FCFE is an important financial indicator, reflecting the net cash flow available to shareholders after the business has paid all operating costs and debt obligations. Understand What is FCFE? helps managers, investors and CFOs grasp the ability to pay dividends, assess cash flow health, and make accurate financial strategy decisions. This article analyzes FCFE in detail, its calculation formula, comparisons with other indicators and practical applications, and suggests financial automation solutions to improve the accuracy of FCFE.

Concept of FCFE and accuracy of financial data

What is FCFE? FCFE is the actual cash flow that shareholders can receive after the business has paid operating costs and debt obligations. Understanding this concept helps managers and investors grasp the ability to generate cash flow, distribute dividends and plan financial effectively.

What is FCFE?

FCFE (Free Cash Flow to Equity) or also known as Net cash flow to owners, is the amount of cash flow available for a business to distribute to shareholders after paying operating expenses, principal and interest on loans.

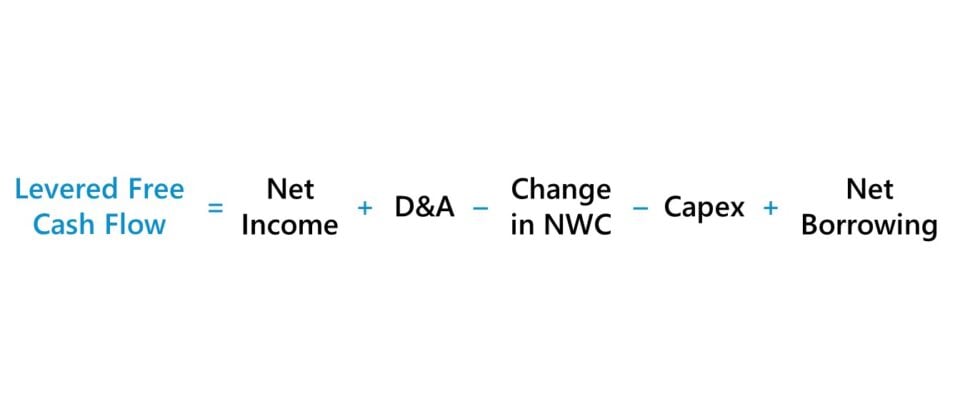

Unlike accounting profit (Net Income – NI), FCFE represents actual cash flow, including the effect of financial leverage, so FCFE is also known as Levered Cash Flow. This is an important indicator to:

- Assessing dividend payout capacity

- Determining intrinsic value in business valuation

- Decide whether to reinvest or reduce debt

Why does FCFE need accurate data?

The reliability of FCFE depends directly on microfinance data such as:

- Net Profit (NI)

- Capital expenditure (CAPEX)

- Working capital (Working Capital)

These data need to be collected and controlled accurately, as any discrepancies affect the accuracy of the FCFE. Financial automation solutions such as Bizzi.vn helps ensure that microfinance data is always reliable, thereby improving the quality of macroeconomic analyses such as FCFE.

Formula and method to determine FCFE accurately

What is FCFE and how to calculate it correctly? This section will present the common FCFE formula, calculation method according to Vietnamese law, and conversion method from FCFF to FCFE, providing you with practical tools to value a business and analyze shareholder cash flow.

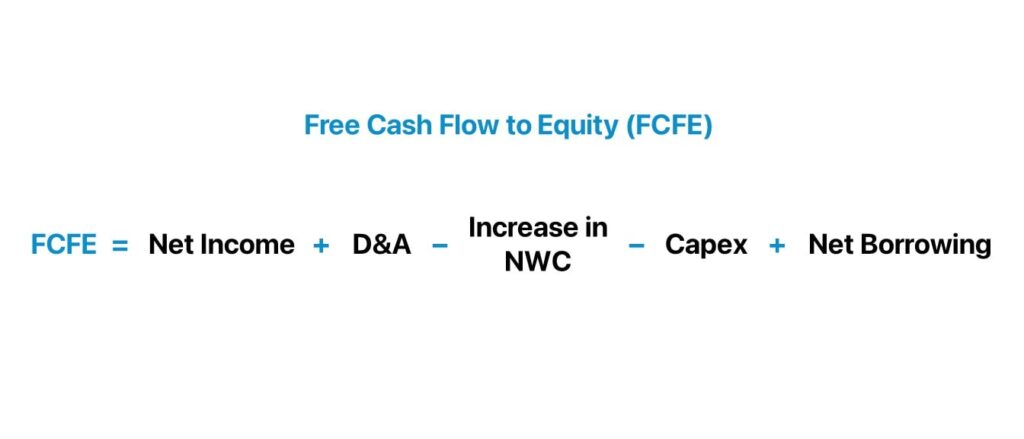

Common FCFE formula

Basic formula:

FCFE = Net Income (NI) + Depreciation – Capital Expenditure (CAPEX) – Change in Working Capital + Net Debt

- Net Income (NI): Cash flow from operating activities after tax.

- Depreciation: Non-cash expenses, added back to cash flow.

- CAPEX: Investment in fixed assets.

- Change in working capital: Increase or decrease in cash flow related to current assets and liabilities.

- Net debt: Increase cash flow from borrowing, minus principal repayment.

FCFE formula according to legal regulations in Vietnam

According to Article 24 of Circular 36/2024/TT-BTC, FCFE is not only a popular financial formula but also standardized by Vietnamese law, helping businesses calculate net cash flow to shareholders in a transparent and compliant manner. Citing this legal formula creates strong trust, especially with investors and management agencies.

FCFE formula according to Circular:

FCFE = Profit after tax + Depreciation – Capital expenditures (CAPEX) – Change in net working capital other than cash + Net debt

Explain the components:

- Capital expenditure (CAPEX): Includes costs for purchasing, constructing, and upgrading fixed assets and long-term assets for business operations. According to Circular 36/2024/TT-BTC, businesses need to eliminate non-cash expenses or expenses not directly related to core operations.

- Change in net working capital other than cash: Is the fluctuation of receivables, payables, and inventories that is not related to actual cash, helping to reflect net cash flow more accurately.

Correct application of the components under the Circular ensures that FCFE accurately reflects the actual cash flow available for distribution to shareholders, while complying with legal regulations in Vietnam.

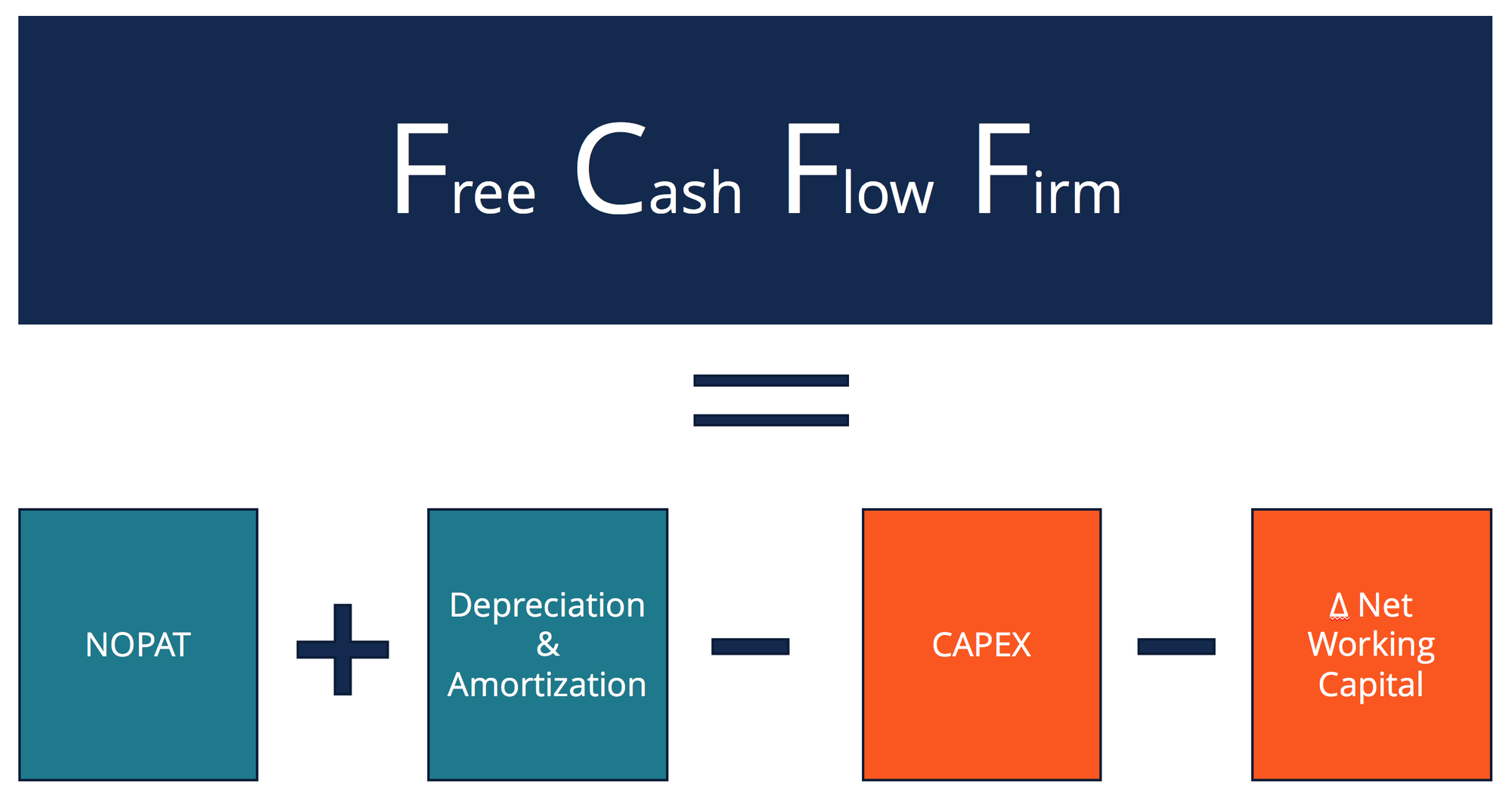

How to calculate FCFE from FCFF (Net Cash Flow of the Business)

In addition to the direct calculation, FCFE can also be converted from FCFF (Free Cash Flow to Firm) using the formula:

FCFE = FCFF + Net debt – Interest expense × (1 – Tax rate)

Explain the difference and semantics:

- FCFF (Free Cash Flow to Firm): Is the cash flow available to all suppliers of capital, including shareholders and creditors.

- FCFE (Free Cash Flow to Equity): Only reflects cash flow attributable to shareholders after debt and interest costs have been paid.

Converting from FCFF to FCFE helps financial analysts understand the true cash flow that shareholders can expect to receive, creating a more accurate valuation basis, especially in DCF models or evaluating potential dividend payments.

Distinguish FCFE from other financial ratios

FCFE differs from traditional metrics such as FCFF, net profit or EBITDA in terms of who receives cash flow and what it is used for. Understanding this difference helps managers make more informed financial decisions.

1. FCFE vs FCFF

- Cash flow recipients:

- FCFF (Free Cash Flow to Firm) is the net cash flow available to all capital suppliers, including shareholders and creditors.

- FCFE (Free Cash Flow to Equity) is simply the actual cash flow remaining for shareholders after debt and interest expenses have been paid.

- Intended use:

- FCFF is used to value the entire enterprise, in line with the overall DCF valuation model.

- FCFE is used to analyze dividend payout capacity and equity value, usually discounted by the cost of equity capital (Re).

- Applicable cases:

- FCFF: When wanting to evaluate the total value of a business, especially for companies with a mixed capital structure (debt + shareholders' equity).

- FCFE: When the investor is directly interested in shareholder cash flows or a valuation model based on potential dividends.

2. FCFE vs Net Income (NI)

- Actual cash flow vs accounting profit:

- NI is book profit, including non-cash items such as depreciation and provisions.

- FCFE reflects the actual cash flows available to shareholders, removing non-cash items and adjusting for changes in working capital.

- Meaning:

- FCFE provides a more accurate picture of a company's ability to generate cash, thus being a more effective measure of its financial health.

3. FCFE vs Dividends

- Affordability vs. Actual Payment:

- FCFE represents the dividend payout potential based on net cash flow.

- Dividends are the actual amount a business has paid to its shareholders.

- Meaning:

- A company with positive FCFE but not yet paying dividends still has the ability to pay or reinvest, helping investors assess long-term potential.

- A company with positive FCFE but not yet paying dividends still has the ability to pay or reinvest, helping investors assess long-term potential.

4. FCFE vs EBITDA

- Basic differences:

- EBITDA reflects earnings before interest, taxes, depreciation and amortization, and is primarily used to evaluate core operating performance.

- FCFE calculates the actual cash flow available to shareholders, including investment costs and changes in working capital.

- Application:

- EBITDA is useful for comparing operating performance between businesses.

- FCFE helps investors and management decide on profit distribution, dividends and financial strategy.

Strategic applications of FCFE in practice

FCFE is an important tool in business valuation and financial policy adjustment. Through forecasting and analyzing FCFE, businesses can optimize dividends, reinvestment or manage debt effectively.

1. FCFE in business valuation

FCFE is an important index in the DCF (Discounted Cash Flow) valuation model, used to determine intrinsic value of a business from a shareholder's perspective. When using FCFE in DCF:

- Discount cash flow using cost of equity (Re): Since FCFE is the cash flow to shareholders, discounting using Re helps accurately reflect the present value of the cash that shareholders can receive in the future.

- Forecast period: In practice, to calculate forecast FCFE, it is usually necessary to at least 03 years of forecast dataFor rapidly growing businesses, forecasting FCFE should consider factors such as capital investments, changes in working capital, and debt strategies to properly assess actual cash flow generation capacity.

- Advantage: FCFE reflects actual cash flow available for distribution to shareholders, helping investors and management make more informed decisions about corporate value, dividend potential, and long-term financial strategy.

2. Adjust financial policy based on FCFE

- When FCFE > 0: Businesses have cash surplus after paying off debt and investment costs. At this point, the company can:

- Pay dividends to shareholders,

- Buy back treasury stock,

- Or reduce debt to optimize capital structure.

- When FCFE < 0: A negative FCFE indicates that the company is spending more than the cash flow it brings in after paying down debt. This could be risk if the company does not have enough money to pay dividends, but it could also be growth opportunities if the business is reinvesting heavily in expansion, R&D, or strategic projects. In this case, the solution is often fundraising from shareholders or debt to ensure business operations and investment development.

Tracking FCFE helps businesses financial planning long term, balancing between dividend payments, reinvestment, and debt management, thereby creating sustainable value for shareholders and improving cash flow health.

The Relationship Between FCFE and Financial Automation

The accuracy of FCFE depends on detailed data, working capital, and investment costs. Financial automation reduces errors, speeds up collections, and optimizes profits, thereby improving the ability to generate real cash flow for shareholders.

1. Why does financial automation directly affect FCFE?

FCFE (Free Cash Flow to Equity) reflects actual cash flow available for distribution to shareholdersHowever, the calculation of FCFE depends on detailed financial data, including net profit (NI), capital expenditure (CAPEX) and working capital (WCC).

This data is often fragmented, disjointed, and error-prone if managed manually. Small errors in reporting expenses, liabilities or CAPEX can lead to FCFE is incorrect, affecting business valuation and strategic financial decisions.

2. Bizzi.vn's solution to optimize FCFE

With these financial automation tools, businesses can not only ensure accurate and transparent data but also Monitor, forecast and optimize cash flow for shareholders proactively. FCFE thus becomes a reliable indicator, helping management make strategic decisions about dividend payments, reinvestment or debt management flexibly and effectively.

- Optimize Net Profit (NI) with Bizzi Expense: Bizzi Expense helps businesses real-time cost control, reducing the risk of overspending. When costs are managed effectively, net profits increase, thereby direct FCFE increase.

- Streamline Working Capital (WCC) through Bizzi AP and AR: Solution Bizzi Bot automatically process input invoices, while Bizzi ARM debt management and quick collection. Thanks to that, businesses reduce errors, increase speed working capital turnover, improving the ability to generate cash flow available to shareholders.

- Unified data platform: Bizzi.vn has the ability Seamless integration with ERP systems existing, ensuring input financial data is always accurate, complete and timely. This not only increases the reliability of FCFE but also supports strategic decisions on dividend payments, reinvestment or debt management.

When financial automation is implemented effectively, FCFE becomes reliable macro indicators, accurately reflects the ability to generate actual cash flow for shareholders. At the same time, businesses can forecasting, planning and optimizing financial strategies more proactively and flexibly.

Frequently Asked Questions about FCFE

1. Is negative FCFE always a bad sign?

Reply: Not necessarily. A negative FCFE indicates that a company is spending more money than it is bringing in after paying down debt. While this can be a sign of financial trouble, in many cases, especially with smaller companies, fast-growing companyA negative FCFE is a positive sign. It shows that the company is reinvesting heavily in fixed assets (plant, equipment, R&D) to expand its scale and generate larger cash flows in the future.

2. Should FCFE be used instead of the Dividend Valuation Model (DDM)?

Reply: FCFE is generally considered a more reliable indicator than DDM because it reflects actual dividend payout ratio, not just the declared dividends. DDM is only useful when the company has a history of stable and predictable dividend payments, while FCFE can be applied to companies that do not pay dividends or have volatile cash flows.

3. Do individual investors need to care about FCFE?

Reply: Yes. For individual investors, FCFE analysis is important. FCFE helps you evaluate a company's ability to generate real cash, its ability to finance itself without relying on debt, and its potential for sustainable growth.

4. How does FCFE relate to Cost of Equity?

Reply: In the DCF valuation model, FCFE is discounted to present value using the cost of equity (Re). FCFE represents the cash flows that shareholders require, so the cost of capital they require (i.e., Re) is the most accurate discount factor.

5. Does FCFE include cash from asset sales?

Reply: Are not. FCFE includes only cash flows from core business operations. Cash flows from the sale of assets (e.g., the sale of an old factory) are usually classified as investing activities and are not included in FCFE unless they are core activities of the business.

6. What is a good FCFE ratio?

Reply: There is no fixed number to evaluate FCFE as good or bad, because it depends on the industry, development stage and strategy of the company. Instead of just looking at a number, you should compare the company's FCFE with competitors in the same industry and analyze the trend of FCFE over the years to have a more accurate view.

Conclude

Hopefully this article has provided you with useful information about what FCFE is? It can be said that FCFE (Free Cash Flow to Equity) is The key cash flow ratio reflects the ability to generate actual cash flows available to shareholders.In business valuation and financial management, FCFE helps managers and investors more accurately assess cash flow health, dividend coverage, reinvestment, and debt management compared with traditional accounting metrics.

However, the value of FCFE is only truly accurate when comprehensive, transparent and tightly managed financial database. Errors in recording costs, CAPEX or working capital can lead to FCFE results that do not accurately reflect the financial capacity of the business.

Solution: Using the systems specialized financial automation like Bizzi.vn help businesses:

- Real-time cost control, net profit (NI) optimization.

- Optimize working capital, manage receivables and automate invoice processing, ensuring accurate cash flow data.

- Seamlessly integrates with existing ERP, creating a unified, reliable data platform for FCFE.

Thanks to that, businesses can Rely on reliable FCFE data to make strategic decisions, from dividend payments, reinvestment to financial risk management.

Businesses that want to improve cash flow management efficiency and improve FCFE accuracy should consider Integrate Bizzi.vn into the existing financial system, transforming FCFE from a theoretical indicator into a practical tool to support strategic decisions.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam