In every business, the Chief Financial Officer (CFO) is not only the head of financial management, but also plays an important strategic role in maintaining financial stability and promoting sustainable development. However, with the strong development of technology and digital transformation trends, the role of the CFO has changed significantly. In this article, we will explore the main responsibilities of the CFO, the changes in their role in the digital age and how modern technologies.

1. Who is the CFO? Main responsibilities of the CFO

The CFO is the leader who manages all financial activities in the enterprise, playing a decisive role in ensuring financial health and promoting sustainable development. The main responsibilities of the CFO include:

- Financial strategy planning: Establish long-term plans to ensure the company's financial development, optimize capital and coordinate financial resources to support business goals.

- Financial Risk Management: Assess, monitor and control financial and market risks, including interest rate, credit and exchange rate risks, to protect the company's assets.

- Transparent financial reporting: Ensure honest and accurate financial reporting, compliance with regulations and timely provision of information to shareholders and stakeholders.

- Support strategic decision making: Use financial data and analysis to advise management, helping to make informed decisions, from investment, market expansion to cost optimization.

With this important responsibility, the CFO directly contributes to building and maintaining the financial strength of the business, thereby enhancing competitive advantage in the market.

2. The role of the CFO & changes in the current era

Before the advent of technology, the role of the chief financial officer (CFO) was largely focused on managing traditional financial elements such as monitoring costs, ensuring the accuracy of financial reports, budget control and maintaining the financial stability of the business. These tasks require CFOs to have solid professional knowledge of accounting and finance, and to use traditional financial management tools to process and analyze financial data. Their role is often tied to ensuring compliance with financial regulations and standards, which helps businesses maintain stable operations in the short term.

However, with the rapid development of technology, especially in the fields of automation, big data analytics and artificial intelligence (AI), the role of the CFO has changed significantly. These technologies help CFOs not only manage finances more effectively but also make strategic forecasts, analyze financial situations in real time and provide deeper insights into the opportunities and challenges that the business may face. This transformation allows the CFO to focus on strategic decisions, participate in shaping the long-term development roadmap of the business and ensure that finance is optimally used to promote growth and innovation.

The common thread between the pre- and post-technology roles is that the CFO is still responsible for managing finances and ensuring the accuracy of financial reports. However, the big change is in the scope and how the work is done. In the past, CFOs faced a large workload of manually collecting, processing, and analyzing financial data. Now, technology allows them to automate these processes, reducing errors and freeing up time to focus on long-term strategies.

3. Digital transformation in finance and software to support financial managers

Digital transformation in finance is revolutionizing the way CFOs do their jobs. Instead of relying on traditional manual processes, CFOs can now use technology to automate daily tasks, increasing accuracy and efficiency.

Current software supporting financial managers includes:

- Cost management software: Solutions such as Bizzi Expense automates the expense management process from invoice collection, validation, to expense approval and reconciliation. This tool helps CFOs save time, increase accuracy, and easily control expenses in real time.

- Financial Planning and Analysis (FP&A) Software: FP&A tools support CFOs in financial planning, forecasting, and data analysis. They provide the ability to track and evaluate financial performance, helping CFOs predict trends and optimize resources.

- Risk management software: These tools help CFOs monitor and manage financial risks, ensure that the business is financially stable and protect assets effectively.

Digital transformation not only simplifies financial processes but also opens up new opportunities for CFOs to improve work efficiency and support leadership in decision making.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/ to experience the solution comprehensive cost management by Bizzi Expense

How software supports financial managers:

- Automate financial processes: Thanks to advances in technology, many manual finance tasks such as data entry, reconciliation and invoice checking have been automated. This has allowed CFOs to shift their focus from administrative tasks to strategic activities such as forecasting and planning.

- Real-time data and advanced analytics: Modern technology provides CFOs with a clear and constantly updated view of the company's financial situation. This allows them to predict trends, make accurate decisions and quickly adapt to market fluctuations.

- Strategic Responsibility: The CFO not only oversees finances, but also leads the financial strategy of the company. With their analytical and predictive skills, they help the management make important decisions such as expansion, investment or merger.

This shift marks the CFO's role from a traditional financial manager to a strategic leader, helping shape the future of the business.

4. Bizzi Expense: Enhancing the role of the CFO

Bizzi Expense is an advanced expense management solution that helps CFOs optimize financial management processes, improve efficiency and better control spending. With outstanding features, Bizzi Expense helps CFOs modernize expense management activities and focus on strategic goals.

Bizzi Expense's notable features include:

- Automate expense reporting: Bizzi Expense eliminates manual data entry, saving time and reducing errors. This feature allows CFOs to focus on strategic tasks instead of dealing with manual expense reports.

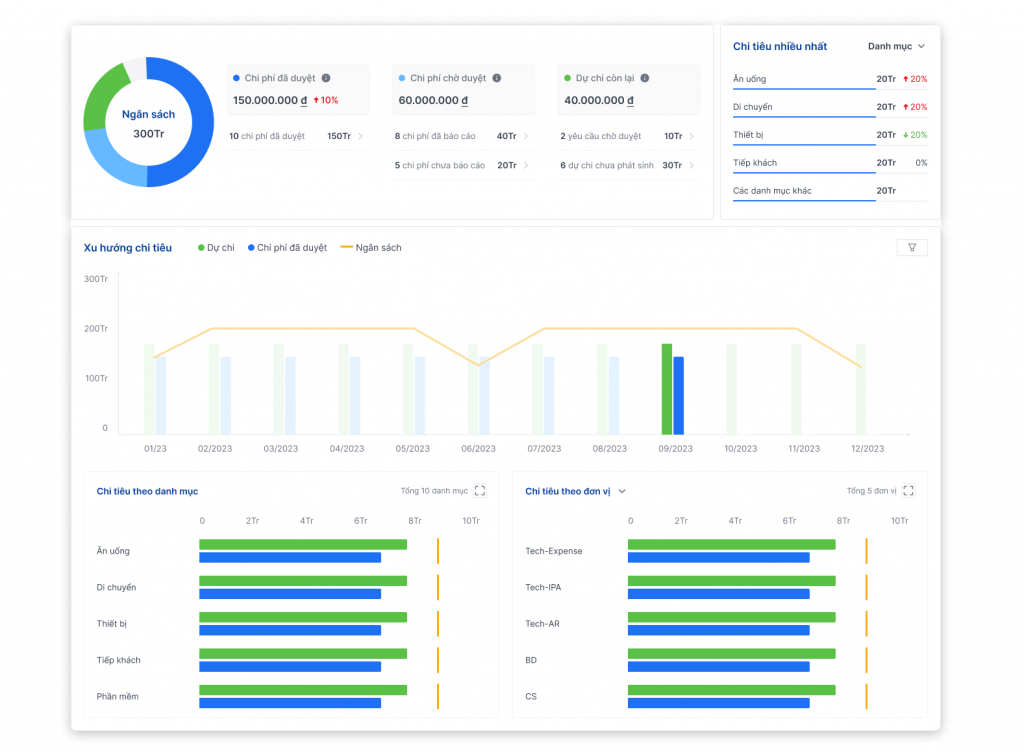

- Real-time spending visibility: Bizzi provides detailed spending tracking by category, department, or project in real time. CFOs can easily control spending and adjust budgets in a timely manner, helping to optimize financial performance.

- Custom spending controls: With the ability to set spending policies and control rules, Bizzi Expense helps CFOs ensure spending stays within budget and company policies, while preventing overspending.

- Easy integration with accounting systems: Bizzi Expense integrates flexibly with existing accounting and financial management systems, helping to synchronize data and optimize accounting processes.

Bizzi Expense is the ideal tool to help CFOs manage costs effectively and provide management with timely data to make informed decisions.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

5. Strategy for the modern CFO

To get the most out of digital transformation and technology, CFOs need to continue to develop their skills and invest in modern tools. Some next steps include:

- Investing in cutting-edge financial technology: Use tools like Bizzi Expense to automate and improve the efficiency of financial processes, allowing CFOs to focus on sustainable growth strategies.

- Focus on data analysis: Develop data analysis skills to be able to make predictions and decisions based on real data, supporting the business development strategy.

- Digital Skills Training and Development: Ensure that the CFO and finance team are up to date with the latest technology to effectively apply it in their work and enhance the business's competitiveness.

6. Conclusion

The role of the CFO has changed dramatically in the digital age. CFOs are no longer just managing costs and books; they now act as strategic advisors, helping to guide the development of the entire business.

Tools like Bizzi Expense have helped CFOs automate processes, provide real-time data, and improve financial efficiency. With these changes, CFOs can focus on long-term goals and become a key force in the sustainable development of the business.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam