Accountant debt Accounts payable is not simply a business concept; it plays a particularly important role in enterprises. Today, accounts payable accounting is no longer limited to recording receivables and payables or reconciling balances periodically. In the context of rapidly growing businesses, complex sales and purchasing models, and increasingly demanding financial management requirements, accounts payable has become the intersection point between accounting, cash flow, and management decision-making.

This article will thoroughly analyze the inner workings of accounts payable accounting, along with concepts such as AR/AP processes, reconciliation, 3-way matching, KPI DSO/DPO/CCC, provision 2293, and automation. Accounts receivable management.

What is accounts payable/receivable accounting in a business, and how is AR/AP managed according to the "cash flow cycle"?

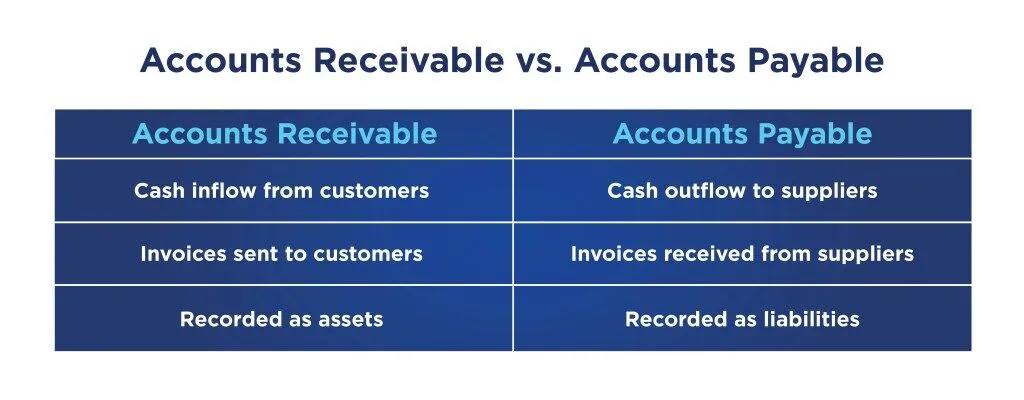

Accounts receivable accounting Accounts receivable (AR) and accounts payable (AP) are functions responsible for tracking, recording, reconciling, and controlling accounts receivable (AR) and accounts payable (AP) arising from a company's buying and selling activities. More than just "debit and credit," accounts receivable directly determines the speed of cash flow turnover and the level of financial risk.

From a CFO's perspective, accounts payable is the intersection of revenue, expenses, and cash flow.

What is AR/AP management based on the “cash flow cycle”?

AR and AP determine how quickly money comes in and how early or late money goes out.

- CFOs don't look at AR or AP in isolation, but rather at the Cash Conversion Cycle (CCC):

- CCC=DSO+DIO−DPO\text{CCC} = \text{DSO} + \text{DIO} – \text{DPO}CCC=DSO+DIO−DPO

In there:

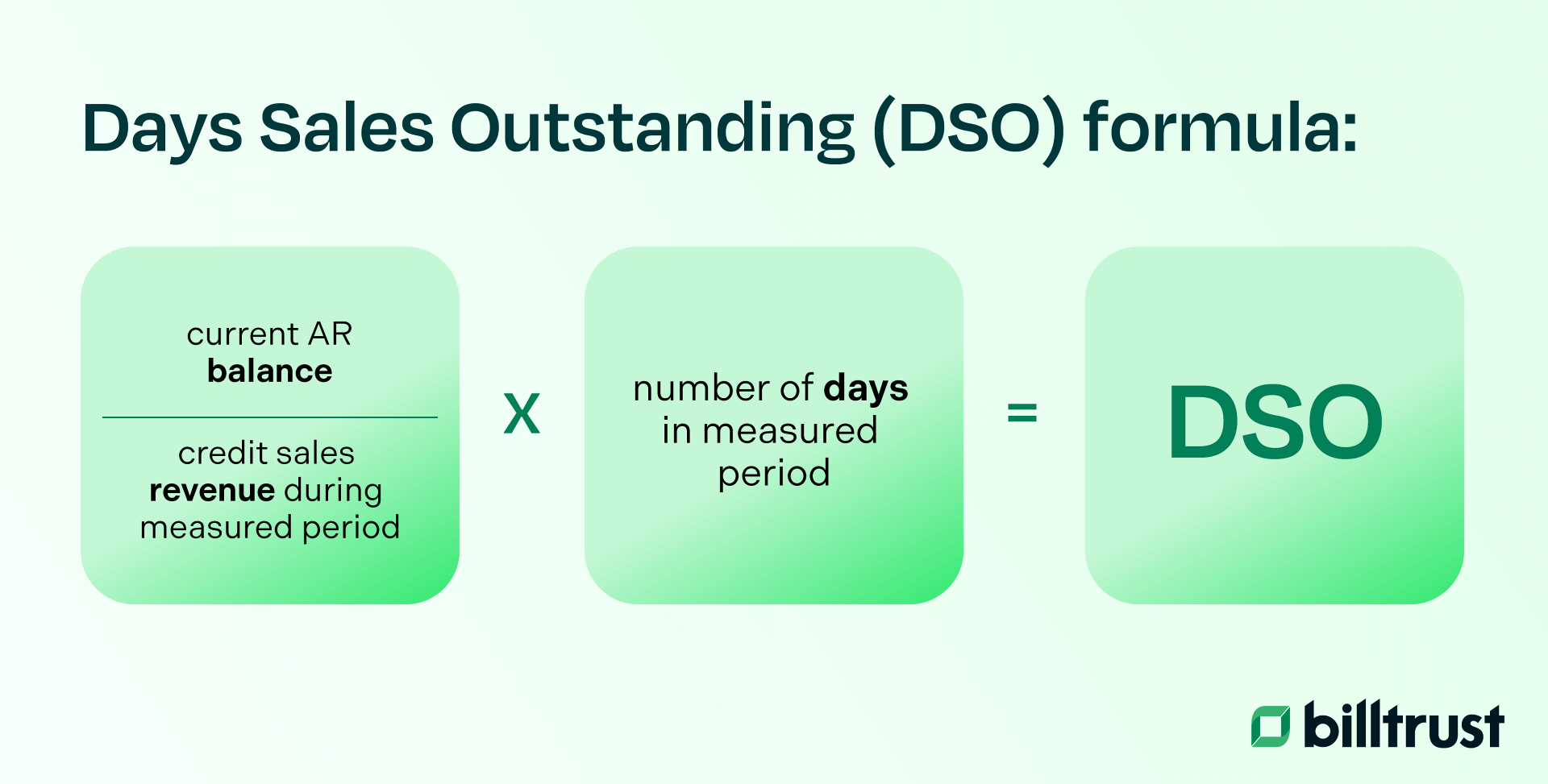

- DSO (Days Sales Outstanding): number of days to collect payment from customers.

