The Finance and Accounting Department is overwhelmed due to the increasing number of invoices, with numerous templates and sources, resulting in hours of manual data entry. Additionally, manually or using Excel to reconcile purchase orders (POs), receipts (GRNs), and invoices is time-consuming. The CFO is under pressure to reduce operating costs, accelerate closing times, and ensure compliance.

In this context, "Autonomous Finance" emerges as a lifeline, expected to address the limitations and challenges facing the finance and accounting departments.

This article by Bizzi will:

- Explain the true nature. What is Autonomous Finance?.

- Describe how a "self-operating" financial system works.

- Clearly distinguish between Automation → Intelligent Automation → Autonomous Finance.

- Outline a practical roadmap that Vietnamese businesses can adopt (and common barriers to entry).

What is Autonomous Finance?

Autonomous Finance is a financial system capable of automatically collecting data, analyzing it, making decisions, and executing tasks without manual intervention in repetitive steps. This is a higher level of automation, where AI plays a coordinating role and suggests financial actions, rather than simply "following rules."

What are the 5 core components that make up autonomous finance?

Below is 5 core components It is often considered the foundation by technology and financial advisory firms (Oracle, Gartner, Workday, Deloitte, etc.). Autonomous Finance.

1. AI/ML – Learning from data, self-prediction

- Cash flow forecast

- Payment suggestions

- Anomaly detection

- Self-optimizing processes based on feedback.

2. RPA – Perform repetitive operations

- Download invoice

- Send email

- Import/export data

- Push data to ERP

3. IDP/OCR – Understanding Invoices & Documents

- Identifying multiple complex invoice templates

- Extract product line, purchase order, tax, and item details.

- Normalize data before integrating it into the ERP system.

4. Rules + Policy Engine – Compliance Control

- Approval limit

- Cost center

- Role-Based Access Control (RBAC) or Attribute-Based Access Control (ABAC)

- Preventing fraud risks and ensuring compliance with Decree 123/Decree 70.

5. Real-time Data Orchestration – System Interoperability

- Two-way connection with ERP

- Synchronize eInvoice – Payment – Procurement

- Data flows continuously, without interruption → creating a "touchless" platform.

How is Autonomous Finance different from Automation?

The difference between the two concepts is that automation reduces manual operations, while Autonomous Finance helps elevate financial operations.

| Aspect | Automation | Autonomous Finance |

| How it works | Run according to fixed rules | Self-learning – self-adapting based on data. |

| The role of human beings | Regular monitoring is required. | Only handle complex exceptions. |

| Output | Automatic data entry/reconciliation | Propose and implement your own financial actions. |

| The level of "no contact" | 30–60% | 80–100% (depending on the process) |

| Scope | Automate each task | Continuous automation + decision making |

In short:

- Automation = "doing it for someone else"

- Autonomous = "think on behalf of + act on behalf of"

Levels of Maturity

Based on these levels, managers will know which level their business is at, allowing them to choose and implement appropriate solutions.

Level 1 – Manual Finance

100% handmade.

- Excel data entry

- Print - sign - scan

- Manual verification

- Many errors, long cycle time.

Level 2 – Automation Finance

Most Vietnamese businesses are at this level: point automation.

- Basic OCR

- Workflow approval

- Import files into ERP

- Continuous intervention is still needed.

Level 3 – Intelligent Automation

Automation + intelligent recognition.

- Advanced IDP/OCR

- Bot downloads, reads, and compares data.

- Suggestions made, but no decision yet.

- Still awaiting approval.

The level many large businesses are starting to aim for.

Level 4 – Semi-Autonomous Finance

This is the most realistic target for Vietnamese businesses in the next 1-2 years. The self-operating system largely consists of repetitive steps.

- Generate invoices automatically → perform 3-way reconciliation automatically → create payment requests automatically

- Only exceptions require a handler.

- ERP, eInvoice, and Payment systems are now integrated.

Level 5 – Full Autonomous Finance

Self-learning, self-decision-making, and self-execution are almost the entire process.

- AI forecasts cash flow and suggests optimal payment methods.

- Auto-posting, auto-reconciliation

- The process is completely touchless.

- The CFO only monitors the dashboard in real-time.

This stage is what some multinational corporations have targeted, but Vietnam needs a longer roadmap.

What is the underlying technology behind Autonomous Finance?

Autonomous Finance is not a single software program, but rather... technology complex to enable the financial system Self-understanding – Self-decision-making – Self-operationThe six layers of technology below form the foundation for true "no-touch" capability.

1. AI in Finance (Financial AI Layer)

AI acts as the "brain," analyzing data and making financial decisions in real time.

- Smart Coding: Automatically suggest accounting accounts/items based on invoice history and context.

- Anomaly Detection: Detecting irregularities in invoices, purchase orders, gross receipts, and payments.

- Payment Prediction: Predict which bills need to be paid first to optimize cash flow.

- Fraud Detection: Identify fraud, duplicate invoices, and risky vendors.

Strengths: AI helps reduce 70–90% of manual inspection operations in AP/AR.

2. Machine Learning (ML Layer)

ML enables the system self-study from the financial behavior of the business.

- Learn spending patterns by supplier, department, and project.

- Forecast cash flow on a monthly/quarterly basis.

- Forecasting the client's DSO/DPD to optimize debt recovery.

- Adjust the model based on real-world feedback (“feedback loop”).

Role: ML helps finance shift from processing the past to predicting the future.

3. Intelligent Document Processing (IDP)

IDP is a technology layer that helps the system understand Documentation — the most important step in AP automation.

- OCR for multiple invoice templates: Understanding Vietnamese invoices with multiple layouts and vendors.

- Extracting complex line items: Quantity, unit price, tax, PO number, product details.

- Auto-classification: Classification: PO/Non-PO, services/goods, recurring invoice.

IDP = OCR + AI + NLP → accuracy is 2–3 times higher than pure OCR.

4. RPA & Hyperautomation (Execution Layer)

If AI is the brain, then... RPA is the arm Take action on behalf of humans.

- Coordinate the entire processing flow (orchestration).

- Create your own payment vouchers/ERP entries (AP posting, GR/IR clearing, payment run).

- Submit approvals yourself based on budget limits or cost center approvals.

- Automate multiple steps in a chain, not just individual tasks.

Hyper Automation = AI + RPA + IDP → true "no-touch" capability.

5. Rules Engine + Policy Engine

Rules Engine and Policy Engine maintain character control – compliance, avoiding financial and tax risks.

- Approval limits are tiered (e.g., under 10 million auto-approves).

- Budgeting rules by department, project, and expense type.

- Conditional approval: approval based on conditions (risk vendor, budget overrun, incorrect invoice template, discrepancy in purchase price, etc.).

- Automatically generate alerts and block non-compliant transactions.

6. Real-time Integration (Connected Finance Layer)

No connection, no "autonomous".

- ERP: SAP, Oracle, Odoo, Bravo, Misa, Fast…

- E-invoice: Connecting the electronic invoicing system according to Decree 123/Decree 70.

- Banking API: Automatically reconcile, create payment orders, and verify cash flow.

- Procurement: Synchronize PO and GRN for 3-way real-time matching.

- BI Dashboard: Real-time data for the CFO.

Real-time connection = no more file imports, no more batch waiting, no more data discrepancies.

What are the practical applications of Autonomous Finance?

Autonomous finance isn't a "distant future" concept. Many corporate finance processes can run autonomously today by combining AI + IDP + RPA + Integration. Here are some examples. 5 most practical applications, creating a clear impact on AP – AR – FP&A – Cashflow.

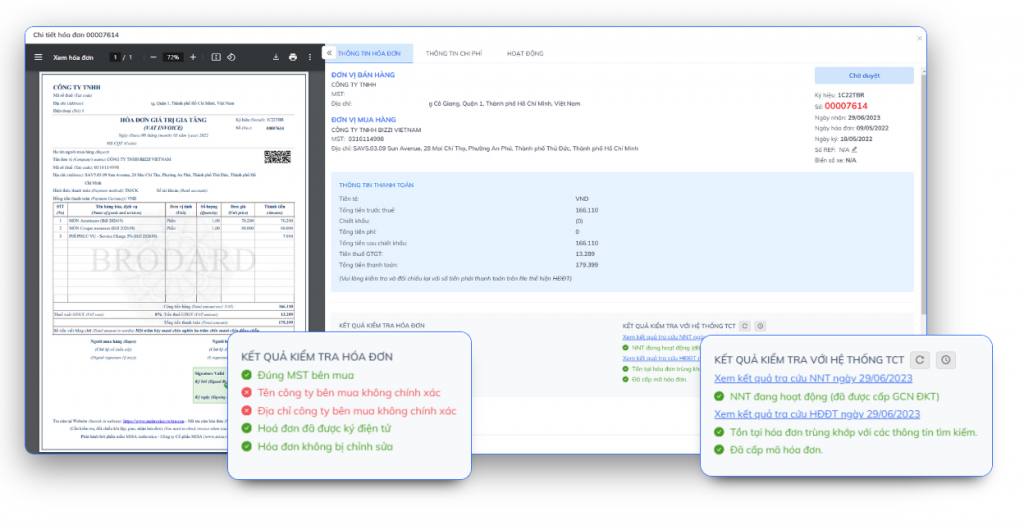

1. Touchless Invoice Processing (AP Automation 100%)

The most obvious and common application of Autonomous Finance.

- Self-receive invoices via email/portal

- Read – extract – validate according to Decree 123/Decree 70

- Self-checking PO–GRN–Invoice (3-way matching)

- Suggest your own payment slip/create your own payment slip. according to budget & cost center

- Auto-posting to ERP (AP entry, GR/IR clearing)

Result: Reduces manual data entry tasks by 70–90%, shortens cycle time to just a few minutes, and minimizes errors and fraud.

2. Autonomous Expense Management

AI tracks, categorizes, and controls spending in real time.

- AI auto-coding: Cost classification by account & cost center

- Budget/Limit Overload Warning

- Auto-reconciliation documents – transactions – banking

- Suggested cost allocation by department, project

Result: The CFO controls the budget in real-time, meaning employees hardly need to do any data entry.

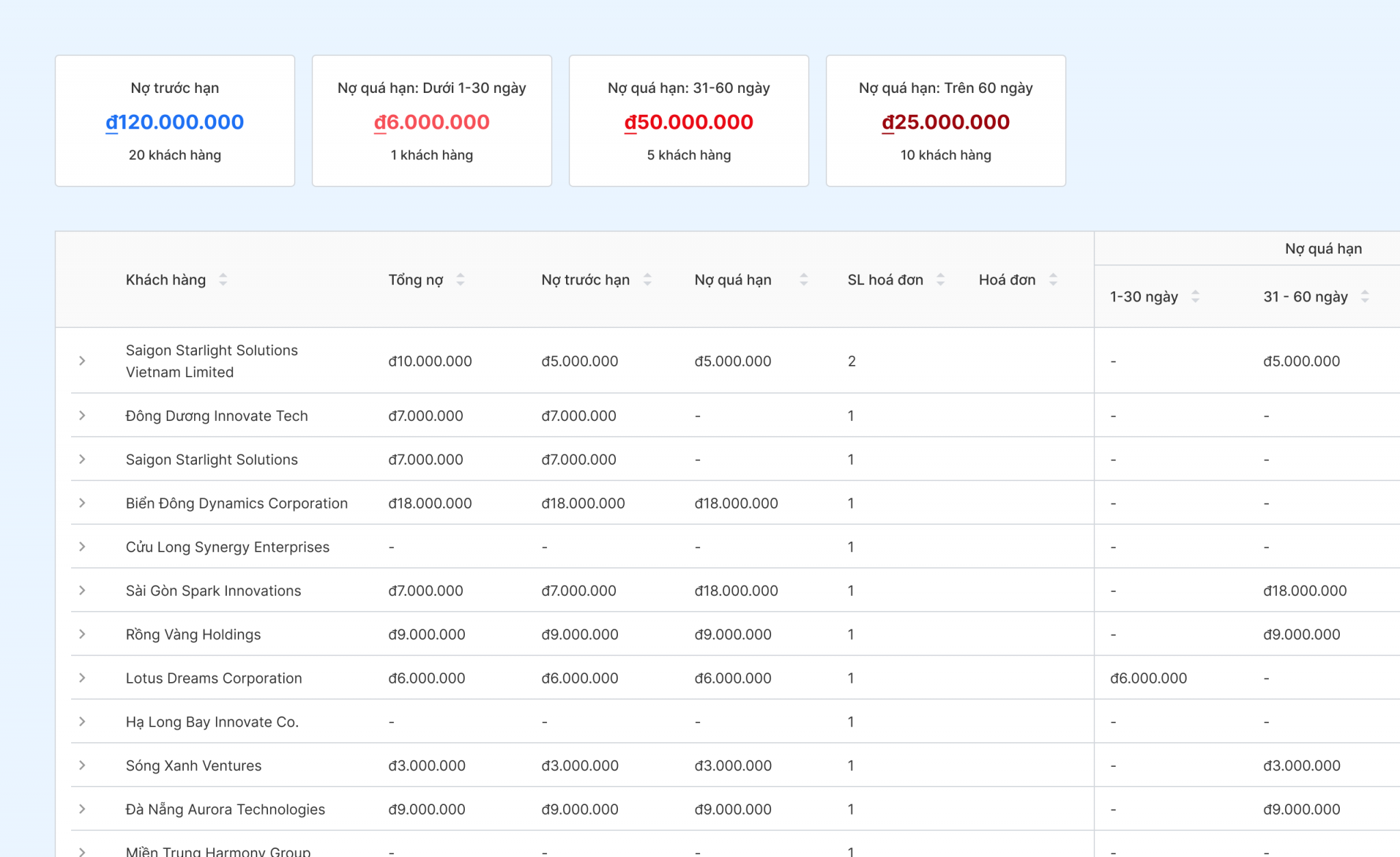

3. Autonomous AR (Accounts Receivable)

Automate debt collection, reconciliation, and reminder processes.

- Self-monitoring of accounts receivable customers by transaction history

- Self-checking payments from the bank

- Predictive Collection: Predicting each customer's ability to pay.

- Self-reminders about debts behavior-based reminders

KResult: Reduce DSO, accelerate cash collection, and improve the accuracy of revenue forecasts.

4. AI-powered FP&A

Increase the intelligence level of planning, analysis, and forecasting.

- Automatic forecast Revenue, OPEX, and CAPEX are based on machine learning.

- Scenario Planning: Simulate multiple P&L and cash flow scenarios.

- Self-updating Dashboard: The dashboard updates in real time; no need to copy and paste Excel.

Result: FP&A is shifting from "report writing" to "strategic consulting" for management.

5. Autonomous Cash Management

Manage cash flow and control liquidity independently.

- Real-time cash flow forecast by week/month/quarter

- Warning of shortage risk. cash flow

- Suggest your own optimal course of action: Reschedule payments, prioritize vendors, optimize working capital.

Result: The CFO has complete control over liquidity and can make timely financial decisions.

Business benefits of using Autonomous Finance

Autonomous Finance offers direct and strategic value For businesses, this ranges from cost savings to improved analytical and decision-making capabilities.

1. Reduce financial costs

- 50–80% AP processing cost thanks to Touchless Invoice Processing

- 40–60% FTE for data entry liberated

- Reduce the costs of errors, fraud, and audits.

Result: Optimize operations and increase ROI for the Finance department.

2. Close the period faster.

The CFO has timely data and reports.

- Shorten 3–5 days compared to manual process

- Cycle time AP – AR – Closing is accelerated

- Assisting the CFO in generating real-time reports.

3. Upgrade control and compliance

The finance team adheres strictly to regulations, reducing both tax and internal risks.

- Reducing fraud by Rules + Policy Engine

- Log all actions completely → Audit trail transparency

- Approval control by limits, cost centers, specific conditions

4. Real-time data for CFOs

CFO becomes Proactive decision-maker, instead of just reporting the past.

- No more waiting for the end-of-month report.

- Immediate decision based on Data is constantly updated.

- Optimizing cash flow, budget, and investment.

5. Finance personnel are shifting from "doing" to "analyzing."

Personnel focus on higher value, reducing repetitive tasks, and increasing analytical and strategic consulting capabilities.

- Accountant → Analyst

- AP → Exception handler

- FP&A → Strategist

What are the risks and challenges of autonomous finance?

Although Autonomous Finance offers many benefits, businesses need to identify the risks and challenges to implement it effectively.

1. Dirty Data Risk

- AI and ML are only accurate when the input data is correct. clean, standardized.

- Duplicate vendor masters, incorrect invoice templates, mismatched purchase orders (POs)/grandparent orders (GRNs) → incorrect results, skewed decisions.

Solution: Data cleansing, validation rules, advanced IDP/OCR.

2. Process Discipline

- Autonomous Finance requires Normalized, clear processing flowFrom AP, AR, Expense, to Cash & FP&A.

- Unclear workflow → automation fails or requires continuous monitoring.

Solution: Process standardization, RBAC/ABAC, policy engine.

3. Security & Access Risk

- ERP systems, banks, eInvoices access sensitive data.

- The solution needed:

- Zero Trust architecture

- MFA (Multi-Factor Authentication)

- RBAC/ABAC detailed permission settings

- Compliance with standards SOC2 / ISO27001

Solution: Strict control, transparent audit trail.

4. AI Bias

- AI/ML can learn from words. data skew → making incorrect or biased decisions.

- Examples include predicting customer payments, categorizing expenses, or suggesting postings.

Solution: Regular testing, AI audits, and in-the-loop human reviews.

5. People Concerns about replacing personnel

- Many businesses worry that Autonomous Finance will Accountant replacement, AP, FP&A.

- Reality:

- Free up personnel from repetitive tasks.

- Personnel focused on handling Except & analysis

- Elevating roles: Analyst, Strategist, Exception Handler

Solution: Communication and training, personnel role transition.

Bizzi – Partnering with businesses on their Autonomous Finance journey

Bizzi doesn't claim to be "completely autonomous," as Autonomous Finance requires a standardized data platform and processes. Instead, Bizzi provides an Automation Foundation – a prerequisite for businesses to move towards autonomous finance.

1. Bizzi Bot – Touchless AP Platform

- Advanced OCR + AI + RPA, reads all types of Vietnamese invoices and various vendors.

- Self-matching of Purchase Order – Gross Receipt – Invoice (3-way matching)

- Automatic anomaly detection and fraud risk warning.

- Create your own ERP documents (posting AP, GR/IR, payment entry)

Result: Reduce manual operations by 70–90%, shorten cycle time (AP), and improve compliance.

2. Bizzi Expense – Autonomous Expense Control

- Self-detection of exceeding spending limits/budgets.

- Suggest your own cost allocation plan. by department, project

- Self-enforce spending policy according to rules and roles

Result: Control expenses in real-time, free up staff from data entry, and focus on analytics.

3. Bizzi ARM – Autonomous Receivable

- Automated debt reminders based on customer behavior.

- Predicting solvency each customer

- Self-check bank reconciliation with ERP and banking data

Result: Reduce DSO, accelerate debt recovery, and improve cash flow planning.

4. Sactona – Autonomous FP&A Foundation

To be "The predictive brain" for the CFO.This supports quick and accurate decision-making, giving CFOs strategic data at their fingertips and reducing planning and forecasting time.

- AI-powered forecasting historical trends, seasonality

- Scenario Planning to simulate P&L, cash flow, and OPEX/CAPEX scenarios.

- Plan vs Actual automatically updates according to real-time data

5. Bizzi = The foundational layer connecting all systems

- ERP Connection (SAP, Oracle, Odoo…)

- Connecting the tax system e-invoice

- Connect Banking API

- Synchronization Procurement / Vendor portal

Result: Seamless data and integrated automation processes create the conditions for businesses to move forward. Autonomous Finance really.

Conclude

The above is a complete explanation of what Autonomous Finance is. In general, Autonomous is a journey, not a "distant future." Vietnamese businesses can progress towards autonomous finance step by step: Automation → Intelligent Automation → Semi-Autonomous → Autonomous Finance. Each step has practical value, from reducing costs and shortening cycle time to improving control and real-time data.

Practical advice for businesses to get started is:

- Starting with Touchless AP: Receive, read, reconcile invoices, and create ERP documents automatically.

- Normalize Expense: Control spending, suggest allocations, enforce policy.

- Expand AR: Automatic debt reconciliation, payment prediction, and automatic debt reminders.

- Building the FP&A data platform: Forecast, scenario planning, real-time dashboard

Starting with these processes helps businesses build a solid foundation before aiming for higher levels of Autonomous Finance.

Bizzi supports Vietnamese businesses:

- Building a safe and practical self-sustaining financial platform.

- Integration with ERP, e-invoice, banking, and procurement systems.

- Adhering to domestic accounting procedures reduces risk and enhances control.

- Free up personnel from repetitive tasks, allowing them to focus on strategic analysis and decision-making.

With Bizzi, businesses don't need to achieve "complete autonomy" immediately, but can gradually reach Autonomous Finance, safely and effectively, and in line with the Vietnamese context. Bizzi is not just a tool, but a platform that connects, automates, and optimizes data, helping businesses build a solid foundation for self-managed finance, reduce costs, accelerate payment processing, control risks, and free up personnel for high-value tasks.

To receive personalized advice, register here: https://bizzi.vn/dang-ky-dung-thu/