In the era of technology boom, the phrase “AI” (Artificial Intelligence) has become familiar to most people. However, the application of AI in practice, especially in the field of finance and accounting, is still an unfinished story. Let’s find out with Bizzi why most financial groups still do not apply AI!

Finance teams still do not apply AI: Opportunity or challenge?

Recently, AI is a popular phrase that everyone knows, but applying AI technology to work is not yet a standard practice for finance and accounting teams.

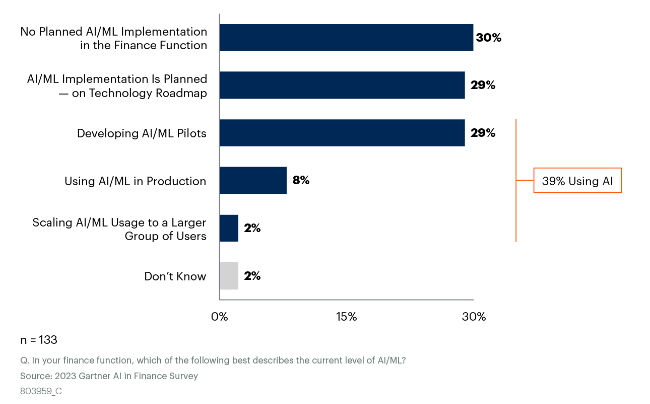

To be sure, two-thirds of finance leaders surveyed by Gartner said they are using or actively planning to use AI or machine learning in their departments. But so far only 39% has done so, and 30% has no plans to use AI in the finance function.

Gartner believes that CFOs have an important role to play in instilling a culture of acceptance and leveraging of AI capabilities.

“The most successful AI finance organizations embrace and evangelize AI at the C-suite level and embed data science teams within finance functions while avoiding reliance on third parties,” said Mark McDonald, senior director analyst at Gartner.

He stressed that maximizing the benefits of AI requires finance staff to keep an open mind about its potential impact on the workforce. “Only when employees embrace AI as a colleague, not a threat to their jobs, will organizations see the greatest potential and success,” McDonald said.

With surveys and actual figures showing a surprising contradiction between the perception and action of finance teams in applying AI. So what is the reason why finance teams are still hesitant before the "AI fever"?

Why is AI still "slow" in the financial industry?

The financial industry is standing on the threshold of a revolution called Artificial Intelligence (AI). The huge potential that AI brings promises to completely change the way we operate, improve efficiency and open up new opportunities for the industry. However, besides the promises, the application of AI in this field is also facing many challenges and barriers that need to be resolved.

Many reasons lead to the slow application of AI in the financial sector, including:

- Lack of understanding about the benefits of AI: Many finance leaders are still not fully aware of the huge potential that AI can bring to their organizations. They do not yet fully understand how AI can automate tedious tasks, freeing up employees' time to focus on higher value-added work, as well as support informed decision-making based on In-depth data analysis.

- Concerns about impact on employment: The fear of AI taking away jobs is ever present, making many finance employees worried about losing their jobs. However, it is important to look at it objectively, as AI will create many new job opportunities, requiring higher skills and helping to improve the capacity of existing employees.

- Difficulties in implementing AI: Implementing AI requires significant financial and technical resources. Financial institutions need the infrastructure and qualified expertise to deploy and maintain effective AI systems.

However, the potential that AI brings to the financial sector is enormous, because AI can:

- Automate manual tasks: AI can automate many manual, repetitive tasks, freeing up human resources to focus on jobs that require higher expertise and thinking.

- Improve operational efficiency: Thanks to the ability to analyze data quickly and accurately, AI helps make wise decisions, optimize operational processes, reduce costs and increase profits for businesses.

- Improve customer experience: AI can personalize financial services, providing solutions tailored to each customer's needs and desires, thereby enhancing customer experience and satisfaction.

- Fraud and risk detection: AI has the ability to effectively detect fraud and potential risks, helping to protect assets and reputation for financial institutions.

Although there are still many challenges, the potential of AI in the financial industry is enormous. Financial institutions need to change their thinking and proactively apply AI to improve operational efficiency, bring benefits to customers and promote the overall development of the industry.

Successful strategies when applying AI

Gartner says it has identified several characteristics of the most successful financial institutions using AI today. “Smaller efforts are also easier for employees to understand, making them more likely to adopt,” Gartner writes in its survey report.

However, transformative results take time. “Only with increased AI capabilities can an organization address complex, company-specific, and transformative use cases such as forecasting, scenario planning, and complex decision support,” Gartner writes. “Many use cases fail when they try to use beyond the available AI capabilities.”

Gartner also notes that data science has emerged as a new role in finance, with the majority of finance teams employing it. While such staffing was once considered “risky and frivolous,” modern finance teams often employ data scientists whether or not they leverage AI.

Gartner recommends that finance departments pursue a balanced approach of teaching basic data science to existing staff and hiring well-trained professional data analysts. “Newly hired professional data scientists provide technical expertise, while internally trained data scientists ensure solutions that address specific finance needs fit into existing workflows,” Gartner writes.

McDonald goes on to advise finance departments to “bring data scientists close to the processes and people who will train AI, ensure those people understand that AI can make their jobs easier, and give them the time they need to produce transformative results.”

Gartner predicts that by 2026, financial institutions with more than three years of investment in AI skills will double their productivity compared to organizations without AI skills. Therefore, financial institutions need to start planning for AI adoption today.

Also by 2026, Gartner says, AI and automation will result in 50% total new hires by top-performing corporate finance functions with backgrounds other than finance or accounting.

To successfully deploy AI, financial institutions need to:

- Raise awareness about the benefits of AI: Finance leaders need to educate their employees about the benefits of AI and how it can be used to improve operational efficiency.

- Develop AI strategy: Financial institutions need to develop a clear strategy for how they will deploy and use AI.

- Invest in infrastructure and expertise: Financial institutions need to invest in the infrastructure and expertise needed to deploy and maintain AI systems.

- Effective change management: Financial institutions need effective change management to ensure that their employees are supported in the transition to AI.

By taking these steps, financial institutions can leverage AI to improve operational efficiency, better manage risk, and enhance customer experience.

Examples of AI applications in the financial industry

- JPMorgan Chase Bank Use AI to detect credit card fraud.

- AIG insurance company Use AI to assess insurance risks.

- Fidelity Investments fund management company Use AI to pick stocks and bonds.

AI is a powerful tool that can help financial institutions improve operational efficiency, better manage risk, and enhance customer experience. While there are still some challenges to address, financial institutions should start planning to adopt AI today to take advantage of the benefits it brings.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam