Bootstrapping method is mentioned when a startup, opens a company with a limited amount of capital. In this article, Bizzi will help you better understand what it means when it comes to starting a company.

What is Bootstrapping?

In business, the self-advocacy method (English: Bootstrapping) is understood as the entrepreneurs using their own capital to operate the business on their own without mobilizing from outside.

Instead of seeking financial support from investors or borrowing from banks, businesses that perform bootstrapping focus on using available resources to maintain and develop their business.

In the case of a start-up, bootstrapping is usually done using the founder's cash, personal assets, or freelance income to fund the initial business operations. Instead of seeking risky capital from outside investors or taking out a bank loan, founders use available resources to maintain and grow the company.

The bootstrapping approach often requires patience, creativity, and the ability to make the most of existing resources. Founders must carefully manage costs, look for ways to save money, and learn how to make the most of resources.

Features of bootstrapping

A startup must be self-advocating when the founder has strong enough financial resources to nurture the startup project in the early stages. Self-funded startups often have a lean, low-cost operating model with fast inventory turnover.

A bootstrapping company also often adopts policies that allow customers to pre-order products, and use the proceeds from those orders to reproduce, develop, and market their products.

Compared to outside funding, bootstrapping has an advantage for the entrepreneur in maintaining control over the business. However, this form brings great financial pressure for startups, especially when they cannot provide enough capital for the company to achieve the expected growth rate.

How bootstrapping works

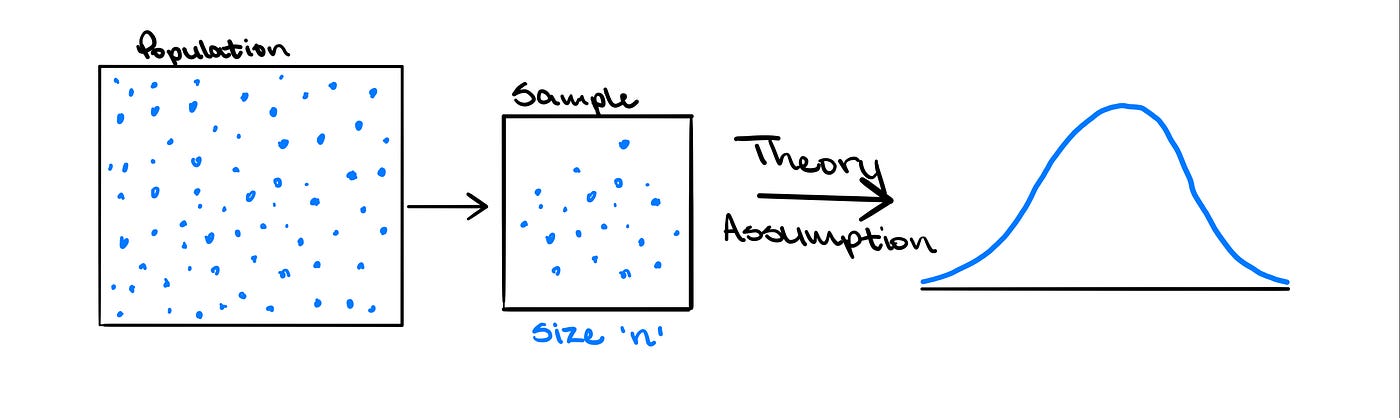

Bootstrapping is a self-sufficient financial strategy in business and startups. This is an innovative and flexible approach that allows businesses to start and grow without depending on external capital. Here's how bootstrapping works in detail:

Use available resources

-

Use personal cash

Founders use cash from personal savings or personal income to invest in the business. This can be done through withdrawing money from a savings account or investing every penny in the original business.

-

Leverage personal property

Founders can use assets such as a house, car, or personal equipment to support the business. Instead of buying new, personal property can be creatively leveraged to reduce initial costs.

Expense management

-

Start-up cost savings

The bootstrapping business seeks to save costs in the start-up phase. This can include renting a reasonable workspace, using affordable technologies and tools, and optimizing the use of the people available within the company.

-

Looking for low cost solution

Instead of spending big on unnecessary goals, bootstrapping businesses look for low-cost solutions and make sound financial decisions. This may include finding low-cost providers, choosing effective advertising campaigns, and optimizing resource utilization.

Looking for freelance income

-

Develop a service or product to make money

An important method in bootstrapping is developing a service or product that customers are willing to pay for. By creating value for customers and collecting money from transactions, businesses can use this income to reinvest and grow further.

-

Take advantage of small business opportunities

Bootstrapping businesses also look for small business opportunities to generate additional income. This may include providing consulting services, leasing properties or taking advantage of small projects that can provide additional income for the business.

Benefits of Bootstrapping

Full control of the business

Bootstrapping allows founders and management team to retain full control over business decisions and direction of business growth. Without having to share control with external investors, businesses can freely make decisions without complying with requests from investors.

Ability to utilize existing resources

Instead of depending on external capital, bootstrapping focuses on making the most of the resources available in the business. This helps optimize the use of existing capital, assets and human resources, while minimizing the risks and costs associated with seeking external funding.

Limit debt and pressure from investors

An important benefit of bootstrapping is minimizing debt and investor pressure. Without paying interest or sharing profits with external parties, businesses can focus on development and growth using internal profits and resources.

Disadvantages of Bootstrapping

Limited expansion and rapid growth

One of the main limitations of bootstrapping is that its ability to expand and grow rapidly is limited due to lack of capital. When there is no financial support from outside investors, enterprises must rely on self-employment profits and self-generated income to reinvest. This can slow expansion and limit your ability to take advantage of new business opportunities.

Difficulty accessing new resources and opportunities

Lack of external funding can make accessing new resources and opportunities difficult. For bootstrapping businesses, finding funding to expand or test new ideas can be difficult. This can lead to limitations in upgrading infrastructure, hiring talented employees, or creating new products and services.

Financial constraints can affect the ability to grow

Bootstrapping can face financial constraints and this can affect the ability of the business to grow. Lack of capital can make it impossible for a business to meet growth and expansion needs, or to launch marketing and promotional efforts to attract new customers. This can interfere with branding, expanding markets, and competing with competitors with more resources.

Despite its downsides, bootstrapping offers many benefits and can be a path to success in startups and business growth. With a proper strategy and careful financial management, bootstrapping can be an effective startup method for founders who want complete control of their business and don't want to depend on external funding. .

