Even if a business is profitable, not proactively planning cash flow can still lead to a liquidity crisis, causing the business to struggle or fail. Cash flow planning helps businesses ensure continued solvency, supports strategic financial decision-making from early detection of potential problems, optimizes resource management and ensures stability.

Let's learn more about this content with Bizzi in the article below.

What is the Nature of Cash Flow & Cash Flow Planning

Below is a deeper analysis of the nature of Cash Flow, providing complete information to help managers have a multi-dimensional view in planning cash flow most effectively.

Definition of Cash Flow and Cash Flow Forecast

Cash flow (Cash Flow) is the flow of cash in and out of a business over a certain period of time, reflecting the ability to generate money, spend and maintain operations. Cash Flow Plan (Cash Flow Forecast) is a cash flow forecasting and management tool that helps businesses control, coordinate and optimize cash resources to ensure payment ability and business operations.

Distinguish between cash flow planning and budgeting

The main difference between budgeting and cash flow planning is shown as follows:

| Content | Budgeting | Cash Flow Planning |

| Target | Develop strategic, long-term financial plans to achieve overall business goals. | Ensuring liquidity means having enough cash at any given time to meet financial obligations, such as salaries, suppliers. |

| Time | Long term, usually 12 months or more. | Short term, usually weeks or months. |

| Scope | Forecast total revenue and total expenses, determining how much the business will spend and how much it will earn to achieve its goals. | Track real-time cash flow – when cash actually comes in and out of your business. |

| Nature | Like a blueprint, it shows the long-term financial expectations of the business. | Very practical and flexible, focusing on cash management at a specific point in time, knowing when to reinvest or when to raise capital. |

>> See more podcasts: Budgeting and cash flow planning for SME businesses 2025, Ms. Le Na – The CashFlow

The strategic role of cash flow planning in business

Cash flow planning plays an important strategic role in financial control, forecasting and business decision making, risk mitigation, and enhancing the ability to raise capital. It ensures that the business can maintain operations and develop sustainably, even when profits are not high. It helps the business “not die from running out of money” by continuously monitoring and adjusting cash inflows and outflows.

The Key to Maintaining Liquidity and Limiting Risk

Cash Flow Planning helps forecast income and expenses before they occur, so businesses can allocate cash appropriately, avoid liquidity shortages and minimize the risk of default or operational disruption.

- Verb context: forecast, control, prevent, protect.

- For example, when forecasting cash flow for the next three months, businesses can postpone or restructure large expenses if they detect a risk of shortage, instead of passively seeking emergency funding.

Support business and investment decisions

A detailed cash flow plan allows a business to assess its financial capacity before deciding to expand or invest. This allows decisions to be proactive, based on real data, reducing risk and optimizing profits.

- Verb context: coordinate, optimize, decide, take advantage of opportunities.

- For example, when forecasting cash flows for new projects, businesses can determine when additional capital can be invested, or choose the optimal timing of borrowing/investing so as not to affect current operations.

Free Cash Flow (FCF) and its significance in assessing financial health

Free cash flow (FCF) is the portion of cash flow available after operating expenses and investments in fixed assets. This is an important indicator to measure the ability to create real value, assess financial health and sustainable profitability.

- Verb context: calculate, evaluate, compare, optimize.

- In-depth meaning: Stable positive FCF shows that the business has the ability to repay debt, pay dividends and reinvest without relying on debt, which is a high credit index for investors and banks.

- For example, a business with positive and steadily growing FCF can expand, acquire new assets, or invest in R&D without affecting liquidity.

Detailed Cash Flow Planning Process

Below is 5-step detailed Cash Flow Planning process Action-oriented and easy to apply in business:

Step 1: Cash Inflow Forecast

Cash inflow is the amount of money the business expects to receive during the period. Need to be classified into 3 activities:

- Business activities:

- Sales revenue, service provision.

- Debt collection from customers.

- Investment activities:

- Capital recovery from sale of fixed assets, financial investments.

- Financial activities:

- Bank loans, bond issuance, capital contributions from shareholders.

Step 2: Cash Outflow Forecast

Cash outflow is expected spending amount. Also classified into 3 activities:

- Business activities:

- Cost of raw materials, employee salaries, operating costs.

- Investment activities:

- Purchase of fixed assets, financial investment.

- Financial activities:

- Loan repayment, interest and dividend payments.

