Accounting ERP software is a comprehensive management tool that helps businesses control finances, automate accounting processes and optimize operating costs. In an increasingly competitive market, choosing the right ERP system not only helps improve productivity but also increases transparency and accuracy in financial reporting. The article below will help you understand what ERP is and suggest 7 highly rated ERP software, suitable for many types of businesses in Vietnam.

1. General introduction to ERP Software

ERP software is a strategic tool that helps businesses optimize operational processes, especially in the field of finance and accounting.

1.1. What is ERP?

ERP (Enterprise Resource Planning) is an enterprise resource planning system designed to integrate and automate all of an organization's core processes — including accounting, finance, purchasing, inventory, sales, manufacturing, human resources, and many other functions — on a single, unified platform.

Instead of using separate software for each department, businesses only need one ERP system The only one to manage all operations synchronously. Data between departments is updated in real time, helping businesses better control resources, reduce errors, increase operational efficiency and optimize costs.

1.2. The role of ERP in financial management - business accounting

ERP plays a central role in digitizing and improving the efficiency of accounting and finance for modern businesses.

- Centralize financial data: ERP allows accountants to consolidate all financial data from multiple departments into a single system. This keeps numbers consistent, reduces discrepancies between departments, and reduces the risk of fraud.

- Automate accounting processes: Manual tasks such as data entry, data reconciliation, reporting, etc. are automatically processed by the system. This not only saves time but also ensures accuracy, allowing accountants to focus on analysis and planning.

- Support for quick financial reporting: ERP helps businesses generate real-time reports with visual data, from cash flow reports, business performance reports to balance sheets. Managers can make financial decisions based on updated data, significantly reducing waiting and processing time.

- Effective cash flow and budget control: With ERP accounting software, businesses can easily track approved budgets, actual spending, and receivables and payables. From there, businesses can proactively control cash flow and plan their finances systematically.

- Compliance with accounting regulations and standards: ERP supports updating the latest accounting standards, in accordance with Vietnamese law, helping businesses avoid legal and audit risks.

2. Core features of an ERP system

An effective ERP system not only focuses on accounting but also fully integrates the core activities of the business, helping to optimize operations, control costs and make accurate decisions based on real-time data. Below are the important subsystems that are often included in ERP accounting software:

2.1. Finance Accounting Subsystem

This is the heart of any ERP system, especially important for businesses looking for ERP accounting software to optimize cash flow and control financial risk.

- General Ledger (GL): Manage all financial transactions, providing a comprehensive picture of the business's financial situation.

- Fixed Assets (FA): Track asset lifecycles, from recognition, depreciation to disposal.

- Accounts Receivable – AR, Accounts Payable – AP: Helps control customer and supplier debts, ensuring stable cash flow.

- Budgeting (BG): Prepare and monitor budgets for each department and project, supporting strategic financial planning.

This subsystem helps minimize accounting errors, comply with accounting regulations and support management in making decisions based on accurate, continuously updated financial reports.

2.2. Other related subsystems

For accounting operations to be seamless and reflect the true state of the business, ERP software needs to integrate the following subsystems:

- Purchase Control: Automate the purchasing process, from purchase requisition to payment; control suppliers and procurement budgets effectively.

- Sales Control: Track orders, discounts, contracts, accounts receivable and sales by customer or region, supporting revenue growth.

- Stock Control: Provide real-time inventory data, support inventory levels, quick inventory, and limit loss.

- Human Resource Management (HRM): Track your recruiting process, manage your resume, compensation, training, and performance reviews – all on one platform.

- Management Reporting: Integrate data from departments and provide visual reports, helping leaders grasp trends and optimize business strategies.

3. Popular ERP software today

Below is a list of commonly used accounting ERP software on the market, supporting businesses in effectively managing finances and comprehensive operations.

3.1. SAP ERP software

SAP is an accounting ERP software that can integrate all financial, production, human resources and supply chain activities on a unified platform. In particular, the financial subsystem helps businesses control cash flow, track accounting transactions and prepare international standard reports.

The software also supports remote operation, automatic data checking and error correction, suitable for large enterprises with complex hierarchical systems.

3.2. Microsoft Dynamics ERP software

Microsoft Dynamics offers a comprehensive ERP solution for medium and large businesses, deeply integrated with the Office ecosystem such as Excel, Outlook and Teams. In the field of accounting and finance, the software supports budgeting, data analysis with BI, debt tracking and operating cost optimization.

Modern, easy-to-use and flexible interface helps businesses increase work efficiency and ensure accuracy in accounting work.

3.3. Oracle ERP Software

Oracle ERP Cloud is a cloud-based accounting ERP software, suitable for large corporations and enterprises. Modules such as Oracle Financials Cloud, procurement, project management, human resources are integrated, helping to build a centralized, transparent accounting system that complies with global financial standards.

This solution helps businesses forecast finances and optimize budget management with advanced analytics tools.

3.4. ERP software MISA AMIS

MISA AMIS is an accounting ERP software suitable for Vietnamese enterprises, fully integrating operations such as revenue management, expenses, debts, electronic invoices and taxes. The interface is friendly, easy to use, supporting accountants to operate quickly and accurately according to Vietnamese accounting standards.

The system also provides real-time management reports, supporting leaders to make timely and effective decisions.

3.5. Fast Business Online ERP Software

Fast Business Online is a web-based and mobile ERP solution, allowing access from any device, supporting flexible business operations.

The software's accounting subsystem fully complies with Vietnam's financial and tax regulations, supports multi-currency, multi-unit and flexible reporting capabilities via OLAP analysis tools.

3.6. BRAVO ERP software

BRAVO provides highly customizable ERP accounting software solutions, suitable for large-scale and multi-industry businesses. The accounting subsystem is built in detail, supporting specialized operations and preparing financial reports according to VAS standards.

The ability to integrate with production - sales - warehouse systems helps businesses better control the financial transaction life cycle.

3.7. Odoo ERP Software

Odoo is a globally popular open source ERP platform that stands out for its customization and ERP implementation cost Reasonable. Enterprises can use subsystems such as accounting, purchasing, human resources, POS and production according to their own needs.

Odoo accounting ERP software is highly appreciated for its intuitive interface, flexible integration capabilities and large support community, suitable for small and medium-sized businesses looking for cost-effective solutions.

4. Bizzi – In-depth support solution for Accounting operations in ERP system

Bizzi is a financial automation platform that enhances the efficiency of accounting ERP software, focusing on cost control, invoicing and receivables processes.

4.1. What is Bizzi?

Bizzi is a comprehensive cost control system that acts as an AI assistant to support the finance and accounting department in streamlining and automating the revenue and expenditure process. The platform integrates more than 30 in-depth features, helping businesses optimize financial operations, collect debts, and make effective B2B payments.

Not a replacement for accounting ERP software, Bizzi is designed to integrate seamlessly, add missing features, and enhance specialization in specific financial processes.

4.2. Bizzi's advanced features support business accounting

Bizzi is not only an accounting ERP add-on software but also a specialized tool that helps businesses comprehensively control all important financial processes.

- Processing, reconciling and managing input invoices (IPA + 3-Way Matching): Apply RPA and AI technology to automatically download invoices, check information and compare with PO – GR in real time. Bizzi helps verify suppliers, warn of risky invoices and store data for 10 years, and synchronize data with accounting ERP software via API.

- Business Expense Management (Bizzi Expense): Support setting budgets by department or project and tracking actual spending. Automatic spending approvals help keep tight budget control, provide detailed expense reports, and ensure compliance with internal policies.

- Business Travel Management (Bizzi Travel): Integrate flight and accommodation bookings according to budget limits. The system tracks all business expenses, supports approvals, and generates comprehensive reports to help businesses monitor travel performance.

- Electronic invoice (B-invoice): Allows creation, export and sending of standard electronic invoices (XML, PDF) with a customizable interface. Direct connection to the tax authority system for authentication, secure invoice storage for at least 10 years, easy integration with ERP.

- Accounts Receivable Management (ARM): Create automatic debt reminder scenarios via email, SMS; track and reconcile customer and supplier debts. Bizzi provides due date warnings and in-depth reports on DSO, debt aging and cash flow.

4.3. Benefits of Bizzi as ERP Complement

When integrated with accounting ERP software, Bizzi not only improves performance but also deeply specializes financial processes, bringing outstanding value to businesses.

- Further specialization: Instead of just using a general-purpose ERP financial module, Bizzi offers specialized features to help control invoices, expenses and debts more effectively.

- Improve efficiency and accuracy: Significantly reduce manual processing time, avoid data entry errors and increase productivity for the accounting and finance department.

- Cash flow optimization: Thanks to the automatic debt reminder system and detailed debt analysis, businesses can easily control cash flow and improve collection efficiency.

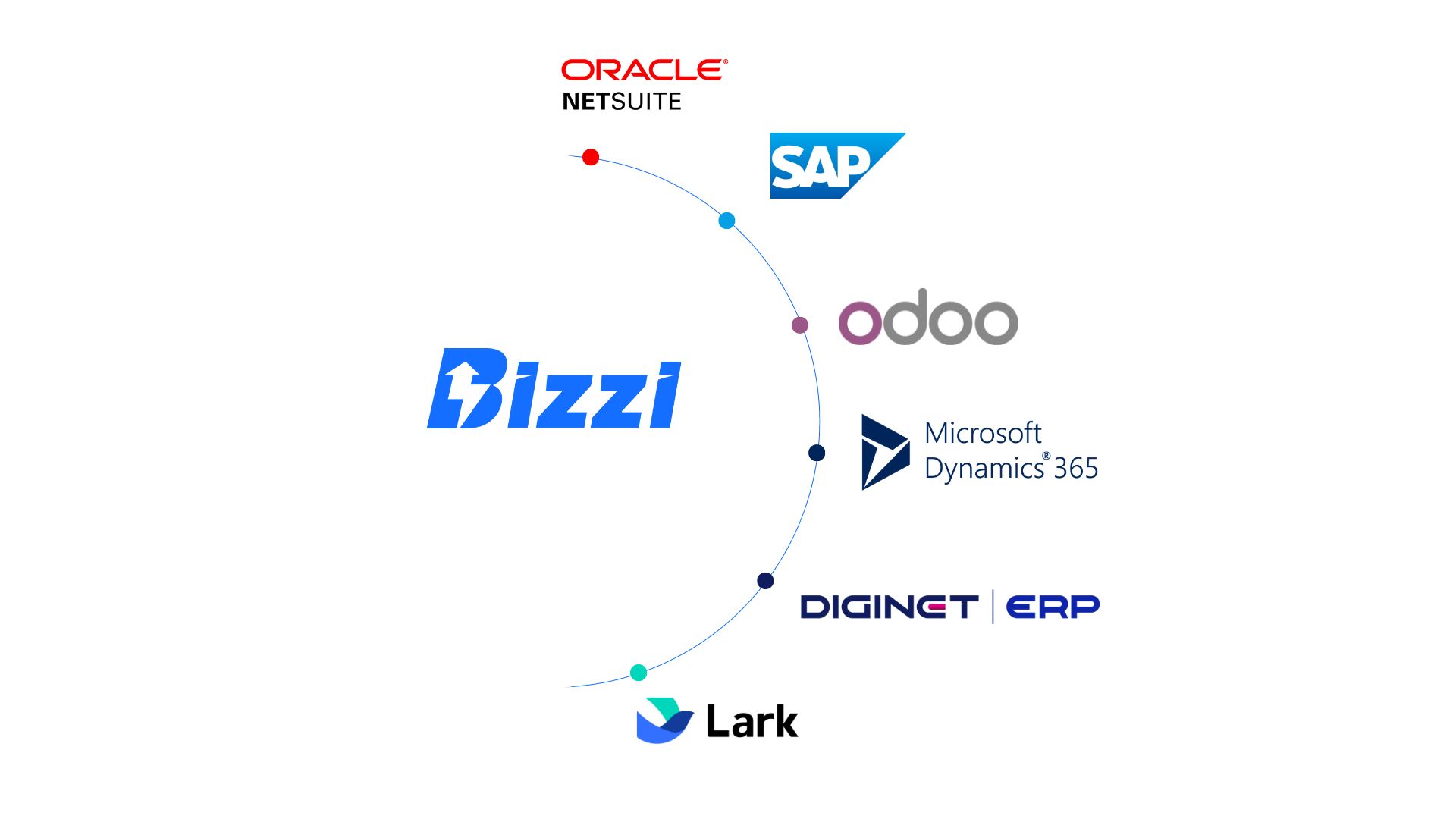

- Flexible integration capabilities: Bizzi can connect with many leading accounting ERP software, helping businesses expand their financial capabilities without changing existing systems. See more at: https://bizzi.vn/tich-hop-erp/

5. When should businesses invest in ERP systems and supporting solutions?

5.1. Signs of need to implement ERP

Businesses should consider investing in accounting ERP software when problems begin to appear in operations, financial management, and data. Common signs include:

- As the volume of business transactions increases rapidly, errors frequently occur in import, export, delivery, information or invoice errors.

- When businesses face problems in manual management, old processes and regulations become cumbersome and complicated.

- When businesses have difficulty storing, managing, retrieving and using data, there is a lack of systematization and centralization.

- When the market is fiercely competitive, businesses need to improve performance and optimize operating costs.

- When businesses want to update new management trends and promote digital transformation.

- In particular, industries such as manufacturing, services, retail, distribution, and financial services have a high proportion of ERP usage and receive many benefits from implementing this system.

5.2. Notes when choosing and implementing ERP

To effectively implement ERP, businesses need to have a clear plan and strategy that is consistent with internal realities. Here are some important notes:

- Define clear goals and needsBusinesses need to clearly identify their needs, industry characteristics and scale to choose the necessary features.

- Prepare budget and resources: ERP implementation is usually a large investment (can range from $150,000 to $750,000 for a mid-sized business) and can be long-term (2-5 years). A detailed plan should be made for the costs of software, licensing, implementation, training, maintenance, and technical support.

- Scalability and Compliance: The ideal ERP software needs to be scalable to grow with the business and must comply with Vietnamese laws and accounting standards.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

6. Conclusion

Implementing accounting ERP software is a strategic step, helping businesses optimize resources, standardize processes and enhance financial control. Based on scale, budget and specific needs, businesses can choose the appropriate ERP solution from the above suggestions. If you are looking for an effective, flexible and easy-to-deploy accounting automation platform, Bizzi can be a worthy choice for modern businesses.