A collection of strategies, methods and tools to help businesses control their finances effectively: from cash flow management, cost optimization, budgeting, to financial analysis and performance evaluation. For CFOs, chief accountants and business owners who want to make data-driven decisions and improve their operational capabilities.

February 9, 2026

What is the start date of the fiscal year in HTKK? When does the fiscal year begin?

The start date of the fiscal year in HTKK is a small piece of information, but it governs the entire logic of the tax period, the time frame, etc.

January 21, 2026

What is FP&A? The role of Financial Planning & Analysis in the CFO's financial decision-making.

FP&A is more than just budgeting or creating Excel reports. It's a function that helps CFOs connect past data –...

January 21, 2026

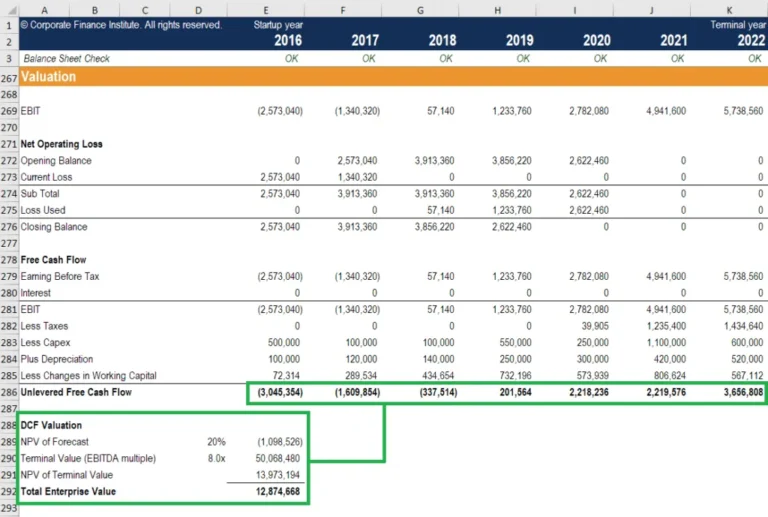

What is discounted cash flow? A guide for CFOs to value and make sound investment decisions.

What is discounted cash flow? It is a valuation method that converts projected future cash flows into their present value...