MBO sounds familiar, but many businesses misuse it, turning it into a "target-hunting" strategy. CFOs are often hampered by a lack of clean data to measure real-time cost, invoice, and accounts receivable targets. This article by Bizzi will explain the true nature of MBO and provide a framework for implementing MBO 4.0 based on verified data, with control mechanisms and automation.

What is MBO in modern business management?

MBO (Management by Objectives) is a management method in which managers and employees agree on objectives, and then all activities, resources, and performance evaluations revolve around achieving the committed objectives.

MBO = Management by Measurable Objectives, rather than Management by Commands or Rigid Procedures. The focus of MBO is not on "What" but "What results were achieved?".

What are the advantages of MBO? MBO aligns personal goals with business strategy:

- Increase employee motivation and autonomy.

- Performance evaluations should be more transparent and fair.

- Reduce micromanagement.

The core components of MBO

MBO is a management system in which goals are set from the top down, with employee participation, and the results achieved are used as the basis for performance evaluation.

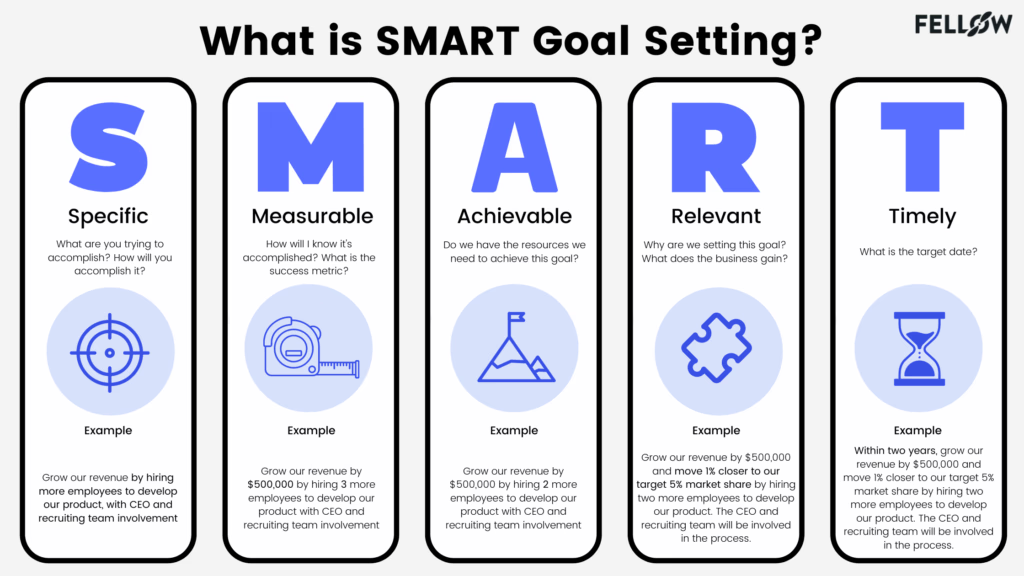

(1) Clear & Measurable Goals

- In line with the business strategy

- Usually according to criteria SMART:

- Specific

- Measurable

- Achievable – Feasible

- Relevant – Strategic relevance

- Time-bound – Limited time

For example:

- "Increase sales"

- "Increase sales on the 25% e-commerce channel in Q2/2026"

(2) Consensus between management & employees

- Target not imposing one-sidedly

- The staff understands. Why must be done and By what criteria are they evaluated?

Increase personal commitment and responsibility.

(3) Monitoring - feedback - periodic adjustments

- Monthly/Quarterly Check-in

- Adjust goals if the context changes (market, budget, resources).

(4) Performance evaluation based on results

- Salary, bonuses, promotions, and recognition → linked to the level of goal achievement.

- Less emotion, more data.

What is the nature of MBO?

"The essence of MBO is commitment to goals, Not assigning targets"That statement is absolutely correct and hits the core of MBO thinking in modern management."

In MBO:

- Businesses empower themselves to decide how to do things.

- The employee is responsible for the results.

No management input (What time to do it, how to do it) that the manager output (the results achieved). This is the major difference between:

- Traditional management → control

- Modern management → trust & responsibility

| Criteria | Assign targets | Commitment to Objectives (MBO) |

| How it is formed | Pressure from above | Co-build |

| Human resource mindset | Being forced – coping | Proactive – take responsibility |

| The implicit question | "How do we finish this?" | "How can we achieve this?" |

| Behavior | Avoid risks, stay safe. | Creative, optimized |

| When it fails | Blaming circumstances | Analysis & Improvement |

MBO is only truly effective when the goal is a two-way promise, not a one-way command. At that time, people didn't do it because... delivered, which is done for committed.

What are the differences between MBO and KPI/OKR, and can they be used interchangeably?

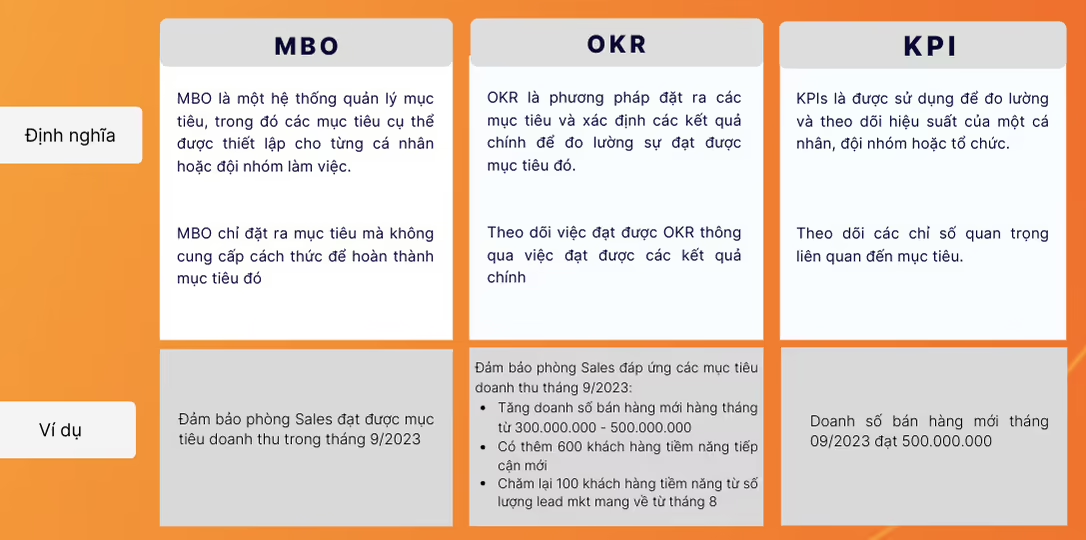

MBO is a management philosophy, not a set of metrics. KPIs and OKRs are tools; MBO is how to use those tools. The core essence: What are MBO, KPI, and OKR?

- MBO: Management Philosophy & Methodology

- KPI: Key Performance Indicator

- OKR: Flexible Objective System

Below is a table comparing the differences between MBO and KPI:

| Criteria | MBO | KPI |

| Level | Management methods | Measuring tools |

| Focus | Commitment to goals | Track the metrics |

| How it is formed | Consensus | Usually applied from above |

| Employee role | Proactive commitment | Performance measurement |

| Time | Medium- to long term | Short-term / operational |

| Risk | Vague commitment | Running low means missing the big target. |

Below is a table comparing the differences between MBO and OKR:

| Criteria | MBO | OKR |

| Philosophy | Stability – commitment | Ambition – Experimentation |

| Completion rate | High expectations (80–100%) | 60–70% is good |

| Cycle | Quarter/Year | Usually quarterly |

| Flexibility | Medium | Very high |

| Fit | Stable business, scale | Startups, innovate quickly. |

The standard 6-step MBO process, and what are the common mistakes made in practice?

MBO doesn't fail because of a flawed model, but because businesses lack discipline and data. Below is an analysis of the standard 6-step MBO process, along with common mistakes made in practice.

| The order of steps in the MBO process | The correct way to do it | Incorrect method |

| Step 1. Establish organizational objectives. | The goals stem from strategy and finance:

Fewer but more important goals, with clear priorities. |

General objectives (“growth”, “more efficiency”)

|

| Step 2. Break down the goals to the unit/individual level. |

|

Functional decomposition, not value decomposition.

The goal is to have a beautiful personal number but not to generate money. |

| Step 3. Agree on Measurement Criteria | Each objective must answer three questions:

|

We have KPIs, but we lack reliable data sources.

KPIs are not controllable.

|

| Step 4. Execution | Management does not interfere with the way things are done.

Personnel have full authority to deploy. Management plays the following role:

|

Management involves both setting goals and micro-controlling.Personnel are responsible for results but do not have decision-making power. |

| Step 5. Periodic Monitoring & Review | Review at a fixed pace:

Focus:

|

|

| Step 6. Evaluation & Adjustment | Evaluate:

Adjust:

|

Assessment is based solely on % completion. No distinction:

Do not adjust the target for the next cycle. |

Why do MBOs often fail due to subjective measurement and reporting delays?

MBO (Multi-Boosting Operations) doesn't usually fail because of a flawed philosophy, but rather because of incorrect measurement methods and feedback that comes too late.

Why does subjective measurement cause MBO to collapse?

MBO thrives on trust; subjective measurement destroys trust. MBO is based on commitment to goals. Commitment only exists when:

- Clear measurement criteria

- The result is uncontroversial.

When measurement involves:

- Subjective comments

- "I see" rating

- Manager's personal opinion

Subjectivity makes the goal lose its "manageability".

Furthermore, an MBO objective is only valuable if: The person responsible knows in advance how they will be evaluated. Subjective measurement leads to:

- The outcome is unpredictable.

- Action not optimized

- Cannot learn from misconceptions.

Personnel are shifting from optimizing results to optimizing visuals.

When there is no data:

- Whoever holds the power decides whether something is "passed/failed".

- MBO was transformed into: "I think you haven't met your goals yet."

The empowering and responsible nature of MBO is suppressed.

Why does reporting lag render MBO ineffective?

MBO is not a summarizing tool, but a navigational tool. If:

- Quarterly/End-of-period report

- Data arrives after all the actions have taken place.

All adjustments were too late to save the outcome.

Furthermore, delays disrupt the link between action and outcome. Reporting delays cause:

- It is unclear which action produces which result.

- No management lessons learned.

MBO loses its role in organizational learning.

In summary, a well-functioning MBO system requires:

- A small but crucial number

- Clear data source

- Short review cycle

- Shared dashboard

What is MBO 4.0 and how does it differ from traditional MBO?

MBO 4.0 is not a fixed academic term, but rather the term for an evolved version of MBO in the context of Industry 4.0 – real-time data – AI – agile organization. MBO 4.0 is an upgraded version of MBO powered by technology, data, and agile thinking, with four pillars:

- Flexible yet committed goals.

- Measurement based on real-time data.

- Provide continuous feedback instead of late summaries.

- AI and dashboards support decision-making.

Simply put: MBO 4.0 = Management by Objectives, based on data, rapid response, and flexible commitment.

Comparing traditional MBO vs. MBO 4.0:

| Criteria | Traditional MBO | MBO 4.0 |

| Target cycle | Year/Quarter | Quarterly + continuous adjustments |

| Nature | Static commitment | Flexible commitment |

| Measurement | Manual reporting | Real-time dashboard |

| Review | Long-term | Short, continuous check-ins |

| Decision-making power | Manage | Data + Team |

| Market reaction | Slow | Fast |

| The role of AI | Do not have | Forecast and warning deviations |

In short

- Traditional MBO: Commitment – but Slow & Rigid

- MBO 4.0: Commitment – Flexibility – Data – Rapid Response

Example of an MBO for the CFO and the Finance and Accounting department.

MBO for CFOs and Finance/Accounting departments is often done incorrectly because it tends to follow the sales model (revenue, growth), while the true value of finance lies in control – cash flow – risk – data discipline.

Below is a true example of MBO for CFO & Finance, not a "sales pitch".

Accounts Payable (AP)

| MBO department | Key KPIs | Data sources |

| Payment was made correctly, in full, and without error. | Invoice exception rate | AP system |

| % pays on time | Bank/AP | |

| Incorrect invoice number | Risk log |

Accounts Receivable (AR)

| MBO department | Key KPIs | Data sources |

| Collect payments on time – no fictitious revenue. | DSO | AR aging |

| % overdue debt | AR report | |

| Value of bad debts | Provide |

General Accountant (GL)

| MBO department | Key KPIs | Data sources |

| Quick, accurate, and valuable reports. | Closing time | GL |

| Adjustment entries | Audit log | |

| Number of audit errors | Audit report |

What are the advantages and disadvantages of MBO? How to overcome its drawbacks through data control?

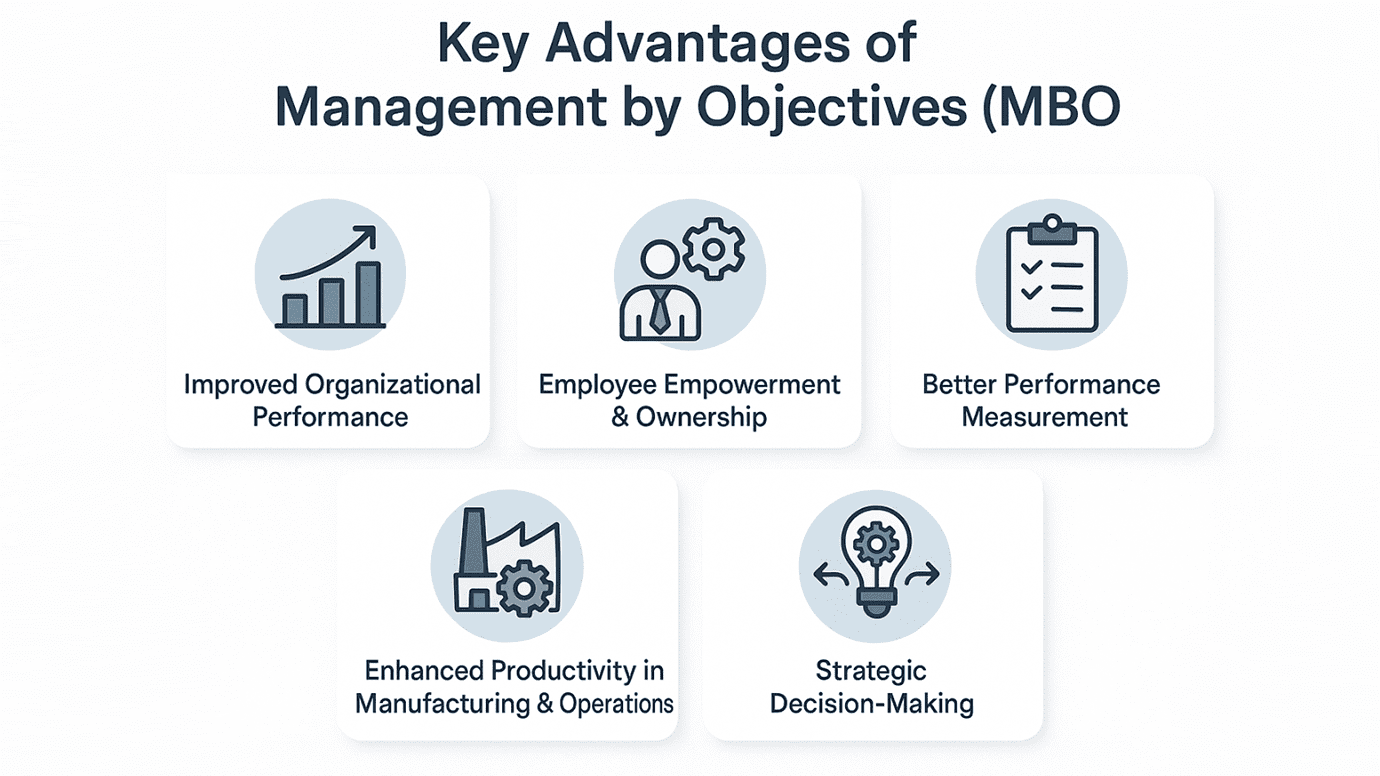

MBO helps to prioritize, increase accountability, and align individual goals with organizational goals. Below is an analysis of the advantages and disadvantages of MBO and how to overcome these drawbacks through data control.

1. What are the advantages of MBO?

- Align personal goals with strategy and finances.

- Each individual understands: "If I perform well, which of the company's financial indicators will improve?"

- Avoid a situation where you do a lot of work but get little value.

- Increase responsibility and proactiveness.

- The goal is a commitment, not a command.

- Management controls the results, not the methods.

- More transparent performance evaluation

- When the measurement criteria are clear: Less subjective, Less controversial.

- Suitable for professional, large-scale environments.

- Establishing management discipline

- Organizational requirements: Clear objectives, Review schedule, Tracking data.

2. What are the disadvantages of MBO?

- Subjective measurement

- Loss of commitment

- Employees prioritize "pleasing the boss" over optimizing results.

- Reporting lag

- Detection of target deviation occurs when it is already too late.

- MBO is now just a summarizing tool.

- Financial goal deviation

- Achieving personal MBO (Mean Balance of Sales) but the company's health doesn't improve.

- Rigid in a volatile environment

- The goal has become outdated.

- Personnel are still pursuing the wrong goals.

MBO has integration ERP How does 3-way matching prevent internal fraud?

MBO not only manages performance but also becomes a mechanism to prevent internal fraud when integrated with ERP and 3-way matching. MBO can be directly linked to the control of the purchasing-receiving-payment process by using 3-way matching between the Purchase Order (PO), Goods Receipt (GR), and Invoice. When data reconciliation is automated, the goals of "reducing errors" and "increasing compliance" become measurable and difficult to manipulate. This helps to objectively evaluate MBO and reduce the risk of internal fraud.

MBO not measuring perceptionwhich measure on ERP dataERP integrates everything:

- PO (Purchase Order)

- GR (Goods Receipt)

- Invoice

- Pay

- GL / Cost Center

Meanwhile, MBO transforms ERP data into a commitment to accountability.

How MBO + ERP + 3-way matching prevent fraud.

ERP and 3-way matching block fraud at the process level. MBO blocks fraud at the responsibility level.

- Shift from “late detection” to “prevention from the start”

- 3-way matching is mandatory.

- No match, no payment.

- Linking fraud to specific MBO indicators

For example, MBO Finance:

| MBO | KPI measurement |

| Payment control | Invoice Exception Rate |

| Reduce internal risks. | % payment via 3-way matching |

| Cost transparency | Cost leakage |

- Task separation + MBO = blocking collusion

ERP allows: Purchase Order creator ≠ recipient ≠ payment approver

MBO assigns responsibility:

- AP is responsible for MBO regarding the invoice error rate.

- Procurement is subject to MBO regarding PO accuracy.

- Warehouse is responsible for MBO regarding GR accuracy.

Checklist for implementing MBO 4.0 in 30–60 days for CFOs

An effective MBO implementation requires a clear, deliverable, weekly roadmap: priority objectives, metrics, data sources, review frequency, and alert mechanisms. Within 30–60 days, the CFO can run a pilot in Finance Ops to demonstrate effectiveness before scaling up. The focus is on reducing lag and increasing the objectivity of measurement.

PHASE 1 (WEEKS 1–2): CHOOSING THE RIGHT GOALS & COMMON LANGUAGE

- Choose 3–5 goals using the 80/20 principle.

No more than 5, prioritize the following goals:

- This directly impacts cash flow.

- The data is already available in the ERP system.

- There is a risk of fraud/loss.

| Group | For example, an MBO is suitable for a CFO. |

| Fight | Reduce DSO |

| Expense | Cost Variance Control |

| Pay | Optimize DPO |

| Risk | Reduce Invoice Error Rate |

| Control | 100% 3-way matching |

- Create a Metric Dictionary (required)

This is the backbone of MBO 4.0; without it, MBO will fail.

| Ingredient | The question needs to be answered. |

| metric name | What are you measuring? |

| Recipe | How do you calculate it? |

| Data sources | Which ERP/module? |

| Original | Who is responsible? |

| Frequency | Day / Week / Month |

| Warning threshold | How much triggers the alarm? |

PHASE 2 (WEEKS 3–4): BASELINE – TARGET – DASHBOARD

- Establishing the Baseline

- Obtain 3–6 months of historical data.

- No editing, no digital beautification.

| Metric | Baseline |

| DSO | 58 days |

| Invoice Error Rate | 6.2% |

| Cost Variance | +4.5% |

- Set targets according to management principles.

| Metric | Baseline | Target |

| DSO | 58 | ≤ 50 |

| Invoice Error Rate | 6.2% | ≤ 3% |

| Cost Variance | +4.5% | ≤ +2% |

Target must:

- There is an owner

- There are specific actions to follow.

- There is a clear deadline.

- Set up Review Cadence & Dashboard

| Metric | Review |

| DSO | Weekly |

| Invoice Error Rate | Daily / Weekly |

| Cost Variance | He |

The dashboard should have:

- Actual vs Target

- Reward

- Exception list

PHASE 3 (WEEKS 5–8): PILOT – EXCEPTION – WARNING

- Pilot run (1–2 rooms/process)

Priority: AP, AR, Procure-to-Pay

Pilot target:

- Check if the data is "live".

- Identifying the real bottleneck

- Exception Handling Design (Extremely Important)

MBO 4.0 exception management, not average.

| Situation | Handle |

| Invoice discrepancy: PO > X% | Block |

| Underpayment GR | Reject |

| Manual Override | Log + review |

- Adjusting the alarm threshold (Threshold tuning)

- Week one: frequent warnings are normal.

- Adjust to:

- Not too sensitive

- Not too late

For example:

- DPO deviation ±2% → warning

- Invoice Error Rate > 3% → escalation

What is MBO (Manual Debugging) in FAQs for CFOs and Accountants?

Below is an FAQ about MBO for CFOs & Finance & Accounting Departments, written using modern management logic + data + risk control.

What is MBO and is it the same as KPI?

No. MBO is a framework for commitment to objectives, while KPI is a measurement tool within MBO.

| Criteria | MBO | KPI |

| Nature | Commitment to goals | Measurement index |

| Answer to the question | What was achieved? | How do you measure it? |

| Level | Strategy / Management | Operate |

| Person responsible | Manager / CFO | Individual / Department |

How can we measure MBO (Meaning of Balanced Income) in terms of cost effectiveness without manual general accounting?

Instead of measuring costs using Excel at the end of the month, we measure them using real-time Cost Variance from the ERP system.

The correct way to do it:

- Linking costs to a budget.

- Compare Actual vs Budget automatically

- Measure using the formula:

Cost Variance=Actual−BudgetCost\ Variance = Actual – BudgetCost Variance=Actual−Budget Variance%=Actual−BudgetBudget×100%Variance\% = \frac{Actual – Budget}{Budget} \times 100\%Variance%=BudgetActual−Budget×100%

Condition:

- Pre-approved budget

- The cost of installing a proper cost center.

- Do not record "pending" expenses.

In that case: Accounting is not aggregated – the MBO system automatically measures.

How can we reduce the delay in MBO financial reporting for decision-making during the period?

Reducing latency = reducing manual intervention. Three essential things:

- Fast Closing → T+3 or T+5

- Dashboard instead of Excel reports

- Review based on exceptions

| Traditional | MBO 4.0 |

| Wait until the end of the month. | Daily monitoring |

| Summary report | The report is inaccurate. |

| Making decisions late | Adjustments during the period |

Can MBO integrate with ERP, and what are the requirements?

Yes – and ERP integration is mandatory for MBO to be successful.

Minimum requirements:

- ERP is Single Source of Truth

- Data cannot be manually edited outside the system.

- There is a clear division of authority.

| ERP components | Roles in MBO |

| GL | Profit, cost |

| AR | DSO |

| AP | DPO |

| Budget | Compare the plans |

| Audit log | Fraud tracing |

What does 3-way matching have to do with MBO and anti-fraud measures?

Three-way matching is a mandatory control condition for cost and payment MBO to be meaningful. Three-way matching includes:

- PO (Purchase Order)

- GR (receiving goods)

- Invoice

Regarding MBO:

| MBO | No 3-way | It has a 3-way |

| Cost Control | After payment | Before paying |

| Cheat | Late detection | Stop it from the start. |

| KPI | Easily influenced by beauty treatments. | Objective |

What should be measured when setting up an MBO (Management by Objectives) for accounting staff to reduce legal risk?

Instead of measuring "doing enough," measure "avoiding mistakes." A suitable MBO example would be:

| Location | MBO | KPI |

| AP | Accurate and secure payment | Invoice Error Rate |

| AR | Actual revenue earned | DSO |

| GL | Report on time | Closing time |

| Tax | No expenses will be excluded. | % costs are excluded. |

What is the role of automation (RPA/AI) in MBO assessment?

Automation helps MBO break free from subjectivity. What can RPA/AI do?

- Read the invoice

- Reconciliation of PO–GR–Invoice

- Deviation warning

- Record in the audit log.

| Not automatic | It is automatic. |

| Easily overlooked | Discovery 100% |

| Dependent on people | Data dependency |

| Subjective review | Review by threshold |

Should MBO reviews be conducted monthly or quarterly?

Both – but with different purposes.

| Cycle | Used for |

| Weekly | Deviation detection |

| He | Adjust |

| Quarterly | Commitment assessment |

What are the signs that MBO is "rushing to meet targets" and needs immediate adjustment?

Red alert if you see:

- KPIs met, but cash flow is poor.

- Many manual overrides

- Review: All explanations, little action.

- KPIs increased, but audit issues also increased.

- Excel is more than a dashboard.

Solution:

- Tighten data

- Review by exception

- Linking MBO to risk and cash flow

Conclude

The above is the complete article on what MBO is. In the context of businesses facing:

- Cash flow pressure

- Costs escalating

- Risks related to invoices, taxes, and internal fraud.

MBO has become a financial management tool, not just a human resources tool. For MBO to truly become a financial control tool, businesses need:

- ERP makes Single Source of Truth

- Automation of the process:

- Receive – read – check invoices

- Reconciliation of PO–GR–Invoice

- False alarm

- Audit trail

Technology doesn't replace the CFO – it helps the CFO gain better control. Platforms like Bizzi help:

- Transform MBO from "end-of-month report" → real-time dashboard

- Shift management from “risk detection” to risk prevention.

- Reduce reliance on human resources, increase data discipline.

In short, MBO + ERP + automation (like Bizzi) = a company's financial immunity. To receive personalized advice on solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/