IFRS is not just an “international accounting standard,” but a data transformation and operational control system that can change EBITDA, debt, equity, and how businesses account to banks or investors. Many Vietnamese businesses face the biggest challenges: fragmented data, dual-bookkeeping, and the risk of tax-accounting discrepancies. This article helps CFOs understand the true nature of IFRS, grasp the regulations for applying IFRS in Vietnam, identify the biggest challenges, and create a checklist for implementation.

What are IFRS and what does IFRS stand for?

IFRS is a set of international financial reporting standards, issued by the IASB, that provides guidance on the recognition, measurement, presentation, and disclosure of financial statements according to established principles. IFRS stands for International Financial Reporting Standards.

Essentially, IFRS doesn't just prescribe "how to account for," but regulates the four core layers of financial reporting: recognition, measurement, presentation, and disclosure. This is what sets IFRS apart from the familiar approach of many Vietnamese businesses.

CFOs need IFRS because it is the common reporting language when working with banks, investors, PE funds, or international partners. IFRS operates on principles (principle-based), requiring professional judgment rather than just rote compliance.

A common risk is interpreting IFRS as an “advanced accounting textbook.” Businesses then focus on writing the policy but ignore data, controls, and the ability to make informed decisions. The common consequence is that reports may show high numbers, but fail to pass audits or provide explanations to investors.

For CFOs, the crucial decision isn't whether or not to adopt IFRS, but rather the scope of adoption, the level of data investment, and the priorities for transformation from the outset.

In the initial phase, Bizzi supports the digitization and standardization of expense, invoice, and accounts payable data – critical input data sources for IFRS. Once the data is controlled through approval, reconciliation, and audit trail, CFOs have a "clean" data base for mapping IFRS and reduce accountability risks later on.

Once you understand that IFRS is a "reporting language," the next step is to differentiate IFRS from IAS and VAS to avoid confusing the scope of conversion.

What are the differences between IFRS, IAS, and VAS that CFOs should be aware of?

Both IFRS and IAS belong to the international standards system, but IFRS is a later group of standards with a more principled approach and stronger disclosure requirements. Compared to VAS, IFRS differs significantly in its fair value measurement, level of judgment, and disclosure requirements.

The core difference between VAS and IFRS lies in the measurement and reflection of risk. IFRS prioritizes fair value over historical cost, requiring assessment of impairment.lower), merge (congestionFinancial instruments and other items that directly affect EBITDA, debt, and equity.

For CFOs, this isn't just about accounting differences, but also about KPIs, bank covenants, and financial close timing. Copying policies from VAS to IFRS often leads to measurement discrepancies and a lack of disclosure, increasing end-of-period adjustments. Bizzi helps standardize expense categories, approval flows, and link expenditure data to budgets. When expense data is structured and audit trail is clear, IFRS classification becomes more consistent, helping CFOs shorten the time to close.

Understanding the differences between IFRS and VAS is fundamental to correctly interpreting the IFRS adoption roadmap in Vietnam.

What are the current regulations for applying IFRS in Vietnam?

Vietnam has issued a plan and roadmap for the application of IFRS in stages: preparation, voluntary application, and eventual application by specific groups. CFOs need to follow this roadmap to proactively plan for data, systems, and personnel.

The IFRS roadmap in Vietnam is not just a timeline, but a complex problem. internal roadmapThe timing of the transition directly impacts the budget, ERP system, audits, and team capabilities. Businesses that are slow to prepare often have to operate on a "double book" system for extended periods, increasing operating costs and risks. CFOs need to identify this. Press Date, prepare open and design the IFRS program as a transformation project.

Bizzi creates the background. data readiness From invoices, expenses, and accounts payable, control is exercised before recording. This helps CFOs reduce the risk of data input errors right from the start of the IFRS transition.

From the roadmap, the next practical question is: to what extent are Vietnamese businesses applying IFRS?

What is the current status of IFRS adoption in Vietnam?

Currently, IFRS adoption in Vietnam is mainly concentrated in businesses needing to raise capital, multinational corporations, or businesses required to prepare consolidated financial statements by their parent company/investors. The majority of these businesses implement IFRS as a project, not as a complete transformation. The most common obstacles lie not in the standards themselves, but in fragmented data, IFRS personnel capacity, and the ability of the financial and accounting system to meet the requirements.

- About WHATThe leading group of businesses is usually listed companies, FDI enterprises, or companies preparing for an IPO. A common approach is to hire Big4 consultants or firms specializing in IFRS, implementing it in stages, prioritizing standards with a significant impact such as IFRS 15, IFRS 16, and IFRS 9. IFRS is usually implemented in parallel with VAS, rarely replacing them completely from the outset.

- About WHYCFOs need to clearly understand their company's "IFRS readiness" to avoid false expectations. Many leaders believe IFRS is merely a matter of accounting techniques, while in reality, it's a complex problem. operations – data – systemsMisjudging readiness levels will lead to inappropriate route selection, prolonging the process and increasing costs.

- About RISKMany businesses assess readiness based on subjective factors: looking at their accounting team, the ERP system they are using, or relying entirely on consultants. As a result, IFRS projects are easily susceptible to problems. behind scheduleThis results in numerous end-of-period adjusting entries and increases the risk of having to explain these to auditors.

- About DECISIONBusinesses are forced to choose the appropriate deployment model: pilot parts (according to standards or units) or Big Bang (mass conversion). This decision is only accurate when based on thorough evaluations such as readiness supervisor, gap analysis and target often model.

Bizzi's involvement in the IFRS problem isn't in the role of a standards consultant, but rather in the role of a class advisor. Standardizing financial operational data:

- Step 1: Bizzi standardizes the flow of spending, invoices, and payments data right from the initial stage.

- Step 2: The data is fully structured, reconciled, traceable, and ready for IFRS audit and analysis.

- Step 3: CFOs have a baseline of quantitative data to assess IFRS readiness realistically, rather than subjectively.

From this situation, it can be seen that the core issue when applying IFRS in Vietnam is... It's not about understanding the standard., which is located data quality and how the business is operating two accounting systems in parallel..

What are the biggest challenges in implementing IFRS in Vietnam?

One of the biggest challenges in implementing IFRS in Vietnam is data and operations, not simply knowledge of standards. IFRS requires detailed, consistent, and readily available data. audit trailWhen data is fragmented, businesses are forced to operate VAS and IFRS in parallel, leading to higher costs, risks of discrepancies, and accountability pressures.

- Regarding WHAT, the challenges of implementing IFRS are typically divided into three groups: Data, People, and System. Of these, Data is often the most significant. root crimeInsufficient or inconsistent data will make it difficult to calculate, explain, and audit IFRS, even if the team understands the standards.

- Regarding why CFOs should prioritize establishing data governance before investing heavily in IFRS consulting or PMOs, if the input data is not up to standard, all IFRS accounting policies will remain on paper, and adjusting entries will accumulate at the end of the period.

- Regarding RISK, many businesses do the opposite: they build their IFRS policy first, then process the data later. The consequence is a lack of evidence, a lack of traceability, increased IFRS adjustments, and the risk of being questioned by auditors or investors.

- Regarding DECISION, instead of asking "which standards should be applied first," a more accurate question is: is the current financial data system a source of truth? This directly relates to concepts such as audit trail, master data and data mapping.

Bizzi addresses IFRS challenges from the operational data layer:

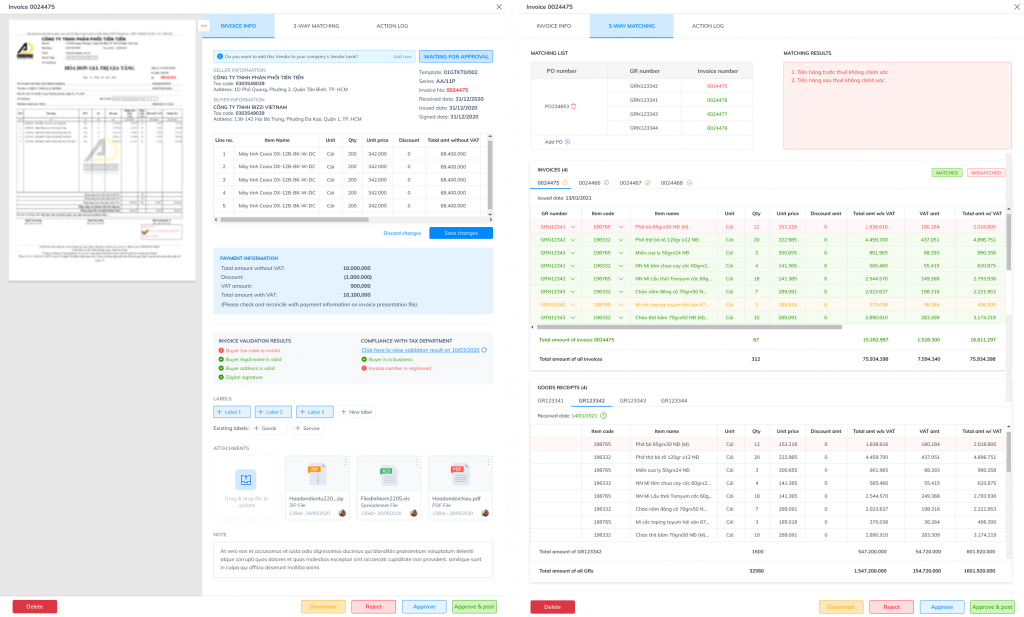

- Step 1: Bizzi Bot automatically checks the input invoice and performs a three-way reconciliation: PO – Invoice – GR.

- Step 2: Invoice and expense data are standardized, reducing errors and ensuring complete tracking.

- Step 3: The CFO possesses clean input data, reducing IFRS adjusting entries and accountability risks.

When data is the biggest bottleneck, the next question CFOs need to answer is no longer "how difficult is it to implement IFRS," but rather why businesses need to maintain two sets of accounting records and how to sustainably reduce double-entry data entry.

What are the two sets of books, VAS and IFRS, and why do they increase operating costs?

"Dual-bookkeeping" refers to the parallel operation of reporting according to VAS and IFRS to serve tax and international reporting objectives. Without a good data architecture, businesses are prone to data entry duplication, discrepancies, and prolonged closing times.

Sustainable solutions are the model. "One data source – two layers of reporting", in which data is standardized from the outset and mapped to different reporting layers. Bizzi helps synchronize cost data into the ERP via API, reducing repetitive data entry and cost-to-comply.

What is data mapping in IFRS projects and what is it used for?

How do you convert the accounting system when applying IFRS?

Chart of Accounts (CoA) conversion It's not simply a matter of adding a few IFRS accounts, but rather a challenge to redesign the accounting data structure to better serve this purpose. measurement – analysis – explanation According to international financial reporting standards, if the Certificate of Analysis (CoA) is not properly designed from the outset, businesses will be forced to make manual adjustments in the final reporting stage, increasing the risk of discrepancies and prolonging the closing period.

Essentially, CFOs typically face three choices. The first is... Expand the current CoA.Firstly, maintain a system of accounts but add an analytical dimension to support IFRS. This approach reduces system changes but can easily overload the system if the CoA becomes excessively large. Secondly, Construct a parallel CoA for IFRS, separate from VAS. This option is technically sound, but has high operating costs and often involves prolonged dual-bookkeeping. The third option is Keep CoA operations compact, combining mapping and reporting layers.This allows the same transaction data to serve multiple reporting purposes.

The key point that CFOs need to pay special attention to is: detail trade-offAn overly detailed Conclusion of Account (CoA) may meet IFRS disclosure requirements but slows operations and increases the risk of errors in recording. Conversely, an overly "raw" CoA will leave the business without enough data to prepare disclosures, forcing manual processing at the final stage – where audit costs and risks are highest. The right decision doesn't lie in "detail or not," but in... Adequate level of detail for the industry, capital model, and fundraising targets..

In reality, many IFRS projects fail because the Conclusion of Analysis (CoA) is designed last, whereas it should ideally be the first step. The foundation of report automation and consolidation.When expense and invoice data are categorized, cost centers and controls are established at the beginning of the spending flow, allowing CFOs to significantly reduce reclassification entries at the end of the period. This is also why pre-recording data control layers – such as digitization, normalization, and transaction tracking – become crucial for the smooth operation of CoA IFRS.

Once the CoA and data mapping are clear, the next risk a CFO faces is often not in accounting, but in the discrepancy between IFRS profits and tax obligations under Vietnamese regulations.

What are the disadvantages of IFRS from a cost, risk, and operational perspective?

The drawback of IFRS does not lie in the standards themselves, but in... the costs and operational complexity that it entailsIFRS requires professional judgment, fair value measurement, and a much higher level of disclosure than VAS, meaning businesses must invest heavily in data, systems, and people.

In terms of costs, IFRS often incurs additional expenses. hidden crimes Many CFOs underestimate these costs in the early stages. These include the cost of cleaning historical data, the cost of training internal staff, the cost of supporting audits, and especially the cost of maintaining parallel VAS-IFRS operations for many years. If the input data is not detailed enough and there is no audit trail, most of these costs will be concentrated at the end of the period, where time pressure and the risk of errors are highest.

From a risk perspective, IFRS puts businesses in a position where they must continuous accountability This involves communicating with auditors and investors about assumptions, estimates, and measurement methods. A lack of baseline data or control over the source of data can result in reports being "correct in numbers" but failing to meet disclosure requirements, directly impacting financial credibility and the ability to raise capital.

In terms of operations, IFRS forces CFOs to recognize this as a project to transform the operating modelThis is not a purely accounting problem. If businesses focus only on policy development while neglecting data governance and expenditure control, they will fall into a cycle of repeated data entry – end-of-period adjustments – audit explanations, driving up costs year after year.

The solution is not to avoid IFRS, but to reallocation of resourcesThis reduces the time and cost spent on manual tasks, reconciliation, and error correction; and increases investment in data standardization, pre-recording control, and financial flow automation. When input data is clean and controlled, audit support costs and operational risks are significantly reduced, allowing CFOs to focus on higher-value IFRS operations.

From the cost and risk analysis, the next step for the CFO is to access IFRS documents from the correct source and in the correct version to avoid discrepancies right from the ground up.

Where can I legally download IFRS standards and what sources should I use for reference?

To Download and look up International Financial Reporting Standards (IFRS). Legally, CFOs should prioritize authoritative sources from the IFRS Foundation or licensed organizations. IFRS is a copyrighted set of standards, so not all documents circulating on the internet are valid or up-to-date with the current version.

The important point isn't just "where to download," but... document version management Throughout the IFRS project, misusing revised standards or outdated interpretations can lead to incorrect policy, incorrect disclosures, and serious audit risks. Therefore, CFOs need to clearly distinguish between original documents, guidance summaries, and translations/interpretations used for internal training.

In reality, many businesses fail not because of a lack of standards, but because they fail to control the relationship between documents, data, and reports. When transaction data and documents are systematically stored and traceable by period and process, CFOs can verify figures even when standards change or auditors require reverse reconciliation.

Having access to accurate documentation is not enough. The CFO needs to continue answering the question: Which financial indicators are most strongly impacted by IFRS, in order to prepare communication strategies for banks and investors.

In IFRS implementation, risks arise not only from using the wrong document but also from failing to demonstrate which version of the data is being applied.

Bizzi supports:

- Store expense documents and data by period, process, and applicable policy.

- Create a clear audit trail when standards or policies change.

- Help CFOs ensure consistency between IFRS documentation and actual financial data.

This is especially important when working with the Big4 or international investors.

How does FRS 16 impact EBITDA and debt when a business leases assets?

IFRS 16 fundamentally changes how businesses recognize and managing outsourcing costsInstead of recognizing the entire rent as an operating expense, IFRS 16 requires recognition. property rights and lease debtThis often leads to an increase in EBITDA as lease costs are replaced by depreciation and interest expenses.

This impact doesn't change the actual cash flow, but it strongly affects it. KPIs, bank covenants, and how investors view financial leverage.An increase in EBITDA can make operating performance look better, while an increase in debt can worsen the Debt/Equity ratio. If the CFO is not prepared to explain this, the company may face the risk of violating its covenant or being misjudged for credit risk.

Here, lease data plays a crucial role. When lease costs are controlled by contract, budget, and recognition period, the CFO can simulate the impact of IFRS 16 before formal implementation, thereby proactively renegotiating covenants or adjusting internal KPIs to suit the new context.

Since IFRS 16, another common flashpoint has emerged: the discrepancy between IFRS earnings and Vietnamese tax – where deferred tax becomes a crucial link. Bizzi helps:

- Manage rental costs by contract, term, and budget.

- Create structured input data to support the analysis of a lease portfolio.

- Minimize contract omissions or misclassifications, which can lead to discrepancies in lease liabilities and KPIs.

As a result, the CFO has a sufficiently clean database to simulate the impact of IFRS 16 before working with the bank.

How does deferred tax help address differences between IFRS and Vietnamese taxes?

Deferred tax reflects future tax obligations arising from temporary differences between IFRS-based book values and the tax base. It's not a tax optimization tool, but rather a way for CFOs to reasonably explain the difference between accounting profit and taxable income.

Misunderstanding deferred tax can lead businesses to misassess future tax obligations and compliance risks. Conversely, if expense and invoice data are recorded correctly, accurately, and are fully traceable, CFOs can better control these discrepancies, reducing the number of late adjustments and accountability pressure to tax authorities and auditors.

Once the key technical points are understood, the CFO needs a practical checklist to transform IFRS from theory into an action plan. Many deferred tax differences arise not from the standards themselves, but from incorrect expense recognition periods or a lack of original data.

Bizzi helps:

- Record expenses in the correct period, with complete supporting documentation.

- Late adjustments cause temporary discrepancies that are difficult to explain.

- Create a common data base for the accounting and tax departments.

CFOs reduce accountability risks and more accurately forecast future tax obligations.

Checklist for preparing CFOs for IFRS implementation.

Effective IFRS preparation begins with assess readiness level Based on five pillars: data, processes, systems, people, and control. The checklist is not intended to list tasks, but to help the CFO identify them. the biggest bottleneck to prioritize budget and resources during the first 90–180 days.

Businesses often fail not because of a lack of IFRS expertise, but because of a lack of structured data and pre-expenditure controls. When financial transaction flows are automated, reconciled, and fully traced, CFOs can significantly reduce data risk – the biggest contributor to the cost and failure of IFRS projects.

Bizzi provided direct support in the IFRS checklist. Data – Process – Control pillar:

- Data: Standardizing invoices, expenses, and accounts payable.

- Process: Approval – Verification – Consistent Recording

- Control: audit trail and traceability

This helps CFOs accelerate readiness without needing to change the ERP system immediately.

What are the frequently asked questions about IFRS standards?

Below is an explanation of frequently asked questions regarding what International Financial Reporting Standards (IFRS) are.

Will IFRS be mandatory for all Vietnamese businesses after 2025?

No. IFRS is implemented according to a roadmap and target groups. Businesses should only commit to a timeline after a thorough assessment of their data, system, and personnel readiness.

Are IFRS accounting standards or financial reporting standards?

IFRS stands for Financial Reporting Standards. IFRS emphasizes presentation, disclosure, and judgment according to principles, so the data requirements and controls to support those figures are generally higher than those of VAS.

Why does applying IFRS increase the volume of disclosures?

Because IFRS requires transparency regarding assumptions, estimates, and risks, a report may be accurate in terms of numbers, but a lack of disclosure will still fail to meet audit requirements or investor expectations.

What is the biggest drawback of IFRS for medium-sized businesses?

Conversion costs and operational costs go hand in hand. If the data is not standardized, businesses will have to manually "clean up" it each period, increasing costs and putting pressure on personnel.

Is dual-bookkeeping mandatory?

In practice, many businesses have to maintain two parallel systems to meet both tax/compliance requirements and report according to IFRS. The optimal approach is to design one data source – two layers of reporting to avoid duplicate data entry.

What data from invoices and expenses is needed for IFRS data mapping?

Structured data is needed regarding suppliers, expense types, expense centers, contracts, and recognition periods. The more detailed and standardized the data is early on, the less manual processing CFO has to do at the end of the period.

Does IFRS 16 change anything about "cash"?

Not directly. IFRS 16 primarily changes the way lease expenses are presented to depreciation and interest expense. EBITDA and debt may change, but actual cash flow does not automatically increase if business operations remain unchanged.

Can deferred taxes help to "optimize taxes"?

No. Deferred tax is not a tax avoidance tool, but rather reflects future tax obligations arising from temporary differences. CFOs use it to forecast risk and plan tax cash flows.

Where can I download the official Vietnamese translation of IFRS?

CFOs should prioritize official or licensed sources and tightly manage document versions. Avoid using unofficial versions due to the risk of incorrect versions and misinterpretations during audits.

What is the first step in preparing for IFRS in 30 days?

Conduct readiness assessments based on five pillars: Data – Process – System – People – Control. Simultaneously, standardize invoice, expense, and accounts receivable data to create a "source of truth" for the mapping phase.

Conclusion: IFRS is a matter of data and control, not just a standard.

IFRS is not simply a question of "to adopt or not," but rather a challenge of data transformation, control, and operation from a CFO's perspective. The current state of IFRS adoption in Vietnam shows that businesses face the most challenges in fragmented data, dual-bookkeeping, and risks in tax and accounting explanations.

To mitigate the drawbacks of IFRS and implement it effectively, CFOs need to start by standardizing input data, designing a "one data source - multiple reporting layers" architecture, and conducting pre-recording controls. IFRS is not just about changing standards, but about controlling data and operating costs. The more a business allows data to "run wild" at the input stage, the more IFRS costs will balloon at the end of the period.

In this process, Bizzi acts as a data and transaction control layer, helping to digitize expenses, invoices, and accounts payable, creating audit trails and reliable data sources. In other words, Bizzi helps CFOs solve this problem by controlling expenses before spending, standardizing before recording, and creating a sufficiently reliable data foundation for IFRS reporting. Once the data is ready, IFRS is no longer a compliance burden, but becomes a tool to enhance governance capabilities and financial transparency for the business.

For in-depth consultation on the right solution for your business, schedule a demo here: https://bizzi.vn/dang-ky-dung-thu/