Liabilities are considered a core factor that determines the financial health and sustainability of a business. Understanding the nature of liabilities not only helps businesses control risks, but also utilize it as a strategic financial tool for expansion and development.

Join Bizzi to learn about the concept of payables and payables management strategies in the article below!

What is the definition of Liabilities?

In accounting, liabilities (Liabilities) is a core concept, reflecting financial obligations that a business must pay to a third party in the future. According to Vietnamese Accounting Standards – VAS 01, liabilities are defined as:

“Liabilities are present obligations of an enterprise arising from past transactions and events that the enterprise must settle by using its resources.”

Liabilities are current obligations of a business arising from past events, the settlement of which would result in a depletion of economic resources. This is a core element reflecting financial leverage and liquidity risk on the balance sheet.

In other words, liabilities are the financial obligations that a business is responsible for repaying to other organizations or individuals, through forms such as cash, goods, services or other economic benefits in the future.

What are the characteristics of liabilities?

Three characteristic attributes that help clearly identify the nature of liabilities include:

- Present Obligation: Arising from transactions or commitments that have already occurred.

- Past Transaction/Event: There is clear evidence proving the obligation was formed in the past.

- Outflow of Economic Benefits: The business will have to use assets, cash or services to pay.

Liabilities are not only monetary “payables”, but also legal and financial commitments that represent the enterprise’s responsibility to related parties.

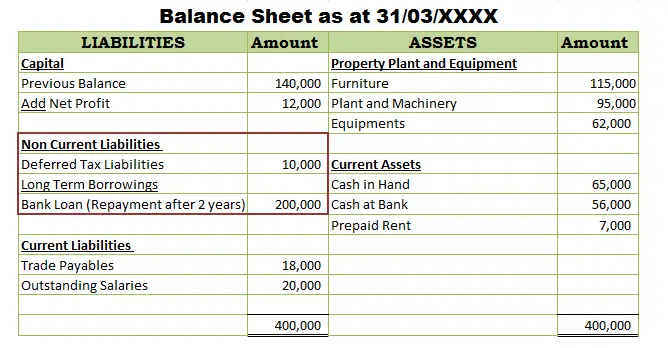

What is the Position and Role on the Balance Sheet of Liabilities?

In the accounting system, Balance sheet is built on the basic equation:

Assets = Equity + Liabilities

- Assets: What the business owns or controls (cash, inventory, fixed assets…).

- Liabilities: Financial obligations that a business must pay in the future.

- Owner's Equity: The remainder belongs to the owner after deducting liabilities, including contributed capital and retained earnings.

- Presentation location: Liabilities are presented in capital side (right side) of the Balance Sheet.

- Usually divided into 2 groups:

- Short-term debt: located at the top (because there is an early payment deadline).

- Long-term debt: presented below short-term debt.

Visual example (simplified form):

Suppose company A has total assets of 50 billion VND, in there 30 billion VND equity and 20 billion dong in debt payable. Then, the accounting formula is expressed as follows:

Assets (50 billion) = Equity (30 billion) + Liabilities (20 billion)

This shows that Liabilities are a source of asset formation., helping businesses maintain operations, expand scale and optimize financial leverage.

Balance sheet (excerpt)

| ASSET | CAPITAL SOURCES |

| Current assets | Liabilities |

| – Cash and cash equivalents | – Short-term debt (payable to suppliers, short-term loans, taxes payable) |

| – Inventory | – Long-term debt (long-term loans, issued bonds, financial leasing debt) |

| Long-term assets | Equity |

| Fixed assets | – Owner's equity |

| – Investment real estate | – Undistributed profit after tax |

The Role of Liabilities on the Balance Sheet

- Core components in financial structure: Liabilities reflect financial obligations of a business with third parties (suppliers, banks, tax authorities…). This is one of the three main elements on the Balance Sheet along with Assets and Owner's Equity.

- Funding sources for activities:

Liabilities are an important source of capital to finance business operations, especially when equity is not sufficient. For example: borrowing from a bank to expand a factory or buying goods on credit from a supplier. - Basis for assessing solvency: From indicators such as Current Ratio good Debt to Equity Ratio, investors and creditors can assess the financial safety of the business.

- Direct impact on financial risk and strategy: High debt helps businesses have more financial leverage, but if not managed well, it will increase debt repayment pressure and the risk of insolvency.

In short, liabilities are more than just a number on the balance sheet. financial report, but also a mirror reflecting the capital usage strategy and financial health of the enterprise.

What are the conditions for recognizing a Liability?

According to VAS 01 – General Standard, an item is only recorded as a liability on the Balance Sheet when it simultaneously satisfies all three of the following conditions:

- Present Obligation: The business has a legal or constructive obligation arising from a past transaction or event (e.g., unpaid purchases, bank loans).

- Settlement by Resources: The business must certainly use economic resources (usually money, assets, or services) to pay this obligation in the future.

- Reliable Measurement: The value of the debt can be reliably determined in monetary terms, with sufficient basis to be reflected in the financial statements.

If all three conditions are not met, the obligation may be considered a contingent liability and only disclosed in the report, not recorded directly in the Balance Sheet.

Illustration:

- When a business purchases goods but has not yet paid for them, the payable to the seller will be recorded as a liability.

- When a business borrows from a bank, the principal and interest due are also recorded as liabilities.

Note: If the obligation is unclear or the amount cannot be reliably measured (for example, a legal dispute without a judgment), the item not yet recorded as a liability, which can only be explanation in financial statements.

Principles for recognizing and measuring liabilities according to accounting standards (VAS, IFRS)

According to VAS 01 – General Standard, an item can only be recognized as a liability on the Balance Sheet when it simultaneously satisfies the following conditions:

Present Obligation:

- The business has a legal or constructive obligation arising from a past transaction or event (e.g., unpaid purchases, bank loans).

Settlement by Resources:

- The business must certainly use economic resources (usually money, assets, or services) to pay this obligation in the future.

Reliable Measurement:

- The value of the debt can be reliably determined in monetary terms, with sufficient basis to be reflected in the financial statements.

If the conditions are not met, the obligation may only be considered a contingent liability and disclosed in the report, rather than being directly recorded in the Balance Sheet.

Illustration:

- When a business purchases goods but has not yet paid for them, the amount payable to the seller will be recorded as a liability.

- When a business borrows from a bank, the principal and interest due are also recorded as liabilities.

Note: If the obligation is unclear or its value cannot be reliably determined (e.g., an unresolved legal dispute), the item is not recognized as a liability but is only disclosed in the financial statements.

Detailed classification of liabilities and items that directly impact cash flow.

Liabilities is one of three important components of the balance sheet, reflecting the financial obligations that a business must pay in the future.

Depending on the payment term and the nature of the obligation, liabilities are classified into short-term, long-term and contingent liabilities.

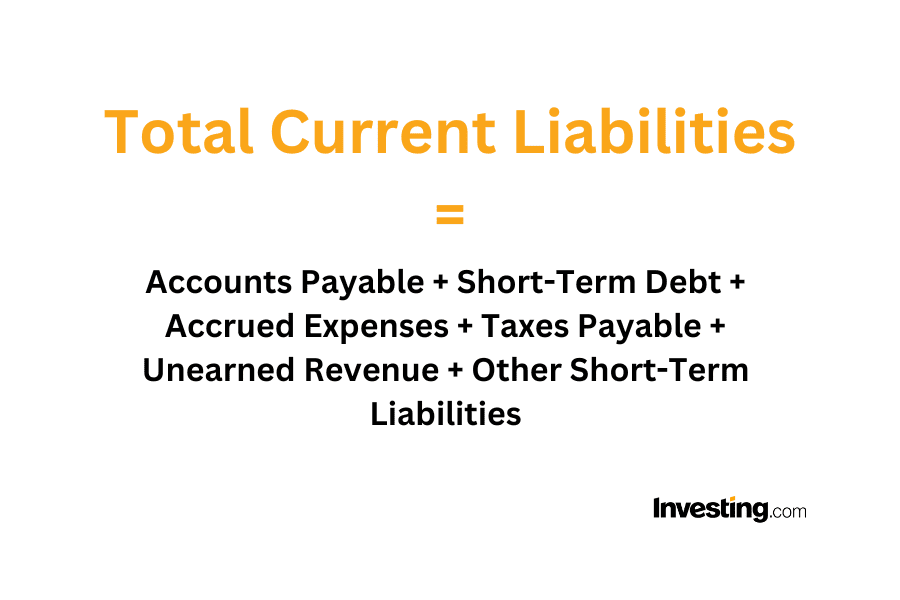

Current Liabilities

Current Liabilities are financial obligations that a business must pay within 12 months from the date of the financial statement or within a normal business cycle (whichever is longer).

Important items:

- Accounts Payable: Debt arising from the purchase of goods or services but not yet paid for. The Accounts Payable (Account 331) item is one of the largest sources of liabilities and also the source with the highest risk of manual errors. Monthly invoice matching between accounting and suppliers is the most time-consuming and labor-intensive process in the Finance and Accounting department.

- Taxes and amounts payable to the State: VAT, corporate income tax, personal income tax, social insurance...

- Payable to employees: Unpaid salaries, bonuses and benefits.

- Short-term loan: A loan from a bank or credit institution with a term of less than 12 months.

Payable expenses: Expenses that have been incurred but not yet paid (interest, office rent, utilities, etc.).

Non-current Liabilities

Long-term liabilities are debts and financial obligations with payment terms of more than 12 months from the date of financial statements or exceeding one business cycle.

Typical items:

- Long-term loan: Loan from bank or credit institutions with long term.

- Bonds issued: Obligation to pay principal and interest to investors who purchase bonds issued by enterprises.

- Long-term finance lease liabilities: Arising from asset lease contracts that essentially transfer ownership.

- Long-term liabilities: Obligations expected to arise in the future such as product warranty costs, environmental restoration costs, severance pay funds.

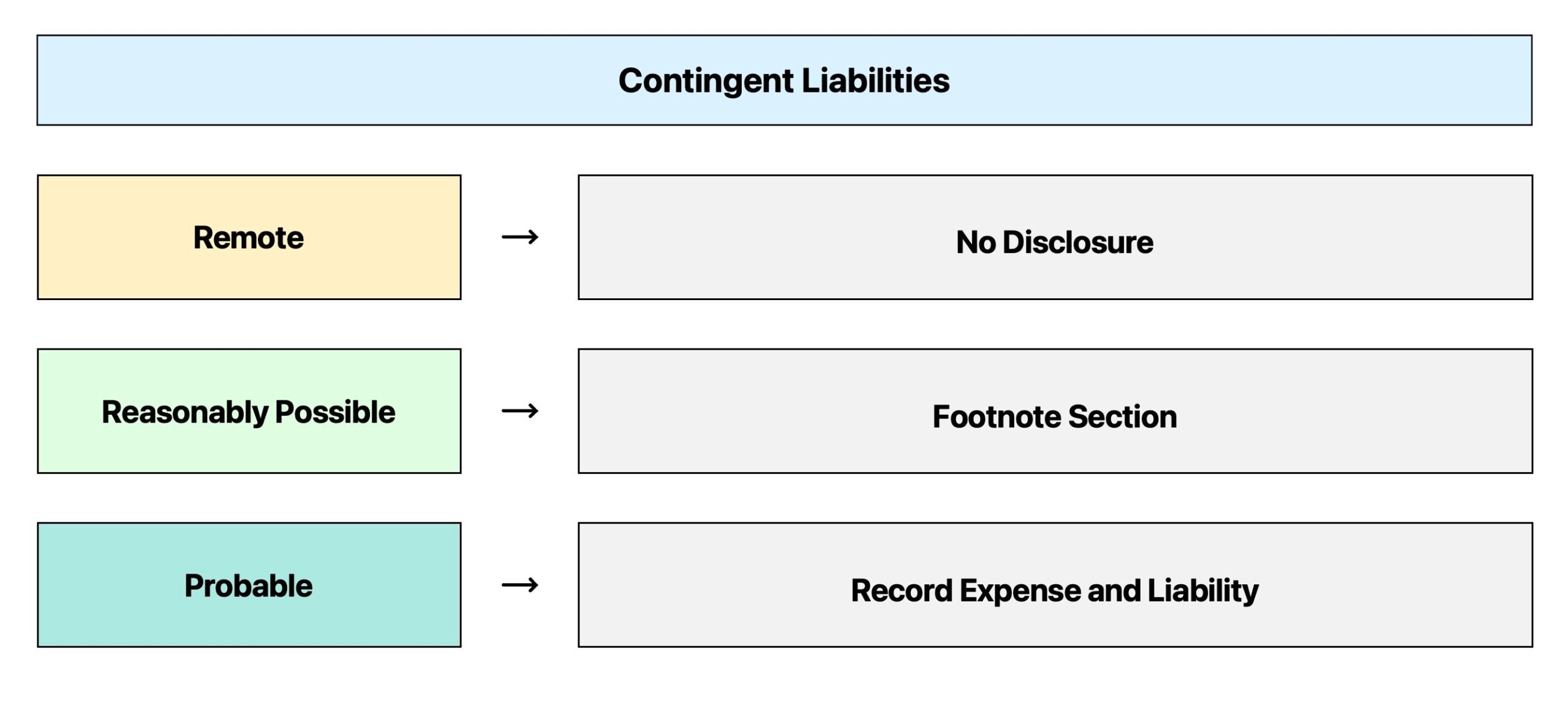

Contingent Liabilities – The Difference

Contingent Liabilities are obligations that may arise in the future depending on the outcome of uncertain events (for example, the outcome of a lawsuit). Contingent liabilities are not recognized in the balance sheet, but are disclosed in the financial statements only if the likelihood of them arising is significant.

Different from regular liabilities:

- Regular liabilities: Once an obligation has arisen, the business is responsible for payment.

- Contingent Liability: Uncertainty about whether an obligation will arise, only the possibility.

Real life example:

- A business is in the process of a legal dispute with a customer. If the court loses, the business may have to pay 20 billion VND in compensation. This is contingent liabilities because it is not certain to happen.

- Guarantee commitment for subsidiary to borrow money from bank. If subsidiary is insolvent, guarantee obligation will become actual liability.

What is the formula and analysis indexes of Liabilities?

Paying attention to the formula and indicators for analyzing payables means paying attention to overall financial health, thereby helping businesses proactively face debt repayment pressure, maintain prestige and long-term sustainability.

Formula for calculating Liabilities

There are two common approaches to identifying and analyzing liabilities:

- Calculate total debt at a point in time, and

- Calculate average payables during the period (used in trend analysis or financial planning).

(1) Total Liabilities Formula: Liabilities = Total Assets – Owner's Equity

This is the basic formula for determining the total financial obligations that a business must pay, showing the balance relationship on Balance sheet.

For example:

If the business has:

- Total assets: 50 billion VND

- Equity: 20 billion VND

→ Liabilities = 50 – 20 = 30 billion VND

This shows that 60% of the business's assets are financed by debt.

(2) Average Liabilities Formula:

Average payables = (Accounts payable at beginning of period + Accounts payable at end of period)/2

Used in financial analysis to calculate turnover ratios, for example: Accounts payable turnover, average payment period. Helps accurately assess the debt situation throughout the period, avoiding errors when only taking the final number.

For example:

- Beginning debt: 25 billion

- Ending debt: 35 billion

→ Average debt = (25 + 35) / 2 = 30 billion VND

If the average debt increases steadily over the periods, the business needs to consider Reasons for increased borrowing – increased investment or increased operating costs.

Financial health index

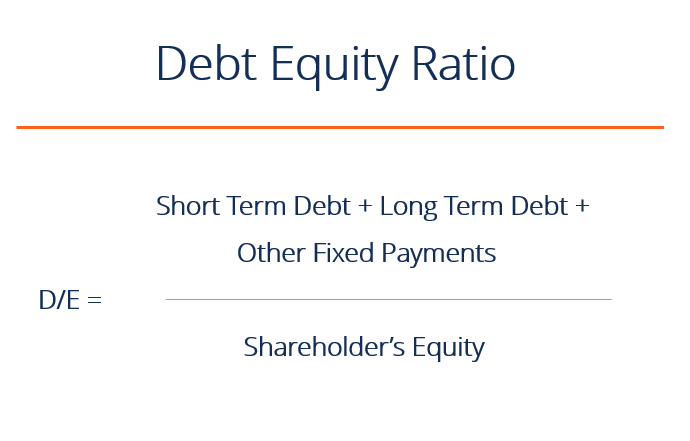

Debt ratios help businesses quantify their financial risk levels and their ability to balance debt and equity. The two most important ratios are the Debt to Equity Ratio (D/E) and the Debt to Total Assets Ratio (Debt Ratio).

Debt to Equity Ratio (D/E Ratio):

- Recipe:

D/E = Total Liabilities/Equity - Meaning:

-

- D/E > 1: The company is using more debt than equity to finance its operations. This can help it expand rapidly, but it also increases its financial risk. For example, a company with a D/E of 2 means it has twice as much debt as equity.

- D/E < 1: Equity capital is dominant, showing higher financial security, less dependence on debt. However, businesses may miss out on rapid growth opportunities due to financial leverage.

- Example interpretation by industry:

-

- Business manufacturing – heavy industry D/E = 1.5–2 is acceptable because large investment capital is required.

- Business services, technology Usually maintain D/E < 1 to ensure financial flexibility.

- Note: High D/E isn't always bad — if the business has stable cash flow and good profit margin, leveraging debt can help increase return on equity (ROE).

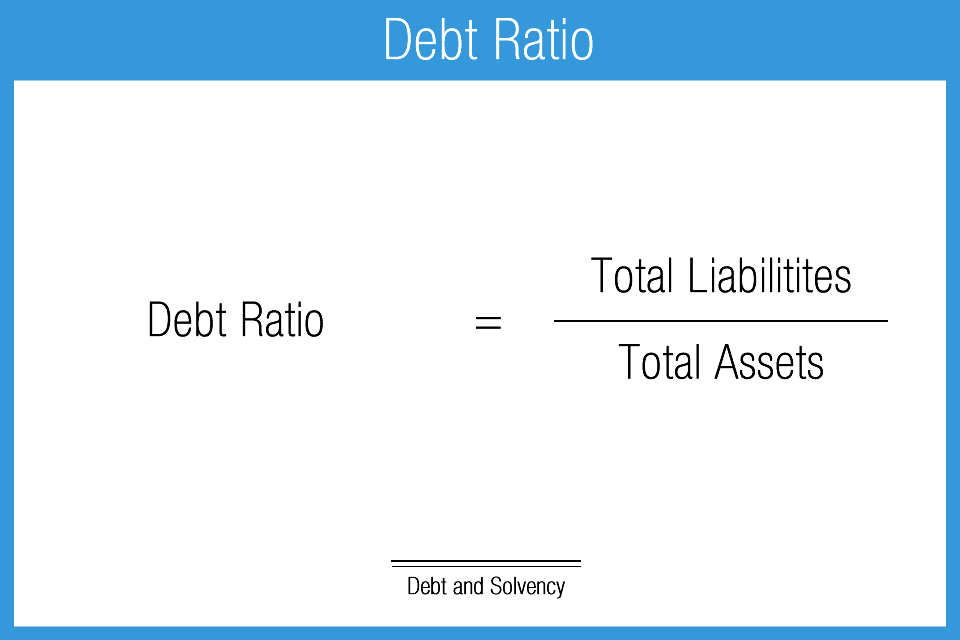

Debt Ratio

- Recipe: Debt\ Ratio = Total Liabilities/Total Assets

- Meaning:

- Debt Ratio > 0.5: More than 50% of assets are formed from debt, showing high risk level and large debt repayment pressure.

- Debt Ratio < 0.5: Most assets are financed by equity, lower risk.

Compare 02 indexes:

- D/E Ratio Focus on the relationship between debt and equity → important to investors and shareholders.

- Debt Ratio shows the proportion of debt in total assets → important for creditors and credit institutions when assessing solvency.

For example:

Total assets: 100 billion, Liabilities: 60 billion →

Debt Ratio = 60 / 100 = 0.6 (60%)

→ Businesses are using 60% loan capital to finance assets, medium-high financial risk level.

Role, Risks and Factors Affecting Liabilities

Enterprises need to pay attention to the role, risks and factors affecting liabilities because this is an important part of the financial structure, directly affecting the ability to pay and the level of financial security.

What is the Role and Risks of Liabilities?

The role of liabilities:

- Financial leverage: Liabilities help businesses expand operations, invest, and grow faster without increasing equity.

- Optimizing capital costs: In many cases, interest can be tax deductible, helping businesses reduce their cost of capital.

- Improve ROE (Return on Equity): When a business uses debt effectively, ROE can increase significantly, showing better profitability on the same amount of equity.

Risk of liabilities:

- Risk of insolvency: If there is too much debt or weak cash flow, the business may face liquidity risks or even bankruptcy.

- Long-term financial pressures: Interest and recurring debt obligations reduce business flexibility.

Debt reduction is not always good:

This is an insight that many managers overlook.

- When liabilities decrease sharply, it may be a sign that the business is downsizing and no longer using borrowed capital to grow.

- On the contrary, a reasonable and well-managed debt level is a positive signal, showing that the business knows how to use external capital to increase productivity and expand the market.

Debt optimization is not about “cutting debt”, but about “leverage management” – using it at the right time, at the right level and for the right purpose.

What are the main factors affecting liabilities?

- Debt size

- Small debt: Less interest pressure, safer but limited expansion.

- Large debt: Can grow rapidly but carries the risk of financial imbalance.

- Sales/Purchase Policy

- Businesses that are on credit from suppliers (trade credit) will have high liabilities.

- Conversely, if the business pays its suppliers immediately, its liabilities will be lower.

- Business cycle

- During peak seasons, businesses often increase short-term borrowing to import goods, produce or expand services. Conversely, during a downturn, debt should be tightly controlled to avoid cash flow risks.

- Macroeconomic situation

- Interest rates, inflation, exchange rates, and the State Bank's monetary policy directly affect the cost of borrowing and the ability to repay debt.

- When the economic environment is unstable, businesses need to diversify their capital sources to avoid relying entirely on bank loans.

Effective Debt Management Strategy with Solutions from Bizzi.vn

What is the difference between traditional accounts payable management and technology applications like Bizzi.vn? Bizzi.vn not only replaces manual operations, but also helps businesses upgrade accounts payable management into a competitive advantage.

Traditional debt management

In many businesses, accounts payable management is still based on manual methods such as tracking with books, Excel spreadsheets or periodic reconciliation between the accounting department and partners. This method, although familiar, has many potential risks: data is easily distorted, takes time to review, difficult to control debt due and puts great pressure on cash flow.

What are the disadvantages of traditional management of payables?

When managing payables in the traditional way (paper books, manual Excel, manual reconciliation), businesses often encounter the following shortcomings:

- Errors and inaccuracies

- Manual data entry can easily lead to data errors (wrong invoices, duplicate data)

- Difficult to control when transaction volume is large, especially for businesses with many suppliers.

- Lack of timeliness

-

- Debt figures are not updated in real time.

- When quick decisions are needed (e.g., payments, negotiations with suppliers), information is often delayed.

- Time consuming and labor intensive

-

- Accountants have to spend many hours entering data, storing documents, and comparing invoices → high operating costs.

- It is easy to get “backlogged” during the accounting period or at the end of the quarter.

- Risk in payment

-

- There is no automatic warning when a debt is about to become due.

- Businesses are vulnerable to penalties for late payments or missed early payment discounts.

- Difficult to analyze and manage cash flow

-

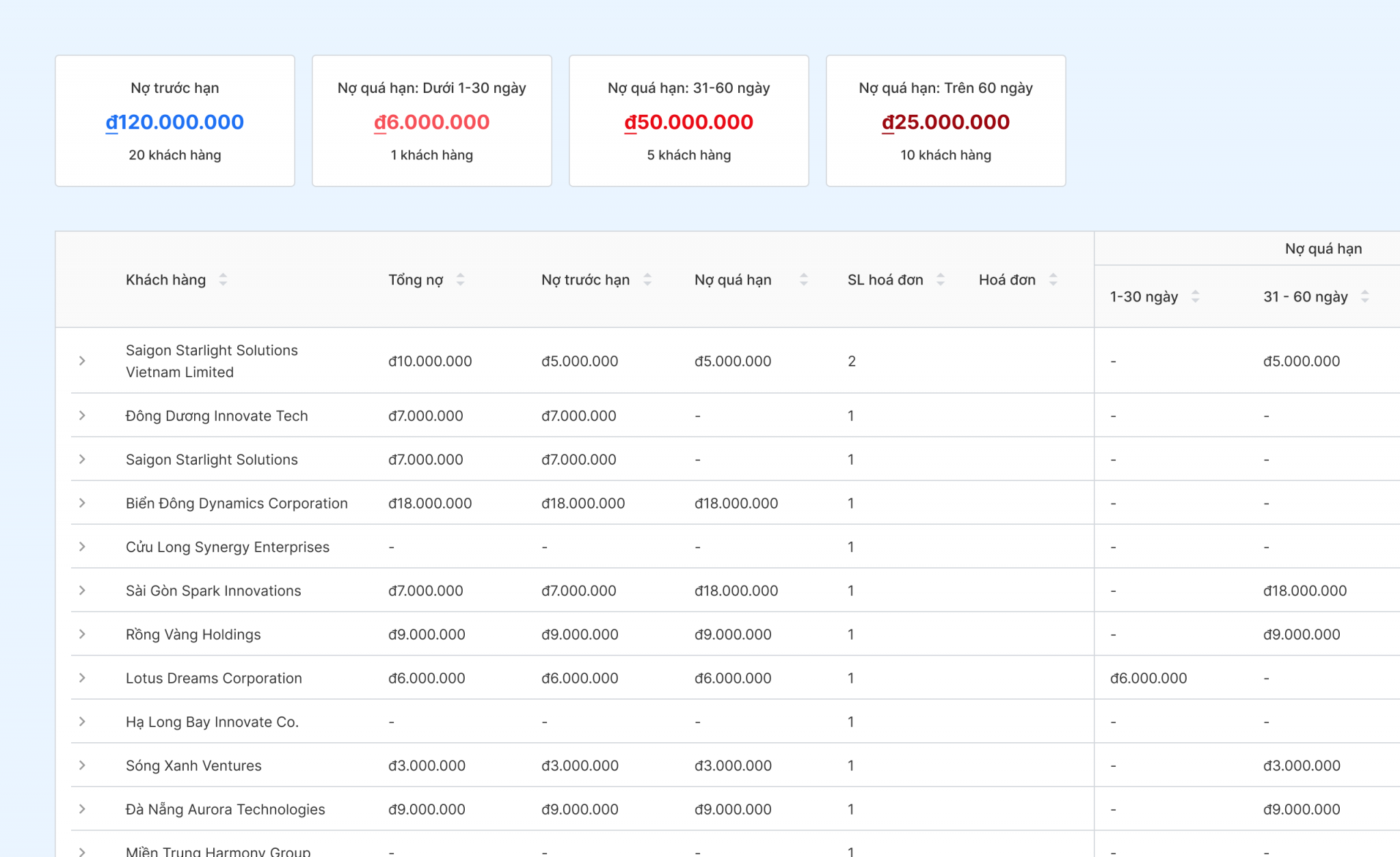

- Lack of in-depth reports (Debt Aging Report, DSO, Cash Flow Forecast).

- It is difficult for management to assess the actual financial status to make strategic decisions.

Applying Technology to Accounts Payable Management – Competitive Advantage

Bizzi.vn offers a modern, optimal and superior debt management solution thanks to the application of technology:

- Automatically collect, check, and verify the validity of input invoices.

- Automatically reconcile accounts payable (Invoice Matching) with purchase orders (PO) and warehouse receipts.

- Automatic warning when debt is about to be due or overdue, helping businesses avoid the risk of late payment.

- Provides in-depth metrics such as Debtor Aging Report, Days Sales Outstanding (DSO), helping administrators quickly assess financial status and make accurate decisions.

With these features, Bizzi.vn not only helps businesses control their payables but also turns financial management into a real competitive advantage.

The Power of Integration – Bizzi.vn and ERP System

Bizzi.vn's standout feature lies in its seamless integration with existing systems. ERP Large systems like SAP, Microsoft Dynamics 365, and Oracle NetSuite. Seamless integration with leading ERP systems (such as SAP, Oracle NetSuite, and Microsoft Dynamics 365 Finance) ensures that accounts receivable data is synchronized in real time, completely eliminating repetitive manual data entry and guaranteeing the absolute accuracy of the balance sheet.

This affirms that Bizzi.vn is not only a debt management tool, but also a comprehensive financial solution, capable of accompanying large-scale enterprises on the path to professionalization and optimization of operations.

FAQ What is a Liability?

Below is a summary and answers to some related questions about payables:

Are liabilities an expense?

→ No. Liabilities are financial obligations that a business must pay in the future, while expenses are the expenditures incurred during the period to generate revenue.

What debt ratio is safe?

→ Normally, Debt Ratio < 0.5 or D/E < 1 is considered safe. However, the “reasonable” level depends on the industry and the profitability of the business.

How to determine the liabilities of a business?

→ Based on the Balance Sheet, liabilities are determined by the formula:

Liabilities = Total Assets – Owner's Equity

How to determine the liabilities of a business?

Liabilities are determined through balance sheet, including:

- Short-term debt: payable to suppliers, short-term loans, payable expenses…

- Long-term debt: long-term loans, bond issuance, deferred tax payable…

When is it necessary to set up a provision for payables?

→ When the business has current obligations (contractual, legal, or other commitment), will definitely have to pay in the future and amount that can be estimated reliably.

Conclude

Managing liabilities is not only about reducing debt for safety, but also about balancing the risks and benefits of financial leverage. The above article has provided information related to what liabilities are, and at the same time shows that an effective debt management strategy is not only about reducing debt for safety, but also about proactive management: balancing risks - profits - growth opportunities.

Traditional methods such as books and excel will be suitable for small businesses with few transactions. However, when the business grows and the transaction volume increases, this management method becomes a barrier, directly affecting financial efficiency and competitiveness.

Don't let manual accounts payable management become a financial barrier. Bizzi helps businesses shift from reactive to proactive management, transforming financial responsibility into a safe leverage advantage. Request a Custom Demo: Experience our automated accounts payable reconciliation and input invoice processing workflow tailored to your ERP system. For a consultation on the solution best suited to your business needs and to experience our features, register here to schedule a demo: https://bizzi.vn/dat-lich-demo/