In an increasingly competitive business environment, raising capital is vital for business growth. However, not all businesses have the collateral to access traditional loans. Therefore, unsecured business loans become the ideal solution, chosen by many businesses.

This form of loan allows businesses to access capital without mortgaging assets, while saving time thanks to simple procedures. But is this the optimal solution for all businesses? This article will provide detailed instructions on the steps to borrow business capital without collateral, from understanding the concept, types of loans, to how to choose the right solution.

Understanding unsecured business loans

An unsecured business loan is a type of loan where the business does not need to mortgage assets to secure the loan. Instead, the lending institution will rely on reputation, credit history, or business cash flow to decide on funding.

Compared to secured loans:

Criteria | Unsecured Loans | Secured Loan |

| Collateral | No need | Obligatory |

| Procedure | Simple, fast | Complicated, time consuming |

| Interest rate | Higher | Lower |

| Loan limit | Lower | Higher |

Advantage

- Simple procedure: No collateral valuation required, saving time.

- Quick: Approval and disbursement process is faster.

- Suitable for small businesses: Businesses without fixed assets can still access capital.

Disadvantages

- Higher interest rates: Because there is no collateral, the lending institution takes on more risk.

- Low loan limit: Businesses may not have access to large loans.

- Creditworthiness requirements: Businesses need to have a good business history to qualify for a loan.

Why do businesses need business loans?

Capital is always the core factor in maintaining and developing any business activity. However, not all businesses have enough equity capital to carry out expansion plans or maintain their operations. Therefore, business loans have become a necessary and popular option for many businesses, helping them to be more flexible in meeting their financial needs. Below are common reasons why businesses need business loans:

Common reasons

- Expand production

One of the main reasons why businesses borrow money is to expand production. When market demand increases or the business plans to grow in scale, it is necessary to invest in new facilities, factories, machinery or hire more workers. These expenses require large capital, and borrowing money is an optimal solution to help businesses carry out expansion plans without having to wait to accumulate enough resources. - Additional working capital

Working capital helps maintain daily business operations, including paying employees, purchasing raw materials, repaying debts, and other expenses. A shortage of working capital can lead to disruptions in production and make it difficult for a business to maintain stability. Working capital loans allow businesses to be proactive in managing cash flow, ensuring that business operations are not interrupted by short-term financial shortages. - Technology investment

In an increasingly competitive environment, updating and investing in technology is essential for businesses to improve production efficiency and product quality. Businesses can borrow capital to upgrade management systems, develop new products, or improve production processes through the application of advanced technologies. This not only helps optimize processes but also helps businesses create a great competitive advantage in the market. - Coping with the crisis

Crises, such as pandemics or recessions, can have a significant impact on business operations. When revenues decline and costs remain high, businesses need a steady stream of capital to sustain operations, protect employee jobs, and continue production. In these difficult times, borrowing is a solution that helps businesses stay afloat and weather the crisis without having to downsize or close.

The importance of capital for business

Capital is not only a tool for operating a business but also a lever to help the business develop. A reasonable capital usage plan can create a great competitive advantage, improve business efficiency and improve profitability. Capital can help the business not only maintain operations but also develop sustainably, thereby improving its position in the market and expanding its scale.

Without capital, businesses will have difficulty accessing new opportunities, reducing their ability to innovate and respond to market fluctuations. Therefore, having a plan to borrow capital and use capital effectively is an important factor in a business's long-term development strategy.

Forms of unsecured business loans

In the context of many businesses having difficulty providing collateral when borrowing capital, forms of loans that do not require collateral become the superior choice. These forms help businesses easily access capital without having to worry about providing assets, while still ensuring financial transparency and business reputation. Below are three common forms of unsecured business loans:

1. Business credit loan

Define:

Business credit loans are a form of capital loan based on the creditworthiness and business revenue of the enterprise without the need for collateral. The capital provider will mainly rely on the financial capacity of the enterprise, including factors such as the enterprise's revenue, profit and credit history to make a lending decision.

Condition:

- Businesses need to be in business for 1-2 years or more to demonstrate stability.

- Good credit history, no bad debt or overdue loans.

- Stable revenue and profit are important factors to ensure debt repayment ability.

Advantage:

- Quick: The loan process is quick and simple, does not require collateral, helping businesses access capital easily and save time.

- No collateral required: This is the optimal choice for businesses that do not have enough assets to secure a loan but still have strong reputation and financial capacity.

Disadvantages:

- High interest rate: Unsecured loan interest rates are usually higher than secured loans because the risk to the lender is higher.

- Financial transparency requirements: Because there is no collateral, businesses need to have clear and transparent accounting books to demonstrate their ability to repay debts.

2. Revenue-based financing

Define:

Cash flow-based lending is a form of financing in which the lending institution relies on the actual cash flow of the business to decide on the loan limit and repayment capacity. This form is especially suitable for businesses with stable, regular cash flow and the ability to repay debt from monthly revenue.

How to calculate loan limit:

The loan limit will be calculated based on a percentage of the business's monthly revenue. For example, if the business has a steady revenue and a certain portion of the revenue will be used to repay the debt, the financial provider will lend an amount that is consistent with the business's ability to repay.

Characteristic:

- Flexible: This form of loan is highly flexible, as loans will be adjusted based on the actual revenue of the business, helping to avoid financial burdens for businesses during periods of low revenue.

- Suitable for businesses with stable cash flow: Businesses with steady cash flow from sales or service provision have easy access to this loan.

3. Borrow from microfinance institutions

Characteristic:

Borrowing from microfinance institutions is a form of capital lending mainly aimed at small businesses or business households. Microfinance institutions often provide small loans with simple procedures and reasonable interest rates, helping small businesses to easily access capital.

Loan process:

The loan process at microfinance institutions is usually very simple, easy to understand and does not require collateral. This helps businesses to quickly complete loan procedures without encountering many administrative barriers.

Advantage:

- Flexible procedures: Microfinance institutions often do not require collateral and have flexible loan processes, making it easy for small businesses to access capital without procedural difficulties.

- Reasonable interest rate: Interest rates at microfinance institutions are often lower than those of unsecured loans or loans from large banks, helping small businesses reduce financial pressure.

Each form of unsecured loan has its own characteristics and benefits, helping businesses easily choose the form of loan that suits their financial needs and repayment ability. Depending on the nature of their operations and financial situation, businesses can consider and choose the appropriate form of loan to support sustainable growth and development.

Business Loan Support Solution – Bizzi Financing

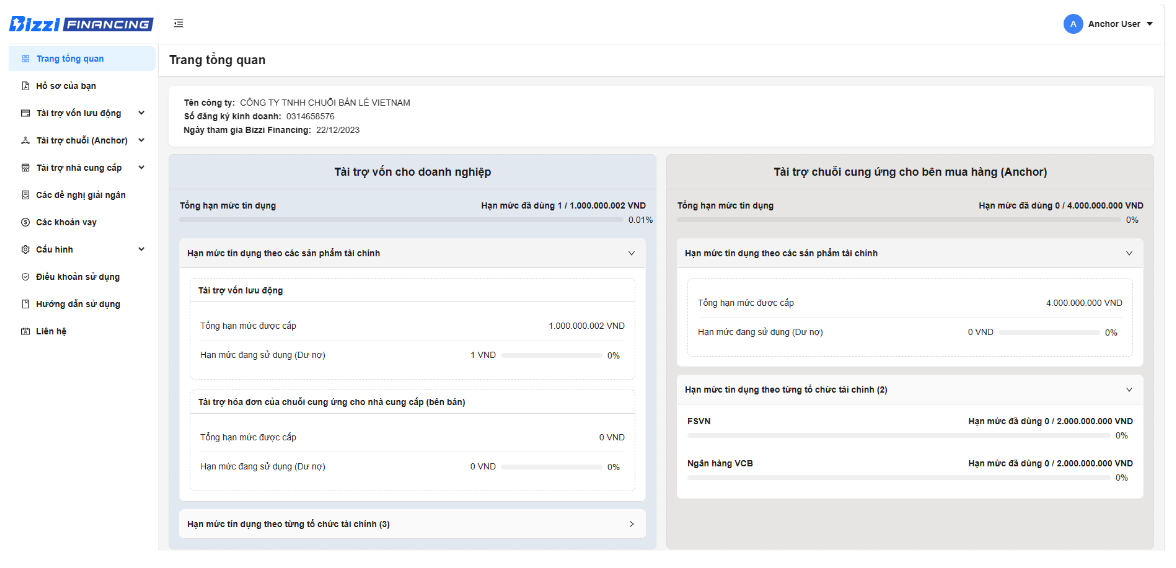

With the strong development of financial technology, connecting businesses with capital sources from investors and financial institutions is becoming easier and more effective. Bizzi Financing is a financial technology platform that helps businesses quickly access supporting capital sources without having to worry about complicated procedures or collateral requirements. Below is detailed information about Bizzi Financing and the outstanding advantages of this platform.

1. What is Bizzi Financing?

Bizzi Financing is a fintech platform that connects businesses with investors and financial institutions. With the aim of simplifying the lending process, Bizzi Financing provides fast and convenient lending solutions, helping businesses save time and costs in finding funding sources. This platform is especially suitable for businesses that need unsecured loans or businesses that want to find flexible and quick sources of capital for development.

Bizzi Financing acts as a bridge, connecting investors with businesses in need of capital. Businesses can register on the platform to receive advice and support in choosing the right loan form for their financial situation and development goals. The loan process on Bizzi Financing is simple and transparent, helping businesses easily access capital without having to worry about cumbersome procedures.

2. Advantages of Bizzi Financing

- Simple process, quick approval.

- Flexible loan conditions, suitable for many types of businesses.

- Competitive and transparent interest rates.

- Professional financial consulting services, maximum support in completing documents.

With outstanding advantages and dedicated support services, Bizzi Financing is an optimal financial solution for businesses, helping them access capital quickly and effectively without having to worry about cumbersome procedures or collateral requirements. Choosing Bizzi Financing to borrow capital will give businesses the opportunity to develop strongly and sustainably in a competitive business environment.

Register for Bizzi Financing information here: https://finance.bizzi.vn/

Conditions and procedures for unsecured business loans

Unsecured business loans are a great option for businesses that want to access capital without having to worry about mortgaging assets. However, to be able to borrow successfully, businesses need to meet certain conditions and prepare a complete loan application. Below is detailed information about the conditions, loan application and unsecured loan process.

1. General conditions

To borrow business capital without collateral, businesses need to meet the following basic requirements:

- Stable revenue in the last 6-12 months:

This is an important factor that lenders will consider before approving a loan. Stable revenue shows the financial strength of the business, helping lenders assess the business's ability to repay debt in the future. - Good profit, no bad debt:

Businesses need to demonstrate that their business is consistently profitable and has no bad debt history. A business with a healthy financial situation will have easier access to loans and receive better loan terms.

2. Loan application documents to prepare

To be able to borrow capital without collateral, businesses need to prepare complete loan documents according to the requirements of the lending organization. Below are the necessary documents:

- Business license:

This is the most basic and important document to prove that your business is legal and operating within the law. - Financial report:

The company's financial statements for at least the last 6-12 months will help the lending institution assess the financial health of the company. These reports include the balance sheet, income statement, cash flow statement, and other relevant documents. - Business contract (if any):

If the business is undertaking large contracts or has specific projects, providing a business contract will help increase transparency in the borrowing process and demonstrate the business's ability to recover capital.

3. Loan process

The process of borrowing unsecured loans through financial institutions or financial platforms will be carried out according to the following basic steps:

- Registration information:

Businesses need to provide basic documents through the lending platform, including information about the business, necessary financial documents and loan purposes. This is the first step for the lending institution to assess the business's loan needs. - Assessment:

After receiving the application from the business, the lending institution will conduct an assessment of the application and financial information of the business. This process will help the lending institution assess the feasibility of providing capital based on the financial situation of the business and the ability to repay the loan. - Sign the contract:

If the loan application is approved, the business will be required to sign a loan agreement with the lending institution. The agreement will detail the loan terms, interest rate, repayment period, and other agreements between the two parties. - Disbursement:

Once the contract is signed, the loan will be transferred to the business account. The business can use this money for business purposes such as expanding production, investing in technology or supplementing working capital.

Notes when borrowing capital for business

Unsecured business loans are a useful financial solution to help businesses grow, but if not managed properly, borrowing can become a financial burden. To ensure effective use of loan capital and avoid unnecessary financial risks, businesses need to pay attention to some important points below:

1. Things to avoid

- Borrowing more than necessary:

One of the common mistakes when borrowing money is to borrow more money than the business actually needs. This not only causes the business to incur a large debt but can also lead to difficulties in repaying the loan later. Before deciding to borrow, clearly define the amount of money needed to serve specific purposes and limit borrowing beyond this amount. - No clear debt repayment plan:

A big mistake many businesses make when borrowing money is not having a detailed repayment plan. This can cause confusion in maintaining cash flow and lead to bad debt. To avoid this risk, businesses need to have a clear repayment plan, including determining the payment period, monthly payment amount and payment method.

2. How to manage capital effectively

- Invest for the right purpose:

Borrowed capital can only be effective when used for the right purpose. Businesses need to ensure that the borrowed money is spent on profitable business activities, such as expanding production, investing in technology, or developing new products. Investing for the wrong purpose can lead to a waste of capital and not meeting economic efficiency expectations. - Continuously monitor cash flow:

Cash flow management is a key element in debt management. Businesses need to regularly monitor their income and expenditure to ensure that their operations are not disrupted and that they have sufficient financial resources to repay their debts on time. Tight control of cash flow will help businesses maintain financial stability and avoid future financial risks. - Make a detailed debt repayment plan:

Having a detailed repayment plan makes it easier for businesses to track payments and prepare for future financial commitments. The plan should include regular payments, payment dates, and remaining balances. If possible, businesses should also negotiate with lending institutions to have the flexibility to adjust repayment terms or amounts as needed.

Conclude

Unsecured business loans are an effective solution for businesses that want to expand without having to mortgage assets. However, choosing the right form of loan and managing capital effectively are key factors for success. Consider carefully and learn more about solutions like Bizzi Financing to optimize your financial resources!

Monitor Bizzi To quickly receive the latest information: