In financial management, many businesses easily confuse between budgeting and financial forecasting. In fact, they are two separate but complementary tools: budgeting helps to set fixed goals and allocate resources from the beginning, while financial forecasting is more flexible and regularly updated according to the actual situation. Understanding this difference will help business owners and accountants manage effectively, make more accurate decisions, ensure financial health and sustainable development orientation of the organization.

Budgeting: A Tool for Control and Setting Fixed Goals

What is Budgeting?

Set a budget is an important first step in financial management, playing a guiding role for all decisions on spending and resource allocation. This is also one of the concepts that is easily confused when compared to financial forecasting. To understand the difference difference between budgeting and financial forecasting, first need to grasp the nature of the budgeting process.

Budgeting is the process of establishing financial goals and spending plans for a specific period of time, usually a fiscal year. This process is based on historical data and development strategies, thereby creating a detailed plan for the financial operations of the business.

The main purpose of budgeting

Financial forecasting not only helps businesses see the financial picture in the future but also plays a role in guiding strategic decisions. Through data analysis, businesses can proactively build plans, limit risks and optimize operational efficiency.

- Control spending & allocate resources: Ensure capital is allocated appropriately to production, marketing, human resources and operations.

- Setting goals & expectations: Determine expected revenue, expenses, and cash flows during the budget period.

- Performance measurement: Provides a basis for performing Variance Analysis, comparing actual results with targets to detect deviations and adjust tactics.

Characteristics of budgeting

Corporate budgets have their own characteristics that distinguish them from other financial management tools. This is an important foundation for businesses to plan and control operations, ensuring that they are consistent with long-term development orientations.

- Time frame: Usually 1 year, can be extended to 3-5 years depending on business strategy.

- Nature: Fixed, rarely changed after approval.

- Level of detail: High, broken down by department, project or cost category.

- Database: Based on historical data combined with strategic orientation.

- Application: Mainly internal service, focusing on cost control, performance evaluation and performance reward mechanism establishment.

In this role, budgeting becomes an indispensable tool, creating the “skeleton” for financial management, and is also a core difference when compared to financial forecasting – which focuses more on flexibility and adaptability to market fluctuations.

Ask: “How should I spend money effectively to meet my company's expectations?”.

Reply: The effective way to spend money in business is not only about "cutting costs" but more importantly spend correctly, spend accurately, spend under controlTo meet the company's expectations, you can refer to the following 3 principles:

- Stick to the approved budget: Budgets are financial guidelines. Spending according to plan helps businesses avoid waste, ensure resources are used properly and support growth goals.

- Prioritize spending that brings long-term value: Investing in technology, staff training, strategic marketing or process automation are expenses that can create sustainable competitive advantages instead of focusing only on short-term costs.

- Track and compare actual spending regularly: Use budgeting software or automation tools like Bizzi to monitor cash flow in real time. This helps managers detect overspending early and make timely adjustments to stay within the company's financial expectations.

Financial Forecasting: A flexible prediction and adaptation tool

Financial forecasting is an important tool to help businesses be proactive in the face of market fluctuations. If the budget is considered a “fixed plan”, financial forecasting acts as a “flexible compass”, supporting businesses to adjust strategies in a timely manner to ensure achieving business goals.

Define

Financial forecasting is the process of estimating a company's future financial performance by analyzing historical data, market trends, and influencing socio-economic factors. It allows a company to determine whether it is on track or needs to change its strategy.

Main purpose

- Predict trends and outcomes: Estimate future revenue, profits, or other financial metrics to shape action plans.

- Support for plan adjustment: Help businesses update plans according to actual situations, avoiding deviation from long-term goals.

- Flexible decision making: Management can quickly adjust production, inventory, or investment activities based on the latest forecasts.

Outstanding features

- Time frame: Forecasting can be done periodically on a monthly, quarterly, or continuously in the form of a rolling forecast.

- Flexibility: Easily adjust as markets change or business performance fluctuates.

- Level of detail: It doesn't need to be as detailed as budgeting, but focuses on core metrics like revenue, expenses, and cash flow.

- Database: Combine current data, consumer trends and economic information to make accurate predictions.

Business Applications

Unlike budgets, which typically compare variances between plans and actuals, financial forecasts focus on continuous updates to support decision making. Businesses can:

- Use forecasting to proactively adjust your financial plan according to market fluctuations.

- Apply rolling forecasts to get real-time information, making strategies more flexible and relevant.

- Forecasting enables Scenario Modeling, which allows management to evaluate different financial scenarios (e.g., recession or boom scenario) for proactive decision making.

- For listed companies, forecasting also plays a role in transparent information disclosure to shareholders and investors.

Question and answer: “Given the volatile nature of the market my organization is operating in, what steps should I take to keep it on track to achieve its goals?”

Key Differences Between Budgeting and Financial Forecasting

In corporate financial managementBudgeting and financial forecasting are often confused with each other. However, the two concepts have distinctly different roles. A budget is a long-term financial plan, while financial forecasting is a tool for continuous prediction and adjustment based on actual data.

Comparison Chart: Difference Between Budgeting and Financial Forecasting

| Criteria | Budgeting | Financial Forecasting |

| Purpose | Is the plan: Determine where the business wants to go | As a guide: Predicting where the business is really going |

| Time Frame & Update Frequency | Usually long term (1–5 years), updated annually | Short or long term, updated regularly (monthly/quarterly) |

| Flexibility | Static, rarely changed after approval | Flexible, adaptable to changes |

| Level of detail | Very detailed, deep analysis of each item | Focus on the main items, less detail |

| Analysis of variance | Compare actual results with budget to detect deviations and make adjustments | No variance analysis required, only actual data used to update forecasts |

| Database | Based on historical, past data | Based on real-time data, constantly updated |

| Impact on compensation | May involve bonus/compensation based on results achieved against budget | No direct impact on salary |

Business Development Stages and Common Mistakes

As a financial professional with many years of experience, I find that understanding when to prioritize which tools and avoiding common mistakes is crucial to sustainable business growth.

Prioritization by Development Phase (Query Path)

- Startup: At this stage, the top priority is Cash Flow Forecast. Startups need to continuously monitor cash flow to ensure liquidity, manage expenses closely, and prepare for funding rounds. This is more important than an initial detailed budget.

- Medium and large enterprises: For established and scaled organizations like Bizzi’s, integrating Rolling Budget and Rolling Forecast is ideal. Rolling budgets help maintain long-term goals, while rolling forecasts provide a continuous view into the future, allowing for real-time strategic adjustments without disrupting the overall plan.

Core mistakes to avoid

- Mistake in purpose: Treating the Budget (a tool for setting goals and allocating resources) as a tool for predicting the future. Budgets are fixed, while markets are always changing. This leads to making decisions based on outdated assumptions.

- The Flexibility Mistake: Treat the Forecast (a flexible estimate of the future) as a rigid spending limit. Forecasts need to be constantly adjusted. If the forecast is treated like a budget, the business will lose the ability to quickly respond to new opportunities or risks in the market.

Optimize budgeting and forecasting processes with Bizzi data automation solution

In a volatile business environment, businesses not only need to have a clear budget but also Continuous cash flow forecasting to make timely decisions. However, with manual management methods, accountants and CFOs often lose weekly to aggregate data, likely to occur error, lack of transparency and it is difficult to make accurate predictions.

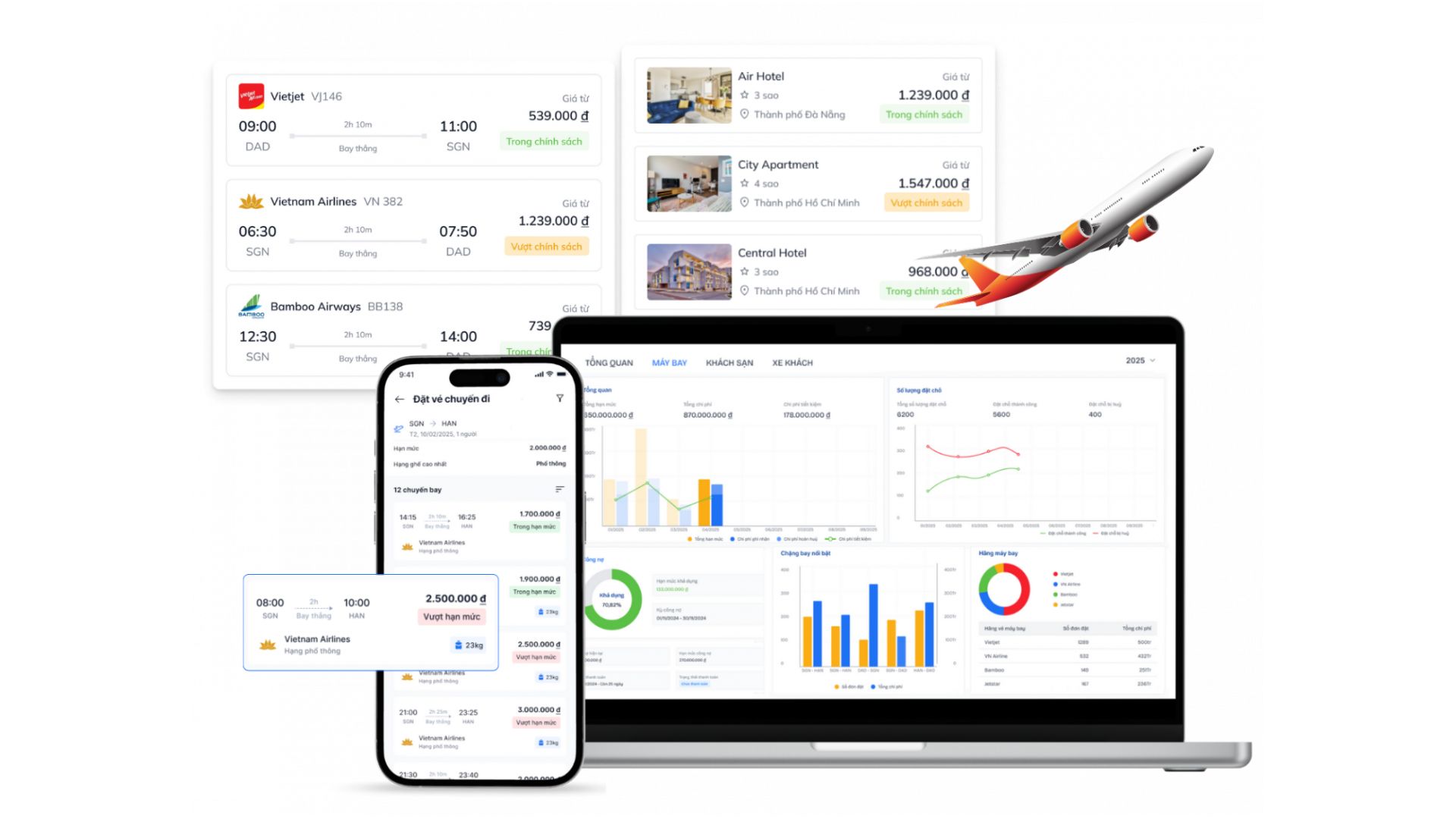

This is the time Bizzi Travel & Expense become a "powerful assistant", helping businesses control spending and upgrade financial management capacity.

Real-time budget control

Helps to create accurate, transparent, and realistic budgets

- Set up multi-level budgeting: Allocate detailed budgets by department, project, or employee, in line with financial strategy.

- 24/7 Budget Tracking: The system updates spending data in real time, allowing managers to know exactly the level of consumption compared to the approved budget.

- Over budget warning: Automatically send notifications when spending is about to exceed the limit, helping the finance department intervene promptly.

- Transparent approval process: Clear disbursement approval process, limiting fraud and loss.

Enhance financial decision-making with real-time data

- This real-time cost control is key to helping CFOs intervene promptly, ensuring resources are used efficiently and optimally. You can learn more about how to manage business costs effective. In this article, Bizzi will provide a case study of Thien Minh Group for you to understand better.

- Result: CFOs and management have a “current financial picture” instead of having to wait for month-end or quarter-end consolidated reports.

Foundational data for accurate financial forecasting

Create forecasts based on accurate & real-time data:

- Data is automatically digitized and classified.: All expenses from business expenses, operations to purchases are updated accurately, replacing manual data entry on Excel.

- Rolling Forecast Made Easy: CFOs can update forecasts monthly or quarterly, ensuring the business is always responsive to market fluctuations.

- Spending trend analysis: Bizzi's AI helps detect unusual trends and predict cash flow in future periods.

- Cross-platform connectivity: Directly synchronized with accounting software, ERP, banking, ensuring data consistency and reliability.

Seamless integration with ERP systems – Elevate financial forecasting efficiency

- The ability to seamlessly integrate with major ERP systems such as SAP, Oracle NetSuite is a distinct advantage, ensuring data is always consistent and reliable.

- Result: Reduce forecasting time by 50–70%, increasing accuracy compared to manual processes.

Optimize management of business expenses and operating costs

Bizzi Travel & Expense not only supports data, but also standardizes the entire expense management process:

- Convenient mobile application: Employees can send payment requests, take photos of invoices, and report business expenses right on their phones.

- Fast approval process: Approve expenses across multiple levels of management with just one tap.

- Automatic invoice recognition (OCR + AI): Reduce 90% of manual data entry operations, ensuring accuracy.

Automate billing and smart reporting

Automatic technology first invoice This eliminates manual data entry, which is the foundation of accurate data for forecasting.

- Smart reporting: Synthesize multidimensional data – by department, project, cost type… to help leaders make strategic decisions.

- For example: Instead of only knowing at the end of the month that the sales department has overspent the budget by 15%, the system will warn at the time of occurrence, allowing immediate adjustment.

Compare the overall benefits for business

Below is a comparison table of the overall benefits of businesses before and after using the Bizzi Travel & Expense solution.

| Benefit | Previously (Manual Management) | With Bizzi Travel & Expense |

| Set a budget | It took weeks to compile the data, and the numbers were incorrect. | Set up and update budgets in hours |

| Control spending | Difficult to track, prone to fraud and loss | Transparent, automatic limit overage warnings |

| Financial forecasting | Forecasts based on historical data, low accuracy | Rolling forecast based on real-time data |

| Approve business expenses | Manual, delayed | Fast online approval |

| Reporting & Decision Making | Dispersed, untimely information | Smart reporting, accurate decision making |

Bizzi Travel & Expense is not only a spending and expense management tool, but also a comprehensive financial management platform, help businesses:

- Be proactive in budgeting and spending control.

- Flexible cash flow forecasting, continuously updated according to business situation.

- Optimize operations and improve performance, completely replacing inefficient manual processes.

Conclude

Set a budget and financial forecast are two indispensable pillars in corporate financial management. When applied complementary to each other, they provide a comprehensive view of the past, present and future direction, helping the management make more accurate decisions. To optimize this process, businesses should take advantage of modern technological solutions such as Bizzi, to automate, improve the accuracy and timeliness of data, thereby achieving financial goals effectively.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/