- DPO (Days Payable Outstanding): the number of days to pay the supplier.

- DIO: Inventory Turnover Ratio (if applicable)

How can a CFO achieve success with proper AR/AP management?

- Unleash working capital without needing to borrow more.

- Improve Free Cash Flow

- Making more precise decisions regarding selling prices and payment terms.

- Proactively plan your spending and revenue for the period.

Many businesses report profits but lack cash flow because their operational and administrative expenses (AR/AP) are managed haphazardly, not following a cash flow cycle.

How does accounts payable differ from accounts payable and general accounting?

Accounts payable accountants focus on managing accounts payable balances and changes by account (AR/AP), while accounts payable accountants focus on processing payments/receipts according to approvals, and general accountants are responsible for compiling journal entries, preparing reports, and controlling overall accounting data.

This is a common misconception in practice, especially in expanding businesses. From an accounting standards perspective and the CFO's viewpoint, these three roles are distinctly different in nature, objectives, and management risks.

Distinguish the differences based on their nature.

| Location | Nature of the job | The questions they answered |

| Accounts Payable/Amounts Accounts Payable (AR/AP) | Manage obligations and rights to collect and pay | Who owes me money? Whom do I owe money to? For how long? Is there any risk involved? |

| Payment accounting | Execution Cash inflow/outflow | Is it permissible to spend the money? How much should it be spent? When should it be spent? |

| General Accountant (GL) | Standardization & Reflection overall financial situation | Are the data accurate, complete, and consistent enough to be included in the report? |

Distinguish the differences in operating procedures.

Accounts Payable AccountantAR/AP)

Focus: payment and collection obligations

- Record AR/AP data based on invoices and contracts.

- Tracking debt aging

- Reconcile accounts payable with customers/suppliers.

- Detecting overdue and discrepancies in debt.

Risks of poor performance

- DSO increases, DPO gets out of control.

- Incorrectly recording accounts payable → inaccurate cash forecast

Payment accounting

Focus: Actual cash inflows/outflows

- Check payment records

- Make a money transfer.

- Track statements, UNC, bank

- Ensure the right people, in the right numbers, at the right time.

Risks of poor performance

- Duplicate, incorrect, or early payments

- Internal fraud occurs if there is a lack of control.

General Accountant (GL)

Focus: Accuracy, completeness, and reporting standards

- End-of-period accounting

- Cost allocation, depreciation

- Compare AR/AP – Cash – Expense

- Prepare financial statements

Risks of poor performance

- Incorrect reporting, audit issue

- Frequent adjustments, slow closing of accounts.

In short, a business only manages its finances well when These three roles are separate, coordinate seamlessly, and are supported by an automated data and control system..

What documents are required to properly record and reconcile accounts payable?

To accurately record and reconcile accounts payable and control risks, accountants cannot rely solely on invoices. Accurate accounts payable must be based on a minimum set of supporting documents to verify the obligations, the time of recording, and the actual cash flow, while also tracing discrepancies during reconciliation.

Below is a checklist of required documents according to AR/AP standards, written in a practical way for operations and control.

AR Document Checklist – Accounts Receivable

- Sales contract/PO: Defines the terms, including price, quantity, and payment terms.

- Sales invoice: The basis for recording revenue and accounts receivable.

- Delivery/Service Acceptance Record: Proof that obligations have been fulfilled.

- Statement of Account: Reconciling the Account Balance (AR) between the two parties.

- Payment receipts (UNC, bank statement, receipt): Basis for offsetting accounts payable.

- No acceptance/delivery → AR could be "fictitious debt"

AP Document Checklist – Accounts Payable to Suppliers

- Purchase Order / Purchase Contract: Legal basis for payment obligations.

- GR / Acceptance Report / Goods Receipt - Goods Issued: Confirmation of receipt of goods/services.

- Supplier invoices: Basis for recording expenses and AP.

- Payment request: Internal control before disbursement.

- Payment vouchers (UNC, bank statement): Confirmation of payment.

- Reconciliation record of supplier accounts payable (periodically): Trace discrepancies, avoid fictitious AP balances.

In short, for accounts payable to be accurate, they must be based on documentation; and for documentation to be secure, it must be complete and verifiable.

Which accounts (131, 331, 141, 138, 338, 136) are associated with accounts payable and when is account 2293 related?

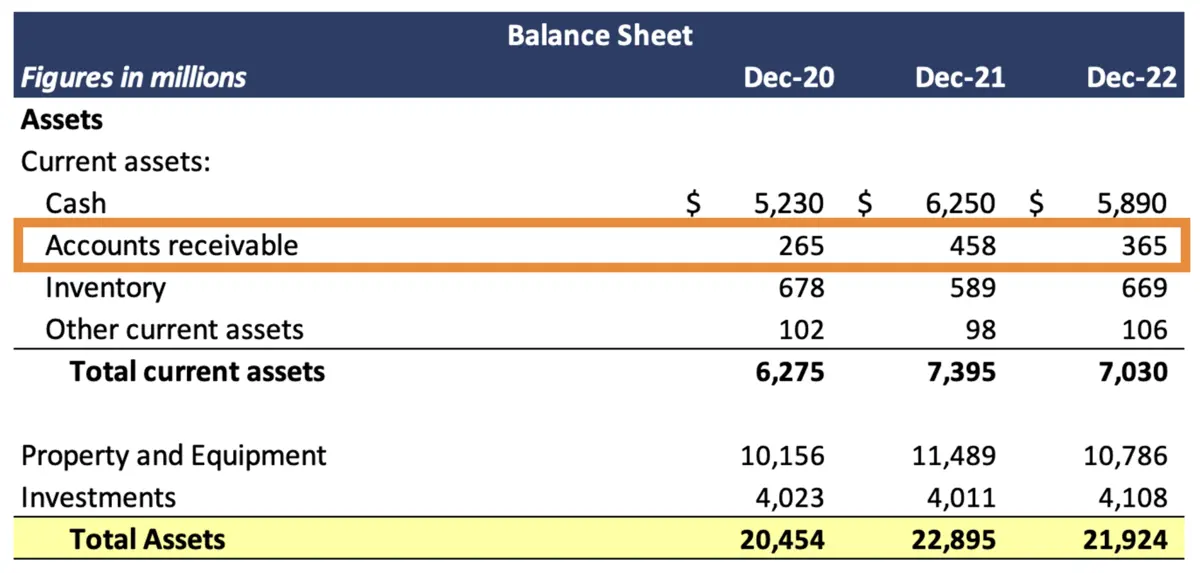

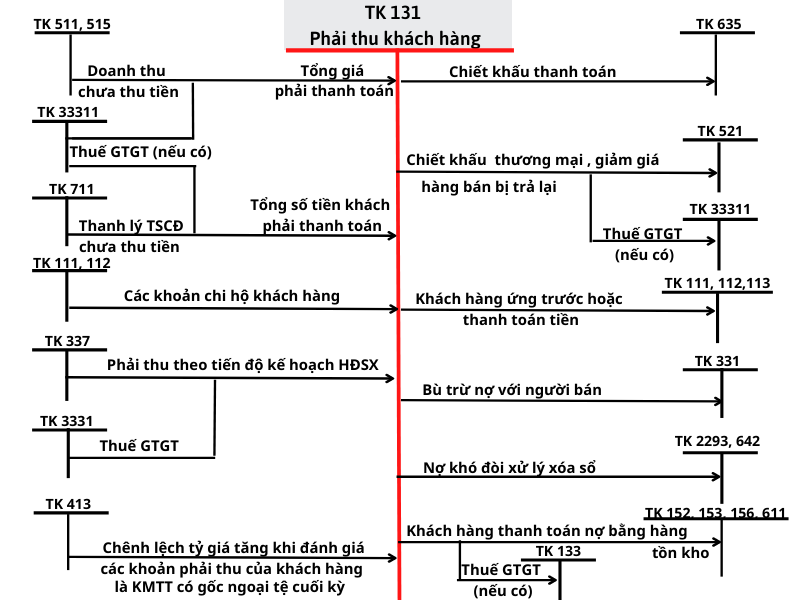

Accounts payable accountants primarily track Account 131 (receivables) and Account 331 (payable), also related to advances, other receivables/payables (141, 138, 338, 136). When recovery risk increases, consideration is needed. Provision for doubtful receivables (2293).

| Account | Type | Related to AR/AP | Notes / Examples |

| 131 – Accounts Receivable | AR | AR | Uncollected accounts receivable. For example: sales invoices have been issued, but payment has not yet been received. |

| 141 – Advances to buyers/customers | Advance | AR (advance payment) | The customer paid in advance, but no sales invoice has been issued yet. When the invoice is issued, the amount will be offset against account 131. |

| 136 – Other receivables | AR | AR | Non-sales liabilities: employee advances, internal loans, other receivables. |

| 331 – Payable to vendors/suppliers | AP | AP | Unpaid accounts payable. For example: receiving a supplier's invoice but not yet making the payment. |

| 338 – Other payables | AP | AP | Non-purchase liabilities: payable for insurance, taxes, internal expenses. |

| 3388 – Advance payment received from the seller | AP advance | AP (advance payment) | We have received an advance payment from the supplier, but the actual invoice has not yet been paid. |

| 138 – Internal/Subsidiary Liabilities | Internal AR/AP | AR/AP | When debts arise between companies/branches within the same group. |

| 2293 – Provision for doubtful receivables | Preventive | Not native AR | When AR (131, 136) is at risk of not being obtained → make a contingency. |

When does it relate to account 2293 – provision for doubtful receivables?

2293 This only applies when an AR (Adversity Risk) provision needs to be established.

- Only relevant Accounts Receivable (AR), not applicable to AP.

- When the customer or the recipient of the money There is a risk of insolvency.:

- Overdue AR > 90–180 days

- Debtors with financial problems/bankruptcy

- Accounting for provisions: recording Debit provision expense / Credit 2293

- When the money is recovered → the provision is reduced: Debit 2293 / Credit 131 or 136

In short, correctly linking liabilities to accounts not only helps accurate report, but also Effectively monitor cash flow and risk..

What are the steps involved in the accounts receivable (AR) accounting process, from recording to collecting the debt?

The accounts receivable process begins with recording revenue/invoices according to payment terms, tracking balances by customer, conducting periodic reconciliation, analyzing aging of debts, and implementing debt reminders/collections according to a plan, ending with cash reconciliation and closing the accounts receivable.

Below is the accounts receivable (AR) accounting process, from recording to collection, according to modern business operating standards, written from the perspective of a CFO and cash flow controller.

1. Phase 1 – Recognition of Accounts Receivable

Objective: To correctly identify the AR number, establish a clear legal basis, and avoid recording fictitious debts.

Steps:

- Sales contract/order (PO/Contract)

- Determine the quantity, price, and payment terms.

- The legal basis for recognizing AR.

- Issue a sales invoice.

- Record the debt under account 131 or 136/141 (if an advance payment is made).

- The basis for accounting for revenue.

- Delivery/Service Acceptance Record (GR/Acceptance)

- Confirmation of completed obligation → Valid AR.

CFO's note:

- If the acceptance step is skipped, AR could be fictitious debt → DSO becomes "virtualized".

2. Phase 2 – Monitoring & Reconciliation

Objective: To ensure AR data is always accurate and to detect discrepancies early.

Steps:

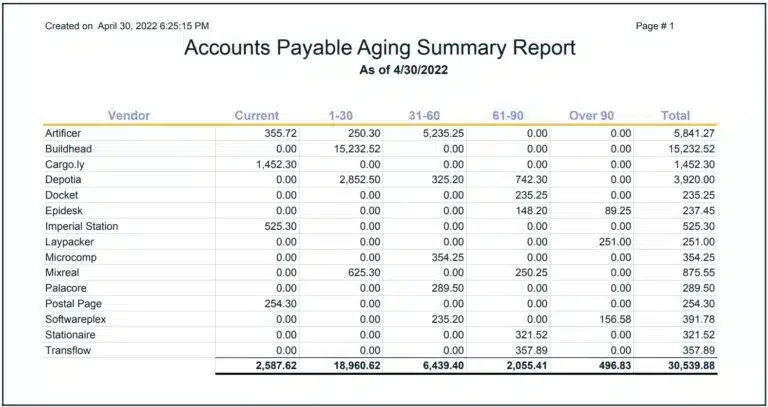

- Track aging AR

- Classification by overdue date: 0–30, 31–60, 61–90, >90.

- Reconciling customer accounts receivable (Statement of Account)

- Send/receive debt confirmations periodically (usually monthly).

- Compare the figures between the client and the internal accounting department.

- Error handling

- Check invoices and supporting documents, and correct any recorded errors in the invoice information.

Attention CFOs:

- Correct AR → accurate cash flow forecast

- A skewed AR increases the risk of DSO (Demand for Sale), and Free Cash Flow is affected.

3. Phase 3 – Debt Reminder and Collection (Collection)

Objective: To ensure that cash is actually deposited into the company on time, reducing the risk of overdue debt.

Steps:

- Regular debt reminders

- Email, phone calls, CRM integrated with AR reporting.

- Prioritize customers based on payment risk/debt size.

- Negotiate and adjust if necessary.

- Payment extension, discount, advance payment off.

- Collect actual payment

- Bank transfer, UNC, cash.

- Recorded decreases of 131 / 136 / 141, and increases in cash / bank deposits.

4. Phase 4 – Risk Assessment and Contingency Planning

Objective: AR has the potential to be lost → record a provision, accurately reflecting profit.

Steps:

- Identifying bad debts

- Overdue by more than 90–180 days, the customer is experiencing financial difficulties.

- Establish a provision for bad debts.

- Debit provision expense / Credit 2293.

- Recovered → Adjust provision

- Debit 2293 / Credit 131 (or 136).

5. Phase 5 – Reporting & Analysis

- Summary of AR / aging report / DSO report.

- AR analysis by customer, industry group, and term.

- Identify high-risk customers early and propose recovery or offsetting plans.

Key CFO KPIs:

- DSO (Days Sales Outstanding)

- Overdue loan ratio / total AR

- Rate of AR collected on time (%)

What is an Aging report and how to read Aging to make debt collection decisions?

Besides understanding what accounts receivable is, the aging report is also a concept that needs attention. The aging report categorizes accounts receivable by the number of days due/overdue, helping businesses prioritize collection, identify risky customers, and forecast cash flow. The value of aging lies in its actions: scheduling debt reminders, resolving disputes, and controlling credit limits.

The objective of the Aging Report is to Displaying customer debt status helps CFOs and accountants prioritize debt collection, assess cash flow risks, and create provisions for bad debts..

How to read AR Aging to make recall decisions.

2.1 Identifying high-risk customers

- Compare total debt >90 days to total AR

- If the ratio is >10–15% → cash flow risk warning

2.2 Prioritize debt reminders and collection

- Debt overdue for more than 30-60 days: call/email to remind the debtor.

- Debts over 90 days: require senior management involvement, negotiation, or advance payment offsetting.

2.3 Payment History Analysis

- Customers consistently pay late → adjust payment terms.

- Customers who pay on time may be eligible for credit extension.

2.4 Decision to establish provision for bad debts

- Overdue AR or customer with financial risk → create provision 2293

- Reduce the risk of reporting inflated profits.

2.5 AR Grouping for CFOs

- Easy AR collection: 0–30 days, on-time collection

- AR needs monitoring: 31–60 days, debt reminders.

- AR risk: >90 days, create contingency plans & issue warning reports.

What is DSO (Days Sales Outstanding) and how can you reduce DSO without affecting customer relationships?

DSO DSO is the average number of days a business takes to collect payments after revenue is recognized; the higher the DSO, the slower the cash flow and the greater the risk of overdue payments. Sustainable reduction of DSO requires disciplined terms and conditions, standardized reconciliation data, and a structured debt reminder process.

To Achieve sustainable reduction in DSO (Days Sales Outstanding) without damaging customer relationships.The CFO and accountant should focus on... Process discipline, accurate data, and scripted debt reminders.. Specifically:

- The payment terms were clearly stated from the beginning.

- Terms and conditions Number of payment days, payment method, credit limit immediately upon signing the contract.

- Recorded in PO / contract and send it back to the customer to avoid disputes later.

- Link AR to standard documents and data.

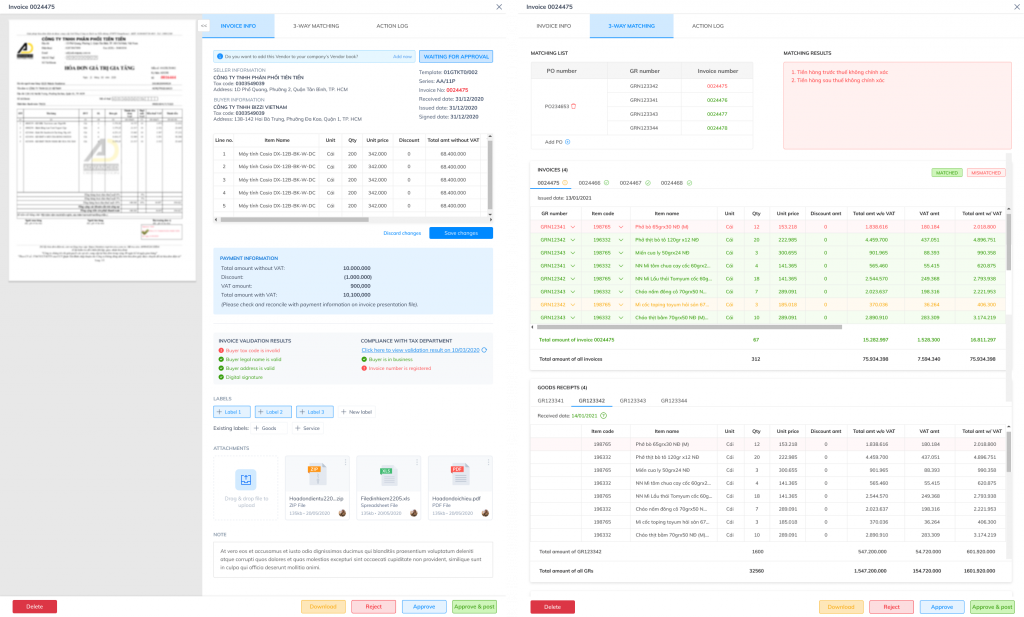

- 3-way matching (PO – GR – Invoice) This helps reduce invoice disputes.

- Ensure invoices, acceptance certificates, and related documents. Match the components before sending them to the customer.

- Debt collection is done according to a script, without putting pressure on the debtor.

- Regular debt reminders Based on the overdue date: 0–30, 31–60, >60.

- Content friendly, professionalAvoid mentioning things in a way that puts pressure on the listener.

- Combine Email + Phone Calls + CRM Automation To ensure guests receive early notifications.

- Customer segmentation by risk

- Group loyal, pay on time → This could extend credit limits and encourage greater purchases.

- Group late payment or risk → Remind customers of outstanding debts early, and limit new sales if payment hasn't been collected.

- Encourage quick payment.

- Apply early payment discount.

- Provide convenient payment gateway: bank transfer, online payment, automation.

- Monitor DSO and make timely adjustments.

- Monitor DSO is near real-time. via ERP / Bizzi.

- Intervene before debts become overdue, instead of waiting until the end of the term to remind the debtor.

What are the control points involved in the accounts payable (AP) accounting process, from invoice receipt to secure payment?

The accounts payable process begins with receiving invoices and purchase documents, comparing them with purchase orders and confirming receipt of goods/services, handling exceptions, submitting payment approvals within the credit limit, making payments, and reconciling statements to settle accounts payable correctly and avoid losses.

Below is the accounts payable (AP) accounting process from invoice receipt to payment, focusing on key internal controls to ensure safety, accuracy, and compliance:

1. Invoice Receipt

Target: Verify the invoice's validity before recording the AP.

Checkpoint:

- Check The supplier has a valid registered tax code..

- Compare PO – GR – Invoice (3-way matching):

- PO: The order was placed with the correct quantity and price.

- GR / Acceptance Report: Received the goods/service.

- Invoice: The data matches both the purchase order (PO) and the gross output (GR).

- Note AP only when 3-way is engaged, to avoid recording incorrect expenses.

2. Payment Approval

Target: ensure Money is disbursed correctly, in compliance with budget and limits..

Checkpoint:

- Check budget envelope → Expenditures exceeding the budget must be justified and require further approval.

- Check the person who approves has the correct authority as prescribed.

- Use an electronic approval workflow (ERP/Bizzi) → avoid out-of-pocket payments.

3. Payment Execution

Target: ensure Money is disbursed safely, to the right person, and to the right amount..

Checkpoint:

- Payment via official banking channelAvoid carrying cash when unnecessary.

- Compare the data. AP vs Payment before review.

- Storing payment documents (UNC, statements) → audit trail.

4. Monitoring & Reconciliation

Target: detect deviations, AP hanging, or parasites.

Checkpoint:

- Compare AP aggregation vs. vendor reporting periodic.

- Check Advance payment to suppliers / prepayment of invoices.

- Warning Overdue unpaid invoices.

5. Reporting and Analysis (Reporting & KPI)

Target: Support the CFO in management. Cash outflow, DPO, payment risk.

Key KPIs:

- DPO (Days Payable Outstanding): average number of days to pay the supplier

- Invoice exception rate: rate of incorrect invoices

- AP aging: Detects expired AP, frozen AP

6. Key points to note for control

- 3-way matching is mandatory.Preventing misuse of funds and internal fraud.

- Budget envelope + approval workflow: Control overspending.

- Sea trail documents: Meeting audit and legal compliance requirements.

- Automation (Bizzi / ERP): Reduce errors, provide early warning of expired APs.

What is 3-way matching (PO–GR–Invoice) and how does it help reduce the risk of incorrect payments in APs?

3-way matching is a comparison. Purchase Order (PO), Confirmation of receipt of goods/services (GR) and invoice before payment. When the three pieces of data match, the risk of paying the wrong quantity/unit price/item is greatly reduced, and it creates a clear traceability for internal control.

3-way matching components

3-way matching (PO–GR–Invoice) To be core AP control process This aims to ensure that businesses only pay for goods/services that have actually been purchased, in the correct quantity and value.

| Ingredient | Role |

| PO (Purchase Order) | Confirm purchase obligationQuantity, price, and payment terms. |

| GR / Goods Receipt / Service Acceptance | Confirm Goods/services have been received, in appropriate quantity and quality. |

| Invoice (Supplier invoice) | Request pay NCC's assessment is based on goods delivered/services accepted. |

The benefits of 3-way matching in reducing payment risk.

All AP payments only occur when the Purchase Order matches the Gross Order matches the Invoice, helping to reduce errors, fraud, and protect the company's cash flow.

- Prevent incorrect/duplicate payments.

- Do not record an AP if the invoice exceeds the purchase order quantity or if the goods have not been received.

- Reduce internal fraud.

- Employees cannot create fictitious payments without a Purchase Order (PO) and a Gross Receipt (GR).

- Improve cash flow

- Only disburse funds when the obligation actually arises → Accurate DPO, reliable cash flow forecast.

- Support for audit and compliance

- All payments have a traceable control record → transparent, auditable.

How should a multi-level payment approval process (Approval Workflow) be designed to optimize cash flow?

Approval workflows are mechanisms for granting permissions and approving expenditures based on limits to ensure that spending aligns with the budget, complies with terms and conditions, and is supported by sufficient evidence before payment. A well-designed workflow reduces the risk of fraud, shortens processing time, and optimizes payment schedules according to cash flow.

Below is the actual design framework, suitable for this perspective. Modern Finance / CFO / AP:

Design Approval Workflow using 4 layers of control

Level 1 – Automation First

Humans should not be used for tasks that machines can do better.

Apply:

- 3-way matching (PO – GR – Invoice)

- Check:

- Unit price

- Quantity

- Tax rate

- Supplier Information

- Payment terms

- A "clean" invoice automatically passes to the next step.

- Invoice discrepancies → go to exception flow

Reduce the number of 30–50% invoices requiring manual signature → shorten payment lead time.

Level 2 – Threshold-based approval

Approval is not based on "job title," but on value and risk level.

For example:

| Invoice value | Suggestion flow |

| < 20 million | AP Manager |

| 20–100 million | Finance Manager |

| > 100 million | CFO / Director |

- Small, recurring bills → go fast

- Large invoices → careful review, but with clear SLAs.

Level 3 – Approval by EXPENSE TYPE

Not all expenses require the same number of tiers. The goal of tier 3 is to prevent "extraordinary" expenses from being mixed in with regular expenses.

| Cost Type | Suggested route |

| Recurring operating costs (rent, logistics) | Levels 1–2 |

| Marketing/KOL booking costs | Add Brand / Marketing Head |

| CAPEX | Finance + CFO |

| Payment outside of PO | Additional levels of control are required. |

Level 4 – Payment Timing Control

This is the most overlooked aspect of cash flow optimization.

Apply:

- Separate approval:

- Approved invoice

- Approved payment date

For example:

- Valid invoice → Approved

- But push the payment date to the due date (D-1 or D0) instead of paying immediately.

The CFO should only be involved in the payment process, not in every single invoice.

A good workflow doesn't make money go faster, but it helps it go "at the right time." If your business shows the following signs, your workflow is backfiring:

- DSO/DPO are fluctuating unusually.

- The CFO has to sign too many small invoices.

- The invoice is valid, but payment is still made early.

- One supplier complained about the delay, but the money was released early to another supplier.

What is accounts receivable reconciliation, and in what order should the causes of discrepancies be traced?

Accounts receivable reconciliation is the process of matching balances and liabilities between a business and its customers/suppliers, as well as between internal departments. When discrepancies arise, it's necessary to trace them in the following order: document → recording time → terms → payment to ensure the correct issue is resolved.

1. What is accounts receivable reconciliation? How many types of accounts receivable reconciliation are there?

Reconciliation of accounts payable is the process of comparing and confirming the balances of accounts payable between:

- Internal company records

z - Partner (customer/supplier)

Target:

- Ensure that accounting data is accurate, complete, and consistent.

- Detecting discrepancies, underpayments/overpayments, incorrect accounting entries.

- Avoid risks:

- Pay twice

- Being unfairly asked for money.

- Creating fictitious accounts receivable → inaccurate cash flow and financial statements.

There are two basic types of accounts receivable reconciliation; here's a comparison:

| Criteria | Internal reconciliation | Compare with partners |

| Target | Error detection and correction | Confirm balance |

| Scope | Sale – Buy – Warehouse – Accounting – Bank | DN ↔ KH/NCC |

| Frequency | Daily / Weekly / Monthly | Month / Quarter / Year |

| Role | Preventing debt discrepancies | Finalize accounts receivable |

| Legality | Internal | High |

When there is a discrepancy in accounts payable – in WHAT ORDER should the causes be traced?

This is the most important part. The principle: go from "objective - original" data → to "internal processing".

Step 1 – Check the BEGINNING BALANCE

The question to be answered is:

- Is there a carry-over of the balance from the previous period?

- Are there any outstanding debts that have been pending for a long time?

Many discrepancies are not new occurrences, but rather errors from previous periods.

Step 2 – Compare with ORIGINAL DOCUMENTS

Depending on whether it's AR or AP:

AR (receivables):

- Sales invoice

- Receipt

- Bank statement

AP (payable):

- Supplier Invoice

- PO

- GR / Acceptance Report

If documentation is missing → immediately identify the problem.

Step 3 – Check the ACCOUNTING

Review:

- Record shortages/excesses

- Wrong account

- Incorrect accounting period

- Incorrect debtor

Common examples:

- Supplier A but accounted for under Supplier B

- Payment has been made, but the reduction in accounts payable has not yet been recorded.

Step 4 – Verify PAYMENT

So:

- Payment date

- Amount

- Transfer details

- Bank fees (who pays?)

Common errors:

- Bank fees were deducted, but the supplier did not deduct them.

- Multiple invoices are combined but recorded on a single invoice.

Step 5 – Check the ADJUSTMENTS

Include:

- Trade discount

- Returns / Discounts

- Offsetting debts

- Adjusting exchange rates (foreign currency)

This is a group where everyone can easily interpret it differently.

Step 6 – Compare the Minutes and Confirm

- Prepare a verification report.

- Both parties sign to confirm.

- Please specify:

- The difference

- Reason

- Procedure & Deadline

How does overdue debt affect the cost of capital and net profit?

Overdue debt not only slows cash flow but also increases working capital requirements, forcing businesses to borrow or miss investment opportunities, thereby increasing the cost of capital and eroding net profits. Good debt management is a way to "free up cash".

From a CFO/Corporate Finance perspective, overdue receivables are not just a matter of recovering money; they directly impact Cost of Capital (WACC) and net profit – even when measured on P&L. Not immediately visible.

1. How does overdue debt INCREASE the cost of capital?

1.1. Increased working capital requirements → increased cost of debt

When customers pay late:

- Money is stuck in AR.

- Businesses still have to pay: Salaries, suppliers, taxes, and operating costs.

Businesses are required to:

- Short term loan

- Overdraft

- Use factoring / invoice discounting

Interest expense increases directly.

Simple example:

- AR is overdue by 20 billion.

- Short-term loan to cover interest payments 10%/year

Capital expenditures amount to approximately 2 billion VND per year.

1.2. Poor credit record → increased interest rates

- DSO high

- Overdue loan ratio > X%

- The Cash Conversion Cycle is extended.

Bank rating:

- High liquidity risk

- Weak debt management

Businesses:

- Interest rates increased.

- Reduce your credit limit.

- Increased collateral requirements

1.3. Increased Cost of Equity Risk

Investors see:

- Unstable cash flow

- Accounting profit ≠ actual cash

Expected:

- Higher return on investment

- Bigger discounts

2. How does overdue debt erode net profit?

2.1. Financial costs incurred

- Interest

- Overdraft fees

- Factoring fees

Decrease in pre-tax profit

2.2. Provision for doubtful receivables must be made.

According to accounting standards:

- Long overdue debts increase the probability of capital loss.

- Provisions must be set aside.

This is a direct blow to P&L. Increased costs – decreased net profit.

2.3. Increased management and recovery costs

- Debt collection personnel

- Legal

- Disputes

2.4. Loss of Profit Opportunity (Opportunity Cost)

Money is tied up in AR, potential profits are being missed:

-

- No investment in marketing.

- No expansion of production.

- Not taking advantage of supplier discounts.

How is the provision for doubtful receivables (Account 2293) related to accounts payable and risk management?

The provision for doubtful receivables (Account 2293) reflects the risk of not recovering accounts receivable and helps businesses present more prudent financial statements. Accounts receivable accountants need to monitor the aging of debts, disputes, and evidence of recovery to support risk assessment and loss control.

Main role:

- Attach debt quality with quality of profit

- Transform potential risks into opportunities. managed numbers

- It serves as a bridge between:

- AR (Accounts Payable Accountant)

- Risk management

- Honest financial statements

What is the connection between account 2293 and accounts payable?

Account 2293 is the final result of the debt risk assessment process, not a standalone entry.

- Accounts payable accounting is the "input data source".

No good AR → no correct 2293. Accounts payable accountant is responsible:

- Track details for each customer/invoice.

- Update: Due date, Actual payment, Dispute status

- Generate an accurate aging report.

Account 2293 cannot be calculated subjectively; it depends on the quality of the accounts receivable data.

- Aging + payment history + disputes = risk classification

This is the central tenet of debt risk management.

(1) Aging – degree of expiration

| Debt group | Significance of risk |

| Not yet overdue | Low risk |

| 1–30 days | Warning |

| 31–60 days | Medium risk |

| 61–90 days | High risk |

| > 90 days | There is a possibility of losing capital. |

(2) Payment history

- Paying on time but being late 1-2 times → low risk

- Repeated delays over multiple periods → systemic risk

- Previous debt write-offs/restructuring → very high risk

Two customers may both be 60 days overdue, but the level of risk could be completely different.

(3) Dispute status

- Contract disputes

- Disputes over product quality

- Legal disputes

Disputed debt = cannot be considered certain to be collected, even if it is not long overdue.

Account 2293 in corporate risk management

- Reduce the risk of inflated profits.

- Revenue is recognized in full.

- But the money didn't come in.

The allocation of 2293 helps to:

- Profit reflects probability of collecting money

- The management made the right decision (expanding/tightening sales credit).

- Customer risk early warning tool

Monitor:

- Reserve ratio / AR

- Loan loss provisioning rates by age group.

Looking at the increase of 2293, you can tell:

- The sales credit policy is problematic.

- Salespeople are "boosting" sales with risk.

- Contact directly regarding the cost of capital.

- Bad debts increase ↑ → risky cash flow increases

- Banks and investors offer bigger discounts.

2293 indirectly affects WACC, Enterprise Value

How does managing accounts receivable using Excel differ from ERP/Automated Tools in terms of risk, performance, and ROI?

Excel is flexible but prone to versioning errors, lacks permission management and audit trail capabilities, struggles with cross-referencing data from multiple sources, and is time-consuming to handle exceptions. ERP/automated tools help standardize data, automate reconciliation, control approvals, and measure accounts receivable KPIs to optimize operational ROI.

From this perspective CFO / Finance Transformation, compare Managing accounts receivable using Excel with ERP / Automated Tool We shouldn't stop at "convenient or not," but must answer three core questions: Where do the risks lie? How do the performance levels differ? And is the ROI truly positive?

- Excel: Manual recording and aggregation tools → human-dependent

- ERP / Automated Tool: control system & data flow → process dependency

Because they are fundamentally different, they are completely different in nature. systemic risk, operational performance, and long-term ROIBelow is a comparison table based on 5 core criteria:

| Criteria | Excel | ERP / Automated |

| Accuracy | Human dependence | Rule-based |

| Tracing | Almost none | Full Audit Trail |

| Decentralization | Weak | Standard SoD |

| Processing speed | Slow, doesn't scale. | Fast, real-time |

| Integration | Handmade | Automatic |

In short, Excel is optimal for record-keeping. ERP/Automation is optimal for control. When accounts receivable exceed human control capabilities, Excel becomes a risk rather than a solution.

How can I integrate Accounts Receivable/Amounts Data into Real-Time Cash Flow Forecasts (FP&A/CFO Perspective)?

Many businesses Accounts payable accounting is correct., But The cash flow forecast is still wrong.The reason is because liabilities are reflected. has arisen, and cash flow reflects When does money actually come in/go out?.

Integrating actual accounts receivable into real-time forecasts requires standardizing AR/AP data by subject and terms, reducing reconciliation lag, and synchronizing with cash flow forecasting models. With continuously updated data, CFOs can predict cash shortages and optimize their revenue and expenditure schedules earlier.

So, how How to incorporate Actual accounts receivable data into real-time cash flow forecasts? By converting accounts receivable from "recorded" to "projected cash flow based on time and probability".

Specifically, FP&A doesn't use revenue or expenses for forecasting, but starts from... Actual AR/AP at the invoice levelEach open invoice is assigned Expected Cash Date based on payment terms and actual past payment behaviorThis date is always updated whenever there are changes (lates, disputes, payment delays).

Then, each debt is linked. probability of receiving or spending, reflecting the level of risk (based on aging, payment history, dispute status).

The value of cash flow forecasts is no longer "the total amount of receivables/payables", but rather expected value.

Once all the bills are ready:

– the amount of money remaining open

– expected cash date

– probability

FP&A only requires Arrange them on a timeline (weeks/days). To see it right away:

– which cash flow is almost certain?

– Which cash flow is risky?

– the period of financial hardship before it happens

Forecast has been updated. as soon as the actual liabilities changeNo need to wait until the end of the month.

In short, Integrate actual accounts payable into forecasts by transforming each invoice into a cash flow with a specific timeframe and probability, rather than a static accounting figure.

Quick Comparison Table: Excel vs. Automated Accounts Receivable Management Systems

Below is a quick comparison table – concise, easy to insert into articles, and from the perspective of a CFO/risk management & cash flow manager.

| Criteria | Excel | ERP / Automated | Chief Financial Officer (CFO) Benefits |

| Audit trail | There is little or no information available; it's difficult to know who did the repair and when. | The log includes all actions, times, and the person who performed them. | Reduce audit risks, increase transparency and compliance. |

| Decentralization of Rights and Rights (SoD) | Roles can easily overlap; one person can edit, compare, and report. | Role-based authorization, separation of processes – approval – payment | Reduce fraud, ensure proper internal control. |

| 3-way matching | Manual, file-dependent, and human-driven. | Automatically match PO–GR–Invoice according to rules. | Prevent incorrect payments from the start. |

| Cycle time processing | Slow, unstable; increases with trading volume. | Fast, stable; scales with automation. | Keep your money in check and optimize your cash flow. |

| Exception management | Late detection, fragmented treatment. | Automatic detection, routing, and status monitoring. | Reduce process bottlenecks and avoid payment delays. |

| KPI DSO / Aging | The final calculation is prone to discrepancies. | Real-time, drill-down based on invoice. | The CFO can identify risks before they arise. |

| Bank/ERP integration | Manual input, manual verification | Direct connection, automatic updates | End-to-end data, reducing system errors. |

| Risk of duplicate/incorrect payments | High error (duplicate file, wrong version) | Low (rule + system control) | Protecting cash and profits |

In short, Excel helps record accounts payable. Automation systems help control risk and cash flow. When the scale of transactions exceeds the capacity of manual control, Excel becomes a point of risk.”

Frequently Asked Questions about "What is accounts payable?"

Is accounts payable accounting the same as internal accounting?

Yes. Accounts receivable and payable (AR) accounting is a part of internal accounting that focuses on managing accounts receivable (AR) and accounts payable (AP) by specific entity (customer, supplier).

The core task of accounts payable accounting is to monitor sub-ledgers, perform reconciliation, and detect early risks related to payments, overdue debts, or data discrepancies.

How does accounts receivable differ from accounts payable?

Yes. Accounts receivable and payable (AR) accounting is a part of internal accounting that focuses on managing accounts receivable (AR) and accounts payable (AP) by specific entity (customer, supplier).

The core task of accounts payable accounting is to monitor sub-ledgers, perform reconciliation, and detect early risks related to payments, overdue debts, or data discrepancies.

What is a good DSO (Demand for Sales) value, and how should businesses track DSO?

There isn't one "good" DSO figure for every business. DSO depends on the industry, business model, and payment terms.

More important than absolute value is:

– Track DSO trends over time

– Decompose DSO by customer group and aging buckets

This tracking method helps businesses take action to reduce DSO, rather than just looking at a total number.

How does automatic 3-way matching differ from manual visual matching?

3-way automatic matching compare PO – GR – Invoice Based on the rule and tolerance threshold, it is possible to:

– Instant error detection

- Note audit trail full

– Exception management

Meanwhile, manual comparison by eye. human dependence, easily overlooked and no standard tracingThis increases the risk of incorrect payments.

When there is a discrepancy in accounts payable, what should be prioritized for quick resolution?

To address the root cause quickly and effectively, the following priorities should be followed in order:

- Documents: missing, incorrect version, outdated.

- Recording time: off-period, early/late recording

- Terms and conditions: Discounts, offsetting, and adjustments not yet reflected.

- Payment: paid but not yet recorded, or recorded twice.

This order helps pinpoint the root cause most quickly, instead of tracing each transaction individually.

Why is it necessary to make provisions for doubtful receivables (2293) and what data supports the assessment?

The provision for doubtful receivables (2293) reflects the risk of cash recovery and helps the financial statements show conservative, realistic profits.

To make an accurate assessment and provision, the following data is needed:

– Age of debt

– Dispute status

– Recall history

– Documents for reconciliation and debt reminders.

Account 2293 is not just an accounting entry, but the result of debt risk management.

When should businesses automate accounts receivable to maximize ROI?

Automation begins to deliver a clear ROI when:

– The number of invoices and partners is increasing rapidly.

– Cycle time long processing

– Numerous and recurring exceptions.

– Discrepancies in accounts payable occur frequently.

– Increasing demands for auditing and tracing.

In that case, automation helps. Reduce errors, speed up processing, and improve financial KPIs..

What roadmap does Bizzi follow to support accounts receivable accountants in reducing errors and speeding up processing?

Automation begins to deliver a clear ROI when:

– The number of invoices and partners is increasing rapidly.

– Cycle time long processing

– Numerous and recurring exceptions.

– Discrepancies in accounts payable occur frequently.

– Increasing demands for auditing and tracing.

In that case, automation helps. Reduce errors, speed up processing, and improve financial KPIs..

What reports does accounts payable need for the CFO to monitor on a weekly/monthly basis?

At a minimum, a CFO needs to:

– Aging by customer/supplier

- Trend DSO/DPO/CCC

– List of major overdue debts

- Report exception AP

– Cycle time approval and payment

These reports help the CFO see... Cash flow risk before it becomes a problem..

How are liabilities related to cash flow forecasting and Plan vs. Actual?

AR/AP directly influences cash-in and cash-out. When actual accounts receivable data is updated promptly, cash flow forecasts are more accurate, and CFOs can detect discrepancies between Plan and Actual earlier to adjust the collection and expenditure schedule, instead of reacting passively.

Conclude

The above information covers everything related to what accounts receivable accounting is. In general, effective accounts receivable management helps businesses:

- Controlling payment risks and overdue debts.

- Improve DSO/DPO, optimize cash conversion cycle (CCC)

- Improve the accuracy of cash flow forecasts and Plan vs. Actual results.

- Create a reliable data platform that enables CFOs to proactively manage operations, rather than react passively.

To achieve that, businesses cannot rely solely on people or disjointed spreadsheets; they need a more holistic approach.

Bizzi doesn't approach the debt problem as a standalone tool, but rather builds an integrated financial solutions ecosystem that covers the entire debt lifecycle – from origination, control, reconciliation to cash flow management.

Specifically:

- Invoice automation and 3-way matching This helps reduce discrepancies right from the input stage, limits the risk of incorrect payments, and creates a transparent audit trail.

- Cost management & approval workflow This helps control budgets, terms, and timing of recognition – factors that directly affect accounts receivable.

- Accounts Receivable Management (ARM) With scripted debt reminders, aging tracking, DSO (Demand-Savings) and collection history, businesses can proactively manage cash-in.

- Centralized, synchronized data It serves management reporting purposes, helping CFOs see a real-time picture of accounts receivable and cash flow, instead of manually compiling it at the end of the period.

Thanks to this connection, Bizzi not only helps accountants "work faster," but also helps smarter financial operations.

The core difference lies not in whether a business uses technology or not, but in... Is that technology integrated into processes, data, and management objectives?To receive personalized solutions tailored specifically to your business, schedule an appointment here: https://bizzi.vn/dang-ky-dung-thu/