Revenue management software It's not simply a sales tracking tool, but a system that helps CFOs comprehensively control revenue, expenses, accounts receivable, and business cash flow management across all financial activities. In this article, Bizzi compiles and categorizes 15 popular revenue management software programs currently available, clarifying each group of solutions suitable for different business sizes and objectives, while also providing essential in-depth financial management insights for managers.

What is revenue management software in corporate financial management?

Revenue management software It is a system that helps businesses track, record, reconcile, and analyze revenue from sales to cash received, ensuring accurate and timely data and supporting CFOs in making decisions about profitability and cash flow.

In corporate financial management, one of the most common mistakes is equating revenue with cash flow. In reality, a business may record strong revenue growth but still lack sufficient cash to operate due to delays in collecting payments, prolonged accounts receivable, or uncontrolled hidden costs.

Therefore, the core role of revenue management software is not just about "recording how much was sold," but about helping CFOs clearly distinguish between Revenue vs. Cash Inflow – that is, accounting revenue versus actual cash flowing into the business.

A truly effective revenue management system must track the entire revenue lifecycle, starting from Booking (ordering/signing contracts), moving to Billing (issuing invoices), then Accounts Receivable (AR) (recording accounts receivable), and ending with Collection (collecting payments). Only when this lifecycle is complete does revenue truly have financial value.

Top 15 Revenue & Cash Flow Management Software by Usage Objective (Updated 2026)

In the context of businesses growing across multiple channels and systems, and facing increasing cash flow pressures, revenue management software is no longer simply a tool for recording sales. For CFOs, it's the infrastructure that helps answer the core question: does this revenue actually translate into cash and profit?

Current revenue management software can be divided into five main groups:

(1) Comprehensive financial control system for CFO,

(2) Multi-channel sales/POS software,

(3) Specialized solutions,

(4) Platform ERP/CRM,

(5) Manual payment or management tools.

Each group corresponds to a different level of financial maturity for the business.

1. Comprehensive cost and revenue control system for CFOs: Bizzi

Bizzi is financial management ecosystem This helps the CFO control revenue, expenses, accounts payable, and financial performance. real timeInstead of just looking at past sales figures.

Unlike most revenue management software that focuses solely on "how much was sold," Bizzi approaches revenue as follows... a complete financial chain: from recording – reconciliation – collecting payments – protecting profits.

Bizzi's area of control lies in back-office financeThis includes Invoice, Expense, AR, and Performance. These are the biggest bottlenecks causing the problem. Revenue Leakage and discrepancies in actual cash flow.

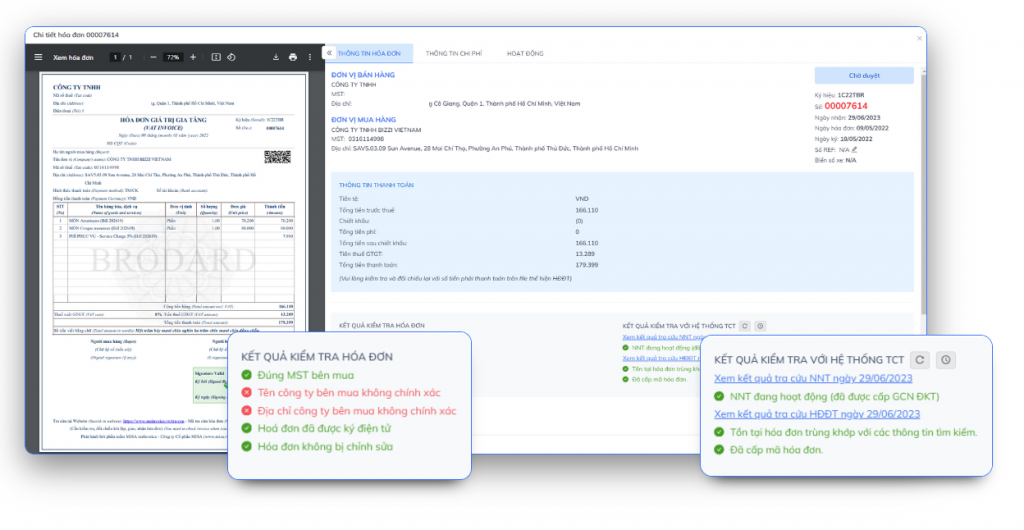

- Bizzi Bot – Invoice Processing Automation It helps to automatically download and read input invoices using AI, and perform reconciliation. 3-way matching (Invoice – PO – GR) In real time, this allows businesses to reduce invoice data entry time by 70–90%, while also mitigating the risk of invalid or incorrect accounting period expenses.

- Bizzi Expense It plays a crucial role in controlling spending right from the source. Every spending request is linked to the departmental or project budget, helping the CFO prevent overspending. before the money leaves the account, instead of handling it through post-audit.

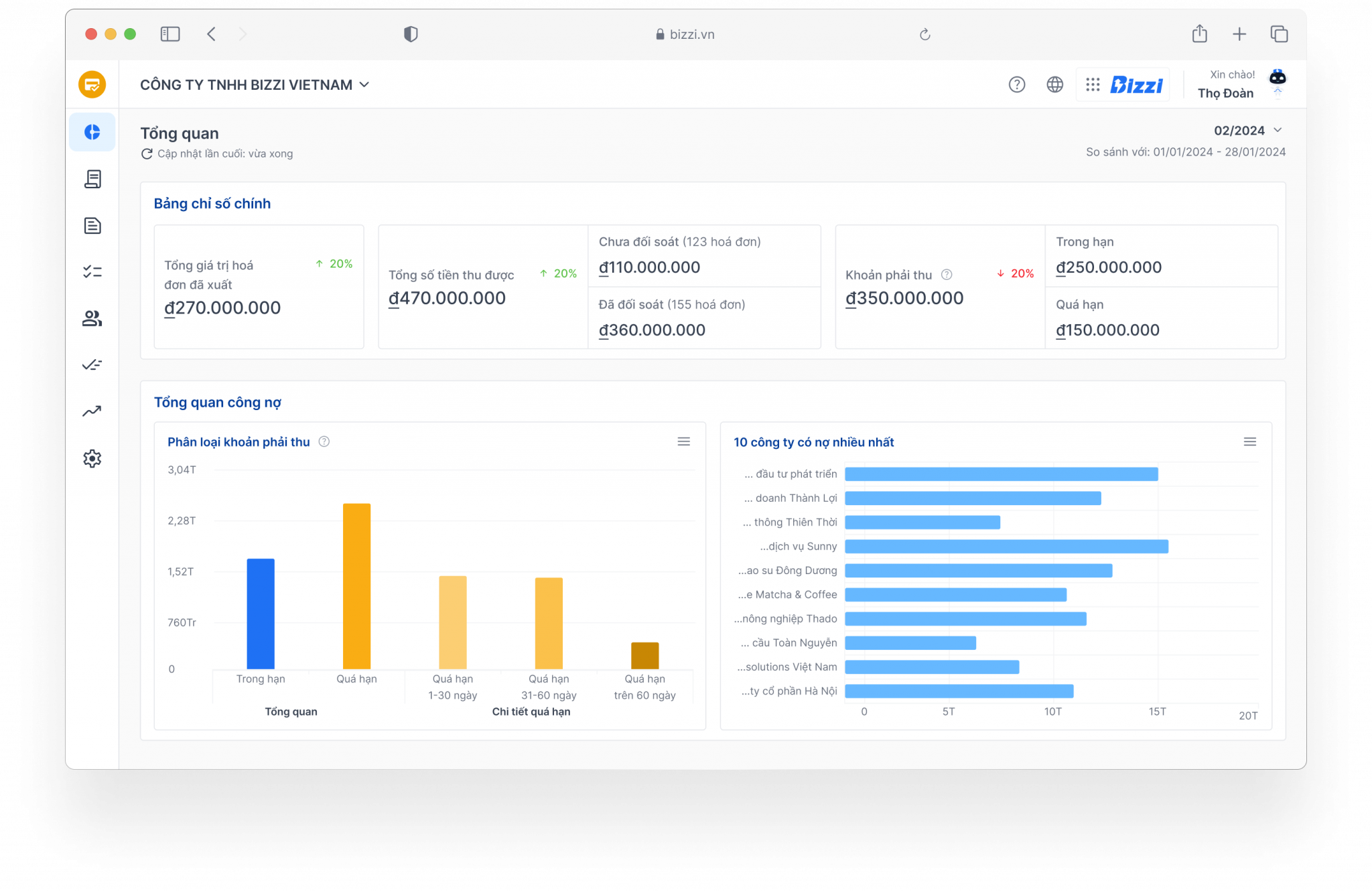

- On the revenue side, Bizzi ARM (Accounts Receivable Management) Supports automated debt reminders based on scenarios, tracks AR Aging, and helps reduce debt. Average DSO 15–30% This can be achieved in just 3–6 months of operation. This is a key factor in improving cash flow that many traditional revenue management software programs overlook.

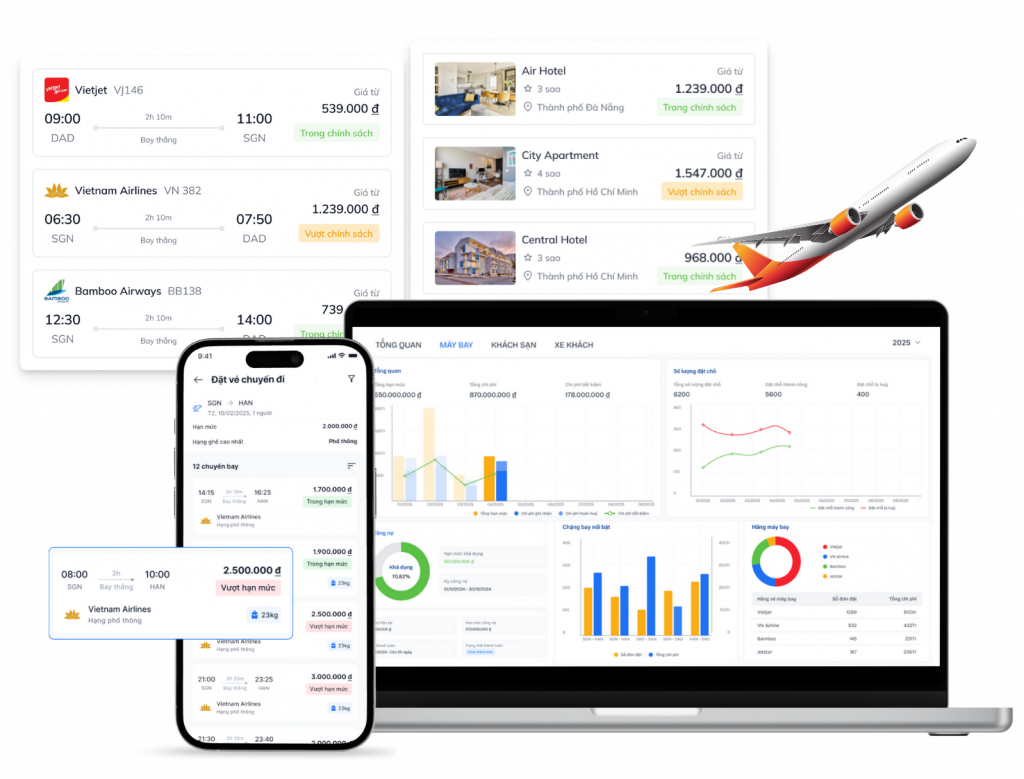

- With a higher level of analysis, Bizzi integrates Sactona (EPM/FP&A) for budgeting, forecasting, and analysis. Budget vs ActualMany businesses have reported that forecasting time has been shortened to just . 5–7 days, instead of several weeks of processing fragmented Excel spreadsheets.

While POS systems only respond with, "How much did you sell today?", Bizzi responds with, "Did this revenue generate real money? What was the net profit, and where are the risks?"

Bizzi is suitable for businesses with 50 or more employees, multiple departments, a large volume of incoming invoices, and where the CFO needs decision support, not just past data reports.

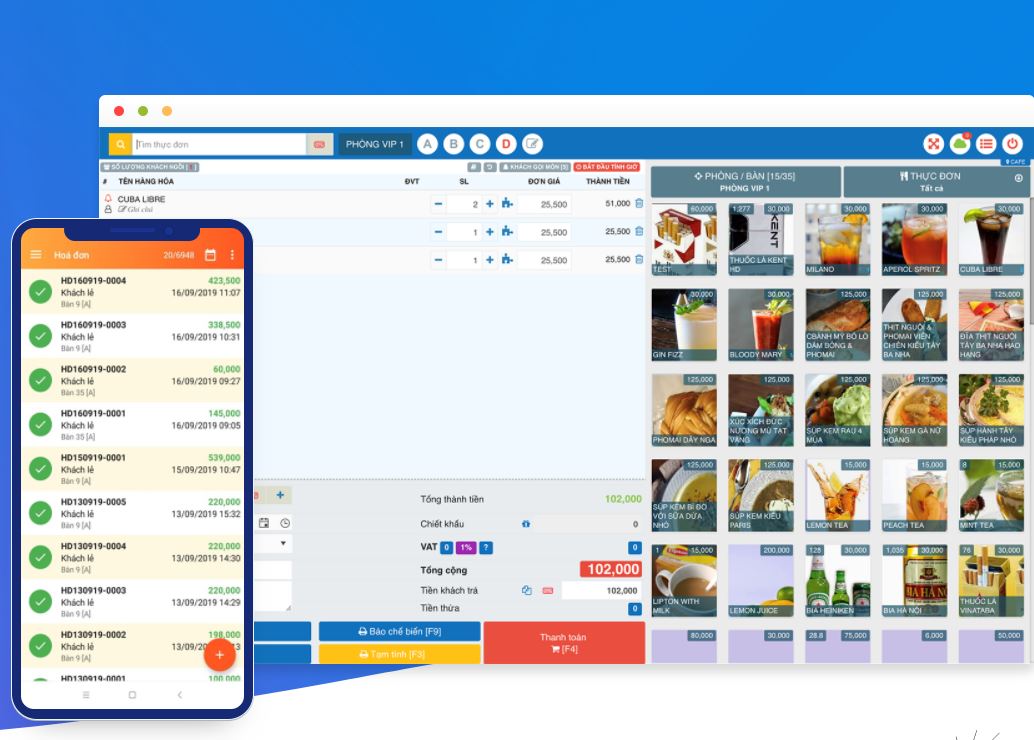

2. Multi-channel sales and revenue management software (POS/Retail)

POS systems are suitable for stores and retail chains, strong in multi-channel revenue recording, but Limitations in controlling costs, accounts payable, and actual cash flow..

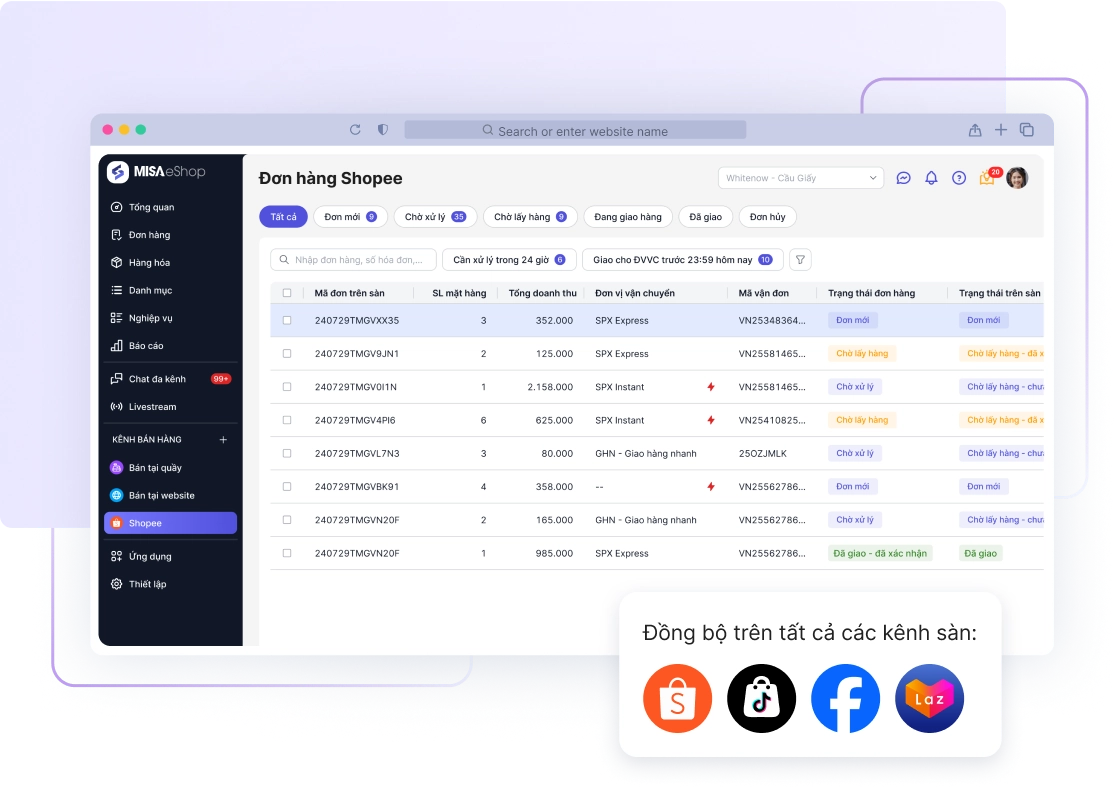

Software such as Sapo, MISA eShop/MShopKeeper, KiotViet, or Nhanh.vn It helps businesses track revenue from stores, websites, and e-commerce platforms. This is the most popular revenue management software class for SMEs and household businesses.

However, the common drawback is Revenue ≠ Cash FlowFloor fees, processing fees, operating costs, and collection delays are often not thoroughly broken down. This makes it easy for net profit to be eroded without the business owner realizing it.

In addition, POS systems lack concepts such as 3-way matching, budget control or variance analysisTherefore, it is not suitable for a CFO-level financial management role.

3. Specialized revenue management software group

Specialized software optimizes operations according to industry (F&B, education, spa, etc.), but it is often Weaknesses in financial consolidation and overall performance analysis..

Solutions such as POS365, Ocha POS, DotB EMS or MasterPro It solves specific operational problems very well: shift management, material consumption planning, tuition fees, or large SKUs.

However, from a CFO's perspective, these revenue management software programs often don't completely solve the problem. cash flow and profit governance, especially when a business expands by opening multiple branches.

4. ERP/CRM software group & advanced financial management.

ERP/CRM is suitable for medium and large businesses that need comprehensive management, but high costs and long implementation time If there is no clear roadmap.

Platforms like MISA AMIS, Odoo, Zoho One or 1C It provides a complete ecosystem, but the deployment time is often lengthy. 3–12 monthsWith costs ranging from several hundred million to several billion VND, ERP systems have become, for many businesses, an "IT project" rather than a tool to support financial decision-making.

5. Payment solutions & manual management tools

Tools like Excel, Loyverse, or payment platforms are only suitable for very small scaleThis carries the risk of inaccuracies and is not scalable as the data grows.

Excel is flexible, but the risk of errors increases with it. geometric progression When the number of transactions is large – something that CFOs often consider a “hidden cost”.

Overview comparison table of revenue management software groups

| Group | Revenue | Expense | Debt | Forecast & FP&A | Fit |

| POS/Retail | ✔️ | ❌ | ⚠️ | ❌ | Shop, small chain |

| Specialized | ✔️ | ⚠️ | ⚠️ | ❌ | Food and Beverage, Education |

| ERP/CRM | ✔️ | ✔️ | ✔️ | ⚠️ | large enterprises |

| Bizzi | ✔️ | ✔️✔️ | ✔️✔️ | ✔️✔️ | CFO, growth company |

Revenue is only meaningful when it is controlled alongside costs and cash flow.

Criteria for selecting revenue management software from a CFO's perspective.

From the CFO's perspective, Revenue is a risk variable.Revenue is not just a number to "show off growth." A revenue management software is only truly valuable when it helps answer three core questions: Is this revenue legitimate? When will it be converted into cash? And what is its actual impact on profit?

Therefore, the first criterion that the CFO considers is data accuracy and integrityThe software must ensure accurate revenue recognition, control end-of-period cut-offs, and store complete audit trails for explanation during audits or tax inspections. If the input data is incorrect, all subsequent reports are meaningless.

Bizzi was chosen by many businesses not because of its ability to "manage revenue," but because it solved problems. The biggest blind spot for a CFO: the relationship between revenue, expenses, and cash flow.By controlling input invoices, operating expenses, and accounts payable, Bizzi helps place revenue within its proper financial context, rather than allowing it to exist as a standalone figure.

Another criterion that CFOs pay particular attention to is early risk detection capabilityBizzi provides real-time data on expenses, invoices, and accounts receivable, helping CFOs see early signs such as expenses increasing faster than revenue, revenue being recorded but not yet received, or discrepancies between planned and actual figures. These are signals that POS systems or end-of-period accounting reports cannot reflect in a timely manner.

Finally, the CFO appreciates the foundations that help Reduce reliance on Excel and manual processing.Bizzi doesn't replace the CFO's analytical role, but it helps standardize incoming financial data so that analyses of revenue, profit, and cash flow are more reliable, especially when combined with FP&A tools like SACTONA.

How does revenue management software differ from sales/POS software?

The difference between POS and revenue management software lies not in the interface or the number of reports, but in... the ultimate goal of the systemSales/POS software focuses on recording sales transactions, while revenue management software focuses on verifying revenue, reconciling accounts receivable, and analyzing profits and cash flow for financial management.

- POS systems are designed for frontline operations: cashiers, store managers, and sales teams. Their primary function is to quickly record transactions, minimize errors at the point of sale, and support basic inventory management. With a POS system, revenue is recorded as soon as an order is paid for or created in the system.

- PRevenue management software views revenue as an incomplete financial chain.Revenue is only considered "completed" when it is recorded in the correct period, reconciled with invoices, accounts receivable are tracked, and the actual money is collected. This brings up concepts that CFOs are interested in, such as Booking vs. Billing, Revenue Leakage, DSO, and cash flow lag.

One major blind spot that POS systems don't address is Multichannel revenue and hidden feesEspecially in e-commerce, POS systems can record successful orders, but they cannot separate platform fees, payment fees, or return fees, leading to net profit being eroded without the CFO noticing in time.

In practice, many CFOs use POS systems for sales operations, but they need a revenue management system at the financial level – where revenue is controlled along with expenses, accounts receivable, and cash flow. Bizzi sits at this level, not replacing POS systems, but complementing them so that CFOs can see the complete financial picture.

Bizzi helps the CFO see net profitIt's not just about revenue. Bizzi doesn't compete with or replace POS systems. Instead, Bizzi plays a role in... The financial control layer behind the POSRevenue data from POS systems is only truly valuable when compared to expense, invoice, and accounts receivable data. Bizzi helps CFOs reconcile these data streams to detect revenue leakage – profit losses that POS systems don't reflect.

For example, with e-commerce revenue, the POS system can record successful orders, but Bizzi helps the CFO see the whole financial picture behind it: exchange fees, payment fees, related operating costs, and when the money actually arrives in the account. This allows the CFO to make an informed assessment. net profit and real cash flow, instead of just looking at nominal revenue.

What components make up a standard CFO revenue management software?

A standard CFO revenue management software must include revenue recognition, invoice and accounts receivable management, data reconciliation, real-time reporting, and the ability to analyze and forecast cash flow to support financial decisions. In the CFO standard, revenue management software should not be designed as separate modules, but rather as closely integrated systems. closed-loop financial process chain.

- Billing & Revenue RecognitionThe system must ensure that revenue is recorded at the right time, to the right recipient, and in accordance with accounting standards. This is fundamental to avoiding reporting errors and audit risks.

- Accounts Receivable & CollectionA revenue management software must have the ability to track accounts receivable in detail, perform AR Aging analysis, and support debt collection. The DSO metric = (Accounts Receivable / Revenue) × Number of Days is an important indicator reflecting revenue quality.

- Reconciliation & Data IntegrityRevenue is only reliable when it is reconciled with invoices, expenses, and related data. The lack of a reconciliation mechanism makes businesses vulnerable to revenue leakage that CFOs may not detect in time.

- Reporting & Real-time VisibilityThe CFO needs to see revenue, accounts receivable, and cash flow in real time, not just wait for end-of-month reports. The ability to drill down from the overview to individual customers, contracts, or sales channels is a key factor in determining the value of the system.

- Forecasting & Variance AnalysisA standard CFO revenue management software must support the analysis of planned-actual discrepancies and cash flow forecasting. This is where many software programs only provide reports but fail to support decision-making.

Bizzi is most heavily involved in the links that directly influence the process. revenue qualityThrough Bizzi Bot, businesses can automatically control and reconcile input invoices, ensuring that expenses related to revenue are recorded correctly, completely, and in the right period. This helps reduce the risk of distorted profits due to incorrect or late expense recording.

In the accounts receivable management area, Bizzi ARM supports tracking Accounts Receivable, sends scheduled debt reminders, and provides real-time DSO data. For CFOs, this is a platform to assess which revenue is truly "quality" and which is negatively impacting cash flow.

Once revenue, expense, and liabilities data are standardized, Bizzi creates a clean financial data layer, ready for reporting and forecasting. Combined with EPM/FP&A tools, CFOs can analyze planned-actual differences, forecast cash flow, and assess the impact of revenue on working capital.

The biggest difference between Bizzi and many other revenue management software is its focus on controlling and optimizing net profit, rather than just displaying revenue. This makes Bizzi particularly suitable for growing businesses with multiple sales channels and those beginning to face cash flow pressures.

Frequently Asked Questions about Revenue Management Software

Below is a summary of answers to some frequently asked questions regarding revenue management software.

Can revenue management software replace an accountant?

No. Software helps accountants and CFOs make better decisions, but it does not replace the professional role and legal responsibilities of an accountant.

How can DSO be reduced using an automated system?

Through scenario-based debt reminders, AR Aging tracking, and late payment alerts, the system helps improve cash flow and reduce revenue leakage.

Can Bizzi replace ERP?

Bizzi doesn't replace ERP, but rather acts as a flexible financial control layer, offering rapid deployment and a focus on cash flow efficiency.

Conclude

Not every business needs one right away. software revenue managementFor small-scale businesses with simple revenue streams, few sales channels, and stable cash flow, managing with POS systems or even Excel might be acceptable in the short term. However, as the business grows, expands its sales channels, generates accounts receivable, and faces cash flow pressures, the revenue figures on the reports will no longer fully reflect the financial reality.

At that point, the question was no longer "whether or not the product would sell," but rather... Does this revenue translate into cash? What is the actual net profit, and where are the risks?This is where the role of revenue management software in financial management becomes crucial. A truly effective system helps CFOs see the entire revenue lifecycle, from recording and reconciliation to managing accounts receivable and payable, and forecasting cash flow and profits.

The major difference between Bizzi and many revenue management software programs on the market lies in this: financial approachWhile POS focuses on sales transactions, ERP focuses on bookkeeping, and CRM focuses on customers, Bizzi focuses on... revenue quality and cash flow efficiencyBizzi not only shows how much revenue is generated, but also helps CFOs understand how much cash that revenue is used to offset costs and how it impacts working capital.

Instead of replacing the entire existing system, Bizzi acts as a replacement. central financial control layerThis connects revenue with expenses, invoices, and accounts payable. As a result, CFOs can reduce financial blind spots, improve data reliability, and make decisions based on actual profitability and cash flow, not just sales figures.

In short, revenue management software Bizzi isn't a tool for "better reporting," but rather a platform that helps businesses protect profits and liquidity as they enter the growth phase. For businesses that have moved beyond manual management, a financial solution like Bizzi can make a significant difference between superficial growth and sustainable growth.

To experience Bizzi's solutions for free, register here: https://bizzi.vn/dang-ky-dung-thu/