Sales invoices record revenue, tax obligations and help buyers prove their rights when transactions occur. Sales invoices will be created and issued by sellers (enterprises, business households, etc.) to buyers when selling goods or providing services.

Considered as the legal basis in commercial transactions, understanding the nature of sales invoices as well as how to distinguish between sales invoices and VAT invoices will help businesses manage their finances effectively.

Sales Invoice Overview

A sales invoice (also known as a regular invoice) is a document prepared by a seller of goods or service provider to record information about sales transactions and payment requests from customers.

What is a sales invoice?

Sales invoice (also known as direct invoice) is an accounting document created by organizations and individuals selling goods and providing services. It is created to record information about the sale of goods and provision of services.

According to Decree 123/2020/ND-CP, an invoice is an accounting document issued by an organization or individual selling goods or providing services. An invoice can be presented in the form of an electronic invoice or an invoice printed by the tax authority.

From July 1, 2022, businesses must use electronic invoices according to the provisions of the 2019 Tax Administration Law.

Subjects using sales invoices

Businesses need to clearly distinguish between tax types and methods to choose the appropriate type of invoice: sales invoice or VAT invoice.

Sales invoices are used for organizations and individuals in the following cases:

- Organizations and individuals declare and calculate value added tax (VAT) using the direct method.: Used for domestic sales of goods and provision of services; international transportation; export to duty-free zones; export of goods and provision of services abroad.

- Organizations and individuals in duty-free zones: Selling goods, providing services domestically or between organizations and individuals in the duty-free zone; exporting goods, providing services abroad. The invoice must clearly state "For organizations and individuals in the duty-free zone" in these cases.

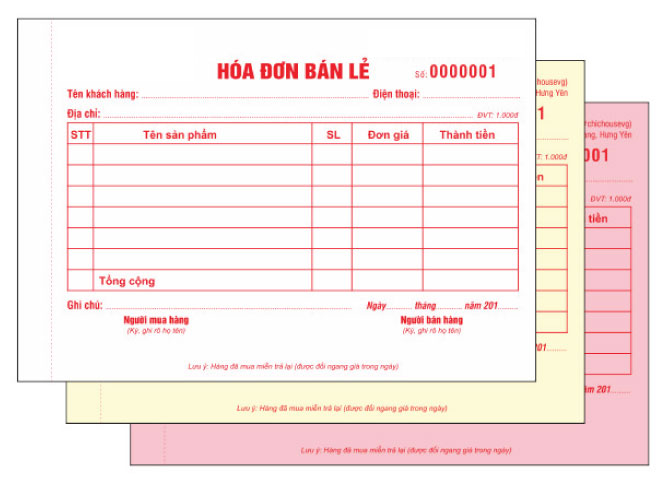

What is the form of a Sales Invoice?

Sales invoices can be presented in many different forms, for example:

- Custom invoices are self-printed, created using a computer device or other tool.

- Electronic invoices, in compliance with the provisions of the Law on Electronic Transactions, do not need to be printed on paper.

- Online sales invoices, sent directly to customers via the internet.

- Printed invoices are printed according to a fixed format and used by individuals, organizations or tax authorities.

Invoices printed by tax authorities, printed documents, and self-printed documents must be preserved and stored in accordance with regulations and must be ready to print or look up when requested.

Content and role of sales invoice in business activities

A sales invoice is an important legal document that helps businesses manage revenue, track receipts and expenditures, prepare financial reports, and comply with accounting regulations. Therefore, the content of a sales invoice must be carefully reviewed to ensure accuracy.

Content required on sales invoice

Sales invoices must ensure essential contents as prescribed to ensure the accuracy and legality of the transaction:

- Invoice name, invoice symbol, invoice number symbol.

- Invoice number.

- Information about the seller/service provider: Includes name, address, tax identification number (if applicable), and contact information. May include a logo.

- Buyer information: Full name and address must be clearly and accurately stated. In case the buyer is an individual end consumer, the retail invoice may not need to show the buyer's name and address. In case the buyer does not have a tax code, the invoice does not need to show the buyer's tax code.

- Details of goods and services: Must fully state the name of the goods or services in detail. Clearly state the unit of measurement (piece, kg, liter, m2, ...). Need to state the actual quantity sold. State the actual selling price (note that VAT is not included on the unit price line). Total amount is calculated by multiplying quantity by unit price.

- Total order value: Write the total value in numbers and words to avoid errors.

- The seller's signature is required. The buyer's signature may be optional depending on the case. For VAT invoices, the signature of the legal representative or authorized person is also required.

- Clearly state the day, month, and year when the sale or service transaction is made (Invoice creation time). The time of digital signature on the electronic invoice must also be recorded.

- Information on fees, charges belonging to the state budget, commercial discounts, promotions (if any).

- In addition to the required content, businesses can add information about logos, contract numbers, shipping orders, customer codes and other information depending on transaction characteristics and management requirements.

- If there are blank lines on the invoice, cross them out to avoid confusion or errors.

The important role of sales invoices

Sales invoice is an important tool in business operations and financial management of an enterprise:

- Legal documents proving the transaction: Is clear evidence of a successful purchase and sale transaction, confirming the rights and obligations of the parties.

- Internal management and accounting tools: As an original document, it supports the accounting process, helping to record revenue and related expenses.

- Determine revenue and expenses: Helps accurately determine the amount of money received from the sale of goods or services and calculate the associated costs.

- Support for handling returns or complaints: It is a basic document that helps to accurately determine information about the original transaction to resolve conflicts fairly.

- Financial proof: Support to prove revenue and expense figures in business accounting activities.

- Transaction management and tracking: Helps businesses track past sales transactions.

- Inventory management: Provide information on quantity and type of goods sold, support inventory tracking and management.

- International transaction documents: Plays an important role as an international transaction document in the case of import and export goods.

Distinguishing between Sales Invoice and VAT Invoice (“Red Invoice”)

Distinguishing between sales invoices and value added tax (VAT) invoices is very important because it affects the way of accounting, tax declaration and the legality of accounting documents in the enterprise.

Why is it necessary to distinguish between sales invoices and VAT invoices?

It is necessary to distinguish between sales invoices and VAT invoices to comply with tax and accounting laws, ensuring accurate and effective tax declaration and cost accounting.

Different in target audience

- Not all businesses are allowed to issue VAT invoices.

- Using the wrong type of invoice (for example, a business pays taxes directly but issues a VAT invoice) may be subject to penalties and not be recognized by the tax authority.

Impact on tax declaration and deduction

- Only VAT invoices contain VAT and are eligible for input deductions.

- If a sales invoice is received, the buyer is not entitled to a tax deduction.

Impact on accounting and financial reporting

- Errors in invoice classification will lead to incorrect tax, revenue and cost figures.

May cause legal risks, affecting audits and tax settlements.

How to distinguish between sales invoices and VAT invoices according to specific criteria:

| Criteria | Sales invoice | Value Added Tax Invoice (Red Invoice) |

| Common name | Sales invoice. Also called direct invoice. | Value added tax invoice (also known as Red invoice, VAT invoice). |

| Target audience | Organizations and individuals declare VAT using the direct method.. Organizations and individuals in duty-free zones. | Organization of VAT declaration according to deduction method. |

| Tax content | Are not Record the tax rate and VAT amount separately on the detail lines. The total payment amount includes (or does not include) VAT depending on the subject. | Have Clearly state the tax rate and VAT amount for each type of goods/service. |

| Issuing Authority/Administration | Issued by the Ministry of Finance or self-printed by businesses registered with the tax authorities. (Note: Some sources refer to “retail invoices” as a common type, not issued by the Ministry of Finance and not strictly managed by the tax authorities). | Issued by the Ministry of Finance or self-printed by enterprises in case the form has been registered with the Tax Authority. Managed by the Tax Authority. |

| Form | There is no separate tax rate item, there may be a square stamp (on paper invoices). | There is a separate tax rate section, usually without a square stamp (on paper invoices). |

| Signature | Seller's signature required. Buyer's signature may not be required. | Signature of the seller, signature of the legal representative of the organization (or authorized person). |

| VAT declaration | Only need to declare output invoices (for sellers), no need to declare in the list of input invoices (form 01-2/GTGT) for buyers calculating tax by the deduction method. It is possible to only need to declare the indicators on Form 01/GTGT or not. | Both output and input invoices must be fully declared. Fully declare all items on Form 01/GTGT. |

| Input VAT accounting | If tax is included in the purchase price, that tax will be added directly to the original cost of the asset. | Input VAT is accounted for separately for deduction from output VAT. |

Real life example:

- Grocery stores of individual businesses selling consumer goods:

→ Use sales invoice (because tax is paid by direct method). - Large trading company, declaring VAT by deduction method:

→ Must use value added invoices, issue to customers for tax deduction.

Important Note:

- Do not use two types of invoices interchangeably. If a business is not subject to VAT deduction declaration but still issues VAT invoices, it is a serious violation.

- From July 1, 2022, all types of invoices will be converted to electronic invoices, but must still clearly state whether they are sales invoices or VAT invoices.

Are sales invoices included in business expenses?

This is an important aspect of business cost management. Sales invoices, although not used to deduct input VAT, are still valid for recording costs.

Conditions for deductible expenses (Corporate Income Tax)

According to regulations, enterprises are allowed to deduct all expenses if they meet the following conditions:

- Actual expenses incurred related to the production and business activities of the enterprise.

- Expenses must have sufficient invoices and legal documents as prescribed by law. Sales invoices are considered documents for accounting for expenses.

- (Note: The conditions for non-cash payment documents for expenses of VND 20 million or more usually apply to VAT invoices used for tax deduction. For expenses based on sales invoices, the main requirement is to have legal invoices/documents proving the actual expenses).

Handling cases of purchasing goods and services without invoices

- In case an enterprise purchases goods and services without an invoice from the seller (for example: purchasing agricultural products, aquatic products, and seafood directly from producers and fishermen; purchasing goods and services from households and individuals doing business with a revenue level below the VAT taxable revenue threshold of VND 100 million/year), the enterprise is allowed to prepare a List of purchased goods and services (according to form No. 01/TNDN) as a basis for calculating deductible expenses when determining taxable income for corporate income tax.

- When using the List, if the purchase price of goods and services on the list is higher than the market price at the time of purchase, the tax authority will base on the market price to re-determine the price for calculating deductible expenses.

Sales invoice with value under 200,000 VND

- Expenses of enterprises purchasing goods and services with a value of less than VND 200,000 from sellers without invoices, if proven to be actual expenses incurred related to production and business activities, will be included in deductible expenses when determining taxable income of enterprises. Enterprises are allowed to prepare a list of deductible expenses without being required to have non-cash payment documents for each purchase under VND 200,000.

What should be noted when using and managing sales invoices?

Below are important notes when using and managing sales invoices that businesses need to understand to ensure legality, validity and effectiveness in accounting and tax management:

Notes when creating and using sales invoices

- When using sales invoices, it is necessary to comply with the principles of invoice creation to ensure validity.

- The content on the invoice must correctly show the name and type of goods/services.

- Invoices must not be erased or altered.

- Use only one ink color when writing invoices (for paper invoices) and this ink color does not fade.

- Invoice at the right time of sale/service provision.

- Must clearly and accurately state the full name and address of the buyer.

- Fill in the full name of the goods and services. If you cannot fill in all the invoice lines, cross out the blank lines.

- Clearly state the unit of measurement and actual quantity of goods sold.

- Write actual selling price excluding VAT.

- Write the total order value in numbers and words.

- The seller and the buyer (if required) co-sign the invoice.

Store and archive sales invoices

- Invoices and documents that are stored and archived must ensure safety, security, integrity, completeness, and not be changed or distorted during the storage period.

- The storage period must comply with the provisions of accounting law.

- Unissued invoices are stored and preserved in the warehouse according to the storage and preservation regime for valuable documents.

- Invoices created in accounting units are stored according to regulations on storing and preserving accounting documents.

- Invoices issued by organizations, households and individuals that are not accounting units are stored and preserved as private assets.

- Electronic invoices and electronic documents are preserved and stored electronically and must be ready to be printed on paper or looked up upon request.

- Ready-made retail invoices usually have 2 copies, one for the buyer and one for the seller. Printed invoices can have 3 copies (Copy 1: For storage, Copy 2: For the buyer, Copy 3: Internal).

Effective Sales Invoice Management in Business

- Sales invoice management is very important to ensure business success and transparency.

- Businesses should use technology solutions such as electronic invoice software or integrated sales management software to create, issue and manage invoices efficiently.

- Using software helps save time, effort, ensures legality and data security.

- The software can provide standard invoice templates or allow customization, making invoice creation quick.

- Unlimited data storage and the ability to easily search and check invoices are the benefits of software management.

- Staff should be trained on the billing process and the process should be regularly reviewed and monitored to avoid errors and ensure compliance.

Comprehensive upgrade of modern workflow with sales invoices with Bizzi

Bizzi is a comprehensive digital transformation solution that helps businesses: Standardize processes - Increase productivity - Reduce risks - Create competitive advantages with professionalism, speed and accuracy.

Businesses can completely upgrade their modern workflow through managing sales invoices with Bizzi, because the software not only helps digitize and automate the accounting and invoice process, but also brings many benefits in terms of law, efficiency and administration. Here are 09 key reasons:

Create legally compliant electronic invoices

- Bizzi allows businesses to issue electronic invoices in XML and PDF formats, in accordance with the regulations of the General Department of Taxation.

- Integrate digital signatures to ensure legality and data integrity.

Custom Branded Invoice Templates

- Businesses can design their own invoice templates: add logos, colors, and layouts according to their brand identity.

- Create professionalism, consistency in transactions and corporate image recognition.

Bulk invoice issuance, save time

- Support creating and issuing multiple invoices at the same time, by order batch or customer list.

Reduce manual operations, increase processing speed for payment accounting.

Authentication code from tax authority

- Connect directly to the General Department of Taxation system, receive authentication code (CQT code) for each invoice.

- Ensure that electronic invoices are legalized upon issuance.

Store invoices for at least 10 years

- Secure cloud storage system, meeting the legal requirement of keeping electronic invoices for at least 10 years.

- Can be easily retrieved when needed for inspection, tax settlement or audit.

Look up invoices easily and quickly

- Accountants can search for invoices by: Invoice number, Issue date, Customer name/tax code, Invoice status...

- Easily control, reconcile and work with tax authorities or customers more effectively.

Download & print invoices anytime, anywhere

- Allows downloading invoices as PDF or XML, with built-in digital signature.

- Can be emailed automatically to customers or printed in hard copy if needed.

Comprehensive invoice status management

- Track each invoice by status: Issued, Sent, Paid, Canceled, Adjusted

- Support error handling, create adjustment/replacement invoices according to regulations.

Integrates with accounting software & ERP systems

- Bizzi seamlessly connects with popular accounting software (MISA, FAST, SAP, Odoo...), helping to automatically: Record revenue - Create accounting entries - Reconcile invoices, orders, payments

Conclude

In short, whether a business is large or small, a sales invoice is not just a piece of paper recording a transaction, but an extremely important legal, financial and administrative tool. Paying due attention to the creation, storage and control of invoices will help businesses operate effectively, comply with the law and build market reputation.

Through this article, Bizzi has provided a comprehensive view of what a sales invoice is, from the concept, object, content, role to how to distinguish it from a VAT invoice, how to account for related costs and notes on use and management, very suitable for the context of business cost management.

Reduce 80% of time and 50% of processing costs, if your business wants to automate the processing of payable invoices, sign up to experience Bizzi's smart features today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/