Financial accounting is more than just record-keeping; it's a system for generating financial reports, controlling risk, and providing data for CFO decision-making. This article explains the nature, process, metrics, and how modern businesses can automate financial accounting.

What is financial accounting according to accounting standards and from a CFO's perspective?

Financial accounting is a system for recording, classifying, summarizing, and presenting a company's financial information according to accounting standards and legal regulations, aiming to reflect the company's financial situation, business results, and cash flow over a specific period.

According to accounting standards: Financial accounting is the accounting system used to prepare and present financial reports to external stakeholders. For the CFO, financial accounting is not just for reporting, but is the living data foundation for financial decisions.

Although they share the same concept, accounting standards and the CFO's perspective approach financial accounting with different objectives.

| Criteria | Accounting standards | CFO perspective |

| Target | Compliance & Reporting | Decision & Control |

| Object | Outside the business | Board of Directors |

| Time | Past | Present & near future |

| Frequency | By period | Near real-time |

| Focus | Revenue, expenses | Cash, risk, volatility |

| Value | Correct - sufficient | Correct – Fast – Usable |

What value does financial accounting create, and who actually uses this data?

Financial accounting creates a “standardized and legally binding source of data.”, help businesses:

- Evaluate financial efficiency

- Control risk invoice or others expenses, liabilities, taxes

- Governance and financing decisions

- Ensuring compliance with the law

The core values of financial accounting It's not about the bookkeeping., which lies in the fact that: Transforming transaction data into reliable information for decision-making and demonstrating legal liability..

Financial accounting provides standardized data to CFOs, management, banks, investors, and tax authorities to assess performance, control risks, and ensure legal compliance.

1. Internal users (decision-makers)

Internally, financial accounting is input for management and operations, not just end-of-period reporting.

| Object | What do they use the data for? |

| CFO | Control costs, cash flow, debt, invoice/tax risk; tracking Target vs Actual; forecast |

| CEO / Board of Directors | Assessing financial health, profitability, scalability, and strategic decision-making. |

| FP&A | Budgeting, variance analysis, financial modeling, cash flow forecasting |

2. External users (evaluation & monitoring)

From an external perspective, financial accounting is legal evidence and belief.

| Object | What are they interested in? |

|---|---|

| Bank | Ability to repay debt, cash flow, and data reliability are factors in credit granting. |

| Investors | Profitability, profit margin, transparency, financial risk |

| Tax authority | Compliance, valid invoices, and legally compliant revenue and expenses. |

In short, financial accounting creates value when its data is used to control risk, protect cash flow, and support decision-making – not just for filing reports.

What is the core objective of financial accounting? Compliance or decision support?

Financial accounting must both ensure compliance with standards and laws and provide timely data to support management decisions, especially those related to costs, cash flow, and risk. Financial accounting has two parallel, non-exclusive objectives:

- Compliance

- Decision support

The issue isn't about choosing one over the other, but rather: Is the business merely meeting minimum compliance standards, or has it leveraged financial accounting data for management purposes?

1. Compliance – a mandatory foundation that cannot be abandoned.

Financial Accounting Right ensure:

- Accounting standards: VAS / IFRS

- Tax lawVAT, corporate income tax, personal income tax

- Documentation & Archiving: invoices, contracts, original documents, retention period

If non-compliance:

- Businesses face the risk of tax penalties, back taxes, and damage to reputation.

- The CFO has no "legal shield" for financial decisions.

2. Decision support – real added value

Financial Accounting only create management value when the data meets 3 criteria: Accuracy – Timeliness – Consistency

CFOs make decisions using financial accounting data:

- ExpenseWhere did the budget overrun occur? At which stage did the leakage happen?

- Accounts Payable/Amounts Payable (AR/AP): DSODPO, aging, collection risk

- Cash flow: money already spent, spending, Not recorded

- ProfitActual margin vs. accounting margin

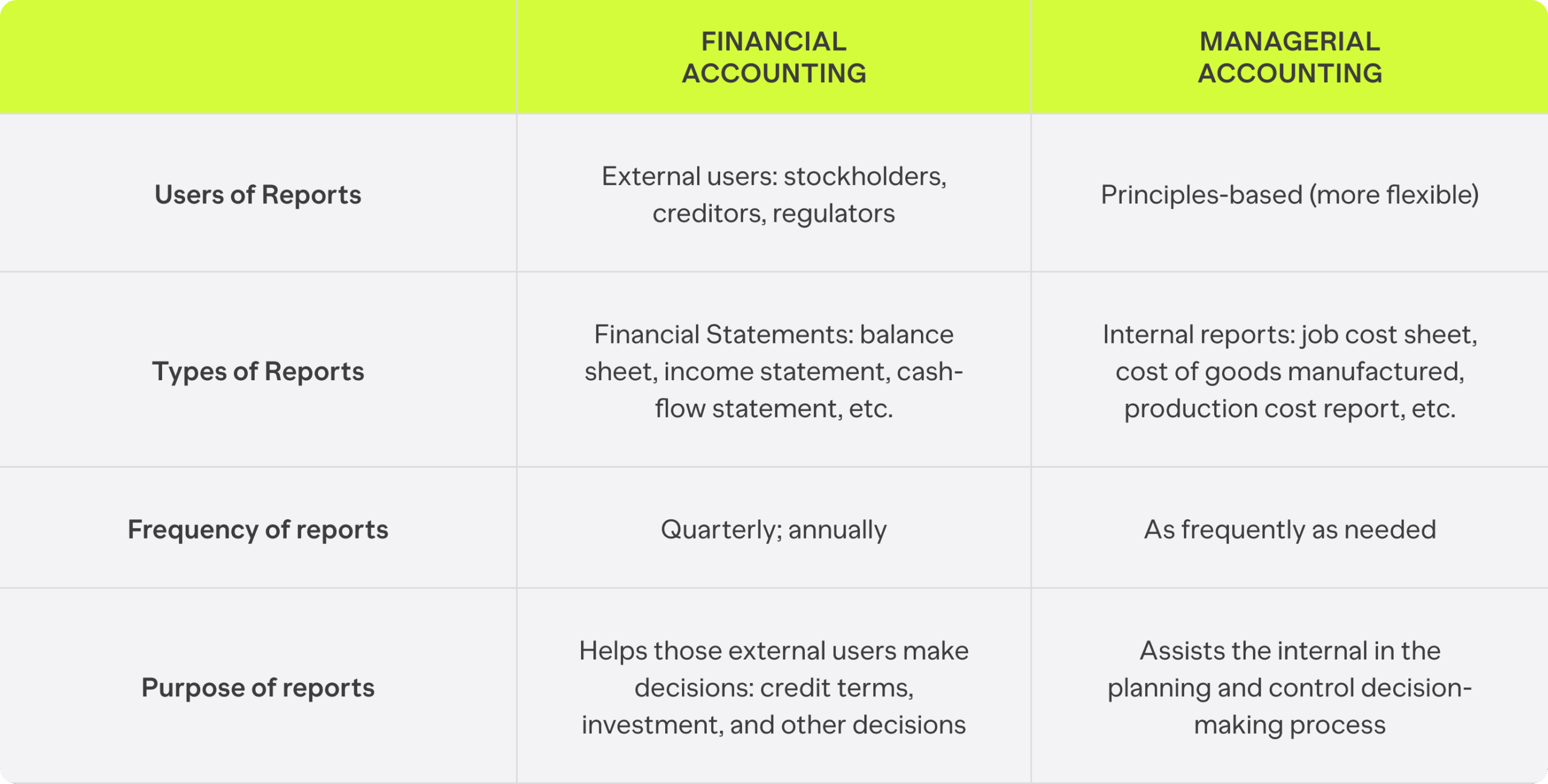

How does financial accounting differ from management accounting and FP&A in practical operations?

Understanding the fundamental nature of financial accounting is essential for CFOs to differentiate it from related concepts. Below is a practical, operational, and CFO-oriented (Finance Ops) perspective.

| Criteria | Financial Accounting | Management accounting | FP&A |

| Target | Compliance & Transparency | Control & Optimization | Forecasting & Decision Making |

| Time | Past | Present | Future |

| Standard | Obligatory | Internal | Model |

| Value | "That's right." | "No waste" | "Going in the right direction" |

Example: The same marketing invoice of 500 million:

- Financial accounting: Is the invoice valid? Which account should it be recorded in? How will the tax authorities handle it?

- Management accounting: Which campaign does this expense belong to? Is it over budget? Who approved it?

- FP&A: If this spending pace continues, what will be the difference between P&L and cash flow at the end of the quarter?

In short:

- Financial accounting helps businesses avoid breaking the law.

- Management accounting helps businesses avoid waste.

- FP&A helps businesses avoid going in the wrong direction.

What is the standard financial accounting process in a business, from documentation to reporting?

Financial accounting is not just a series of bookkeeping operations, but a process of controlling data from source to report, enabling businesses to both comply with the law and make timely decisions.

1. Source Document Generation and Collection

Source of documentation:

- Input/Output Invoices

- Contract, Purchase Order, Acceptance Certificate

- Receipts and payment vouchers, bank statements

- Payroll, cost allocation

Standard requirements:

- Legally valid (taxes, electronic invoices)

- Sufficient information: Supplier, price, tax, date, content

- Have business owner (owner)

2. Document control and approval (Pre-control)

Target: control before recording

- Check:

- Invoice ↔ Contract ↔ Purchase Order (3-way matching)

- Within budget? Within authority?

- Workflow approval

This is the step often overlooked, but the decision: the business Is the expenditure correct or incorrect?, not an accountant.

3. Accounting Records (Recording & Posting)

- Accounting entries according to VAS/IFRS

- Classify:

- Costs vs. Assets

- OPEX vs CAPEX

- Note:

- According to accrual accounting.

- Not following the cash flow

Principle: Recording at the right time is more important than recording quickly.

4. Reconciliation & Adjustment

Required reconciliations:

- Accounts Receivable (AR) – Aging

- Accounts Payable (AP)

- Bank statement

- Taxes – invoices

Final adjustments:

- Accrual / prepaid

- Depreciation, allocation

- Preventive

If you skip this step → report correct register But incorrect in nature.

5. Closing the accounting books

- Finalize data by period (month/quarter/year).

- No edits outside of the established process are allowed.

- Prepare a closing record.

What the CFO is interested in:

- Closing cycle time

- The faster the data, the more usable it is for decision-making.

6. Financial Reporting and Analysis

Required report:

- Balance Sheet

- Income Statement

- Cash Flow Statement

- Notes to financial statements

Report to management:

- Cost vs. Budget

- AR/AP & Cash Flow

- Variance analysis

Report only has value when: correct + timely + explainable.

What are the risks associated with invoices and supporting documents for financial accounting?

All financial reporting discrepancies, tax risks, or expense losses originate from invoices and input documents. Incorrect invoices, risky suppliers, or manual data entry can distort expenses, create tax risks, and prolong closing times, directly impacting the reliability of financial reporting.

1. Legal & Tax Risks (Compliance Risk)

Input invoices can cause:

- VAT is not deductible.

- Expenses disallowed during corporate income tax settlement.

- Collection of arrears, penalties for late payment, administrative fines.

Common causes:

- Invalid/Incorrect Invoice

- NCC is at risk, has absconded, or has ceased operations.

- The documents are insufficient to prove the expenses.

This is a risk that directly impacts the company's P&L and reputation.

2. Misstatement Risk

Incorrect invoice → incorrect recording:

- Cut-off

- Incorrect account

- Incorrect classification of costs versus assets.

Consequences:

- Profits are distorted.

- The costs do not accurately reflect the activities.

- CFOs make decisions based on data. unreal

Reporting that is "correct in the records" but inaccurate in substance is the most dangerous risk.

3. Risks of Expense Loss & Fraud (Spend Leakage & Fraud)

Common scenarios:

- Duplicate invoice

- Invoice with inflated prices

- Off-budget expenditures

- Internal collusion – suppliers

If you only check after payment, then: Fraud is already done, the money is gone, and the risk of recovery is irretrievable.

4. Accounts Receivable/Amount-Acceptable Payable & Cash Flow Risk (AR/AP & Cashflow Risk)

The CFO has lost the ability to forecast real cash flow.

- Incorrect AP recording → Incorrect DPO → Unbalanced cash flow

- Late bills → insufficient accrual → accumulated costs

- Late payments → lose discount or incur penalties.

5. Operational & Human Risk

Hidden costs: labor hours + stress + audit risk

- Manual data entry → high error rate

- Disjointed processes → untraceable

- Personal dependence → taking a break is a problem.

6. Timeliness Risk

- The bill arrived late.

- Slow browsing

- Delayed recording

Consequences:

- The report was released late.

- Failure to intervene in time to cover costs.

- Missed opportunity to adjust cash flow during the period.

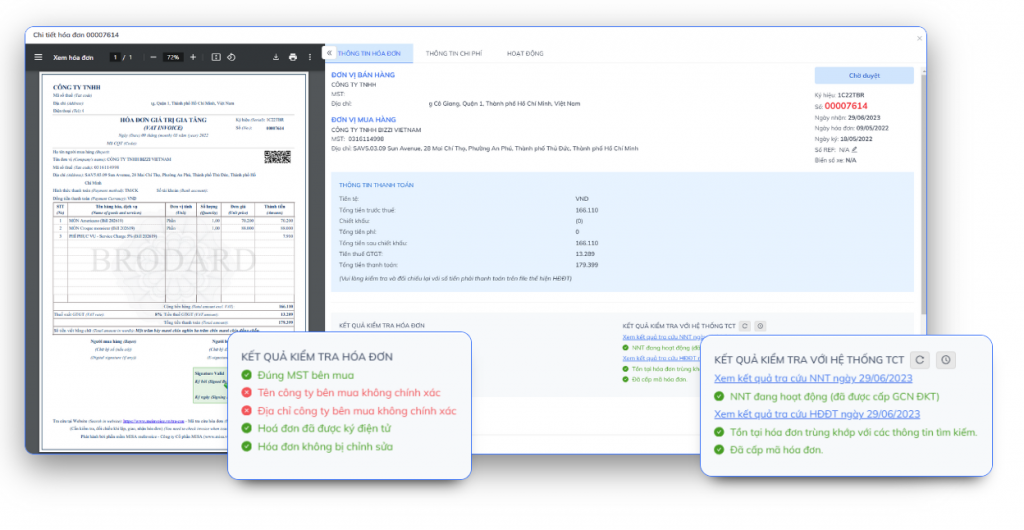

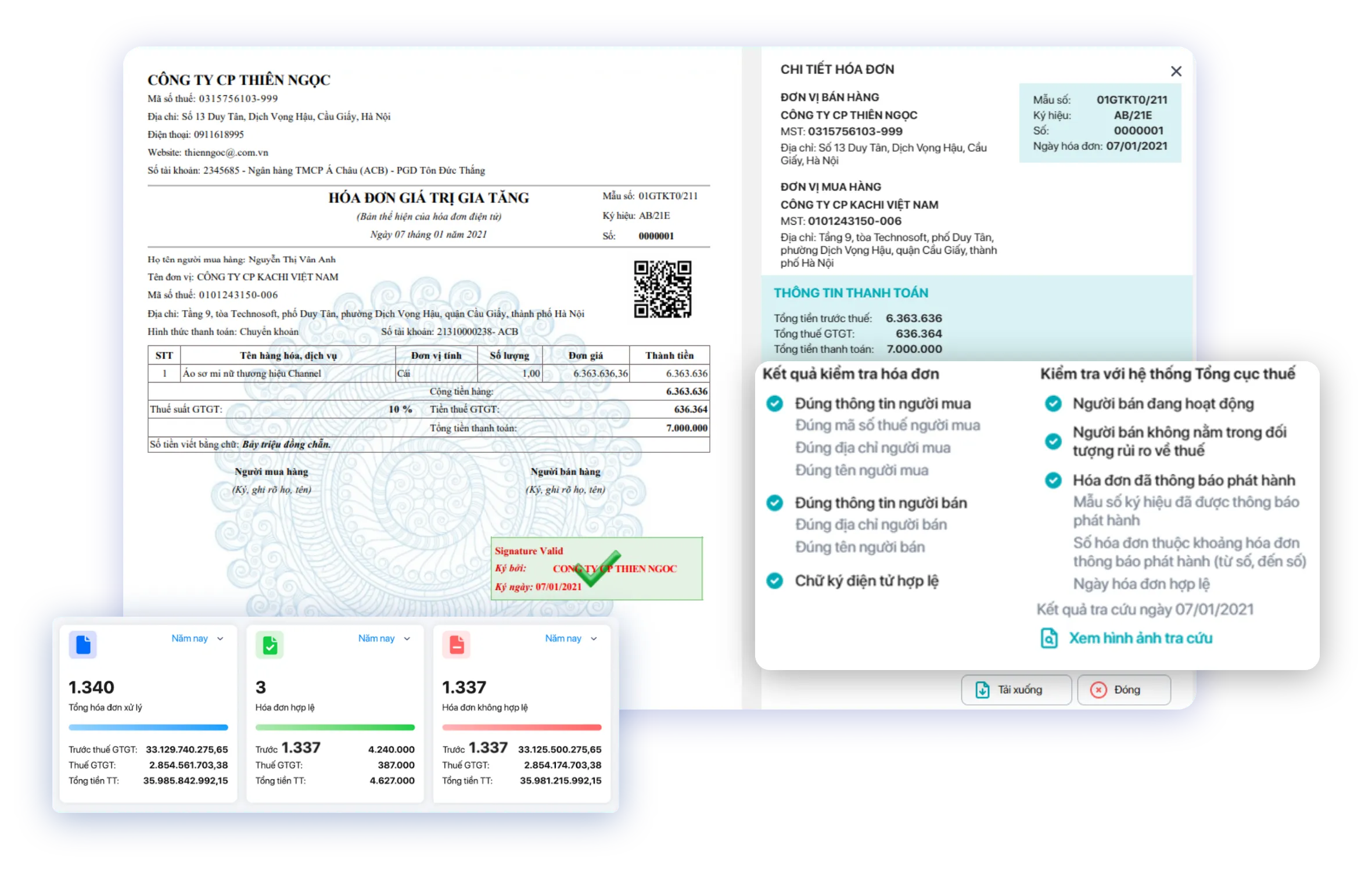

Advantages of using Bizzi to avoid input invoice risks.

Bizzi helps shift invoice control from “correcting errors after recording” to “preventing risk before expenses are recognized and paid.” Bizzi not only helps process invoices faster, but also helps CFOs control invoice risk right from the start – before expenses impact profits and cash flow.

Step 1. Bizzi Bot automatically receives invoices from email/e-invoice portal.

The problem with handmade crafts.

- Lost or misplaced invoices

- Sent to the wrong person, slow processing.

- No control logs

Bizzi's advantage

- Consolidate 100% invoices into one point.

- There are traces of receipt (timestamp, sender).

- Reduce personal dependence

Step 2. OCR extracts invoice data.

Problems when entering data manually

- Incorrect Tax Identification Number (TIN), incorrect amount, incorrect tax rate.

- It wastes accounting time.

- Difficult to expand as volume increases.

Bizzi's advantage

- Automatic extraction: Tax ID, invoice number, date, value, VAT

- Normalize data from the start.

- Reduce data entry errors.

Step 3. Automatically check the Tax Identification Number (TIN), supplier status, and invoice validity.

Common problem

- NCC is at risk and has ceased operations.

- Invalid invoices are still being processed.

- Discovering errors during… tax settlement

Bizzi's advantage

- Check:

- Does MST exist?

- NCC status (active/risky)

- Invoice validity

- Automatic comparison, independent of personal experience.

Step 4. Warning about risks before recording expenses.

Traditional issues

- Errors discovered after accounting entries have been made or payments have been processed.

- The flow of money cannot be reversed.

Bizzi's advantage

- Early warning:

- Duplicate invoice

- NCC risk

- Abnormal data

- Allow:

- Recording temporarily suspended.

- Request for additional/replacement invoice

How does Accounts Receivable/Accounts Payable (AR/AP) accounting affect a company's cash flow?

Cash flow does not depend on accounting profit, but rather on how the business manages AR/AP.

Financial accounting is where:

- Record accounts receivable accurately, completely, and on time.

- Tracking debt aging

- Providing data for the CFO to manage actual cash flow.

1. Accounts Receivable (AR) Management – Are the funds being received on time?

The role of financial accounting

- Record revenue and accounts receivable at the right time.

- Monitor aging AR according to:

- Client

- Payment terms

- Risk group

- Detect:

- Overdue debt

- Bad debts

- Invoice-contract discrepancies

Impact on cash flow

- AR increases → money Not back yet

- DSO increases → cash gets stuck

- Revenue is recorded but no payment is received → illusory profits

The CFO can only push to collect money when AR data is timely and reliable.

2. Managing Accounts Payable (AP) – Is the money being spent at the right time?

The role of financial accounting

- Record all APs (including invoices that have not yet arrived – accrual).

- Monitor aging AP

- Control:

- Pay on time.

- Avoid duplicate payments and unnecessary early payments.

Impact on cash flow

- Poor AP management → early payment → quick cash out

- AP notes a shortfall → cash flow "taken by surprise"

- The payment terms were not taken advantage of.

Good AP management = Keep your money longer without violating your commitment..

3. The relationship between AR/AP and Cashflow & Working Capital

Cash = Quick Collection (DSO) + Time Payment (DPO) – Reasonable Inventory

| Index | Meaning |

| DSO | Cash collection rate |

| DPO | Payment speed |

| CCC | Currency conversion cycle |

4. Risks associated with poor AR/AP (Audit, Financial, and Administrative) accounting.

- Cash flow report does not reflect real money.

- The CFO failed to forecast capital needs.

- We had to take out short-term loans because our cash was tied up.

- Increased liquidity risk

This is why CFOs care. The aging report is better than the P&L. at various times.

Common problems faced by CFOs stem from:

- Accounts receivable are only reviewed at the end of the month.

- Aging discrepancies due to delayed invoices and reconciliation.

- DSO/DPO only "see" the problem when it's too late to intervene.

Bizzi ARM helps CFOs see and manage accounts receivable in near real-time.

1. Automatic debt aging tracking (AR/AP Aging)

Bizzi ARM:

- Update the debt age as follows:

- Bill

- Payment terms

- Reconciliation status

- Subgroups:

- Not yet due

- The deadline is approaching.

- Overdue

2. Automated debt reminders and reconciliation.

For AR (receivables):

- Remind me of my debt before the due date.

- Track customer feedback.

- Record the payment status.

For AP (paid):

- Invoice reconciliation – accounts payable

- Avoid duplicate payments and unnecessary early payments.

- Prepare a payment plan.

CFO value: reduce DSO without losing customers, increase DPO under control.

3. The CFO monitors DSO/DPO in near real-time.

CFOs can:

- Early intervention for high-risk customers.

- Adjust supplier payment schedule.

- Cash flow decision-making during the period, not after the period

What is Financial Accounting 4.0 and how does automation help reduce data entry?

Accounting Industry 4.0 applies AI and RPA to automate invoice processing, reconciliation, and recording, reducing manual data entry, increasing accuracy, and providing real-time data for CFOs.

What is Financial Accounting 4.0?

Financial Accounting 4.0 is an accounting model in which:

- Data is collected, checked, verified, and recorded primarily through automation and AI.

- Accountants are shifting their roles from data entry and error correction to control, analysis, and decision support.

- The CFO receives timely, accurate, and traceable data.

In short: Accounting 4.0 = Compliance + Decision-support + Automation

How does automation help reduce 80% data entry?

Automation doesn't replace accountants, but rather replaces the data entry work of accountants. The value of Financial Accounting 4.0 lies in:

- Better control

- Make decisions faster.

- Less risk

1. Automatically collect documents

- The bot receives invoices from:

- e-invoice portal

- No longer available:

- Download by hand

- Save as separate files

Reduced data entry = no need to retype existing information.

2. OCR & AI data extraction

- Auto-read:

- MST

- Some bills

- Day

- Value

- Tax

- Format standardization

3. Automated verification and reconciliation

- Check:

- MST

- NCC status

- Duplicate invoices

- Amount discrepancy

- 3-way matching (PO – GR – Invoice)

4. Automatic accounting and data pushing

- Account mapping, tax rates

- Move accounting entries to ERP.

- Keep audit trail

Data entry is replaced by review and exception handling.

In summary, Financial Accounting 4.0 helps businesses reduce data entry by 80% in exchange for increased control and timely decision-making capabilities. Bizzi is a platform that helps financial accounting transition to the 4.0 model: less data entry – more control – data usable for decision-making.

- Step 1: Bot receives the invoice.

-

-

- The bot automatically collects invoices from: Accounting email, Electronic invoice portal.

- Attach a timestamp and source information.

-

- Step 2: OCR extraction

-

-

- OCR + AI extraction: Tax code, invoice number, date; Pre-tax value, VAT, total amount

- Data format normalization

-

- Step 3: 3-way matching PO–GR–Invoice

-

- Automatic reconciliation: Purchase Order (PO), Receipt of Acceptance/Delivery Report (GR), Invoice

- Warning about discrepancies in Price – Quantity – Tax

- Step 4: Push data to ERP/accounting

- Account mapping, tax rates

- Data transfer to: ERP, Accounting software

- Maintain consistent accounting logic.

- Step 5: Archive and audit trail

- Store original invoices and documents.

- Record the entire history: Receive – process – approve – edit

- Ready for tax audits and inspections.

What skills and tools does a modern business require of a financial accountant?

In modern businesses, financial accounting is no longer just a "bookkeeping department" but a data pillar for the CFO and the Executive Board. Therefore, skills and tools need to be viewed in three layers: foundation – analysis – technology.

Modern financial accounting requires a combination of standard knowledge, data control skills, and the ability to use digital tools to ensure accurate, timely, and audit-ready reporting.

1. Core skills of modern financial accounting

1.1. Compliance skills

- Understand and apply:

- VAS / IFRS (at a practical level, not just theoretical)

- Tax laws: VAT, Corporate Income Tax, Personal Income Tax

- Manage and store documents and invoices properly and legally.

Key metrics that CFOs care about.

- No retroactive collection/penalties.

- Audit pass

- Clear contact tracing record

1.2. Data management and decision-support skills

A good financial accountant must be able to "talk business with numbers.". Skill Required:

- Understanding accounting data serves the following purposes:

- Cost management

- Accounts Receivable/Amounts Payable (AR/AP)

- Cash flow

- Read and explain:

- P&L

- Balance Sheet

- Cash Flow

Important mindset

- From “accurate recording” → “accurate and timely recording”

- Know how to ask questions:

- Are these costs ballooning?

- Are DSO/DPO pulling or pushing the money flow?

1.3. Risk Control & Internal Management Skills

- Identifying risks:

- Invalid invoice

- Risk provider

- Off-period expenses

- Understanding and operation:

- 3-way matching

- Authorization – approval

- Audit trail

Accountants don't just do numbers; they act as "gatekeepers."

2. Technology & Data Skills (required in Accounting 4.0)

The data entry clerk will be replaced, but the system administrator will not.

2.1. Accounting Automation

- Understand how:

- OCR invoices

- Bot collects documents

- Auto-posting

- Learn how to handle exceptions instead of manually entering 100%

2.2. Data & Reporting Skills

- Advanced Excel (pivot, power query)

- Basic BI (Power BI / Looker / Tableau – at the reading and interpretation level)

- Understanding the logic of indices:

- DSO, DPO, CCC

- Gross margin, operating margin

Accountants in the 4.0 era don't need to be data scientists, but they must be able to read dashboards.

FAQ – What are some frequently asked questions from CFOs and Accountants about financial accounting?

Below is a compilation of answers to some frequently asked questions related to financial accounting.

How can I reduce data entry time for 80% while maintaining accuracy?

Principle

- Not optimized for "faster human input".

- But Eliminate manual input.

Effective methods

- The bot automatically receives invoices from email/e-invoice portal.

- OCR extracts data (date, amount, tax, supplier).

- Normalize data before recording.

- The accountant only handles it. exception (exception)

Key CFO metrics to monitor

- Automation rate (% invoices not entered manually)

- Cost per invoice

How does 3-way matching help prevent internal fraud?

Principle of control

- No purchase order → not recorded

- No GR → no payment

- Invoice with price/quantity discrepancies → blocked

Common scams were prevented.

- Fake invoices without purchase orders attached.

- Collusion to raise prices

- Payment for goods not yet received

CFO interested

- Exception rate by mismatch type

- Invoice number blocked before payment

How can we control expenses in real time instead of at the end of the month?

Traditional issues

- Expense report = past

- A CFO knows when to exceed the budget… only after they've already exceeded it.

A new approach

- Attach budgets to the approval workflow.

- Track spend vs budget at the time of request for payment

- Warning: Exceed threshold before approval.

Key KPIs

- Overrun %

- Use leakage

- Cycle time for expenditure approval

How can I identify a risky supplier before making a payment?

Common risks

- NCC has absconded.

- MST has ceased operation.

- The invoice was invalid but was still processed.

Effective control methods

- Automatic check:

- MST

- NCC operating status

- Invoice validity

- Attach risk warnings before recording expenses.

CFO monitoring

- Vendor risk rate

- The invoice number was blocked due to risk.

How does digital transformation in accounting and finance affect free cash flow?

Direct impact

- Reduce DSO by monitoring AR in real time.

- Control DPO, avoid early payments.

- Reduce miscalculations and erroneous invoices.

Financial consequences

- Release working capital

- Improve CCC

- Free cash flow increases without increasing revenue.

What are the most common differences between financial accounting and tax accounting that are easily confused?

| Easily confused | Financial Accounting | Tax accounting |

| Target | Accurate reflection | Tax optimization and compliance |

| Standard | VAS / IFRS | Tax law |

| Timing | Accrual | Cash / declaration |

| User | CFO, BOD, investors | Tax authority |

Do small businesses need to automate their financial accounting?

Early automation is far cheaper than late fixes. The smaller the business, the sooner it needs it. Automation helps:

- Reduce errors

- Standardize from the start.

- Easy to scale when growing

Conclude

The above is a complete explanation of the nature of financial accounting. For the CFO, financial accounting is not just a department that records data, but the central nervous system that reflects the financial health of the business. real timeA proper understanding of the nature, processes, risks, and key indicators directly impacts the ability to control costs, cash flow, and legal risks.

Implementing solutions like Bizzi offers clear advantages for businesses, both from the CFO's perspective in financial management and in daily accounting operations. The biggest difference isn't about "doing it faster," but about earlier, more accurate, and less risky control.

Bizzi is not just an accounting tool, but a platform that helps CFOs control costs, invoices, accounts payable, and cash flow in real time. Implementing Bizzi helps businesses:

- Optimizing financial efficiency

- Reduce legal risk

- Freeing up accounting resources

- Enhance financial management capabilities in a sustainable manner.

To receive personalized solutions tailored specifically to your business, register here: https://bizzi.vn/dang-ky-dung-thu/