Explore a wealth of in-depth knowledge about finance and accounting for modern businesses: from cash flow management, budgeting, management reporting to financial digital transformation trends. This section provides up-to-date, easy-to-understand, highly applicable information – exclusively for CFOs, chief accountants and business owners who want to turn finance into a competitive advantage.

January 13, 2026

Deductible expenses for corporate income tax: Conditions, documentation, and actual list (Updated 2026)

Unlike expenses that are not deductible when calculating corporate income tax, the more standardized businesses become in terms of deductible expenses when calculating corporate income tax...

January 13, 2026

What are expenses that are not deductible when calculating corporate income tax? 37 excluded expenses, examples, and how to handle them during tax settlement.

Expenses that are not deductible when calculating corporate income tax in 2025 are those expenses actually incurred but which do not meet the following criteria...

January 13, 2026

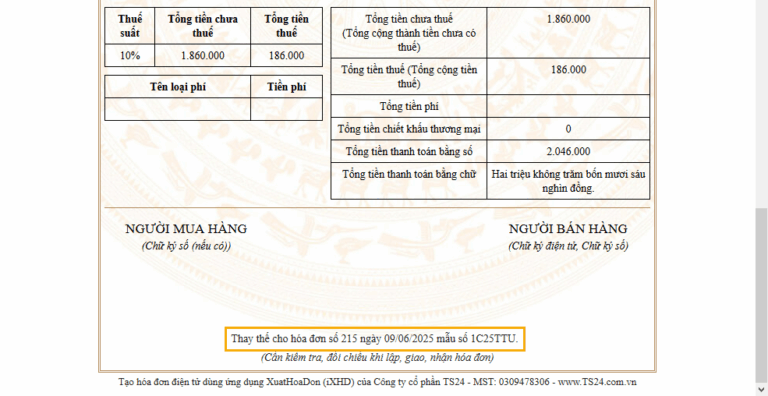

Common errors in electronic invoices and how to handle them according to the latest regulations.

Errors on invoices are mistakes that occur during the process of creating, issuing, receiving, and declaring invoices, etc.