In today's volatile business landscape, the role of the Chief Executive Officer (CEO) is not only about strategic planning and driving growth, but also includes ensuring the stability and sustainable development of the business through effective financial management.

It can be said that strong financial capacity helps CEOs deeply understand business operations, make wise strategic decisions and communicate effectively with stakeholders. CEOs are responsible for managing the company's finances, including budgeting, financial planning and financial reporting.

Having a thorough understanding of current financial conditions and future forecasts allows CEOs to make data-driven decisions, which is critical to navigating economic uncertainties like recessions and inflation.

In fact, many small and medium-sized enterprises are facing the risk of closing down due to poor financial management, especially in difficult economic times. Lack of financial control can lead to serious risks such as cash flow imbalance, increased interest rates, reduced market purchasing power and even insolvency.

Therefore, the CEO's priority is to build and maintain a solid financial control system, supported by a "three-layer defense strategy", which not only protects the company's assets but also creates a foundation for trust and sustainable development. CEOs who have knowledge and confidence in the company's financial numbers will be able to run the company more effectively, make timely and accurate decisions, thereby improving the company's chances of success and prosperity.

“Three-layer strategy” in financial control: Concept and role

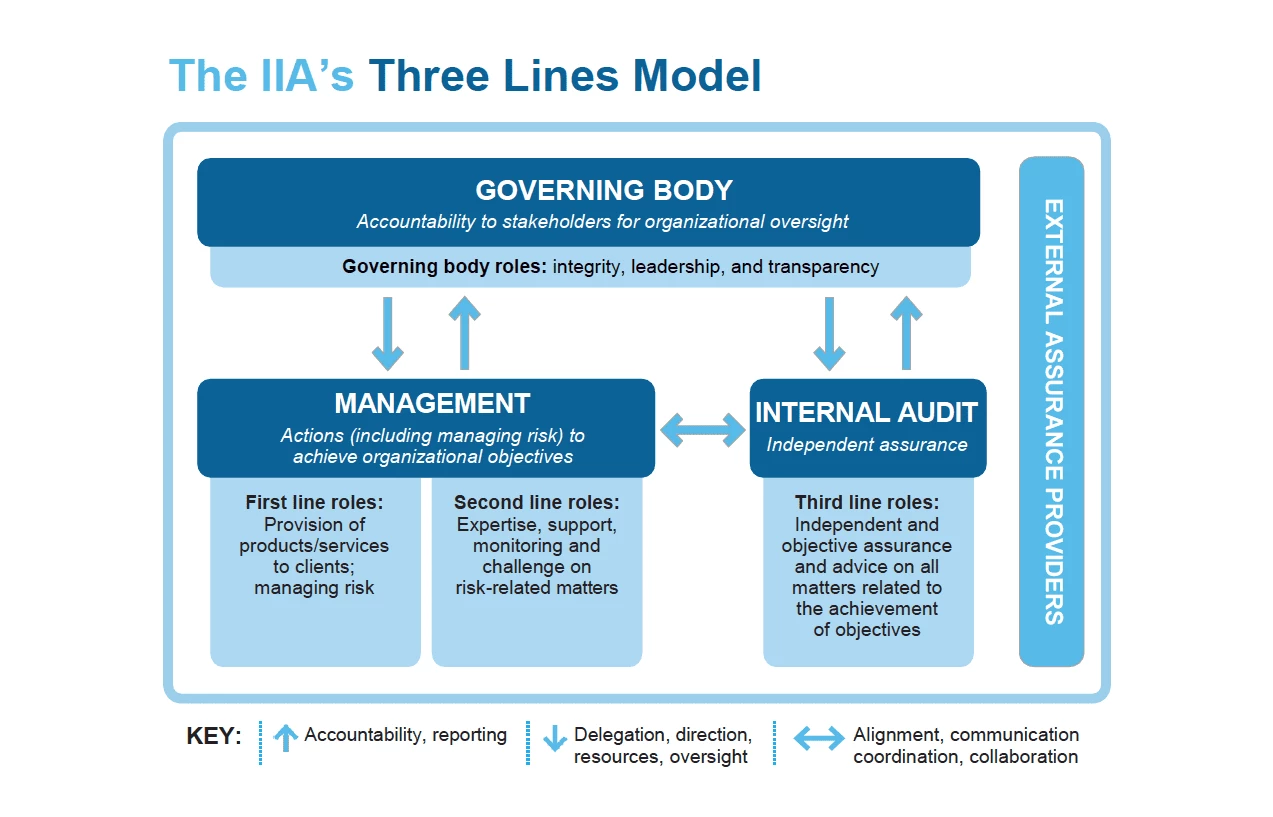

The “Three Lines Strategy” is a concept of a multi-layered defense strategy that has been widely recognized in the risk management and corporate governance fields. A typical model is the “Three Lines Model” of the Institute of Internal Auditors (IIA).

This model divides risk management responsibilities into three lines: the first line is operations management, the second line is risk management support functions such as compliance and risk management, and the third line is internal audit, which provides independent assurance on the effectiveness of risk management and control processes.

In the context of CEO financial control, the “Three-Layer Strategy” can be understood as applying the principles of this multi-layer model specifically to the financial aspects of the business. Instead of focusing on a single control measure, this strategy builds a solid defense system with many layers, to prevent financial risks, ensure regulatory compliance and optimize financial performance.

The development of the Three Lines Model represents a more proactive approach, not only to prevent losses but also to create value and improve operational efficiency. Therefore, a modern “Three Lines Strategy” in financial control not only helps CEOs protect the business from financial risks but also contributes to the achievement of business goals and sustainable growth.

A tight cost management model rooted in the Three-tier strategic foundation

According to Bizzi Vietnam, a cost management model is designed to manage the entire life cycle of costs, from the pre-, during and post-incurrence stages, to ensure tight control. This model includes three main layers:

Class 1 – Setup:

This is an important stage in building the foundation for effective cost management. This layer includes establishing clear internal spending regulations by department and level, in order to create an orderly, transparent and effective financial management system.

Based on the established business plan and financial regulations, the enterprise needs to establish a detailed operating budget, allocated to each business unit and department. Finally, planning specific expenditures for activities and projects is also an indispensable part of this establishment layer.

Class 2 – Control:

This layer focuses on implementing cost control measures in the operations process. A key element is the delegation of authority and responsibility for approving expenditures. This ensures that all expenditures are reviewed and approved by authorized personnel, in compliance with financial management principles. An effective cost control system should ensure organization, efficiency, and compliance with financial regulations.

Class 3 – Monitoring:

This final layer plays a key role in ensuring that cost management measures are working effectively. It involves regular and real-time monitoring of key cost indicators and items. Multidimensional analysis of cost data, comparison with approved budgets, determination of the proportion of each cost item, and detection of unusual costs are the main activities of the monitoring layer.

Bizzi's “Three Layers of Defense” Packaging

After separating from the cost management model, Bizzi Vietnam, after working and consulting with many multi-industry businesses of different sizes, has concluded the "Three layers of defense" model. The model is specially designed to empower CEOs to control finances effectively.

Bizzi's model provides a practical framework for realizing the idea of a solid financial defense system.

The “Set Up” layer in the cost management model corresponds to the establishment of basic controls and guidelines for financial operations. It is similar to the first line of defense in the three lines of risk management model, where operations management (under the direction of the CEO) establishes the processes and procedures necessary to ensure financial prudence.

The “Control” layer focuses on enforcing controls on spending, ensuring that financial transactions are approved and comply with established regulations. This can be seen as part of the second line of defence, where oversight functions (either the finance department or designated managers) ensure compliance with the established framework.

Finally, the “Monitoring” layer involves monitoring financial performance against approved plans and budgets. This corresponds to both the second and third lines of defense, where regular review and independent assurance (perhaps through internal audits or detailed financial statements reviewed by the CEO) verify the effectiveness of controls and identify any deviations or problems.

Bizzi’s “Three Lines of Defense” model provides a concrete and actionable framework for implementing the abstract concept of “three lines of defense” in the area of financial control, with a particular focus on cost management. By integrating sound cost management principles into a multi-layered defense strategy, CEOs can create a robust system that not only prevents financial loss but also fosters a culture of financial responsibility throughout the organization.

Applying the Three Defenses Model in Business Cost Management

Class 1 – Setup:

To effectively implement this layer of setup, CEOs need to be proactive in developing basic financial policies and plans.

Detailed Actions for CEOs:

- Develop a comprehensive internal spending policy: This policy should clearly define who has the authority to spend, in what circumstances, and what documents are required. It should be tailored to the specifics of each department and level.

- Establish a realistic operating budget: This process involves forecasting revenue and expenses over a specific period of time, allocating resources to different departments and projects based on strategic priorities. The CEO plays a key role in guiding overall finances and approving budgets.

- Develop detailed cost estimate plan: For large projects or recurring expenses, a detailed plan should be developed, outlining expected costs and approved in advance.

=> Analysis: This layer of setup is essential to proactive financial control. By clearly defining rules and setting financial goals, the CEO can prevent many potential problems before they arise. The CEO’s involvement in setting rules and approving key policies and budgets ensures that the entire organization adheres to financial control goals.

Class 2 – Control:

To implement effective control, CEOs need to establish clear approval and delegation mechanisms.

Detailed Actions for CEOs:

- Set up a clear spending approval system: Identify who has the authority to approve different types and amounts of spending. This ensures that spending is reviewed and approved by the appropriate level of management.

- Implement the Separation of Duties Principle: Avoid having a single individual assume all financial responsibilities. Split tasks such as payment initiation, approval, and account reconciliation to reduce the risk of error or fraud.

- Applying Technology to the Approval Process: Implement software solutions that automate the approval process, making it more efficient and transparent.

=> Analysis: The control layer focuses on preventing unauthorized or inappropriate spending in real time. By establishing checks and balances, CEOs can ensure that financial resources are used responsibly. Investing in technology can significantly improve the efficiency and productivity of the control layer, providing greater visibility and accountability into spending.

Class 3 – Monitoring:

To ensure the effectiveness of the front lines of defense, CEOs need to establish robust monitoring and reporting systems.

Detailed Actions for CEOs:

- Regularly Review Key Financial Ratios: Track metrics such as actual versus budgeted spending, expense ratios, and any unusual or unexpected expenses. This allows for timely identification of potential problems.

- Real-time Monitoring System Deployment: Use accounting software and dashboards to get an ongoing view of your company's financial performance.

- Perform Volatility Analysis: Regularly compare actual financial results with budget and investigate any significant differences. This helps to understand the causes of deviations and take corrective actions.

- Setting up Reporting Mechanism: Ensure that timely and accurate financial reports are generated and reviewed by the CEO and other stakeholders.

=> Analysis: The monitoring layer provides important feedback on the effectiveness of the first two layers. By tracking financial performance and identifying deviations, the CEO can make informed decisions and adjust strategy when necessary. The ability to monitor financial data in real time allows the CEO to be more agile and responsive to changes in the business environment.

Discussion and recommendations to CEO on implementing the Three Lines of Defense model

To successfully implement the Three Lines of Defense strategy in financial control, the CEO needs to pay attention to several important factors. Commitment from the highest levels of the company, especially from the CEO himself and the management team, is a key factor. Without support and determination from the leadership, implementing this strategy will be difficult.

In addition, close coordination between departments in the company also plays an important role. Financial control is not only the responsibility of the accounting department but requires the participation and awareness of all departments.

Implementing the right technology, such as accounting software and expense management tools, can significantly enhance the efficiency and productivity of a three-tier defense system. However, CEOs also need to be aware of potential challenges, such as employee resistance to change or issues related to data accuracy and integrity. The CEO also needs to balance tight control with operational agility.

Recommendations for CEOs:

- Be a role model: CEOs need to demonstrate a personal commitment to prudent and responsible financial management.

- Building a culture of financial responsibility: Encourage all employees to be cost conscious and adhere to company financial policies.

- Empowering the finance department: Ensure that the finance department has sufficient resources and authority to effectively implement and monitor the financial control strategy.

- Regularly discuss financial performance: Update information on the company's financial situation to all stakeholders.

- Seek outside support: Consider working with financial experts or advisors to develop and implement a three-layer defense strategy.

Conclude

Effective financial control is a key factor for CEOs to lead businesses to success and sustainability.

The Three Lines of Defense strategy is a modern, streamlined, and effective cost management model. It helps CEOs control their finances comprehensively without having to “look” at every single number on a daily basis. By:

- Level 1: Look at the core financial statements correctly (cash flow statements, profit and loss statements, accounts receivable & payable statements) and establish detailed rules and plans (internal spending regulations, operating budgets, and expenditure plans).

- Layer 2: Use technology (financial & accounting software, cash flow alerts) to automate processes and decentralize cost control (decentralized approval).

- Layer 3: Apply monitoring strategies (periodic monitoring, multidimensional analysis) and intelligently optimize costs and profits (set cost limits, monitor profit margins, maintain reserve funds).

When the CEO understands and effectively implements this system, the business's finances will operate in the right direction, creating a solid foundation for sustainable development. Tools such as Bizzi Expense can assist CEO in budget planning, cash flow control, cost analysis and internal administration closely

To successfully implement the “Three Defenses” model, businesses need to have commitment from management, close coordination between departments and investment in appropriate technologyNow, CEOs can build a solid management system, strong finances to help businesses break through!

Proactively applying and adapting this framework to the specific needs and context of each organization will help CEOs build a solid financial system, creating the premise for business prosperity.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam