Determining the debt limit in financial and business management not only helps maintain financial stability but also contributes to improving the efficiency of resource management. In this article by Bizzi, let's find out what the debt limit is to come up with an effective solution to control the debt limit.

What is the credit limit? What is the formula for calculating the credit limit?

A credit limit is the maximum amount of money an individual or business can borrow/ow (without paying in advance) from a financial institution (bank, credit card company) or partner/supplier over a specified period of time, based on an agreement.

What is an example of a credit limit?

- Enterprise A sets the debt limit with agent B as 200 million dong.

- That is, the total amount of goods that agent B can take without payment does not exceed 200 million VND at any time.

Formula for calculating debt limit

There is no single formula that is set for every business, but here is a common formula to use as a guide:

Accounts receivable limit = Average monthly sales × Accounts receivable turnover

In there:

- Average Monthly Sales: The average value of orders in 1 month.

- Debt turnover: Number of times debt is collected during the year (usually calculated as: 360 / Number of days of debt collection).

Formula to determine Current Outstanding Balance:

Outstanding debt = Debt limit – Total transaction value + Total value paid by the Customer.

Meaning of Outstanding Balance > 0: Condition for Corporate Customers to continue transactions.

Common types of credit limits

Below are common types of credit limits in businesses – especially in the distribution, retail, or service sectors:

| Limit Type | Features and examples |

| Customer Credit Limit | Is the maximum debt allowed for each specific customer/dealer. Based on: transaction history, financial situation, payment ability. For example: Agent A is given a limit of 300 million - meaning the total unpaid orders cannot exceed 300 million. |

| Group Credit Limit | Applied to a group of customers with the same characteristics (by region, dealer level, product line...). Management is easier when a business has hundreds of small customers. For example: All level 2 agents are only given a limit of 150 million, not considered individuals. |

| Credit Term Limit | Regarding payment term: maximum time that a customer can owe without being penalized/blocked.

For example: Customers are allowed to be in arrears for up to 45 days. After 45 days of non-payment, the credit limit will be locked or delivery will be stopped. |

| Per Transaction Limit | Credit limit for each individual order, not to exceed a specific amount. For example: An order cannot exceed 50 million, even though the total limit is 300 million. |

| Revolving Credit Limit | Customers are given a limit as a “debt revolving” that can be continued after paying off the old debt.

For example: Limit of 500 million: if 200 million has been paid, there will be 200 million available. |

| Temporary Credit Limit | Issued in special cases such as promotions, peak sales, or seasonality. For example: During Tet, customers' limit is increased from 300 to 500 million in 30 days. |

What factors determine credit limit?

Determining and setting credit limits is an important step in managing a business’s finances and credit risk. Here are the details:

- Financial capacity: Assets, revenue, cash flow, debt repayment ability.

- Credit history: Reputation, history of timely repayment (good history = higher limit).

- Business Relationships: Long-term, trustworthy relationships (resulting in higher limits).

- Contract Type: Affected by contract type and transaction risk level.

- Limit issuer policies: Internal regulations, financial strategy, risk assessment process.

Process of setting and adjusting credit limits

The process of setting and adjusting debt limits plays a very important role in financial management, risk control and maintaining healthy cash flow of the business.

Initial setup:

- Assess financial needs and ability to repay.

- Choose a source (bank, financial institution), compare interest rates, conditions.

- Application with documents proving income, credit history.

Review and approval:

- Check credit history to assess repayment ability (account balance, history of timely repayment).

- Determine maximum limit based on financial information and credit history.

- Decision announcement.

Adjust and manage:

- Request adjustments when financial needs change or if you want to increase your limit.

- Fulfill financial responsibilities (pay debts on time, do not exceed the limit).

- Keep a close eye on the limit.

- Contact the limit issuer if you encounter difficulties or need to make changes.

Adjust over time:

- Limits may be reviewed and adjusted based on credit and financial history.

- Maintaining a positive credit history can help increase your credit limit and lower your interest rate.

What is the role of debt limit? Why is it necessary to set debt limit?

The credit limit is not only a financial management indicator, but also an important tool to help balance the interests of the seller (creditor) and the buyer (debtor/borrower). Below is an analysis of the specific roles for both parties, and why setting a limit is necessary.

| The role of credit limits with the seller (lender/supplier) | The role of credit limit with borrowers (customers, agents, distributors) |

| Credit risk management: Helps businesses control total receivables, avoid exceeding financial capacity or being over-leveraged.

Cash flow protection: Maintain a steady cash flow for operations and production, without being "blocked" by overdue debt.

Filter and classify customers: Limits are granted according to the reliability and liquidity of each customer → easy to decide to sell or stop trading.

Balance sales growth and risk management: Allow controlled credit expansion, supporting customer growth without compromising financial risk. |

Increase the ability to purchase without immediate payment: Help customers have more working capital to rotate business, especially agents or small businesses.

Increase reputation and cooperation opportunities: Being granted a high limit shows trust from the supplier, which can lead to additional incentives (discounts, marketing support, etc.).

Easy to manage internal finances: Knowing the maximum amount of debt helps customers plan better payments and avoid having their orders blocked due to overdue debt. |

What is the reason for setting a credit limit?

- Avoid losing control of receivables: Without clear limits, customers may owe more than they can afford, increasing the risk of losing capital.

- Ensure fairness among customers: Have a clear basis for approving limits based on actual capacity, avoiding bias or emotion.

- A tool for building transparent credit policies: Helps sales, accounting, and finance teams coordinate effectively.

- Increase business professionalism and reputation: Having a debt control process shows professionalism and helps partners trust more.

Risks associated with credit limits

Setting a debt limit helps businesses manage their finances effectively, but if not well controlled, financial and operational risks can still occur. Below are common risks, ways to limit and control debt limits effectively:

- Customers are unable to pay: Causes bad debt, loss of capital, affects cash flow.

- Uncontrolled quota overrun due to weak censorship system, overly “flexible” sales staff

- Incorrectly determining the limit due to underestimating the risk, granting too high a limit to an incompetent customer, leading to loss of debt collection ability.

- Lost sales opportunities due to low quota

- Not monitoring and updating debt limits in a timely manner

- Limits are not adjusted when customers' financial situation changes → leading to potential risks.

- Customers "procrastinate" and extend payment deadlines

- Not exceeding the limit but the debt cycle is prolonged, causing capital to be "frozen".

How to control debt limit effectively

Effective debt management is the backbone of corporate financial management, especially when the business expands or operates on a deferred payment or trade credit model. Good debt management not only helps control cash flow, but is also a tool for sustainable business development and preventing financial crises.

| Measure | Target |

| Establish transparent credit policies | Create a unified control platform between departments |

| Customer segmentation by risk | Close control with poor history customers, flexible expansion with good team |

| Use debt management software | Automate real-time alerts, analysis, and reporting |

| Business staff training | Help them understand the role of limits, avoid "selling at all costs" causing debt overload |

| Periodic inspection and reporting | Debt performance analysis: collection rate, over-limit rate, overdue debt |

Software Bizzi Providing solutions for managing receivables and payables, supporting businesses to effectively control debt limits with outstanding features:

Accounts receivable management

- Detailed debt tracking: Manage debt by invoice, contract and customer, helping businesses grasp the debt situation accurately.

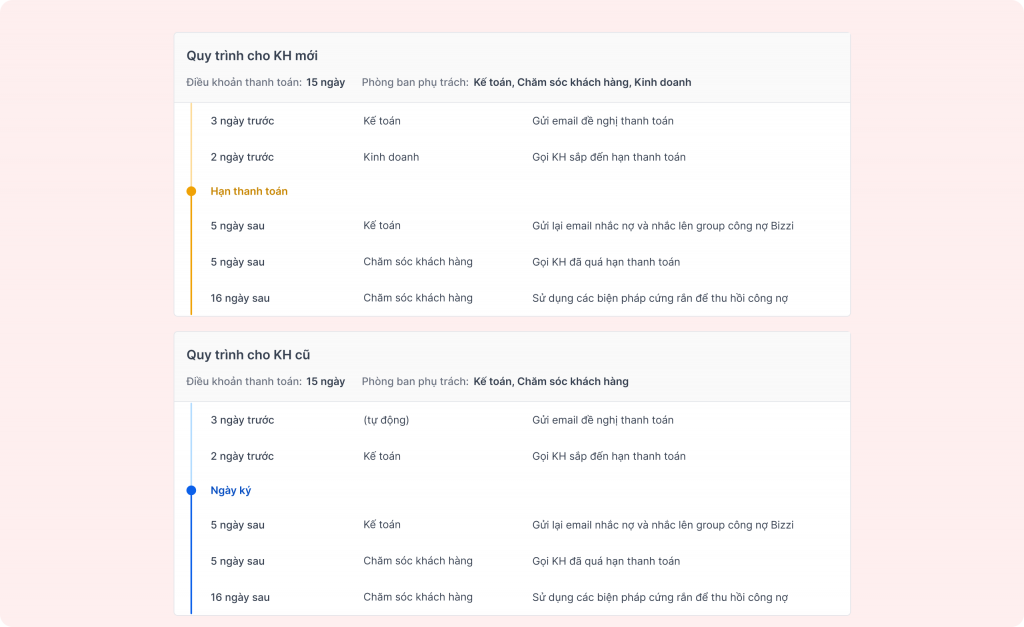

- Automate debt collection: Set up customized debt collection processes based on your needs, including payment reminders and due date alerts.

- Reporting and analysis: Provides key metrics such as days outstanding (DSO), debt aging reports, supporting the assessment of debt collection efficiency and credit risk.

Accounts Payable Management

- Automate your payment process: Automatically collect invoices, approve and update supplier profiles, reducing errors and fraud.

- Payment reconciliation: Automatically reconcile payments with bank statements, ensuring accuracy and transparency in transactions.

- Update debt status: Automatically notify relevant departments about debt and payment status, helping to manage cash flow effectively.

Integration and expansion

- Integration with ERP systems: Bizzi can integrate with ERP systems like Odoo, helping to synchronize data and optimize accounting processes.

- Expense settlement support: Bizzi Travel & Expense helps digitize the entire business workflow and spending, from payment request to approval and reconciliation

Epilogue

In short, understanding the nature of debt limits and setting debt limits is an indispensable step in corporate financial management - helping to balance growth and safety, sales and collection, and risks and opportunities.

Good management of debt limits and debt in general contributes to risk control, capital optimization, strengthening partnerships and maintaining stability and sustainable growth for businesses.

Using Bizzi, businesses can effectively set and control debt limits, minimize financial risks and optimize cash flow. To learn more or sign up for a trial, you can visit Bizzi's official website at bizzi.vn.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/