Wasting time isn't just about "laziness" or "distraction," but is often a symptom of manual processes, fragmented data, and cumbersome approvals. For CFOs, wasted time always boils down to three consequences: increased OpEx (operating costs), increased risk of errors/fraud, and slowed cash flow (especially in invoices and accounts receivable).

This article helps you define what "wasted time" is, identify the causes of wasted time in businesses, quantify it using formulas, and apply a set of process-technology solutions to eliminate repetitive tasks at their root.

What constitutes wasted time in a business, and why should CFOs define it in terms of "value created"?

Wasted time in business refers to the time spent on activities. does not create value Or it can create low value relative to the resources expended, increasing operating costs and prolonging decision-making time. For CFOs, "waste" must be measurable using data.

Why should CFOs define time in terms of "value created"?

The CFO views time as equal to money. Each hour worked is equivalent to: Salary, Benefits, Opportunity Cost. If time doesn't create value, then it is: Hidden costs is eroding profits.

A team can:

- Do it faster

- Do more

But if:

- Incorrect order of priority

- Optimizing non-critical tasks

The CFO considered this to be local efficiency optimization.

The CFO is responsible for resource allocation. Time is the most scarce resource, and the most difficult to expand:

- Budget

- Tools

- Human Resources

Defining by value helps the CFO:

- Decide what to automate.

- Which process should be eliminated or simplified?

- Where should you invest in technology to get the fastest return on investment?

In short, wasted time in a business equals time that does not generate economic value or operational capacity. For a CFO, defining time in terms of “value created” is a prerequisite for:

- Profit protection

- Optimize cash flow

- Preparing for sustainable growth

How is wasting time different from being inefficient and distracted?

Wasted time typically involves spending time on non-value-adding tasks or repetitive work due to process errors, while inefficiency results in low value creation due to poor skills/methods. Distraction is a contributing factor, but not the root cause, of wasted time in a business.

| Concept | Nature | CFO looks at | For example |

| Wasting time | Work does not create value | Should this activity exist? | Prepare a report. nobody uses it

The meeting was just for "updates," but indecisive Manually check for risks. There are already automatic rules. |

| Ineffective | Do doing the right thing But It wastes too many resources. | Is there a better way to do it? | Manual invoice reconciliation instead of 3-way matching. The approval process is the same for all expenditures. Create reports manually in Excel instead of using the dashboard. |

| Distraction | Time fragment, without achieving results | Why couldn't it be completed? | One report took three days to complete due to constant interruptions. Financial decisions are being delayed due to a lack of focus window. |

Why are CFOs particularly concerned about "wasted time"?

- Inefficient → additional costs

- Lack of focus → slow decision-making

- Wasting time → creates no value regardless of the cost.

A CFO can accept temporary inefficiencies, but cannot tolerate maintaining activities that don't create value.

5 signs that your business is wasting time on financial and accounting operations.

Businesses are wasting time with signs such as: lengthy approval wait times, multiple manual data entry attempts, reports dependent on Excel, backlog of exception handling, and having to "chase after" invoices/accounts receivable instead of proactively managing them.

1. The finance team is "very busy" but always lacks time for analysis.

Token

- Accountants and finance professionals often work overtime.

- Most of the time is spent on data entry, reconciliation, and error handling.

- Little time for:

- Cost Analysis

- Cash flow forecast

- Business consulting

Nature: Time is being "burned" for low-value operational tasks, instead of high-value financial thinking.

CFO Warning: Finance is playing a role back-office records, Not business partner

2. The multi-tiered approval process is still slow and risky.

Token

- Approval via email, chat, or written documents.

- Every expenditure has to go through the same multiple levels.

- It still happens:

- Late payment

- Incorrect payment

- Loss of budget control

Nature: Time-consuming human inspectionbut not controlled by Risk & Data.

CFO Warning

- "Many steps" ≠ "Safe"

- Approval not based on risk level is Wasting collective time

3. Handling recurring invoices and accounts receivable, firefighting.

Token

- Many invoices were returned due to errors:

- Supplier Information

- Unit price, tax rate

- Missing purchase order/document

- Personnel spend many hours:

- Check again

- Email exchange

- Manual adjustment

Nature: Time is wasted because system errorIt's not human error.

CFO Warning

- Businesses are "paying" for recurring error correction

- Each incorrect invoice = hidden cost + audit risk

4. Lots of reports, few decisions.

Token

- Multiple Excel files, multiple versions

- Reports are submitted regularly, but:

- Rarely read

- Fewer actions taken

- The decision was still based on emotion.

Nature: Time spent on report production, Not generating insights.

CFO Warning

- Reports that do not support decision-making = Wasting collective time

- The CFO should ask: "If we remove this report, will anyone be affected?"

5. The closing time is lengthy and highly dependent on human factors.

Token

- Month-end / year-end closing is stressful

- Data is scattered and difficult to reconcile.

- Risk:

- Error

- Delayed reporting

- Dependent on key person

Nature: The system is not good enough to self-operatingThat must be compensated for by human time.

CFO Warning

- Businesses are not yet ready to scale.

- The time in finance was "locked" in the past, not looking to the future.

What are the causes of wasted time at the workplace, and why isn't simply "changing habits" enough?

The causes of wasted time typically stem from three layers: personal habits (lack of focus), organizational processes (cumbersome meetings/approvals), and data technology (fragmented systems, manual data entry). If only the behavior is addressed without correcting the processes, the waste will return.

Grade 1 – Personal Habits (the most easily observable manifestation)

Token:

- Lack of focus, constantly switching tasks (context switching)

- Delay due to unclear priorities.

- Responsive work (responding to emails and messages)

Why isn't changing habits enough?

- Human nature reacts to the environment.

- If the environment requires: waiting for approval, asking for information multiple times, handling urgent tasks due to delays from others. Good habits also wear down..

Bad habits are often symptom, is not the cause.

Level 2 – Organizational Processes (Core Causes)

The biggest source of waste:

- Many meetings, but no decisions were made.

- Multi-tiered approval process, lack of clear SLA.

- Overlapping roles and responsibilities

- The job is being rotated due to a lack of entry standards.

A familiar example:

- "Waiting for boss approval" accounts for 40% of processing time.

- The report was completed but had to be revised 3-4 times because there was no standard template.

- Meetings were held to "update on the situation" rather than to make decisions.

When the process is poor, The harder the employees try, the more tired they become. but the effectiveness did not increase.

Grade 3 – Technology & Data (the amplifier of waste)

Common problems:

- Discrete system → repetitive input

- Excel, email, and chat are out of sync.

- No real-time data → must ask – confirm – wait

Consequences:

- A simple decision takes days.

- Employees are acting as "data clerks" instead of creating value.

- Manual error → correction → additional time wasted

The technology is not good. amplifying all weaknesses of the process.

Wasted time at the workplace isn't due to "undisciplined employees," but rather the result of a poorly designed system. Therefore, "changing habits" only touches the surface, not addressing the root cause. For sustainable time savings, businesses must design systems that make doing things right easy and doing them wrong difficult.

How do manual processes in accounting and finance lead to wasted time?

Manual processes are wasteful as personnel have to repeatedly enter data, visually check, manually compare documents, and correct errors multiple times. Each "touch" increases the risk of errors, prolongs processing time, and increases costs. Personnel costs.

Manual data entry → wasteful right from the start.

Symptoms:

- Re-enter data from paper/PDF invoices into Excel or ERP.

- Copying between multiple files and systems

Waste incurred:

- Repeat data entry time

- Verification/Inspection Time

- Time taken to correct typos

A manually entered invoice can be costly. 3–10 minutesbut minor errors can lead to problems. hours of dealing with the aftermath.

Manual reconciliation → an invisible "bottleneck"

Common examples:

- 3-way matching (PO – GR – Invoice) done by hand

- Reconcile accounts payable in Excel.

Wasting time:

- Find the file, find the email, ask another department.

- Waiting for a response to confirm the discrepancy.

- Stop the entire process because a mismatched line

Manual approval → more downtime than processing time

Familiar signs:

- Print a signed receipt.

- Send email request for approval

- I don't know where the file is "stuck".

The biggest waste:

- Waiting time

- Tracking time – reminders

Manual reporting → waste of intellectual resources.

Reality:

- Accountants download data, merge tables, and adjust formatting.

- Each cycle starts from scratch.

Consequences:

- Finance personnel are working as "data clerks" instead of analysts.

- CFO receives reports late → decisions are delayed.

Manual error correction → wasteful production line

Chain of waste:

- Incorrect input → late detection

- The document must be undone.

- Impact on reporting, taxes, and audits.

A small error at the beginning of the process can multiply into a larger one. many hours of processing at the end of the period.

Waste is difficult to measure but very costly.

Besides the time wasted, manual processes also cause:

- Stress and overload at the end of the semester.

- Loss of motivation for talented employees.

- Dependence on human resources → risk of employee turnover

This is hidden waste, not visible in reports but clearly evident in operations.

In short, time is wasted not because accountants are slow, but because the system forces them to work slowly. To save time, the solution is not to rush people, but to eliminate manual operations from the process.

Why does multi-level approval create a bottleneck and increase decision latency in businesses?

Multi-level approval processes create bottlenecks when decisions are delegated to a small number of people, lacking clear limits/rules and relying on chat/email. The consequences include increased waiting times, backlogs, delayed payments, and leaders being drawn into micromanagement instead of strategic decision-making.

The following analysis focuses on the operating mechanism, not just the symptoms.

Decision-making is concentrated among a small number of people → structural bottleneck

Mechanism of obstruction:

- Every expenditure – however small – must be escalated to a higher level.

- The approver becomes the "single point of failure".

Consequences:

- Dozens of small decisions are lined up waiting.

- Strategic decisions are being interrupted by operational issues.

The bottleneck isn't about the number of steps, but about the lack of decisive flow control.

Lack of quotas and rules → approval instead of critical thinking.

When:

- Approval threshold (role-based limit)

- The rule is clear: when to auto-approve, and when to escalate.

What actually happened:

- In every case, it's "up to the boss to decide."

- Approvals are subjective and inconsistent.

Businesses are outsourcing their thinking to their superiors.

Dependence on chat/email → decision latency increases exponentially.

Main problem:

- I don't know where the file is.

- There are no SLAs for each approval level.

- No decision log

Consequences:

- Short processing time

- Extremely long waiting time.

Decision latency = total response waiting time, not processing time.

Sequential approval → cumulative delay

Danger mechanism:

- Level A approval is required before Level B approval is granted.

- One step slows down → the whole chain comes to a standstill.

For example:

- Each level is only "busy for one day".

- 4 levels of review → decision takes 4–5 days

This is linear latency; it doesn't generate additional value.

Leaders are drawn into micromanagement.

The opposite consequence:

- Leaders take the time to review the details.

- Limited time for strategy, high risk analysis.

Multi-level approvals are wasting the time of the most expensive person.

The ripple effect on finance and operations.

- Late payments → loss of supplier's reputation

- Miss out on early payment discounts!

- Pressure builds up at the end of the period → increased risk of errors

- Employees are "chasing signatures" instead of creating value.

High decision latency isn't due to a lack of decision-makers, but rather to flawed decision design. Efficient businesses don't reduce control; they bring decisions to the right level, at the right time, and in the right context.

How can wasted time increase financial risk and internal fraud?

When processes are too slow, employees are more likely to create "shortcuts" such as sending documents via chat, making payments upfront and then supplementing later, or skipping verification steps. These "shadow processes" not only waste time (rework) but also increase the risk of errors and fraud due to a lack of traceability.

