Accounts receivable is an inevitable part of every business. Effective debt management not only helps maintain a stable cash flow but also plays an important role in controlling business finances and costs. Understand What is debt management? and mastering the debt collection process will help businesses limit financial risks, improve financial health and promote sustainable development. This article will explain in detail the concept of debt management and guide the steps of effective debt collection, to support business owners and accountants in optimizing financial management.

1. What is Debt Management?

1.1 Concept of Debt

Accounts receivable is the sum of all debts owed to customers and debts owed to suppliers at a given point in time. This is the result of transactions for the purchase of goods, services or loans that have not yet been paid. Managing accounts receivable helps businesses accurately track cash flow and ensure financial stability.

1.2 Concept of Debt Management

Accounts receivable management is the process of controlling and coordinating activities related to the collection of receivables from customers, partners or individuals. At the same time, it includes recording and monitoring receivables and payables, ensuring that the business does not suffer a working capital deficit due to debts not being processed promptly.

1.3 Objectives and Importance of Debt Management

Debt management is a key activity that helps businesses ensure timely and effective collection of money, thereby maintaining continuous operating capital. Good debt control not only minimizes financial risks but also contributes to enhancing the stability and sustainable development of the business.

- Ensure efficient and timely collection of funds, helping to maintain continuous operating capital.

- Control cash flow so that businesses can pay expenses and invest in development.

- Minimize bad debt risk, increase cash recovery ability, thereby minimizing debt handling costs.

- Increase financial stability, creating a solid foundation for sustainable business development.

- Optimize the use of capital, avoid capital being "stuck" in uncollected debts and unprofitable capital.

- Maintain good relationships with customers, ensuring long-term and sustainable cooperation.

- Evaluate financial performance through key metrics such as collection cycle and bad debt ratio.

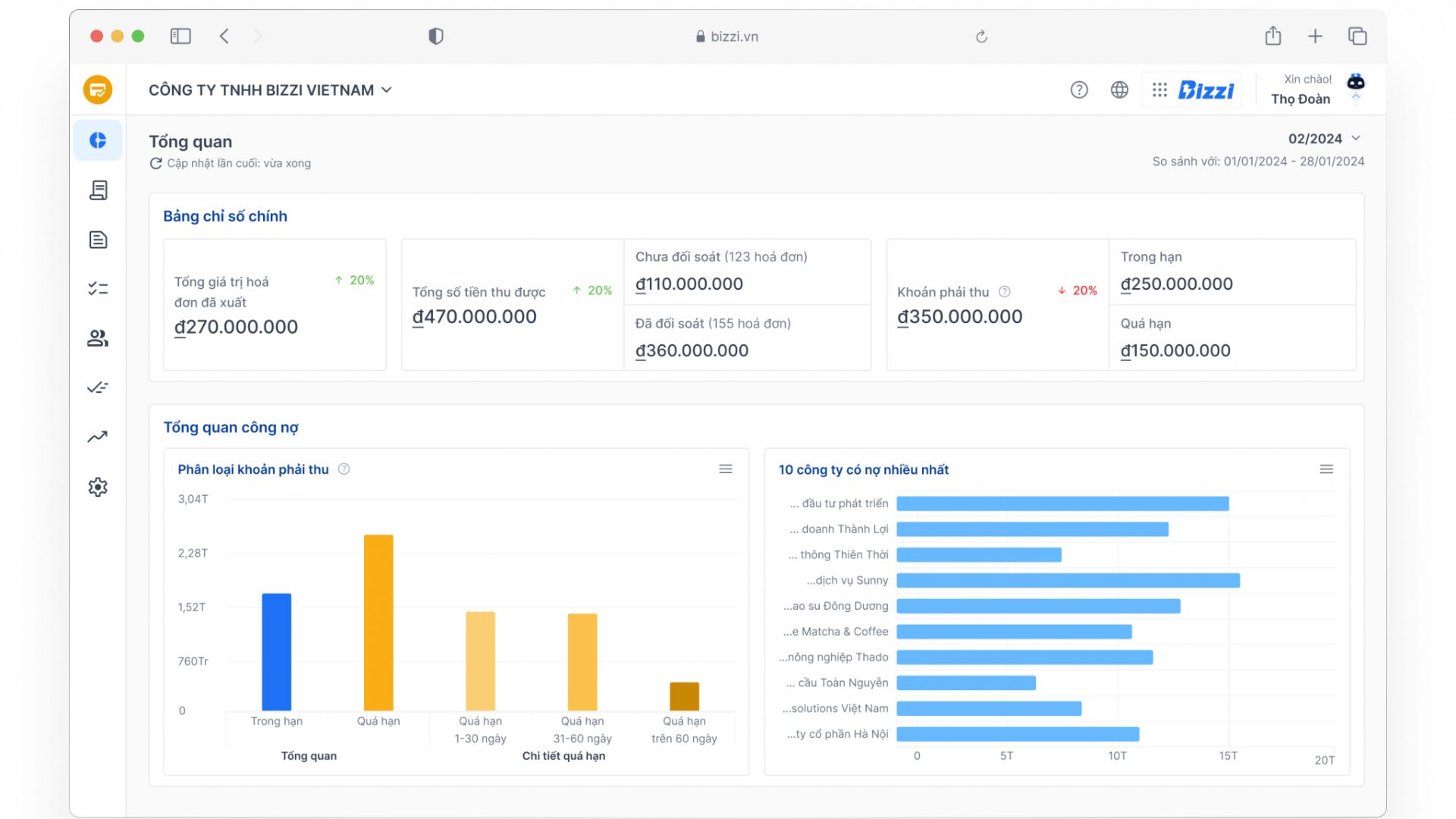

In Bizzi.vn, we understand that debt management is a key factor in maintaining cash flow and financial health of the business. Bizzi debt management software is designed to help business owners and accountants easily track, remind and handle debt effectively, thereby optimizing the capital recovery process and minimizing financial risks.

2. Debt Classification

Clearly understand What is debt management? First of all, you must understand the common types of debts in business. Debt classification helps business owners and accountants have an overview, thereby building effective debt collection strategies and optimal cost management.

The main types of debt that businesses need to focus on managing include:

- Accounts receivable from customers: This is the amount of money that a business sells or provides services but has not yet collected from customers. This is also the focus of debt collection process, because accounts receivable directly affect the cash flow and solvency of the business.

- Accounts payable to vendors and suppliers: This is the amount of money that a business has purchased goods or services but has not yet paid for. Managing accounts payable helps businesses control costs, avoid the risk of losing reputation and maintain good relationships with suppliers.

Understanding What is debt management? and correct classification will create a solid foundation for the next steps in effective debt management, helping businesses increase their ability to recover and control finances sustainably.

3. Requirements for Effective Debt Management

Effective debt management not only helps businesses protect cash flow but also maintains sustainable customer relationships and enhances reputation in the market. To answer the question “What is debt management”, Bizzi emphasized that this is a process of controlling and collecting receivables in a strict and scientific manner based on the following important factors:

- Establish a clear debt policy: Enterprises need to develop policies on credit limits, payment conditions, debt collection procedures and bad debt handling in a strict, transparent and continuously updated manner to minimize credit risks. This policy creates a solid foundation for debt management, helping departments easily coordinate and implement effectively.

- Identify reliable customers: Before providing services or goods, businesses should conduct a thorough credit check on customers. This assessment helps limit the risk of bad debt and select suitable partners, protecting the company's assets and reputation.

- Close debt monitoring and collection: Apply a scientific debt tracking system to ensure timely recording of receivables. The collection process needs to be standardized, implemented on time, combining flexible and strict measures to optimize debt collection efficiency.

- Effective customer engagement: Proactive and timely communication with customers about debts helps to quickly resolve disputes or complaints, while maintaining positive business relationships and avoiding potential risks that affect cash flow.

- Using technology in debt management: Bizzi.vn encourages businesses to apply automatic debt management software to increase accuracy, reduce errors and save time in tracking, reporting and debt collection.

- Intensive staff training: Equip employees with debt collection, customer communication and situation handling skills to improve their ability to handle arising problems, contributing to creating a flexible and effective debt management process.

Bizzi believes that when businesses apply the above factors synchronously, they will have a solid foundation for implementing a professional and effective debt management process, thereby optimizing cash flow and minimizing financial risks in business.

4. Tools to Support Effective Debt Management

What is debt management and how to control debt effectively is a question of interest to many business owners and accountants. Currently, there are many tools to support debt management, from traditional methods to modern solutions, helping to optimize processes, minimize errors and improve cash flow management efficiency. Below is an overview of popular tools with their advantages and disadvantages to help you easily choose the right one.

- Traditional books: This is the most basic way to manage debts, does not require high costs and high-tech skills. The advantage of books is that they are easy to use, suitable for small businesses or startups. However, this method is very time-consuming, easy to confuse, difficult to review and summarize, and has the potential risk of data loss if not carefully preserved.

- Excel: Compared to books, Excel is more modern with the ability to automatically calculate and arrange data scientifically, helping to save time on manual recording. However, Excel is still limited when it has to be stored on personal devices, making it difficult to work in groups and still has the risk of losing data due to technical errors or wrong operations. Besides, Excel lacks advanced features such as automatic debt reminders or professional detailed reports.

- Sales management software and specialized debt management application: This is the most optimal solution for modern businesses, especially those with large scale and transaction volume. The software helps track debts accurately and in detail, manage reasonable debt limits, automatically update debts for each transaction, and store transparent payment history. The automatic debt reminder feature via Messenger and SMS helps minimize overdue debts, while also exporting detailed reports on debt status and debt age so that businesses can proactively control cash flow and avoid ineffective capital appropriation. In addition, the software also manages complete customer and supplier information, helping to professionalize the process and save working time. The only downside is that the initial investment cost can be high depending on the type of software, but the long-term benefits are clearly superior.

- Examples of effective debt management software – Bizzi.vn: Bizzi provides a smart debt management solution with comprehensive features such as accurate debt control, automatic debt reminders, detailed management of customers and suppliers, multi-dimensional reports on debt status and debt age. This solution helps businesses control cash flow effectively, minimize financial risks and improve the productivity of the accounting department. With Bizzi, debt management is no longer a burden but becomes an important competitive advantage for businesses.

Bizzi's automated debt management platform for businesses helps solve all problems in debt processing and collection:

- Increase overdue debt collection efficiency through reminders and automated emails. Ensure no overdue customers are missed.

- Save time, costs, limit risks. Avoid procedural hassles, shorten debt repayment time.

- Monitor employee debt collection process, track customer debt collection history

- Track debts by invoice, contract and customer conveniently.

- Manage pending payment reconciliation lists and automatically reconcile with bank statements.

- Automatically notify relevant departments about debt and payment status.

If you are looking for the optimal solution to the problem What is debt management? and want to improve work efficiency, Bizzi is a reliable choice with modern technology and diverse features, helping you confidently develop a sustainable business.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/

Conclude

Debt management is not simply about collecting and paying money, but also a vital factor, directly affecting the cash flow and financial stability of the business. Understanding What is debt management? helps businesses build effective debt control strategies, thereby minimizing the risk of capital loss and improving liquidity. A good debt management system will help businesses optimize capital sources, balance cash flow, and contribute to improving efficiency in cost management and business operations.

Vietnamese businesses, especially business owners and accountants, should consider applying modern methods and professional support tools such as Bizzi management software. This software not only helps automate the debt tracking process but also supports cash flow analysis and forecasting, helping businesses make more accurate and timely financial decisions. Investing in smart debt management solutions is a strategic step to help businesses develop sustainably in an increasingly competitive market.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/