Just like blood nourishes the body, cash flow nourishes the business. Without blood, the body collapses; without cash flow, the business loses its ability to survive even if the profit report is still positive. To help you grasp quickly, below is the core definition and 3 pillars of cash flow.

Cash Flow is the movement in and out of cash and cash equivalents (such as treasury bills, short-term investments with original maturities of not more than 3 months) in a business.

Cash flow plays three crucial roles in the survival of an organization:

- Ensure immediate payment ability (Solvency).

- Create a basis for business valuation and investment attraction.

- Provide resources for reinvestment and expansion.

Read Bizzi's article below to learn more about its nature. What is cash flow?, while embracing traditional management methods and especially automation solutions to ensure financial health.

What is Cash Flow? Differences and Core Concepts

What is cash flow? Cash flow is the movement of cash and cash equivalents into and out of a business over a period of time. It reflects the ability to generate cash and use cash for business, investment and financial activities. According to accounting standards, “cash and cash equivalents” are not only cash in hand, bank deposits but also include short-term investments with high liquidity, easily converted into cash and with low risk of value fluctuations (usually maturing within 3 months).

Difference from profit: Profit represents business performance on paper, while cash flow reflects the actual amount of money a business has and can use immediately.

Distinguishing Cash Flow from Revenue and Profit

To make it easier to understand, the table below summarizes the differences between the concepts:

| Criteria | Cash Flow | Revenue | Profit |

| Nature | Cash received or paid | Recorded sales and service value | The difference between revenue and expenses |

| Time of recording | When money actually comes in/goes out | When the transaction occurs (accrual accounting) | After accounting for all costs and taxes |

| Measurement | Actual solvency and liquidity | Business scale | Business profitability |

| For example | Customers pay immediately or debt is not paid yet | Issue sales invoice | Revenue minus costs of raw materials, wages, etc. |

Concepts related to Cash Flow

- Cash Inflow: Amounts received from sales, services, loans or investments.

- Cash Outflow: Payments to suppliers, employee salaries, operating costs, tax…

- Net Cash Flow: The difference between cash inflow and outflow.

- Positive cash flow: Cash in is greater than cash out → increases liquidity.

- Negative cash flow: Cash out is greater than cash in → need to control spending or raise more capital.

What is the importance of Cash Flow to business?

Cash flow is considered the "blood vessel" of a business, determining:

- Short-term solvency: Ensuring salary payment, debt repayment, operating costs.

- Financial risk management: Limit the risk of insolvency despite accounting profits.

- Make strategic decisions: Identify opportunities for investment, business expansion, or financial restructuring.

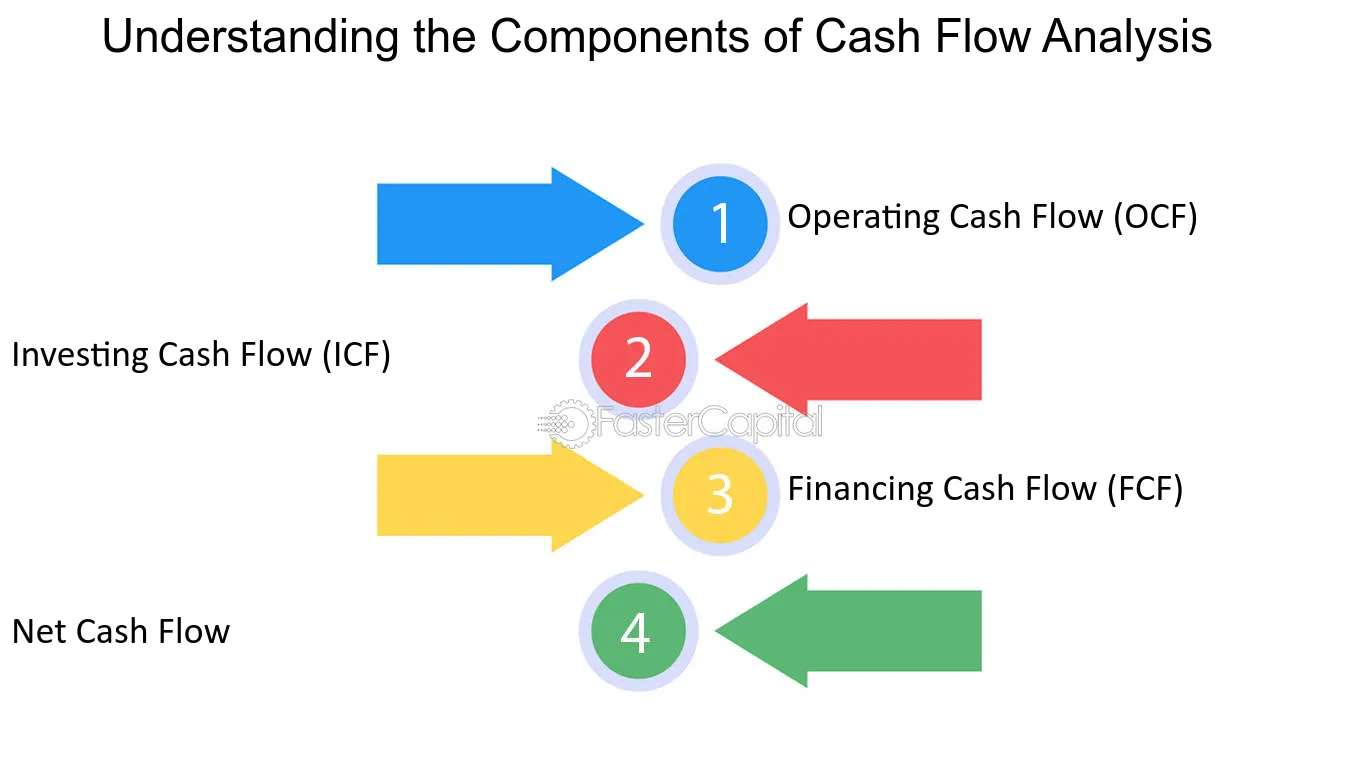

Cash Flow Classification: Components of the Cash Flow Statement

Cash flow statement (Cash Flow Statement) is an important tool to help businesses track cash movements and assess profitability, liquidity, and overall financial health. In Vietnam, this is a mandatory report that must comply with Vietnamese Accounting Standards (VAS) or international standards (IFRS) if applicable.

Cash flow classification helps businesses and investors clearly see the nature of cash flow, where it comes from and where it is used, instead of just relying on profit figures. In other words, understanding cash flow classification is grasping the financial "blood vessels" of the business, helping to manage effectively and predict risks early.

Operating Cash Flow (OCF)

This is the cash flow arising from main business activities of a business, including sales, provision of services, payment of operating expenses, taxes and payments related to regular business operations.

- Reflects the amount of cash generated from core business activities (sales, service provision).

- An important measure of a company's ability to generate cash without relying on external funding.

- Is the most important indicator to assess the ability to generate cash from core operations.

- Positive OCF cash flow → the business is generating cash from operating activities.

- Negative OCF cash flow → can warn of business performance or problems business cash flow management.

Investing Cash Flow (ICF)

- Cash flows arising from the purchase, sale, or investment in long-term assets such as buildings, machinery, real estate, or other long-term financial investments.

- Usually cash outflows when buying assets and cash inflows when selling assets or recovering investments.

- Helps managers evaluate the level of investment and profitability of long-term investments.

Cash Flow from Financing Activities (Financing Cash Flow – FCF)

Cash flow from capital raising or repayment activities, including borrowing, issuing shares, paying dividends or repaying principal.

- Record proceeds from borrowing, issuing shares and payments of dividends and debt repayments.

- Demonstrates the enterprise's strategy for raising and using capital.

- Helps investors and CFOs track how the business leveraging debt and equity to develop or maintain operations.

Net Cash Flow

Is the difference between total cash inflow and cash outflow during the period, cknow the business is increase or decrease the amount of cash Actual during the period is the basis for making liquidity decisions and managing reserve funds.

- Recipe: Cash flow = OCF + ICF + FCF

Free Cash Flow (FCF)

Is the amount remaining after a business has spent on capital expenditures (CAPEX) from operating cash flow

- FCF is an important indicator for business valuation and investment decisions.

- Positive free cash flow → the company has the ability to pay debt, pay dividends and reinvest.

- Negative free cash flow → the business may need to raise additional capital or cut spending.

Meaning:

- For CFO: Assess the ability to finance new operations without additional debt.

- For investors: A key indicator in business valuation, reflecting actual cash generation power.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) is a valuation analysis method based on converting expected future Cash Flows to Net Present Value (NPV), using a Discount Rate (usually Weighted Average Cost of Capital – WACC).

Other important cash flow analysis ratios

- Operating Cash Flow/Current Debt Ratio (Current Liability Coverage Ratio): Measures the ability of a business to pay short-term debts with cash flow generated from core business activities, demonstrating financial autonomy.

- Debt coverage ratio (Debt Service Coverage Ratio – DSCR): An extremely important indicator in capital financing decisions, indicating whether operating cash flow is sufficient to cover debt obligations (principal and interest).

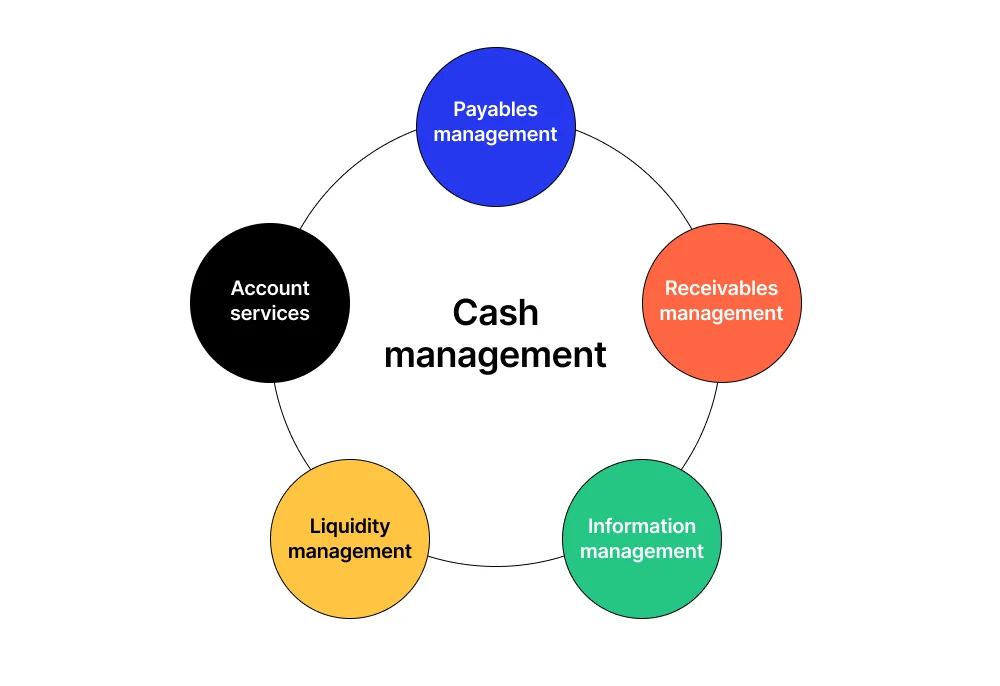

Effective Cash Flow Management Methods

Not only is it important to understand the nature of cash flow, but effective cash flow management is also extremely important. This is not just about "earning more than spending", but also about balancing the pace of revenue and spending, optimizing receivables and payables to maintain a positive, stable and sustainable cash flow.

So what is the solution to cash flow management?

Financial Planning and Cash Flow Forecasting

Financial planning is the first step in cash flow management, helping businesses Estimate cash needs and anticipate future fluctuations.

Main steps:

- Cash Inflow Forecast: Estimate cash flow from sales, debt collection, financing sources.

- Cash Outflow Forecast: Including operating costs, salaries, debt payments, investments.

- Calculate Net Cash Flow: Compare cash inflows and outflows to determine surpluses or shortages.

- Take action: If a shortfall is forecast, it is necessary to prepare short-term loans, adjust costs or promote debt collection.

Cash flow planning and forecasting helps businesses be proactive in all situations, avoid the risk of sudden cash shortages and optimize capital efficiency.

Optimizing Cash Flow (Accounts Receivable Management – AR)

AR management helps businesses speed up debt collection, improve available cash flow and reduce credit risk from customers.

Optimization strategies:

- Payment policy & incentives: Encourage customers to pay early with discounts; establish clear payment terms.

- Tracking & debt reminders: Use automatic system to remind customers, reduce bad debt risk.

- DSO (Days Sales Outstanding) Index: Reflects the average time (number of days) it takes for a business to collect money after generating revenue.

-

- Low DSO: Fast debt collection, stable cash flow.

- High DSO: Risk of capital stagnation and liquidity shortage.

Optimize cash flow to help Reduce capital costs, improve operating efficiency and improve overall financial performance.

Optimizing Cash Flow Outflow (Accounts Payable Management – AP)

AP management helps businesses maximize payment terms, control costs and maintain good relationships with suppliers.

Strategies:

- Take advantage of payment terms: Use the full credit period that the supplier allows, both to maintain reputation and to maintain cash for other activities.

- Negotiation with suppliers: Negotiate longer terms or discounts for early payment.

- Cost Control: Limit overspending, review unnecessary expenses.

Effective cash flow management helps businesses preserve capital, balance liquidity and improve profits.

Cash Flow Management in the Digital Age

In a rapidly changing market, manual Excel management methods can no longer meet the demands of speed and accuracy. Errors in data entry or delays in reconciliation of accounts receivable can lead to poor financial decisions.

The Role of Financial Automation in Cash Flow Management and Solutions from Bizzi

Cash flow management is not just about planning or forecasting, it also requires use technology to automate financial processes, helping to reduce errors, speed up cash collection and disbursements, and improve capital efficiency.

With Bizzi.vn, financial automation is not only about saving time, but also a strategic tool to help businesses manage cash flow effectively, reduce risks and create a solid foundation for long-term growth. Bizzi is currently the leading financial automation solution in Vietnam, trusted and chosen by many large enterprises, typically:

- N KID – children's entertainment and retail center system.

- GS25 – Korean convenience store chain.

- Guardian – famous pharmaceutical and cosmetic retail brand.

- TIKI – top e-commerce platform in Vietnam.

….

The trust from major brands shows that Bizzi not only solves cash flow problems effectively but also meets strict requirements on scale, accuracy and system integration capabilities.

Accounts Payable Automation (AP Automation)

Bizzi.vn applies AI and RPA to process input invoices quickly, eliminating manual errors. This solution allows businesses to strictly control cash flow through:

- Automated invoice processing using AI/RPA: Bizzi.vn applies artificial intelligence (AI) and robotic process automation (RPA) to automatically collect, check and classify input invoices. This helps to minimize manual errors and save processing time.

- Automatic 3-way matching to prevent fraud: The system automatically compares invoices with purchase orders and delivery notes, helping to detect discrepancies and prevent incorrect payments.

- Maximize the utilization of payment term: AP automation helps businesses control costs, take advantage of payment terms and maintain good relationships with suppliers, thereby optimizing cash flow.

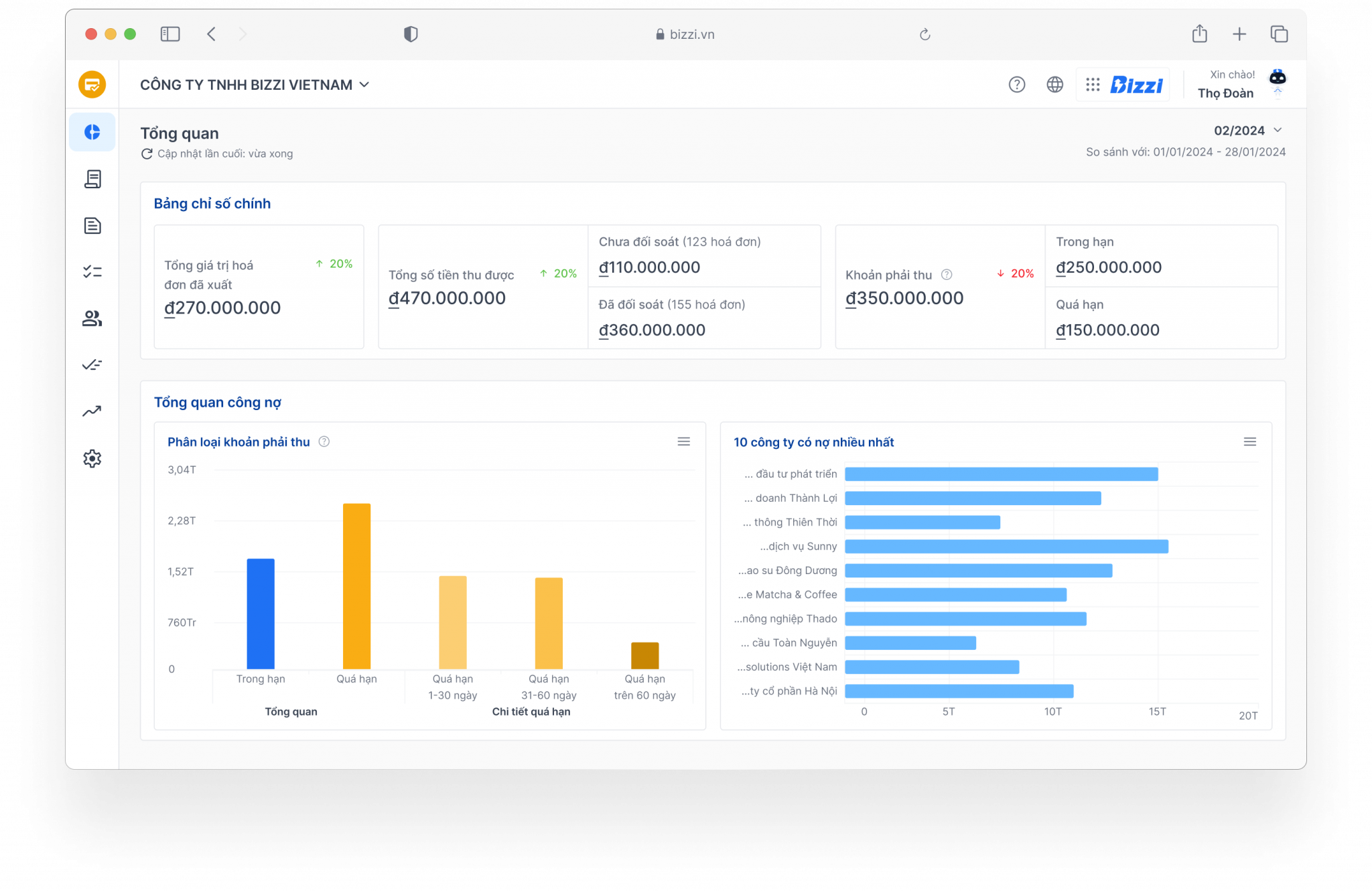

Accounts Receivable Management Automation (AR Automation)

A common problem in cash flow management is slow debt collection, causing capital to stagnate. Bizzi.vn provides an automatic debt reminder system via email/SMS, and also provides a real-time Aging Report tool.

- Automatic debt reminder: Bizzi.vn provides automatic debt reminder solutions via multiple channels such as email and SMS, helping to reduce debt collection time and improve cash flow.

- Tracking the debt aging index (Aging Report): The system automatically updates and classifies debts by age, helping CFOs easily track and manage debts.

- Improve cash flow: AR automation helps businesses speed up debt collection, reduce credit risk, and improve solvency.

Optimizing Financing Readiness

A little-known but extremely important advantage of Bizzi is the ability to standardize financial data. When all invoices and debts are digitized and transparently authenticated on the system, businesses own a "clean" and reliable credit profile. This is an important database that helps financial institutions quickly assess, thereby making it easier for businesses to access working capital or supply chain financing to handle short-term cash flow deficits.

Budgeting and Spending Control

With Bizzi Expense, businesses can monitor spending in real time and set up automated approval processes for each expense. This keeps budget overruns and unplanned spending under control, helping to maintain a healthy cash flow.

- Real-time spending monitoring: Bizzi.vn provides real-time expense tracking tools, helping businesses control budgets and prevent overspending.

- Automated approval process: The system automates the spending approval process, ensuring compliance with financial policies and improving administrative efficiency.

- Cost optimization: Controlling spending and budgeting helps businesses optimize costs, increase profits and improve cash flow.

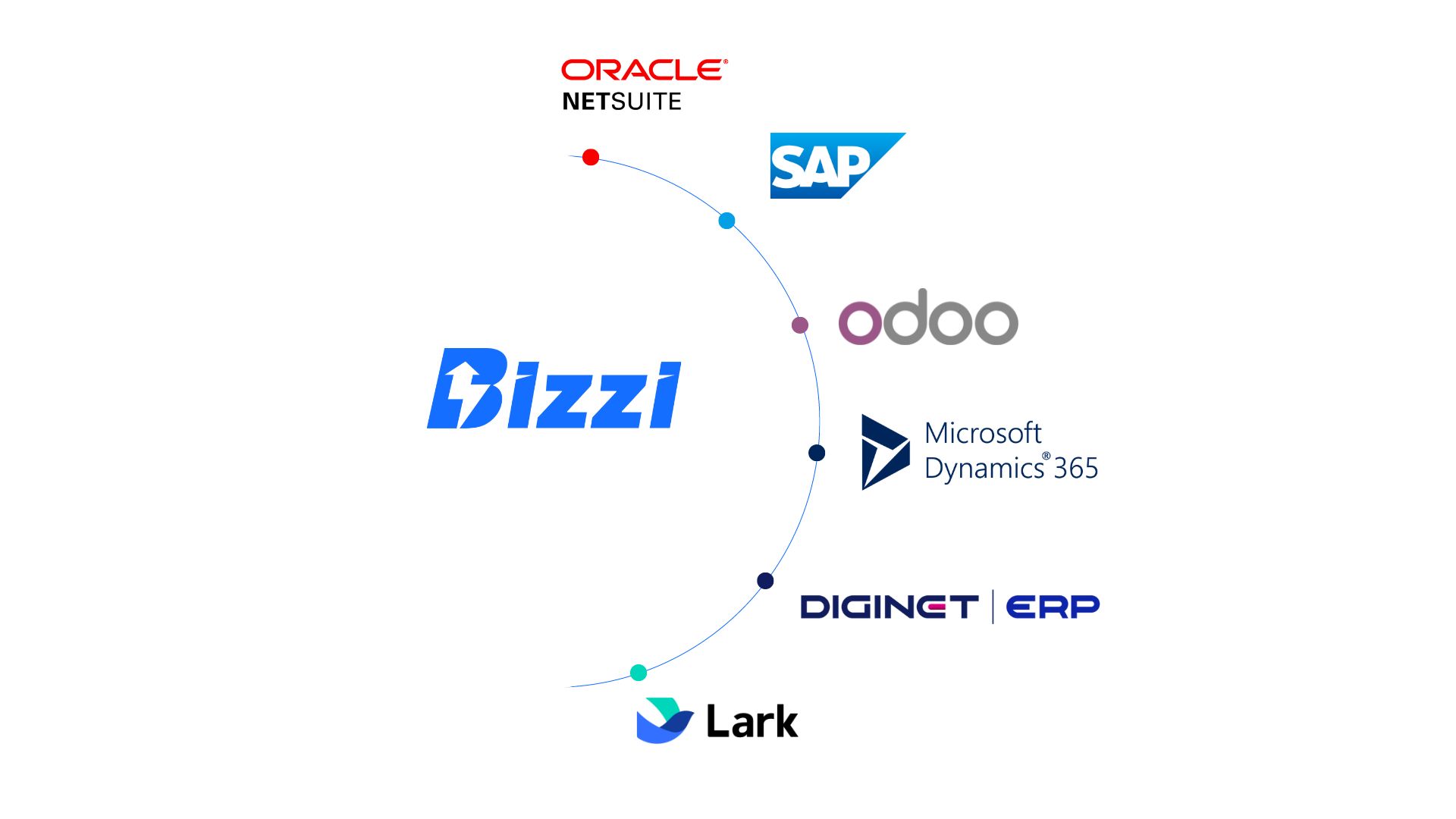

Seamless integration with ERP systems

Bizzi.vn's outstanding strength is its ability to Integrates with leading ERP systems such as SAP, Oracle, Microsoft Dynamics. All debt, expense and invoice data is synchronized, creating a unified financial ecosystem, helping CFOs and administrators make decisions based on accurate, real-time data.

For Bizzi.vn, financial automation is not only a time saver, but also a strategic tool to help businesses manage cash flow effectively, reduce risks and create a solid foundation for long-term growth.

FAQ What is Cash Flow?

Below are answers to some questions related to what is cash flow, comparison and how to optimize cash flow in a business.

Is negative cash flow dangerous?

Negative cash flow is not always a bad thing. For example, when a company invests heavily in expansion, marketing, or M&A, the cash flow may be negative in the short term but bring long-term benefits. However, if the negative cash flow comes from core business activities (no revenue from sales), it is a sign of high liquidity risk.

How is cash flow different from profit?

- Profit is an “accounting figure” that reflects the results of business operations (which may include uncollected revenue or unpaid expenses).

- Cash flow reflects the actual money going in and out of the business.

A business can have positive profits but negative cash flow (due to outstanding debt, large inventories), or vice versa.

How to improve business cash flow?

Efficient AR/AP management, cost optimization and financial automation applications.

- Manage AR (accounts receivable): Shorten collection time, improve DSO.

- Manage AP (accounts payable): Make the most of your payment terms without compromising your reputation.

- Inventory control, optimizing working capital turnover.

- Application financial automation (like Bizzi.vn) to reduce errors, speed up invoice processing and cash flow.

Does cash flow affect business valuation?

Yes. Most current valuation methods (e.g. DCF – Discounted Cash Flow) based on the ability to generate future cash flows. Investors and CFOs are often interested in Free Cash Flow (FCF), because this is the real capital available to pay dividends, reinvest or repay debt.

Conclude

With Bizzi.vn, financial automation is not only a time-saver, but also a strategic tool to help businesses control costs, debts and manage cash flow effectively in real time. Don't let liquidity risk hinder your business. Sign up for a consultation and try Bizzi's solution today: https://bizzi.vn/dang-ky-dung-thu/