DSO is not only an accounting number but also a strategic indicator for businesses to balance cash flow, credit risk and business performance. The following article by Bizzi will clarify the concept, formula and meaning of DSO. At the same time, Bizzi will give advice and provide effective DSO management strategies for businesses.

What is DSO? Definition and Importance of DSO for Accounting, Finance and Business

To better understand the nature of DSO, let's find out specific information about the definition and importance of DSO in finance and business.

Days Sales Outstanding (DSO) Definition:

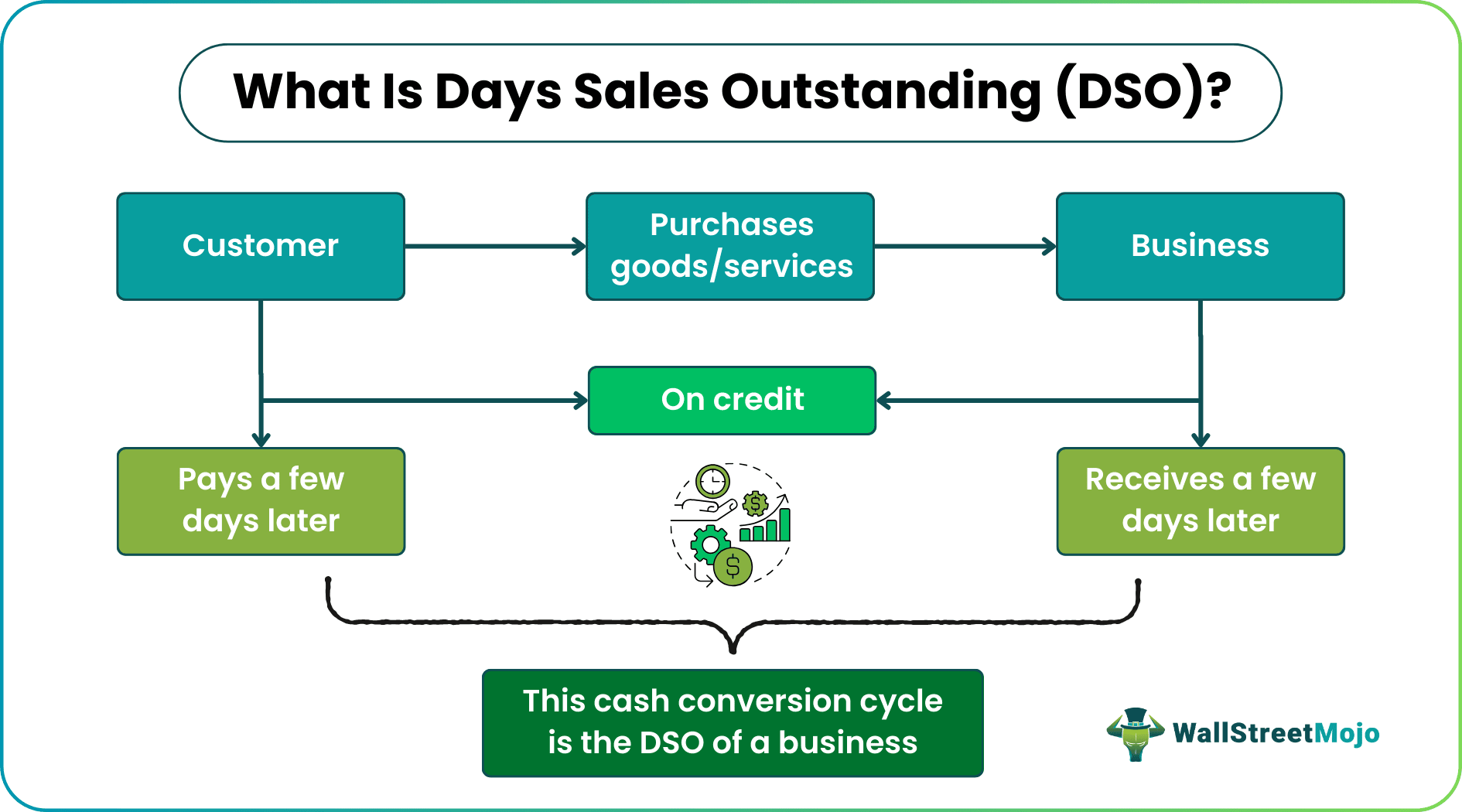

What is DSO? DSO stands for Days Sales Outstanding. This is an index that measures the average number of days it takes a business to collect money from issued invoices. (Unit: day)

The lower the DSO index, the faster the business collects money. cash flow into stability. Conversely, a high DSO indicates tied up funds, posing a liquidity risk.

Meaning of DSO from 3 perspectives:

-

Accounting Perspective: DSO helps the accounting department grasp the cash flow rhythm and debt management efficiency. By tracking DSO, accountants can:

-

- Gmaintain a steady cash flow.

- Support for adjusting payment terms (e.g. 30 days, 45 days).

- Helps detect bad debt early by monitoring unusual increases in the index.

-

Financial Perspective

- Is an indicator of the cash flow health of the business.

- High DSO: money is “stuck” in receivables, reducing liquidity and increasing working capital pressure.

- Low DSO: shows that the business collects money quickly, improving liquidity and reducing financial risk.

-

Business Perspective

- DSO reflects the efficiency of debt collection processes and customer payment habits.

- An increase in DSO can signal: the customer has credit problems or the sales team is lax in managing contracts and debts.

- From here, businesses can tighten credit policies or reclassify customers according to risk level.

Understanding what DSO is not only helps accountants track debts, finance control cash flow but also helps businesses optimize customer relationships. This is an important indicator to maintain financial health and efficient operation of the business.

What is the formula for calculating DSO? Introducing the Countdown method

Below is the formula and scope of application for DSO.

Scope of application:

- Applies to credit sales (customers buy now, pay later).

- Can be calculated monthly, quarterly, or yearly to track debt collection performance.

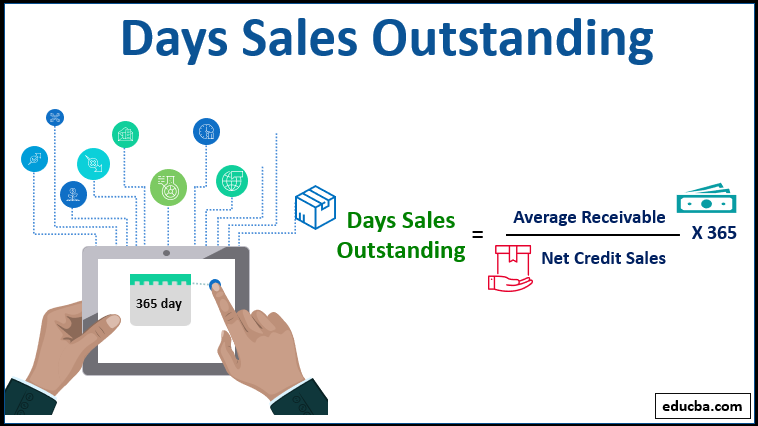

Calculation formula:

Below is the most common DSO calculation formula:

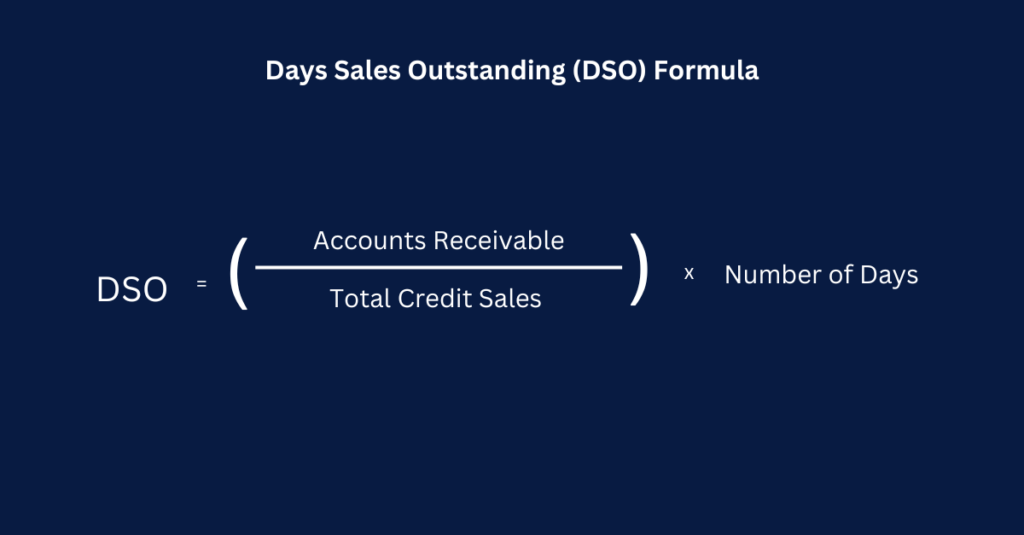

- DSO = (Total Accounts Receivable / Sales Revenue) *Number of Days

In there:

- DSO: Average days to collect receivables

- Accounts Receivable (AR): Total amount of money the customer owes at the time of calculation.

- Annual credit sales: Revenue generated from sales but not yet collected.

- Number of days in period: Can be 30 (month), 90 (quarter) or 365 (year).

Illustration:

- Credit sales in September: 3,000,000,000 VND

- Ending receivables (September 30): VND 1,200,000,000

- Number of days in period: 30 days

DSO= (1,200,000,000/3,000,000,000) *30 = 12 days

Thus, it took businesses an average of 12 days to collect debts in September.

Count-back Method

In addition to the average formula, businesses can also apply Count-back Method, an advanced method that accurately determines the actual collection time.

- Instead of relying solely on the average receivable balance, this method goes back in time to determine what sales have yet to be paid.

- How to do:

- Determine the balance of receivables at the end of the period.

- Compare to daily (or weekly) sales.

- Work backwards until the balance is “covered” by the revenue generated.

- Advantage:

-

- Shows actual collection time, not “clouded” by averages.

- Especially useful for businesses with highly fluctuating revenue seasonally or by project.

DSO Ratio Evaluation: “Good” or “Bad”?

DSO is an important indicator of a company’s debt collection rate and cash flow management efficiency. However, low or high DSO does not always mean “good” or “bad”. To make an accurate assessment, it is necessary to consider the industry context, size, business strategy and trends over time.

General meaning

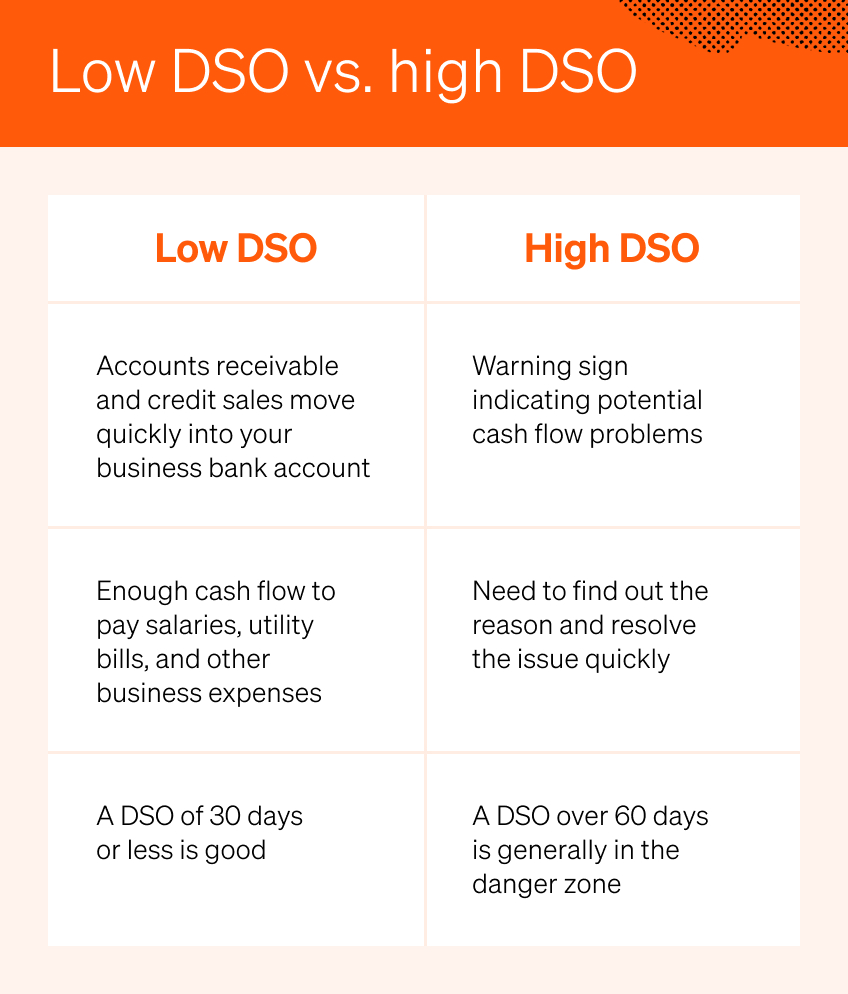

- Low DSO (good):

- Businesses collect debts quickly, customers pay early on average.

- Help stable cash flowworking capital effective rotation, reducing the need for short-term debt.

- Show strict debt management process and good customer quality.

- High DSO (bad):

- Customers pay late, collection time is long.

- Potential liquidity risk, putting pressure on cash flow and the ability to pay short-term obligations.

- Can reflect poor debt collection process, loose credit terms or risk of customer default.

What are the four typical factors to consider contextually when evaluating DSO?

There are many factors that affect DSO, but below are the four most common factors chosen for evaluation:

- Industry Benchmark:

- Each industry has different characteristics. For example, the construction industry often has a high DSO due to the long-term nature of contracts, while retail often has a very low DSO due to prompt payment.

- Business Size:

-

- Large enterprises often achieve lower DSOs due to their corporate governance systems. debt and strict collection process.

- Small businesses may be more flexible, but are at risk of customers taking over capital.

- Trend over time:

- Looking at DSO changes over quarters/years is more important than looking at a single value.

- Decreasing DSO: a sign of improving debt management.

- Increasing DSO: risk warning, need to review debt collection process.

- Business policy & strategy:

-

- Sometimes a high DSO isn't necessarily “bad”: it could be a market expansion strategy, where a business accepts longer credit terms from customers to build relationships and increase market share.

- The important thing is whether DSO is under control and in line with long-term financial strategy.

In general, there is no “absolute threshold” for DSO. Businesses should evaluate DSO in the context of their industry, size, trends, and strategy, rather than just looking at high or low numbers.

What are the Causes and Solutions for DSO Management?

High DSO is not only due to customers but also due to poor internal management of the business. DSO management does not stop at a technical measure to reduce the average number of days to collect payment, but is essentially optimizing the entire financial process chain, from issuing invoices, controlling debts, to reporting and decision making.

Common problems that lead to high DSO

- Policy & Procedure Issues

- Loose credit policy: Payment terms are too long or customers are not classified according to risk.

- Incorrect or late invoices: Causing payment delays, loss of reputation with customers.

- Customer Behavior & Debt Collection Issues

- Customers pay late due to lack of timely reminders.

- Businesses lack clear internal debt collection processes, leading to inconsistent debt management.

3 Strategies to Shorten DSO

- Credit Policy Review

- Classify customers by risk level and set clear credit limits for each group.

- Reduce the possibility of overdue and bad debt risk.

- Simplify Payment Terms

- Create terms that are transparent, understandable, and accessible.

- Make it easy for customers to make payments on time.

- Proactive Debt Collection

- Build an automatic debt reminder schedule via email, SMS or phone.

Ensure consistent reminders, reducing the risk of forgetting or late payments.

- Build an automatic debt reminder schedule via email, SMS or phone.

Applying all three strategies simultaneously will help Reduce DSO, improve cash flow and enhance debt management efficiency.

What is the Role of Automation in DSO Control?

Effective DSO management is not just about measurement, but also about optimize debt collection process to keep cash flow into the business stable. This is the reason financial automation become a strategic tool. Bizzi.vn provides a comprehensive solution to help CFOs, accountants and debt collection teams control DSO quickly, accurately and transparently.

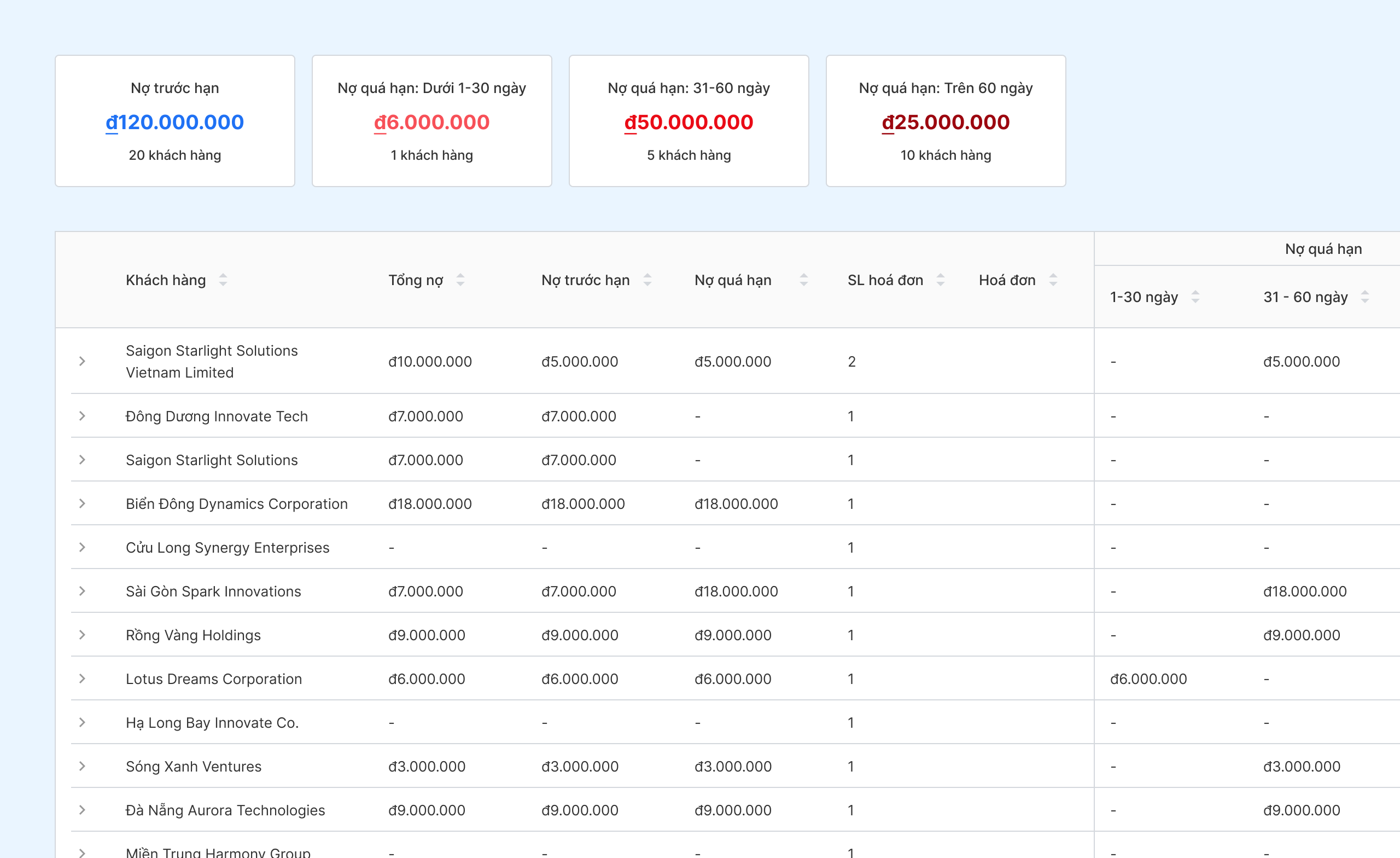

Automated debt management – real-time data sources & reporting

- Track level of detail: Bizzi's ARM records each invoice, date, due date, payment history of each customer and status (reconciled/disputed/late).

- Aging Report & DSO realtime: Dashboard continuously updates buckets (0-30, 31-60, 61-90, 90+ days) and DSO periodically (daily/monthly/quarterly) – helping CFOs/collectors detect increasing DSO trends as soon as they appear.

- Automatic dispute reconciliation & classification: When an invoice has a dispute (error, missing documents), the system automatically flags it and switches to the dispute resolution workflow - reducing the time it takes to "erode" DSO due to prolonged disputes.

Benefit:

- Reduce bad debt risk.

- Optimize cash flow, keep the company always have working capital.

- Support decision making based on real data, not relying on manual reporting.

Automate debt collection – accelerate cash flow with proactive action

One of the main reasons for high DSO is customers forget or delay payments. Bizzi.vn solves this problem through debt reminder automation:

- Automatic debt reminder chain: Set up scenarios (pre-due reminder → due day → 7/15/30 days overdue → escalation). Bizzi sends emails/SMS automatically to each customer group.

- Personalization & Segmentation: Automatically change the frequency and tone of debt reminders according to risk classification (e.g. customer A – gentle reminder; customer B – strong reminder + CC account manager).

- Payment CTA Incorporation: Send payment link / transfer instructions to reduce friction → easier for customers to pay.

- A/B testing debt reminder content: The system allows testing of message templates (schedule, content) to choose the optimal strategy for each segment.

- Actual results: Reaching customers in a timely manner, reducing “forgotten” payments – often results in significant improvements in DSO (e.g. reduction of several days to dozens of days depending on the business).

Benefit:

- Shorten debt collection time, reduce DSO.

- Reduce stress and effort on debt collection team.

- Increase proactive cash flow management, helping to stabilize cash flow.

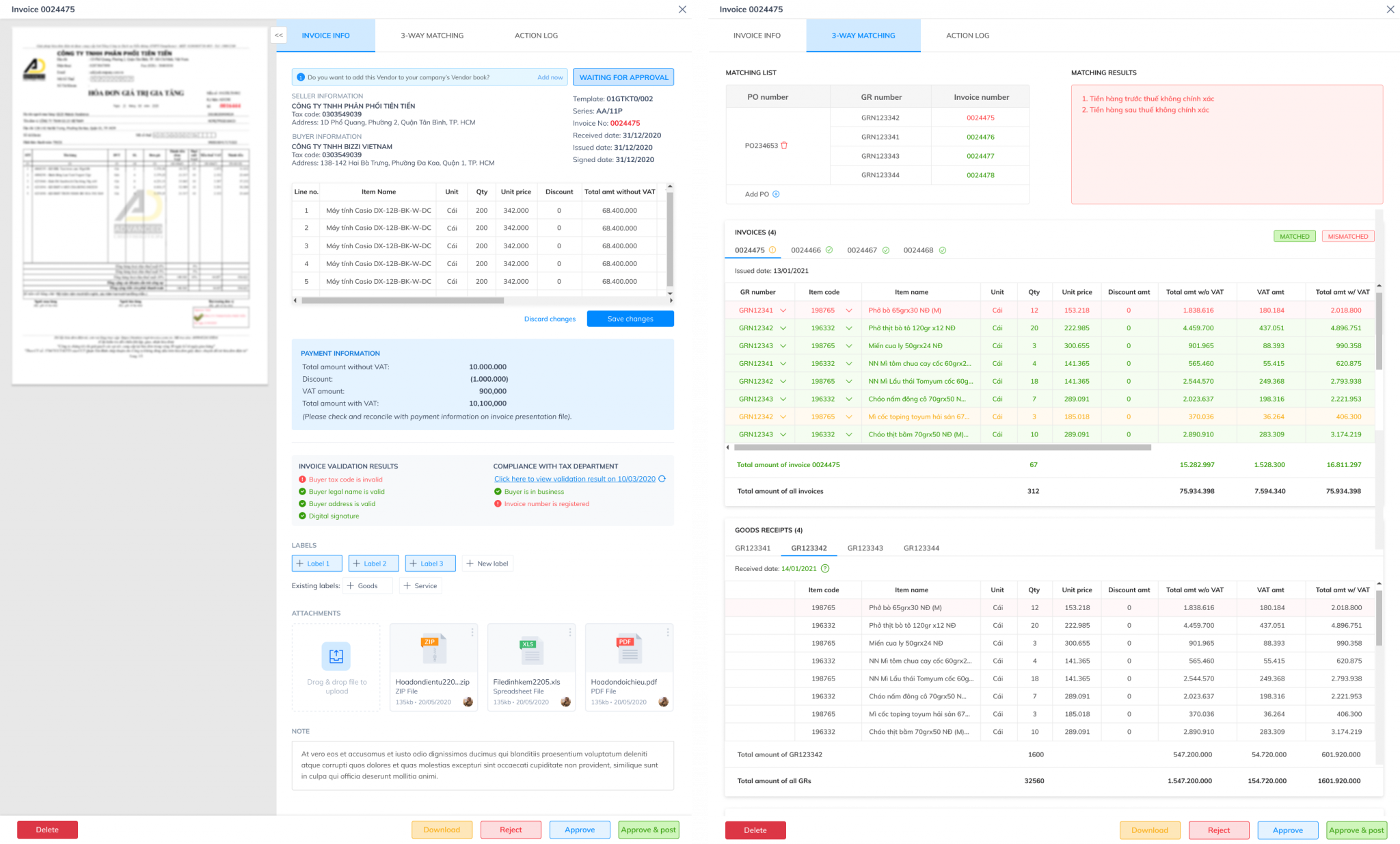

Ensure the accuracy of invoices:

- Automatic invoice processing: OCR + AI extracts data, checks tax codes, supplier information, contract numbers...

- 3-way matching: Automatically compare Invoice ↔ PO ↔ Warehouse Receipt; if there is any difference, the system will automatically create a dispute ticket and send it to the relevant department.

- Reduce “non-payment” due to errors: Many invoices are paid late due to incorrect information or missing documentation – automated processing and early warning will reduce this rate.

- Optimizing dispute resolution process: When disputes occur, the system tracks SLAs, assigns handlers, and updates status – reducing dispute closure time, thereby reducing DSO

Benefit:

- Prevent invoice errors – the reason why customers delay payment.

- Ensure debt data is always accurate and reliable.

- Accelerate cash inflow, reduce DSO sustainably.

DSO in the Overall Financial Picture of the Enterprise

Looking at DSO in the overall financial picture is necessary because DSO not only reflects debt collection efficiency but also directly affects cash flow, working capital and financial capacity of the entire enterprise.

DSO and Accounts Receivable Turnover

- Distinguish:

- DSO measures the average number of days it takes to collect receivables.

- Receivables turnover measures the frequency of collection of debts during the period. (Receivables Turnover = Credit Sales / Average Receivables).

- Additional relationships:

- Low DSO ↔ High turnover → Fast paying customers, stable cash flow.

- High DSO ↔ Low Turnover → Funds are locked for a long time, increasing liquidity risk.

Understanding both metrics simultaneously helps businesses optimize credit policy and control working capital, instead of just looking at a simple average number.

DSO and Cash Conversion Cycle (CCC)

- Formula: CCC = DSO + DIO – DPO

In there:

- DSO (Days Sales Outstanding): Time to collect payment from customers.

- DIO (Days Inventory Outstanding): Average number of days inventory.

- DPO (Days Payable Outstanding): Number of days to pay suppliers.

Role of DSO:

- DSO is the most important ingredient in CCC because it reflects the speed of cash collection from core business operations.

- Helps CFOs forecast working capital needs, balance income and expenses, and plan investments or debt repayments.

Actual impact:

- Short CCC ↔ Businesses collect money faster, maintaining efficient cash flow.

- High DSO ↔ Extended CCC → Working capital locked up, liquidity pressure increases.

DSO and DPO (Days Payable Outstanding)

- DSO: Reflects the speed of collecting money from customers.

- DPO: Reflects the time it takes to pay suppliers.

- Monitor DSO (cash in) and DPO (cash out) in parallel to balance income and expenditure, avoiding the situation of "cash out faster than cash in", leading to capital shortage.

- For example: DSO = 30 days, DPO = 45 days → the business holds cash longer than the time it takes to pay debts, improving liquidity.

Strategic application:

- Improve DSO by improving collection process.

- Negotiate reasonable DPO with suppliers to optimize working capital.

CEI and BPDSO

To gain more insight into DSO management effectiveness, businesses can use rare attributes that are rarely mentioned in conventional guides:

- Collection Effectiveness Index (CEI):

Evaluate the performance of the debt collection team based on % of debt collected according to plan.

-

- High CEI → Effective debt collection, well-controlled DSO.

- Low CEI → Need to review debt collection process, remind or train staff.

- BPDSO (Best Practice DSO / Ideal Collection Date):

Compare actual DSO and ideal DSO to determine how many days are “lost” due to process delays.

-

- Help identify How many days does it take for money to not reach the business? due to slow collection processes or slow customer payments.

- Provide a basis for process improvement, set KPIs for the collection team and reduce liquidity risk.

Overall, DSO is not just a single number but an important part of managing a business's cash flow, working capital and debt collection performance.

Conclude

When grasping the essence What is DSO, Managers will understand that Days Sales Outstanding (DSO) is not just a financial number, but a strategic indicator that reflects the business's operational efficiency, debt management and cash flow management ability.

Reducing DSO is not simply about shortening debt collection time, but also a comprehensive change in thinking and debt management process, from issuing invoices to debt reminders and payment control.

With Bizzi.vn's specialized automation tools, businesses can proactively control cash flow, minimize risks, and prepare financial resources for ambitious expansion plans.

To get specialized solutions specifically for your business, register for a consultation here: https://bizzi.vn/dat-lich-demo/