In the context of increasingly complex business and increasingly stringent financial management requirements, the use of budgeting software Not only does it help businesses control cash flow, it also optimizes spending and makes decisions faster and more accurately. In 2026, many budgeting software solutions specifically for businesses have stood out with flexible features such as budgeting, budget tracking by department/project, real-time reporting, ERP, HRM, CRM integration, etc. These tools are becoming powerful assistants for business owners and accountants in effectively managing finances and growth strategies.

Budget Management: Strategic Role and Input Data Challenges

The budget is not simply a spreadsheet of income and expenditure, but also a “compass” for financial direction and development strategy. Enterprises with tightly managed budgets will easily maintain stability, optimize resources and seize growth opportunities.

Budget: Financial guidance for every step of development

Budget management is the foundation that helps businesses clearly position their financial development direction. set a budget support rational resource allocation, control expenditure and build long-term strategies based on real data. An effective budget system contributes to promoting sustainable growth, improving investment capacity and the ability to respond to market fluctuations.

The Challenge of “Struggling” with Manual Budgeting

Managing budgets using Excel or manual books often creates many problems: time-consuming, error-prone, lack of transparency and slow data updates. This is an unavoidable risk for accountants, directly affecting the ability to track and evaluate the effectiveness of business spending.

Core Benefits: Data Automation and Variance Analysis

In the digital age, budget management using traditional spreadsheets (Excel) has gradually revealed many limitations: time-consuming manual data entry, prone to errors, difficult to update data in a timely manner, and lack of flexibility when the business scale expands. To overcome these challenges, budgeting software was born as a comprehensive solution, supporting businesses to improve financial management efficiency and optimize resources.

The outstanding benefits of budgeting software can be analyzed in detail as follows:

- Automate and reduce errors: Instead of manually entering data into spreadsheets, the system allows businesses to set up an automated process to collect and aggregate data from multiple sources. This not only saves time but also significantly reduces the risk of errors in numbers.

- Accurate financial forecasting: Specialized FP&A software integrates Scenario Planning and Sensitivity Analysis tools, helping managers forecast cash flow and profits in many different situations. Helps managers forecast cash flow, profits and costs in many different situations. From there, businesses can proactively develop strategies to respond to market fluctuations.

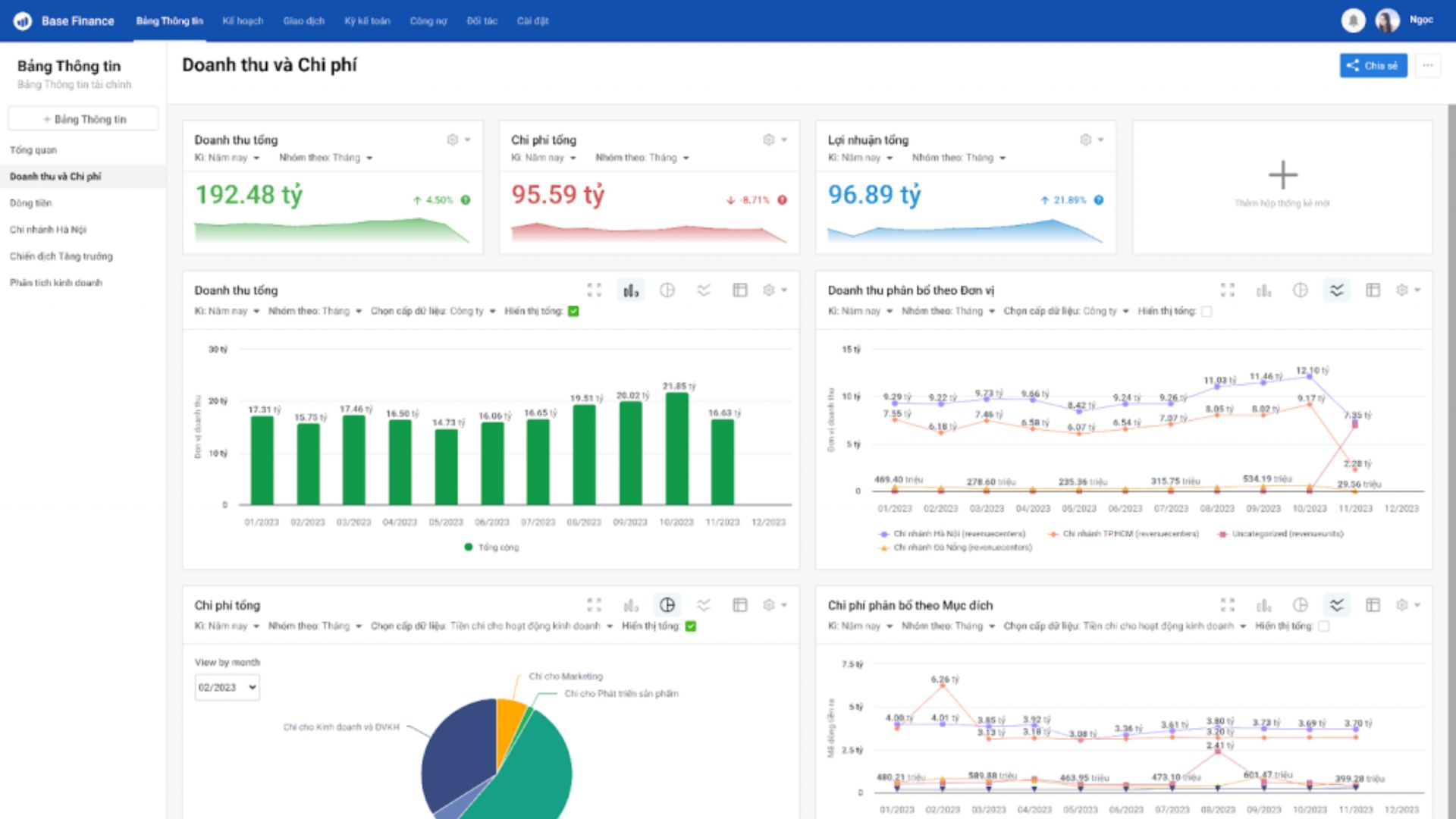

- Real-time budget tracking: The system provides an intuitive dashboard, displaying constantly updated financial data, allowing comparison between plans and reality. This is a solid basis for the management to make strategic decisions based on real-time Variance Analysis and promptly adjust when differences arise.

- Budget Alerts and Control: The budget limit warning feature helps businesses detect and handle unreasonable expenses early. At the same time, the ability to analyze detailed expenses helps optimize cash flow and allocate resources more effectively.

- Flexible integration capabilities: Budgeting software can connect directly to existing ERP, CRM or accounting software, ensuring data consistency, transparency and minimizing information duplication.

- Support strategic decision makingWith in-depth financial data analysis and visual reports, managers have a comprehensive view of performance, thereby building business plans, pricing products or expanding investments more accurately.

It can be said that applying budgeting software not only helps businesses modernize financial management but also creates sustainable competitive advantages in the digital age, where speed and accuracy of data play a key role in every decision.

Top 7 business budgeting software by integration and scale criteria

When managing finances, choosing the right budgeting software will help businesses optimize cash flow, reduce risks, and make more accurate decisions. Below are 7 popular budgeting software that are trusted by many businesses today.

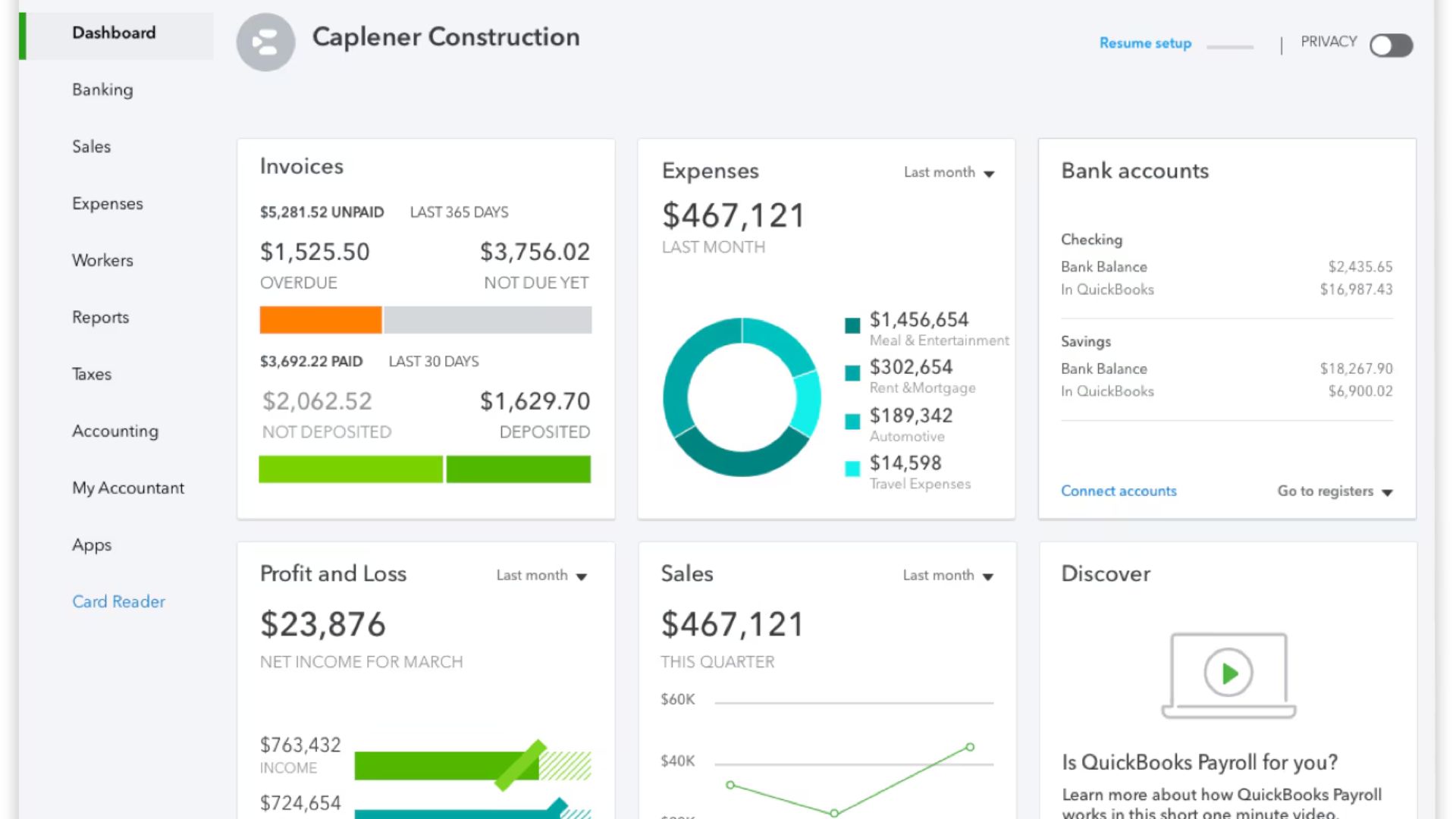

QuickBooks Online: The Top Choice for SMBs

QuickBooks Online is one of the most popular cloud accounting software in the world, featuring flexible integration between budgeting, cash flow management and overall accounting system. With an intuitive, easy-to-use interface, this software is highly appreciated for its comprehensive support for businesses in monitoring, controlling and analyzing financial situations.

- Suitable Object: QuickBooks Online is especially ideal for small and medium-sized businesses (SMBs) and startups looking for a tool that can both manage accounting and support effective budgeting.

- Outstanding advantages: In addition to being user-friendly, the software also provides a comprehensive set of features from transaction recording, invoice management, payroll to detailed financial reporting. The ability to budget and track cash flow in real time helps businesses be more proactive in decision making.

- Points to consider: Costs tend to increase significantly if businesses use advanced packages or need access from multiple users. In addition, some advanced features may be redundant for micro-businesses that only need basic management tools. Although user-friendly, these solutions lack the ability to drill down into detailed cost transactions, and do not meet the complex Modeling and Reporting needs of medium and large-sized businesses.

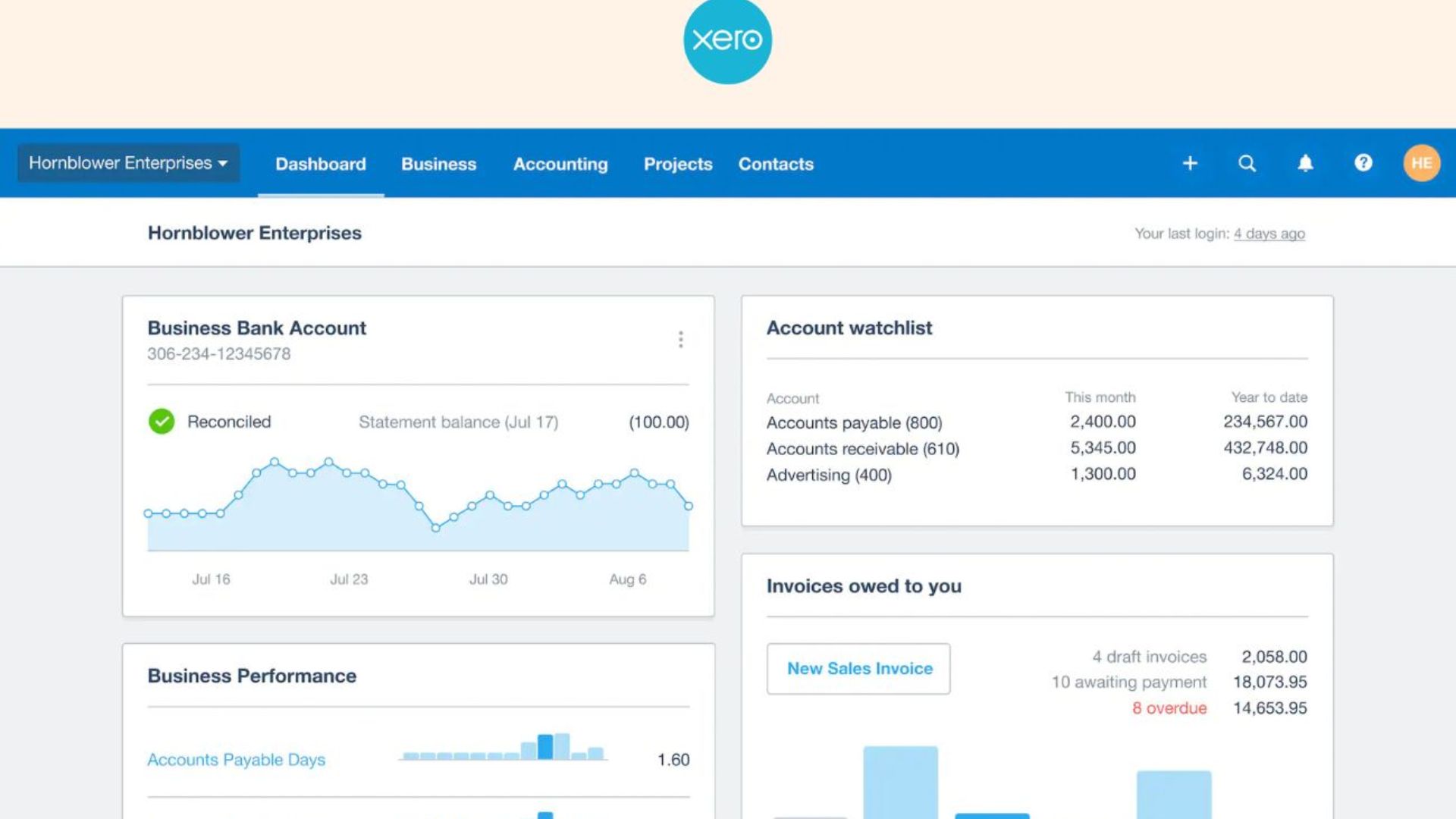

Xero: Simple, modern and efficient

Xero is a cloud accounting software that stands out for its user-friendly and modern interface design, developed to bring an easy experience for users in managing finances and budgeting. With a focus on simplicity but efficiency, Xero has quickly become a popular choice for many global businesses.

- Suitable Object: Xero is especially ideal for small and medium-sized businesses, especially those that prioritize convenience and need an integrated accounting system with basic budgeting tools.

- Outstanding advantages: In addition to its user-friendly interface, Xero also scores points for its ability to connect directly with banks to automate transactions, saving time on bookkeeping. The multi-currency support feature also brings great advantages to businesses with international trade activities, ensuring that financial reports are always accurate and timely.

- Points to consider: While Xero does offer budgeting features, the level of depth is not comparable to dedicated budgeting software. Therefore, for businesses that need complex financial analysis or multi-scenario forecasting, Xero may not be enough.

Although user-friendly, these solutions lack the ability to Drill-down deep into detailed cost transactions, and fail to meet the complex Modeling and Reporting needs of medium and large sized businesses.

With a balance of simplicity, affordability and flexible integration, Xero offers an effective financial management solution for small and medium-sized businesses in the digital age.

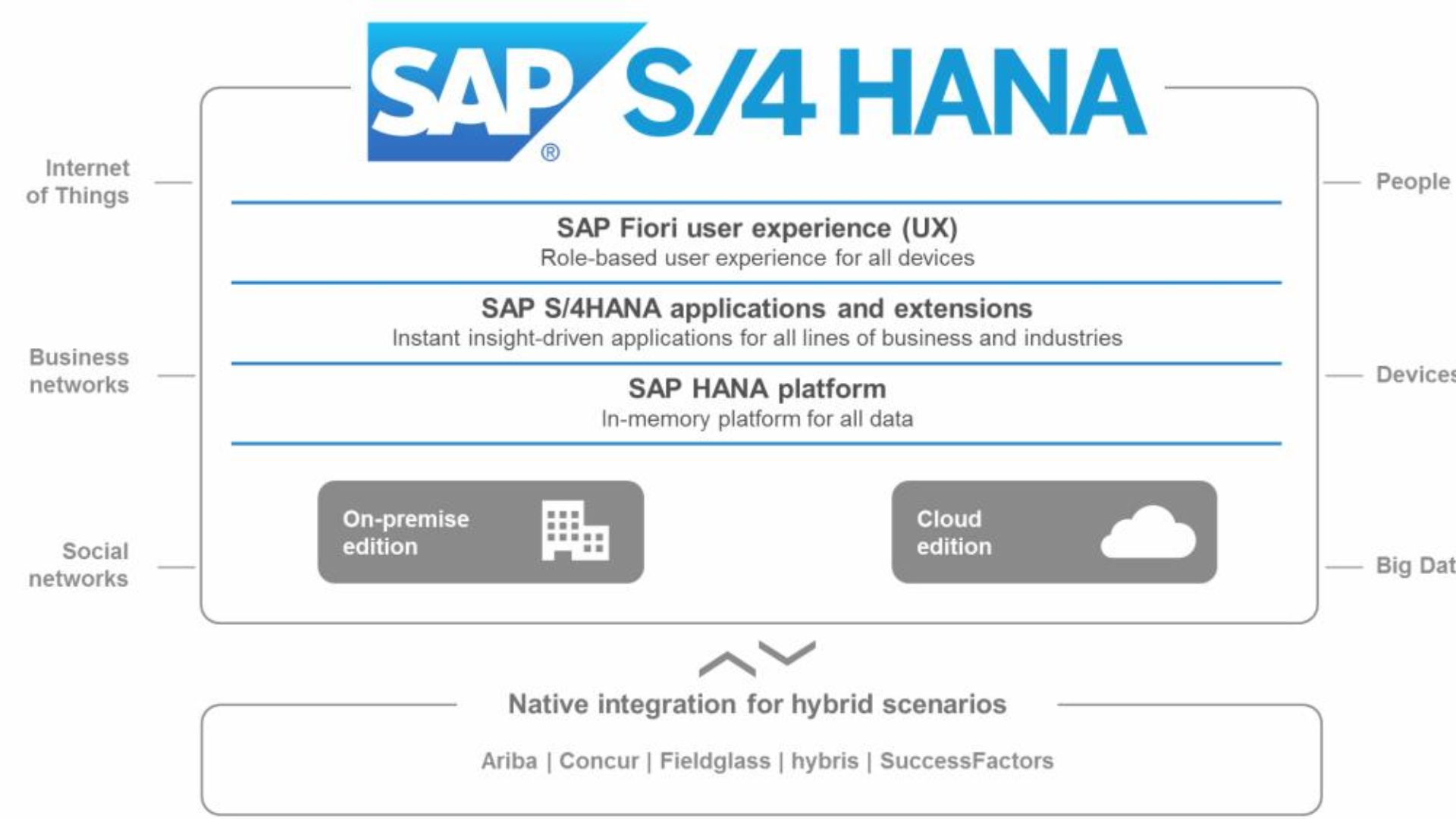

SAP S/4HANA (and SAP Business One): Comprehensive solutions for large enterprises

SAP is known as one of the world's leading ERP systems, providing a comprehensive set of management tools, including financial, accounting and budgeting modules. With two prominent options - SAP S/4HANA for large businesses and SAP Business One aimed at medium and large enterprises – SAP offers solutions that cover the entire business process, from operations to finance.

- Suitable Object:

- SAP S/4HANA: Optimized for large-scale corporations and businesses with complex management needs and global data integration requirements.

- SAP Business One: Suitable for medium and large enterprises that want to deploy ERP but at a more reasonable cost and scale.

- Outstanding advantages: SAP stands out for its high customization, easy scalability, and integration of all business processes such as accounting, supply chain management, manufacturing, sales, human resources, and budget management. In-depth analytical reports and the ability to process large volumes of data in real time help management make strategic decisions based on accurate and timely data.

- Points to consider: SAP implementation often requires large investment costs, long implementation time and requires highly qualified internal IT team to operate. Therefore, this is a more suitable choice for businesses with strong financial potential and long-term vision.

With a strong ecosystem and comprehensive support capabilities, SAP is not only a budgeting software but also a strategic tool that helps large enterprises improve operational efficiency and maintain competitive advantages in the global market.

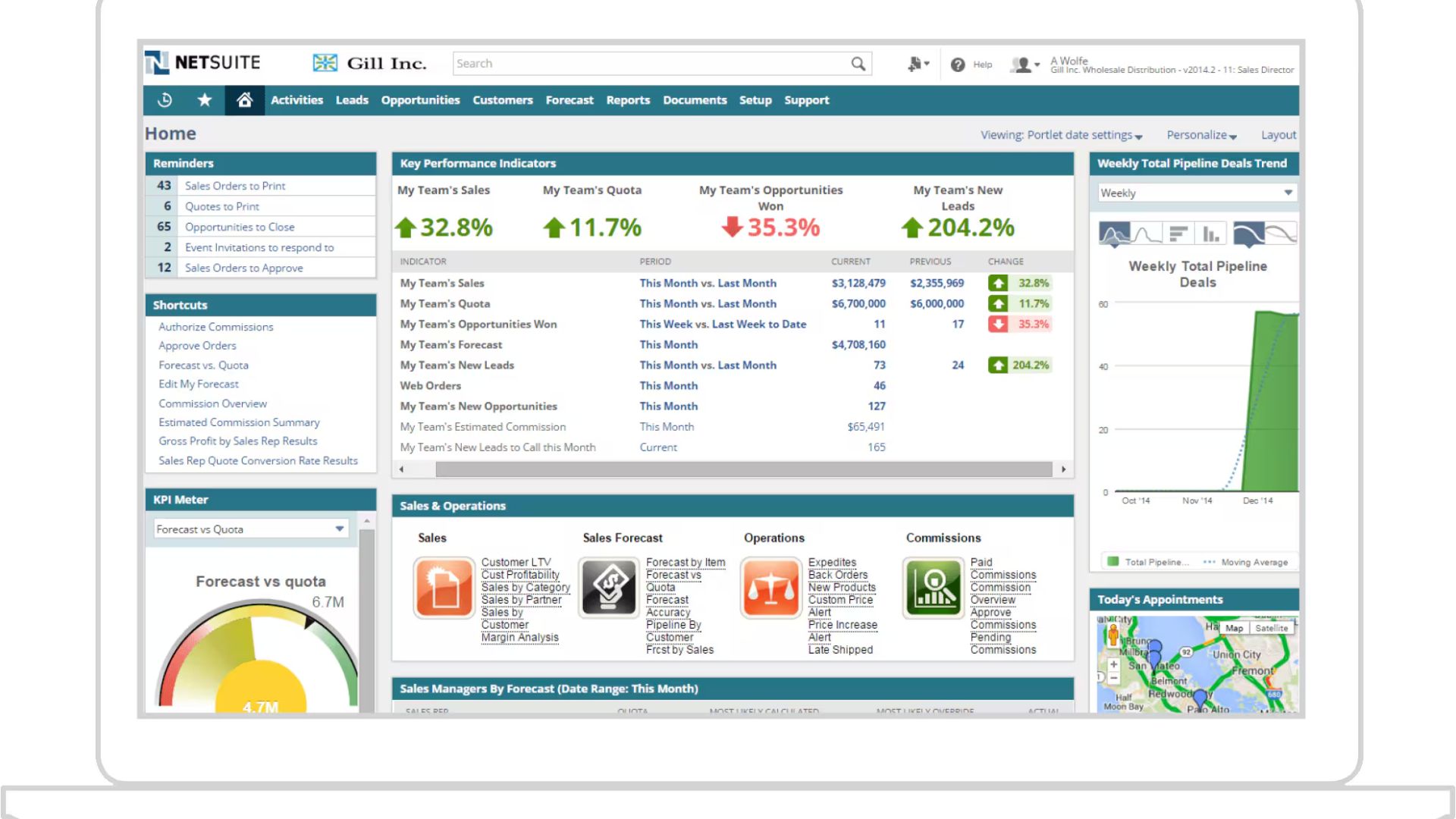

Oracle NetSuite: Cloud ERP Power for Growing Businesses

Oracle NetSuite is one of the world's leading cloud ERP platforms, designed to provide comprehensive support for businesses in financial management, planning and budgeting. With the ability to integrate multiple functions on a single system, NetSuite helps businesses manage finances more centrally, transparently and effectively, while providing powerful budgeting tools to serve the needs of forecasting and strategic planning.

- Suitable Object: NetSuite is ideal for medium and large businesses, and especially multinational corporations that need a unified financial management platform across multiple branches, countries, and business units.

- Outstanding advantages: The system offers flexible scalability, easily adapting to business growth. In addition, NetSuite also provides centralized financial management tools, multi-dimensional reporting, and in-depth real-time data analysis, helping leaders make quick and accurate decisions.

- Points to consider: NetSuite's initial investment and maintenance costs are quite high compared to popular software. The implementation process is also complex, requiring time, detailed planning and thorough staff training to exploit the system's full potential.

With its technological strength and comprehensive integration capabilities, Oracle NetSuite is not only a financial management software but also a strategic platform that helps medium and large enterprises optimize resources and maintain sustainable competitive advantages in a globalized environment.

Workday Adaptive Planning: Financial Planning Expert (FP&A)

Workday Adaptive Planning is specialized FP&A software focused on budgeting, forecasting, and financial reporting.

- Suitable Object: Medium and large businesses, organizations with complex financial planning needs.

- Advantage: Flexible modeling, powerful “what-if” scenario engine, friendly interface.

- Limit: Does not cover all accounting operations; high cost, not suitable for small businesses.

This is the optimal choice for organizations that need in-depth financial planning and analysis to support strategic decision making.

MISA AMIS Accounting: A reliable "purely Vietnamese" solution

MISA AMIS Accounting is software belonging to MISA's business management ecosystem, designed to fully comply with Vietnamese accounting standards and laws, while integrating basic budgeting tools for businesses.

- Suitable Object: Vietnamese businesses of all sizes, from small to large.

- Advantage: Easy-to-use Vietnamese interface, fully compliant with domestic accounting regulations, quick technical support service.

- Limit: Limited ability to integrate and expand with international systems.

This is a safe and optimal choice for Vietnamese businesses that want to digitize accounting and budget management in accordance with legal regulations.

Base Finance+: Financial automation with AI for Vietnamese businesses

Base Finance+ is a solution of the Base.vn ecosystem, focusing on automating financial processes, budget control and data analysis using AI.

