Other Expenses that are not deductible when calculating corporate income tax.With deductible expenses for corporate income tax purposes, the more standardized a business is from the start, the lower the risk of being disqualified during tax settlement. For expenses to be deductible for corporate income tax, invoices are only a necessary condition. The sufficient condition lies in the documentation, procedures, and the ability to prove that the expenses are linked to revenue-generating activities.

This article by Bizzi will provide comprehensive information on the conditions for deductible expenses when calculating corporate income tax, and guide you on how to effectively manage deductible expenses, which not only helps businesses legally reduce their tax liability but also enhances their long-term financial management capabilities.

What are deductible expenses when calculating corporate income tax?

Deductible expenses for corporate income tax purposes are those expenses actually incurred, accepted by tax laws, and deductible from revenue when determining the taxable income of the enterprise.

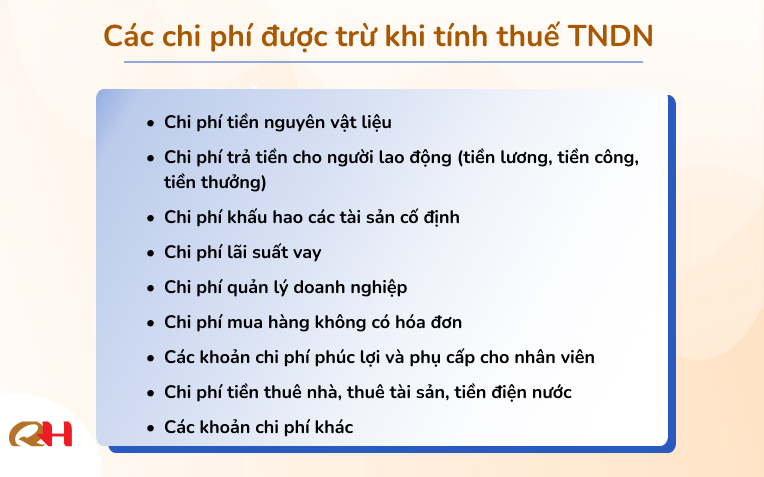

Common categories of reasonable expenses when calculating corporate income tax.

| Cost group | For example |

| Salary and allowance costs | Salary, bonuses, social insurance, and benefits are within acceptable limits. |

| Cost of raw materials | Purchasing goods and supplies for production and business operations. |

| Service costs | Outsourcing, transportation, repair |

| Depreciation expense | Fixed assets meet the eligibility criteria and are depreciated correctly. |

| Financial costs | Interest rates within acceptable limits. |

| Management costs | Stationery, electricity, water, office rent |

Conditions for expenses to be considered reasonable when calculating corporate income tax and to be deductible.

An expenditure deductible when calculating corporate income tax. If while simultaneously meeting the following three conditions:

Arose from practical needs, serving production and business activities.

- Directly or indirectly related to revenue-generating activities

- Suitable for the registered business activities.

We have all the necessary legal invoices and documents.

- Valid electronic invoice

- Supporting documents: contract, acceptance report, list of items, decision, etc.

- The invoice content reflects accurate transaction

Payment is made according to regulations.

- Invoice from 20 million VND or more must pay cashless

- Transfer the right target audience, with valid bank documents

What are the most common categories of deductible expenses when calculating corporate income tax?

Below is List of the most common deductible expense categories when calculating corporate income tax.This is compiled based on actual tax audit and settlement data, helping businesses. Easy to review and compare:

Cost of raw materials and goods

- Purchase raw materials directly for production.

- Buy goods to resell.

- Packaging, accessories, and consumable tools.

Personnel costs (Salary – Bonuses – Benefits)

- Salary and wages as per employment contract.

- Allowances and subsidies (meal allowance, fuel allowance, telephone allowance, etc.)

- The reward system has clear regulations and decisions.

- Social insurance, health insurance, unemployment insurance contributions are paid by businesses.

- Welfare expenses (weddings, funerals, vacations, etc.) ≤ 1 month's average salary per year

Outsourcing service costs

- Hiring transportation and logistics

- Hire consultants, accountants, auditors, and legal professionals.

- Hire security guards, cleaners, IT staff, marketing personnel.

- Renting machinery, equipment, and factory space.

Rental costs

- Rent office space, warehouses, and factories.

- Rent cars and machinery.

- Renting property from an individual (with complete tax records provided on behalf of the individual)

Asset depreciation expense permanent

- Depreciation of machinery, equipment, and factory buildings.

- Depreciation of vehicles used in production and business activities.

Financial costs

- Interest on loans for production and business activities

- Interest on loans is subject to the amount of the registered capital contributed.

- Interest rates must not exceed the limits stipulated by tax regulations.

- Stationery

- Electricity, water, internet

- Entertainment expenses, travel expenses (with supporting documents)

- Conference and personnel training expenses.

Cost of sales

- Advertising, marketing, and promotional expenses.

- Sales commissions and discounts

- Packaging and shipping costs

- Support for dealers and distributors.

Cost of tools and equipment

- Small value tools and equipment

- Allocate costs according to the time of use.

- There is a clear handover and allocation record.

Other expenses are deductible according to regulations.

- Provisions for contingencies have been set aside in accordance with regulations.

- Environmental costs, waste treatment

- Taxes and fees that are allowed to be included in expenses (except corporate income tax)

What are some of the expenses that are "thought" to be deductible but are most often disallowed?

Tax authorities don't just look at whether or not there's an invoice, but also consider:

- Procedure

- Time

- Payment methods

- Partner

- Attached documents

Just one broken link can cause a legitimate expense to be disallowed. Below are some expenses that are "thought" to be deductible but are most often disallowed during corporate income tax audits and settlements.

There is an invoice but no acceptance/handover.

This type of expense does not demonstrate that the service/goods were completed and served the business operations. The expense is disallowed due to a lack of evidence of actual occurrence, even with a valid invoice.

There was a contract, but the payment method was incorrect.

Expense kDoes not meet payment conditions cashless with invoices exceeding 20 million. Therefore, ccost Not deductibleThe invoice is "invalid" for tax purposes.

Reasonable costs but out of sync

This type of expense cannot be substantiated. the time of occurrence associated with the tax period. Expense Excluded from the current settlement period., which increases taxable income.

Costs have a ceiling, but the ceiling isn't being tracked.

Businesses exceed the limit without separating the excess amount. The excess amount is disallowed, easily leading to retroactive tax collection and late payment penalties.

Supplier-related costs and risks

The problem stems from weak documentation and unreliable sources of funding. The expenses were... in-depth examinationThey are easily disqualified if they cannot prove the entire transaction chain.

New regulations on deductible expenses for corporate income tax purposes, updated for 2025-2026.

Below is a summary of notable new points regarding reasonable expenses when calculating corporate income tax for the period 2025–2026, explained according to accounting and tax practice logic, based on the Corporate Income Tax Law 2025 (effective from October 1, 2025, Article 9 – according to the Legal Library):

Re-establishing the framework for deductible expenses when calculating corporate income tax (Article 9 – Corporate Income Tax Law 2025)

The law standardizes the principle: Deductible expenses = expenses serving production and business activities + sufficient legal documentation + not included in the exclusion list. This reduces the previously "open" interpretation and tightens the requirement for proof.

Actual impact:

- It's not just about "real spending," but it must also:

- Compatible with revenue-generating activities

- Proven the economic nature of the transaction

- Business We need to manage records from the beginning.It cannot be "patched" during the final settlement.

Clarifying the cost group for scientific research – innovation – digital transformation

The law specifies the expenditures for:

- Research & Development (R&D)

- Innovation

- Digital transformation (infrastructure, software, technology solutions)

Key conditions for deduction:

- Serving directly the production and business activities.

- Have:

- Project/Plan

- Contract – Acceptance

- The result or output

Meaning: To open up clearer "legal avenues" for expenses that were previously suspected of being "future expenses" or "non-revenue generating expenses".

Record the costs associated with net zero emissions reduction (ESG).

Notable new features:

- For the first time, the law clearly addresses the costs of reducing greenhouse gas emissions and protecting the environment, aiming for net zero emissions.

- Condition: related to the business operations of the enterprise.

Examples of things that can be subtracted:

- Invest in improving processes to reduce emissions.

- Costs of measuring and reporting emissions.

- Environmental consulting and technology solution costs

Important note: Simply "because it's ESG" doesn't automatically qualify for deductions. A reasonable, direct or indirect connection to the business must be demonstrated.

How to handle and prevent deductible expenses when calculating corporate income tax.

Below is How to handle and prevent disallowed expenses when settling corporate income tax., presented according to Practical thinking for CFOs/Chief Accountants, not theoretical in nature.

How to handle expenses that are at risk of being disallowed when settling corporate income tax.

When reviewing expenses before the tax year, the first thing a business needs to do is not rush to decide "to discard or keep," but rather... Classify costs according to the likelihood of completing the documentation..

Group A – Documents can be supplemented

- Lack of acceptance and handover

- Lack of decisions and regulations

- Lack of proper payment documentation.

- Outdated but with justifiable adjustments.

Group B – Must be eliminated

- Exceeding the expense limit (benefits, clothing, etc.)

- Interest on the loan corresponding to the unpaid principal.

- Cash payments exceeding 20 million cannot be modified.

- The invoice from the supplier is risky and lacks proof of the transaction.

After categorization, businesses need to review each expense based on three core pillars: contracts, acceptance and handover, and payment. Each expense needs to be checked comprehensively:

- Contract: content – scope – timing

- Acceptance/Handover: Confirmation of Completion

- Payment: by the correct method and on time.

If even one pillar collapses, the reasonable cost can be disqualified.

Regarding the handling of the declaration, it should be noted that non-deductible expenses do not necessarily mean they must be written off from the accounting records.

- Non-deductible expenses are still accounted for normally.

- When settling accounts:

- Add up the amounts at item B4 – Non-deductible expenses (03/TNDN)

- Prepare a detailed internal explanation table: Reason for exclusion – Legal basis – Impact on tax amount

Taking proactive steps to correct mistakes helps reduce the risk of being accused of wrongdoing.

Preventing costs from being eliminated at the source: control them as soon as they arise.

To minimize deductible expenses when calculating corporate income tax, businesses need to shift their mindset from "end-of-period review" to Control costs right from the moment they arise.An effective expenditure approval process is typically designed in three layers.

Grade 1 – Request for payment

Clearly state the purpose, cost categories, and beneficiaries.

Class 2 – Documents

- Bill

- Contract

- Acceptance/Handover

- Relevant regulations

Level 3 – Payment Reconciliation

- Payment method

- Time

- Compare the limits and cost ceilings.

When an expense doesn't meet these three criteria, stopping the payment early on can help avoid future risks.

In addition to processes, businesses need to establish "warning principles" for each cost category.

- Benefits: Warning when approaching one month's average salary.

- Clothing → Warning: Exceeds 5 million VND/person/year

- Invoices exceeding 20 million VND must be paid via cashless method.

- Individual hire → mandatory tax filing

Another common weakness lies in record-keeping. When invoices, contracts, and acceptance documents are stored haphazardly in multiple locations, it becomes difficult for businesses to demonstrate the continuity of transactions. Instead, storing them in "transaction files," meaning each expense corresponds to a complete set of records, significantly enhances the ability to defend expenses during audits. This approach not only saves retrieval time but also clearly demonstrates the economic nature of the transaction.

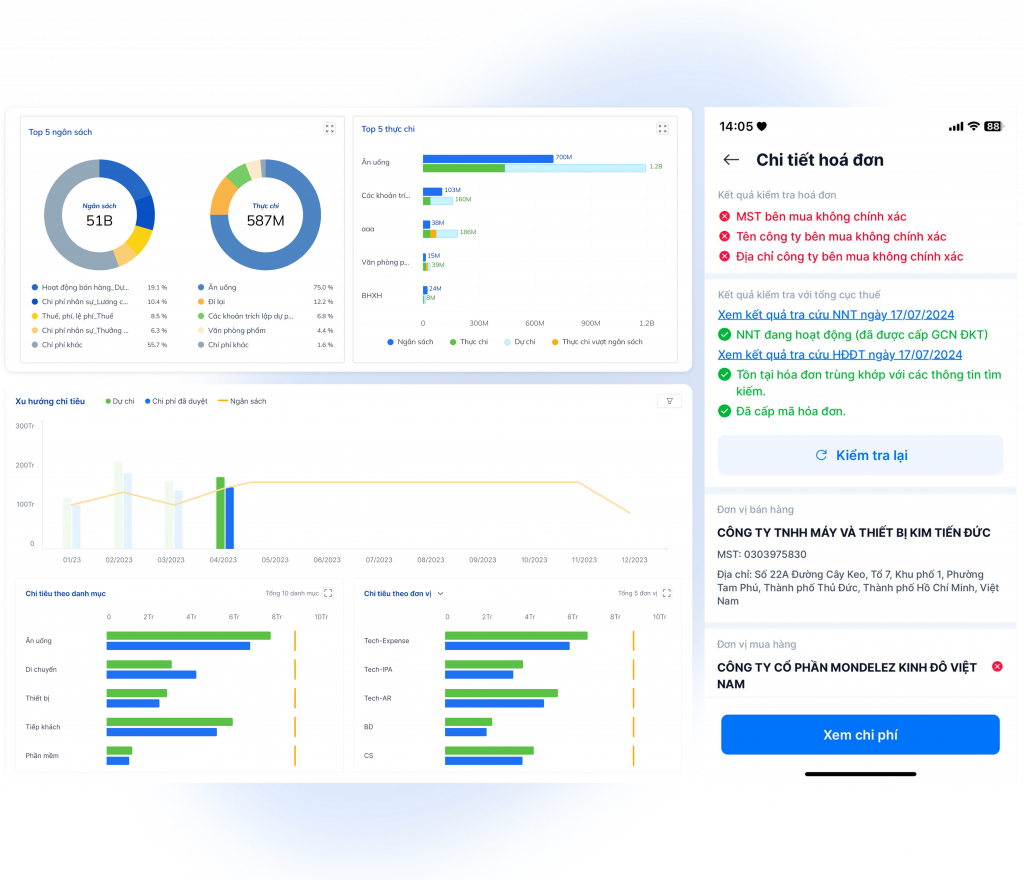

The role of technology in controlling deductible costs when calculating corporate income tax.

In fact, Expenses disallowed during corporate income tax settlement rarely stem from a "lack of understanding of the law.", which comes from:

- The file was incomplete at the time of issue.

- Incorrect payment method was made, but the error was discovered too late.

- No control over cost ceilings.

- The relationship between costs and revenue-generating activities could not be demonstrated.

These are the points Excel and manual checks are very easy to miss.This is especially true when the business has large costs, multiple departments, and numerous suppliers.

