In debt management, even small errors can cause serious financial losses and affect the reputation of the business. That is why the 3-way matching process is increasingly focused on in modern accounting. The following article will help you understand what 3-way matching is, why it is a core factor in controlling costs, reducing fraud, and discover how to automate the 3-way matching process to optimize financial efficiency with Bizzi.

1. What is 3 way matching?

3-way matching, also known as 3-way matching or 3-way matching, is an important internal control process in accounts receivable and corporate financial management. This method helps ensure that the business only makes payments when there is a match between three documents: purchase order, goods receipt and invoice. This is an important step to increase transparency, control costs and prevent fraud.

1.1. Concept and role of 3-party reconciliation in accounts receivable accounting

1.1.1. Definition of 3-way matching

3 way matching, also known as 3-way matching or 3-way matching, is an important internal control process in accounts receivable and payable accounting. corporate financial managementThis method ensures that payment is only made when there is a match between three documents:

- Purchase Order (PO)

- Receiving Report (RR or Goods Receipt – GR)

- Invoice from supplier

The main goal of 3-way matching is to verify the consistency and validity of transactions before payment, thereby minimizing the risk of errors and fraud during the shopping and payment process.

1.1.2. Main purpose of 3-way matching

The 3-way reconciliation process is not only an accounting procedure, but also an important tool to help businesses control costs, ensure accurate and transparent payments.

- Ensure that the company only pays for goods/services that are ordered and received.

- Timely detection of deviations in quantity, unit price, quality or related details.

- Prevent fraud such as fake invoices, duplicate payments, and false payments.

- Increase transparency and internal control throughout the accounts receivable process.

- Meet audit requirements and comply with financial regulations.

1.2. Main documents involved in 3-way matching

To understand what 3-way matching is, businesses need to understand the three key documents involved in this process. This is the basis for accounting, purchasing and financial management to ensure transparency, accuracy and better control. Accounts Payable.

1.2.1. Purchase Order (PO)

A purchase order is an official document issued by a buyer to confirm a purchase request to a supplier. The PO serves as the first step in the three-way matching process, creating the legal basis for the purchase transaction. The contents of a purchase order typically include:

- List of goods or services to purchase

- Specific quantity, agreed price and payment terms

- Order number (PO number) for tracking and tracing

- Expected delivery date and related conditions

PO helps businesses manage purchasing plans effectively and is a standard for comparison with received goods and future payment invoices.

1.2.2. Receiving Report (RR / Goods Receipt Note – GRN / Order Receipt)

A goods receipt is prepared by the warehouse or goods receiving department after checking the quantity and quality of goods received from the supplier. This document helps confirm that the goods have been delivered as described in the order. Important contents of the goods receipt include:

- Information about item code, actual quantity received and product status

- Date of receipt and name of recipient

- Note on discrepancies (if any) between order and actual goods

This is an intermediate document that plays a key role in detecting errors or mismatches between PO and invoice.

1.2.3. Invoice

Bill is the official payment request sent by the supplier to the business after the delivery is completed. This is the basis for the accounting department to carry out the final payment steps. A valid invoice in 3-way reconciliation must have:

- Invoice number, issue date and supplier contact information

- List of goods/services, quantity and unit price

- Discounts or adjustments if any

- Total amount payable, payment terms

Reconciling invoices with POs and receiving notes helps businesses prevent incorrect or fraudulent payments.

1.3. How does the 3-way matching process work?

The 3-way matching process is a core part of internal control and debt management, helping businesses ensure that payments are only made for valid and accurate transactions. Properly applying the process not only avoids financial risks but also improves the operational efficiency of the accounting department.

1.3.1. Steps to perform comparison

To understand what 3 way matching is in practice, businesses can refer to the basic implementation steps below:

- The Accounts Payable (AP) department receives an invoice from the supplier: This is an invoice that records the transaction value and requests payment for the supplied order.

- Reconcile Invoices with Purchase Orders (POs): Compare key elements such as product quantities, unit prices, item codes, and totals between invoices and approved purchase orders.

- Check Goods Receipt (GRN): Confirm that the goods or services have been delivered in the correct quantity, quality and time as stated in the order.

- Payment Approval: If all three documents match completely in terms of information and value, the accounting department will proceed to pay the supplier.

- Handling discrepancies (if any): In case of discrepancies such as missing items or incorrect prices, the invoice will be held. The business will only pay when the errors are resolved with the supplier or relevant department.

