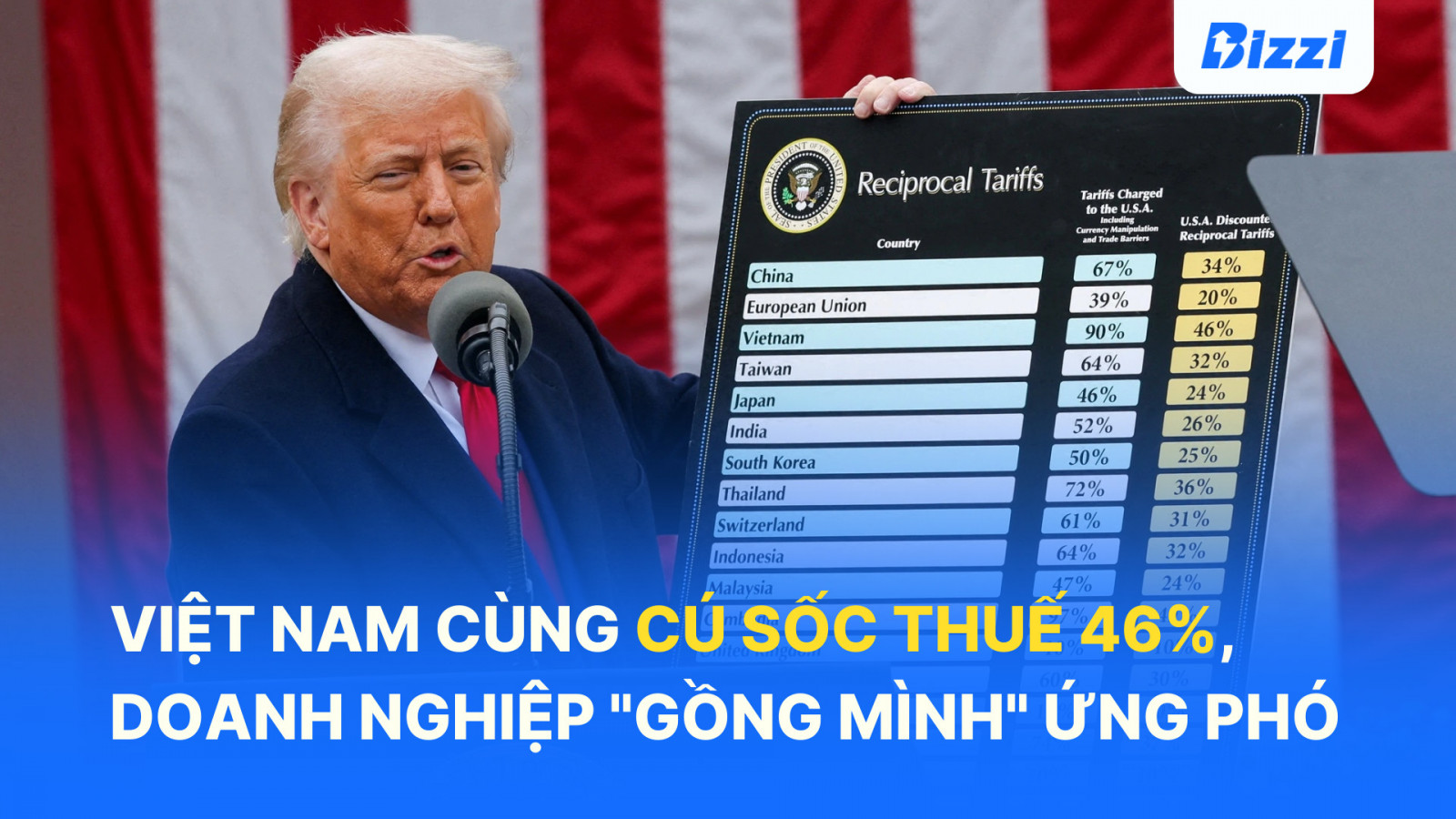

On April 2, 2025, US President Donald Trump announced reciprocal tariffs on more than 180 countries. Vietnam was hit with a tariff of 46%, the highest among the affected countries. The base tariff is 10%, but countries with large trade deficits with the US will be hit with higher tariffs. This is part of the “Liberation Day” strategy to change the global trade landscape.

Join Bizzi to learn about the impacts on Vietnamese businesses and some strategies to respond to this tariff policy!

US Countervailing Duty Rate

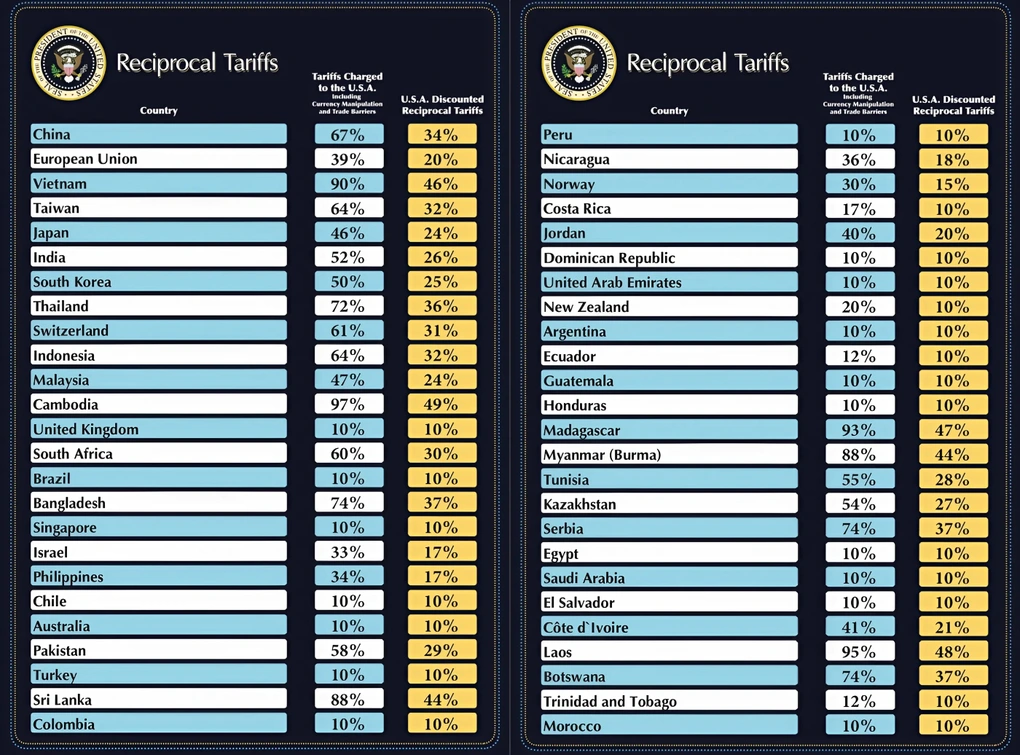

According to an announcement from the White House, President Trump has announced reciprocal tariffs that apply to more than 180 US trading partners. The plan includes a base tax rate of 10% Applicable to most countries.

Countries with large trade deficits with the US, such as Vietnam, will be subject to higher tariffs (46%). President Trump explained that this is a countermeasure to reduce the trade deficit and protect domestic production.

The US administration has said that reciprocal tariffs are set at about half the rate that other countries charge on US exports, which it describes as “reciprocal” tariffs. However, the exact method for calculating these tariffs, including whether non-tariff barriers and subsidies are taken into account, is not entirely clear.

While the concept of “reciprocity” is presented as fair, the lack of transparency in the calculation method raises concerns about the possibility of bias and the actual fairness of the tax rates applied.

>> Read more: President Donald Trump announces US reciprocal tariffs

Global reactions and concerns

Affected countries, such as China and South Korea, have reacted strongly, vowing to retaliate. China has called the move “bullying” and South Korea has expressed concern about the negative impact on its export-oriented economy. Allies such as Britain and the European Union have also expressed displeasure at the high tariffs.

In addition, global economic experts have expressed deep concerns about the negative impact of President Trump's reciprocal tariff policy. Many believe that this is a shock for the world economy and could be a "turning point" for the globalization system.

>> Read more details: After the US's massive tax action: Reactions and concerns from countries and global experts

How do new tariffs affect the world?

President Trump's imposition of wide-ranging reciprocal tariffs is expected to have many negative impacts on the global economy.

- Inflation and consumer prices increase: The tax will push up the price of goods, especially items like cars, electronics and everyday consumer goods.

- Risk of trade war: Countries hit by tariffs could retaliate, causing global trade tensions.

- Supply chain disruption: Businesses will have to adjust their supply strategies to avoid high tariffs, which will affect the entire international supply chain.

- Impact on economic development: Developing economies with trade ties to the US will be hit hard, especially in exports.

>> Read details: Notable global economic impacts

Tax rate 46% has a big impact on Vietnamese businesses

Vietnam is one of the countries subject to the highest reciprocal tax rate from the US, at 46%. This tax rate is calculated based on the US trade deficit with Vietnam. With exports of 136.6 billion USD to the US and imports of 13.1 billion USD, the trade deficit reaches 123.5 billion USD, resulting in a tax rate of 46%.

High tariffs could reduce orders and revenue for exporting businesses, while increasing production costs, forcing companies to seek alternative markets or adjust prices. This could reduce the competitiveness of Vietnamese goods and disrupt supply chains.

Industries most affected

Vietnam's major export industries will be strongly affected by the new tariffs, including:

- Electronics and components: Companies like Samsung, Foxconn, and Luxshare may face rising costs, forcing them to reconsider their manufacturing strategies.

- Equipment: The industry will also struggle with rising costs and falling demand.

- Textile: The US accounts for nearly 50% of textile and garment export revenue, leaving companies like Vinatex and TNG facing fierce competition and falling orders.

- Footwear: Vietnam exports nearly a third of its footwear to the US, and brands like Nike may need to adjust prices or shift production.

- Wood furniture: The lumber industry will also be hit hard, especially for companies that supply US retailers like Wayfair.

>> See more: Which Vietnamese industries are hurt when the US imposes a huge tax of 46%?

Vietnamese Government's response and response plan

The Vietnamese government has taken steps to reduce import tariffs on US goods to reduce the trade surplus and ease tensions. Decree 73/2025/ND-CP recently revised tariffs on items such as automobiles, wood products and corn. The government is also actively negotiating with the US to find a suitable solution.

Prime Minister Pham Minh Chinh chaired a meeting with ministries and sectors to find ways to respond. The government stressed the need for the US to have a fairer tax policy, in line with the good relations between the two countries.

Potential future strategy

- Bilateral negotiations: Seek tax exemptions or reductions for strategic products.

- Market diversification: Expand exports to Europe, Japan, South Korea and ASEAN to reduce dependence on the US.

- Support domestic businesses: Provide financial and tax policies to help businesses cope with the impact of tariffs.

- FDI attraction: Encourage direct investment in sectors less dependent on exports to the US.

- Enforcement of rules of origin: Preventing the act of “laundering Vietnamese origin” and maintaining integrity in trade relations.

>> See more: The most important thing for Vietnamese businesses before the US imposes 46% tax

How do Vietnamese businesses overcome shocks and turn danger into opportunity?

In the context of high tax rates, Vietnamese enterprises will face many great challenges. However, in danger there is always opportunity, and enterprises need to proactively seek solutions to minimize negative impacts and take advantage of new opportunities.

Long-term adaptation strategy for Vietnamese enterprises

- Diversify export markets:

Instead of being overly dependent on the US market, businesses need to actively explore and expand into alternative markets, such as the EU (taking advantage of the EVFTA), Japan, Korea, ASEAN and potentially emerging markets such as Russia, Australia and New Zealand.

At the same time, participating in trade promotion events and strengthening trade relations with other countries. Reducing over-reliance on the US market is important to minimize the impact of changes in US trade policy and build long-term resilience.

- Improve competitiveness:

Businesses need to focus on improving product quality, improving technology, reducing production costs and building strong brands to increase competitiveness in the international market, even when facing tariffs.

Businesses should also invest in research and development, apply technology and train the workforce to improve productivity and create higher value products.

- Supply chain optimization:

Businesses need to review and optimize their supply chains to minimize costs arising from tariffs and other trade barriers. Finding alternative sources of raw materials and components may become important.

- Product structure shift:

In some cases, businesses may need to consider shifting their product mix to items that are less affected by tariffs or have growth potential in other markets.

- Take advantage of trade agreements:

Vietnam has signed many free trade agreements (FTAs) with major economic partners in the world. Enterprises need to make the most of tariff incentives and other commitments in these FTAs to expand their markets and minimize the impact of US tariffs.

- Cooperation and association:

Businesses can strengthen cooperation and connect with each other to share information, experience and resources, and overcome difficulties together. Industry associations also play an important role in supporting businesses to respond to external challenges.

- Government support policy:

Timely and effective support from the Government is a key factor in helping businesses overcome tariff shocks. Support policies can include reducing operating costs, facilitating access to capital, supporting trade promotion and finding new markets, as well as supporting training to improve business capacity.

Rapid Response Strategies for Business Owners

Businesses cannot stand still and need proactive strategies to protect profits and maintain growth. Here are practical solutions to help businesses optimize costs, manage cash flow and be ready to adapt.

Smart cost control

There are many ways business owners can optimize costs in the face of new tariffs. One important strategy is to diversify suppliers and explore sourcing domestically or from non-tariff regions to reduce import costs.

Negotiating better terms with suppliers, such as volume discounts, longer payment terms or sharing the burden of tariffs, can also help reduce costs.

Optimizing operational efficiency by eliminating unnecessary costs, automating processes, and adopting lean inventory management strategies can help reduce overall operating costs.

Additionally, businesses can consider strategically adjusting their pricing structure, such as using value pricing, cross-selling, or applying targeted discounting to maintain revenue without losing competitiveness.

It is also important to research and apply favorable trade rules and ensure correct classification of goods according to the Harmonized System (HTS) to avoid unnecessary tariff payments.

Effective Cash Flow Management

Effective cash flow management is critical for businesses to overcome the challenges posed by tariffs. Businesses should enhance their cash flow forecasts to anticipate the potential impacts of tariffs and adjust their financial plans accordingly.

Diversifying supply chains and supplier payments can help reduce dependence on high-tax regions and improve resilience. Optimizing working capital management by extending payment terms with suppliers, accelerating collections from customers, and leveraging supply chain finance programs can help maintain liquidity.

Considering financing options such as factoring or loans to support businesses affected by tariffs can also help maintain steady cash flow. Building a cash reserve to deal with unexpected costs or disruptions that may arise due to tariffs is an important precaution.

Preparing for FDI Manufacturing Enterprises

Manufacturing companies engaging in FDI should prepare for the impact of tariffs by carefully reviewing their supply base and supply chains to identify areas that may be affected by tariffs. They should evaluate existing contracts with suppliers and customers to understand whether tariff costs can be passed on or whether price adjustments are required.

Planning for different scenarios of the impact of tariffs on budgets and prices can help businesses make informed decisions. FDI businesses should also explore alternative sourcing options in countries that are not subject to high tariffs or consider the possibility of shifting production to other regions to mitigate the impact of tariffs.

Investing in traceability and supply chain transparency can help prevent trade fraud and ensure regulatory compliance. In addition, businesses should strengthen cooperation with domestic partners to increase localization and reduce dependence on imported raw materials.

Financial digitalization solutions from Bizzi Vietnam – promoting effective response strategies

Bizzi Vietnam understands that in the context of increasing tariffs, businesses need flexible and optimal financial solutions to maintain competitiveness and sustainable development. We provide a comprehensive digital solution ecosystem, helping Vietnamese businesses quickly deploy strategies to optimize costs, manage cash flow and prepare for the future. Here is how Bizzi Vietnam supports businesses in implementing the above 3 strategies:

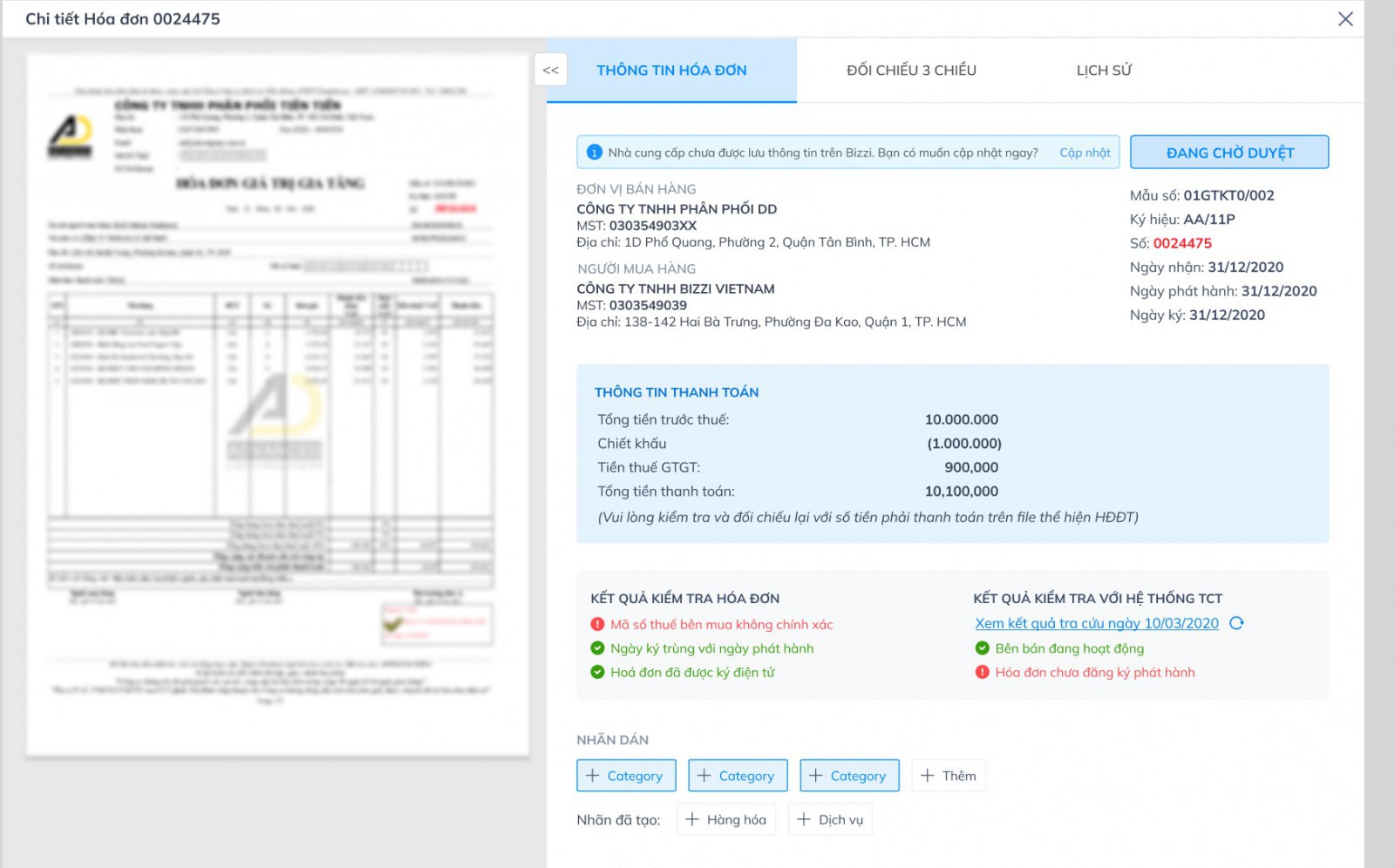

Automate processes with the ability to first invoice processing smart entry:

Bizzi Vietnam provides solutions to automate financial and accounting processes, helping businesses reduce human resources costs and errors in daily work.

Bizzi helps businesses automate the process of processing input invoices, from identification, data extraction to storage and reconciliation. This helps minimize errors, save time and human resources costs, and increase the ability to control costs, especially costs related to sourcing and importing.

Effective invoice management also helps businesses accurately grasp costs arising from tariffs, thereby providing a basis for making decisions to adjust prices or find more optimal alternative sources of supply.

Tight and comprehensive control of business costs

Solution Expense management Bizzi Expense allows businesses to track and manage all expenses in a centralized and transparent manner. Businesses can easily analyze expenses by category, department or project, thereby identifying areas for optimization and cutting unnecessary costs.

In a climate of rising tariffs, keeping a tight control on operating costs is more important than ever to maintain profitability. Bizzi provides detailed and visual reports, helping business owners make informed and timely financial decisions.

Smart and flexible cash flow management

Managing cash flow during times of rising tariffs is a major challenge for businesses. Bizzi offers debt management tools receivables and payables, helping businesses track payment status of customers and suppliers.

The automatic payment reminder feature helps businesses collect debts faster, improving cash flow. At the same time, tight management of payables helps businesses be proactive in paying suppliers, maintaining good relationships and being able to negotiate more favorable payment terms in the context of increasing input costs due to tariffs.

In addition, Bizzi has the ability to connect businesses with reputable financial partners, providing loan solutions flexible and tailored to the needs of each business. During the period of being affected by tariffs, businesses may face cash flow difficulties due to increased costs and extended payback periods.

Bizzi helps businesses access short-term loans or supply chain financing solutions to ensure business continuity and overcome financial challenges.

Although the US imposition of reciprocal tax 46% is a big challenge for Vietnamese enterprises, with proactiveness, flexibility and continuous efforts, along with support from the Government, enterprises can completely overcome this difficult period, restructure operations and seek new development opportunities in the global market.

The results of the upcoming trade negotiations between Vietnam and the US will also play an important role in shaping the future of trade relations between the two countries and affecting the business strategies of Vietnamese enterprises.

To support businesses in responding to this challenge, smart financial and accounting solutions from Bizzi will be an effective tool to help optimize costs, manage cash flow and optimize processes, helping businesses overcome difficulties and grow stronger in a globally competitive environment.

Learn about Bizzi Vietnam's solutions at: https://bizzi.vn

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam