Regulations on signatures value added invoice (VAT) depends on the type of invoice (electronic or paper) and the business form of the seller. This article by Bizzi will help you understand the requirements and regulations on signatures on value-added invoices for both types.

What is a value added tax (VAT) invoice?

A value added invoice is an accounting document prepared by organizations and individuals selling goods or providing services to record information about sales and service provision in accordance with the law.

This type of invoice is applied to organizations and individuals who declare and calculate taxes according to the deduction method. Value added invoices can be presented in many forms such as self-printed invoices, electronic invoices, or printed invoices.

The importance of signature on value added tax (VAT) invoice:

- Ensure the legality and authenticity of invoices and transactions.

- Information transparency, avoid falsification and errors.

- Serves tax and accounting management.

Regulations on signatures on Value Added Tax Invoices (paper form)

For paper invoices, the seller's signature is required, and the buyer's signature may or may not be required. Below are detailed regulations on signatures on paper (traditional) Value Added Tax (VAT) Invoices - applicable to invoices used before the mandatory conversion to electronic invoices or in some special cases where they are still used.

- Legal basis: Article 4 Circular 39/2014/TT-BTC, Articles 19 & 20 of Accounting Law No. 88/2015/QH13.

- General signature requirements:

- The buyer and seller must sign and print their full names on the invoice.

- Must have seller's stamp (if any) and date of invoice.

- Ink type and signature form:

- Signatures must be signed with a ballpoint pen or indelible ink pen.

- Do not sign in red ink or stamp with a pre-engraved signature.

- Signature may not be altered or erased.

- A person's signature must be consistent and true to the signature specimen register.

- Seller's signature:

- The head of the unit is responsible for signing. In case the head of the unit does not sign, there must be a power of attorney for the person directly selling to sign, clearly state the full name on the invoice and affix the organization's seal on the upper left of the invoice.

- It is not required to sign directly on each invoice copy if the invoice is not a payment document. Signing on copy 1 and printing on carbon paper to the other copies is considered valid.

- The company may authorize one or more vendors to sign invoices as needed.

- Buyer's signature:

- Signature is not required in case of indirect purchase, such as purchase by phone, online, FAX. When making an invoice, the seller must clearly state this form of sale in the criteria "buyer (signature, full name)".

- For the sale of goods and provision of services abroad, the invoice does not necessarily have to have the signature of the foreign buyer.

- Penalties for violations of signatures on paper VAT invoices (according to Decree 41/2018/ND-CP, effective from May 1, 2018):

- Fines from 3 to 5 million VND for acts such as erasing or correcting signatures; signing invoices in red ink or faded ink; signing with a pre-engraved signature stamp.

- Fines from 5 to 10 million VND for acts such as signing without fully recording the content under the responsibility of the signer; signing invoices without proper authority; the signature of a person is inconsistent or inconsistent with the signature sample registration book; there are not enough signatures according to the title specified on the invoice.

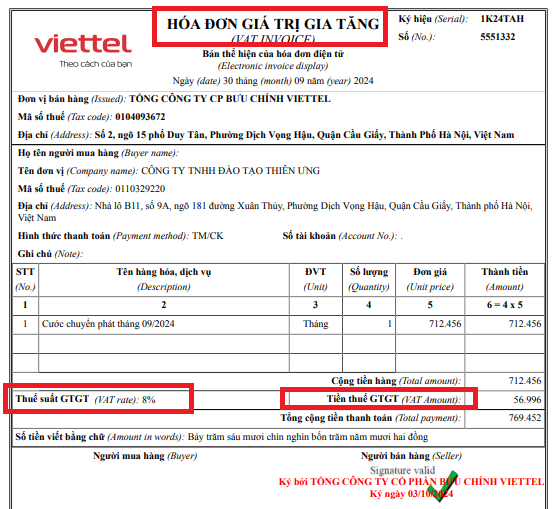

Latest regulations on signatures on Value Added Tax Invoices (electronic invoices)

For Electronic invoice, the seller's digital signature is mandatory, while the buyer's signature may or may not be required depending on the agreement between the two parties. Below are the latest detailed regulations (updated to 2025) on signatures on Electronic Invoices (E-Invoices) according to regulations.

- Legal basis: Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC.

- Definition of Electronic Invoice: An invoice with or without a tax authority code, expressed in electronic data form, created by organizations and individuals selling goods or providing services using electronic means to record information about the sale of goods or provision of services according to the provisions of law.

- General requirements for digital signature:

- Seller's digital signature:

- Enterprises, organizations: Use digital signature of business, organization.