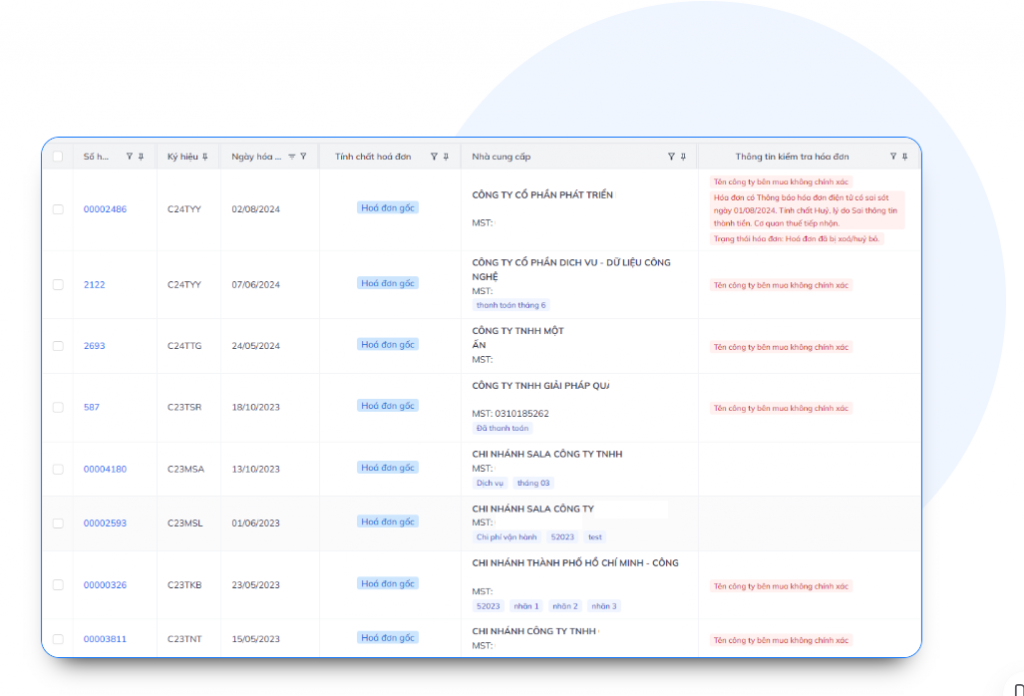

Bizzi doesn't replace accountants or tax preparers, but rather acts as a substitute. intermediate control layer, help businesses Prevent the risk of expenses not being deductible from the moment they are incurred., instead of "firefighting" at the end of the term.

1. Standardize the expenditure approval process – prevent risks right from the expenditure request stage.

One of the reasons why expenses are disqualified is The expenditure request does not specify the purpose and nature of the expense.This leads to incomplete documentation during the settlement process.

Bizzi helps businesses:

- Standardize the expenditure request form for each individual tax expense group (human resources, services, outsourcing, benefits, marketing, etc.)

- Required declaration:

- Purpose of expenditure

- Beneficiaries

- Department/Project involved

- Link the expenditure to specific business activities, creating a trace to prove that the service costs generated revenue.

This helps reduce costs. Having a solid "tax logic foundation" right from the start.Instead of having to provide explanations only at the time of final settlement.

2. Group invoices and supporting documents into separate "transaction files".

A very common risk during tax audits is: There are invoices – but not enough contracts, acceptance certificates, or related decisions can be found.

Bizzi helps transition from discrete storage to Stored as part of a transaction record., in which each expenditure is fully accounted for:

- Electronic invoice (XML + PDF)

- Contract

- Minutes of acceptance / handover

- Internal decisions and regulations (if any)

- Payment documents

When settling accounts, accountants don't have to "request documents," but can... Issue the complete set of expense documents. in just a few minutes.

3. Point out missing documents and warn of risks before accounting and payment.

Instead of discovering ineligible charges after the final settlement, Bizzi offers the following support:

- Warning when:

- Lack of acceptance/handover

- Lack of contracts

- Lack of decisions and regulations for specific expenditures.

- Block or alert incorrect payment method:

- The bill was over 20 million VND but paid in cash.

- Incorrect payment made on the invoice.

This is a key point that helps significantly reduce the group of reasonable expenses that are supposed to be deductible when calculating corporate income tax, but are most often disallowed in practice.

4. Control cost ceilings and sensitive expenses according to tax logic.

Expense categories with caps or those that are easily scrutinized (benefits, attire, entertainment, interest payments, etc.) can easily exceed limits if not closely monitored.

Bizzi supports:

- Attach warning threshold by cost group

- Track expenses by real time, not waiting until the end of the year to discover exceeding the ceiling.

Businesses should proactively make adjustments within the year to avoid having expenses disallowed and taxes levied later.

5. Supplier risk warning – reducing the risk of costs being traced back to their source.

Even if the costs are real transactions, invoices from risk suppliers The expense may still be disallowed if the entire transaction chain cannot be proven.

Bizzi supports:

- Check the supplier's tax identification number and operational status.

- Warning:

- The supplier has ceased operations.

- There are signs of invoice risk.

- Flag risks for accounting purposes. Prioritize a more thorough review of the documents.

Reduce the risk of costs being disallowed due to "partner" issues, which are difficult to address if detected late.

6. Avoid changing accountants – this helps accountants avoid having to "fix problems during the final accounting period".

The most important point in Bizzi's approach is:

- This does not replace accounting and tax practices.

- Do not interfere with professional decisions.

- This helps accountants have enough data, records, and early warnings to make the right decisions.

As a result, businesses:

- Reduce end-of-period settlement pressure.

- Reduce the risk of expense disallowances, retroactive collection, and penalties.

- Improving long-term cost management capabilities goes beyond simply "paying taxes."

Controlling deductible expenses for corporate income tax purposes is not an extra task at the end of the year, but rather a management capability that needs to be designed from the moment the expenses are incurred.

Technologies like Bizzi act as a preventative control layer, helping businesses not only reduce taxes legally, but also build a transparent, robust financial system that is prepared for any audit or settlement.

Answering frequently asked questions about deductible expenses when calculating corporate income tax.

Below are answers to frequently asked questions about deductible expenses when calculating corporate income tax, highlighting reasonable expenses for corporate income tax purposes.

What documentation is required for entertainment expenses to be deductible?

Entertainment expenses not only require valid meal receipts but also proof that the purpose served business operations. In practice, tax authorities often require additional supporting documents such as the decision to entertain guests, the content of the meeting, the guests being entertained, or the connection to a specific contract or project. If only meal receipts are provided without clarifying the reason for entertaining guests, these expenses are easily assessed as personal expenses and disallowed during tax settlement.

Are contracts and acceptance procedures mandatory for outsourcing costs?

In principle, outsourcing costs are almost the same. A contract is required.Especially for consulting, marketing, IT, maintenance, and outsourcing services, in addition to contracts, acceptance reports or documents confirming service completion are important evidence to prove actual costs incurred.

In cases where only an invoice is available without a contract or acceptance certificate, tax authorities often suspect the authenticity of the transaction and the type of expense.

Can cash payments exceeding 20 million VND be deducted from the tax?

According to regulations, invoices for the purchase of goods and services are valid. From 20 million VND or more (including VAT) Only non-cash payments are allowed to be included as deductible expenses.

If a business has paid cash for an invoice exceeding 20 million VND, even if the invoice is valid and the expense is for production and business purposes, this payment is still considered a loss. Not deductible when calculating corporate income tax. and taxable income must be adjusted upwards during tax settlement.

Interest on loans taken out before the full amount of registered capital is contributed is partially disallowed.

In cases where a business has not contributed the full registered capital, interest expenses will be disallowed for the amount corresponding to the remaining capital shortfall. In other words, interest is only deductible on the portion of capital already contributed. The interest incurred to cover the uncontributed capital will not be considered a deductible expense and is often subject to intense scrutiny during tax audits.

When can digital transformation costs and net zero costs be deducted?

From date October 1, 2025When the Corporate Income Tax Law 2025 comes into effect, expenses for scientific research, innovation, digital transformation, as well as expenses related to reducing greenhouse gas emissions (net zero) will be included. Please clarify the legal basis for considering the expense as deductible..

However, expenses deductible for corporate income tax purposes are only allowed if their connection to business operations can be proven, and if there is a plan, contract, acceptance, and appropriate output. This is not an "automatic deduction," but rather a deduction that fully meets the conditions based on the economic nature of the expense.

Conclude

Deductible expenses for corporate income tax purposes are not on a fixed list, but are determined by the conditions, documentation, and how the business manages expenses throughout the transaction lifecycle. The same expense may be deductible or completely disallowed, depending on whether the business can demonstrate its economic nature, its connection to production and business activities, and compliance with regulations regarding contracts, acceptance, and payment.

Entering the 2025-2026 period, when the Corporate Income Tax Law 2025 officially comes into effect, the mindset regarding cost management needs to change significantly. Tax authorities will not only check "whether invoices exist," but will focus on evaluating whether expenses are reasonable, controllable, and managed according to proper procedures. Seemingly familiar expenses such as client entertainment, outsourcing, loan interest, welfare, or digital transformation can all become risks if records are fragmented, tracked manually, and lack interconnectedness.

Therefore, instead of handling costs in a "firefighting" manner during final settlement, businesses need to proactively control them. from the moment the expense is incurredStandardizing the expenditure approval process, linking invoices to contracts – acceptance – payment, monitoring expense ceilings, and classifying deductible/non-deductible expenses early will significantly reduce the risk of being disallowed during tax audits.

In that context, technological solutions such as Bizzi Bizzi plays a crucial supporting role in management. Instead of just storing invoices, Bizzi helps businesses. Standardizing cost processesThis system consolidates all documents for each transaction, alerting to missing records, incorrect payment methods, and supplier risks from the outset. As a result, accountants and CFOs can systematically and transparently control costs and be more proactive in corporate income tax settlement.

For more specific advice on management solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/