Understanding what outsourcing costs are is not only a technical accounting and financial requirement but also a strategic management tool that helps businesses save costs, avoid risks and make better decisions.

The following article by Bizzi will provide full information related to outsourcing costs as well as how to accurately account for outsourcing costs.

What are the costs of outsourcing services?

Definition of outsourced service costs

What are outsourced service costs? These are the costs that a business must pay to a third party (not an internal employee) to perform tasks or provide services for business operations. This is an important part of operating costs, especially in areas that require specialized services such as transportation, advertising, maintenance, consulting, security, etc.

The nature of outsourced service costs

- Expenses incurred to receive completed service: Not buying goods or tangible assets, but buying the result of performing a service.

For example: hiring a video production crew → the business does not own the filming crew, only owns the finished video. - Engage with third parties: Are entities that are not part of the company's payroll (agency, freelancer, service company...).

- Usually arises under contract or agreement: Can be under long-term contract or on a per-occurrence basis, usually with VAT invoice attached to account for reasonable costs.

- No fixed assets or long-term prepaid expenses (with some exceptions): Once the service is finished, it is an end cost and has no long-term value.

What are the identifying characteristics of outsourced service costs?

| Criteria | Identification mark |

| Supplier | Is an individual/organization outside the business |

| Type of cost | Related to labor, skills, expertise, techniques, promotion, etc. not performed internally |

| Not reusable | The service expires once used and cannot be repeated unless payment is made again. |

| Have invoices and service documents | VAT invoice, service contract, acceptance report... |

| Does not create assets | Does not increase the value of the company's assets |

| No direct pay | Not the cost of salaries and allowances for internal employees |

Classification of outsourcing service costs in enterprises

Outsourcing service costs are often divided into the following main groups:

Manufacturing/Operations Outsourcing Services:

- Hire product processing, semi-finished products

- Hire design, print packaging, labels

- Freight forwarding, logistics

Administrative support services:

- Hire accounting and auditing services

- Security, cleaning, IT services

- Human resource training and legal consulting services

Advertising and communication services:

- Cost of hiring marketing agency, KOLs

- Cost of producing promotional videos

- Google, Facebook advertising services...

Maintenance and technical services:

- Repair of machinery and equipment

- Maintenance of software systems and electrical equipment

Common Outsourced Service Charges

Understanding common outsourcing costs is a crucial element of corporate financial management. It not only helps to better control expenses, but also contributes to improving budget efficiency, making accurate decisions and ensuring compliance with legal regulations.

Here are some of the most common types of outsourced service costs:

- Office rental costs

- Electricity, water, internet and telecommunications costs

- Shipping and logistics costs

- Consulting and professional services fees

- Maintenance, repair and servicing costs

- Advertising, marketing and communication costs

- Cost of training and human resource development

Distinguishing the cost of outsourced services in the enterprise

Distinguishing the cost of outsourced services in a business is extremely necessary because it helps ensure that the business manages its finances transparently and in accordance with regulations, and at the same time makes more effective decisions in operations and strategies. Below is how to distinguish the cost of outsourced services in a business from other types of costs based on characteristics:

| Cost Type | Characteristic | How is this different from the cost of outsourced services? |

| Cost of raw materials | Cost to purchase raw materials for production | Is the cost of purchasing "material", while outsourced services are the cost of services |

| Labor costs | Paying salaries to employees in the business | Internal human resources, while outsourcing services are hired from outside. |

| Fixed asset depreciation costs | Cost of allocating assets such as machinery and buildings over time | Attached to business assets, not services |

| Financial costs | Interest, financial investment costs, exchange rate differences... | Not related to production and operation service rental activities |

| Selling and administrative expenses | Including the cost of outsourced services | Outsourcing services are part of this group. |

How are outsourced service costs accounted for in accounting?

Managing outsourced service costs in accounting is an important part to ensure transparent, reasonable and tax-compliant business financial activities. Below are instructions on managing and accounting for outsourced service costs according to Vietnamese accounting circulars (Circular 200/2014/TT-BTC or Circular 133/2016/TT-BTC depending on the type of business).

- Valid documents required

In order for the cost of outsourced services to be included in reasonable expenses when calculating corporate income tax, it is necessary to have:

| Document | Request |

| Service contract | Agree clearly on content, value and implementation time |

| Financial invoice | VAT invoice or sales invoice from service provider |

| Acceptance report | Clearly state the work completed |

| Payment documents | If over 20 million VND, no cash required |

- Classify costs for the right purpose

Based on the purpose of using the service to classify:

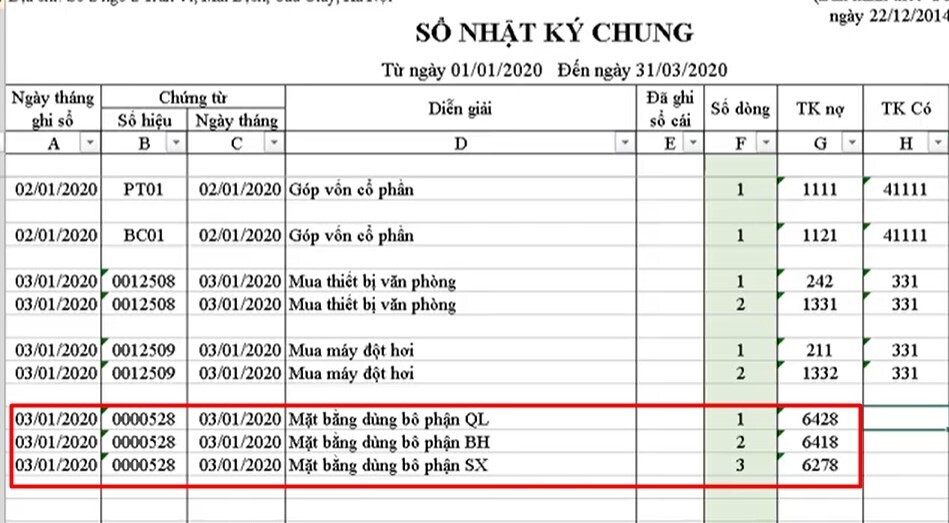

| Intended use | Outsourced service costs are accounted for in the account. |

| Production service | Account 627 – General manufacturing costs |

| Sales service | Account 641 – Cost of sales |

| Serving business management | Account 642 – Enterprise management costs |

| Outsource investment services | Record into Long-term unfinished assets (Account 241) if conditions for forming fixed assets are met. |

Outsourcing cost optimization strategy

Optimizing the cost of outsourced services is an important strategy for businesses to reduce operating costs without affecting service quality or work performance. Below are effective and practical optimization strategies that are easy to apply for both large and medium-sized businesses.

Periodically evaluate outsourcing effectiveness

- Compare outsourcing costs and output efficiency.

- If outsourcing costs are high but quality is poor → consider changing suppliers or switching to in-house.

- Set clear KPIs for each service provider to track performance (e.g. reach, orders, processing time…)

Compare quotes – bid for services

- Before each new rental, it is advisable to get at least 2–3 quotes from different suppliers to create competitive pressure.

- Internal bidding can be organized for high-value services such as advertising, design, content production.

Sign a long term or package contract for better price

- For frequently used services such as maintenance, agency marketing, design, etc., consider negotiating monthly, quarterly, or yearly packages instead of paying individually.

- Prioritize lump sum contracts to control costs more easily (avoid unexpected expenses).

Negotiate payment terms and reduce hidden costs

- Negotiate delayed payments (30-45 days) to improve cash flow.

- Check the contract carefully to avoid unclear additional fees such as maintenance fees, additional consulting fees, tax differential fees, etc.

Automate and internalize where appropriate

- For services that can be done internally (content, design, basic ad running, etc.), it is advisable to build an in-house team to reduce long-term costs.

- Or invest in tools/AI to replace costly outsourcing services (e.g. Canva, ChatGPT, email marketing software…).

Reuse of assets or service content

- For example: identity design service → can reuse layout and template for many different campaigns.

- Video production service → retain original footage to recreate another version, no need to start over.

Application of tools to support management of outsourced service costs

Applying tools to support the management of outsourced service costs is an essential step in the process of improving operational efficiency and controlling corporate finances, especially in the context of outsourcing costs increasingly accounting for a large proportion of total operating costs.

| Tools | Uses |

| Google Sheets/Excel | Track outsourcing costs by department and project |

| Bizzi Expense Management Software | Control costs strictly according to policies and budget

Complete and valid invoices and documents Prepare budgets by department, project and spending category Warning when costs and payment requests do not/do exceed the budget Display quick reports of spending information, updates on estimated spending - actual spending in focus Dashboard for intuitive, multi-dimensional cost management in real time across multiple platforms |

| Trello/Notion/ClickUp | Manage outsourced work in progress, control output results |

| KPI Tracker | Link outsourcing costs to performance to evaluate spending efficiency |

Outsourcing service cost management solution with Bizzi

Bizzi Expense is one of the leading cost management software solutions, trusted by large enterprises such as Masan Group, Mondelez International, Pierre Fabre,... thanks to its superior automation power and integration capabilities. Modern expense management solution – Bizzi Expense helps businesses closely control outsourcing costs and other types of spending in an automated, transparent and controlled way.

Outsourcing Cost Management Process with Bizzi Expense

Below are the operations performed on Bizzi Expense cost management software:

Step 1: Create a service cost request

- Employees or departments in need of services (e.g. machine maintenance, IT outsourcing, marketing agency hiring...) submit payment requests on Bizzi Expense.

- Please specify:

– Service Name

– Expense list

– Intended use

– Estimated budget

– Attached documents/contracts (if any)

Step 2: Approve expenses by level

- The request is sent to the approval authority, according to the established authorization scheme:

– Department Head

– Finance/Accounting level

– Director level (if exceeding the limit)

- Quick approval possible via app or web.

Step 3: Order service and record cost

- After approval, the person in charge proceeds. buy service from supplier.

- Invoices/receipts are sent to the email address on the app of the person in charge. Once the invoice is in the system and available on the app, Bizzi Expense automatically:

– Scan & check invoice validity information

– Attach the cost to the previously created spending request

Step 4: Track costs & budgets in real time

- Expenses are recorded and deducted from the approved budget.

- Display system:

– Total budget – spent – remaining

– Warning if approval is exceeded

Step 5: Automatic accounting & synchronization with accounting software

- Expenses are automated:

– Assign accounting code

– Synchronized with accounting software (SAP, MISA, Fast, Bravo…)

- Minimize data entry time and limit errors.

Step 6: Summary report & cost analysis

- The system automatically generates reports:

– By service type, provider, department

– Compare actual vs. budget

– Analyze service usage trends to optimize future contracts

Outstanding features of Bizzi in managing outsourced service costs

Bizzi is the “smart financial assistant” for modern businesses, helping to control maximum spending, increase operational efficiency and optimize cash flow – especially necessary in an economic context that requires flexibility, transparency and prudence. Here are some outstanding features of Bizzi:

Set up a budget according to your business structure

- Allocate budget by department, project, expense type (outsourced services, stationery, business expenses, etc.)

- Easily set budget limits and update throughout the fiscal year.

- Help each department proactively control spending without "breaking the rules".

Automatic real-time budget overrun warnings

- When an employee makes a payment request, the system: Compares with the remaining budget – Warns if the threshold is exceeded – Can set the mode: not allowing submission or requesting further approval from a higher level

- Helps reduce unplanned or duplicate spending.

Control documents - invoices are complete and valid

- Staff upload financial invoices, contracts, acceptance reports, etc. to each payment request.

- The system checks the validity according to accounting and tax regulations.

- Easy to retrieve and compare later → reduce risks during audits or tax settlements.

Real-time and cross-platform management

- Intuitive dashboard, updates estimated expenditure - actual expenditure - remaining budget by category and department.

- Accessible via mobile, tablet, computer, very convenient for middle/senior managers who need quick approval.

- Clear delegation of authority, flexible and transparent online spending approval.

Smart reports, quick export when needed

- Summary or detailed report by each criterion: By project, By cost type, By implementing unit

- Easily export Excel and PDF files for management, financial explanation, or presentation to the Board of Directors.

In the context of economic instability, businesses need more flexible, transparent and effective financial management tools than ever. Bizzi does not stop at the integrated corporate card solution for expense management, but also pioneers the application of RPA, Machine Learning and AI technology to automate the entire invoice processing and budget management process.

New trends in outsourcing service cost management

Outsourcing cost management is undergoing a major transformation thanks to technology and changing supplier partnerships. Businesses are no longer focused solely on cutting costs, but on optimizing operational efficiency and building long-term strategic partnerships. Here are some of the trends:

Digital Transformation & Automation

Businesses are gradually eliminating paper processes, manual Excel… and prioritizing the deployment of expense management software with features such as OCR, AI, automatic approval processes… to replace manual spreadsheets. This not only helps control spending more transparently but also significantly reduces processing time and the risk of accounting errors.

On-demand Services

Instead of signing long-term fixed contracts, many companies turn to flexible outsourcing according to actual needs at each time. This model helps businesses save operating costs, easily change suppliers when needed and optimize service performance.

Outsourcing under strategic partnership model

Service providers are no longer simply “third parties” but rather an extension of the business. This partnership often comes with shared KPIs, long-term commitment, and proactive optimization of efficiency, sharing mutual benefits.

Challenges in managing outsourced service costs

Along with the opportunities, businesses also face a host of challenges when managing outsourcing costs – from cost volatility to quality and security risks. Without the right management tools and processes, these “hidden” costs can have a major impact on cash flow and business performance. Challenges in managing outsourcing costs include:

Price Fluctuations and Inflation

Service costs, especially in logistics, transportation or technology, can increase rapidly due to market, raw material or exchange rate impacts. This makes budgeting and cost control difficult.

Service quality assurance

Choosing the right supplier is a difficult task. Low price does not mean good quality. Many businesses face the situation of “losing both money and health” because they do not evaluate capacity carefully or do not have clear evaluation criteria from the beginning.

Information Security

Sharing internal data with third parties always carries the risk of information leakage. Without strict security policies and tight contracts, businesses can easily fall into crisis.

Disjointed Supplier Management

Many businesses still manage suppliers using emails and individual Excel files, without a consolidated system. This causes information to be fragmented, making it difficult to access spending history, contracts, or evaluate the effectiveness of each partner.

Solutions to overcome challenges with technology

To solve the above problems, businesses need to apply technology such as AI, big data analysis, blockchain and cost management software. These tools help make the outsourcing process transparent, while improving decision-making efficiency and controlling financial risks. Some solutions businesses can refer to:

AI Applications & Big Data Analytics

AI can help businesses analyze spending history, compare unit prices between suppliers, and forecast service price trends. At the same time, big data analysis tools support performance evaluation and warn of cost anomalies.

Automate management processes

From service proposals, approvals, contracts to payments, everything can be digitized and automated on one platform. Modern systems like Bizzi Expense also integrate AI to check invoices and warn of over-budgets – helping businesses save time and control risks.

Blockchain in contract management

Blockchain technology is being used in contract management to ensure transparency, tamper resistance, and easy traceability of transaction history. This increases trust in long-term cooperation with strategic service providers.

Frequently asked questions about outsourcing costs

Here are some questions related to outsourcing costs:

Are outsourced service costs included in reasonable expenses for corporate income tax deduction?

- Yes, if there is a valid contract, financial invoice or payment via bank for amounts over 20 million VND

Is a contract required for each outsourced service?

- For high-value, long-term or periodic services → There should be a clear contract. For small, short-term services, orders, quotations and acceptance reports with invoices can be sufficient for accounting purposes.

How to control outsourcing costs effectively?

- Make clear budgets for each department/project

- Approve expenses according to the process

- Require full documents and invoices

- Use tools like Bizzi Expense to monitor, warn of budget overruns, check validity

Conclude

Optimizing the cost of outsourced services is not about cutting back haphazardly, but about smart and proactive management. Businesses need to have a flexible combination of measuring efficiency, smart negotiation and strategic planning to master long-term services. Hopefully, the above article by Bizzi will help you better visualize what the cost of outsourced services is, how to manage and optimize costs for businesses.

Sign up for a trial now to experience Bizzi Expense and modernize your business's expense management process:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/