How a company grows using Bootstrapping

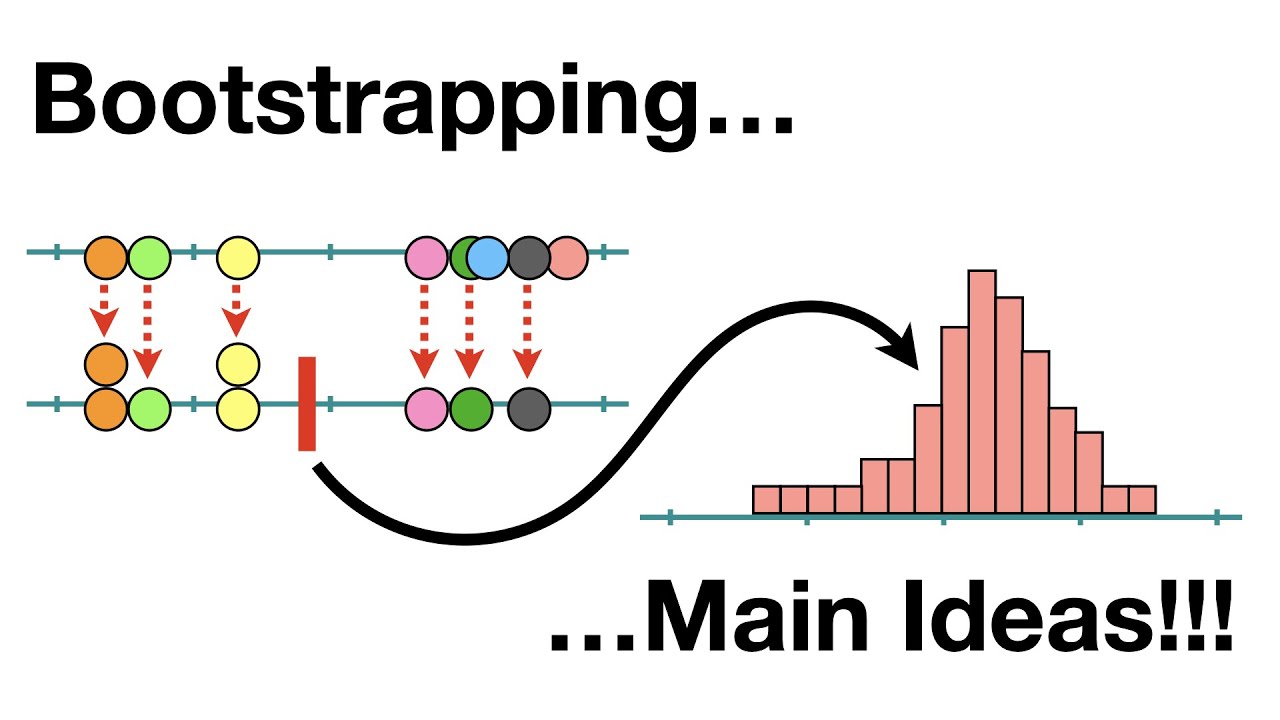

A self-made startup will usually go through two stages:

- State 1: Use your own money. At this stage, startup founders will have to put their own money, be it accumulated savings or cash flow from a side job, another investment or business to raise the startup idea.

- Phase 2: Money sponsored by the customer. When ready to launch the first products, the startup will now raise money from potential customers through pre-orders. This money will be reinvested, rotated many times to create cash flow so that the startup can operate on its own without the founder funding anymore.

After stage 2, the startup can choose to continue operating with cash flow from the business itself or raise capital from outside. In fact, external funding often takes place when the startup is in the saturation stage and must use external investments to stimulate and accelerate business activities.

Startups succeed thanks to Bootstrapping

In fact, there are many successful startups just by Bootstrapping, such as GitHub, Spanx, Airbnb, Mailchimp, etc.

GitHub

GitHub is a popular project management and source code hosting platform widely used in the software development community. The founders of GitHub started out using their personal savings and resources to build the platform. They leverage free development and user communities to create value and attract interest from investors. Eventually, GitHub became a multi-billion dollar company and was acquired by Microsoft in 2018.

Spanx

Spanx is a well-known brand for lingerie, especially underwear and cardigans. Sara Blakely, founder of Spanx, started the company from selling by bootstrapping. She used her personal savings and worked from her apartment on product development and marketing. With creativity and relentless efforts, Sara has built Spanx into a successful international brand, becoming America's first self-made billionaire in the field of lingerie.

Airbnb

Airbnb is a popular worldwide online booking and accommodation sharing platform. Initially, the founders of Airbnb used a bootstrapping strategy to launch the company. They started by renting out their apartment at a big event in San Francisco and using that rent to develop the Airbnb platform.

They leverage their vision and the natural growth of the sharing economy market to attract users and homeowners. With its success, Airbnb has become one of the most significant companies in the travel industry and is worth billions of dollars.

Dell

Entrepreneur Michael Dell founded this iconic brand named after him from his dorm room at the University of Texas at Austin. There, Dell built and sold computers made from off-the-shelf components. He eventually dropped out of school as the business grew. In 2019, Michael Dell was ranked 18th on the Forbes 400 billionaires list.

MailChimp

MailChimp is a popular email marketing platform used by small and medium businesses. MailChimp's founders used a bootstrapping strategy to grow the company from the ground up. Instead of looking for outside investment, they create quality products and services, focusing on building good customer relationships and interactions. MailChimp has built a large user community and has become a highly valued company in the email marketing industry.

Apple

Apple is also a typical bootstrapping startup story, starting with a one-bedroom office in Jobs' parents' suburban home.

Entrepreneurs Steve Jobs and Steve Wozniak founded this mighty company in 1976. But the original headquarters where Wozniak built the Apple I himself is not located in some Silicon Valley technology campus. It was in a bedroom at the suburban home of Jobs' parents. Eventually, the company moved into the garage when they needed more space.

Above are some examples of successful startups and the bootstrapping strategies they used to build and grow their businesses. These stories demonstrate that, despite their downsides, bootstrapping can be a successful route to starting a business and growing a business. Hope the content that Bizzi provides can help your work.

>> See more: Number of accountants: Explaining the term “Account Payable”

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam