You set your goals, but at the end of the month you still don't know where you've gone off track. The problem is often not with SMART, but with goals not being aligned with the budget, real-world data, and mechanisms for monitoring before money leaves the company.

This article by Bizzi will help CFOs and the Finance-Accounting department understand the essence of goal setting, how to set goals that are truly meaningful, measurable, and achievable through processes and systems (Bizzi Expense, Bizzi Bot, Bizzi ARM).

What is goal setting in a business, and why should CFOs "set the right goals from the start"?

Setting goals is the process of defining the desired outcomes, measurable by specific indicators, with a deadline and accountability. For businesses, goals are only "right" when they are linked to resources (budget), measurable data (actual), and a monitoring mechanism to detect deviations early.

What is goal setting in business?

Setting goals is a process:

- Identify what the business wants to achieve.

- Within a specified period

- And who is held accountable, according to specific metrics?

In modern business, the goal is not just to "motivate," but to:

- Resource allocation

- Coordinate actions between departments.

- Risk control

- And make the right financial decisions at the right time.

Goals are the "operating compass" of a business.

Why should the CFO be involved and "get it right from the start"?

Setting the right goals from the start won't make your business grow faster, but it will prevent it from going down the wrong path. Incorrect goals from the beginning equal inaccurate measurement throughout the entire period.

Regardless of:

- Expanding the market

- Revenue growth

- Optimize operations

- Let's embrace digital transformation.

They all have an impact:

- Expense

- Cash flow

- Profit

- Financial risk

If the goal is set as follows:

- Cash flow is not taken into account.

- No budget included.

- Financial performance cannot be measured.

Business It might be the "right strategy," but there's still not enough money to live on..

If the target is wrong:

- KPIs look good, but the cash flow is bad.

- The department met its targets, but the company lost money.

- Risks accumulate and are only discovered at the end of the period.

The CFO is the one who suffers the consequences, even though they didn't directly set the goals.

| Good goal | Poor target |

| Connect cash flow | Revenue-only |

| There is a baseline | Target only |

| There is a data source. | It has to be assembled manually. |

| There is a warning threshold. | Wait until the end of the term. |

By understanding what goal setting entails, CFOs ensure that their goals are "measurable, controllable, and actionable."

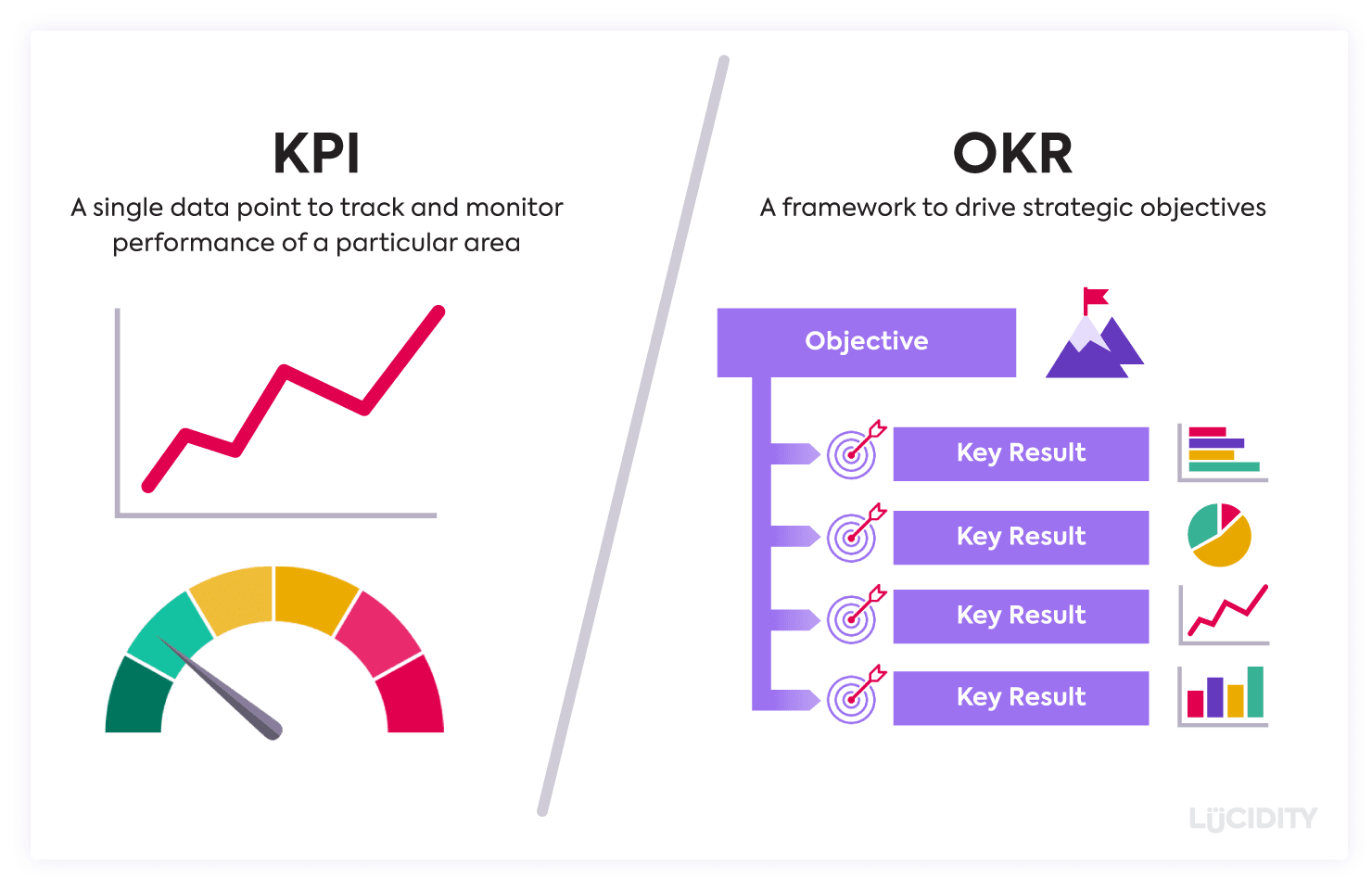

How do goals differ from objectives, KPIs, and OKRs in a performance management system?

A goal is a destination. KPIs are metrics to measure progress and determine whether you're moving toward your goal or deviating from it. OKRs are a framework for achieving goals through key results. Purposes are typically directional, while goals must be measurable and have deadlines.

Below is a comparison table of the four concepts above.

| Concept | What is it used for? | Nature | Measurement | Time | Short example |

| Site | Identify the destination | Desired outcome | It can be measured. | Medium- to long term | Cash flow control |

| Objective | Specify the Goal | Priority results | Measure at the result level | Short- to medium term | Reduce cash collection time. |

| KPI | Monitoring operations | Measurement index | Continuous measurement | Daily / Monthly | DSO = 50 days |

| OKR | Create a breakthrough | Ambitious framework | Measured via KR | By quarter | DSO decreased sharply in Q3. |

In short:

- KPI: run continuous, implementing rewards and punishments

- OKR: run by quarter, without direct rewards

- Goal / Objective: plays a guiding role

How do you set a baseline so that your goals aren't unrealistic?

The baseline is the truth. The goal is to make controlled improvements from that truth. There is no right baseline – all goals are just expectations. Setting financial goals should always begin with “cleaning up the data,” not “beautifying the numbers.”

1. What is a baseline?

Baseline To be database path, reflects current situation of the business before setting goalsBaseline not the targetNo "beautification" allowed, no emotional adjustments.

- Good goals = controlled improvement from the true baseline.

- A flawed baseline equals unrealistic goals from the design stage.

2. Where should the CFO set the baseline?

The baseline should not be taken from manually compiled reports, but from the original operating system.

| Data group | Required baseline source |

| Cost | ERP – GL module / Budget |

| Invoice | Electronic invoicing system |

| AR/AP | ERP – Accounts Receivable Details |

| Fight | Bank statement / Cash module |

3. Baseline based on the four key groups of CFOs

3.1. Baseline Cost

Baseline should be:

- Actual cost according to the cost center

- Compared to the approved budget

Suggested recipe:

Cost Variance=Actual Cost – Budgeted Cost

Note to the CFO:

- Do not include extraordinary expenses (one-off).

- Separate operating costs from investment costs.

3.2. Baseline Invoice

Baseline should be:

- Total number of input invoices

- The invoice contains errors (incorrect tax code, incorrect tax, missing purchase order, etc.).

Required formula:

Exception Rate = Number of Error Invoices / Total Number of Invoices

This is the baseline for:

- MBO invoice quality

- MBO reduces tax risk.

3.3. Baseline AR / AP (Accounts Payable/Debt)

Baseline should be:

- Detailed Aging Report

- Do not use the total.

Baseline index:

Days Sales Outstanding (DSO)

- DSO= (Accounts Receivable/Credit Sales)×Days

Days Payable Outstanding (DPO)

- DPO= (Accounts Payable/COGS) xDays

The baseline must be analyzed as follows:

- Customer/Supplier Group

- Overdue bills

3.4. Baseline Cash

Questions the CFO needs to answer:

"How much money do businesses actually burn through each month?"

Baseline should be:

- Cash inflows and outflows

- Do not use accounting profit.

Suggested formula (run-rate):

- Run-rate=Actual YTD/Number of months elapsed

Baseline Cash helps:

- Set survival goals.

- Avoid growth that leads to dead money.

SMART is still necessary, but it needs to be written in a CFO-style way so that it can be measured numerically when setting goals.

SMART isn't wrong. The mistake is writing SMART without attaching numbers, data, and control metrics. The CFO-style SMART is about goals that the system can measure itself – no need to ask anyone else.

How to write SMART goals without falling into the "SMART trap"

SMART is only the minimum requirement for clear, measurable, and limited goals. For businesses, SMART needs two more things: measurable data (actual) and control mechanisms (guardrails). Without these two components, SMART will still fail when implemented.

-

S – Specific

"Reduce domestic customer's DSO (Demand for Sale)"

Rules: Specific = call the correct number, not called a concept.

-

M – Measurable

DSO= (Accounts Receivable/Credit Sales)×Days

Rules: Do not have recipe → Not a SMART CFO.

-

A – Achievable

Baseline: 60 days – Target Q1: 55 days – Target Q2: 50 days

CFO Rules: Improve 10–20% per cycle, unless there is a structural change.

-

R – Relevant (Strategically relevant)

The CFO asked: Does this objective directly affect money, risk, or profit?

"Reduce reporting delays to adjust cash flow during the period."

-

T – Time-bound

The CFO asked: When should the review be conducted so that adjustments can be made in time?

Weekly review, quarterly review

Time-bound CFO style: It's not just deadlines, but also... Cadence review.

How can we ensure that budget targets are set and not simply left unfulfilled?

In fact, many businesses:

- Set goals at the beginning of the year.

- Create a separate budget.

- And they operate as two parallel systems.

Consequences:

- Target achieved

- But spending exceeded the budget.

- Cash flow shortage

- The CFO has to "put out the fire".

For a CFO, a goal is only valuable when it "locks in" the budget.

Why do incorrect cost targets distort real cash flow?

Expense targets determine the budget envelope and the amount of money leaving the business. If expense targets are set off-base or lack guardrails, overspending will eat into cash flow, causing cash and profit plans to deviate.

Expenses are cash outflows, not just P&L figures.

- P&L can look beautiful thanks to its acrobatic design.

- But The money is still leaving the account.

If the cost objective is "Excluding payment intervals" or "Excluding payment timing", then The cash forecast will be wrong from the start.

Incorrect cost targets → incorrect budget → incorrect cash plan

Common chain of errors: High targets → overspending → excess expenditure → cash flow deficit → short-term borrowing → decreased profits

CFOs don't lose money on "expenses," but on... Cash flow is being eroded..

