In an increasingly competitive and volatile business environment, effective debt management and collection is the key to helping businesses operate smoothly and avoid risks related to finance and cash flow.

- For administrators and accountants, building a standard debt management and collection process not only minimizes financial risks but also improves reputation and work efficiency. This is directly related to cost management, as prolonged debt can cause losses and collection costs.

- This article will clarify the concept of debt collection, its meaning, common forms and detailed procedures for effective debt collection.

What is debt collection?

Debt collection is the process by which the creditor requests the debtor to pay other amounts of money or assets when due or overdue according to the agreement/contract or according to the decision of a competent state agency (in case of a lawsuit in court).

This is an important activity in the financial management of a business, helping to ensure cash flow and liquidity.

What is the meaning of debt collection in business?

Effective debt collection plays a vital role in the financial performance and sustainable development of a business. Here are the key implications:

Improve cash flow

- Help businesses maintain stable cash flow, have enough resources to pay salaries, operating costs, purchase goods, raw materials, etc.

- Avoid cash shortages that lead to borrowing or operational stagnation.

Minimize financial risk

- Long-standing debt can easily become bad debt or irrecoverable debt.

- Timely withdrawal helps minimize the risk of capital loss, especially in volatile market conditions.

Improve capital efficiency

- Proceeds from debt can be reinvested in business operations, growth or expansion.

- Avoid the situation of “dead capital” lying in unprofitable receivables.

Increase business reputation

- Businesses that control debt well often have healthy financial reports, creating trust with partners, banks, and investors.

- Demonstrates professional and systematic financial management skills.

Optimize operating costs

- Timely debt collection helps reduce costs related to management, monitoring, legal, or opportunity costs due to not being able to use cash flow at the right time.

Support accurate business decisions

- Information from the debt collection process helps assess the payment capacity of each customer, thereby: Adjusting credit policies, Choosing more suitable partners and avoiding repeating mistakes in lending.

What are the forms of debt collection?

In Vietnam, businesses often apply many debt collection Depending on the status of the debt, the relationship with the customer, as well as the severity of the late payment. Below are common forms of debt collection:

| Form | How to do it | Advantage | Disadvantages |

| Direct debit reminder | How to do: Call, email, text, or meet in person to remind customers to pay.

Suitable for: Newly due or slightly overdue debt; maintain good customer relationships. |

Low cost, maintain goodwill between both parties. | No guarantee if the debtor is unwilling or evasive. |

| Send written notice/request for payment | How to do: Send official documents (debt reminder letters, warning letters) with the company's red seal.

Suitable for: Long overdue debts, repeatedly reminded not to pay. |

Create light legal pressure; serve as a basis for further processing steps. | |

| Apply financial/legal measures in the contract | Suitable for: Customers are deliberately procrastinating; there are clear handling terms in the contract.

|

Guarantee rights, have legal basis, low cost. | |

| Third Party Collection (Debt Collection Service/Attorney) | How to do: Authorize a debt collection agency or law firm.

Suitable for: Long-term, complex, difficult to collect debt. |

Have expertise, put strong pressure on debtors. | |

| File a lawsuit in court or economic arbitration | How to do: Bring the case to court or commercial arbitration for settlement.

Suitable for: Large debt, serious violation by partner, no more flexible handling. |

Deterrent, precedent-setting; can enforce judgment. | Time consuming, costly and affects business relationships. |

| Debt sale (debt transfer) | How to do: Sell debt to a debt trading company at a price lower than its original value.

Suitable for: Businesses want to quickly recover part of their cash to solve cash flow problems. |

Get money fast, no long term commitment.

|

Often have to accept low transfer prices. |

What is the debt collection process? Guide to building an effective process for businesses

The debt collection process is a series of steps established by businesses to ensure timely collection of receivables from customers, limit bad debt, increase transparency and proactively manage cash flow. This process includes not only debt collection actions but also document preparation, debt classification, internal coordination and legal action if necessary.

In addition to understanding what debt collection is, below is a commonly used 4-step reference process.

Step 1: Identify and Evaluate Debt.

- The Accounting or Finance department (sometimes with Legal) is primarily responsible.

- Monitor and periodically reconcile accounts receivable with customers and suppliers.

- Periodically report on due/overdue debts and assess recovery potential.

- Assess the risk of each debt based on value, time overdue, customer payment history/ability.

- Classify debt into risk groups to prioritize and develop appropriate strategies.

- Share assessment results with relevant departments.

- Use accounting software to track debt age, automatic reminders.

Step 2: Plan Debt Collection.

- Determine specific collection targets for each debt group.

- Set a specific deadline for collection.

- Designate a person/group of people responsible for collection

- Choose the appropriate collection method for each case (e.g. debt notice, email, phone call for due debt; face-to-face meeting for overdue debt).

Step 3: Implementation Collection.

- Send professional, clear, and informative debt reminders.

- Communicate respectfully but firmly.

- Select the appropriate recovery person/agency (in-house or professional) based on skills, experience, and legal knowledge. Management may need to be involved if the employee is having difficulty.

- Closely monitor progress and results, adjusting steps based on customer feedback.

- For bad debts, consider flexible solutions: debt restructuring, deferral, partial debt reduction, recording and signing legal documents.

- Consider referring the debt to a professional debt collection agency if negotiations are ineffective.

- Last resort: consider legal action, carefully evaluate costs, recovery possibilities, and image impact. Consulting a lawyer is essential.

- Closely manage to ensure compliance with laws and not aggravate financial situation.

Step 4: Evaluate, Report, Feedback, and Improve Process

- Self-Assessment: Periodically evaluate process performance (success rate, time, cost) to identify areas of effectiveness and room for improvement.

- Collect customer feedback: Understand customer satisfaction, improve credit policies and services.

- Process Improvement: Analyze collected information to update credit standards, risk assessment criteria, credit terms, communication methods, etc. This is a continuous cycle.

- Staff training: Improve team capacity in methods, tools, techniques, communication, negotiation, software usage, and legal knowledge.

Prevent future debt

Preventing debts from arising and becoming bad debts is an important part of corporate financial management. Below is a detailed guide on how to prevent future debts, helping businesses proactively control risks.

Carefully assess customers before granting credit

- Collect information: Transaction history, market reputation, financial reports, solvency.

- Risk Rating: Classify customers according to credit rating (A, B, C…) to adjust payment terms accordingly.

- Find out about the legal representative: For businesses, it is advisable to verify the legality, representative, and compare information on the national information portal.

Establish a clear credit policy

- Specific regulations on payment limits, terms, early discount conditions and penalty interest for late payment.

- Prepare a tight contract with terms on: Payment terms – Late payment penalties – Liquidation and litigation conditions

- No "leniency" when applying credit policies.

Sign full contract, keep tight records

- Have delivery/receipt records, invoices, contracts, reconciliation statements, etc.

- Keep full soft and hard copies as evidence when needed for comparison or legal processing.

Debt management software application

- Use systems like Bizzi, MISA, Fast, or integrated ERP software to: Track payment history, Automatic debt reminders, Due/overdue debt warnings

- Minimize risks from manual debt management.

Communicate and follow up regularly

- Set up a periodic debt reminder process (3–5 days before due date, due date, overdue date).

- Maintain good relationships to catch financial difficulties from customers early and find solutions early.

Training accounting and sales team

- Understand the debt checking process and handle late payment.

- Understand contracts to coordinate smoothly with legal/accounting department.

Limit debt with flexible payment methods

- Recommend partial prepayment/100%, COD (cash on delivery), or payment through a guaranteed intermediary partner.

- Apply early payment discounts to motivate customers.

Periodic review and reconciliation of accounts receivable

- At least once a month: Send debt reconciliation to customers for confirmation.

- Avoid data discrepancies due to recording errors.

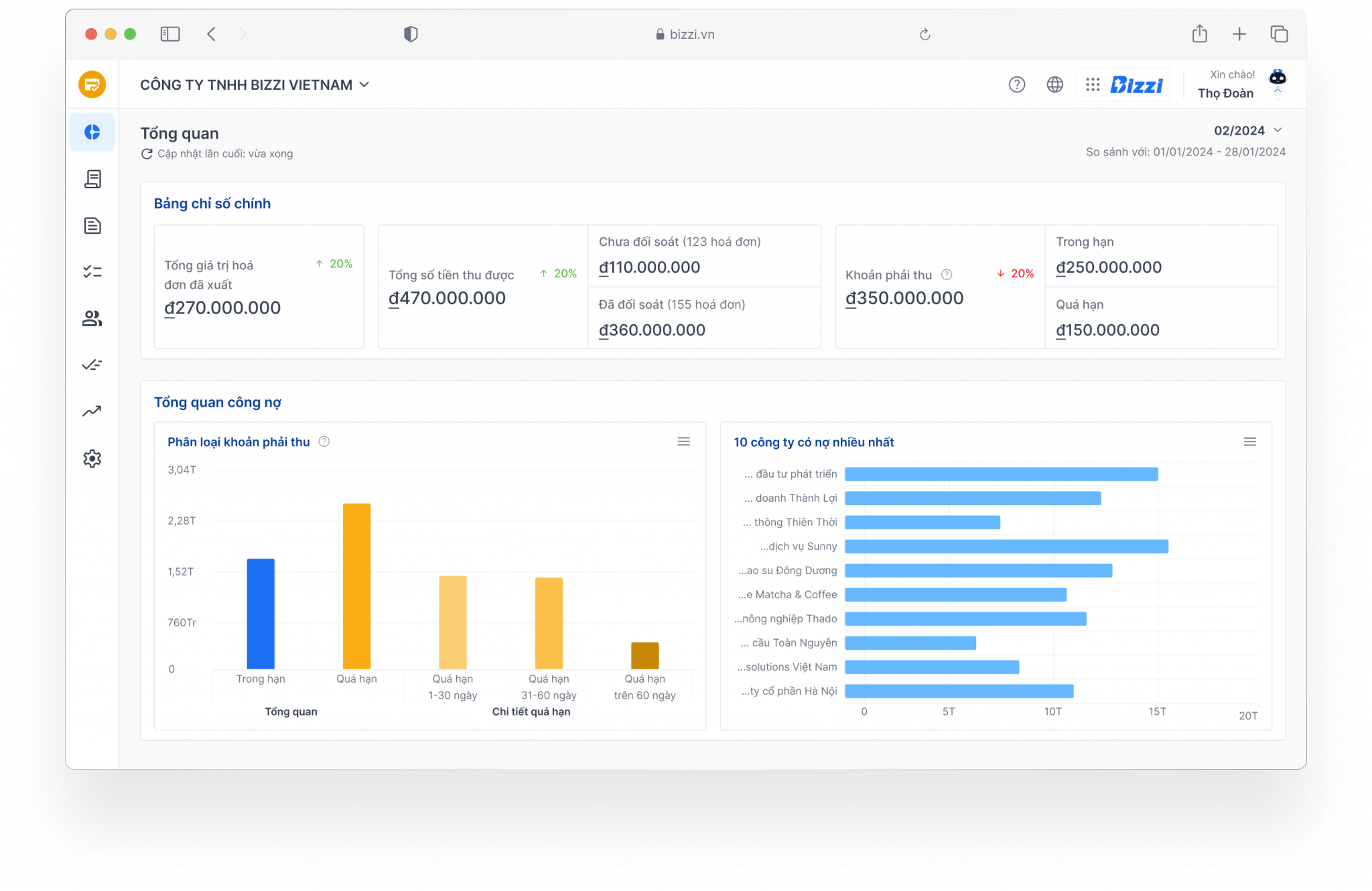

Bizzi – Modern solution to support debt collection management

Bizzi is a comprehensive solution for modern finance departments. With Bizzi, businesses can build smart financial management processes, save maximum implementation time and optimize cash flow effectively.

Automatic debt reminder

- Set up debt collection procedures according to available scenarios.

- Send debt reminders via email and SMS automatically and on time.

Comprehensive debt management

- Track and reconcile debts for each partner (customers & suppliers).

- Manage important indicators such as: DSO (Days Sales Outstanding), Aging Report

Record and track detailed debts

- Automatically update debt data.

- Track debt balances of each customer and each supplier.

Debt due warning

- The system detects and warns of debts that are about to mature or are overdue.

- Help businesses proactively handle and limit credit risks.

Reconciliation of debts

- Compare and verify data between business and customers/suppliers.

- Ensure transparency and accuracy in financial data.

Flexible debt reporting

- Create custom reports on debt status.

- Support fast, intuitive data-driven decision making.

Conclude

Understanding the nature of debt collection and building an effective debt management and collection process is an indispensable part of effective business management. Each step in the process plays an important role in ensuring financial stability and sustainable development.

In addition, training and capacity building for staff is a key factor. To improve work efficiency, using modern accounting software can effectively support, reduce workload and increase accuracy.

With Bizzi's automatic debt management solution and smart reminder process, it helps automate the payment process, shorten debt collection time and optimize cash flow. Applying an effective process helps businesses improve their financial situation, optimize cash flow and build a foundation for sustainable growth.

Sign up now to experience the automated debt management platform for businesses.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/