“Becoming an international financial and supply chain center: What do Vietnamese businesses need to prepare?” is a question that requires careful preparation of long-term strategies from leaders. This is considered a big step, but to take advantage of this opportunity, Vietnamese businesses need to prepare both “internal strength” and “external strength”.

Join Bizzi in exploring the role of the SCF financial supply chain and assessing the challenges and opportunities in this economic development process.

What is SCF? The role of supply chain finance?

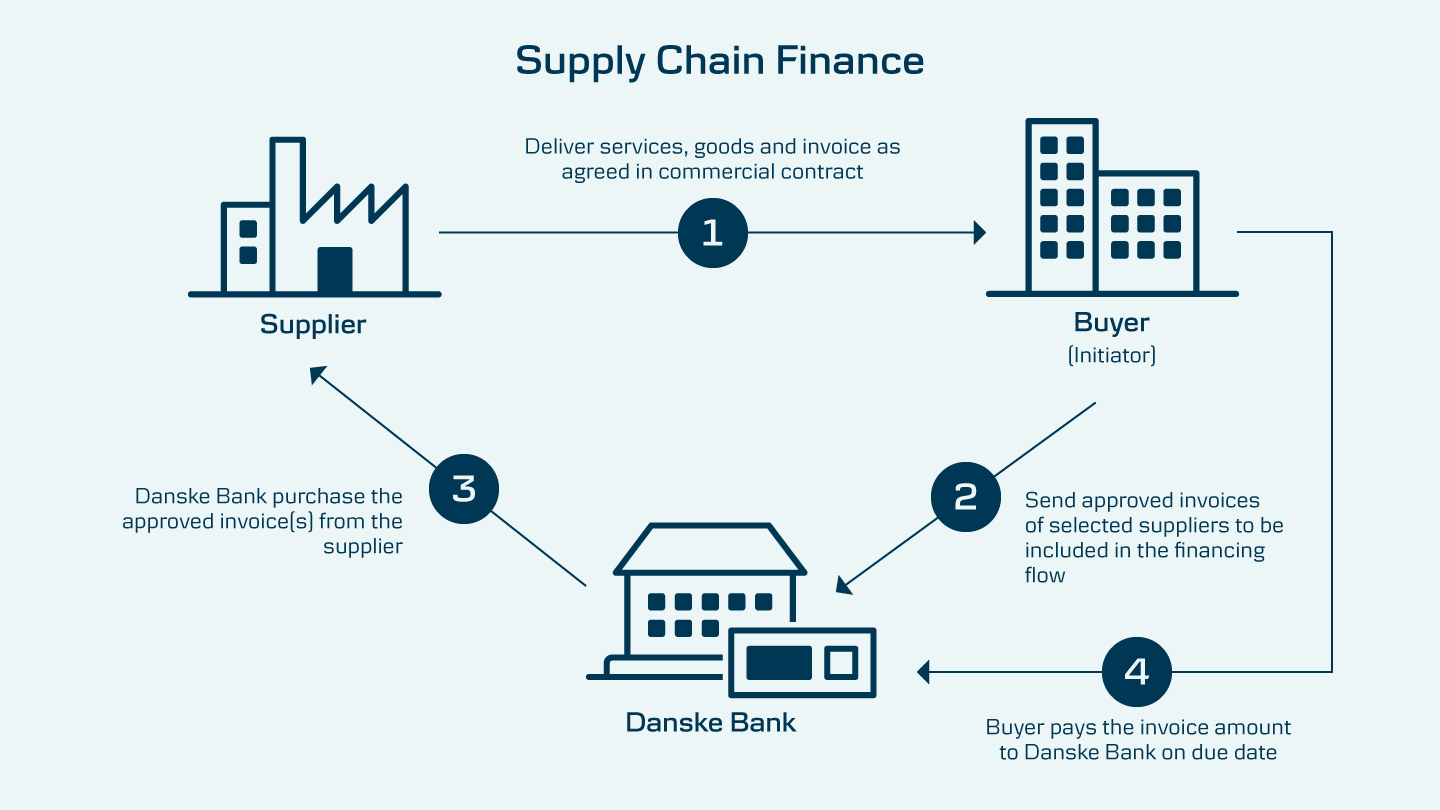

SCF (Supply Chain Finance) is a set of financial solutions designed to optimize cash flow in the supply chain, helping suppliers - buyers - banks/financial institutions benefit.

The Role of Supply Chain Finance (SCF):

- Cash flow optimization: SCF helps suppliers turn their undue receivables into cash quickly, solving the problem of working capital shortage.

- Reduce financial costs: Suppliers can access finance at lower costs, as they benefit from the better credit rating of large buyers.

- Improve operational efficiency: SCF enables suppliers to increase output, invest in infrastructure, and pay workers on time, thereby increasing productivity and creating jobs.

- Improve supply chain relationships: SCF creates a financial ecosystem where parties trust each other more, reduce risks and enhance sustainable cooperation.

- Support for small and medium enterprises (SMEs): SCF makes it easier for SMEs to access capital, especially in emerging markets, helping them integrate into the global trade chain.

Becoming an international financial and supply chain center: What do Vietnamese businesses need to prepare? Based on the role of SCF analyzed, here are some essential elements:

- Enhance international competitiveness

- Developing high quality human resources

- Building modern technology and financial infrastructure

- Improving the business environment and legal framework

- Strengthening global network connectivity

- Ensure stability and transparency in business operations.

Assessing the current state of Vietnamese enterprises

The current situation of Vietnamese enterprises is characterized by an abundant labor force but a lack of expertise, leading to a brain drain and a lack of skilled workers for developing industries. The number of private enterprises tends to decrease in the period 2010-2020 due to many factors such as lack of capital, specialized human resources, fear of risk and a complex business environment.

Key challenges:

- Labor resources: Although abundant, the current labor force has not been invested in enough expertise and skills, causing a shortage in high-skilled occupations and leading to a "brain drain".

- Lack of high quality human resources: Businesses are having difficulty recruiting and retaining skilled, highly specialized workers, especially for the development of the digital economy.

- Difficulties in capital and business environment: Private enterprises face barriers in accessing capital, have difficulty expanding their business and are concerned about changes in the business environment.

- Trend of declining number of enterprises: The 2010-2020 period recorded a significant decline in the number of private enterprises, reflecting the challenges that businesses are facing.

Opportunities and development orientation:

- Digital economic development: Vietnam aims to promote businesses to develop towards a digital economy, which requires investment in improving the quality of its workforce.

- Improve competitiveness: There is a need for policies and efforts to improve the professional qualifications of workers to meet the increasing demands of businesses and the economy.

When Vietnam becomes an international financial and supply chain center: What do Vietnamese businesses need to prepare?

Vietnam’s move towards becoming an international financial center and global supply chain requires changes for both the country and businesses. From the perspective of Vietnamese businesses, there are some important preparation steps as follows:

For international financial centers:

- Improve competitiveness: Businesses need to focus on high-value financial services, invest in financial technology (Fintech) and expand their markets internationally.

- Human resource development: Training a team of internationally qualified financial experts with knowledge of capital markets, risk management, and advanced financial instruments.

- Infrastructure Improvements: Invest in information technology infrastructure, global financial network connectivity systems, and modern trading platforms.

- Improving the business environment: Build a transparent legal framework that is friendly to international investors and create a favorable environment for diverse financial activities.

For international supply chain centers:

- Strengthening connectivity and cooperation: Building a global network of partners, participating in regional and international supply chains.

- Investment in technology and digitalization: Apply technology to supply chain management, improve operational efficiency, and reduce costs.

- Improving logistics capacity: Invest in modern transportation infrastructure, warehousing, and professional logistics services to reduce time and costs.

- Logistics human resource development: Train a team of logistics professionals with knowledge of international supply chain management, transportation, and global trade.

- Ensuring stability and transparency: Build an effective risk management system, ensuring transparency in every stage of the supply chain to attract international partners.

General preparation for both:

- Promoting digital economy: Developing the digital economy is an important factor, facilitating financial activities and supply chains.

- Strengthening international links: Close cooperation with financial institutions and international organizations, participating in free trade agreements.

Bizzi Financing: SCF solution helps businesses increase working capital, reduce risks

Bizzi Financing is the foundation Connecting funding for businesses, acts as an intermediary between businesses and a network of financial partners (including reputable banks and financial institutions in Vietnam). The platform supports a variety of financial products such as:

- Supply chain finance: advance 100% invoice, simple profile, competitive interest rate.

- Working capital financing: including credit limit, overdraft, guarantee, letter of credit (L/C)…

Bizzi does not directly provide capital, but leverages its technology ecosystem and partners to help businesses access it quickly, conveniently and cost-effectively. Bizzi Financing.

Bizzi Financing Highlights:

- Quick disbursement: Businesses only need to provide sales invoices or contracts, Bizzi connects directly with financial institutions to approve and disburse in a short time.

- No collateral required: Applications are reviewed based on actual transaction data and debt history, reducing pressure on SMEs that do not have many collateral assets.

Flexible funding options:- Invoice Financing

- Contract Financing

- Short-term credit limit based on actual cash flow

- Transparent and easy-to-estimate costs: Interest rates and fees are clearly disclosed, businesses can calculate in advance to balance cash flow.

- Integrated right on Bizzi Platform: Businesses can both manage debt and proactively access working capital in just one system.

Advantages when businesses apply Bizzi Financing

-

Flexible and diverse access to capital

-

- Comprehensive solution: covering working capital, supply chain finance, overdraft, guarantee, L/C… suitable for each stage and specific needs.

- Advance bill up to 100% Helps businesses quickly rotate capital for production, manage inventory, and maintain continuous cash flow.

-

Quick procedures, optimized operations

-

- Completely online application with the ability to choose the right loan package in just 30 seconds—saving time and reducing administrative procedures.

- Integrated with Bizzi ecosystem (managing invoices, debts, expenses, budgets...), helps financial operations run more seamlessly and efficiently.

-

Cost-effective and transparent

-

- Competitive interest rates, thanks to Bizzi's connection with many financial partners; helping businesses reduce financial costs compared to traditional loans.

- Centralized and clear management helps avoid waste and increases transparency in the funding process and cash flow control.

With Bizzi Financing, SMEs can confidently “pump blood” into their business operations, reduce cash flow pressure and increase competitiveness even in a volatile market. If you need advice on loan solutions that suit your business needs, register here: http://finance.bizzi.vn

Conditions and documents required to participate in SCF

To participate in SCF (Supply Chain Finance), businesses need to meet general conditions such as having a valid legal entity, effective business operations and a good credit history. Documents to be prepared include: business registration, financial statements, sales contracts with partners and invoices requiring financing.

General conditions for joining SCF:

- Legal status: The enterprise must have valid legal status.

- Business activities: Need to have an effective, feasible and profitable business plan from current business operations.

- History of activity: Minimum 1-2 years of operation.

- Credit history: A good credit history is required, especially for buyers in Reverse Factoring.

- Partners in the chain: There should be clear contracts for the purchase or supply of goods and services with partners in the supply chain.

- Collateral: Depending on the level of risk and the sponsor's requirements, collateral or specific commitments may be required.

Documents to prepare:

- Business registration certificate: Legal business license.

- Financial report: Financial statements such as income statements, balance sheets.

- Sales contract: Contracts for the purchase/supply of goods/services with partners in the chain.

- Bill: Valid, confirmed invoice (for Factoring/Reverse Factoring).

- Other documents: Depending on the specific requirements of the financial institution, additional documents such as credit history or related commitments may be required.

Conclude

SCF can be considered a win-win solution when: Buyers get extended payment, Suppliers receive money early, Banks collect fees safely. This is an important piece if Vietnam wants to become an international financial and supply chain center. What do Vietnamese businesses need to prepare? Perhaps through this article, managers and leaders have more perspectives on the current situation and suitable solutions.

In general, businesses need to proactively source capital before the market becomes more competitive. SCF will help SMEs participate more deeply in the global supply chain, avoiding "capital congestion" by creating flexible cash flow. When combined with solutions such as Bizzi Financing - acting as a "lubricant" to help the supply chain operate smoothly, reduce disruptions, thereby opening up many opportunities.

To learn and try Bizzi Financing – SCF solution for small and medium enterprises, Register here: https://finance.bizzi.vn/