In business, red invoice is also known as value added invoice (VAT) is an important accounting document, commonly used in transactions of buying and selling goods and providing services. However, not everyone clearly understands what a red invoice is, in what cases it is used, what its legal value is, and what to note to ensure compliance with legal regulations.

The following article compiled by Bizzi will help business owners and accountants understand the nature, functions and latest regulations related to VAT invoices - an indispensable part of accounting and tax work of every business.

1. Overview of Red Invoice

Red invoice – or value added tax (VAT) invoice – is a popular and indispensable accounting document in the purchase and sale of goods and services, playing an important role in financial management and tax obligations of enterprises.

1.1 What is a red invoice?

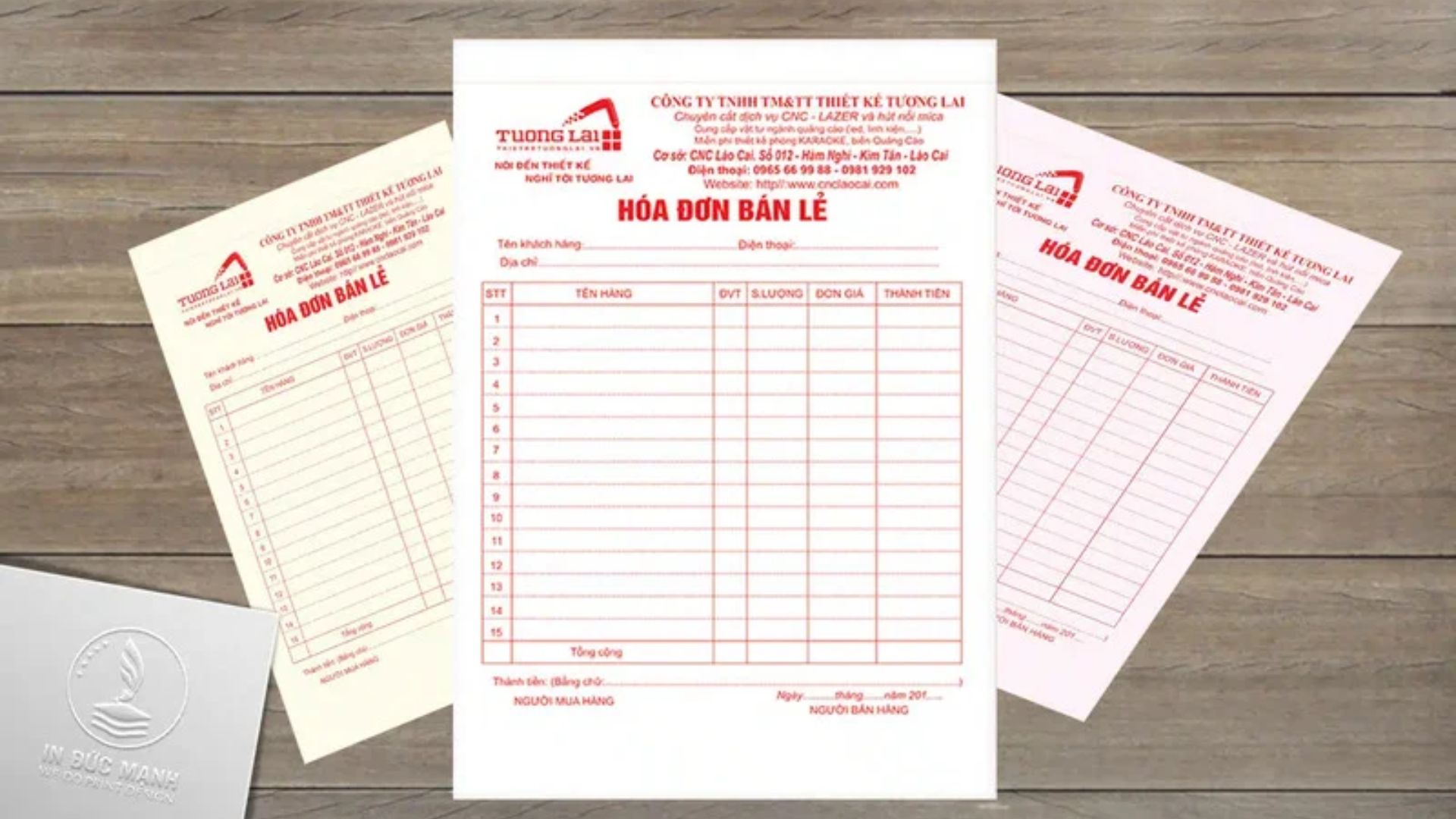

Red invoice is the common name for Value Added Tax (VAT) Invoice – also known as VAT Invoice – an important accounting document issued by the seller when providing goods or services. The name “red invoice” comes from the red or pink color of the second copy given to the customer on the traditional three-copy paper invoice form.

Currently, red invoices mainly exist in the form of electronic invoices according to the provisions of Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC. Depending on each case, electronic invoices may or may not have a code from the tax authority and have the same legal value as paper invoices.

According to regulations, invoices are the basis for recording the sale of goods and provision of services and are used in tax management, accounting, payment, and dispute resolution.

1.2 Why should we issue/use Red Invoices?

Job VAT invoice Not only is it a legal responsibility, but it is also a tool to support transparent and effective financial management for both sellers and buyers:

- Legal responsibility: Sellers of goods and services are required to issue invoices in accordance with the provisions of the Law on Tax Administration and guiding documents.

- Tax declaration basis:

- Sellers use red invoices to declare output VAT and record revenue.

- Buyers use input VAT invoices to declare tax deductions and account for reasonable expenses.

- Legal documents: Invoices are the basis for settlement with state management agencies, proving economic transactions that arise.

- Administration tools: Using VAT invoices helps businesses control cash flow, costs, and revenue clearly, creating favorable conditions for auditing, financial reporting, and business decision making.

- Protection of rights: VAT invoice is legal evidence to help buyers ensure their rights when there are complaints or disputes related to goods and services.

1.3 Regulations on minimum value for which a red invoice must be issued

Depending on the time of application, the regulations on mandatory invoice issuance are different:

- Before 01/07/2022: According to Circular 39/2014/TT-BTC, sellers must issue invoices when the value of goods and services is VND 200,000 or more per sale. If the buyer does not take the invoice, the seller must still issue and clearly state the reason on the invoice.

- From 01/07/2022 onwards: Pursuant to Decree 123/2020/ND-CP, all transactions of selling goods and providing services must issue electronic invoices to the buyer. value-neutralThis regulation is mandatory for organizations and individuals using electronic invoices according to the national roadmap.

2. How to issue a Red Invoice (VAT Invoice)

Understanding and implementing the correct procedure for issuing red invoices (also known as VAT invoices) is not only a mandatory requirement under the law but also helps businesses ensure financial transparency and convenience in tax declaration. Below are detailed instructions for businesses.

2.1 Invoice time

The time of invoice issuance is an important factor in the VAT invoice issuance process, determining the legality of the document.

- For sales of goods: The point of invoice is when ownership or right to use the goods is transferred to the buyer, regardless of whether payment has been collected or not.

- For service provision: The time of invoice issuance is the time of completion of service provision. In case the enterprise collects money before or during the provision process, the invoice must be issued at the time of collection (except for advance deposits for special services such as accounting, auditing, tax consulting, etc.).

- For contracts for multiple deliveries or partial delivery of services, Enterprises must issue invoices corresponding to each delivery.

2.2 Principles when issuing VAT invoices

To ensure valid and legal VAT invoices, businesses need to comply with the following principles:

- Reflect the profession correctlyInvoices must accurately reflect the economic content that has occurred, in accordance with the contract and delivery minutes.

- Use legal invoices: Enterprises are only allowed to issue invoices when they have registered for use with the tax authority and received approval.

- Record correct VAT rate: Even in the case of applying a tax reduction policy, the tax rate stated on the invoice must still be accurate according to regulations.

- Full and accurate information: Invoice must clearly state the name of goods/services, unit, quantity, unit price, tax code, payment method, etc.

- Compliance with formalities: No erasures or overwriting; use the same ink; invoice numbers must be consecutive; correct time of occurrence and clearly state the form of payment.

2.3 VAT invoice issuance process for businesses

This is the basic process for issuing electronic red invoices - the most popular form today:

- Step 1 – Invoicing: Sellers use electronic invoice software to create invoices. The content must be carefully checked before signing and sending. Depending on the case, the invoice may require the buyer's signature.

- Step 2 – Send invoice: Send invoices to customers via email or electronic system. At the same time, store invoices in the internal system of the enterprise according to regulations.

- Step 3 – Tax declarationEnterprises use established VAT invoices to declare VAT periodically, ensuring transparency and accuracy.

Understanding What is the purpose of issuing VAT invoices? Not only does it help businesses legalize sales and service activities, it also ensures tax benefits and compliance with state regulations.

2.4 Important notes when issuing VAT invoices

Some points businesses should not ignore when issuing invoices:

- Right Time: Timely invoice issuance as prescribed in Decree 123/2020/ND-CP is mandatory.

- Absolutely accurate information: Even small errors can result in fines or rejection of invoices by tax authorities.

- Keep your receipts carefully: Even though it is an electronic red invoice, businesses must still store it according to regulations on document storage period.

- Regularly updated with new regulations: Invoice and tax laws are regularly updated – timely understanding will help businesses limit legal risks.

- Avoid administrative violations: Behaviors such as losing invoices or buying and selling fake invoices can be severely punished and affect the business's reputation.

3. Distinguish between Red Invoice (VAT Invoice) and Sales Invoice

Distinguishing between these two types of invoices is very important in declaration and accounting.

3.1 Main differentiating criteria

| Criteria | Sales invoice | Red invoice (VAT invoice) | Evaluate |

| Legal name | Sales invoice | Value Added Tax (VAT) Invoice | Other |

| Object of creation/use | Organization, individual declare and calculate VAT by direct method, or organizations/individuals in the duty-free zone. | Organization VAT declaration by deduction method. | Other |

| Invoice content | There is no VAT rate and amount line. Total payment amount does not separate VAT. | There are tax rates and VAT amounts. Total payment includes VAT. | Other |

| Invoice declaration | Only need to declare output invoices (revenue). It is possible to only declare the indicators on Form 01/GTGT or not to declare. | Fully declare both output and input invoices. Fully declare all items on Form 01/GTGT. | Other |

| Input VAT deduction | Input VAT cannot be deducted (as there is no separate VAT line). Tax is added to the purchase price. | Yes, if the business purchases goods and calculates VAT using the deduction method. | Other |

| Accounting | The tax on the input invoice is added directly to the value of the imported goods. For example: Debit account 156: 55,000,000 / Credit account 331: 55,000,000 (including tax). | Input VAT must be accounted for separately to calculate deduction. For example: Debit account 156: 50,000,000, Debit account 1331: 5,000,000 / Credit account 331: 55,000,000. | Other |

| Signature | Seller's signature. | Signature of seller, signature of legal representative (or authorized person). (For electronic invoices, there is a time of digital signature). | Other |

| VAT reduction (Decree 44/2023/ND-CP) | Record in the line "Total amount of goods and services" according to the reduced number 20%, the rate % on revenue, with notes. | Record in the tax rate line “8%”. | Similar in rate of reduction, different in form of expression |

4. Processing and managing input invoices (received red invoices)

Input invoice is an important accounting document reflecting transactions of purchasing goods and services for production and business activities. Receiving and managing red invoices in accordance with the correct procedures helps businesses both ensure legality in accounting and avoid tax risks during future inspections and audits.

4.1 The importance of input invoice management

Input red invoices are the basis for businesses to declare value-added tax (VAT) deductions and record reasonable expenses. If strictly managed, these documents contribute to:

- Rationalize business costs, optimize tax obligations

- Ensure transparency and accuracy when settling with tax authorities

- Limit the risk of being charged expenses due to errors in document declaration

- Meet internal control, audit and financial appraisal requirements

Especially, with the trend of digital transformation, electronic red invoice are gradually replacing traditional paper invoices, requiring businesses to develop appropriate storage, verification and reconciliation processes.

4.2 Are input sales invoices included in expenses?

Some businesses accept Sales invoice (not VAT invoice) input often wonder whether this expense is included in reasonable expenses. According to regulations:

- If the purchase and sale activities are real and invoices and documents are prepared in accordance with regulations, the enterprise is allowed to account for deductible expenses when calculating corporate income tax (CIT).

- However, with Sales invoice, business VAT not deductible, because this is not a value added invoice.

- In case of purchase without invoice, business can make List of purchased goods and services (form 01/TNDN) to calculate costs, if proven reasonable and serving production and business.

- With valuable transactions under 200,000 VND and cash payments, if there are complete accompanying documents and clear purpose of use, the business can still record them as expenses.

Job What is the purpose of issuing VAT invoices? not only to meet tax declaration obligations but also to create conditions for purchasing partners to deduct VAT. Therefore, both buyers and sellers need to perform VAT invoice process timely, complete information and in standard form to ensure the legality of the transaction.

If you are looking for a solution Automate the input invoice processing process, reduce errors and save time for accounting teams, smart invoice management platform from Bizzi might be the right choice. Try it today to maximize your business's financial performance.

5. Applying technology in managing Red Invoices

5.1 Switch to electronic invoices

Concept What is red invoice? Nowadays, it is no longer limited to traditional red-stamped paper invoices. Instead, input electronic invoices are also considered as electronic red invoice, especially when meeting legal and accounting standards.

According to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, all businesses are required to switch to electronic invoices, completely replacing paper invoices. Compliance with this regulation is not only a legal requirement but also brings many practical benefits:

- Save on printing, shipping and storing invoices.

- Automate processing, minimizing errors due to manual operations.

- Secure data and avoid the risk of lost invoices.

- Easy to look up and retrieve when needing to compare input and output information.

Switching to electronic invoices also helps businesses standardize VAT invoice process, ensure the What is the purpose of issuing VAT invoices? carried out in accordance with regulations, serving accurate tax declaration and accounting.

5.2 Software solutions to support Red Invoice management

In the digital age, management electronic red invoice Manual methods are no longer suitable. Instead, businesses should apply electronic invoice software or integrate it into the accounting system to optimize operations.

One of the typical solutions is Bizzi, a platform that helps automatically process, compare and store input invoices. With technology Bizzi Bot (RPA + AI combination), the system can:

- Automatically download invoices from multiple sources.

- Check validity and detect risky invoices (invalid tax status, tax code…).

- Perform real-time reconciliation of invoices with purchase orders (POs) and warehouse receipts (GRs), thanks to technology IPA + 3-way matching.

- Automatically record valid invoices and store them securely for a minimum of 10 years.

- Early warning of unusual problems helps accountants proactively handle them.

Besides, Bizzi It also easily integrates APIs with existing ERP systems and accounting software, ensuring data streams are continuously synchronized and accurate.

Conclude

Understanding What is red invoice? and how to use them properly not only helps businesses ensure the legality of their business operations but also avoid many tax and audit risks. In the context of digital transformation, managing value-added invoices automatically and transparently is more important than ever.

Bizzi – with the solution of electronic invoice automation – committed to accompanying businesses and accountants in optimizing accounting processes, minimizing errors and saving time in processing invoices. Experience the smart solution from Bizzi to effectively manage invoices and standardize accounting and tax work!

Businesses try it out at: https://bizzi.vn/dang-ky-dung-thu/