- Individual: Use the digital signature of an individual or authorized person.

- Buyer's digital signature:

- No electronic signature of the buyer is required, including the case of issuing electronic invoices when selling goods and providing services to customers abroad.

- Except in case The buyer is a business establishment and the buyer and seller have an agreement that the buyer meets the technical conditions for digital signature and electronic signature on the electronic invoice issued by the seller.

- Time of digital signature on electronic invoice is one of the contents required on the invoice.

- For electronic invoices with tax authority codes: Invoice maker (enterprise, organization, household, individual business) digital signature required on the invoice created before sending the invoice to the tax authority for code issuance.

- Digital signature safe: The signature on the value-added invoice must ensure the security conditions according to Article 9 of Decree 130/2018/ND-CP, including being created during the validity period of the digital certificate, being verifiable by the public key, and the secret key being only under the control of the signer at the time of signing.

- Seller's digital signature:

- Cases where the signature on a value-added invoice in the form of an electronic invoice does not necessarily include:

- Electronic invoices issued by tax authorities for each occurrence.

- Electronic invoice for selling gasoline to individual non-business customers.

- Electronic invoices are stamps, tickets, and cards (except for stamps, tickets, and cards that are electronic invoices with codes issued by tax authorities).

- Electronic documents for air transport services issued via websites and e-commerce systems are prepared according to international practices for non-business individual buyers.

- Invoice used for Interline payments between airlines.

- Invoices are generated from cash registers that are connected to transfer data to tax authorities.

- Electronic invoices for sales at supermarkets and shopping malls where the buyer is an individual not doing business.

- Benefits of using signature on value added invoices (applicable to electronic invoices):

- Save administrative costs: No time wasted traveling or waiting.

- Flexibility: Signing electronic invoices can take place anywhere, anytime, with just an Internet connection and the right to use a digital signature.

- Increase transaction speed: Transferring signed documents and files to partners, customers, and management agencies is convenient and fast.

- Ensuring legality and anti-counterfeiting: Invoices are guaranteed to be consistent in form, avoiding counterfeiting or other strict legal regulations such as ink color and erasure.

Bizzi – Solution to support invoice management and signatures on value-added invoices

Integrating more than 30 features, Bizzi provides a comprehensive cost control system for businesses, acting as an AI assistant for the finance and accounting department in automating the revenue and expenditure process. Trusted by medium and large companies in many fields such as Masan Group, kewpie, VT healthcare, Bizzi's outstanding advantage is cross-platform compatibility, easy integration with management systems and sales software.

With superior automation features, Bizzi is becoming top effective solution in supporting businesses Accounts PayableHere's how Bizzi helps businesses Reduce up to 80% of time and 50% of cost Invoice processing and related procedures:

- Solution Bizzi B-invoice (Electronic invoice):

- Create electronic invoices according to prescribed standards: Meet tax authority requirements, XML/PDF format.

-

- Digital signature integration: Allows downloading and printing of invoices in PDF, XML format, and integrates digital signatures, ensuring the legality of invoices.

-

- Manage invoice status: Track issued, sent, paid, canceled or adjusted invoices, helping businesses closely control the invoice circulation process.

- Solution Bizzi IPA + 3way (Processing, reconciling and managing input invoices):

-

- Automatic processing of input invoices: Use Bizzi Bot with RPA and AI technology to upload, check and reconcile invoices.

-

- Verify valid supplier: Check the supplier's Tax Identification Number (MST) and operating status on the tax system, helping to ensure the legal origin of invoices.

-

- Risky Invoice Warning: Detect invoices from suppliers that have signs of risk, including issues with invoice validity or errors (which may involve signatures or other information).

-

- Electronic invoice authentication: Check the validity of invoices according to accounting regulations, including checking the existence and validity of digital signatures on invoices.

Conclude

Compliance with the regulations on signatures on value-added invoices, whether paper invoices or electronic invoices, is extremely important to ensure the legality, accuracy and transparency of business transactions. It can be affirmed that digital signatures on electronic invoices have brought outstanding benefits compared to signatures on paper invoices, helping to optimize processes, save costs and improve management efficiency.

Applying technology solutions such as Bizzi B-invoice and Bizzi IPA + 3way is the key to helping businesses easily comply with current regulations, effectively manage invoices, and minimize the risk of errors and fraud.

Considered as AI assistant for finance and accounting department in automating revenue and expenditure processes, Bizzi has become a trusted partner in digitally transforming the financial and accounting processes of businesses. If you are also looking for a financial management solution specifically designed for your business, schedule a consultation and register for a trial of Bizzi's products here:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/