Budgeting is a mandatory step if you want to manage finances properly, ensure that your business operates sustainably and can develop in the long term. In other words, the budget is like a “financial map” so that your business knows how much money it will earn, where it will spend it, and what results it expects. Especially for CFOs and Chief Accountants, budgeting is the first step to automating cost control and real-time cash flow management – vital elements in a modern ERP system.

Let's join Bizzi to learn in detail about budgeting and how budgeting benefits each business in this article.

What is a budget and why are the benefits of budgeting important?

A budget is a detailed financial plan that projects income and expenses over a specific period of time. Budget serves as a roadmap for managing and allocating financial resources. For businesses, this is an important tool to help control cash flow, optimize profits and orient development strategies.

An effective budget = Clear goals + Realistic + Comprehensive + Flexible + Monitorable.

- Clear goals: Budget should be linked to specific business goals: revenue growth, market expansion, cost optimization...

- Comprehensiveness: Full coverage of all areas: expected revenue, fixed cost, variable cost, profit, cash flow. Not just for one department (e.g. marketing) but need to have an overall budget for the whole company.

- Based on actual data: Use data from previous years, market trends, industry reports… instead of just making emotional estimates; help the budget be feasible, avoid “drawing out beautiful plans” that cannot be achieved.

- Flexibility: Budget required buffer for risks or unexpected changes (e.g. fluctuations in raw material prices, epidemics, stronger competitors).

- Details & reasonable allocation: The more specific, the easier to manage (by department, by activity, by month/quarter). Prioritize resource allocation to categories. create maximum value for Business.

- Have a monitoring & evaluation system: Must include KPIs and measurements to compare budget – actual, Periodically review (monthly or quarterly) for adjustment.

- Transparency & Consistency: The budget needs to be clearly communicated to relevant departments. Everyone must understand and commit to the common direction.

- Foundation Benefits: Budgeting for Individuals and Families: Before delving into the business level, budgeting also brings essential benefits to personal and family finances. It helps each individual control debt, build savings habits for long-term goals (such as buying a house, education, retirement), and significantly reduce financial stress. Personal budgeting is the foundation for each person to understand their cash flow, thereby making reasonable spending and investment decisions.

Benefit set a budget is considered a fundamental factor for effective financial management and achieving financial goals, thereby maintaining stability and sustainable development for the business. In essence, budgeting is to control spending and optimize the use of money, not to limit spending unnecessarily.

6 core benefits of corporate budgeting

A budget is like a “compass” that helps businesses know how much money they need, where they will spend it, and what they expect to earn. Budgeting is a mandatory step if you want to manage your finances properly, ensure your business operates sustainably and can develop in the long term.

Here are some of the benefits of business budgeting:

1. Control Over-Budget Costs with Automatic Input Invoice Reconciliation

Budgets help businesses keep a close eye on their income and expenses, identify necessary expenses, and prevent overspending. Budgets help conduct periodic Variance Analysis to compare Actuals with Forecasts, thereby detecting Working Capital issues. Bizzi ensures that each expense is reconciled with the approved Invoices and Purchase Orders (POs) in the budget.

2. Accurately forecast Cash Flow and set up Contingency Budget.

Budgeting helps identify and assess potential financial risks, and creates emergency reserves to deal with unforeseen fluctuations. It allows predicting bad situations in revenue and cash flow to prepare response plans. Accurate cash flow forecasting is also the basis for businesses to be proactive in deciding on Capital Financing when needed.

3. Support Strategic Planning & Smart Decision Making.

Budgeting is the foundation for businesses to define long-term and short-term financial goals, thereby building appropriate business strategies. Budgets provide a comprehensive view of the financial situation, helping managers make smart and informed investment and spending decisions.

4. Optimize Resource Allocation & Enhance Transparency and Accountability

With a clear budget, businesses can allocate financial and human resources appropriately, avoid waste and focus investment on areas that bring the highest efficiency. Departments with clear budgets will be responsible for the use of resources, increasing transparency throughout the company.

5. Monitor, Evaluate Performance and Continuously Optimize

By comparing actual figures with budgets, businesses can evaluate the effectiveness of strategies and make timely adjustments. Budgets provide a strong internal governance mechanism, hold departments accountable, and serve as a foundation for setting results-based KPIs.

6. Increase Credibility, Attract Investors and Funding Opportunities

A scientifically constructed budget demonstrates excellent financial management and sustainable development strategy, builds trust and attracts investment capital.

Businesses can automate their expense management process using software. budget management, spending. This software can help businesses create budgets, track actual spending, analyze variances, and make adjustments. Automating the expense management process can save businesses time and money.

With this aspect of budgeting benefits, there is immediately a "weapon" to help businesses manage their finances.

- Effective budget planning tools: Accurately forecast financial needs for all activities (business, human resources, raw materials, payroll funds, etc.), thereby building an optimal budget and monitoring actual performance for timely adjustments.

- Transparent cash flow control system: Closely manage each expense, compare budget - estimated - actual expenditure, helping CEO understand and allocate cash flow immediately.

- In-depth cost analysis solution: Automatically compile detailed reports by period, compare recent periods to identify trends, thereby supporting forecasting and making accurate financial decisions.

- Smart internal management: Review and update all activities by day/month/quarter/year, by region or product. The process is digitized and streamlined, helping all employees easily apply and form a cost management mindset in their daily work.

Popular budgeting methods for businesses

To build an effective budget, businesses can apply many different methods, each method has its own advantages and disadvantages:

Zero-Based Budgeting (ZBB)

Requires all expenditure to be justified at the beginning of each budget cycle, not based on the previous year's budget. This method eliminates unnecessary costs and allocates resources more efficiently, making it suitable for businesses looking to restructure spending or start-ups.

Incremental Budgeting

Build a budget based on the previous year's budget, then adjust it up or down by a certain percentage. This method is simple, saves time, but can maintain unnecessary expenses. Suitable for businesses with a stable business environment.

Activity-Based Budgeting (ABB)

Focus on the cost of each activity required to produce a product or provide a service. ABB helps understand the true cost of each activity and optimize the process. However, it requires detailed data systems and complex analysis.

With the characteristics of small and medium enterprises (SMEs) - Bizzi's target - the combination of Incremental Budgeting to maintain stability and ZBB elements for new projects or tight control of each cost item will bring the highest efficiency, especially when supported by automation technology.

In addition, you can also refer to “common mistakes when budgeting” to avoid basic mistakes.

The above traditional benefits can only be maximized (Momentum) when businesses switch from manual Excel to professional management systems. So, how have AI and RPA optimized the budget process?

Budget and Automation: Differentiating Benefits of Using Technology (AI & RPA)

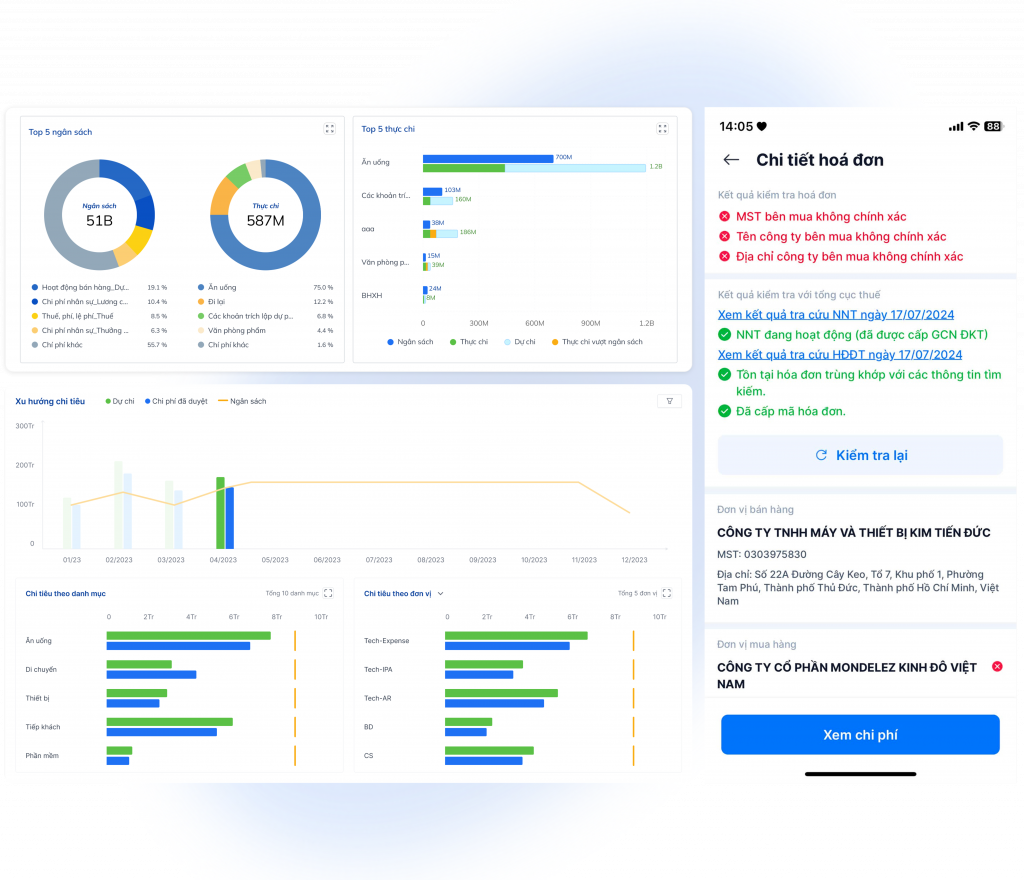

Budget management is not just a financial task, but also a key factor that determines the sustainability of the business. With the support of Bizzi, the entire budget process – from data collection, data validation to approval – is automated, helping to control costs quickly, accurately and transparently.

Whether applied to the entire enterprise, each department or project, the budgeting benefits of applying the Bizzi solution bring a data-driven management system, minimizing manual errors, shortening decision-making time and optimizing capital efficiency.

- Automation & Efficiency: Bizzi app AI and RPA to process invoices, approvals and payments, streamline financial operations and cut costs.

- Accurate & Transparent: Data updated real time, verify suppliers, track spending requests, ensuring absolute transparency.

- Real-time data & smart forecasting: Managers can easily monitor spending in real-time, while leveraging financial trend forecasting algorithms to make quick and proactive decisions.

With Bizzi, businesses are not only save time but also increase profits from the ground up thanks to smart budget management.

Budgeting for 2026: Optimize Your Spending with Bizzi Travel & Expense

Entering 2026, the business environment will continue to fluctuate with many challenges such as increasing raw material costs, exchange rate fluctuations, trends in cutting operating expenses... Therefore, budget 2026 It is not only a matter of forecasting revenue and expenses, but also of taking into account the factors Flexible and smart spending control.

To help businesses effectively plan their budget for 2026, Bizzi offers two key solutions:

- Bizzi Expense – Manage operating costs & budgets

- Support businesses in setting up overall budgets for each department and project.

- Closely monitor actual costs against approved budget.

- Analyze spending trends from historical data, helping to forecast 2026 financial needs more accurately.

- Bizzi Travel – Control your business & travel budget

- Allows planning of work budgets by department or by individual employee.

- Integrate approval, payment, and reimbursement processes, ensuring transparency and saving travel costs.

Provide detailed reports on business expenses, helping to optimize spending in 2026.

With the combination of Bizzi Travel & Expense, businesses can proactively prepare a realistic 2026 budget, limit the risk of overspending and ensure resources are optimally allocated to strategic activities.

Conclude

In short, the benefits of budgeting are that it provides a sustainable way for businesses to manage finances effectively, achieve goals, and adapt to change. It fosters financial responsibility, helps control spending, and is essential to maintaining stability, minimizing risk, and achieving sustainable growth.

It is important that budgeting is an ongoing process, requiring regular review and adjustment to effectively adapt to changes in the business environment.

In a context where businesses are facing pressure to optimize costs and make quick decisions, Bizzi has become an indispensable financial management tool. By automating the entire budget and spending process, Bizzi helps businesses:

- Reduce manual errors and ensure transparency in every expense.

- Real-time data tracking, helping CEOs and managers have a clear, up-to-date financial picture.

- Optimize capital efficiency, cut excess costs and increase sustainable profits.

- Make quick and accurate decisions, based on intelligent analytics and forecasting data.

In other words, with Bizzi, businesses not only manage their finances better but also turn data into competitive power, improve operational capabilities and sustainable development.

To get advice on suitable solutions and experience Bizzi's features, register for an appointment here: https://bizzi.vn/dat-lich-demo/