Work in progress is not just a “pending number” – it is an ongoing financial health indicator. Good work in progress management is a solid foundation for sustainable business development.

This article by Bizzi will provide the most detailed information about what work in progress is and how to account for work in progress to improve business efficiency.

What is work in progress?

Work in progress Work in Process Cost or Work in Progress Cost) is a type of cost that arises during the production/business period but is related to products and services. unfinished at the end of the period. This is part of inventory, specifically work in progress inventory.

For example: A company manufactures tables and chairs. At the end of April, they are processing 20 tables, each of which is about 70% complete. All the costs that have gone into it (wood, paint, labor) are called work in progress costs.

The nature of work in progress

Work in progress reflects the economic value of raw materials, labor, and manufacturing overhead used to create an unfinished product. The nature of work in progress includes:

- Temporary and transitional: Work in progress costs do not exist for a long time. When the product is completed, these costs will be transferred to the cost of the finished product.

- Reflects the actual production status: Helps businesses know the remaining workload, avoiding incorrect assessment of production efficiency.

- As part of the costs that have been incurred: Even though the product is not yet completed, costs such as raw materials used, workers used, electricity and water consumed, etc. are all actual costs and need to be recorded.

- Impact on cost of goods sold: If work in progress is calculated incorrectly, it will affect cost of goods sold, thereby distorting profits and financial statements.

Distinguishing Work-in-Progress from Other Types of Costs/Assets

It is extremely important to distinguish work in progress from other types of costs or assets to avoid misrecognition in accounting books and financial statements. Below is a comparison table and detailed explanation for you to visualize:

- Work in progress vs. Completed manufacturing costs

| Criteria | Work in progress | Completed manufacturing costs |

| Product status | Unfinished product | Finished product |

| Accounting position | Assets (in inventory) | Can be converted to cost of goods sold when sold |

| Purpose | Track work in progress value | Calculate official product cost |

- Work in progress vs. Selling & administrative expenses

| Criteria | Work in progress | Selling/Administrative expenses |

| Purpose | Create physical products | Business Support |

| Nature | Accumulation in inventory | Immediately included in accounting period costs |

| Reporting location | In stock | In the income statement (operating expenses) |

- Work in progress vs. Raw materials inventory

| Criteria | Work in progress | Raw materials inventory |

| Usage status | Already in production | Not used, still in stock |

| Note | Group by product/stage | Record by type and quantity |

| Price impact | Yes, because it is creating a product. | No effect on price yet |

Work in Progress vs. Prepaid Expenses (Current Assets)

| Criteria | Work in progress | Prepaid expenses |

| Purpose | Related to the product being manufactured | Allocate over multiple periods (rent, insurance, repairs…) |

| Note | Attached to the production process | Associated with service time |

| For example | Cost of processing unfinished chairs | Office rental fee paid in advance for 6 months |

- Work in progress vs. Fixed assets

| Criteria | Work in progress | Fixed assets |

| Nature | Temporarily, will convert to product cost | Long lasting, use >1 year |

| Note | In inventory (short term) | On the fixed asset accounting books |

| Depreciation | No depreciation | Depreciation over time of use |

What is the importance of determining work in progress?

Accurately determining work in progress is critical to accounting and business management. Here are the key reasons why it is important to do this carefully:

Ensure the correctness of product prices

Work-in-progress is a part of the product cost. Work-in-progress at the end of the period is the basis for determining the value of finished products in stock during the period (Cost = Work-in-progress at the beginning of the period + Work-in-progress incurred during the period - Work-in-progress at the end of the period). If calculated incorrectly:

- The price will be higher or lower than the actual price.

- Causes distortion of profits leading to financial statements not reflecting true operating performance.

Management decision support

- Determine production efficiency.

- Production planning, process adjustment, product pricing, etc.

- Detect unnecessary waste or backlog in production.

Serving accurate financial reporting

- Financial statements must accurately reflect the value of inventories (including work in progress).

- Work in progress affects cost of goods sold (COGS) and profit. If COGS is incorrectly recorded, it will result in gross profit and final profit being incorrect.

Minimize accounting fraud and risk

- Some businesses deliberately adjust work in progress costs to "beautify" their financial reports.

- Accurate identification helps to tighten controls and reduce the risk of error or fraud.

Classification of work in progress

Work in progress in production can be classified from many different perspectives, depending on management or accounting purposes. Not only understanding what work in progress is, but also classifying work in progress will help identify the right costs in different types of businesses.

- Classification by product cost elements

Here is the basic classification according to the nature of the cost:

| Cost Type | Content |

| Direct material cost | Value of raw materials used for products but not yet completed. |

| Direct labor costs | Salaries and other payments to workers directly involved in production. |

| General manufacturing costs | Indirect costs such as electricity, water, machinery depreciation, workshop management costs, etc. |

- Classification by stage, product status

| Type | Describe |

| Work in progress at the beginning of the period | Is the cost related to unfinished products existing from the previous period. |

| Work in progress incurred during the period | Is the cost incurred in the current period to produce the product. |

| End of period work in progress | Is the manufacturing cost of unfinished products at the end of the period |

- Classification by department or manufacturing process

For businesses with multiple production stages:

| Type | Describe |

| Work in progress cost by stage | For example: cutting - sewing - finishing, each stage has its own unfinished cost. |

| Work in progress cost by department/workshop |

- Classification by cost aggregation object

For management by specific product or order:

| Type | Describe |

| Work in progress by product | Each product type has its own work in progress cost. |

| Work in progress by order/contract | Often applied to construction, custom garment, contract manufacturing. |

Method of determining and calculating the value of unfinished products at the end of the period

Determining the value of unfinished products at the end of the period is an important step in calculating product costs and preparing accurate financial statements. Depending on the type of production and the level of management, businesses can apply many different methods.

Here are the 5 most popular and easy to understand methods:

| Method | How to calculate | Apply | For example |

| Percentage-of-Completion Estimation Method (most common) | Value of unfinished products at the end of the period = Production cost of 1 completed product x Number of unfinished products x x Completion rate | The completion rate of unfinished products can be determined (eg: 30%, 60%, 80%…).

Easy in continuous production businesses. |

Cost to complete 1 product: 1,000,000 VND

Work in progress at the end of the period: 10 products, completion rate 60% |

| Standard method (according to standard cost) | Value of unfinished products = Total cost norms according to completion rate | Stable production enterprise, has established clear cost norms.

Often used in management accounting. |

Raw material/product standard: 500,000 VND

20 unfinished products, completion level 50%

Value of unfinished materials = 500,000 × 20 × 50% = 5,000,000 VND |

| Direct materials cost elimination method | End-of-period SPDD = Total manufacturing costs incurred - Direct material costs included in all products | The enterprise has a short production cycle, raw materials are brought in at the beginning of the period, but the processing stage is unfinished.

|

|

| Direct method (physical inventory) | Summarize details of each unfinished product → specifically evaluate each type of cost spent (raw materials, labor, general costs...). | Can inventory the quantity, volume, and completion rate of unfinished products at the factory.

Suitable for single piece production, production according to order. |

|

| Average manufacturing cost allocation method | The completion rate is not clearly defined → use the average method to allocate costs.

|

Total manufacturing costs during the period are allocated equally to finished and unfinished products according to equivalent output. |

Process for Determining End-of-Period Work-in-Progress Value

– Step 1: End-of-period inventory to determine the quantity of unfinished products and the level of completion (if applying the equivalent method).

– Step 2: Choose an evaluation method that is suitable for the production characteristics of the enterprise (must be consistent between periods).

– Step 3: Collect total production costs incurred during the period (raw materials, finished goods, production costs).

– Step 4: Apply the selected method to calculate the value of work in progress at the end of the period.

– Step 5: Calculate the cost of completed products during the period.

Instructions for accounting for unfinished costs (Account 154)

Accounting for construction in progress using Account 154 – Cost of production and business in progress is very important in accounting for manufacturing enterprises. Below are detailed and easy-to-understand instructions for you to grasp quickly:

Account 154 is used to collect all costs related to the production process of products and services that are in progress but not completed at a given time.

The structure of Account 154 is shown as follows:

| DEBIT SIDE | SIDE HAS |

| – Collect actual costs incurred such as: raw materials, labor, general production costs... | – Transfer costs when products and services are completed (transfer to account 155 – finished products; or 632 – cost price). |

Detailed accounting instructions

| Major | Debit Account | Account Yes | Note |

| Export raw materials for production | 154 | 152 | According to actual price of raw materials in warehouse |

| Calculate direct worker salary | 154 | 334 | Direct labor wages |

| Deduct social insurance, health insurance, and union funds for direct workers | 154 | 338 | The prescribed deduction |

| Collection of general production costs (electricity, water, machine depreciation, etc.) | 154 | 111, 112, 214, 331,… | Depends on the source |

| When the product is completed, transfer the cost to the finished product. | 155 | 154 | For businesses with physical goods |

| If the product is completed and sold immediately, transfer to cost price | 632 | 154 | Not through account 155 |

What should be noted when accounting for unfinished construction costs?

- Not used to account for sales costs and business management costs.

- General production costs must be allocated reasonably (by labor hours, by output, etc.).

- At the end of the accounting period, unfinished products must be evaluated to determine unfinished costs and calculate the correct cost of goods sold.

- If the business has many types of products or workshops, it is necessary to track the details of account 154 according to each cost aggregation object.

What is the optimal solution and effective management of work in progress costs?

Effective management and optimization of work-in-progress costs are the key to help businesses control costs, avoid losses and increase profits. Below is a summary of solutions to optimize work-in-progress costs from each perspective of management - accounting - operation:

Apply appropriate costing methods

- Choose the method of cost aggregation and allocation that is appropriate to the nature of production (simple, coefficient, norm, step-by-step, etc.).

- Apply a reasonable method of determining unfinished products at the end of the period to avoid incorrect recording of cost of goods sold.

Tightly control costs of raw materials, labor, and general production costs

- Use material consumption standards for each product type.

- Record costs by stage and by order.

- Compare actual costs with planned costs to detect anomalies.

Use accounting/manufacturing software for automated tracking

- Apply software (Fast, MISA, Bravo, ERP...) to: Automatically collect costs into account 154, Automatically calculate cost, Export detailed reports of unfinished products

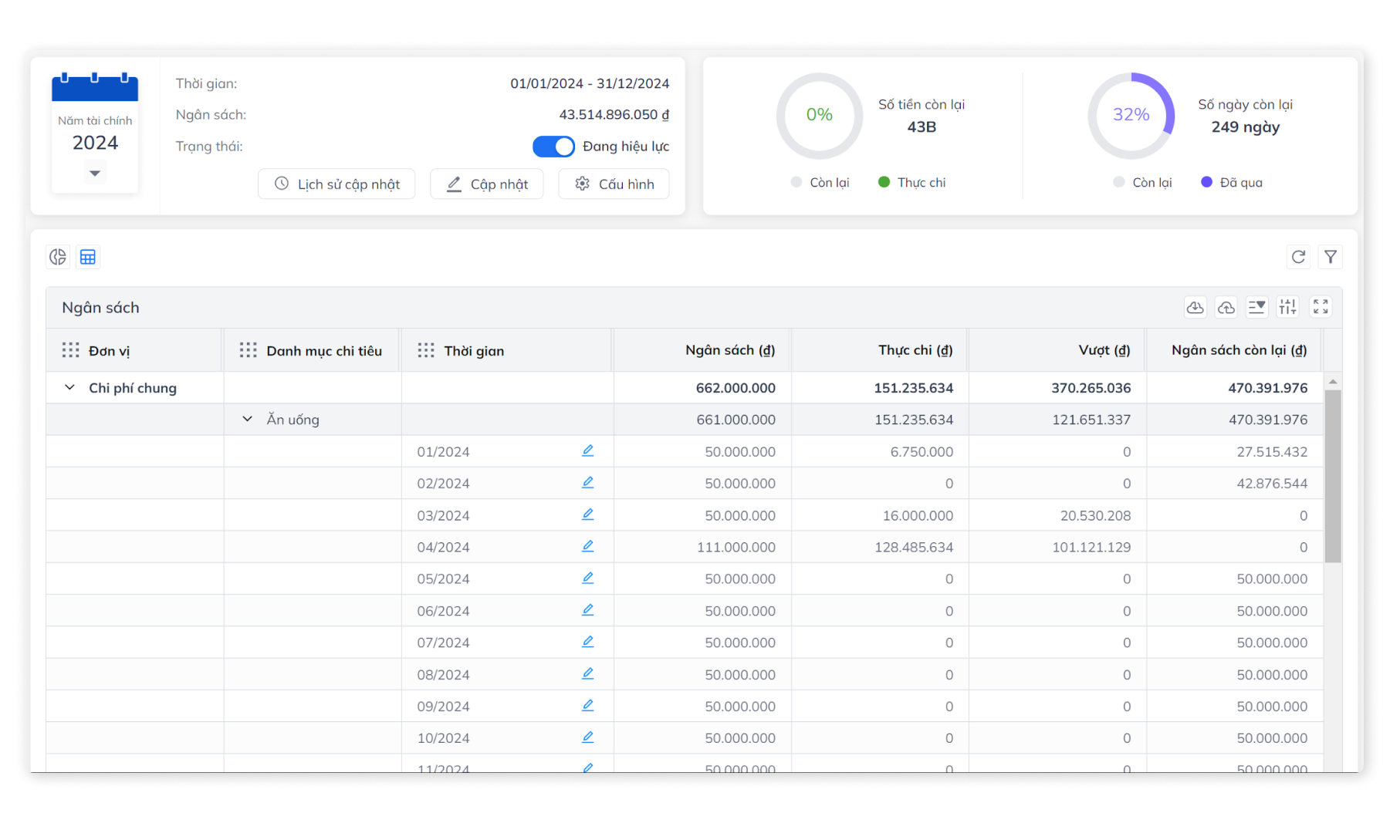

- Use comprehensive business expense management software like Bizzi Expense to automate reporting systems, spending budgets, and real-time cost tracking. Set up budgets by department/project as well as allocate budgets by group, department, or project to control spending.

Organize periodic inventory at the factory

- Check quantity - status - progress of completion of unfinished products periodically (end of month, quarter).

- Compare actual with accounting books, detect differences.

Build clear production process & standardize stages

- Standardize each step to easily control time and costs.

- Applying technology and automation to optimize productivity and reduce labor costs.

Training of accounting and factory management staff

- Ensure employees understand the principles of cost aggregation, standards, and SPDD allocation.

- Close coordination between accounting department - production workshop - KCS/QA department.

Common difficulties in managing work in progress costs

Below are common difficulties in managing work-in-progress costs, especially in construction, manufacturing or capital investment businesses:

- Difficult to control construction progress and arising volume

- There is no detailed tracking system, lack of software or detailed management tools for each item and project, leading to delays or errors in cost synthesis and analysis.

- Many businesses still track manually via Excel, which is prone to errors or omissions.

- Lack of valid and reasonable documents: Expenses incurred but without complete invoices, acceptance reports, contracts, etc., leading to ineligibility for recording.

- Loose management and storage of documents creates risks when auditing or settling projects.

- Difficult to determine the completion rate of the project

- Over-budget costs are not controlled in a timely manner due to the lack of regular reconciliation between the incurred costs and the plan. This leads to the failure to identify over-budgets early, leading to increased investment capital.

Bizzi Expense – Modern solution to support businesses in managing and optimizing unfinished costs

Bizzi Expense is built on a foundation of in-depth analysis of spending behavior and actual business operations. With a friendly interface and simplified processes, Bizzi helps businesses control costs and budgets easier than ever.

Set up and control effective budgets

- Set up budgets by department/project: Allocate specific budgets to each department, team or project.

- Monitor spending against budget: The system automatically alerts when spending exceeds the allocated budget.

Flexible and automatic spending approval

- Automated Approval System: Reduce approval time through automation.

- Flexible approval flow: Easily set up processes by level, branch type, or department.

- Track spending request status: Transparent and clear on approval progress (pending, approved, rejected).

- Submit expense requests in advance: Employees can submit requests before expenses are incurred, ensuring proactive control.

Monitor and track spending in real time

- Real-time expense tracking: Continuously update spending status, help make quick decisions.

- Attach expenses to each project/task: Identify each expense, support monitoring and analysis of project performance.

- Multidimensional expense reporting: Drill down by category, department, project or time.

Compliance and transparency in spending policies

- Set up internal spending policies: Apply spending limits and regulations for each position/department.

- Clear control process: From purchase proposal → approval → payment → reconciliation → storage.

- E-invoice authentication: Check validity, avoid errors or invoice fraud.

Risk monitoring and warning system

- Instant alerts: When there are new requests, budget overruns or unusual transactions.

- Controlling the risk of unfinished costs: Early detection of unreasonable expenses helps businesses avoid capital increase or loss.

All cost accounting operations can now be performed quickly, transparently and in strict compliance with internal processes – reducing risks, increasing efficiency and optimizing operating budgets.

Conclude

In short, in business, understanding what work in progress costs are and accurately accounting for work in progress costs is not only an accounting requirement but also a key factor in ensuring the financial health and management quality of the business.

To be able to control unfinished costs and create a basis for accounting for unfinished construction costs fully and accurately, businesses should apply comprehensive cost management software Bizzi Expense. Bizzi Expense is designed with an intuitive and user-friendly interface, making it easy to record, track and manage costs.

With full features from recording invoices, classifying expenses to creating and approving online expenses, collecting invoices, Bizzi Expense will help businesses save up to 80% in expenses and control budgets in the simplest, smartest way.

Contact Bizzi now to learn about the possibility of digitizing and automating revenue and expenditure transactions for your business:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/

_____

FAQs – Frequently asked questions about work in progress and accounting for construction in progress

- Is work in progress inventory? (Yes, it is part of inventory).

- Why is work in progress an asset on the Balance Sheet? (Because it contains future economic benefits when completed and sold).

- Which account is used to record construction in progress costs?

- Account 241 – Construction in progress is used for tracking.

– Account 2411: Purchase of fixed assets.

– Account 2412: Basic construction.

– Account 2413: Major repairs of fixed assets.

- What are the necessary documents to account for unfinished construction costs?

Construction contract.

– Minutes of acceptance of work volume.

– Invoices and documents for purchasing and outsourcing costs.

– Minutes of acceptance and handover of the project (upon completion).

– Design documents, estimates, and project finalization.

- Does the service business have work in progress costs? (Yes, for uncompleted contracts).

- How often should work in progress be evaluated? (Usually at the end of each accounting period: month, quarter, year).

- How to choose the appropriate method of evaluating unfinished products? (Based on the characteristics of the technological process, product type, management requirements...).