A business model is not just an "idea for generating revenue," but also a way for a business to control costs. cash flow and operational risks. In reality, some popular business models today, such as B2B, B2C, SaaS, or Subscription, have completely different cost and cash flow structures, requiring CFOs to have separate assessment methods.

This article helps CFOs understand the true nature of business models, common production and business models, and how to operate, measure, and control them using practical systems like Bizzi.

What is a business model, and why can't a CFO just look at revenue?

A business model is how a business creates value (Value Proposition), delivers that value to customers, and converts that value into money through its revenue structure, costs, cash flow, and risk level. From a CFO's perspective, a business model is only considered effective when both accounting profits and real cash flow are sustainable over time, rather than simply "increasing revenue on the report."

In fact, many businesses fall into this state. Revenue is increasing, but cash is running low.The reason stems from equating accounting profit with cash flow, while these two concepts are completely different. Profit reflects efficiency on paper, while cash flow reflects the business's ability to survive in actual operation.

From a financial perspective, CFOs always analyze business models based on three pillars:

- Value PropositionWhat problem does the business solve, for whom, and is that value readily available for payment?

- Reward ModelWhere does the revenue come from? Is it a one-time payment or a recurring payment? Is it collected immediately or paid later?

- Cost Structure: Fixed costs, variable costs, hidden costs, and the degree of control.

Key CFO metrics that are mandatory to track include: Gross Margin, Operating Cash Flow and especially Cash Conversion Cycle (CCC = DSO + DIO – DPO)The CCC indicates how many days it takes a business to convert its expenses into cash flow – a measure even more important than revenue growth rate.

