Bizzi would like to inform customers about updating the new Cost Allocation feature. Hopefully this improvement will help improve businesses' professionalism. Hopefully the new improvements will help customers improve the efficiency of their financial accounting operations.

✅ Overview of features

During operations, businesses often incur common costs related to many units such as departments, projects, stores, etc. participating in the use of costs (room rental costs, insurance costs). insurance, team building, marketing,...)

The new Cost Allocation feature helps users allocate total costs into smaller costs corresponding to each specific department and project. Thereby helping accountants and financial managers accurately determine the actual expenditures and remaining budgets of the business units in the enterprise.

Expenses have the following allocation statuses:

- Not yet allocated: ordinary, unallocated expenses. Users can consider allocating these costs into smaller costs to assign to other units if necessary.

- Allocated: Expenses have been allocated into other, smaller expenses. These costs help record original information of invoices, approval flows, etc. but will not be recorded as actual expenses in the budget. Reallocation of allocated costs can be performed.

- Allocated: Costs are allocated from a total cost. These costs help specifically record actual expenses for related units participating in a total cost. Allocation cannot be made on allocated costs requiring an advance

Users can only allocate costs approved & unallocated or reallocate costs allocated, through 2 ways.

- Method 1: Allocate expenses from the invoice details screen

- Method 2: Allocate costs from the cost details screen

✅ Allocate expenses from the invoice details screen

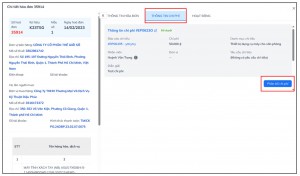

Step 1: Open the invoice details popup

Step 2: Select tab “Cost information”. Here, users can view the expense information created for the invoice.

Step 3: If the cost is approved, the user can click the button “Cost Allocation” to make the allocation.

An allocable cost:

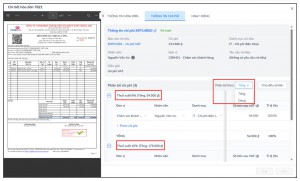

1. By total:

- Applies to both expenses with and without electronic invoices

- In case an invoice has more than 1 type of tax rate, allocate according to the total of each tax rate.

- By default, for each tax rate, the system automatically generates a cost line in the table “Allocation of expenses” (get information from original cost) contains 100% amount to be allocated

- Users can manually add other costs to the allocation list, requiring filling in the information fields:

– Unit: select a unit to which costs are allocated (a unit that participates in the use of costs)

– Employee: select an employee of the selected unit. If the unit has only 1 team leader, automatically fill in the team leader in this field.

– Category: select a spending category that corresponds to the cost and is included in the selected employee's policy, default is taken according to the category of the original expense (if the above conditions are met).

– Explanation: enter the explanation of the cost, default is taken according to the category of the original cost.

– Debit/credit account: arbitrarily entered by the person making the allocation (usually the accountant).

– Amount after VAT (d): is the amount allocated to each unit participating in the use of costs

– Ratio (%): is the percentage between the amount allocated to each unit compared to the total amount on each type of tax rate. When users adjust the amount after VAT, the percentage will also change and vice versa.

– The total amount after VAT and % ratio on each allocation line must be equal to the total amount and ratio 100%, otherwise an error will be reported.

- For quick operations, users can click the button “Split the money evenly” to evenly add the total amount to the existing rows in the table.

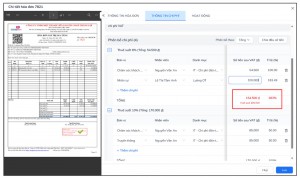

2. Follow the line

- Applies to expenses with electronic invoices

- Users allocate the amount of each line of goods/services in the invoice into small costs. For example, an invoice summarizes the company's business airline tickets for the month, each line corresponding to 1 ticket that needs to be allocated to the corresponding units and employees.

- By default, for each line of goods/services, the system automatically generates a cost line in the table containing 100% the amount of that type of goods/services.

- The principle of allocation is similar to that of total allocation.

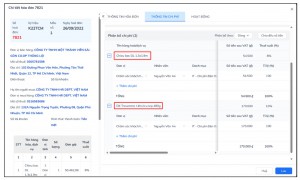

✅ Allocate costs from the cost detail screen

Users can access details of an approved cost to perform cost allocation.

Or reallocate previously allocated costs.

The allocation logic in the expense detail page is similar to that for allocation from the invoice detail popup.

With costs allocated, from the details screen you can view the original cost information. And the cost code is also attached with a suffix (for example -001, -002) showing the relationship with the original cost code.

✅ Expenditure reports related to cost allocation

Allocation can only be made to approved costs, that is, costs that have been actually recorded for the enterprise. Therefore, allocated costs (from original costs) when created are automatically assigned the approved status and placed in an expense report to record the corresponding actual costs for the related unit.

In case, after allocation, multiple expenses arise with the same unit and employee information, they will be combined into one expenditure report. For example: an invoice for the purchase of 2 laptops and 1 connection port is allocated to 2 employees in the Engineering and Sales departments; After allocation, employee A generates 1 more report containing the cost of buying a laptop + connection port, employee B generates 1 more report for purchasing a laptop.

From the expense report details screen, you can view the allocation status of the expenses in that report.

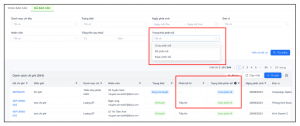

✅ List of expenses, expense reports and statements related to cost allocation

On the expense list and expense report screens, additional columns are added allocation status & word distribution (unit of original cost) shows the allocation information of the cost.

Additionally, users can filter expenses by allocation status criteria.

When exporting the expense report sheet - expense statement sheet, the system defaults to only exporting expenses whose allocation status is unallocated or allocated because these are costs that are actually recorded in the business's business units. Expense allocated These are expenses that are no longer recorded as actual expenses, so they will not appear in the expense report.

Above is the new feature that Bizzi has launched right on the platform. In the coming time, we will continue to research and improve features to enhance user experience and increase work efficiency for accounting and finance teams of businesses. Bizzi hopes to bring many new experiences to customers and partners who trust and use Bizzi products.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam