FSSC is not only a modern financial management trend but also a leverage for businesses to grow in scale while controlling costs, risks, and data. Therefore, more and more Vietnamese businesses are starting to switch to the Finance Shared Service Center model to standardize from the ground up and create a foundation for data automation and analytics.

This article by Bizzi will help businesses understand:

- What is Finance Shared Service Center and how does it work?

- Is this model suitable for Vietnamese businesses?

- Benefits, risks, KPIs and core technologies required when implementing FSSC.

- Bizzi's role in building a modern – automated – transparent financial Shared Service platform.

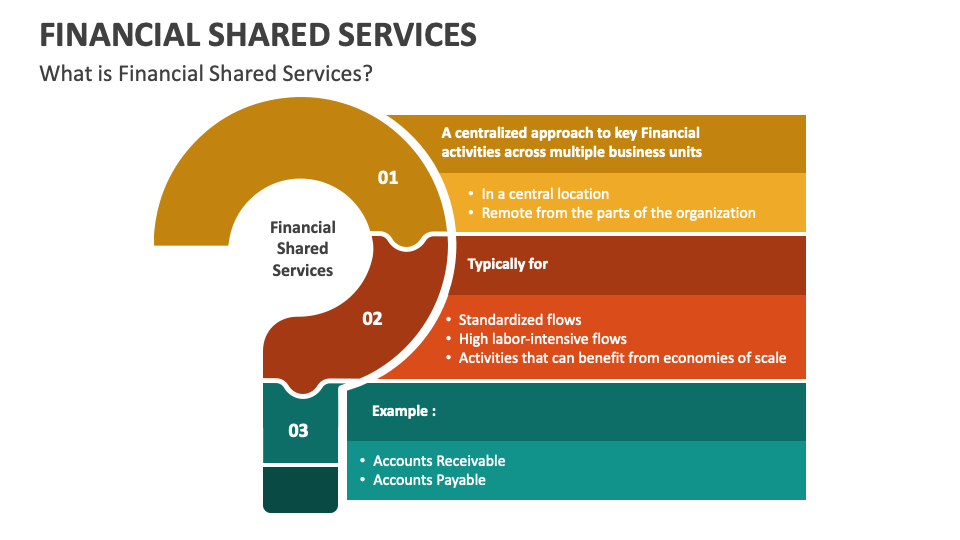

What is a Finance Shared Service Center?

Finance SSC = a shared financial services center where all of a company's financial operations are processed centrally according to a unified standard, operating as "one internal service unit".

As businesses grow, financial and accounting operating costs increase faster than revenue, forcing management to seek a leaner model. FSSC has become the top choice because it meets all three objectives: speed, standardization, and cost savings.

When each branch and each department operates accounting and finance in a different way, the business faces a series of problems:

- A fragmented, inconsistent process leads to asynchronous data and a lack of a "single source of truth".

- Time-consuming operations: from AP, AR, reconciliation, adjustment, closing to audit preparation—everything is slow.

- Costs increase but productivity does not increase because the amount of manual work is too large.

- CFOs don't just want to “reduce errors,” they want to: standardize – centralize – automate – control costs in real time.

Finance Shared Service Center was born to solve these bottlenecks:

- Centralization All transaction-heavy financial transactions into a single center.

- Establishing a unified data platform, helping CFOs make faster and more accurate decisions.

- Reduce errors – reduce costs – increase operating speed, thanks to standardized processes and a high degree of automation.

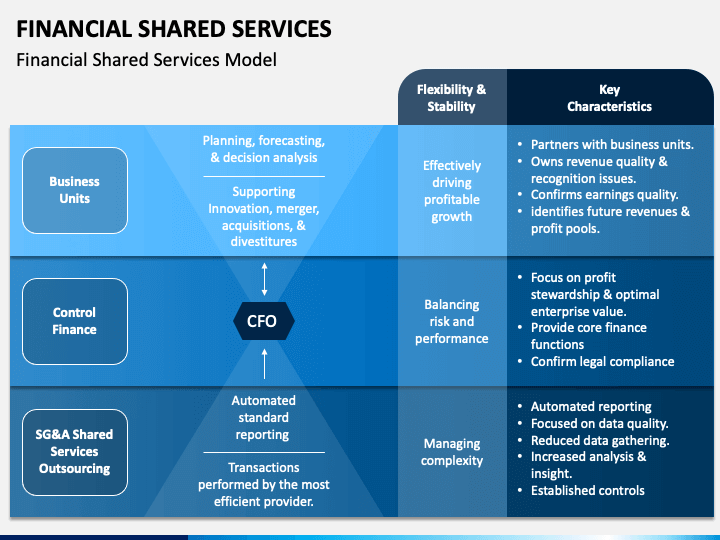

Distinguishing Finance SSC from other models

| Model | Operating characteristics | Limit |

| Centralized Finance Department | Consolidate financial operations into a single department to reduce personnel duplication. | Lack of process standardization, no clear SLA/KPI, difficult to expand when the business increases in size. |

| Finance Shared Service Center (FSSC) | Focus on standardizing processes + SLA + KPI + automation technology. Act as an “internal service” to serve units within the enterprise. | Initial investment is needed in technology, processes, and training. |

| Outsourcing / BPO | Outsource part or all of the financial operations (AP, AR, reconciliations…) to an external entity. | Data security risks, reduced control, vendor dependency. |

| GBS (Global Business Services) | Extended version of FSSC: combines multiple functions such as Finance + HR + Procurement + IT into one integrated service center. | Requires a very high level of operational maturity; suitable for large, multinational corporations. |

Why do businesses need FSSC?

The more the business expands, the more FSSC shows its value.—especially in retail, F&B, distribution, logistics, chain stores, and multi-company enterprises.

Each branch has its own AP/AR system, leading to fragmented data that is difficult to consolidate.

Each branch handles invoices, accounts receivable/payable reconciliation, and revenue/expenditure management according to its own set of procedures. The result:

- Inconsistent forms and document standards

- Delay in sending documents to headquarters.

- The errors are repeated but there is no common control mechanism.

- CFOs can't get a real-time overview of cash flow

FSSC addresses this by standardizing the entire AP/AR process, centralizing all documents in one location, ensuring data consistency, and enabling control right from the input stage.

Slow closing due to manual reconciliation, late information

As the number of branches increases, the volume of business increases exponentially:

- Reconciling cash, accounts payable, and inventory is more complex.

- Revenue/expense information is often late.

- Each closing period is prolonged → delaying management reports and financial plans

FSSC included:

- Standard procedure, with clear SLAs for each business operation

- Automation technology (OCR, workflow, automated reconciliation)

- A single source of truth

Help the closing mechanism be pulled down. a few weeks → a few days, even real-time in some metrics.

Increase branches but cannot increase financial staff accordingly

Without FSSC, the more a business expands, the more it has to hire local accountants.

This leads to increased costs, inconsistent quality, and difficult training.

With FSSC, businesses can:

- Handle larger volumes without a proportional increase in staff.

- Grant centralized control to the Head Office.

- Easily open new branches without creating process chaos

Standard functions of Finance Shared Service Center (according to international standards)

A Finance Shared Service Center (FSSC) is built around a company's critical financial processes. Below are four core functional groups that a modern FSSC typically performs.

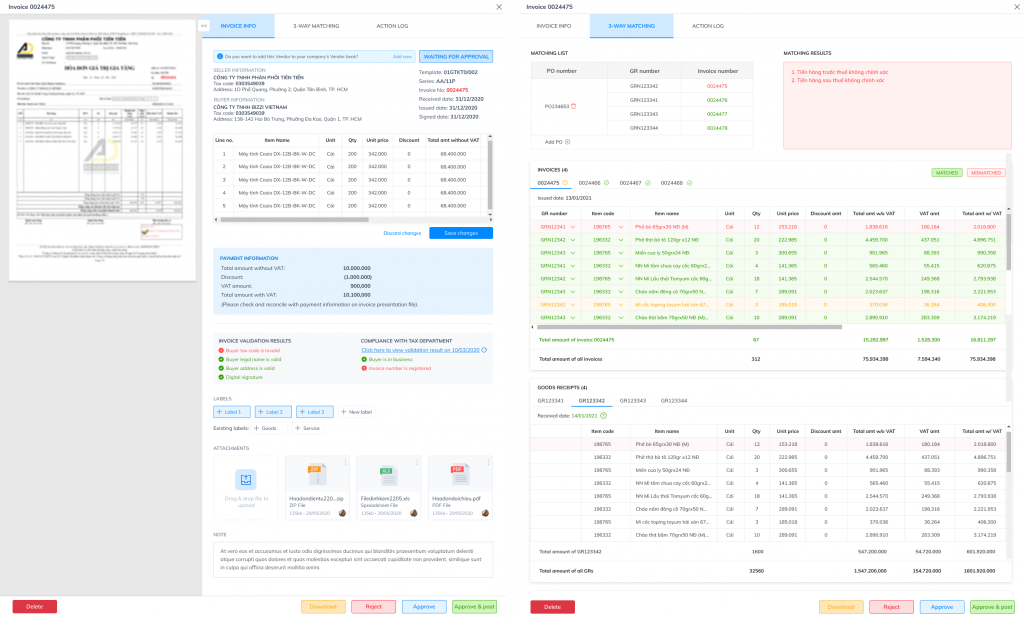

Accounts Payable Shared Services (P2P – Procure to Pay)

Centralized processing of all purchasing and supplier payment transactions helps reduce errors, speed up invoice processing, improve risk control, and optimize costs.

- Receiving and processing input invoices according to unified standards.

- OCR + AI data extraction To reduce manual data entry and errors.

- 3-way match (PO – GRN – Invoice) Ensure validity before payment.

- Payment schedule Optimize cash flow & payment timing.

- Vendor master data management: Control supplier data, avoid duplication and errors.

Accounts Receivable Shared Services (O2C – Order to Cash)

Effective management throughout the "sales - cash collection" cycle helps to bring in cash faster, reduce overdue accounts, and increase transparency for Sales & Finance.

- Invoice generation, sending, and tracking. to customers according to a standardized procedure.

- Automated payment reconciliation from many sources (bank, payment gateway, POS…).

- Dunning: automatic debt reminders according to SLA and priority level.

- Accurate revenue allocation, reducing confusion and minimizing DSO (Days Sales Outstanding).

Record-to-Report Shared Services (R2R)

The functional group ensures the accuracy of books and reports:

- Bank reconciliation Automatically by day or by session.

- Reconcile accounts according to the unified CoA standard.

- Closing the books periodically with clear SLAs (daily/weekly/monthly close).

- Prepare financial statements and management reports. Based on a single source of truth.

This helps shorten closing times, improve report quality, and reduce audit risk.

Payroll, Travel & Expense, Fixed Assets

International FSSCs often integrate additional processes to help reduce errors in personnel costs, increase transparency, and improve asset control.

Payroll & T&E (Travel & Expense)

- Automate the cost request and approval process.

- Control documentation according to compliance standards.

- Prepare payroll, calculate deductions and personal income tax.

Fixed Assets (FA)

- Track assets, allocate depreciation, and calculate depreciation automatically.

- Conduct periodic inventory and reconciliation of assets.

Financial processes are standardized when integrated into a Shared Service Center (SSC).

To operate effectively, a Finance Shared Service Center should not only "consolidate work in one place," but must also... Standardize all data, processes, and outputs.This is the foundation that helps businesses achieve high productivity, reduce errors, and increase control.

Master Data & Templates Standardization

Data standardization is the most important step for FSSC to become a "single source of truth":

- Chart of Accounts (unified) across the entire company, helping to ensure consistent financial reporting and management.

- Taxonomy of cost center, project code, department code It is designed according to a clear hierarchical principle.

- Vendor / Customer master data is standardized → Avoid duplicates, incorrect names, incorrect tax identification numbers, and incorrect payment information.

- Standard forms: Purchase Order (PO), invoice template, cost request form, goods receipt record, etc.

Once the input data is accurate, the entire downstream process can be automated and measured.

Process & Workflow Standardization

FSSC has developed a unified set of procedures that apply to all branches/departments:

- Expense approval follow a single flow, with a clear hierarchy (limits, levels).

- P2P cycle (order – receive – payment) transparent: who does what, at what step, how long is the SLA.

- Error and exception handling procedures clearly defined → reduces congestion and shirking of responsibility.

- Automate the steps that can be automated: OCR, match, reconcile, send debt reminders, allocate collection…

Standard workflow is the foundation for FSSC to ensure stable service quality (service consistency).

Standardize output (Reporting & Performance Standards)

The output of the SSC must be measurable, comparable, and meet financial standards:

- Reporting according to IFRS/VAS standards, ensuring compliance and ease of consolidation.

- Real-time dashboard: cashflow, DPO, DSO, aging, AP/AR backlog, exception rate…

- Operational KPIs include:

- SLA (Service Level Agreement) – committed time to process each transaction

- FTR (First Time Right) – % right job the first time

- TAT (Turnaround Time) – average processing time

- Accuracy, cycle time, auto-match rate…

The calibration process helps FSSC operate as an "internal service" with clear KPIs, similar to a professional service provider.

Strategic benefits of implementing Finance Shared Service Center (FSSC)

Finance SSC not only helps businesses "reduce accounting costs," but also a long-term strategy to build a standardized, transparent financial platform ready for comprehensive digital transformation.

Reduce 40-60% financial operating costs

FSSC creates economic efficiency through centralization and automation:

- FTE Optimization: reduces the number of personnel required when processing large volumes of transactions.

- Reduce operational errors, limiting tax penalties, adjusting documents, double-payment…

- Reduce audit and internal control costs Thanks to standardized processes, consistent data, and high transparency.

This is why this model is adopted by large corporations: cost savings without sacrificing quality control.

Speed up processing of important operations (AP, AR, Closing)

Thanks to standardization + workflow + automation:

- Invoice processing time faster 5-10 times compared to manual process.

- Period close shorten 30-50% by comparing and standardizing the data.

- AP/AR processes according to SLA, limits backlog and reduces stress for the finance team.

High processing speed helps businesses make faster decisions and reduce operational risks.

Transparency & superior compliance

FSSC is designed for tight control:

- Audit trail 100% for all operations.

- Homogeneous data, easily available to inspectors, internal auditors and Big4.

- Reduce risk internal fraud Thanks to automated permission management, logging, and workflow.

The more branches, the greater the risk; FSSC is the “first line of defense”.

Improving data quality – the foundation for FP&A & financial strategy

FSSC provides the following data:

- Clean – synchronized – real-time

- Easy analysis by cost center, project, region, product

- Improved forecast accuracy for 20-40% due to more accurate input.

FSSC is the “data engine” that drives modern FP&A, BI, and financial planning.

Building the Foundation for Digital Finance Transformation

FSSC is the first step in the roadmap for the digital transformation of international finance:

- Growth to GBS (Global Business Services)

- Applying Process Mining to measure and optimize business flows

- Moving towards Predictive Finance, cash flow simulation & automated forecasting

Without FSSC, it is very difficult for businesses to implement in-depth digital transformation.

What is the core technology to operate Finance Shared Service Center?

A modern Finance SSC operates on a 6-layer technology architecture. Each layer serves a role in the P2P – O2C – R2R chain and is tightly connected to ERP.

ERP (SAP, Oracle, Dynamics, Odoo, Bravo…)

To be core system (system of record) place to store ledgers, CoA, accounts, invoices, vouchers, and provisions. ERP is responsible for: books, general accounting, finance, and master data. ERP is considered as the backbone of FSSC.

RPA – AI – OCR

Technology layer to eliminate 80-90% manual data entry operations:

- OCR/AI extracts invoice data.

- RPA automatically reconciles, accounts, and allocates.

- End-to-end support for P2P, O2C, R2R.

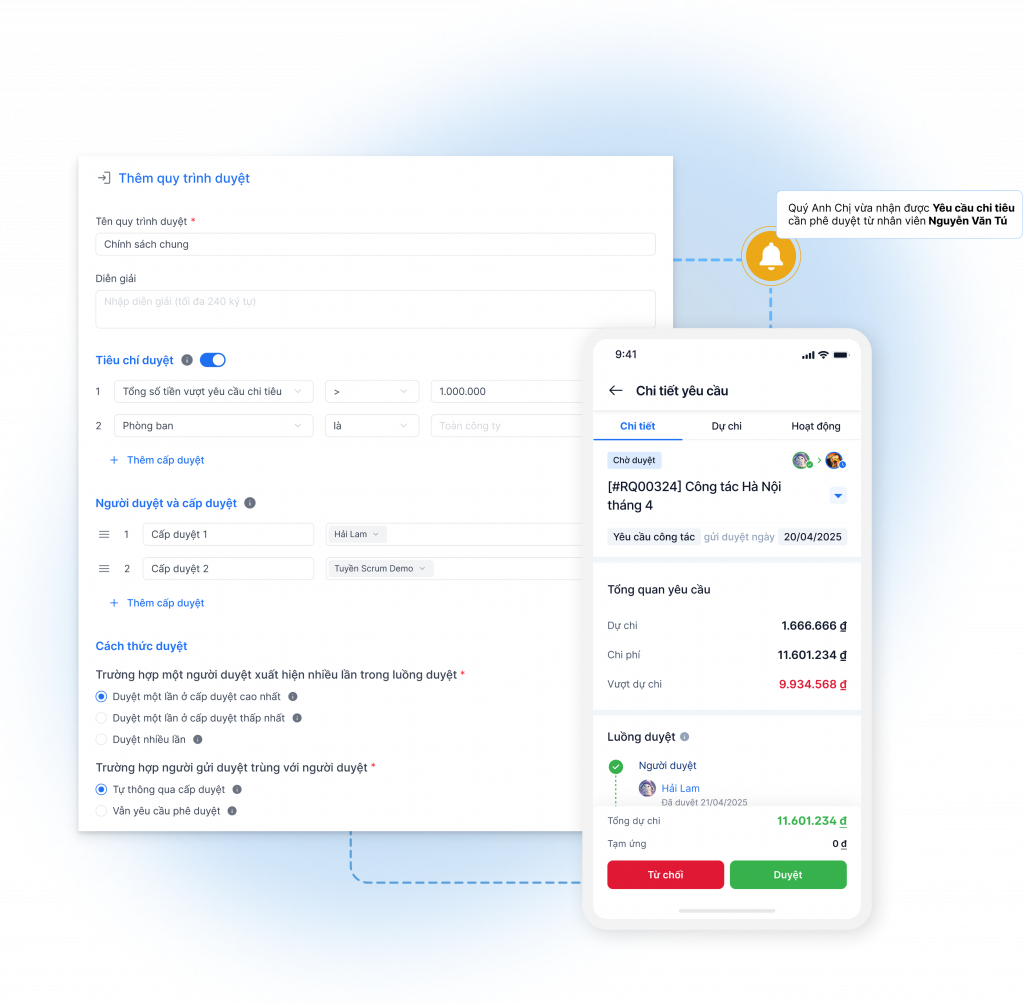

Workflow Automation

The approval and process control coordination system in SSC:

- Standardize expense approval across the group.

- Flexible routing based on cost center, project, and budget.

- Full log for audit trail 100%.

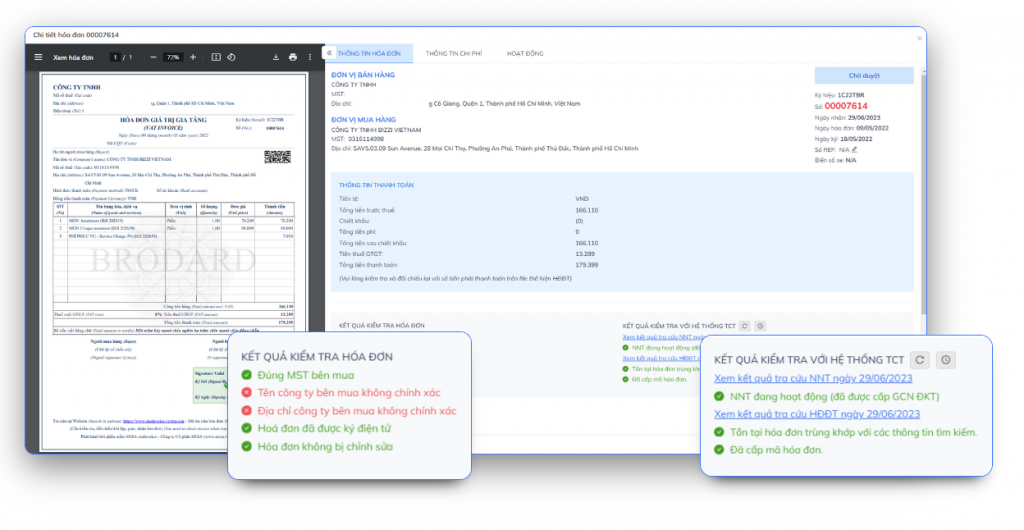

E-invoice Integration

Key integration layer in Vietnam:

- Verify the validity of the invoice according to tax standards.

- Synchronize invoice status with tax department & supplier.

- Reduce errors and fraud.

Process Mining

Technology to see the process "in action":

- Detect bottlenecks, loops, and delays.

- Measure actual cycle time and exception rate.

- Identify the operations that are Highest ROI on automation.

BI Dashboard (Ops + CFO)

Information display layer for decision making:

- SSC operations dashboard: SLA, TAT, FTR, backlog, workload.

- CFO dashboard: cash flow, DSO, DPO, AP Aging, Variance, Closing Status.

What are the risks and challenges of building a Finance Shared Service Center?

Implementing Finance Shared Service Center (FSSC) is a major transformation project, involving process – people – data – technology. Enterprises often face the following challenges:

Lack of standardization before collection to SSC

This is the most common mistake: each branch/department has different P2P – O2C – R2R processes → when consolidated into the SSC, the processing volume increases but the processes remain disorganized, leading to:

- Overlapping and inconsistent processes

- Difficult to measure KPIs

- SSC became a "manual mega-processing unit" rather than an efficient center.

Resistance to change from local personnel

Branch staff are often accustomed to outdated procedures ("we've been doing it this way for 10 years"), leading to:

- Delay in data delivery

- Failure to comply with the new procedure.

- Errors arise from manual data entry.

- Internal tensions between SSC and branches

Distributed data – difficult to integrate legacy ERP

Large enterprises often use ERP that has been deployed for many years, data:

- Distributed by department/branch

- Inconsistent format

- Have ERP but still enter data manually → data errors

This prevents the SSC from functioning smoothly.

Lack of clear KPI & SLA makes SSC operate inefficiently

A well-functioning SSC needs:

- SLA for invoice processing

- SLA for approval

- KPIs on cycle time, variance, backlog, overdue

- Real-time transparent dashboard

Without it, SSC operates in a hazy manner, is difficult to measure effectively, and is easily misunderstood as "increasing staff but not increasing productivity".

High startup costs without automation technology

An SSC often requires:

- Recruiting more staff to process documents

- Infrastructure investment

- Rebuild the process from scratch

If still done manually, the cost is even higher than the traditional model in the first 1-2 years.

Bizzi's role in the modern Finance Shared Service model

In the FSSC 2.0 generation, technology not only supports transactions but also creates a layer of intelligent data and automation, forming the foundation for financial operations, control, and decision-making. Bizzi is designed specifically for this goal: standardization, automation, integration, and real-time.

Bizzi creates a "Data Layer" for SSC.

The prerequisite of any FSSC is clean, unified, synchronized data. Bizzi takes care of all the heavy lifting:

- Collect, read, extract and validate invoices.

- Clean data before pushing into SSC/ERP.

- Standardize vendor master, tax code, and order information.

- Create a centralized data source for FP&A, BI, and CFO dashboards.

Bizzi becomes a common data layer for the entire financial system, helping SSC operate more accurately and faster.

Bizzi reduces AP Shared Services workload by 60-80%.

AP is the most time-consuming operation in SSC. With Bizzi IPA:

- Automatically process input invoices from OCR-AI to full validation.

- Real-time 3-way match (PO – GR/GRN – Invoice).

- Check tax code, supplier activity status, invoice validity.

- Automatically route invoices to the correct department for approval.

- Reduce errors that cause compliance risks and tax penalties.

AP workload is greatly reduced, allowing SSC to focus on control and analysis instead of manual processing.

Bizzi standardizes the expenditure approval process within the SSC.

Bizzi Expense helps businesses build a Standard workflow across the entire corporation:

- An approval flow for the entire branch/department.

- Real-time over-budget warnings.

- Automatically assign costs by department, cost center, and project.

- Optimize pre-control instead of post-error detection.

SSC doesn't need to "catch up on errors," but operates on standard procedures from the start.

Bizzi integrates seamlessly with ERP systems – reducing data entry and errors.

Bizzi acts as an intermediary integration layer between data sources and ERP, helping FSSC operate smoothly even when a business has multiple different systems.

- 2-way API with SAP, Oracle, Odoo, Bravo, Misa, FAST…

- Synchronize documents, vendor master, payment run, AP subsystem, and GL subsystem.

- Eliminate double entry – the source of most accounting errors.

- Easy to deploy for legacy ERP systems or multiple ERPs across branches.

Bizzi becomes the “automation backbone” of the modern FSSC

Bizzi not only reduces operating costs but also turns FSSC into a data & productivity growth center.

When partnering with SSC, Bizzi unlocks 3 levels of value:

- SSC → Transaction Hub

Focus on transaction-heavy operations: AP, AR, Expense, R2R.

- SSC + Bizzi → Automation Hub

AI – OCR – Workflow – Validation – ERP integration creates automatic processing flow.

- SSC + Bizzi + BI → Insight Hub

Clean data → real-time CFO dashboard → increase forecast quality & decision making.

What are the frequently asked questions about Finance Shared Service Centers?

To help managers have a more specific perspective on the nature of Finance Shared Service Center, below is a summary of answers to related questions.

1. How is FSSC different from BPO?

The difference between the two concepts above:

- FSSC: Operate inside the business, with standardized processes, SLAs, KPIs, automation technology and tight control.

- BPO: Outsourcing vendor processes; higher security risks and difficulty in quality control.

In short, FSSC is suitable for businesses that want to keep data & control in-house; BPO is suitable for high volume processing but does not need sensitivity.

2. What are the benefits for the finance department from the Finance Shared Service Center?

Solutions like Bizzi contribute to Increase the efficiency of FSSC through P2P automation – Expense – ERP integration – data standardization. From there, the finance department will:

- Reduce operating costs by 40-60%.

- Increased AP/AR/Closing processing speed.

- Transparency – compliance – full audit trail.

- Clean data forms the foundation for analytics & FP&A.

- Reduce manual workloads so that finances can focus on strategy.

3. Which businesses should implement SSC?

Best suited for businesses:

- Have 3-5 branches/centers or more.

- Expanding rapidly → AP/AR/Closing is “congested”.

- Using multiple accounting/ERP systems.

- Want to standardize processes and increase control over spending.

- Have a financial digital transformation orientation.

4. What services are included in FSSC?

According to international standards, FSSC includes 4 professional groups:

- P2P / Payable Accounts: input invoice processing, 3-way reconciliation, payment.

- O2C / Accounts ReceivableIssuing, sending, and reconciling invoices; collecting debts; allocating funds.

- R2R: account reconciliation, banking, closing, financial reporting.

- Supporting Services: Payroll, T&E, Fixed Assets.

Bizzi Comprehensive P2P, Expense/T&E and deep R2R connection through ERP integration.

5. How much does it cost to build SSC?

Costs include:

- Design & standardize processes.

- SSC Recruitment.

- Technology (Workflow, OCR, RPA, Integration…).

- Operator training.

With Bizzi, startup costs are significantly reduced thanks to:

- Automation is available (no need for complex custom RPA).

- Fast deployment time (a few weeks to a few months).

- Reduce FTE required for AP/Expense.

6. Is RPA suitable for SSC?

Yes — but not always necessary.

- RPA is suitable for repetitive tasks with clear rules.

- However, traditional RPA deployment is expensive: writing bots, maintaining bots, fixing bots.

Bizzi offers built-in automation (OCR – AI – Workflow – Integration), enabling SSC to achieve the same efficiency as RPA but without the limitations of SSC. Faster deployment – less risk – lower cost.

7. What does SSC management KPI include?

3 main KPI groups:

Performance (Operational KPIs)

- Invoice cycle time

- First-time-right (FTR)

- On-time approval

- AP/AR Backlog

Compliance KPIs

- Audit exceptions

- Error rate

- SLA fulfillment

Financial KPIs

- DSO

- AP Aging

- Pressure cycle

- Variance reporting accuracy

Bizzi helps businesses track KPIs. real time via integrated dashboard.

8. Does Bizzi meet SSC requirements?

Yes. Bizzi is suitable for the modern FSSC with 4 core capabilities:

- AP Automation (P2P): OCR – AI – Validate – 3-way match – Vendor check.

- Expense/T&E Workflow: Standardize approvals, alert you to budget overruns.

- ERP Integration: 2-way API with SAP, Oracle, Odoo, Bravo, Misa…

- Audit Trail + Data Layer: Centralized, clean data, ready for BI/FP&A.

Bizzi helps businesses build FSSC faster, cheaper, and more efficiently.

Conclude

The above information covers everything related to what a Finance Shared Service Center (FSSC) is. It's clear that a Finance Shared Service Center (FSSC) is a turning point that helps businesses move away from decentralized operations and towards a standardized, automated, transparent, and cost-effective model on a large scale. As businesses expand, FSSC becomes an indispensable platform for maintaining growth while controlling risk and productivity.

At the heart of any successful FSSC is clean data, standardized processes, and a high degree of automation. These are also the biggest gaps that cause many SSC projects to fail.

Bizzi fill that gap.

Bizzi helps businesses build a "financial foundation" right from day one with:

- Invoice data is checked, standardized, and synchronized.

- Workflow approval is standardized across the entire corporation.

- Automating AP/Expense significantly reduces the workload for SSC.

- Two-way integration with ERP to eliminate data entry and errors.

Thanks to Bizzi, businesses can Implementing FSSC faster – lower cost – higher efficiencyThis also opens up a solid data foundation for future FP&A and Finance Transformation.

Register here to receive advice on solutions tailored to your business: https://bizzi.vn/dang-ky-dung-thu/