late for more than 90 days: Fine from 8 - 15 million VND, and late tax payment fee (0.03%/day on the late payment amount).

- Incorrect declaration leads to underpayment of tax or overpayment of tax exempted/reduced/refunded:

- Penalty 20% for tax arrears, tax refund or reduction is higher.

- At the same time, the full amount of tax and late payment must be paid.

- False declaration but does not change tax obligations:

- Fine from 500,000 - 8,000,000 VND, depending on the level of violation.

Frequently asked questions and differences between taxes

Preparing corporate income tax settlement documents not only requires a firm grasp of legal regulations but also practical experience to avoid small but potentially damaging errors. Below are some common problems and solutions to help businesses minimize risks.

Do businesses that do not generate revenue have to submit a declaration?

Have. According to regulations, all operating enterprises (not yet dissolved or not yet ceased operations as notified to the tax authority) must submit a corporate income tax finalization declaration, even if there is no revenue, expense or profit.

- Reason: The obligation to declare is to ensure transparency, helping tax authorities monitor the actual operating status of the enterprise.

- Exemptions: Enterprises that have completed dissolution or cessation procedures and have been confirmed by the tax authority do not have to submit declarations from the time of termination of tax obligations.

Distinguish between corporate income tax settlement and personal income tax settlement

- Corporate income tax settlement:

- Object: Business

- Content: Summarize the business production results of the year, determine taxable income, valid expenses, corporate income tax payable or exempted, and loss transfer.

- Nature: The enterprise is directly responsible for declaration and submission.

- Personal income tax settlement:

- Subject: Individuals with taxable income.

- Content: Determine total income from salaries, wages and other income in the year, calculate the amount of tax temporarily deducted, the amount to be paid additionally or refunded.

- Nature: Employees can authorize the business to settle the payment or do it themselves if they have multiple sources of income.

Core difference: CIT reflects the tax liability of a business on its profits, while PIT reflects the tax liability of an individual on their income.

Corporate income tax finalization declaration and latest changes (from 2025 onwards)

To ensure compliance with the law, businesses need to promptly update new regulations:

- 2025: The Ministry of Finance plans to add some indicators in the 03/TNDN declaration form related to the declaration of deductible expenses and the loss transfer appendix.

- Continuously updatedEnterprises should regularly monitor new Circulars and Decrees to understand changes in:

- Declaration form and attached appendix.

- Reasonable and valid cost conditions.

- Deadline for submitting documents and penalties for violations.

It is necessary to build an “internal update” in the accounting department to promptly adjust the declaration process according to new legal documents, reducing risks when settling payments.

Automate your tax settlement process together Bizzi.vn

Tax settlement is the “heaviest” stage of the year for the accounting and finance department. If the process is still done manually, businesses often encounter:

- Data error: Manual data entry from paper invoices or Excel files is prone to errors, leading to inaccurate reporting.

- Time consuming and manpower consuming: Accountants have to review thousands of documents, labor costs increase during settlement season.

- Legal risks: Late submission or false declaration may result in fines and collection of arrears, affecting the business's reputation.

By applying technology to automate, businesses can minimize these errors while focusing resources on analysis and strategic decision-making.

Bizzi.vn provides a platform automate document processing and tax settlement, helping businesses save time and reduce risks:

- Automatically retrieve data from electronic invoices

No need for manual input. Bizzi system automatically collects and reads data from multiple invoice providers, reducing manual data entry by up to 80%.

→ Learn more about the solution Electronic bill by Bizzi - Automate document and data reconciliation

Bizzi automatically reconciles invoices, vouchers, bank statements and accounting books to detect discrepancies instantly.

→ See feature details Automatic reconciliation - Tích hợp liền mạch với hệ thống ERP (SAP, Oracle, Odoo…)

Data from Bizzi is synchronized directly to the ERP system, helping to standardize and synchronize financial reports and final settlement declarations instantly.

→ Explore solutions ERP integration by Bizzi

The application of Bizzi not only helps Reduce 50-70% time to prepare settlement documents but also creates a transparent, easy-to-control process and meets the deadline for filing documents according to the 2019 Tax Administration Law.

- Save time and money

- Shorten reporting time with the ability to summarize and classify costs according to accounting standards in just a few minutes.

- Reduce the workload of settlement season, reduce the cost of outsourcing settlement services.

- Allows accountants to focus on data analysis instead of manual operations.

- Optimizing financial management processes

-

- Bizzi integrates directly with ERP (SAP, Oracle, Misa, Fast…), helps data flow seamlessly.

- Support storing electronic documents for easy retrieval during inspection/check.

- Help businesses comply with standards and reporting deadlines according to Circular 80/2021/TT-BTC.

- Increased transparency and internal control

-

- The system provides a log that tracks each processing step, who entered the data, who approved it, reducing the risk of fraud.

- Easily present to management and partners, increasing financial transparency.

Conclude

Above is all the latest updated information on the corporate income tax finalization declaration form. It is necessary to avoid mistakes when preparing the corporate income tax finalization declaration because this is an important legal document that directly affects the tax obligations and reputation of the enterprise. Experience Bizzi for free See how your business can reduce 70% invoicing time and reduce errors with just a few clicks.

Sign up to receive advice on solutions specifically for your business here: https://bizzi.vn/dat-lich-demo/