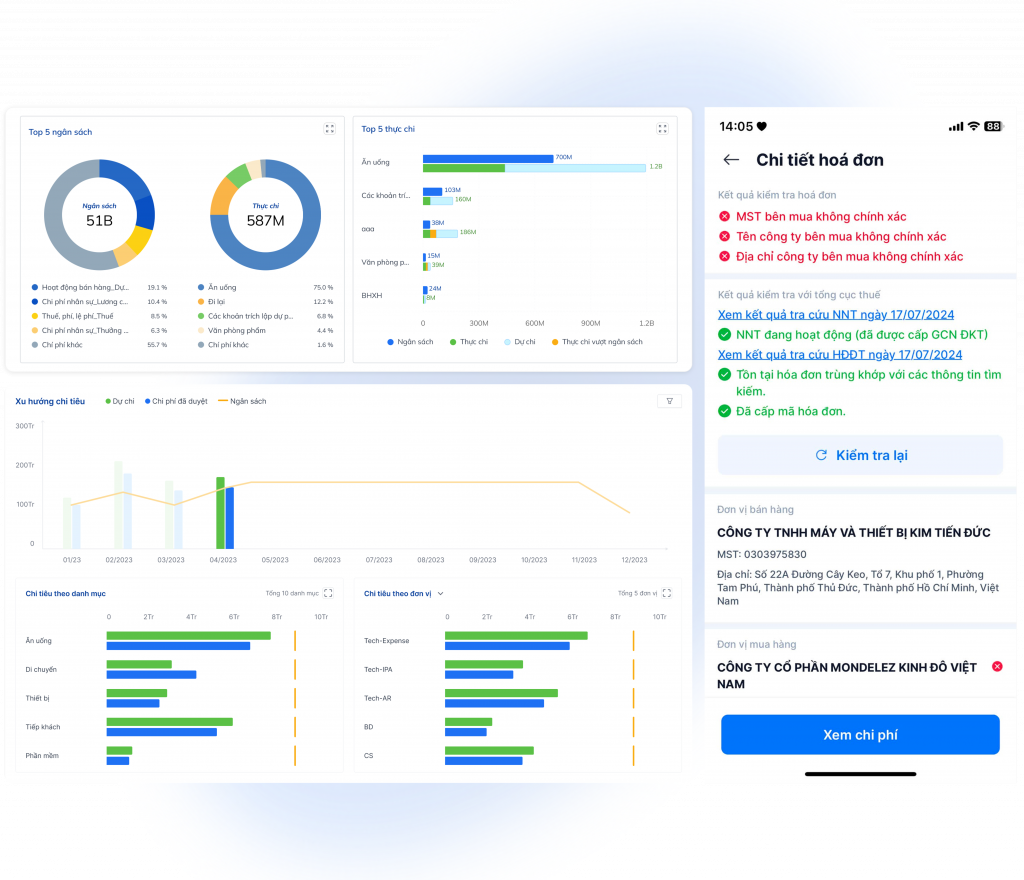

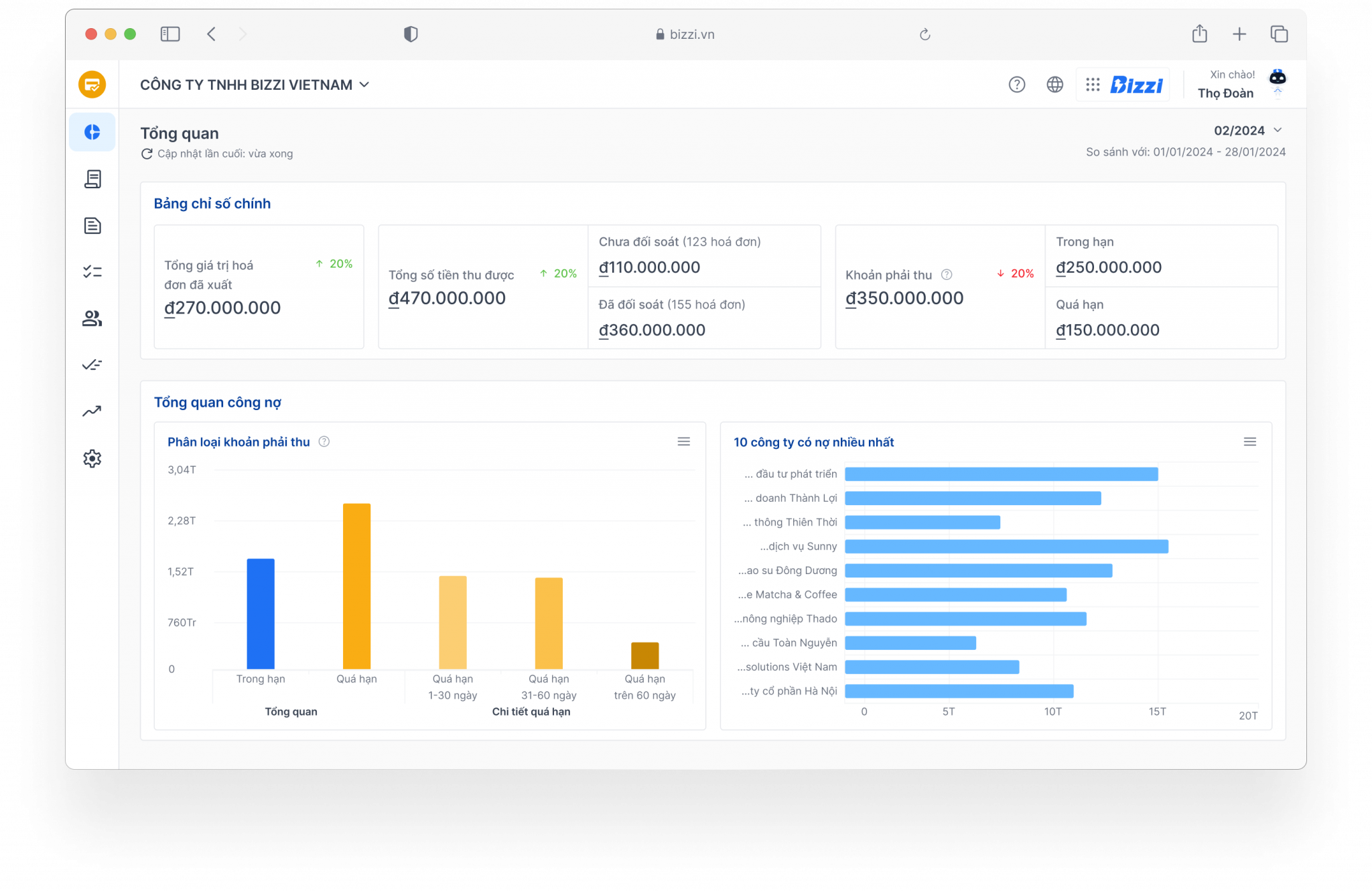

Bizzi helps CFOs standardize expense and invoice data from all departments, and then display it. The direct impact of costs and invoices on cash flow in real time. on the dashboard. As a result, the business model is no longer a vague strategic concept, but becomes a measurable operating system.

How does a production and business model differ from an overall business model?

If the business model answers the question How do businesses make money?, then business production model Answer the question How does the business operate to translate that strategy into tangible financial results?. In a logical sequence production managementThe relationship is clearly demonstrated:

Business Model → Operating Model → Financial Results.

The business model focuses on activities that generate the greatest costs and risks, such as: Procurement of raw materials, production, inventory, logistics, and delivery.This is also where it originated. COGSThis directly impacts profit margins and cash flow.

For the CFO, two key metrics in the business model are: COGS and DIO (Days Inventory Outstanding)Large inventories help ensure continuous production, but they also mean capital is "tied up" in inventory, prolonging the cash flow cycle.

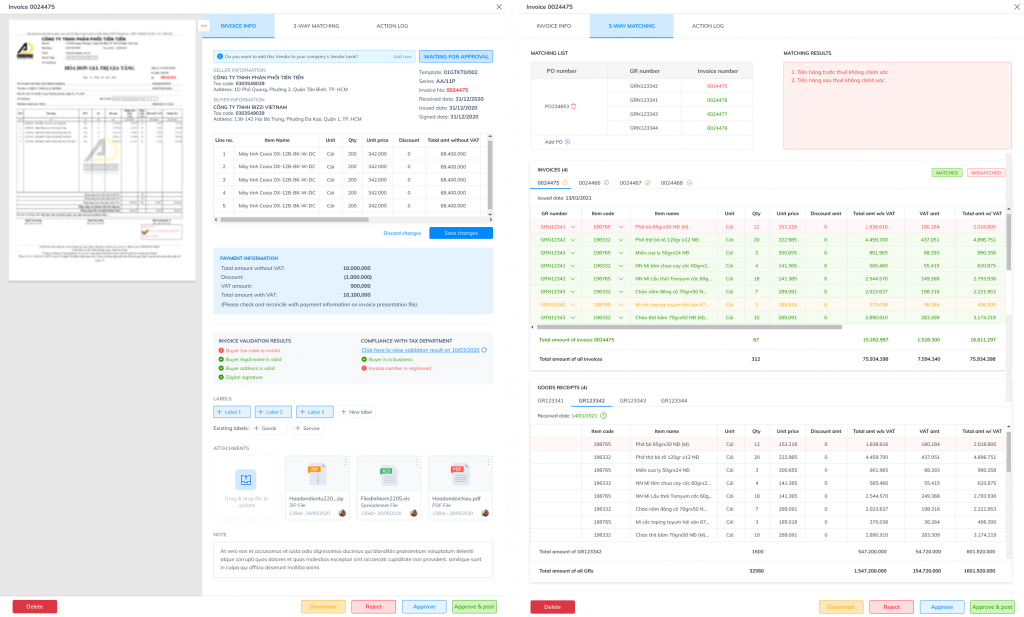

Many businesses are separating production from finance. Meanwhile, data shows Most of the cash flow risk for manufacturing businesses comes from inventory, purchasing, and supplier payments., not from sales. Bizzi closely links purchasing costs and input invoices to PO – Inventory Receipt – Accounting Period, helping the CFO to track difference between planned cost of goods sold and actual cost of goods sold This should be done periodically, instead of waiting until the end of the month or quarter to detect discrepancies.

18 common business models and key CFO metrics to monitor.

Each business model creates a completely different cost structure, cash flow, and risk profile. Therefore, a CFO cannot apply a single set of KPIs to all models.

Below is an example of a common business model in Vietnamese enterprises, along with a financial perspective to help CFOs assess its actual effectiveness.

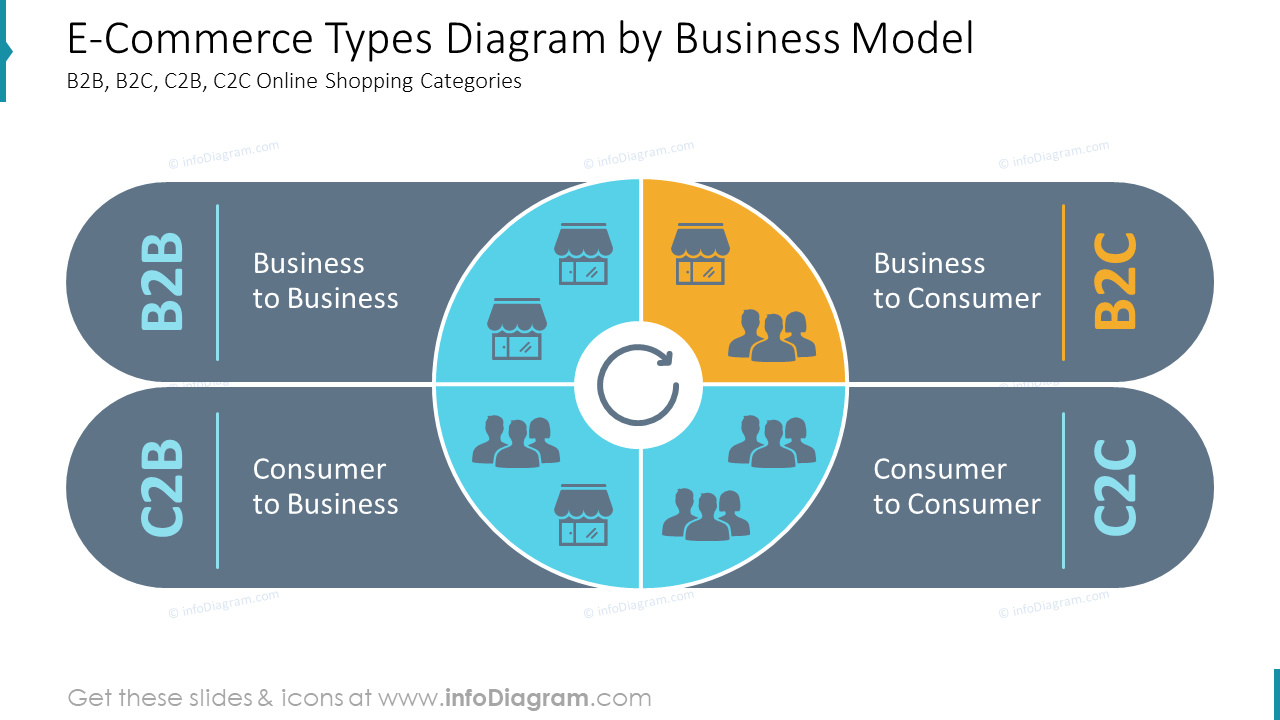

Model groups based on transaction type (B2B, B2C, C2C, B2B2C, C2B, B2G)

These models determine contract value, sales cycle, debt risk, and collection methods.

For example, B2B models often have long DSOs, requiring very tight control over contracts, invoices, and accounts receivable. This is Examples of business production models This is typical in manufacturing and specialized service businesses, where accounts receivable risk and collection cycle are top concerns for the CFO.

Meanwhile, B2C has faster cash flow but is more susceptible to being eroded by marketing and return costs.

Model groups based on platform and technology (SaaS, Platform, E-commerce, etc.)

This group leverages technology to scale rapidly and reduce marginal costs. CFOs need to focus on metrics such as ARR, churn, deferred revenue, and take rate, rather than just looking at recorded revenue.

Within this group, SaaS includes business models that can scale quickly, but require CFOs to tightly control deferred revenue, churn, and infrastructure costs to ensure long-term cash flow.

Revenue-based and operational model groups (Subscription, Freemium, Pay-per-use, etc.)

These groups directly impact cash flow stability. Subscriptions provide consistent cash flow but carry churn risk; pay-per-use offers flexibility but is difficult to predict; and freemiums incur costs for serving users who do not generate revenue.

Regardless of its category, the Business Model Canvas (BMC) remains the standard framework for CFOs to outline their model, but it only becomes valuable when linked to a real-world financial control system. Examples of business production models According to recurring revenue figures: accounting profits may look good, but if churn is high or DSO is prolonged, the business will still face cash flow pressure.

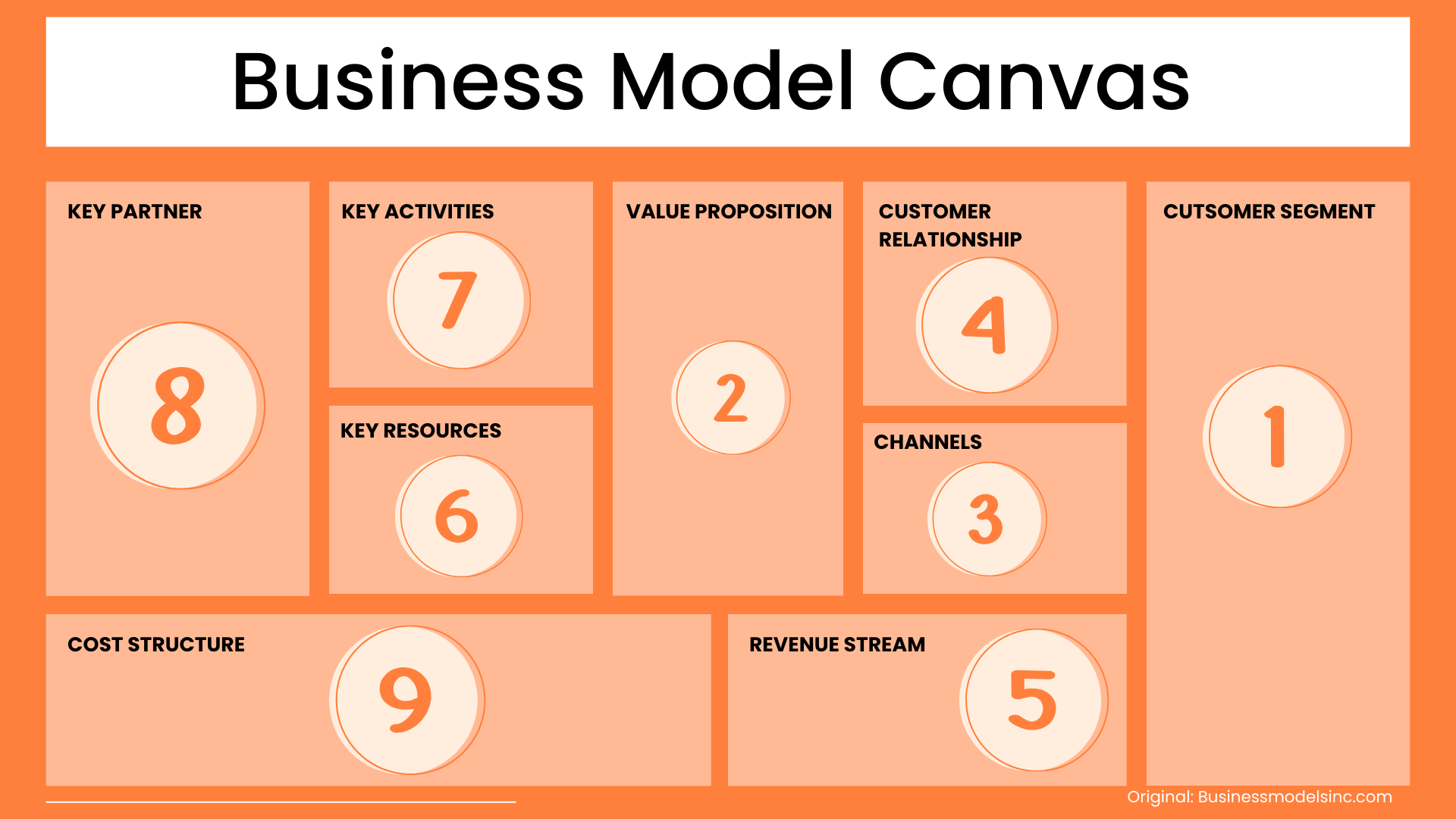

9 components of the Business Model Canvas from a CFO's perspective.

The Business Model Canvas (BMC) is often used as a strategic tool to describe how a business operates. However, from a CFO's perspective, the Canvas is only truly valuable when each component is translated into specific financial metrics, cash flow risks, and control requirements. A business model that looks "good" on the Canvas but fails to control costs, invoices, and accounts receivable will quickly disrupt cash flow.

Below is an analysis of the 9 components of the BMC from a financial perspective, going beyond mere "description" to answer the question: Where does the money come from, how does it go, and where are the risks?.

1. Customer Segments – Customer Segmentation and Cash Flow Risk

Customer segments are not just about "who buys the product," but for CFOs, it's about... The biggest source of debt risk and cash flow volatility.Each customer segment will have different payment behaviors, repayment capabilities, and service costs.

For example, B2B customers typically generate large revenues but have a long Date of Sale (DSO), while B2C customers have quick cash flow but high marketing costs and easily eroded profit margins. Without clearly separating segments in financial reports, CFOs will not be able to identify which segments are actually consuming the cash.

2. Value Proposition – Does the value delivered outweigh the costs?

The Value Proposition is often described very well from a marketing perspective, but CFOs are more interested in the core question: Does that value generate a sufficiently large Gross Margin?.

Many businesses fall into the "high value - high cost" trap, resulting in thin gross profit margins that are insufficient to cover operating expenses. In this case, the business model, despite revenue growth, is unsustainable.

3. Channels – Sales channels determine the speed of revenue collection.

Channels are not just channels for reaching customers, but also crucial. Will the money arrive quickly or slowly?Two sales channels with the same revenue but different DSOs will create completely different cash flow pressures.

Businesses that sell through distributors, e-commerce platforms, or directly require different credit and reconciliation policies. If the CFO only looks at total revenue without analyzing by channel, the risk of cash shortages will be obscured.

4. Customer Relationships – Customer Retention Costs and Cash Flow Lifecycle

Customer relationships determine customer retention costs and revenue lifetimes. For CFOs, the issue isn't "whether or not to retain customers," but rather... Does the cost of customer retention exceed the customer lifetime value (LTV)?.

Many businesses maintain customer relationships through discounts, promotions, and after-sales services, but fail to measure the true financial impact, leading to silently eroded profits.

5. Revenue Streams – Revenue recognized other than cash received

Revenue Streams is the most misleading part. Revenue recognition doesn't necessarily mean the money has arrived. For the CFO, what's important is... When does revenue turn into real cash flow?.

Subscription, deferred payment, or long-term project models all have significant payment delays, directly impacting cash flow.

6. Key Resources – Assets or Capital Burdens?

Key resources include people, assets, technology, and capital. From a CFO's perspective, these are: long-term "money locking"This affects Working Capital and cash flow.

An asset-heavy production model will require tighter management of depreciation, inventory, and debt financing than an asset-light model.

7. Key Activities – Where costs are most difficult to control.

Key Activities are where actual costs most often exceed planned costs: production, procurement, operations, and delivery. Without proper control at the source, CFOs only discover problems after the financial statements have been finalized.

8. Key Partners – Billing Risk and Supplier Dependence

Key Partners are not just strategic partners, but also Sources of risk related to invoices, taxes, and fraud.A supplier ceasing operations or issuing incorrect invoices can result in expenses not being deductible, directly impacting profits.

9. Cost Structure – The Final Picture of the Business Model

The cost structure aggregates all fixed and variable costs. For the CFO, this is where the crucial question is answered: Does the business model generate positive cash flow?.

If costs increase faster than revenue or consistently exceed the budget, even a strategically sound business model will fail financially.

In summary, the Business Model Canvas is only truly valuable when connected to real financial data and cash flow. From a CFO's perspective, each block in the Canvas represents a control point for costs, liabilities, or risks. Bizzi acts as the technology layer that transforms the Canvas from a "strategic diagram" into a practical, operational financial management system.

Controlling costs, invoices, and accounts receivable – a "blind spot" in most business models.

Most business models – whether built systematically on the Business Model Canvas or applying some common business production models – fail not in strategy, but in the control of day-to-day financial operations. Three often overlooked but crucial elements for the survival of cash flow are: actual costs, input invoices, and accounts receivable/payable.

1. Cost control: Why do budgets always exceed actual costs despite being "right on paper"?

In many businesses, budgets only exist at certain levels. beginning-of-period Excel fileIn addition, costs are scattered across various departments: purchasing, production, marketing, and logistics. The CFO typically only sees the total cost after the books have been closed, at which point any discrepancies have already been identified. irreversible.

The core problem isn't the lack of "no budgeting," but the lack of real-time cost control:

- The expenses were approved but not tied to the remaining budget.

- Unexpected expenses were not blocked from the start.

- Do not break down costs by business model, project, or product line.

The consequence is a prolonged period of negative cost variance, reduced accounting profits, and a silent erosion of cash flow.

2. Invoice control: the biggest but often overlooked financial risk area.

Input invoices are where The costs are legalized., but it is also where the greatest financial risk lies:

- The invoice does not match the purchase order/inventory receipt.

- Duplicate invoices, incorrect prices, incorrect tax rates

- Supplier ceases operations → expenses are not tax deductible.

- Payment made only after discovering the error → no refund possible

In many examples of business production models, the risk does not come from production, but from manual invoice processing causing businesses to:

- Incorrect COGS recorded

- Gross Margin Deviation

- Bearing tax and audit risks

3. Accounts Receivable Control: High revenue but no cash flow indicates a business model failure.

Many businesses experience strong revenue growth but still face cash shortages. The most common causes are high Date of Sale (DSO), large Deposit of Income (DIO), or imbalances in Deposit of Prepaid Expenses (DPO), leading to a prolonged Cash Conversion Cycle (CCC).

In B2B, B2B2C, or order-based manufacturing models, accounts receivable is the biggest cash flow bottleneck, yet it is often managed haphazardly using Excel spreadsheets, emails, and manual debt reminders.

How does Bizzi address all the "financial blind spots" in its business model?

Instead of handling each issue individually (expenses – invoices – accounts payable), Bizzi is designed as a comprehensive financial control layer throughout operations, allowing CFOs to see and control cash flow from the moment expenses are incurred until the money actually comes in or goes out.

Addressing cost blind spots: Shifting from "post-audit" to "pre-audit" with Bizzi Expense

- Budgeting by department – project – business model

- Link each spending request to the remaining budget.

- Budget overrun warnings are issued as soon as they occur, not at the end of the period.

Result: CFOs gain real-time control over the Cost Structure, limiting prolonged negative Cost Variance – a common cause of failure in many business models despite increased revenue.

Addressing invoice blind spots: mitigating risks before money leaves the business.

- Read and normalize invoice data.

- Three-way matching (PO – GR – Invoice)

- Check the supplier's legal status (MST, inactive).

- Flag discrepancies before payment.

Result: CFOs reduce the risk of incorrect payments, duplicate payments, and invalid expenses, protecting Gross Margin and Audit Trail for the entire business model.

Address the blind spots in accounts receivable and cash flow: turn revenue into real cash with Bizzi ARM.

- Track accounts receivable by customer – contract – term.

- Automatic debt reminders based on a set scenario.

- Track DSO and its impact on the Cash Conversion Cycle (CCC) in real time.

Result: The CFO shortened the Date of Sale (DSO), improving cash flow without increasing revenue, something many business models overlook.

Conclude

Business models and production models are only truly effective when they are powered by accurate financial data, cost control – invoices – accounts payable, and continuous cash flow forecasting. Regardless of the business's choice... some business production models Efficiency is only guaranteed when costs, invoices, accounts payable, and cash flow are monitored in real time.

Through the Examples of business production models As seen in the article, the role of the CFO is not just about "recording results," but also about designing a financial system that ensures sustainable operation. This is also why modern businesses use Bizzi as a layer of financial control and FP&A, supplementing ERP to proactively manage their business model.

Bizzi plays that role: connecting strategy with operations, transforming business models from PowerPoint blueprints into real cash flow, real profits, and sustainable growth.

Register here to try out the tools Bizzi offers: https://bizzi.vn/dang-ky-dung-thu/