Below is a systematic explanation of the cause-and-effect mechanism.

Slow processes → “shortcuts” appear (shadow processes)

When staff have to wait:

- Approval takes too long.

- Cumbersome reconciliation

- The system is not responding in time.

Behavior that arises:

- Send documents via personal chat/email.

- Pay upfront, submit documents later.

- Thanks to "verbal approval," they reversed the process.

The shadow process is not due to intentional fraud from the outset, but rather to time pressure.

Shadow process → loss of audit trail

The core issue:

- No time log – reviewer – reason

- There is no unified version of the profile.

- The data is scattered across chats, emails, and personal files.

Consequences:

- It is not possible to determine who is responsible.

- It is difficult to detect systematic deviations.

- Audits only see the "results," not the "process."

Fraud thrives best when there is a lack of traceability, not when there is a lack of regulations.

Skipping the control step → risk multiplies exponentially.

Commonly skipped steps:

- 3-way matching

- Check budget limits

- Verify supplier/payment terms

Risk chain:

- Duplicate Payment

- Incorrect unit price paid

- Invalid payment to supplier.

One instance of "flexibility" can pave the way for intentional repetition of the behavior.

Rework and post-work cleanup → secondary waste of time.

When errors are discovered late:

- Undo the document

- Adjust the report.

- Explanation to auditors/tax authorities

Business I lost both money and time., and moreover loss of internal credibility.

End-of-term pressure → ideal environment for cheating

End of month / end of quarter:

- Consolidate files

- Meeting deadlines

- Prioritize "getting the job done" over "following the correct procedure."

Cheating rarely happens when there's no work to do – it happens when there's too much work.

The Fraud Triangle has been triggered.

Wasting time contributes to creating all three of the following factors:

- Pressure: delayed payments, pressure to meet deadlines

- Opportunity: The process is broken, lacking control.

- Rationalization"I'll do this temporarily to finish on time, and I'll add more later."

Wasting time not directly committing fraud, But creating an ideal environment for fraud to occur..

What is wasted time and how does it affect cash flow through DSO and cost of capital?

When debt collection is slow due to manual reminders or undisciplined debt aging tracking, the Date of Sale (DSO) increases and cash flow is delayed. This results in higher capital costs for the business (because it has to finance working capital), even though paper revenue remains unchanged.

How does wasting time negatively impact cash flow through DSOs?

Slow debt collection process → Increased DSO (Debt Collection Order).

Common sources of wasted time in AR:

- Tracking debt aging manually using Excel.

- Debt collection is not on a standard schedule and depends on the individual.

- Late-discovered invoice disputes

Direct consequences:

- The invoice arrived late to the customer.

- Reminding someone of a debt at the wrong time.

- Overdue debts were not scalded in time.

The increase in DSO is not due to bad customers, but because businesses are slow to react.

Increased DSO → working capital gets "stuck"

Core formula: Capital Tie = Average Daily Revenue × DSO

When DSO increases:

- The money stays with the customer longer.

- Businesses must self-finance their operations.

Delayed cash flow → increased cost of capital even though revenue remains unchanged.

Businesses must:

- Use cash reserves.

- Or short-term loans/overdrafts

Additional costs incurred:

- Interest

- Opportunity cost (not being able to invest)

In the P&L report, No "costs incurred by DSO" are listed., but it erosion of real profits.

Wasting time in AR creates a negative spiral.

- Late debt reminders → disputes → wasted time resolving

- Incomplete documentation → customer delays payment

- Work accumulates at the end of the period → errors → further increase in DSO (Demand on Sales).

How does wasted time affect the cost of capital?

Unstable cash flow → increased financial risk

- Large cash-in fluctuations

- CFOs must maintain a high cash buffer.

Dependence on short-term capital

- Borrowing to cover working capital

- Missed out on early payment discounts.

Long-term impact on valuation

- Weak cash flow → High WACC

- Investors assess liquidity risk.

Do popular time management methods actually reduce wasted business time?

Pomodoro, Eisenhower, or to-do lists help individuals focus better, but they only address the "symptoms" when waste stems from processes and data. For businesses, it's necessary to combine personal techniques with standardized processes and tools to truly reduce waste.

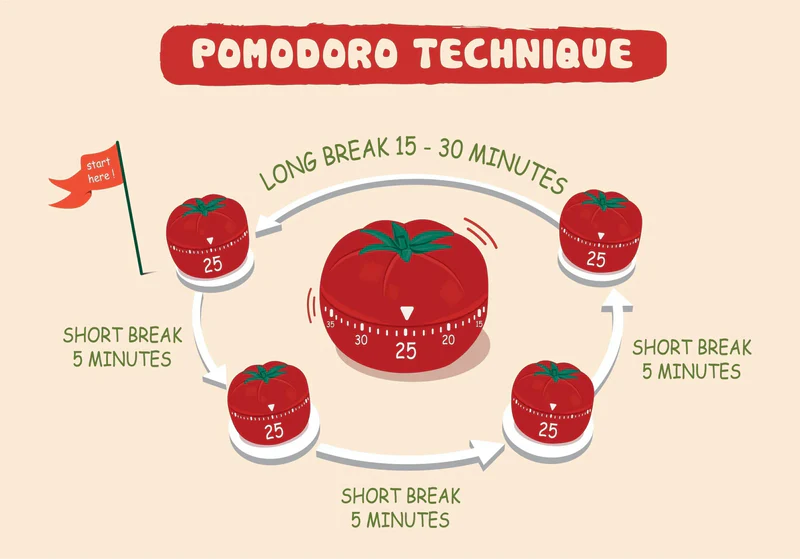

Pomodoro

Help:

- Increase personal focus

- Reduce distractions and procrastination.

Unresolved:

- Awaiting approval

- Insufficient input information

- The work was interrupted by someone else.

Eisenhower Matrix (Important – Urgent)

Help:

- Prioritize better jobs.

- Avoid getting caught up in trivial matters.

Unresolved:

- The "urgency" is created by a slow system.

- Work was delayed due to a process error.

To-do list / GTD

Help:

- Reduce memory load

- Track your personal progress

Unresolved:

- Repetitive work due to lack of standardization

- Rework due to data errors.

- The job depends on others.

Despite the widespread implementation of Pomodoro, Eisenhower, and to-do lists, many businesses still It fails to reduce wasted time in a substantial way.The reason lies in these methods. touching personal behavior, while wasting time is beneficial. It arises from how businesses operate their systems..

In short, the widespread application of these methods project time management or individuals They don't fail because they're wrong.because they are expected to solve a problem. belongs to the systemUntil processes, data, and decision-making mechanisms are redesigned, any efforts to manage individual time will only benefit the business. better at tolerating waste, rather than letting it go to waste and disappear.

Where should businesses cut wasted time: invoices, expense approvals, or accounts receivable?

If the goal is to generate ROI quickly by cutting wasted time, businesses shouldn't start with seemingly strategic processes that have little measurable data. Instead, they should target processes with three key characteristics: high volume, high repetition, and direct impact on costs and cash flow. The three areas that best meet these criteria are invoice processing (AP), expense approval, and accounts receivable management (AR).

Why are these points of interest that generate ROI quickly?

First, large volume and high frequency: Invoices, expense requests, and accounts payable transactions arise daily and weekly. Each small task, if done manually, would add up to hundreds or thousands of hours of work per year. By simply reducing a few minutes per transaction, the total time saved is enough to see a clear ROI.

Secondly, its high repeatability makes it very suitable for automation: Steps such as entering invoices, reconciling purchase orders (PO-GR-Invoice), submitting approval requests, sending approval reminders, and reconciling accounts payable all follow relatively fixed rules. This is a type of "mechanical" waste, where technology and digital workflows can quickly replace humans without increasing risk.

Thirdly, it directly impacts costs and cash flow.

- Delayed AP → late payments, lost discounts, wasted time processing exceptions.

- Confusing expense approvals lead to uncontrolled expenses or a backlog of work at the end of the period.

- Poor AR → High DSO, cash flow is tied up.

Cutting time here not only saves staff but also Direct conversion to cash, lower costs, and better predictability of cash flow..

Which logic should be prioritized to see results sooner?

If you have to prioritize tasks to generate ROI quickly, a common approach is:

- Start with invoice processing (AP): where data is clear, easy to measure before and after, and easy to normalize. Businesses often see immediate reductions in data entry time, errors, and outliers.

- Next is cost approval.When the workflow is streamlined, waiting times are drastically reduced, allowing the entire AP–AR chain to operate more smoothly.

- Finally, there is accounts receivable management (AR).At this point, AR is optimized as a consequence, with DSO reduced thanks to invoices being issued correctly, completely, and quickly, and the approval process no longer experiencing bottlenecks.

How does automating invoice processing and three-way reconciliation reduce wasted time?

Automated invoice processing and three-way reconciliation (Invoice – Purchase Order – Grand Finale) It's not just about making it "faster"., but Cut the right out for the biggest time-wasting issues in AP.: Manual input, waiting, error correction, and reprocessing. The waste reduction mechanism occurs in three distinct layers.

1. Eliminate manual data entry time – the most obvious source of waste.

In the manual model, each invoice must:

- Enter each line manually.

- Check supplier information, purchase order number, unit price, and tax.

- Correct any errors.

Automation (OCR + rule engine) helps:

- Extract invoice data immediately upon receipt.

- Standardize format, supplier code, and account.

- Directly input data into the accounting/ERP system.

drastically reduce repetitive work hours.This also reduces human error – the cause of numerous subsequent repair cycles.

2. Change from “handle all” to “handle only exceptions”

The biggest difference with automation is not speed, but... human attention distribution.

With automatic 3D verification:

- Invoices matching PO & GR within acceptable limits → automatically approved

- Only the bills discrepancies in unit price, quantity, tax, and terms. recently added to the exception queue.

Result:

- AP personnel are no longer processing 100% invoices.

- Focus time for 20–30% invoices carry real risk.

- Significantly reducing "peace of mind" checks without adding value.

3. Early detection of discrepancies → reduces rework and avoids incorrect payments.

Three-way reconciliation helps:

- Discover the error as soon as the invoice arrives, don't wait until the payment deadline.

- Prevent overpayments, duplicate payments, or payments that violate terms.

- Avoid the rework chain: pay the invoice – adjust the purchase order – reconfirm the gross order – re-enter the data.

Compared to manual processing, where errors often only become apparent in the final step, 3-way matching Block errors at the source., help:

- Reduce the number of reprocessing cycles.

- Shorten billing cycle time.

- Reduce conflicts with suppliers due to incorrect or delayed payments.

4. Direct impact on costs and cash flow

When invoice processing time is reduced:

- Paying on time → avoids penalties, maintains supplier reputation.

- Proactively take advantage of early payment discounts.

- Outflows can be predicted more accurately.

ROI comes not just from personnel savings, but from real cash flow and lower risk.

In summary, automated invoice processing combined with three-way reconciliation reduces wasted time by:

- Eliminate manual data entry and verification.

- Only pass exceptions for human handling.

- Detect discrepancies early, reduce rework, and avoid incorrect payments.

In other words, businesses aren't speeding up an old process, but redesigning it so that people only do value-added work.

- See more content about workflow drawing software. here

How does automated expense approval eliminate bottlenecks while still controlling risk?

Automating expense approvals isn't about "getting it over with quickly," but about eliminating unvalue-adding waiting time while tightening risk control through rules and data. This mechanism can be seen through four layers.

1. Remove bottlenecks with a clear approval process: the right person – at the right level – at the right time.

In manual modeling, bottlenecks typically stem from:

- It is unclear who has the authority to approve which expenditures.

- One person has to review too many types of expenses.

- Unnecessarily going through too many levels of review just to be sure.

Automation solves this by:

- Define spending limits by role, department, and expense type.

- Set up automatic browsing routes: within limit → fast browsing; exceeding limit → escalated.

- Send your request directly to the person ultimately responsible, without intermediaries.

Waiting times have been drastically reduced because No more asking - transferring - reminding.

2. Replace manual control with rule-based control.

Instead of being controlled by the subjective feelings of the reviewer:

- "Is this amount reasonable?"

- "Did we exceed the budget?"

Automated system:

- Compare costs with the approved budget.

- Check if this type of expenditure is permitted.

- Apply rules based on time, project, and cost center.

Reviewer No need to check from the beginning., and decisions are made only within a risk-filtered context.

3. Reduce risk through approval traceability and tracking capabilities.

A common concern for CFOs is: "Does going faster lead to a loss of control?"

In fact, automation helps control. better because:

- Each browsing step has timestamp, reviewer, review content

- No more browsing through chats and disjointed emails.

- Easy to audit: who approves what, and based on which rules?

The risk of fraud and post-audit disputes has been significantly reduced.

4. Early warning instead of dealing with it when it's too late.

The automated approval system allows:

- Warning The budget was exceeded as soon as the request was created.

- Block or request clarification before submitting for review.

- Real-time aggregation of spending data.

Businesses are shifting from extinguish the fire after the expenditure luxurious Control before money leaves the account.

How does automated debt reminder system reduce wasted time and improve DSO (Debt Service Order)?

Automated debt reminders based on scenarios not only replace the "quick email" method, but also redesign the entire way businesses track and collect payments, thereby cutting wasted time and directly impacting DSO (Demand Service Order). This mechanism creates value in four key areas.

1. Eliminate waste caused by reliance on memory and repetitive tasks.

Manual debt collection methods typically rely on:

- Excel file for tracking debt aging.

- HR personnel remember the schedule for sending emails and making phone calls.

- Copy and edit the same reminder content.

The consequence is:

- Remind late or forget to remind.

- Inconsistent reminders among customers

- Many hours are wasted on operations that don't add value.

Automation helps:

- Schedule debt reminders in advance based on the age of the debt (pre-due, due, overdue).

- Automatically send emails/notifications based on a script.

- Regardless of individual circumstances or peak work times.

AR time is freed from repetitive tasks.

2. Reminding at the right time – a key factor in reducing DSO.

A debt was mentioned:

- Paying ahead of schedule increases the probability of paying on time.

- On time → demonstrates professionalism

- As soon as the deadline passes → reduces the risk of "being forgotten".

Automation ensures:

- Don't miss any important deadlines.

- Remind them early and regularly, don't wait until they're long overdue.

- Maintain pressure to collect payments. light but continuous

The decrease in DSO (Debt Collection Order) was not due to coercion, but rather to disciplinary action regarding debt collection.

3. Monitor responses and update debt aging in real time.

Unlike fragmented manual debt reminders, automated systems offer:

- Record customer feedback (payments, appointments, disputes).

- Update aging AR as soon as there is a change

- Adjust the next reminder scenario based on the actual state.

AR personnel No need to review from the beginning. each follow-up.

4. Focus resources on "problematic" debt.

When debt reminders are automated:

- On-time payments almost "flowed naturally".

- System only Warning about upcoming or long overdue payments.

Thanks to that:

- The HR team focused on making phone calls and negotiating for difficult deals.

- Reduce the processing time for debts that "shouldn't need handling."

It saves both time and increase the actual cash-in rate.

FAQ: Frequently Asked Questions about the causes of wasted time in businesses.

Below is a summary of answers to some common questions about time waste in businesses.

What is wasting time?

Wasting time is Time is wasted on activities that create little or no value.Waste often arises from manual processes, fragmented data, and slow approvals. In a business environment, waste should not be measured by the "feeling of being busy" but rather quantified through... cycle time, number of rework cycles and personnel costs associated with each process.

How can we measure wasted time in the accounting department?

To accurately measure performance, businesses need to break down each process, such as invoice processing, expense approval, or accounts receivable reconciliation, and then track core metrics: cycle time, number of touches (touchpoints), rework hours and exception rateWhen converting these indicators into working hours and operating costs (OpEx), the CFO will be able to identify the bottlenecks that need priority improvement.

How do you convert wasted time into costs and ROI?

- Wasted time can be directly converted into cost using the following formula:

C₍waste₎ = H₍waste₎ × Cost₍hour₎. - ROI is calculated based on the difference between the benefits gained and the investment costs:

ROI = (Benefit – Cost) / Cost × 100%.

In there, Government It comes not only from saved working hours, but also from Reduce errors, minimize incorrect payments, and improve the speed of cash collection and disbursement..

Why does ERP still waste time in budget planning and forecasting?

Even after implementing ERP, many businesses still spend a lot of time on budgeting and forecasting because Fragmented data, slow updates, and reliance on manual Excel aggregation.The CFO and the FP&A team must spend most of their time standardizing and consolidating data, rather than analyzing and making decisions.

How does 3-way matching automation reduce waste at APs?

Automated three-way reconciliation (Invoice – Purchase Order – Grand Finale) helps Eliminate manual data entry and verification., while only pushing incorrect cases to the exception handling stream. This “exception-only” approach reduces rework, shortens cycle time, and limits the risk of incorrect payments.

How does a slow DSO (Demand for Sale) relate to wasted time and capital costs?

An increase in DSO means that The money arrived late.This forces businesses to compensate for working capital shortfalls through borrowing or by sacrificing other investment opportunities. The underlying cause often stems from... Manual debt tracking and reminders lack discipline.This makes collecting money dependent on individuals rather than the system.

How can we reduce the approval bottleneck without increasing the risk of fraud?

The solution lies in establishing quotas and approval routes based on rules, combined with task separation (SoD) and approval trailing (audit trail). Automation doesn't reduce control, but shifts control from subjective to systemic, enabling faster approvals while still managing exceptions and fraud risks.

Which areas should a CFO prioritize cutting wasted time in first?

CFOs should prioritize high-volume, repetitive processes that directly impact cash flow, such as invoice processing, expense approval, and accounts receivable collection. These are the areas that deliver the quickest ROI by reducing labor hours, minimizing errors, and improving cash-in.

How does Bizzi help businesses eliminate wasted time at its root?

Bizzi addresses the root cause of waste by automating repetitive tasks in finance and accounting: bots process and reconcile invoices, digitize expense approvals, and automatically send debt reminders based on scenarios. As a result, businesses reduce cycle time, minimize rework, and mitigate cash flow delays.

Conclude

What is the nature of wasted time? The cause of wasted time doesn't lie in "slow employees," but in businesses letting people handle tasks that shouldn't require human intervention. This includes time wasted on repetitive data entry, waiting for approvals, correcting errors, manual reminders, and merging disparate data – activities that don't directly create value but silently erode costs, cash flow, and decision-making capabilities.

Businesses can only control it when:

- True to nature

- Accurately measured using cycle time.

- Convert correctly to OpEx and ROI

- Address the root cause through process automation.

Platforms like Bizzi not only help businesses work faster, but also reduce the negative consequences of wasted time, including:

- Reduce year-end pressure for the finance and accounting department.

- Reduce the risk of incorrect, delayed, or duplicate payments.

- Reduced DSO and cost of capital due to delayed cash inflows.

- Free up CFO's time for strategic analysis and decision-making.

By automating invoice processing, expense approvals, and debt reminders based on scenarios, Bizzi helps businesses cut waste at the system level, rather than requiring people to "try harder."

To receive personalized solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/