In the process of creating electronic invoices, many accountants encounter errors such as incorrect tax codes, customer names, amounts or invoice symbols. These errors, if not handled properly, can lead to legal risks or fines from tax authorities.

This article will guide you in detail how to cancel electronic invoice legally (according to) Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP), along with the necessary minutes, implementation procedures on the software, penalties and important notes to avoid when applying.

When to cancel and when to adjust an electronic invoice?

According to Article 19 of Decree 123/2020/ND-CP, the handling of erroneous invoices depends on the status of the invoice. Enterprises need to cancel invoices in the following cases:

- Invoice has been created but not sent to buyer and found errors.

- Invoice sent to buyer but there is error in tax code, invoice amount, incorrect specifications, quality of goods.

- Tax authorities requested cancellation because the invoice was found to be invalid.

Quick Comparison Table: Cancel Invoice and Adjust Invoice

| Invoice status | Treatment options | Required |

|---|---|---|

| Sent to buyer, undeclared | ✔️ Cancel invoice | Make a record of withdrawal and issue a new replacement invoice. |

| Sent to buyer, declared tax | ❌ No cancellation allowed | Must be established Adjustment invoice. |

Important Note: Never cancel an electronic invoice that has been declared for tax by the seller or buyer. This is a violation of the law and will be severely punished.

How to cancel electronic invoices according to Circular 78?

To cancel an electronic invoice in accordance with the regulations at Clause 1, Article 7, Circular 78/2021/TT-BTC, businesses need to follow these 4 steps:

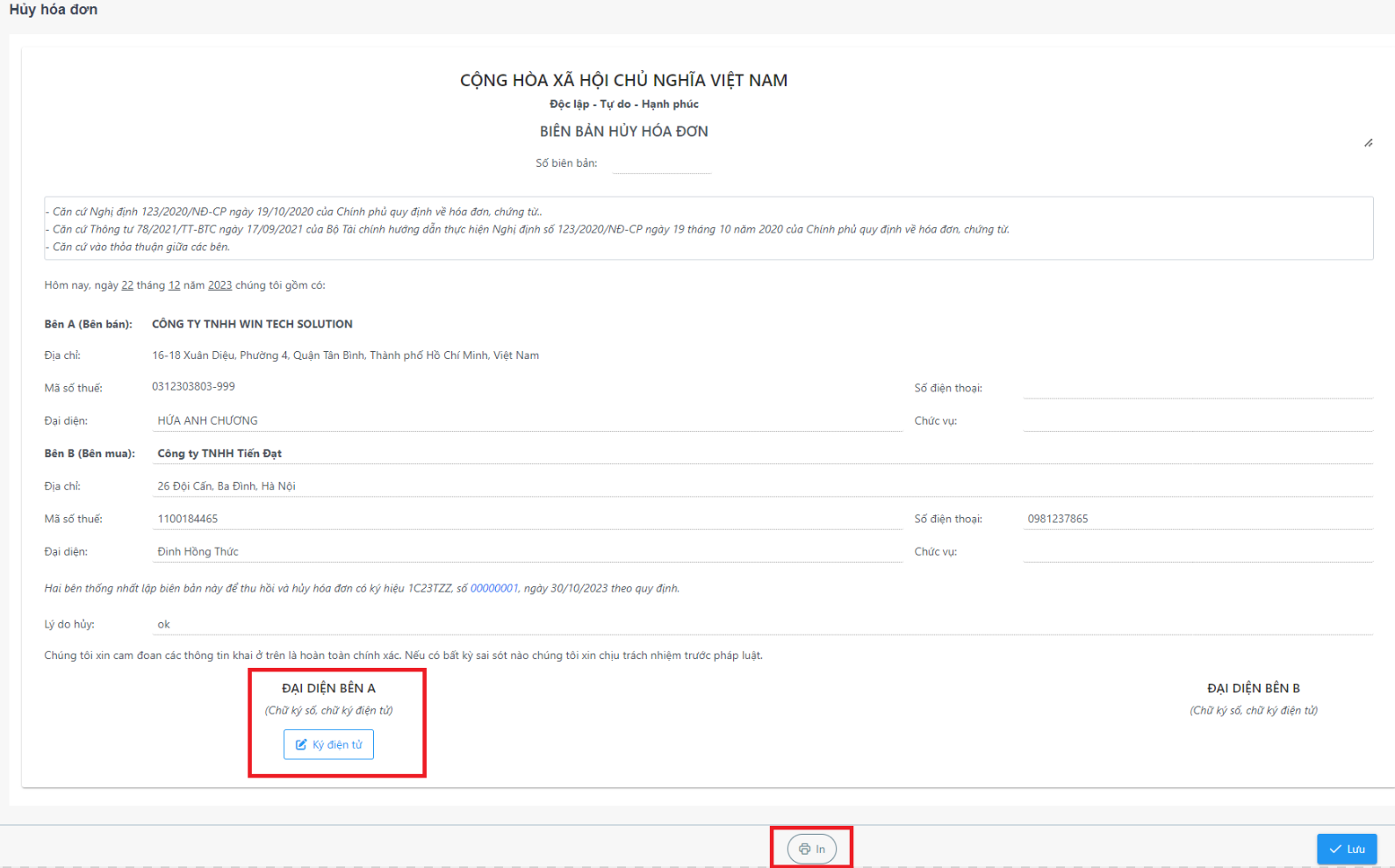

Step 1: Make a record of invoice withdrawal/cancellation

If the invoice has been sent to the buyer, both parties need to make a Record of Invoice Revocation. This document must have the digital signatures of both the seller and the buyer, stating clearly the reason for invoice revocation.

- The minutes must clearly state: invoice number, symbol, date of creation.

- Reason for cancellation (e.g. wrong buyer information, wrong amount).

- Commitment of both parties not to use this invoice for declaration.

In case the invoice is created incorrectly but not sent to the buyer, the seller can cancel it on the software without needing a record with the buyer.

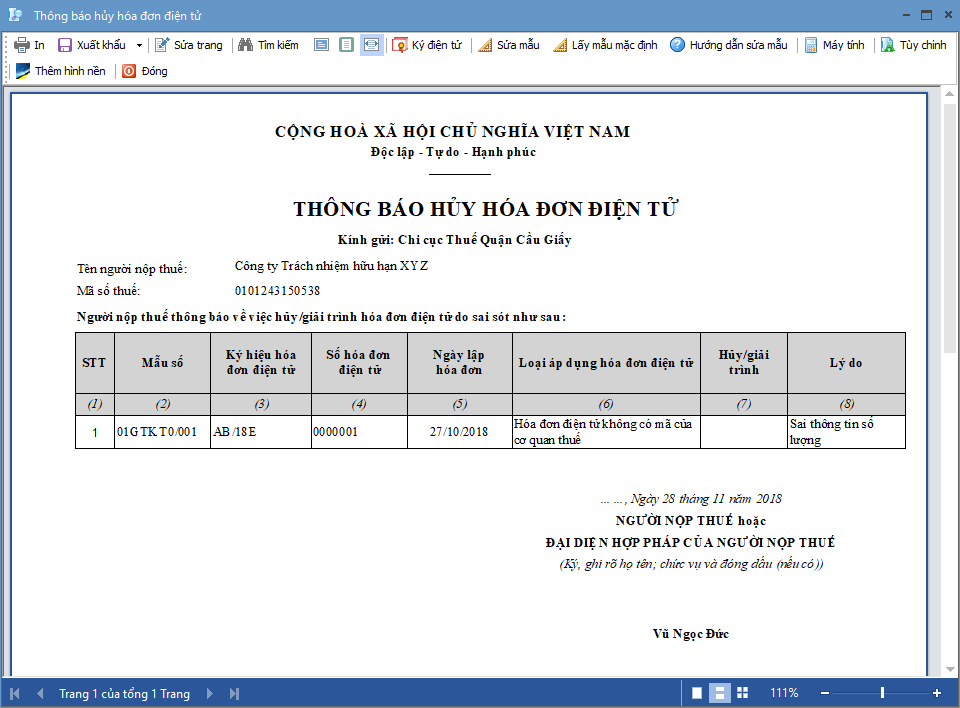

Step 2: Send error notification Form 04/SS-HDDT to the Tax Authority

The seller must send a Notice of Incorrect Electronic Invoice (Form No. 04/SS-HDDT issued with Decree 123) to the tax authority regarding the cancellation of the invoice. This can be done directly on the electronic invoice software that the business is using.

Step 3: Cancel the invoice on the software

- Access to electronic invoice software (B-Invoice, MISA, Viettel, VNPT…).

- Select the “Cancel invoice” function, find the invoice to be canceled and enter the reason.

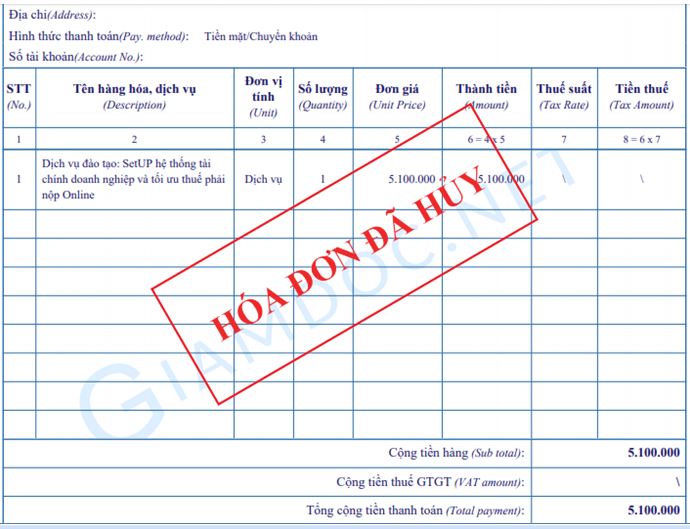

- Perform the cancellation operation. The software will record the invoice in the status “Cancelled”.

*Note: The software must ensure that the entire invoice cancellation history is saved for future inspection and examination by tax authorities.

Step 4: Create new electronic invoice and store records

After cancellation, the enterprise needs to create a new electronic invoice to replace it. The new invoice must clearly state: "This invoice replaces invoice number [Old invoice number], symbol [Old invoice symbol], date [Date of old invoice]".

All relevant records must be stored electronically for at least 10 years as required, including:

- Invoice withdrawal/cancellation record.

- Error notification Form 04/SS-HĐĐT has been sent to the tax authority.

- New invoice has been created to replace.

Important notes when canceling electronic invoices

To ensure legal compliance and avoid risks, accountants should keep in mind the following points:

- Before canceling: Always double-check the status of the invoice. Has it been sent to the buyer? Has it been declared for tax? This is the deciding factor in whether it can be canceled or adjusted.

- When performing: A written agreement is required if the invoice has been sent. Make sure the software saves the cancellation history and successfully sends the Form 04/SS-HĐĐT notification to the tax authority.

- After cancellation: Absolutely do not use the canceled invoice for declaration or accounting. Immediately create a new invoice to replace it and make sure it has the note “replacement for invoice number…”.

What is the penalty for canceling an electronic invoice in violation of regulations?

According to Decree 125/2020/ND-CP, canceling invoices incorrectly can lead to serious administrative penalties. Businesses should pay special attention to:

| Violation | Fine (VND) | Legal basis |

|---|---|---|

| Do not create an Error Notice (Form 04/SS-HDDT) when canceling. | 2,000,000 – 4,000,000 | Article 29 |

| Incorrect or incomplete content on invoice withdrawal minutes. | 2,000,000 – 4,000,000 | Article 29 |

| Lost, burned, damaged canceled invoices. | 4,000,000 – 8,000,000 | Article 26 |

| Use invoices that have been canceled for transactions and tax declaration. | 20,000,000 – 50,000,000 | Article 28 |

Instructions for canceling issued electronic invoices on B-Invoice

B-Invoice software provides a clear and compliant invoice cancellation process. Here are the detailed steps:

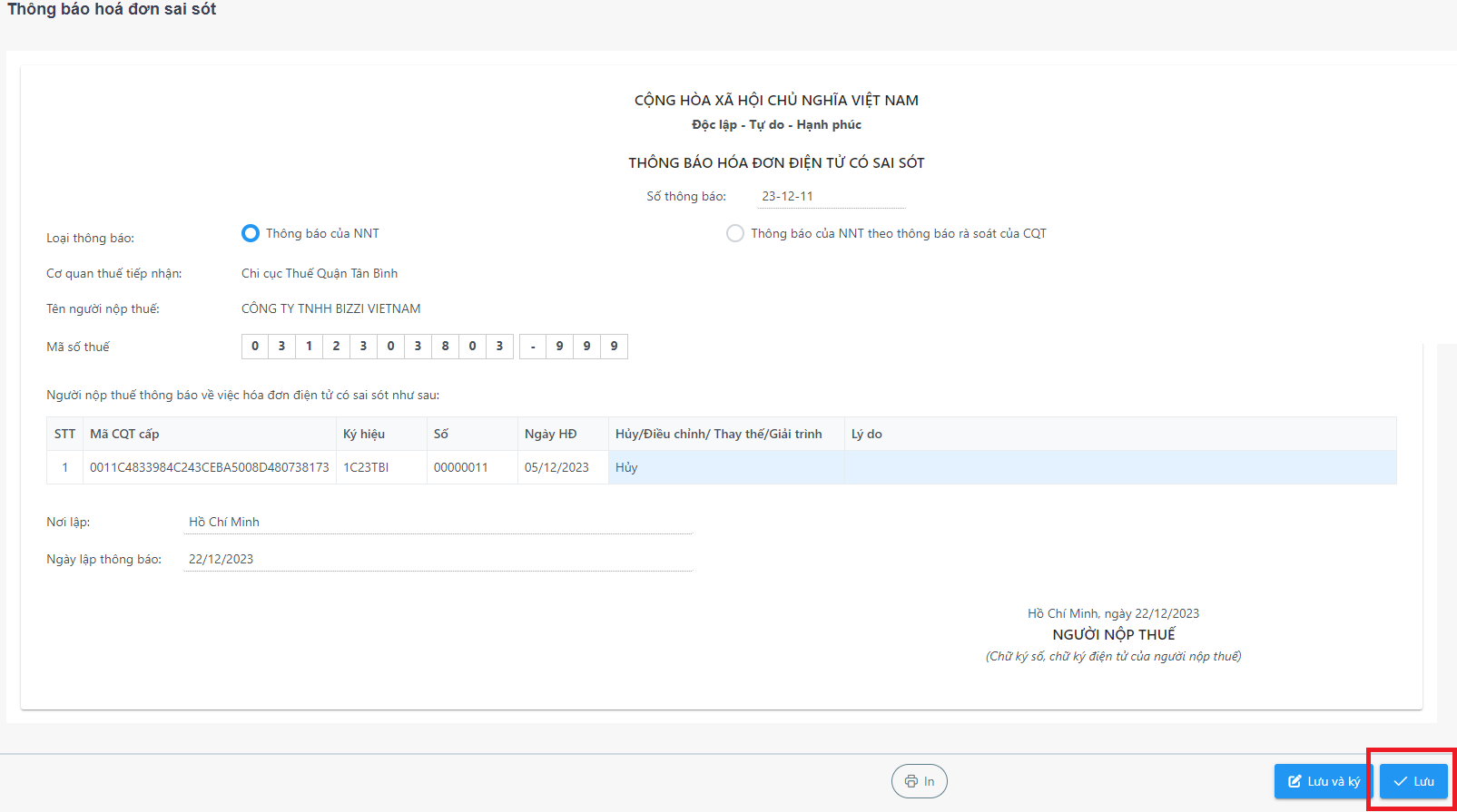

Step 1: Create Incorrect Invoice Notification (Form 04/SS-HDDT)

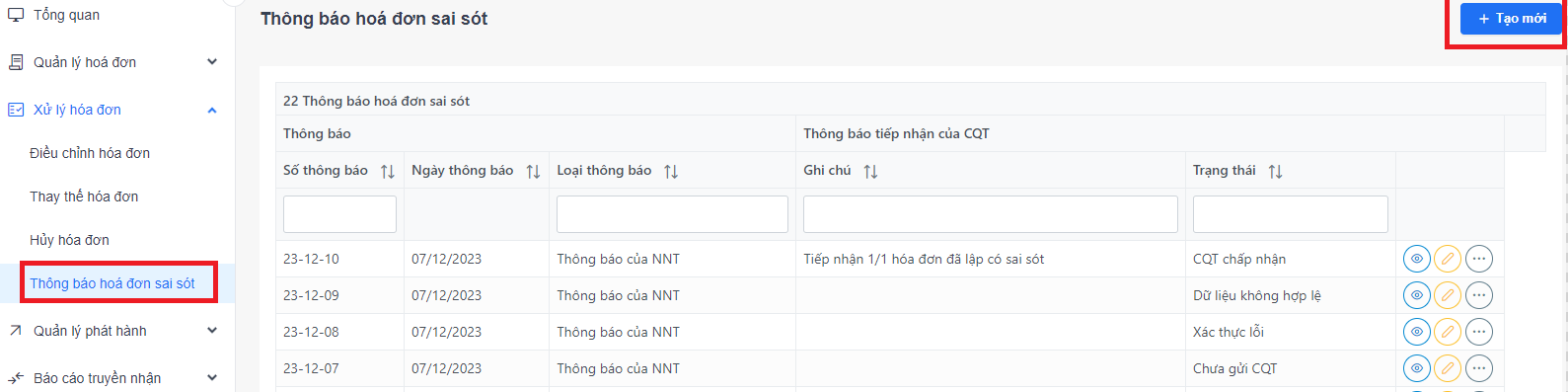

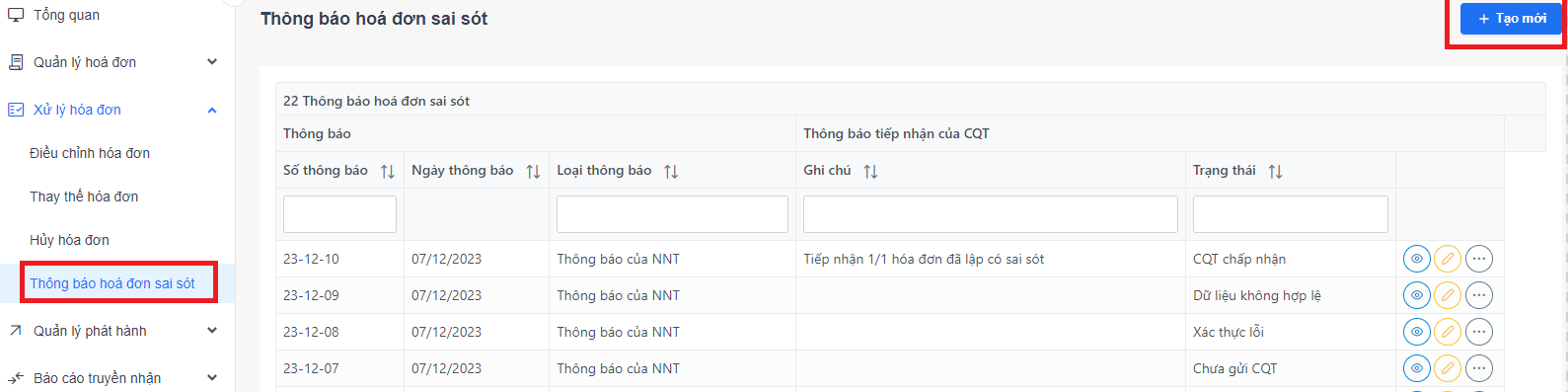

On the Menu bar, go to “Process invoices” > “Report incorrect invoices” > “Create new”.

Use filters to search for invoices that need error reporting.

Select the processing method as "Cancel" and enter “Reason for reporting error”. Once done, press "Save" to create a notice and send it to the Tax Authority.

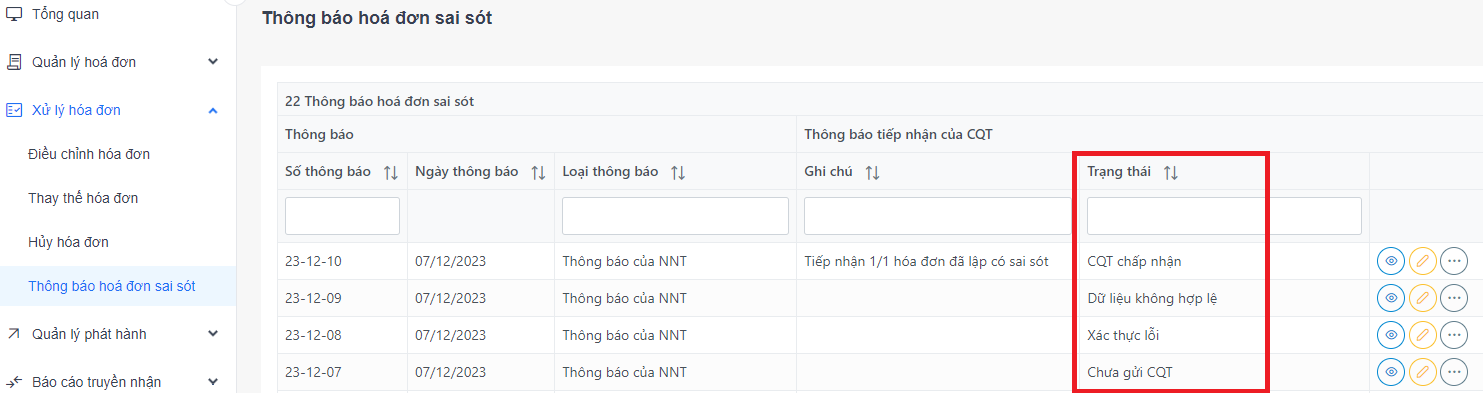

The system will update the status of sending notifications and responses from the Tax Authority.

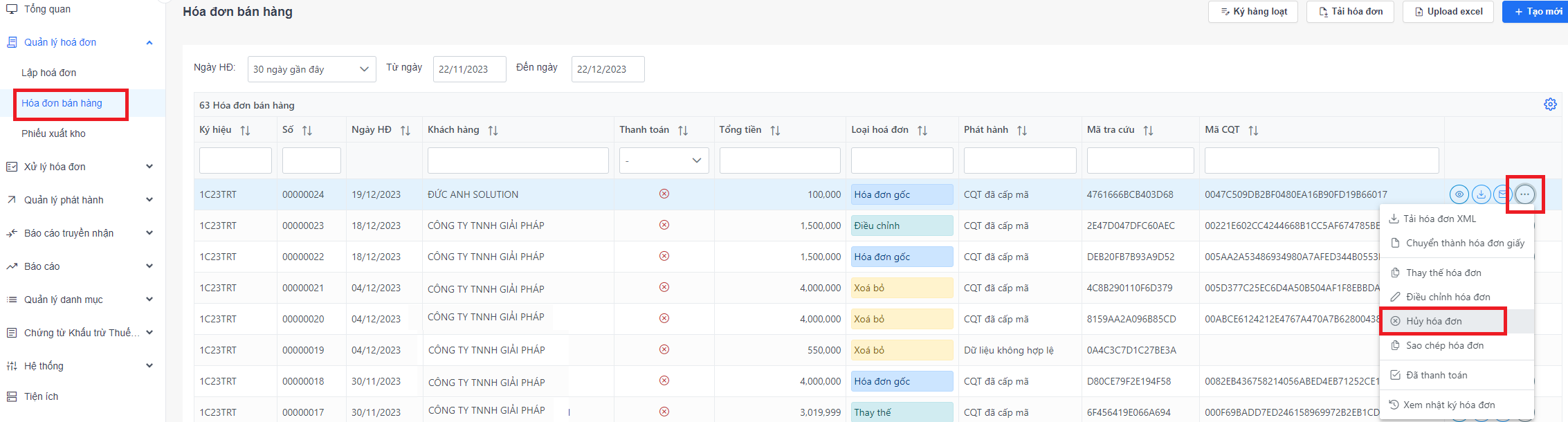

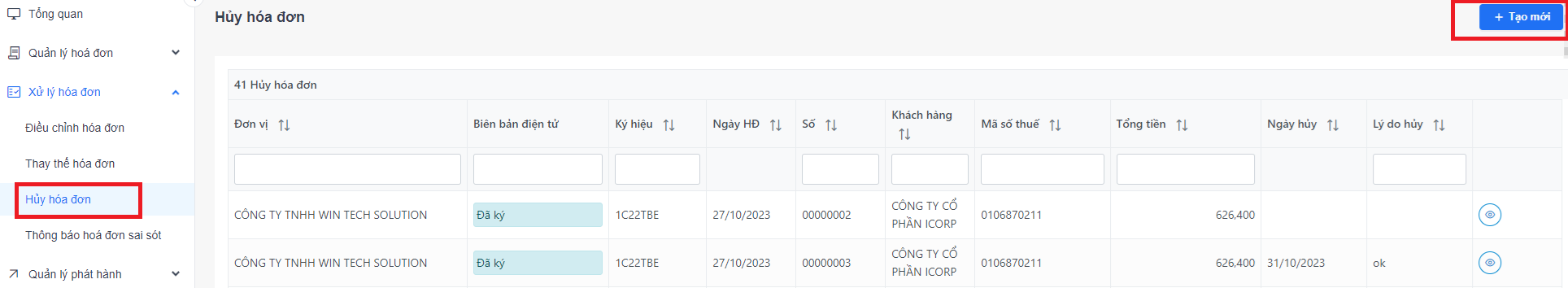

Step 2: Cancel invoice on the system

Once the Notice of Error is accepted by the Tax Authority, you can proceed to cancel the invoice.

Method 1: On the "List of Sales Invoices" screen, find the invoice to be canceled and select the function “Cancel invoice”.

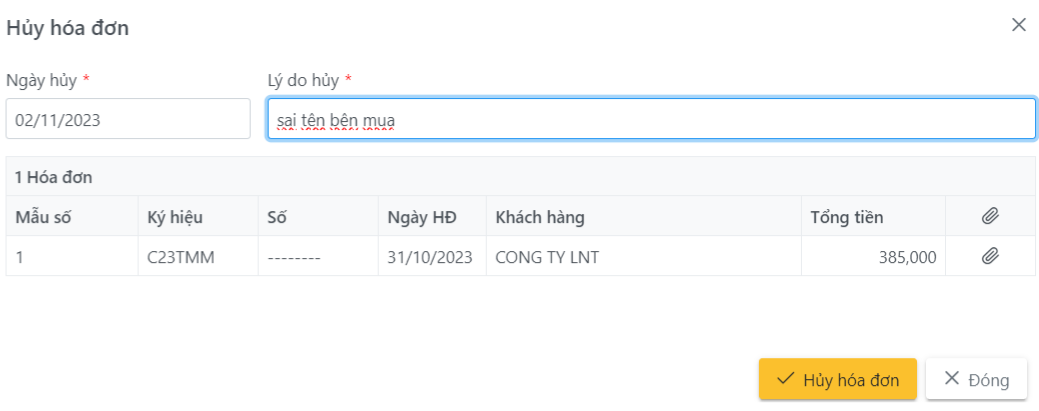

Enter “Reason for cancellation” and confirm.

Method 2: Go to section “Process invoice” > “Cancel invoice” > “Create new” and select the invoice to cancel from the list.

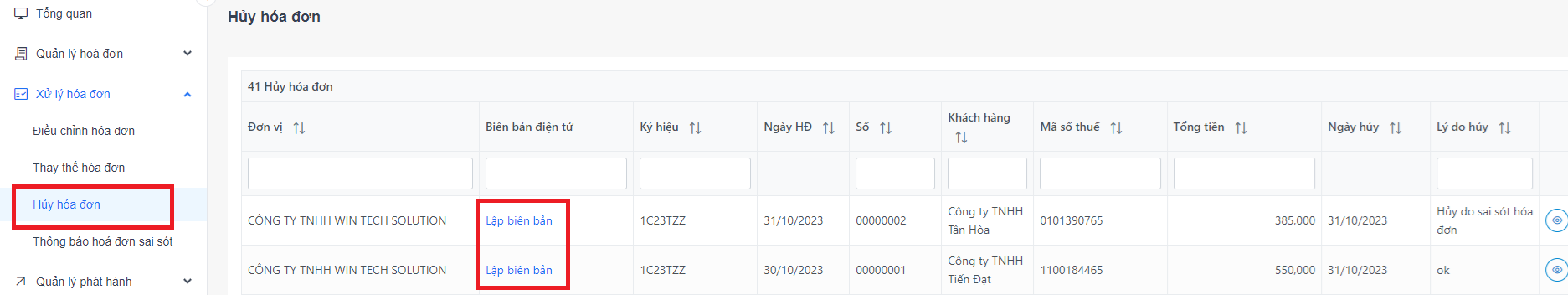

Step 3: Create and store the Invoice Cancellation Record

If you need to make a record, go to “Process invoice” > “Cancel invoice”, find the canceled invoice and select "Make a record".

Enter the minutes number, check the information, then electronically sign and press "Print" to download PDF file for storage.

This record must be signed by both parties and kept as legal evidence.

“If you use other systems such as MISA, Viettel, VNPT,… the processing procedure will be similar, including the following steps: reporting errors, making a record (if necessary), canceling and creating a new invoice. Refer to the supplier's instructions for the most accurate operations.”

In short, to ensure legal compliance and avoid fines, businesses need to cancel electronic invoices according to regulations, at the right time and following the right procedures. Understanding the rules regarding when to cancel, the steps to take, and reporting obligations to tax authorities is key to helping accountants confidently handle any errors.

Experience Bizzi Bot – Accountant's powerful invoice processing assistant

Applying smart AI - RPA technology, Bizzi Bot's ability can automate 90% of accountants' invoice processing work from "receiving invoices" to "transferring data to accounting software" with an accuracy of up to 99.9%, helping to save 80% of time and 50% of costs for businesses.

Increasing productivity

Each business after registering with Bizzi will be given a separate email integrated with Bizzi Bot. When the supplier sends the invoice to email, millions of bots will help the accountant download the invoice, check the validity and legitimacy of the invoice, etc., and will signal green if the invoice is approved and red if the invoice is approved. The application is in the "at-risk" category. After the accountant finishes checking and clicking "Approve", the data will be automatically retrieved to the accounting software.

Reduce errors, lost invoices

No more worrying about incorrect input, missing entries, or lost invoices. Bizzi is a diligent and meticulous assistant that scientifically manages all paper and electronic invoices for you in one place.

Affordability

Package design services according to the size of the business. The cost of a bill is cheaper like a glass of iced tea.

Smart comparison

Bizzi's intelligent algorithm compares each line of invoices and POs in real time, helping to detect discrepancies quickly.

Speed up approval

Bizzi supports accountants in approving documents and papers for employees anytime, anywhere via computer or phone quickly and easily.

Supplier management

Confirm electronic invoice, PO and communicate with your suppliers easily. Manage payment due dates and automatically confirm invoice status with vendors

Expense management

Digitize the entire process of creating payment requests and approving expenses from departments. Expenses for travel, reception, shopping, etc. are managed transparently and effectively.

By automating the accounting process with robots, Bizzi's RPA technology optimizes workflow, helping businesses increase productivity, reduce costs as well as optimize business operations. In particular, limiting the risks of errors with an accuracy of 99.9% and ISO 27001 certification for information safety and security helps businesses accelerate breakthroughs on the digital transformation journey.

In addition, Bizzi Bot's ability to work 24/7, without taking leave, sick leave, or quitting work... ensures smooth and seamless work progress. In short, in the context of businesses needing to optimize costs and improve business efficiency, integrating solutions electronic invoice management will bring many advantages in management at state agencies, including tax authorities.

If your business is interested in a powerful assistant tool for accountants, supporting the cancellation of electronic invoices, then experience Bizzi right away:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

See more: