Index

ToggleRobotic Process Automation (RPA) in Accounting

By Nuong Ho Pham

The future of robotic process automation (RPA) is looking brighter and brighter, as robotic software becomes more and more popular across multiple industries.

Deloitte's Global RPA survey estimated that about five years ago, almost every industry globally was automated by robotics.

Accordingly, today we will look at the effects and applications of robotic process automation in accounting, the software that is expected to revolutionize the industry.

A McKinsey report estimates the global automation potential for finance and accounting at 43%. In addition, UiPath specifies an automation rate of 80% for common processes such as accounts receivable or accounts payable.

Let's take a closer look at some of the real-world robotic process automation use cases and learn some strategic steps towards leveraging RPA in accounting.

Robotic process automation (RPA) use cases in accounting

1. Accounts Payable (AP)

We were told that such tasks seem to hold the lead when it comes to leveraging RPA in accounting.

The software robot can transfer incoming invoice information (such as invoice number, received data or amount) from PDF files to SAP web applications and internal spreadsheets.

As a result, they can place a copy of the PDF on the internal server. This is a very useful thing to do to ensure regulatory compliance and can reduce supplier invoice processing cycle times by up to 60%.

2. Accounts Receivable (AR)

Bots can more easily (i.e. faster and more accurately) handle customer key file maintenance and credit approval. The same goes for order processing and collection.

Late notifications can be emailed faster, thus minimizing the hassle that often occurs with last-minute notifications.

3. Control function

The robot can automatically match the current period invoice feed with the previous period, whenever the controller opens the data file. This significantly reduces the processing time required to compare data between different periods.

Data that cannot be easily processed, i.e. data that is superior to automatic adjustment, are the exceptions and such data is left to the accounting staff to handle. Results are much faster and staff only need to process when the data “changes”.

4. Cost Allocation

Automation easily combines data from different sources (like email, Excel spreadsheets, Google documents, etc.) into one master file, which can then be uploaded directly to the Data Management and Programming program Enterprise Resource Planning (ERP).

This can be done by software in short time i.e. under a minute.

5. Closing and Financial Reporting

This is an epitome of cross-department, multi-system processing. We believe it is not an exaggeration to say that posting tax entry data from many different business units is a tedious and painful task.

That's why a software robot is needed to reduce and simplify it. Moreover, its error resistance also adds value to the process.

6. Accounting reconciliation

Accounting data that requires reconciliation of sub-account balances is obtained from a variety of sources, such as Excel spreadsheets or customer invoices. Accountants can automate the process and download data in the desired format.

Then data validation and exception searching can be done much faster. This is the case because balance entries are properly created and used to handle invoice discrepancies.

7. Delivery reconciliation

Orders must be confirmed against shipments, which requires delivery notes to be reconciled with the purchase order.

The robot can help you check and approve all matching orders or data. It will only notify you when an exception is encountered.

8. Compare supplier prices

Among cash advance operations, accountants must prepare customer quotes. They must carefully go through each item and compare supplier price lists.

Robots can greatly reduce the burden by providing accurate comparisons in a short time.

9. Financial and accounting activities

Pricing review, as well as discount processing, can be automated based on a review of customer contracts and pre-approved price lists. After processing detailed monthly sales data, the commission can be calculated accurately.

Finally, the results can be collected in files and emailed to the recipients required for approval.

10. Regulatory reporting

Software robots are good candidates to handle the heavy lifting of data collection and cleaning, and then automatically generate regulatory reports.

Furthermore, when it comes to complex year-end reports, RPA can streamline the process by pre-populating spreadsheets.

Conclude

The list above illustrates some of the accounting processes that, if transferred to robots, can help businesses run more efficiently, while reducing operating costs. RPA use cases in accounting outline an assistant profile that promises to lead to the achievement of your business goals.

However, we wanted to identify the use of robotic process automation that illustrates a humane, human-centered approach to business where people really matter. The human employee role remains important in accounting. With the help of software robots, they will have more time to focus on making complex and critical decisions with customers.

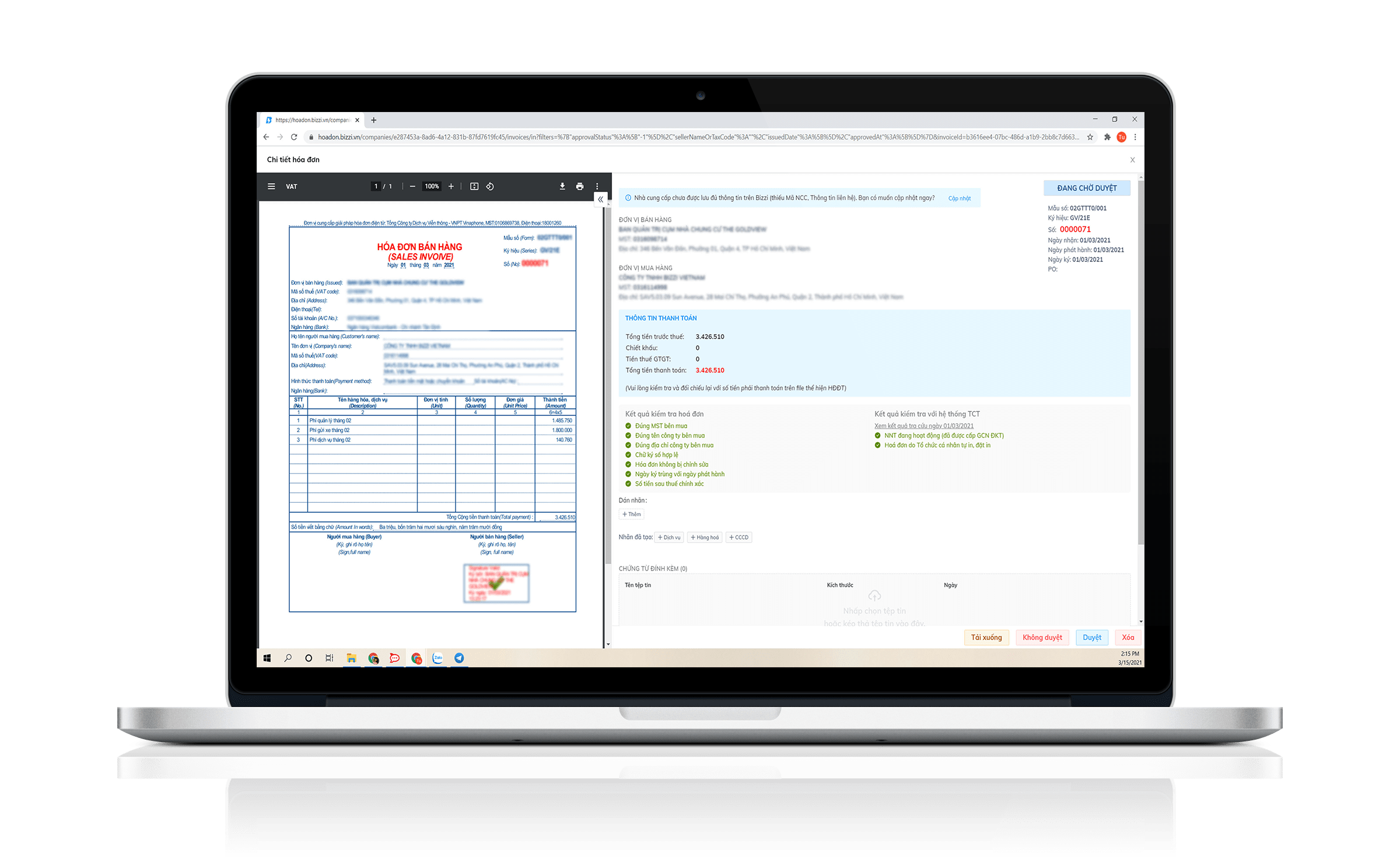

Bizzi - Automated and comprehensive Invoice management technology solution

- Automatically extract, check the validity of Invoices.

- Reduce 80% time to process incoming e-invoices.

- Manage and store invoices efficiently and scientifically.