1.3.2. Illustrative example

To help you better understand what 3-way comparison is, let's look at the example below:

- Purchase Order (PO): Company ABC orders 100 products from supplier XYZ at a unit price of 50 USD/product, total value of 5,000 USD.

- Invoice: Supplier XYZ sends an invoice requesting payment of $5,000 for 100 products.

- Goods Receipt: ABC Company confirms receipt of 100 products as ordered.

- Reconciliation and approval: ABC's accounting department performs a 3-way reconciliation between PO, Invoice and GRN. Once all information is verified to be correct and consistent, payment will be made.

2. Compare 2-way matching and 3-way matching

In debt and payment management, data comparison between documents helps businesses avoid errors and limit payment risks. The two popular methods today are 2-way matching and 3-way matching. Below is a detailed comparison of the two methods:

2.1. What is 2-way matching?

2-way matching is the process of comparing a Purchase Order (PO) and an Invoice. The goal is to verify that the business only pays for the exact items or services ordered in the PO, based on information from the PO and Invoice.

Concrete example of 2-way matching

ABC Company orders 100 products from supplier XYZ at a unit price of $50/product (PO). When XYZ sends an invoice for $5,000 (Invoice), the accounting department compares the purchase order with the invoice. If the information matches, payment is made without checking the goods received.

Note: This method does not confirm whether the goods have been delivered or not, leading to risks if the supplier sends an invoice but has not delivered the full goods.

2.2. Why is 3-way matching superior?

What is 3-way matching – This is a method of matching three documents including Purchase Order (PO), Payment Invoice (Invoice) and Receiving Report/Delivery Note.

Checking all three documents helps ensure that:

- Businesses only pay for what they order (PO).

- Invoiced accurately

- And actually received the goods or services (Receiving Report)

Advantages of 3D over 2D comparison

Compared with 2-way matching, 3-way matching method provides higher accuracy and safety in invoice processing process and payments. Some of the notable benefits include:

- Minimize the risk of incorrect payments: Avoid paying for undelivered items or incorrect quantities.

- Increase Accuracy: Ensure consistent data from purchasing to receiving and invoicing.

- Fraud or error detection: If the goods have not been received but the invoice has been sent, the system will automatically alert.

- Strengthen internal controls: Help businesses better control supply chains and cash flow.

3. The Challenges of Manual Reconciliation and the Benefits of Automation

Although 3D matching offers high accuracy, it is still risky and costly to do manually. Today, many businesses are turning to automating matching to save costs, save time and increase operational efficiency.

3.1. Problems with manual reconciliation

3.1.1. Time consuming and costly

Manual invoice reconciliation requires staff to search and check each document individually – from purchase orders to invoices to delivery notes. Each invoice processed manually can cost an average of $11, and up to $25 depending on the complexity.

The costs add up when you factor in the writing of checks, mailing them, manual filing, etc. In a year with thousands of invoices, a business can lose hundreds of thousands of dollars – not to mention the risk of penalties for late payment or missing out on early discounts.

3.1.2. Prone to errors and fraud

When entering data manually and comparing each document one by one, it is very easy for humans to make mistakes: entering incorrect quantities, unit prices, or creating duplicate payments.

Not only do errors cause financial losses, they also put a lot of pressure on the accounting team, especially during peak seasons. Furthermore, manual processes are not capable of detecting sophisticated frauds such as changing invoices, falsifying delivery data, etc.

3.1.3. Limited visibility and impact on supplier relationships

Lack of real-time information on invoice or order status leaves businesses unable to effectively control cash flow.

Late or incorrect payments not only disrupt the supply chain, but also damage the reputation of the supplier, reducing the ability to negotiate and cooperate in the future.

3.2. Benefits of automating the reconciliation process

3.2.1. Improved accuracy and superior performance

3-way reconciliation automation allows the system to instantly check for matches between POs, invoices and receipts. This reduces processing costs by up to 81% and increases work efficiency by up to 73% according to reports from businesses that have successfully implemented it.

Instead of manually processing each step, accountants can focus on more strategic work.

3.2.2. Improve cash flow management and supplier relationships

Automated reconciliation systems help process invoices on time, allowing businesses to take full advantage of early payment incentives and increase their reputation with partners.

All data is updated in real time, helping management have a clear view and make timely and accurate financial decisions.

3.2.3. Risk mitigation and audit support

Automation helps detect anomalies like mismatched invoices, duplicate orders, or overpayments.

In addition, the system stores and organizes all electronic documents scientifically, helping to save auditing time and ensure compliance with financial regulations.

4. Bizzi: Digital and automated solution for 3-party reconciliation in Accounts Receivable

When it comes to 3-way matching, most businesses are concerned about the accuracy, speed and level of automation in the accounts receivable process. Bizzi provides a powerful digital platform that helps automatically match invoices - orders - receipts accurately and in real time, minimizing the risk of incorrect payments and improving cash flow efficiency.

4.1. How does Bizzi support 3-party reconciliation automation?

4.1.1. Automatic processing of input invoices

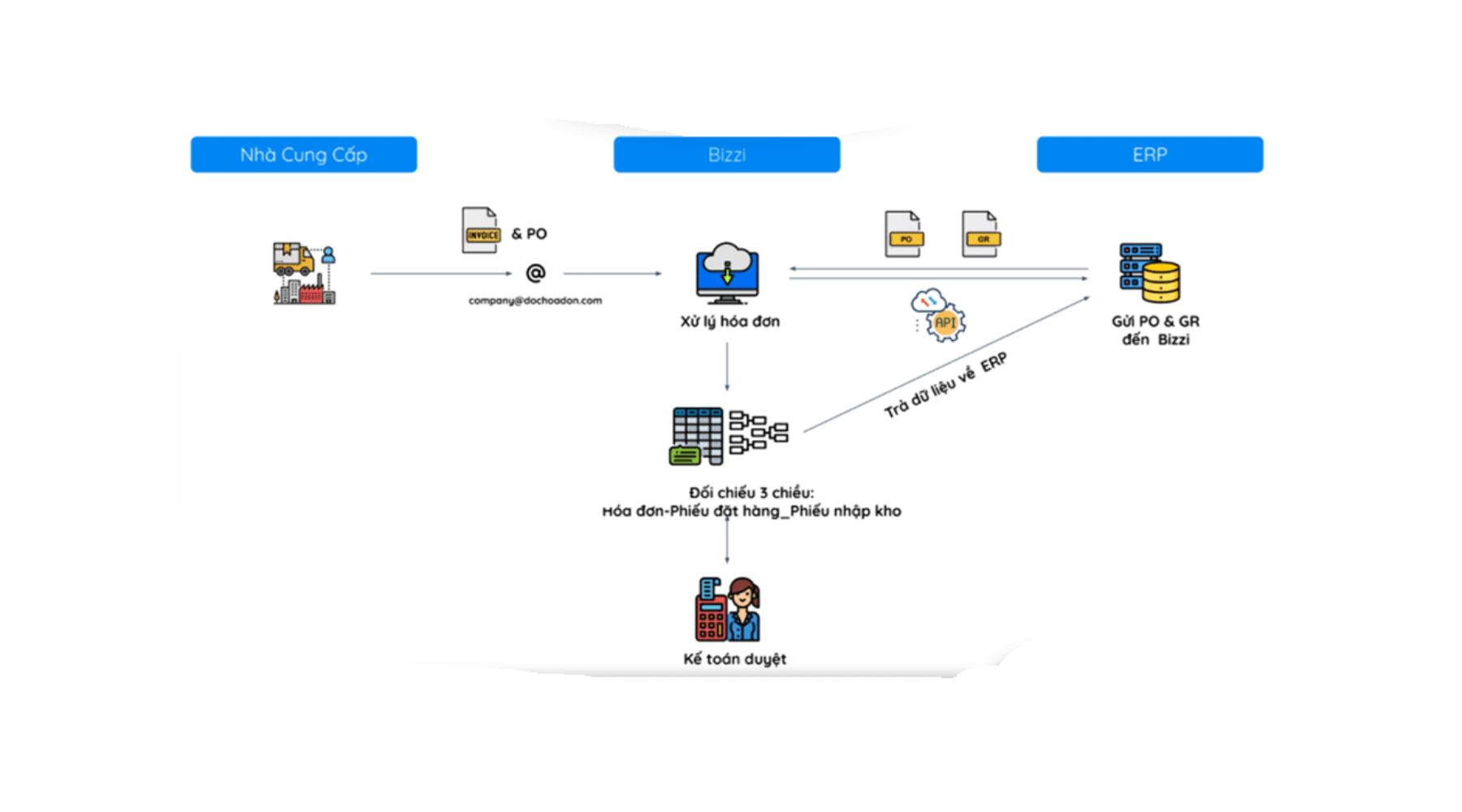

Bizzi applies Bizzi Bot technology - a combination of RPA (Robotic Process Automation) and AI, to automatically collect electronic invoices from email or supplier portals.

- The system automatically extracts invoice information (tax code, date, amount, item code...) and checks validity.

- Help businesses reduce risks related to incorrect invoices, invalid invoices and limit tax risks.

4.1.2. Automatic PO – GR – Invoice reconciliation (3-way matching)

Bizzi performs 3-way reconciliation between invoices, purchase orders (POs) and warehouse receipts (GRs) fully automatically and in real-time:

- Smart 3-way collation with more accuracy than 99%.

- Handle all reconciliation cases on the system: 1PO – 1INV – 1GR; 1PO – nINV – nGR; nPO – 1INV – nGR; nPO – nINV – nGR

- Detect deviations quickly and improve data accuracy.

- Automatically get PO number from invoice/email from supplier/invoice file.

- Support creating invoices and comparing goods for farmers from templates.

- Automatically convert units of goods and manage goods intelligently.

4.1.3. Related features to support debt management

In addition to the ability to automatically reconcile 3D, Bizzi also provides many additional features to help businesses manage debt more effectively, minimize risks and increase financial control:

- Verify suppliers and alert on risky invoices.

- Automatically store electronic invoices with a storage period of up to 10 years, in compliance with legal regulations.

- Monitor budgets by department or project, track spending in real time.

- For receivables, Bizzi supports automatic debt reminders via email/SMS and effective customer debt tracking.

4.2. Outstanding benefits of using Bizzi for accounts receivable accounting

Using Bizzi is not just about deploying a digital tool, but also a strategic transformation that helps businesses comprehensively optimize their accounts receivable process – from saving resources to enhancing cash flow control:

- Save time, increase transparency: Reduce invoice processing time by up to 80%, reduce errors and automate invoice reconciliation in real time.

- Improve cash flow management efficiency, reduce bad debt: Accurately track debt, detect overdue or difficult-to-collect debt early, helping businesses handle it promptly.

- Easy integration with existing systems: Bizzi provides APIs to connect with accounting software - ERP such as MISA, Fast, Bravo, SAP, NetSuite, Dynamics 365, Odoo, helping to synchronize data instantly.

- Flexible financial connections: Bizzi offers corporate credit cards and invoice financing solutions – PO with fast processes, competitive interest rates, suitable for both startups and small and medium enterprises.

4.3. Bizzi's position in the enterprise software ecosystem

In the current enterprise management software ecosystem, Bizzi plays the role of a specialized technology solution, supporting the automation of financial and accounting processes effectively without replacing operating systems such as ERP or CRM. With a clear direction, Bizzi helps businesses shorten document processing time, increase control and transparency in debt and input invoices.

4.3.1. Specialized focus

Unlike traditional ERP or CRM, Bizzi focuses heavily on back-office financial automation, especially invoices and receivables.

- ERP manages the entire operational chain (production, purchasing, human resources, etc.).

- CRM supports customer care and management.

- Bizzi is optimized for accounts receivable, helping to increase efficiency and financial accuracy.

4.3.2. Strong integration capabilities

Bizzi seamlessly integrates with major ERP systems such as SAP, NetSuite, Microsoft Dynamics, Odoo via Open API, file integration or cloud connection, helping businesses to upgrade financial efficiency without changing existing infrastructure.

4.3.3. Additional, non-replacement solution

Bizzi does not replace ERP or CRM, but acts as an additional layer of in-depth technology, helping to increase the efficiency of accounting and payment processes, while supporting CRM in processing invoices and debts in customer transactions.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

5. Conclusion

Understanding what 3-way matching is not only helps businesses grasp a technical check in accounts receivable accounting, but also opens up opportunities to limit financial risks and optimize cash flow. Implementing a methodical 3-way matching process will help accountants better control the accuracy of documents, while increasing transparency in spending.

To simplify and automate this process, businesses can consider applying digital solutions such as Bizzi - a platform that helps to quickly reconcile invoices, minimize errors and save time for the accounting department.