Link goals and budgets to avoid "setting goals and then leaving them unfulfilled."

The goal is to lock up the budget – the budget must lock up the money – the money must be monitored in real time.

3.1. Assign each cost objective to a specific budget.

Each cost objective must address:

- What is the budget?

- For how long?

- What rhythm does it follow?

3.2. Cost targets must have a baseline.

Goals that don't come from a baseline equal unrealistic budgets.

For example:

- Baseline operating costs: 10 billion VND/month

- Objective: Reduce 10%

- New budget envelope: 9 billion VND/month

3.3. Turn goals into budget control rules.

The goal is not just to "meet the deadline," but to:

- Block excess spending during the period.

- Early warning

| Target | Control rule |

| Cost variance ≤ +2% | Block POs from exceeding budget. |

| No expenses outside of the plan. | Requires senior-level approval. |

| Keep OPEX ≤ X% DT | Real-time alerts |

In short, setting the wrong goals not only distorts KPIs, but also distorts cash flow and actual profits. Even with good cost control, CFOs can still "lose money" if invoices are incorrect and tax risks increase. Next are goals related to invoice compliance and risk control.

What are the ways to set goals for tax compliance and reduce invoice risk according to operational standards?

Tax compliance isn't about "avoiding penalties," but about controlling invoice risks right from the moment they arise. Therefore, the goal not measured by the number of traffic violation tickets.which is measured by The deviation rate is blocked before payment..

Below is how to set tax compliance goals and reduce invoice risk according to operational standards, written from a CFO's perspective – control before money leaves the business, along with a set of measurable and operational KPIs.

What metrics should be used to measure the goal of “reducing invoice risk”?

Invoice compliance targets should be measured by operational metrics such as the rate of incorrect invoices, the rate of failed reconciliations, processing time, and the number of risky suppliers. Meeting these targets correctly will reduce tax risk and decrease manual processing time.

Exception Rate – The percentage of invoices that generate exceptions.

The percentage of invoices flagged as risky by the system or accounting department (incorrect, missing information, exceeding thresholds).

Exception Rate = Exception Rate = Number of invoices with exceptions / Total number of invoices received

Management significance

- Measure invoice input quality

- Early warning of tax and expense risks

Operating standards

- The business is operating well: ≤ 5%

- On 10%: there is a problem with the input process.

High exception rate = Budget and cash flow are under threat.It's not just an accounting error.

3-way Mismatch Rate – The rate of discrepancies between PO–GR–Invoice

The percentage of mismatched invoices between:

- Purchase Order (PO)

- Goods/Service Receipt (GR)

- Bill

Mismatch Rate = Number of invoices without 3-way matcha / Total number of invoices with purchase orders.

Common types of bias

- Incorrect unit price

- Quantity error

- Incorrect tax rate

- Incorrect payment terms

- NCC issued incorrect legal information.

CFO objectives

- Standard: ≤ 2–3%

- 5%: Risk of incorrect payment and tax arrears

This is Incorrect blocking index before payment, not just a formal KPI.

Vendor Risk Rate – High-risk vendor rate

The percentage of invoices coming from:

- NCC is on the list of tax risks.

- New NCC, not yet audited.

- NCC has a history of misconduct.

Vendor Risk Rate = Number of invoices from risky supplier / Total number of invoices

Meaning

- Measure supplier ecosystem risks

- Poor control leads to the risk of fraudulent or invalid invoices.

Recommended CFO threshold

- ≤ 5%: good control

- 10%: The vendor onboarding process needs to be tightened.

The tax arrears were not due to accounting errors, but because the wrong supplier was chosen.

Invoice Processing Cycle Time – Invoice Processing Time

This is Time from receiving the invoice to being ready to pay.

Cycle Time = Payment Date – Invoice Date

Why is compliance relevant?

- Slow processing → urgent payment → bypassing controls

- Quick payment = Paying for an unsecured bill carries significant risk.

Operational objectives

- Standard: ≤ 3–5 business days

- 7 days: risk of skipping the control step

A long cycle time doesn't make a business safer – it only accumulates risk.

How to set DSO and cash flow targets to optimize working capital without alienating customers.

DSO is the average number of days to collect payment after a sale. An increase in DSO means capital is tied up, and cash flow is strained even with good sales. Setting the right DSO target helps free up working capital and increase reinvestment capacity.

What is DSO and why is it the most "worthwhile" target for a CFO?

Standard formula:

DSO = (Account Receivable / Credit Sales) * Number of Days

Simply put

- Today's sales

- Lost how many days Then the money will be credited to the account.

Why is DSO the most "worthwhile" target for CFOs?

DSO (Days Sales Outstanding) is the average number of days a business needs to collect payment after recognizing sales on credit. For CFOs, DSO is not just an accounting indicator – it's a direct leverage point for real cash flow.

DSO directly impacts Cash Flow, without any "interpretation".

- Reduced DSO = earlier payment

- No need:

- Increase revenue

- Cost reduction

- Change the product

Low DSO = reduced cost of capital and reliance on short-term debt.

High DSO → CFO must:

- Use overdraft

- Short term loan

- Extend DPO to compensate.

Low DSO → business:

- Self-financing of working capital

- Reduce interest expenses.

- Low liquidity risk

Reducing the Daily Output (DSO) by 1 day ≈ saves interest costs for the entire system..

DSO stands for "revenue quality," not fictitious revenue.

Revenue looks good, but:

- Late payment

- Outstanding debts

- Difficult to collect

→ P&L looks good, Cash looks bad.

DSO helps CFOs answer the crucial question: "How much of this % revenue actually translates into cash?"

DSO reflects discipline throughout the entire operational chain.

DSO is not solely the fault of the accounts payable accountant. It reflects:

- Sales: Are the payment terms too lenient?

- Legal: Is the contract legally binding?

- Finance: Can you issue the invoice in time?

- AR: Is debt tracking and reminders effective and disciplined?

DSO is Cross-departmental KPIsThe CFO has the authority to "take the lead".

DSO is a measurable, interventionable, and improveable goal.

Unlike:

- Profit (distorted by accounting)

- EBITDA (not cash)

- Growth (capital-intensive)

DSO:

- There is a clear baseline.

- Track by day/week

- Improve through processes and data.

This is the goal. The CFO has control., independent of the market.

How to break down goals from CEO down to CFO and departments to avoid having "everyone with their own KPIs".

This is The method of breaking down objectives from CEO → CFO → department. According to modern management thinking, in order to Avoid a situation where "everyone has their own KPI, and everyone works independently." – A very common mistake when implementing MBO/KPI/OKR in businesses.

The core issue: why does the "everyone has their own KPI" situation always occur?

It's not the employee's fault, but the fault of... The wrong way to break down the target from the start.:

- CEO placed strategic objectives

- CFO transformed into Finance Department targets

- Other departments are running. Local KPIs

Result:

- Increased sales lead to increased revenue → Increased DSO (Demand for Sales)

- Finance tightens costs → operations slow down.

- Procurement pulls DPO → NCC reaction

Cascade of Goals: From Strategic Objectives to Operational KPIs Following a Cause-and-Effect Chain

Proper goal breakdown involves transforming strategic goals into functional goals, and then into operational KPIs that can be measured weekly/monthly. Each KPI must have a cause-and-effect relationship with the higher-level goals, avoiding "measuring for fun."

Step 1. The CEO sets company-level goals (Outcome).

CEO example: “Improve net cash flow from operating activities by +30% over 12 months.”

This is Outcome, not yet departmental KPI.

Step 2. The CFO converts Outcome into “financial leverage”.

CFO analysis:

- Cash flow = Cash In – Cash Out

- The greatest leverage: DSO, DPO, Costs, Inventory

CFO's choice 3–4 main levers, For example:

- Reduce DSO

- Cost Control

- Reduce invoice risk.

- Optimize DPO (controlled)

This is CFO promotion goal, not individual KPIs.

Step 3. Break down the structure into departments based on "role and impact".

Don't divide KPIs evenly – divide them accordingly. point of contact with the original target

In short, target breakdown isn't about breaking down targets into smaller parts, but about assigning the right people to the right touchpoints in the cash flow.

Monitor Target vs Actual and analyze the variance to make necessary corrections.

Target vs. Actual only has value when you look beyond the numbers to identify the true points of deviation in the operational chain. The core principle: What is the purpose of Target vs. Actual? Not for making the report look good, but to answer the three questions CFOs need to know during the period:

- What is the difference?

- Deviated Where in the operational chain?

- It is possible to intervene. during the period or not?

What pace should we follow when reviewing Target vs. Actual to detect discrepancies early?

Effective goal tracking requires a clear review rhythm: weekly for operational metrics, monthly for financial, and quarterly for strategic. The right rhythm helps detect deviations early and allows for adjustments before closing the books. Standard tracking framework: 4 layers of data (CFO view)

Level 1 – Target (The goal has been finalized)

- There is a clear baseline.

- There is a tolerance threshold.

- Related to budget and cash flow

Grade 2 – Actual (Reality of the period)

- Get from data source (ERP, AR/AP, Invoice)

- No manual adjustments

Grade 3 – Variance (How much is the deviation?)

Variance = Actual - Target

%Variance=(Actual – Target)/Target * 100%

Class 4 – Driver (Cause of misalignment)

- Who exerted influence?

- Which step in the process?

- Because behavior, procedure good data?

CFOs need more Grade 4 qualifications than Grade 3 qualifications.

When should we adjust our interim targets (reforecast) and based on what data?

A refresh isn't an admission of failure, but rather a management action taken when the nature of the data has changed. A timely refresh helps the CFO maintain control. An ill-timed refresh turns a goal into a compromise.

The CFO should only make a refresh when:

- The initial assumption is no longer valid.

- Or the financial leverage has reversed.

How does adjusting targets differ from "loosening KPIs"?

A refresher target is an update based on actual changes (market, orders, cash), not a lowering of standards to make reports look better. Proper adjustments must be based on data and accompanied by actionable solutions.

Group 1. Actual Operating Data

Source: ERP, AR/AP, Invoice, Bank

Group 2. Dynamic Baseline (Run-rate)

- YTD

- Last 3 months (rolling)

- Separate by:

- Customer – Supplier – Cost Group

CFO needs living baseline, no baseline at the beginning of the year.

Group 3. Driver variance data

It's not just about knowing "how much it's off," but also about knowing:

- Price discrepancies

- Due to mass

- Due to the timing

- Due to behavior

Refurbishing without knowing the driver is like fixing something blind.

Group 4. Cash & liquidity data

- Cash balance

- 13-week cash flow

- Credit limit

- Upcoming payment obligations

Cash decided to set a target, not an ambition.

How to set digital transformation goals in Finance Ops: How to properly measure effectiveness and ROI?

Digital transformation in Finance Ops is not about "modernization," but about reducing operating costs, shortening timelines, and mitigating financial and tax risks.

Setting digital transformation goals for Finance Ops along three mandatory axes.

- Axis 1 – Processing Time (Speed)

- Axis 2 – Quality & Risk

- Axis 3 – Operating Costs

What metrics should be used to measure the goal of "reducing manual labor time," and how should the ROI be calculated?

The goals of digital transformation in finance should be measured by processing time, error rates, and operational cost savings. ROI is only meaningful when the time saved and risk reduced can be quantified in monetary terms.

Key metric: Manual Processing Hours (MPH)

The core MPH indicator is Total hours finance personnel spend on manual tasks:

- Data entry

- Reconciliation

- Check the invoice

- Summary report

MPH = ∑(Number of transactions) * Processing time per transaction

Supplementary indicators (to avoid being "unrealistic")

| Index | Meaning |

| Avg. Processing Time / Invoice | Processing time for one invoice |

| Touchless Rate (%) | % transactions do not require manual processing. |

| Rework Rate (%) | % transaction needs to be redone |

| Exception Rate | Error rate |

How to properly calculate the ROI of digital transformation in Finance Ops?

ROI = (Annual Financial Benefit – Investment Cost) / Investment Cost

Comprehensive example

| Amount | Value / year |

| Save working hours | 864 million |

| Reduce errors & rework | 630 million |

| Reduce tax risk. | 300 million |

| Total benefit | 1.794 billion |

- ROI > 100% → A worthwhile project

- ROI < 50% → Review the range or expectations

What are some quick comparison charts and implementation checklists to help the team avoid making mistakes in goal setting right from the first week?

A good goal-setting system requires: clear objectives, measurable KPIs, a consistent data source, a review schedule, and a pre-expenditure control mechanism. Checklists help reduce the risk of "ordering and then abandoning" and facilitate faster team onboarding.

Table 1: “Goal vs KPI vs OKR”

| Criteria | Site | KPI | OKR |

| Concept | Desired outcome at the target level | Performance metrics | Framework for change/breakthrough goals |

| Purpose | Answer the question, "What do we want to achieve?" | Answer "Is it good or bad?" | Answer the question, "How can we change?" |

| Nature | Outcome | Measurement (Metric) | Commitment + Priority |

| Example: Finance Ops | Improve cash flow | DSO, Exception Rate | Reduced DSO from 60 to 45 |

| Writing style | Short, no formula | There is a clear formula. | Objective + 2–4 KR |

| Monitoring frequency | Quarter / Year | Day / Week / Month | Month / Quarter |

| Data sources | Financial summary | ERP, AR/AP, Invoice | KPI +l |

| Common errors | Writing too generally | Use as a target | Write it as a to-do checklist. |

| When to use | Long-term orientation | Stable operation | We need to change quickly. |

Table 2: “Common CFO Objectives and Measurable KPIs”

| CFO objectives | Key performance indicators (KPIs) | Recipe / Notes |

| Improve cash flow | Operating Cash Flow | Cash Report |

| Reduce DSO | DSO | AR / Credit Sales × Days |

| Cost Control | Cost Variance (%) | (Actual – Budget) / Budget |

| Reduce invoice risk. | Exception Rate | Error invoices / Total |

| Preventing incorrect payments | 3-way Mismatch Rate | Invoice ≠ Purchase Order ≠ Gross Price |

| Optimize DPO | DPO | AP / COGS × Days |

| Reduce manual labor time. | Manual Processing Hours | ∑(Transactions × Time) |

| Increase automation | Touchless Rate | Auto / Total |

| Speed up processing | Invoice Cycle Time | Pay – Receive |

| Tax compliance | Vendor Risk Rate | Risk vendors / Total |

CFO Rules:

- 1 goal associated with 1–2 core KPIs

- Do not assign more than 3 KPIs to one goal.

FAQ on how to set goals for the CFO and the Finance and Accounting department.

Below is a section answering questions related to goal setting.

What is goal setting?

Setting goals is the process of identification desired outcome, Okay:

- Measure by specific index

- Have guilty (starting point)

- Have deadline

- Have The owner is responsible.

- There is a tracking mechanism. Target vs Actual

For the CFO, the goal is... It is only valid when measured with real data..

What is the difference between goals and objectives?

Purpose is a direction, while goals are measurable and time-bound targets.

| Criteria | Purpose | Target |

| Nature | Orientation | Destination |

| Measurement | Optional | Measurement required |

| Duration | Long term | There is a deadline. |

| Responsibility | Shared | Clearly, Ms. |

For example

- Purpose: Improve cash flow

- Target: Reduce DSO from 60 to 45 days over 6 months.

Which KPIs are most important for evaluating automated cost control?

Prioritize KPIs that reflect "pre-control" (blocking spending before it happens), not post-auditing.

| KPI | Meaning |

| Overrun % | Over-budget ratio |

| Spend Leakage | Off-process spending |

| Approval Cycle Time | Approval time |

| Exception Rate | Anomaly rate |

Good KPIs are KPIs Block the money before it leaves the business..

How can we link budget targets to the spending approval process?

Finalize budgets by department/project, set approval thresholds, and enable over-budget alerts before approval. The correct way (CFO standard).

- Budget Envelope

By department / project / expenditure category

- Set the review threshold.

In budget → fast review

Exceeding the budget → escalation

- Turn on alerts before browsing.

Don't wait until the final report.

How do I set tax compliance goals related to invoices?

It's not measured by "avoiding penalties," but by the percentage of risks that are mitigated early. Tax compliance is about process management, not dealing with consequences.

| KPI | Target |

| Invoice Exception Rate | ≤ 5% |

| 3-way Mismatch Rate | ≤ 2–3% |

| Vendor Risk Rate | ≤ 5% |

| Invoice Cycle Time | ≤ 3–5 days |

What is DSO and how do you set DSO targets without losing customers?

DSO (Days Sales Outstanding) is the average number of days to collect payment after a sale.

Setting DSO goals correctly

- Customer segmentation (key / long-tail)

- Don't apply one number to everyone.

- Monitor:

- Aging report

- % AR >30 / 60 days

- Early intervention before the deadline.

Where should the goal of achieving "positive cash flow" begin?

Start by controlling expenses before spending (spend), reduce DSO using debt collection scenarios, and reduce invoice discrepancies.

When should you refresh your target?

Refresh when Assuming the background has changed, not when it "fails".

Required signals

- Run-rate deviation >10–15%

- Costs are consistently exceeding the threshold.

- DSO increases for an extended period.

- Revenue/profit margin fluctuates significantly.

Referecast is management actionsNo compromise.

How do you calculate the ROI of accounting automation goals?

Principle: ROI is only meaningful when can be converted into money..

Standard calculation method

- Convert time savings

Cost savings = Hours saved * Hourly labor cost

- Error conversion & rework reduction

Cost savings due to reduced errors = Δ(Error Rate) * Cost per Error * Number of transactions

- Excluding deployment costs

ROI = (Annual Financial Benefit – Investment Cost) / Investment Cost

Conclude

The above information covers what goal setting is and how to set effective goals for a business. Generally speaking, goal setting isn't just a strategic exercise on paper; it's a management action that determines whether money stays or leaves the business. For CFOs and the Finance and Accounting department, incorrect goals not only lead to incorrect KPIs but also result in skewed budgets, distorted cash flow, and accumulated risk.

A well-defined goal helps the CFO:

- Prioritize the right financial leverage (DSO, expenses, invoices, cash).

- Align CEO strategy with departmental operations.

- Detect discrepancies early and correct them during the period, instead of explaining them at the end of the quarter.

- Protect cash flow and ensure compliance, not at the expense of short-term gains.

Conversely, vague or unmeasurable goals will:

- Make each department run a KPI.

- Turn the budget into a reference figure.

- This leads CFOs to "chase numbers" instead of controlling the system.

In reality, the goal often fails because:

- Distributed, manual data

- High reporting lag

- Subjective measurement

- The team spent time compiling data instead of analyzing it.

This is the time for them Finance Ops technology solutions like Bizzi Maximize value. Solutions such as Bizzi Help the CFO:

- Normalize input data: invoices, expenses, accounts payable

- Pre-control settings: Blocking overspending, pre-payment risk invoices

- Automated KPI measurement: DSO, exception rate, cycle time, cost variance

- Track Target vs Actual real-time, reducing decision lag

- Unleash resources: Reduce manual labor time, increase analysis and operational time

Then:

- The goal is no longer dependent on the Excel file.

- KPIs are no longer just "reported numbers".

- Finance team moved from handle luxurious control & value creation

In summary, setting the right goals helps CFOs control the future using current data. Implementing Bizzi solutions ensures those goals are accurately measured, tracked in a timely manner, and executed with fewer resources. To receive personalized advice on solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/