On April 2, 2025 (US time), US President Donald Trump announced a series of new tariffs, described as “reciprocal” tariffs, effective immediately. This move, the Trump administration called “Liberation Day”.

The plan imposes reciprocal tariffs on imports from more than 180 countries and territories, including a base rate of 10% that applies to most countries and higher, more personalized tariffs targeting countries with large trade deficits with the United States.

Notably, Vietnam faces a tariff rate of 46%, one of the highest next to Cambodia. The decision is expected to have far-reaching consequences for the global economy, including the possibility of rising inflation, slowing economic growth, and escalating trade tensions due to the US’s massive tariffs.

Join Bizzi as we explore the details of these new tariffs, assess the reactions from countries such as China, South Korea and the UK, as well as the views of global economic experts on the impact on the world economy. In particular, we will examine the impact on Vietnamese businesses, identify the industries most affected, the concerns and response plans of the Government, and the challenges and opportunities that Vietnamese businesses face after the US imposed huge tariffs.

President Donald Trump announces US reciprocal tariffs

According to the White House, President Trump announced reciprocal tariffs on more than 180 of America's trading partners. The plan includes a base tariff of 10% for most countries. However, about 60 countries will be subject to higher tariffs, based on the US's assessment of trade imbalances and trade barriers they impose on American goods. The US's decision to impose this huge tariff has shocked global public opinion.

The announcement was made to fulfill a campaign promise to address what the U.S. considers unfair trade practices and boost domestic manufacturing. The tariffs are part of a broader “reciprocal” trade strategy, aimed at matching taxes imposed by other countries on U.S. goods.

To justify these measures, President Trump invoked the International Emergency Economic Powers Act (IEEPA), declaring a national emergency caused by foreign trade practices. The use of IEEPA shows that the administration views the trade deficit as a serious threat to US national security and sovereignty.

The US administration has said that reciprocal tariffs are set at about half the rate that other countries charge on US exports, which it describes as “reciprocal” tariffs. However, the exact method for calculating these tariffs, including whether non-tariff barriers and subsidies are taken into account, is not entirely clear. This lack of transparency raises questions about the US’s move to impose massive tariffs.

While the concept of “reciprocity” is presented as fair, the lack of transparency in the calculation method raises concerns about the possibility of bias and the actual fairness of the tax rates applied.

The detailed tax rate table announced at the event in the White House Rose Garden shows significant differences between countries. For example, China subject to tax 34%, not counting the additional 20% tariffs that were imposed earlier in Trump's second term, bringing the total tariffs to 54% for Chinese goods. Korea and Japan, two Asian allies of the US, are also subject to high tariffs, respectively. 25% and 24%. Notably, Vietnam among the countries with the highest reciprocal tax rates, up to 46%.

Opposite, Older brother only face the tax 10%, half of the 20% rate imposed on goods from the European Union (EU). Other countries in the Southeast Asian region are also subject to high tariffs, such as Cambodia (49%), Malaysia (24%), Indonesia (32%), Thailand (36%), Laos (48%) and Myanmar (44%). The US imposing a huge tax of 46% on Vietnam is shocking news.

After the US's massive tax action: Reactions and concerns from countries and global experts

China's Ministry of Commerce reacted strongly, declaring that there would be "resolute countermeasures" and urged Washington to cancel unilateral tariff measures. China called the imposition of reciprocal tariffs a “typical unilateral bullying behavior” and goes against international trade principles. This reaction shows deep dissatisfaction with Donald Trump's decision when the US imposed huge tariffs.

China also expressed displeasure at the US calling Taiwan a “country” in its tariff announcement. Chinese state media described the US move as a “tariff sweep” and warned of rising unemployment and a possible recession in the US. It also said many countries had expressed dissatisfaction and opposition to the tariffs. China has previously retaliated against US tariff hikes by imposing tariffs on US goods and tightening export controls.

Toward KoreaActing South Korean President Han Duck-soo has ordered a “full-scale response” to the higher-than-expected tariffs from the United States, amounting to 25%, and convened an emergency meeting. He described the situation as very serious, suggesting a global trade war is looming. Analysts note that the tariffs could invalidate the Korea-US Free Trade Agreement (FTA).

South Korea's KOSPI index fell sharply on the news, with auto stocks in particular seeing a sharp drop. Analysts in Seoul said the tariffs were higher than expected and would cast a shadow over export-dependent economies like South Korea.

Concerns have been raised about the potential for “fatal” damage to South Korea’s export-dependent economy. They also fear that exports to the US from South Korean companies’ production facilities in Vietnam will also be severely affected, as Vietnam will also be subject to high tariffs.

Prime minister Older brother – Keir Starmer expressed optimism that the UK was only hit with 10% tariffs, saying his patient diplomacy with Washington had paid off. He stressed that the lower tariffs than the EU (20%) had “saved” thousands of jobs. However, he also affirmed that he would continue to negotiate a trade deal to eliminate tariffs completely.

Other British officials have expressed frustration that Mr Trump has upended the global trading system and has not exempted Britain, a close ally. British trade minister Jonathan Reynolds has warned that Britain will not rule out retaliation if a trade deal is not reached, and said he has spoken to industries that are at risk, including pharmaceuticals, steel and cars.

The European Union, which also faces the 20% tariffs, is likely to retaliate. The European People’s Party Group chairwoman has criticized the tariffs as an attack on fair trade. Countries including Australia and Italy have also criticized the tariffs, with Australia calling them “unjustified.” Thailand, which faces the 36% tariffs, has said it has “prepared a number of steps” to address the situation.

Taiwan has called the 32% tariffs “very unreasonable” and will negotiate. The widespread negative reactions from key US allies and trading partners underscore global concerns about a return to protectionist trade policies and the possibility of a broader trade conflict.

In addition, global economic experts have expressed deep concerns about the negative impact of President Trump's reciprocal tariff policy. Many believe that this is a shock for the world economy and could be a "turning point" for the globalization system.

Mr. Takahide Kiuchi, chief economist at Nomura Research Institute, commented that Mr. Trump's tariffs could “destroying the global free trade order” that the US has pioneered since World War II. Antonio Fatas, a macroeconomist at INSEAD business school, predicts that the US and global economies will become worse, more unstable and likely to move towards global recession.

According to estimates by the Japan External Trade Organization (JETRO), the imposition of reciprocal tariffs on all US trading partners, along with auto tariffs and additional duties on Chinese goods and steel and aluminum, could cause Global GDP to fall by about 0.6% by 2027, equivalent 763 billion USD.

In there, America are expected to suffer the greatest damage at GDP decreased by 2.71% in 3 monthsJETRO argues that rising import costs will reduce the profits of US businesses that rely on foreign goods, and that auto tariffs will also leave US consumers with less money to spend.

Mr. Olu Sonola, director of US economic research at Fitch Ratings, commented that with the new global tariffs, the average US tariff rate on imports will increase to 22%, the highest since 1910, and this is a “game-changing move” for both the US and global economies, could lead to recessions in many countries.

IMF Managing Director Kristalina Georgieva said a global recession was unlikely at the moment, but noted that the impact would be different for each economy due to large fluctuations in reciprocal tariffs.

Notable global economic impacts

President Trump's imposition of wide-ranging reciprocal tariffs is expected to have many negative impacts on the global economy.

- High inflation and consumer prices: Experts predict that these tariffs are likely to lead to increased inflation and higher consumer prices in the United States due to increased costs of imported goods. The tariffs have been described as a “massive tax hike” that will inevitably lead to higher prices for American families. The Yale University Budget Lab estimates that the April 2 announcement alone could result in an average loss of $2,100 per household annually. Specific examples include potential price increases for electronics, cars, clothing, shoes, wine, spirits, furniture, coffee, and chocolate. Most economists agree that the tariffs will increase costs for American consumers, potentially undermining any benefits from boosting domestic production in the short term.

- Risk of trade war: Countries that are subject to tariffs could retaliate by imposing tariffs on US goods, leading to a spiral of escalating trade tensions, or a trade war, that would harm international trade and global economic growth.

- Supply chain disruption: Tariffs could force businesses to adjust their existing supply chains, which have been in place for years. Companies that rely on international supply chains for components and finished goods would be particularly affected. These tariffs could lead to supply chain restructuring as companies seek to avoid higher costs. Imposing broad tariffs creates uncertainty and forces businesses to reassess their sourcing and manufacturing strategies, potentially leading to significant changes in global supply chains.

- Impact on developing economies: If tariffs push the US economy into recession, this would hit developing countries that have close trade ties with the US hard. The reduced demand for imports from the US would hurt their exports.

Tax rate 46% has a big impact on Vietnamese businesses

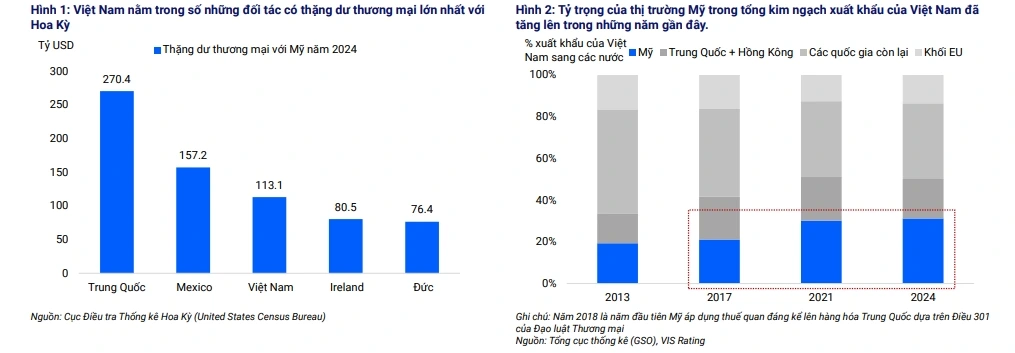

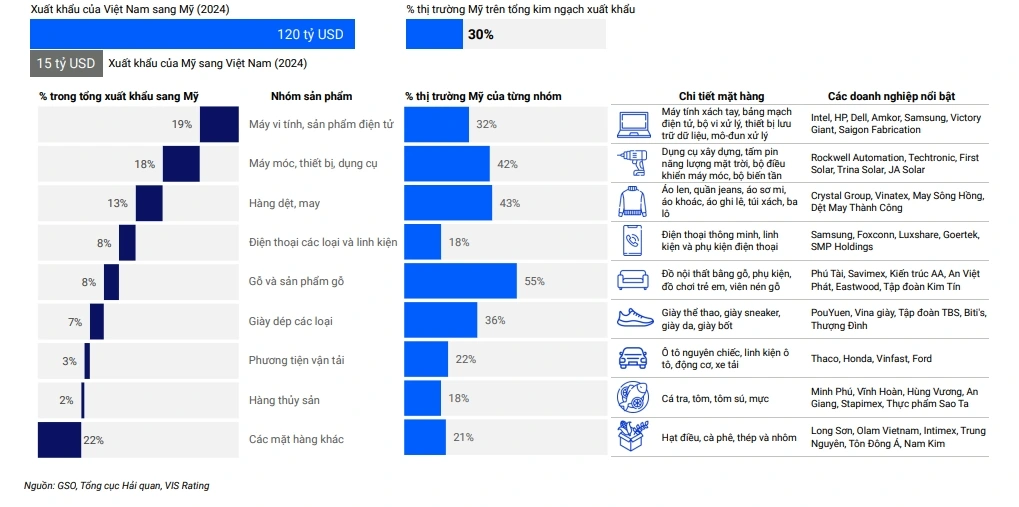

Vietnam is one of the countries subject to the highest reciprocal tariffs from the US, with 46%. This tax rate is calculated based on the US trade deficit with Vietnam divided by the value of Vietnam's exports to the US, and then halved. With Vietnam's exports to the US reaching 136.6 billion USD and imports from the US at 13.1 billion USD, the trade deficit is about 123.5 billion USD, resulting in a ratio of 90% and an imposed tax rate of 46%.

These high tariffs could result in reduced orders and revenue for Vietnamese businesses exporting to the US. Increased production costs due to tariffs could force companies to cut costs, seek alternative markets or adjust prices, potentially making their goods less attractive to US consumers. Tariffs could also disrupt global supply chains and impact Vietnam’s overall economic growth.

On the morning of April 3, Prime Minister Pham Minh Chinh chaired a meeting with ministries and branches after the US announced new tax rates on goods imported from Vietnam.

Which Vietnamese industries are hurt when the US imposes a huge tax of 46%?

According to analysts, Vietnam's industry groups with the largest export turnover to the US and therefore will be most strongly affected by reciprocal taxes include:

- Electronics and electronic components: The sector, which accounts for a significant portion of Vietnam’s exports to the US, is particularly vulnerable. Major manufacturers such as Samsung and Apple suppliers in Vietnam (Foxconn, Luxshare, Pegatron) could face rising costs and may need to reassess their production strategies, potentially looking for alternative locations such as India or Mexico.

- Equipment: This group, which also has significant exports to the US, reaching $22 billion last year, is also expected to face rising costs and falling demand.

- Textile: Vietnamese textile and garment companies are heavily dependent on the US market and will face greater competitive pressure due to rising costs. The US is the largest market for Vietnamese textiles and garments, accounting for nearly 501 billion USD of the industry’s total export revenue ($16 billion last year). Companies such as Vinatex, May 10 and TNG may face difficulties due to reduced orders and weaker purchasing power from US partners.

- Footwear: Similar to textiles, the footwear industry, with nearly a third of all US footwear imports coming from Vietnam, is vulnerable. Brands such as Nike and Adidas, which have significant manufacturing operations in Vietnam, are likely to face higher costs and may need to consider adjusting prices or shifting production.

- Wood furniture: Vietnam is a major exporter of wooden furniture to the US ($9 billion last year), and the industry is likely to see a significant negative impact, potentially affecting companies like Wayfair, which sources from Vietnam.

While multinational companies manufacturing electronics and machinery equipment in Vietnam may be better able to respond by shifting part of their production or finished goods to other countries, domestic manufacturers in the textile, footwear and furniture industries may have fewer options to shift and find alternative consumption markets.

This could lead to higher costs, lower order volumes and poorer operating cash flow for businesses that rely heavily on export sales to the US.

The most important thing for Vietnamese businesses before the US imposes 46% tax

The 46% reciprocal tax imposed by the US will certainly cause deeply concerned for the Vietnamese Government, especially regarding the negative impact on export growth, employment and the competitiveness of Vietnamese goods in the US market. Compared to other competitors, Vietnam is subject to significantly higher tariffs, from 10-20%, which will weaken its competitive advantage.

Recently, the Vietnamese Government has taken steps to deal with potential tariff risks from the US. These measures include: reduce import tariffs on a range of goods from the USDecree 73/2025/ND-CP dated March 31, 2025 amended and supplemented preferential import tax rates for a number of items, including automobiles, ethanol, frozen chicken thighs, nuts, wood products, LNG, ethane, corn kernels and soybean meal.

The aim of this tax reduction is to boost imports of US goods, reduce Vietnam's trade surplus with the US and hopefully ease trade tensions.

In addition, the Vietnamese Government has also Approves new agreements allowing US corporations to operate in Vietnam, to attract investment and strengthen economic relations. The government has also actively negotiate new trade measures with the US to cope with tariff risks.

On the morning of April 3, Prime Minister Pham Minh Chinh chaired a meeting with ministries and sectors following the US announcement of new tariffs on imports from Vietnam. The meeting was attended by heads of the ministries of Finance, Industry and Trade, Agriculture and Environment, Science and Technology, the State Bank and many other agencies.

“Vietnam wants the US to have a policy more suitable to the good relationship between the two countries,” the Prime Minister said, adding that this is suitable to the conditions and circumstances of Vietnam as a developing country, which must continue to overcome the severe and prolonged consequences of many years of war.

With tariffs looming large, Vietnam will need to explore all available options. Diplomatic negotiations offer a direct way to address the issue with the US. Diversifying markets reduces dependence on a single, potentially volatile partner.

At the same time, supporting domestic enterprises to overcome difficulties and attracting FDI can create new economic opportunities. The US's imposition of huge tariffs poses significant challenges, but at the same time, it is also an opportunity for Vietnam to restructure its economy, improve its competitiveness and seek new growth drivers in the context of global trade fluctuations.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam