Average working capital is the “blood” of a business – it determines the ability to maintain daily operations, seize market opportunities, manage risks, and demonstrate financial health. Businesses that manage their working capital well will have a solid foundation for long-term growth.

In this article, let's Bizzi Let's analyze the concept in more detail to understand what average working capital is!

What is average working capital?

Average Working Capital is a financial ratio that reflects the average amount of current assets used by a business over a given period of time (e.g. a quarter, a year). It shows a more general solvency and short-term financial health of a business than working capital at a specific point in time.

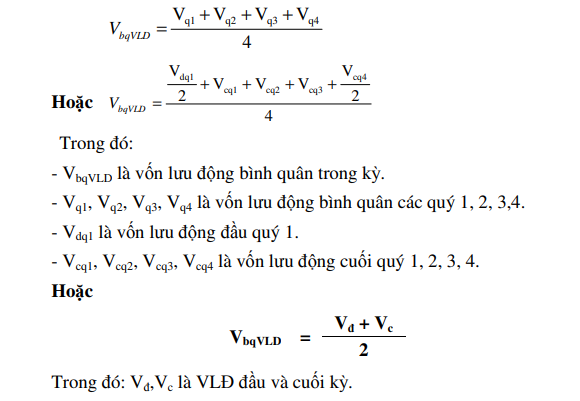

What is the formula for calculating average working capital?

- Average working capital = (Beginning working capital + Ending working capital) / 2

In there:

- Working Capital = Current Assets – Current Liabilities

- Current assets: Cash and cash equivalents, accounts receivable, inventories.

- Current liabilities: Accounts payable, short-term loans, accrued expenses.

What is the role of average working capital?

Working capital operates as a continuous financial flow throughout the enterprise. It keeps production and business activities uninterrupted, cost optimization and capital turnover, balancing liquidity and profitability. A healthy “flow” will help businesses operate smoothly, seize opportunities, and develop sustainably.

Here is the role of average working capital for each business:

Ensure short-term solvency

- Working capital reflects the difference between current assets and current liabilities.

- This is a “safety cushion” that helps businesses maintain their ability to repay debts on time, avoiding the risk of loss of reputation and liquidity crisis.

Maintain continuous operation

- Working capital provides resources for businesses to purchase raw materials, pay employee salaries, and cover daily operating costs.

- Without working capital, business operations can easily be disrupted or forced to rely on borrowing.

Increase financial flexibility

- Businesses with abundant working capital will be more flexible in taking advantage of business opportunities, for example: importing low-priced goods, expanding production, implementing promotional programs.

- Conversely, weak working capital forces businesses to miss out on many growth opportunities.

Risk Management Support

- A reasonable working capital structure (inventory, receivables, payables) helps businesses reduce the risk of cash flow imbalance.

- From there, businesses avoid the situation of "profit on paper, loss in reality" because they cannot keep up with cash flow.

Reflects the financial health of the business

- Working capital is an important measure in financial analysis to assess short-term operating capacity.

- Investors, banks, and partners often consider working capital before making decisions on cooperation, financing, or lending.

Optimizing capital efficiency

- Effective working capital management helps businesses reduce interest costs, limit excess inventory, and speed up debt collection. As a result, operating performance is improved and profits grow sustainably.

What are the factors that affect average working capital?

Factors that affect average working capital include: industry, size of business, financial situation, business cycle, sales and payment policies, inventory management, receivables and payables management, and other macroeconomic factors.

Understanding these factors helps businesses build effective working capital management strategies, ensuring continuous and stable business operations.

- Business size and characteristics

- Large businesses or industries that need to stockpile raw materials (such as manufacturing, construction) will need higher working capital than services.

- Business cycle & capital turnover

- Long production - sales - debt collection cycles require more working capital.

- On the contrary, fast capital turnover (selling goods and collecting money immediately) means low demand.

- Trade credit policy

- If a business gives customers long-term credit → must "lock up" capital longer → increase working capital.

- If the supplier gives you credit for many days → reduces working capital pressure.

- Inventory management

- Large inventory → a lot of capital is "buried".

- Efficient inventory management → reduces average working capital requirements.

- Debt management capabilities

- Slow debt collection → increased working capital needs.

- Good debt management → shorten collection cycle, reduce capital required.

- Economic environment & market volatility

- Interest rates, inflation, exchange rates… affect financial costs and working capital value.

- Unstable environment → need to reserve more working capital.

How to optimize average working capital with Bizzi technology solutions

To optimize average working capital, businesses can apply technology solutions to manage inventory, optimize payment and debt collection processes, and improve cost management efficiency. By applying these technology solutions, businesses can optimize average working capital, minimize financial risks, improve operational efficiency, and enhance competitiveness.

Bizzi is a comprehensive solution that helps businesses transform digitally, optimize workflows and improve operational efficiency. Suitable for most businesses of all sizes, especially those with many input invoices, wanting to optimize invoice and cost processing, Bizzi provides a solution set that integrates many features to help businesses solve financial problems effectively and concisely:

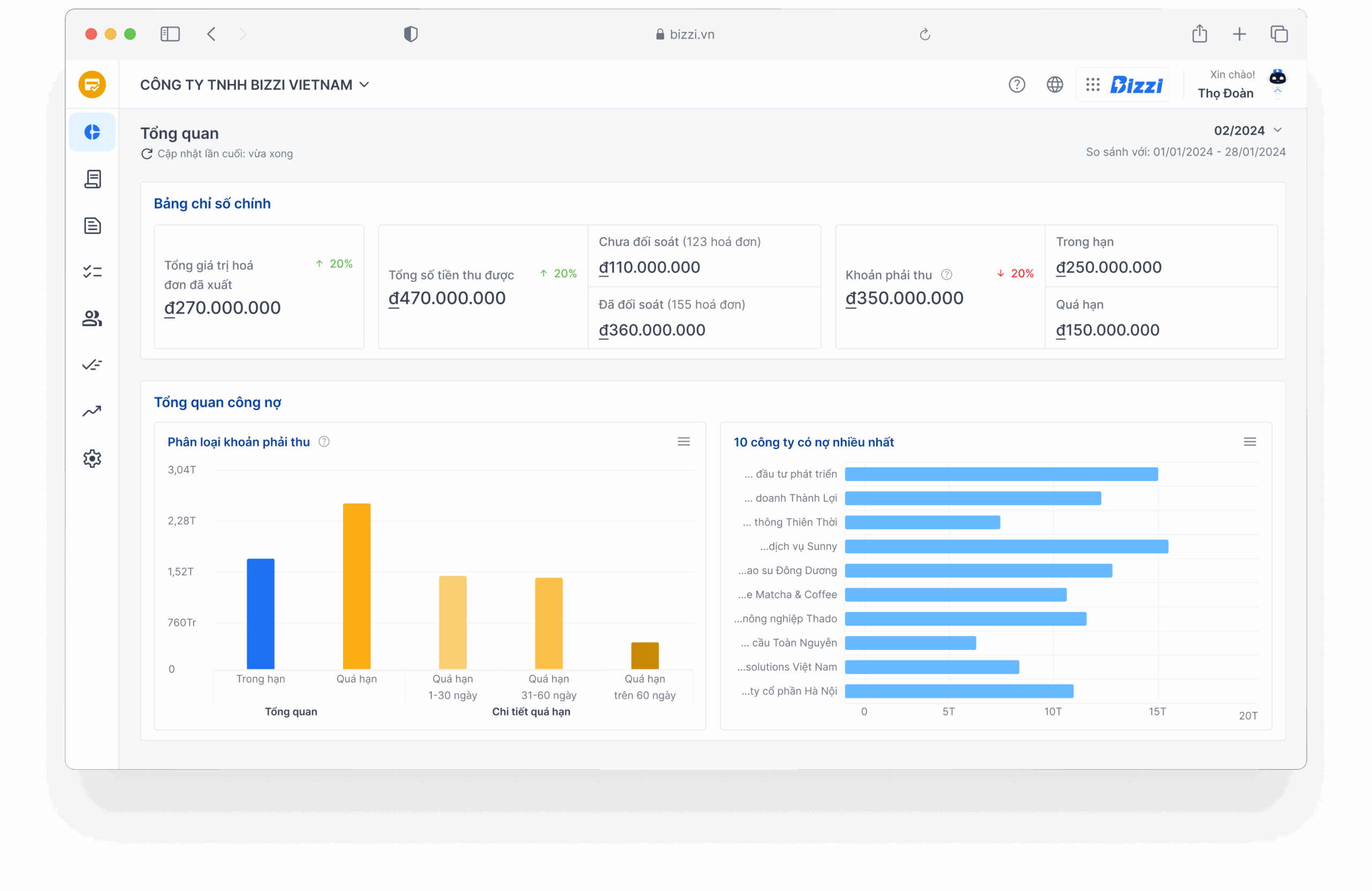

Speed up accounts payable and receivable processing with Accounts Receivable Management (ARM) Bizzi's:

- Automate invoices, quickly reconcile → limit errors, help pay on time, avoid penalty interest.

- Easily track cash inflows and outflows to forecast capital needs.

Automate your invoicing process with IPA + 3way:

- Automated invoice processing and reconciliation (PO – GR – Invoice)

- Supplier verification and risky invoice alerts help businesses manage payables efficiently and securely.

Optimize cash flow with Bizzi Expense:

- Budgeting Support

- Real-time spending monitoring

- Timely cash flow warning.

- Suggest cost adjustments or payment plans → maintain working capital at a safe level.

Reduce operating costs:

- Thanks to accounting automation, businesses save on personnel costs and processing time.

- Reducing this cost means increasing the efficiency of working capital use.

Provide real-time financial reporting and analysis:

- Management (CFO/CEO) can monitor liquidity ratios, debt turnover, and cash flow instantly.

- From there, make timely decisions to keep the "working capital flow" stable.

Seamless integration with ERP and accounting software:

- Ensure data is synchronized and accurate, making it easier to calculate and analyze average working capital.

Conclude

Through the above article of Bizzi, hopefully readers will have a more specific view of what average working capital is. In general, average working capital is not just a number, but a measure of the health and operational efficiency of the business. To optimize this index, businesses need a system financial management efficiently, automate manual processes.

Technology solutions such as the Bizzi platform are powerful tools to help businesses control and optimize working capital comprehensively. Bizzi.vn Helps shorten working capital cycle, optimize debt - cost - cash flow management, support quick and accurate decisions, thereby minimizing risks and improving average working capital efficiency.

To get advice on suitable solutions and experience all the features of Bizzi, register to make an appointment here: https://bizzi.vn/dat-lich-demo/