Processing costs are considered an important factor in production and business activities, directly related to the process of converting raw materials into finished products. In this article, Bizzi will provide information on processing costs as well as how to accurately calculate processing costs.

What is the processing cost?

Processing costs (Processing Cost) is the total cost incurred in the process of transforming raw materials into products through production stages, including direct and indirect costs related to the processing process. These are costs that increase with production output, contributing to the value of the product, minus the direct cost of raw materials.

Processing costs are an important part of product cost, especially in manufacturing industries such as garment, mechanical, food processing, electronics, etc. Therefore, the calculation of processing costs requires more accuracy and care.

Specific items of processing costs

Processing costs include expenses incurred during the manufacturing process. Specific processing cost items are classified into three main groups: Direct labor costs, Manufacturing overhead costs, and outsourcing costs.

- Direct labor costs: Salary, allowances, social insurance for direct production workers; Overtime, shift, and night work wages

- General production costs: Including indirect costs for processing activities (Depreciation of machinery and production equipment; Costs of electricity, water, fuel for production; Costs of machinery repair and maintenance; Costs of auxiliary materials and production tools; Factory rental costs; Salaries and allowances of workshop management and technical staff

- Outsourcing costs (if any): In case the enterprise hires another unit to process part of the process (outsourcing), this cost is included in the processing cost.

The role of processing costs

Processing costs play an important role in the production and business activities of enterprises.

Processing costs play an important role in the production and business activities of enterprises.

- Direct impact on product price: Processing costs account for a large proportion of total costs, especially in industries that use a lot of labor or machinery. Optimizing processing costs helps reduce costs and increase competitiveness in the market.

- Basis for calculating selling price and production planning: Businesses rely on processing costs to price products; plan budgets, cash flows; allocate orders to factories (internal or outsourced)

- Evaluation of production efficiency – labor productivity: Comparing processing costs between periods, lines, or outsourced suppliers helps evaluate: Machine productivity, Labor efficiency, production management efficiency

- Making the decision “in-house or outsource”: If the outsourcing cost is lower than the internal cost while still ensuring quality, the business can choose this form. outsourcing to optimize resources.

- Basis for making estimates and business production plans: Help businesses plan production and business reasonably, ensuring resources.

Principles of processing cost accounting

Below are clear and practical principles for accounting for processing costs, especially suitable for manufacturing enterprises (including both internal and outsourced production):

- Processing cost accounting must be recorded in the correct accounting period, not allocated to the wrong time or wrong cost bearer.

- It is necessary to clearly classify what processing costs are: direct costs (labor, outsourcing), general manufacturing costs.

- Accounting by processing cost collection object such as: product code, production order, contract, processing order.

- Accounting for processing costs requires valid documents: invoices, payroll, warehouse receipts, processing contracts, etc.

Processing cost accounting guide

Accounting for processed goods must comply with specific principles for both the outsourcing party and the outsourcing party as prescribed.

At the outsourcing party

When transferring goods and raw materials for processing, accountants need to note that these assets are still owned by the business. The business does not sell, give or donate them, but only transfers them to perform services.

- Do not record the value of goods and materials in accounts receivable (accounts 131, 138) or accounts payable (account 331).

- Production costs, outsourcing processing, raw materials, and outsourced goods are tracked in account 154.

At the processing side

For the processing party, raw materials and goods imported for processing are not owned by the enterprise, are not the assets of the enterprise,,,,.

- These raw materials and goods should not be tracked in inventory accounts (accounts 152, 155, 156),,,,.

- When receiving goods for processing, the enterprise proactively creates a warehouse receipt, monitors and records information about the entire value of materials and goods received for processing,,,,.

- When returning processed goods, create a Warehouse Delivery Note and only issue a VAT invoice (or sales invoice) for processing fees and raw materials and accessories (if provided by the processing party).

Regulations relating to processed goods

Goods processing activities are subject to a number of regulations on invoices, documents and value added tax, specifically as follows:

- The party sending goods for processing: When exporting goods (semi-finished products, raw materials, fuels) for processing, the enterprise only needs to create an Internal Delivery and Transportation Note and a Transfer Order.

- For export processing: When transporting goods to the border gate or place of export procedures, create a Warehouse Delivery Note and Internal Transport Note. After completing export procedures, create a value-added invoice for exported goods.

- Processing party: When returning processed goods, create a Warehouse Delivery Note and only issue a VAT invoice (or sales invoice) for the revenue from processed goods and the cost of raw materials and accessories (if provided).

About value added tax (VAT)

- Raw materials and supplies imported for production and processing of export goods under contracts signed with foreign parties are not subject to VAT.

- Goods processed in transit according to commercial law are subject to tax rate 0%.

- Export goods processing services under contracts signed with foreign countries are subject to VAT rate 0%.

About VAT calculation price

- The price for calculating VAT for goods processing is the contract processing price excluding VAT, including wages, costs of fuel, power, auxiliary materials and other costs for goods processing.

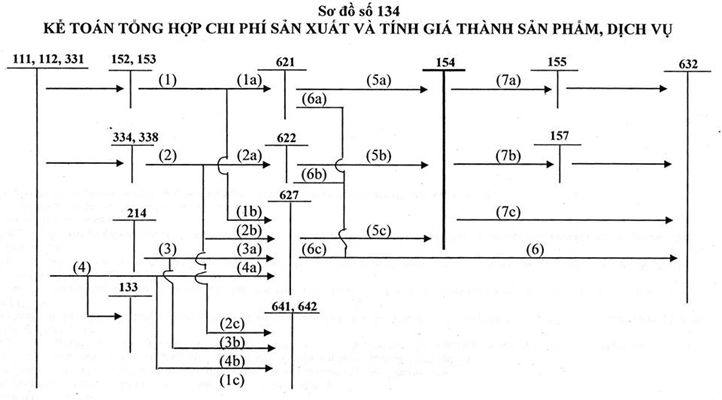

Instructions for accounting for processing costs according to Circular 200

Accounting for processed goods according to Circular 200/2014/TT-BTC is carried out in detail for both the lessee and the processing party.

At the outsourcing party

Accounting entries reflect the process of sending goods, incurring costs and receiving finished products.

- When purchased goods or raw materials are transferred directly to processing (not stored in the warehouse):

- Debit account 154: Value of goods and materials transferred (excluding VAT)

- Debit account 1331: Input VAT

- Account 111, 112, 331,…: Total payment amount

- When exporting goods and raw materials for processing:

- Debit account 154: Value of goods and materials for processing

- Credit account 1561, account 152: Warehouse value

- Record processing costs and other costs incurred:

- Debit account 154: Costs incurred during processing

- Debit account 1331: Deductible VAT (if any)

- Credit account 111, 112, 331, 334,…: Total amount paid/to be paid

- When the finished goods are stored in the warehouse, sent for sale or sold directly:

- Debit account 1561 (Imported goods into warehouse), Debit account 152 (Imported materials into warehouse), Debit account 157 (Sent for direct sale), Debit account 632 (Direct sale)

- Credit account 154: Value of completed processed goods

- Outsourced finished products are evaluated at actual cost, including direct material costs, outsourcing costs and costs directly related to the outsourcing process.

At the processing side

Accountants do not track processed goods in the warehouse on inventory accounts. Tracking is mainly done through warehouse receipts/deliveries and recording information about value. Accounting entries for processing costs arise when determining revenue from processing wages.

- When determining the revenue from the actual processing fee received:

- Debit accounts 111, 112, 131.

- Credit account 511 – Sales revenue and service provision.

- Credit account 3331 – VAT payable.

How to calculate cost of goods processed

Cost of processed goods is the total actual cost that the enterprise has spent to create processed products, including: Cost of raw materials (NVL), Cost of outsourcing, Transportation and packaging costs, and other related costs (if any).

Cost of processed goods is calculated based on the costs incurred during the product processing. Calculating cost of processed goods is an important step to determine the correct actual cost of finished goods after processing, serving the purpose of cost accounting, financial reporting and profit determination.

To calculate the cost of processed goods accurately, it is necessary to determine the following cost components:

- Direct material cost: Cost of main and auxiliary materials used directly, including cost of transporting raw materials (if any).

- Direct labor costs: Salaries, wages, allowances, insurance and other payments to direct production workers.

- General manufacturing costs: Costs related to factory, machinery, utilities, maintenance, depreciation of fixed assets, management during the production process.

- Processing costs (if outsourced): Processing fees and costs of transportation and storage of products during processing (if partially or fully outsourced).

Formula for calculating cost of processed goods

- Cost of processed goods = Direct material cost + Direct labor cost + General production cost + Outsourcing cost (if any).

Some notes when calculating the cost of processed goods

- Cost of goods sold must reflect the true nature of costs, excluding selling and administrative costs.

- In case of material loss, it is necessary to allocate costs reasonably according to actual output.

- If the unit accepts the processing (ie you are the hired party), the cost price will be the actual cost of performing that stage and does not include the materials provided by the outsourcing party.

Processing costs in Management Accounting

Management accounting uses cost information in a different way than financial accounting, focusing on supporting internal decision making.

Difference between Management Accounting and Financial Accounting

- Scope: Management accounting looks at the details, classifying costs by activity or product/service. Financial accounting is more general, less detailed in breaking down costs.

- Intended use: Management accounting uses information to manage production efficiency, decide on prices, products, and optimize processes. Financial accounting is used to calculate product costs and prepare financial reports.

- Calculation method: Management accounting is more flexible, and can use methods such as ABC. Financial accounting typically uses the traditional method based on direct labor/materials, which is less flexible.

- Reporting time and frequency: Management accounting reports periodically and flexibly (daily, weekly, monthly) to support quick decision making. Financial accounting reports on standard cycles (quarterly, annually), and is less frequently updated.

The role of processing cost accounting in management accounting

Manufacturing costs provide essential information for effective cost management and business decision making in management accounting.

- Determining product cost: Is an important component to help determine reasonable selling price, ensuring profit and competitiveness.

- Manage and track production costs: Provide detailed information to track and monitor resource efficiency, identify waste, savings opportunities, plan and control spending.

- Developing a costing model: Based on detailed information, businesses can apply different costing models (by product, process, etc.) suitable to the specific characteristics of the business.

- Identify and eliminate waste: Detailed analysis of expenses helps identify potential waste points, evaluate the efficiency of resource use (labor, materials, energy), find causes and propose solutions to improve processes to save costs and increase profits.

How does the Bizzi platform help in managing and accounting for outsourcing costs?

In manufacturing activities, outsourcing costs or related costs such as transportation, packaging, etc. all require valid input invoices to:

- Record expenses in accordance with accounting regulations

- Accounting for costs in cost price

- VAT deductible (if any)

Ensure legality when settling taxes.

However, many businesses face problems:

- Invoice with incorrect information, missing required indicators

- Late invoices cause delays in cost accounting

- Invoice does not match actual cost (causing cost deviation)

- Unable to control invoices from outsourcing suppliers

Bizzi helps businesses automate the entire input invoice processing process, especially useful for manufacturing, trading, or managing multiple outsourcing suppliers. Outstanding features include:

| Feature | Characteristic | Benefit |

| Automatically download and process input invoices

Check and verify valid suppliers |

Using Bizzi Bot applying RPA (Robotic Process Automation) technology combined with AI, the system can:

|

|

| Automatic invoice reconciliation – PO – GR | Compare invoice with:

Check product name, quantity, unit price, tax rate... to detect discrepancies |

|

| Store and manage invoices securely |

|

|

| Integration with ERP and accounting systems | Bizzi provides powerful integration API with software such as: SAP, Oracle, Bravo, Misa, FAST, Odoo...

Automatically synchronize invoice data with accounting and cost management systems |

|

Conclude

Mastering the concept of processing costs, principles and accounting methods according to current regulations (such as Circular 200) is essential for business accountants. At the same time, analyzing processing costs from a management accounting perspective helps managers make effective decisions to optimize production activities and increase profits.

Accounting for processing costs must comply with the principle of collecting costs according to the correct objects, recording fully and in the correct accounting period. Accurate accounting helps businesses control costs closely and have financial transparency.

To improve the efficiency of managing processing costs in particular and other types of costs in general, Bizzi helps businesses ensure accuracy right from the step of collecting input invoices. Integrating features to automate the entire invoice processing process, especially useful for manufacturing, trading businesses, or managing many outsourcing suppliers, using Bizzi Expense, businesses can save time, optimize and effectively control cash flow.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/