In business, costs are the total amount of money, assets, labor, materials, services, etc. that a business must spend in a certain period to carry out production and business activities to generate revenue and profit. Tight control of all types of costs in a business is an important key for managers to be able to cost optimization most effectively

This article by Bizzi will provide full information on what the costs are, and also categorize them. types of costs in the business in the most detailed way.

What is cost in business?

Expenses are the total value of the amounts that reduce economic benefits during an accounting period. Expenses are recorded as decreases in assets or increases in liabilities, resulting in decreases in equity. Simply put, cost is the amount of money or resources an individual or organization must spend to achieve a specific goal, such as purchasing goods or using services.

Costs have the following basic characteristics:

- Associated with the decline in economic benefits: Every expense comes with the business having to sacrifice an asset or take on additional debt.

- Can be reliably measured: Costs must be determined based on documents, invoices or objective data.

- Comply with the appropriate principles: Expenses should be recognized in the same period as the revenue they generate.

- Quantified in money and determined in time: Costs must be calculated in monetary terms and tied to a specific period of time.

- Business related: Costs incurred from core business activities such as production, transportation, marketing and administration.

Why is it important to manage costs in business?

Effective management of all types of costs in a business is a key factor for the success of every organization. It is not only the responsibility of the accounting department, but also a strategic tool that helps:

- Profit Optimization: Balance costs to increase profits.

- Determine product selling price: Cost is the basis for pricing products/services competitively and reasonably.

- Business decision support: Accurate cost data helps management make decisions about investment, market expansion, or cutting inefficient operations.

- Performance Control: Cost is a measure to evaluate the effectiveness of each department and each project.

- Improve competitiveness: Cost optimization helps reduce prices and create advantages in the market.

- Minimize financial risk: Tight cost management helps maintain stable cash flow and sustainable development.

What is cost classification in accounting and business administration?

Classifying costs in a business helps leaders have a deep and multi-dimensional view of expenses. What is cost has been answered above, so let's see how costs can be classified according to many different criteria, depending on the purpose of use.

Classification by economic nature (Cost factor)

This classification is based on the nature of expenditures, which helps in budgeting and analyzing the efficiency of resource use.

- Material cost: Value of main and auxiliary materials, tools and equipment used in production.

- Fuel and power costs: Cost of gasoline, oil, coal, electricity, water used for operation.

- Salary costs: Total salary, wages, allowances paid to employees.

- Salary deductions: Social insurance (SI), health insurance (HI) and union fees.

- Fixed asset depreciation costs: Periodic deduction to recover capital invested in fixed assets.

- Outsourcing service costs: Costs for outsourced services such as transportation and repairs.

- Other expenses in cash: Remaining expenses not reflected above (taxes, fees, hospitality).

Classification by economic function (Cost item)

This classification helps to calculate product cost and control the cost of each part.

- Direct material cost: The cost of raw materials used directly to make a product.

- Direct labor costs: Salaries and deductions from salaries of direct production workers.

- Production cost shared: Costs related to service and production management at the workshop.

- Selling costs: Costs incurred in the process of product consumption (advertising, commissions, transportation).

- Business management costs: Costs for general management activities of the entire enterprise (board of directors' salaries, entertainment costs).

Classification by relationship to output

This is the most important classification in cost management, helping to analyze break-even points and planning.

- Fixed Costs (FC): The total amount of money remains constant whether output increases or decreases within a certain range (e.g. factory rent, management salaries).

- Variable Costs (VC): Changes in direct proportion to the level of production or business activity (e.g. direct materials costs, direct labor costs).

- Total cost formula: Total cost (TC) = Fixed cost (FC) + Variable cost (VC).

What are common mistakes when recording expenses?

Incorrectly recording expenses in a business can lead to misleading business results and poor decisions. Common mistakes include:

- Confusion between Expense and Expenditure: Spending is the act of paying, while expense is the reduction in economic benefits recognized in the income statement.

- Incorrect asset depreciation recording: The value of fixed assets must be gradually allocated to the costs of each period through deductions. depreciation, not all at once.

- Confusion between cost and inventory value: Raw materials only become costs when they are used in production. While they are in inventory, they are asset.

- Expense recognition depends on the invoice: Expenses are recorded when they are incurred, regardless of when you receive the invoice from the supplier.

Manage and optimize all types of costs in the business effectively thanks to technology

Cost management is a complex task that requires precision and consistency. The application of technology, especially cost management software is an essential solution to help businesses automate and optimize this process.

What are the benefits of technology in cost management?

- Process automation: Reduce time and effort on repetitive tasks like data entry and invoice reconciliation.

- Real-time control: Help managers grasp the spending situation quickly and accurately.

- Minimize errors: Automated software eliminates human error, ensuring data transparency.

- Smart decision support: Provide detailed reports, in-depth analysis, as a basis for optimal decisions.

Bizzi – A comprehensive solution to optimize and manage all types of costs in the enterprise

Bizzi.vn is a specialized technology platform that helps businesses manage and optimize costs effectively.

- Processing and managing input invoices: Automatically process invoices using AI and RPA technology, compare invoices with purchase orders and warehouse receipts, saving up to 80% of data entry time.

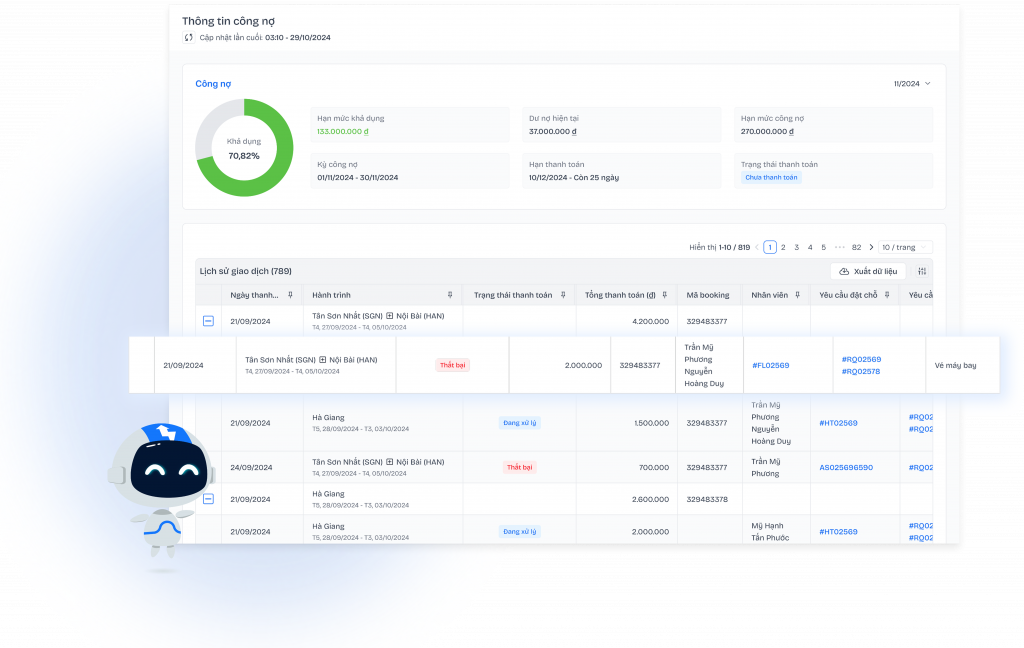

- Business Expense Management (Bizzi Expense): Allows setting and monitoring of real-time spending budgets, automatically approving spending in streams, preventing overspending.

- Business Travel Management (Bizzi Travel): Integrate automatic flight booking according to budget, manage all business expenses from travel, accommodation to incidental expenses.

- ERP Integration: Seamless connectivity with ERP systems leading like Oracle NetSuite, SAP, Microsoft Dynamics 365 Finance, Odoo, help synchronize comprehensive financial data.

What are the frequently asked questions when it comes to cost management?

Below is a summary of answers to common types of business costs:

-

How are fees and charges different from costs?

- Fee: An amount paid to cover the cost of receiving a public service (e.g. road toll).

- Fees: A fixed amount payable when a government agency provides a public service, not intended to cover costs (e.g. business license fees).

- Expense: A decrease in economic benefits during the accounting period, directly related to business activities.

-

Does cost management mean cost cutting?

Are not. Expense management is a comprehensive process that includes planning, monitoring, analyzing and controlling costs to achieve business goals. Meanwhile, cut costs is simply a specific action in the management process, focused on eliminating inefficient spending.

-

Which types of business expense management software are suitable for which organization sizes?

Cost management software is suitable for all business sizes, especially businesses with large transaction volumes, many branches or regularly having to handle complex financial operations.

Conclude

Understanding the nature of costs will help managers grasp the key to a particularly important indicator that directly affects business performance and the existence of the enterprise. Mastering the concepts, classifying and effectively managing costs in the enterprise is the foundation for optimizing profits and sustainable development.

In the context of technological development, businesses should proactively apply advanced solutions such as Bizzi.vn to automate cost management processes, thereby improving operational efficiency, minimizing risks and enhancing market competitiveness.

To get advice on cost management solutions specifically for your organization, Click here to schedule a demo: https://bizzi.vn/dat-lich-demo/