- Suitable Object: Vietnamese businesses, especially those that have used other products of Base.vn.

- Advantage: Powerful automation thanks to AI, deeply integrated in the Base ecosystem, helping with synchronous and transparent management.

- Limit: New users may take some getting used to if they are not familiar with the Base ecosystem.

This is a worthy choice for Vietnamese businesses that want to combine modern financial management with AI technology.

While the above software focuses on “Financial Planning”, Bizzi provides an automated “Real Expense Management & Control” solution. It acts as an important bridge, ensuring that spending data is digitized, transparent, and controlled in real time – creating a solid foundation for the most effective budget execution and adjustment.

Bizzi: The Puzzle Piece for Your Automated Financial Ecosystem

While traditional budgeting software focuses on financial planning and forecast, many businesses still face difficulties in Manage and control actual spending – the deciding factor in the accuracy of the budget. This is the gap that Bizzi Travel & Expense providing complete solutions, helping businesses not only set a budget but also Control and optimize budget execution in real time.

Support budgeting based on accurate data

One of the reasons why budgets are not feasible is that Incorrect input data or not updated in time.

Bizzi Travel & Expense solves this problem by:

- Automatically collect and classify spending data: Bizzi automatically collects, digitizes and reconciles invoices/expenses, helping to minimize input data errors to 90%, ensuring the feasibility of BvA budgets. All expenses from business expenses, purchases, operations... are instantly digitized through OCR and AI technology, reducing 90% of manual data entry.

- Multi-level budget classification: Set up a budget by department, project, cost type, ensuring adherence to overall financial strategy.

- Over budget warning: The system automatically sends notifications when expenses are about to exceed the limit, helping the finance department. active cash flow control.

Benefit: CFOs and accountants can build budgets based on accurate, real-time data, rather than relying on delayed or inaccurate reporting.

Foundational data for flexible financial forecasting

To make accurate financial forecasts, businesses need transparent and continuously updated data.

Bizzi offers:

- Rolling Forecast made easy: CFOs can update monthly/quarterly forecasts based on actual consumption data, rather than gut-feel predictions.

- Spending Trend Analysis: AI assisted detection unusual trend, helping businesses predict risks and optimize costs in the next period.

- Financial ecosystem integration: Bizzi connects seamlessly with ERP, accounting software, CRM, ensuring data continuity and no interruptions.

Result: Businesses can easily adjust their budgets and financial strategies according to market fluctuations without spending much time synthesizing.

Standardize and automate expense management

Budgeting is only effective when properly executed. Bizzi Travel & Expense helps standardize the entire expense management process:

- Convenient mobile application: Employees can easily create payment requests, capture invoices, and submit expense reports anytime, anywhere.

- Fast, transparent approval: Clear hierarchical approval process reduces fraud and budget loss.

- Instant Report: Cost statistics by department, project, type of expenditure, supporting the management to make accurate decisions.

For example: Instead of waiting until the end of the month to find out that the Sales department overspent the 20% budget, Bizzi Alerts as soon as a transaction occurs, allowing CFOs to make timely adjustments.

Bizzi – Completing the Financial Management Circle

Bizzi Travel & Expense is not only a travel expense management software but also a an important piece in the automated financial ecosystem of the business:

- From budgeting → build optimal financial plan.

- Arrive Expense management → ensure correct, sufficient and transparent spending.

- And financial forecasting → make strategic decisions based on real-time data.

When combining Bizzi with powerful budgeting software like SAP, Oracle NetSuite or MISA, businesses will have a complete financial system, minimizing manual errors and optimizing operational performance.

Conclude

Investing in a business budgeting software Appropriate solutions not only help save time, improve the efficiency of budget management but are also the key to successful business strategy planning. In 2026, outstanding solutions such as Viindoo Budget, MISA Bumas, Asia Soft, Fast Business Online, ... all bring modern features suitable for all scales from SMEs to large enterprises.

Carefully consider your actual needs such as budgeting capabilities, real-time reporting, ERP/CRM integration capabilities and compare costs and benefits to choose the most suitable software. When chosen correctly, budgeting software will become a reliable assistant, helping business owners and accountants to have a clear, flexible and sustainable financial direction.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/