What is Account Receivable (AR)? Effectively manage receivables to optimize business costs

Accounts Receivable (AR) – Accounts Receivable plays a very important role in the financial and operational activities of a business. In this article, let’s learn what Accounts Receivable (AR) is and the importance of managing accounts receivable in business cost management.

This article by Bizzi will provide information on the components, accounting processes, AR management methods and how to prevent risks to minimize costs.

What is Account Receivable?

Concept and characteristics

Account Receivable (abbreviated as AR or A/R), also known as receivables, are amounts that a business has provided products/services for but has not yet received payment.

Account Receivable represents money customers owe to a business from purchasing goods or services.

The Role of Account Receivable

Accounts Receivable (AR) – Accounts Receivable plays a very important role in the financial and operational activities of a business.

- Current assets are important, reflecting the amount of money that a business is entitled to collect, helping to demonstrate the size and financial capacity of the business.

- Direct impact on cash flow: Accounts receivable are future cash, so collecting debts on time will improve cash flow. If Account Receivable is poorly managed, cash flow will be slow, which can cause liquidity shortages despite high revenue.

- Represents sales and credit policies: Businesses can expand sales by allowing customers to buy on credit. AR reflects creditworthiness and business strategy: businesses accept credit risk to increase revenue.

- Customer assessment tool: AR tracking helps assess the payment status of each customer, businesses can determine who is a good customer, who is often late in paying to adjust sales policies accordingly.

- Impact on financial performance: High AR ratio but not collected will lead to bad debt. Effective AR management helps improve receivable turnover, thereby improving capital efficiency.

- Contributes to corporate credit assessment: Investors or banks will look at AR to assess the financial health, collectability and credit risk of the business.

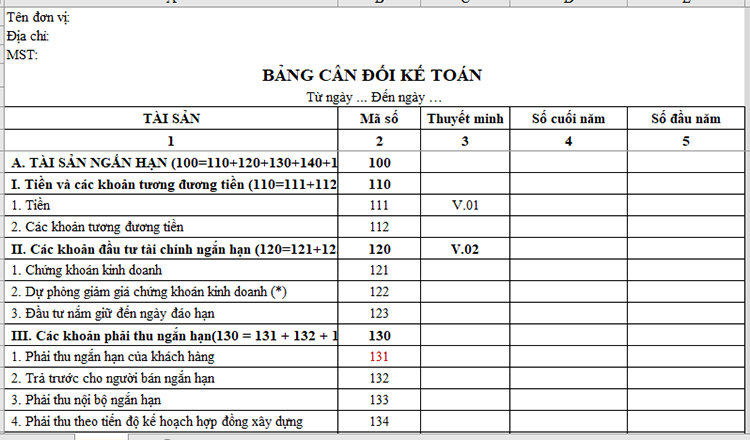

Compare Accounts Receivable (AR) and Accounts Payable (AP)

| Criteria | Accounts Receivable (AR) – Accounts Receivable | Accounts Payable (AP) – Accounts Payable |

| Define | Is the amount of money that a customer owes a business after purchasing goods/services but not yet paying. | Is the amount of money a business owes to suppliers after purchasing goods/services but not yet paying. |

| Role | To be asset cash flow on balance sheet. | To be liabilities (financial obligations) in the balance sheet. |

| Where to record | Beside asset short term | Beside liabilities short term |

| Who owes whom? | Client in debt business | Business in debt supplier. |

| Impact on cash flow | Cash flow enter (cash inflow) future. | Cash flow go out (cash outflow) future. |

| Management objectives | Optimize debt collection to improve cash flow. | Manage payment schedules well to maintain reputation and optimize working capital. |

| For example | A business sells products to other business customers and allows payment after 30 days. | The company purchases raw materials from suppliers with a payment term of 45 days. |

Components of Account Receivable

Grasp the essence each component of Account Receivable (AR) – Accounts receivable will help businesses understand the role and impact of each part on the financial and operational activities of the business.

Below are the components of Account Receivable:

- Sales Invoice: Is the original document recording the sales transaction that the customer has not paid for. Including: amount, date of sale, payment deadline, customer information, product/service provided.

- Accounts Receivable Ledger: Is a detailed record of each customer's debt. Track information such as: transaction date, debt amount, due date, payment received, remaining balance.

- Customers/Debtors: Receivables are people or organizations that have purchased products/services but have not yet paid.

- Due Date / Payment Terms: Is the period agreed upon in the contract or invoice for the customer to pay.

- Early Payment Discount: Some businesses offer discounts if customers pay early.

- Allowance for Doubtful Accounts: Is an estimate of the amount that is likely to be uncollectible from some customers, Helps to accurately reflect the true value of receivables on financial statements.

- Bad Debts: Is the portion of receivables determined to be irrecoverable after repeated reminders and processing. Can be written off according to accounting regulations.

- Aging Report: This is a report classifying receivables by overdue time: for example <30 days, 30–60 days, >90 days; helping businesses assess the level of risk and plan debt collection.

Effective Account Receivable Management Accounting Process

Establishing an effective Account Receivable (AR) management process is vital to helping businesses maintain stable cash flow, reduce bad debt risks, and increase debt collection capabilities. Below are some suggestions that businesses can refer to and flexibly apply to their operating system:

Establish a clear credit policy

- Specify who can buy on credit, maximum credit limit, payment terms.

- Check customer's reputation and credit history before accepting credit.

Issue accurate and timely sales invoices

- Describe the billing process in full detail.

- Note about sending invoices quickly through different channels.

- Upon delivery or completion of service, accountants need to: Prepare Sales invoice correct value, tax, time, payment due. Send invoices to customers on time via email, system or paper.

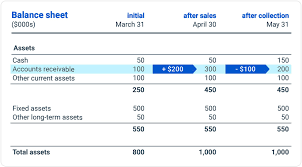

Record receivables in accounting books

- Recorded to customer receivables in the general ledger.

- For example:

Debit account 131 – Customer receivables

Credit account 511 – Sales revenue

Credit account 3331 – VAT payable (if any)

Monitor and update debt regularly

- Use accounting software or a detailed debt tracking table for each customer.

- Create report Aging Report to see which debts are about to or are overdue.

Reminder and debt collection

- Before the due date: send a gentle reminder email or call.

- After overdue: send official reminder letter, warning to stop providing service, charge late fee (if any).

- Depending on the case, it is possible to negotiate an extension or partial withdrawal.

Payment recording

When the customer pays, record the receipt:

- Debit account 111/112 – Cash/deposits

- Credit account 131 – Customer receivables

Compare with bank statement or receipt.

Bad debt settlement and provisioning

- For long-term overdue and difficult-to-recover accounts: Establish provisions for doubtful debts:

- Debit account 642 – Management expenses

- Credit account 139 - Provision for doubtful debts

- Bad debt write-off case:

- Debit account 139

- Have account 131

Periodic review, evaluation & improvement

- Periodically (monthly, quarterly) analyze debt situation: total outstanding debt, collection rate, bad debt rate.

- Evaluate the effectiveness of credit policies and adjust as necessary.

Optimal Account Receivable (AR) Management Methods

Finding optimal methods for managing Account Receivable (AR) is essential because AR is not only an accounting indicator but also an extremely important financial lever to help businesses operate effectively.

Use modern software

Software is a tool, but its effectiveness depends on how businesses use it. By combining modern software with standard management processes and thinking, businesses can optimize AR management comprehensively, from collection speed to risk and cost control.

- Track debt by customer and contract.

- Automatic debt reminders, overdue warnings, quick report creation.

- Intuitive interface makes debt management easy, reducing manual errors.

- Ability to integrate with ERP systems for comprehensive management.

Classify customers and set appropriate credit limits

- Segment customers by risk (A, B, C), based on credit history and sales.

- Flexible credit limit & payment schedule by group

- Set early payment discount conditions

Monitor and evaluate the status of Account Receivable periodically

- The importance of preparing periodic AR reports to monitor past due receivables.

- Reassess customer's ability to pay to adjust credit policy.

Apply tools and techniques to optimize Account Receivable

ERP (Enterprise Resource Planning) System

- Ability to integrate data and automate Account Receivable management processes.

Aging Analysis

- Use Excel / Google Sheets tool with debt aging summary table, BI software like Power BI, Tableau to visualize AR data

- Focus on handling the highest risk accounts.

- Analyze which accounts are due soon and how long they are overdue.

- Apply debt aging analysis results to assess financial situation and debt collection ability.

Automate debt reminders & sending invoices

- Tools: Email marketing automation (Mailchimp, HubSpot); ERP system with auto reminder feature; SMS/WhatsApp API

- Send automatic recurring or early payment reminders.

- Reduce manual processing time, increase on-time debt collection rate.

Implement professional debt collection process

- Apply standard email templates, record full interactions to reduce bad debt without losing customers.

- Build professional, clear relationships.

Cash flow forecasting techniques from AR

- Using tools like Excel + historical payment collection forecasting models or AI/ML integrated in ERP (major platforms like SAP, Oracle) helps businesses plan finances, investments and spending more accurately.

How to prevent risks related to Account Receivable

To effectively manage Accounts Receivable (AR) and prevent risks such as bad debt, late payment, or inability to collect debts, businesses need to synchronously deploy many measures. Below are ways to prevent risks related to AR:

Thoroughly check customer credit

- Financial statements (if business)

- Payment history (if you are a previous customer)

- Credit rating from third party (if any)

Establish clear credit policies and debt limits

Debt limit according to: Customer size; Trust level / cooperation time

- Specify specific payment time (Net 15, Net 30,…)

- Penalty for late payment or stop transaction if limit is exceeded

Draft contracts & strict payment terms

- Payment terms, terms.

- Overdue remedies (penalty interest, contract termination, etc.).

- Where to resolve disputes, under what law?

Issue invoices promptly and accurately

- Avoid mistakes that give customers an excuse to delay payment.

- Invoices must have correct company name, tax code, value, tax rate, payment deadline, etc.

Track debt and remind debt periodically

- Use accounting software with integrated automatic debt reminders.

- Send email, SMS or call to remind about payment before and after due date.

- Have a plan for soft and hard reminders according to debt level.

Use of payment guarantee / deposit / prepayment

- Especially with large contracts, new clients or high risk.

- May require: Deposit 30-50%; Bank guarantee (LC, SBLC); Tripartite contract (supplier – customer – guarantor)

Apply for Trade Credit Insurance

- Purchase insurance for receivables from third parties (revenue insurance). If the customer defaults, the business is covered in part or in full.

Build an effective debt collection process using software

Debt management and collection is one of the important problems that helps businesses maintain healthy cash flow and financial stability. Using technology solutions such as Bizzi and B-Invoice, businesses can automate the entire debt collection process, saving time and increasing efficiency.

Bizzi – Smart debt management tool, automatic debt reminder Provides a comprehensive debt management system with many outstanding features:

- Automatic invoice issuance: Integrate order information, payment deadlines, ensuring transparency and accuracy.

- Closely monitor debt: Continuously update important indicators such as days outstanding debt (DSO), debt aging report...

- Multi-channel automatic debt reminder: Trigger debt reminders based on due dates or optional timelines. Send debt reminder emails according to appropriate scenarios for each customer group.

- Fast debt reconciliation: Automatically reconcile with bank statements, manage pending payments and accurately offset debts.

- Flexible management: Track debt by invoice, contract or specific customer.

- Automatically create debt collection jobs: Link related departments, update debt status and create task reminders to process according to the process.

B-Invoce is an electronic invoice software integrated with debt collection. leading today, has been used by many businesses such as Guardian, GS25, Ba Mien Consulting and Management Company Limited… trusted. B-Invoice stands out with:

- POS machine integration, suitable for retail businesses.

- Fully comply with Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

- Automate your accounts receivable process: Easily customizable according to business needs, supports fast debt collection, minimizes financial risks.

- Friendly interface, easy to integrate with ERP systems and accounting software.

With our automatic debt management solution Bizzi with smart reminder process, helps automate payment process, shorten debt collection time and optimize cash flow.

The importance of Account Receivable management in business cost management

Managing Account Receivable (AR) plays an extremely important role in business cost management, because it is not only related to revenue but also directly affects cash flow, capital efficiency and operating costs.

Below are the roles and positive impacts when businesses manage Account Receivable effectively.

Maintain a steady cash flow

Explain how effective AR management helps ensure regular cash inflows, thereby reducing dependence on external sources of funding and interest costs.

Minimize bad debt and related costs

Collecting debt on time helps reduce costs for debt reminders, monitoring, and legal actions (calling, sending documents, hiring lawyers, etc.). In addition, when receivables turn into bad debts, businesses must set up risk provisions, reducing accounting profits.

Improve overall financial health

AR is collected on time, helping businesses proactively manage cash flow and have timely investment capital in profitable activities (advertising, R&D, production expansion, etc.).

Optimize operating costs

- Balance operating capital more accurately, reducing unexpected costs.

- Increase transparency in financial management – reduce loss and internal fraud.

Increase scalability & sustainability

- Scale up without relying too much on debt.

- Gain high credibility with investors, banks, and partners, thereby reducing future capital mobilization costs.

Conclude

In short, managing Accounts Receivable (AR) is not just about tracking customer debts, but also contributes greatly to controlling costs and optimizing the financial efficiency of the business. Above is all the information analyzing what Account Receivable is, as well as how to manage this revenue effectively.

If your business is looking for an automated debt management solution for your business, contact us now. Bizzi to experience it for free!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/