Step 3: Determine Net Cash Flow

- Formula: Net cash flow = Cash inflow – Cash outflow

- Meaning:

- Positive net cash flow: The business has a cash surplus, good ability to reinvest or repay debt.

- Negative cash flow: Potential risk of liquidity shortage, need to find additional cash source promptly.

Step 4: Determine the Ending Cash Balance

Ending balance = Beginning balance + Net cash flow

- Provides an overview of available cash after each period.

- Helps businesses monitor liquidity continuously.

Step 5: Handling Cash Surplus/Short Scenario

- When short of cash:

- Adjust spending: postpone non-urgent expenses.

- Increase revenue: promote debt collection, accelerate revenue.

- Capital mobilization: bank loans, bond issuance or additional capital raising.

- When there is excess cash:

- Reinvestment: expand production, purchase fixed assets, R&D.

- Financial investment: deposit in bank, buy bonds, stocks.

- Early repayment: reduce interest costs and improve financial health.

By implementing this process, businesses can maintain liquidity, ensure sufficient cash flow for operations and development, thereby increasing competitiveness and firmly stepping on the path of sustainable growth.

Key Performance Indicators (KPIs) and Challenges in Cash Flow Planning

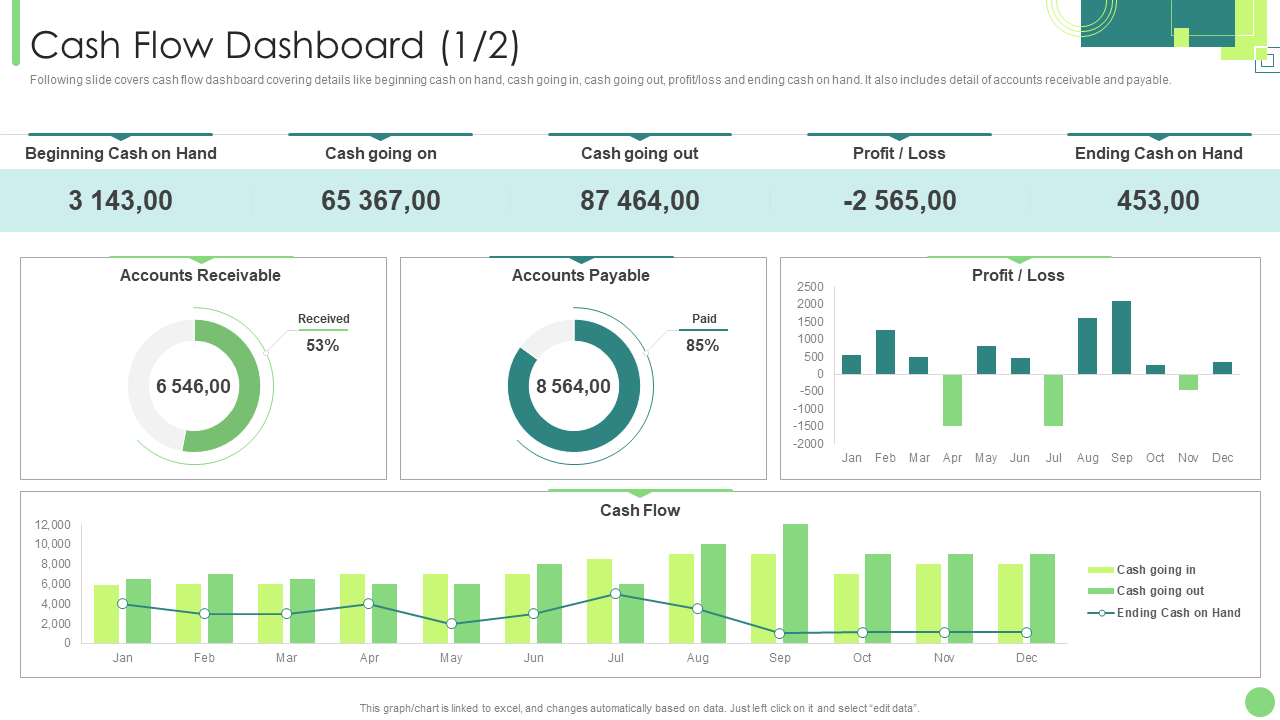

Cash flow management and planning KPIs help measure a business's liquidity and cash flow efficiency. Specifically:

Key Cash Flow KPIs to Track

- DSO – Days Sales Outstanding (Average number of days to collect payment from customers)

- Measures the average time it takes a business to collect debt from its customers.

- Meaning: Low DSO → fast collection, increased liquidity; High DSO → risk of cash shortage and bad debt.

- DPO – Days Payable Outstanding (Average number of days to pay suppliers)

- Measures the time it takes a business to pay its suppliers.

- Meaning: High DPO → businesses keep cash longer, improving cash flow; DPO too high → affects supplier relationships.

- Working Capital Cycle

- Calculated by: Working capital cycle = DSO + DIO – HPO

- In which: DIO = Days Inventory Outstanding (number of days of inventory).

- Meaning: Short cycle → fast cash flow, high profitability; long cycle → money locked in business operations.

- Current Ratio / Quick Ratio

- Current Ratio = Current Assets ÷ Current Liabilities.

- Quick Ratio = (Cash + Accounts Receivable + Short-Term Investments) ÷ Current Liabilities

- Meaning: Assess the ability of a business to pay short-term debt and protect liquidity against fluctuations.

Fully tracking these indicators helps businesses optimize cash flow, prevent risks and make accurate business decisions.

Common Challenges and Mistakes to Avoid

- Inaccurate data

- Data entry errors, outdated reports, or lack of clear classification between income/expenses.

- Consequence: unrealistic cash flow forecasts, leading to wrong investment or spending decisions.

- Lack of inter-departmental coordination

- Sales, accounting, purchasing and financial management departments are not in sync.

- Consequences: inconsistent cash flow forecasts, difficulty in controlling debt and liquidity.

- Market uncertainty

- Fluctuations in raw material prices, exchange rate fluctuations, changes in customer behavior.

- Consequence: cash flow plans are easily deviated, businesses need to have timely solutions.

Smart financial management with Bizzi: The key to optimizing cash flow and cash flow planning

Scenario Planning helps businesses forecast multiple scenarios and prepare plans, but it is still laborious and prone to errors. When applying the automation solution that Bizzi brings, the process becomes automatic, accurate and proactive, while providing tools to monitor, warn and optimize cash flow in real time, elevating from forecasting to strategic cash flow management and coordination.

The core difference between Scenario-based cash flow planning (Scenario Planning) and when Bizzi supports it, it comes down to the level of automation, accuracy and real-world responsiveness.

Scenario Planning

Traditional cash flow planning is often based on fixed assumptions, but markets and business operations are always changing. Scenario Planning is a method of forecasting cash flow under many different scenarios (normal, bad, optimal), helping businesses:

- Identify potential risks before they occur.

- Adjust spending plans, loans or investments in a timely manner.

- Compare the impact of business decisions on cash flow, thereby making more proactive and effective decisions.

How Bizzi.vn helps businesses control and optimize cash flow

Bizzi helps businesses manage cash flow intelligently by automating spending processes, tracking customer debts, and providing visual reports on financial situations, thereby optimizing cash flow and supporting effective financial planning. :

- Expense Control – Real-time budget management (Bizzi Expense)

- Helps businesses track costs by department, project, or phase.

- Prevent overspending, protect cash flow.

- Accounts Payable Automation (AP Automation)

- Ensure timely payments, reducing the risk of late fees and penalties.

- Integrate automatic reminders, approvals and recordings, saving time and increasing efficiency.

- 3-way matching: Invoice – Purchase Order (PO) – Receiving Report (GR)

- Check the accuracy and validity of expenses before payment.

- Avoid errors and fraud, strengthen Authoritativeness in corporate financial management.

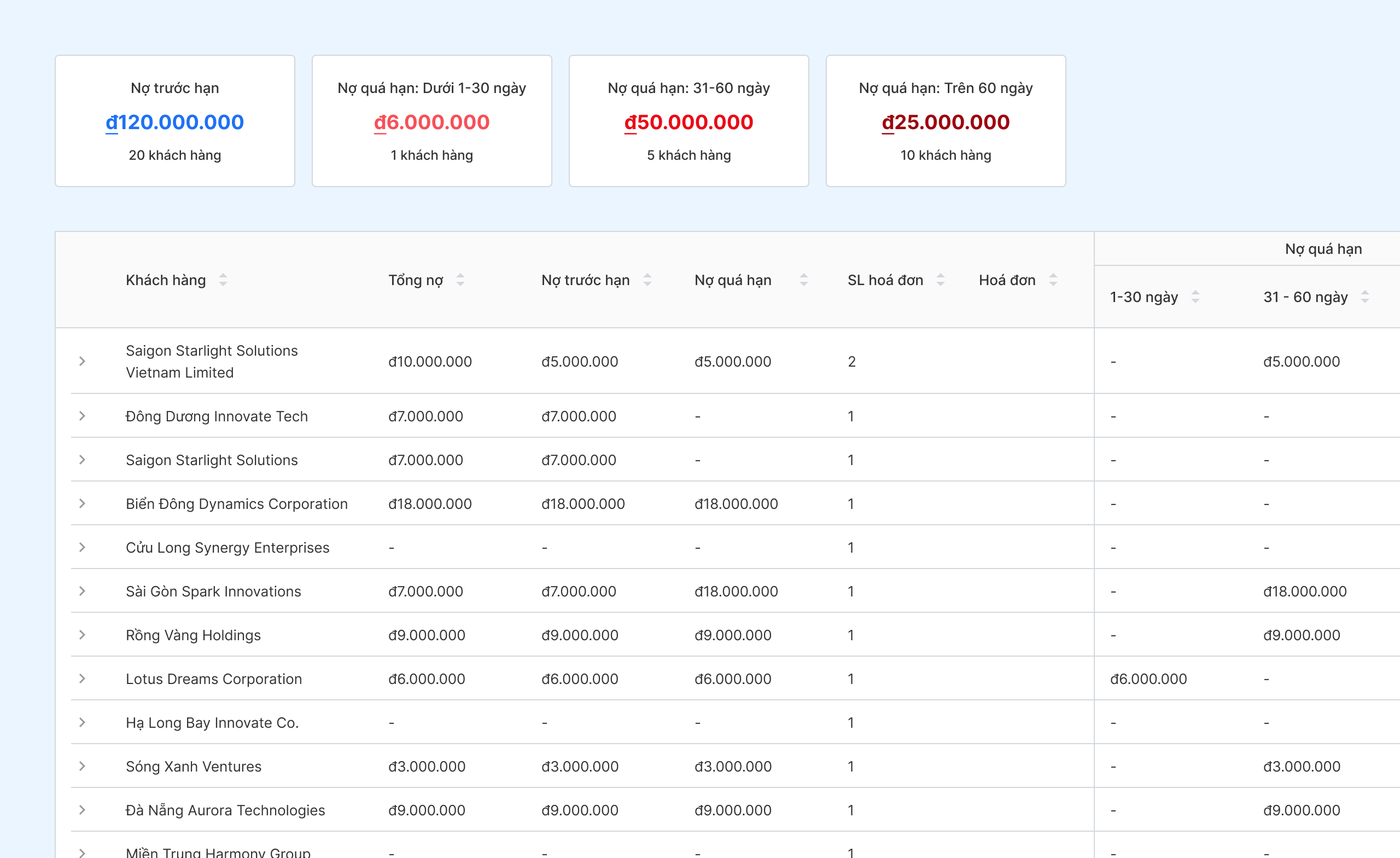

- Automate debt collection – Reduce DSO

- Automatic debt tracking system, customer reminders and accelerated cash flow into the business.

- Results: shortened collection time, improved liquidity.

Bizzi is not just an accounting software, but a cash flow strategy assistant, helping businesses proactively forecast, control and optimize cash flows, reduce risks and increase business efficiency.

Conclude

The entire cash flow planning process plays a core role in corporate financial management, helping to proactively forecast and coordinate cash flows. Compared to traditional management, the application of technology improves management efficiency by automating tasks, providing in-depth data analysis, and increasing forecast accuracy. Technology is the foundation for businesses to plan cash flows, make timely financial decisions, and optimize cash resources.

With a user-centric philosophy, Bizzi is committed to providing solutions and services that comply with international standards, while ensuring that user experience is a top priority. Bizzi offers comprehensive automation solutions, from expense control, invoice processing, debt management, to real-time expense reporting, helping businesses reduce errors, optimize cash flow and have an overview of financial health. As a result, Bizzi becomes a cash flow strategy assistant, supporting businesses to maintain liquidity and make effective business decisions.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/