ERP ERP and CRM are often cited as two "pillars" in enterprise digital transformation, but many CFOs and managers still confuse the roles of these two systems. Misunderstanding the nature of ERP and CRM not only leads to incorrect software investments but also causes data fragmentation, inaccurate reporting, and long-term financial risks.

This article will compare ERP and CRM at the data, process, and decision-making levels, rather than just comparing surface features, to show how ERP and CRM differ. It will also clarify why ERP and CRM alone are insufficient for CFOs, and how solution layers like Bizzi and EPM/FP&A (SACTONA) help complete the real-time financial management picture.

What is ERP and why is ERP considered a "System of Record" in financial management?

ERP (Enterprise Resource Planning) is a recording system Actual financial and operational data has been generated., including general accounting, accounts payable, purchasing, inventory, and cash flow. In financial management, ERP is considered to be System of Record Because this is the only data source used for financial reporting, auditing, and tax compliance.

In essence, ERP doesn't help businesses "predict the future," but rather... Confirm financial facts It has happened. Every transaction recorded in the ERP system has... Audit Trail, ensuring traceability from the original document to the ledger.GL), serving the closing process (Strong Cycle) and independent audit.

From the ERP system, the CFO tracks key performance indicators:

- DSO (Days Sales Outstanding) = Accounts Receivable / Average Daily Revenue

- DPO (Days Payable Outstanding) = Accounts Payable / Average Daily Cost

However, the inherent limitations of ERP are: The problem was only discovered after the transaction had already occurred.Once the invoice has been recorded and the debt is outstanding, the CFO has no choice but to deal with the consequences.

Bizzi Not a replacement for ERP., which plays a role ERP pre-control layer:

- Before the invoice is recorded in the ERP system, Bizzi Bot automatically reads, checks, and verifies data. Invoice content with Purchase Order (PO) and Grand Place (GR).

- Detecting incorrect pricing, duplicate invoices, or wrong suppliers. before the data becomes "frozen" in the ERP system.

- Reduce the risk of data discrepancies and invalid costs right from the source.

To understand why ERP cannot replace CRM, it is necessary to clarify that CRM manages a completely different type of data.

What is CRM and what goals does CRM serve in a business?

CRM (Customer Relationship Management) is a system for managing projected revenue data (Forecast), focusing on the customer journey from Lead → Opportunity → Deal. CRM helps businesses see future sales potential, rather than just past financial results.

The core metrics of CRM include:

- Win Rate = Winning Deals / Total Chances

- Pipeline Coverage = Pipeline / Target Revenue

These are all leading indicators, useful for sales teams and revenue growth. However, for a CFO, CRM is not sufficient for:

- Record revenue

- Prepare financial statements

- Accurate cash flow forecasting

The reason is that CRM data is subjective, subject to change, influenced by sales behavior, and lacks audit standards.

How does Bizzi connect to CRM? Bizzi doesn't interfere with sales operations, but:

- Get forecasts from CRM.

- Compare directly with the Actual data from ERP.

- Early detection of situations: a well-designed pipeline but low revenue potential, or projected revenue failing to translate into cash flow.

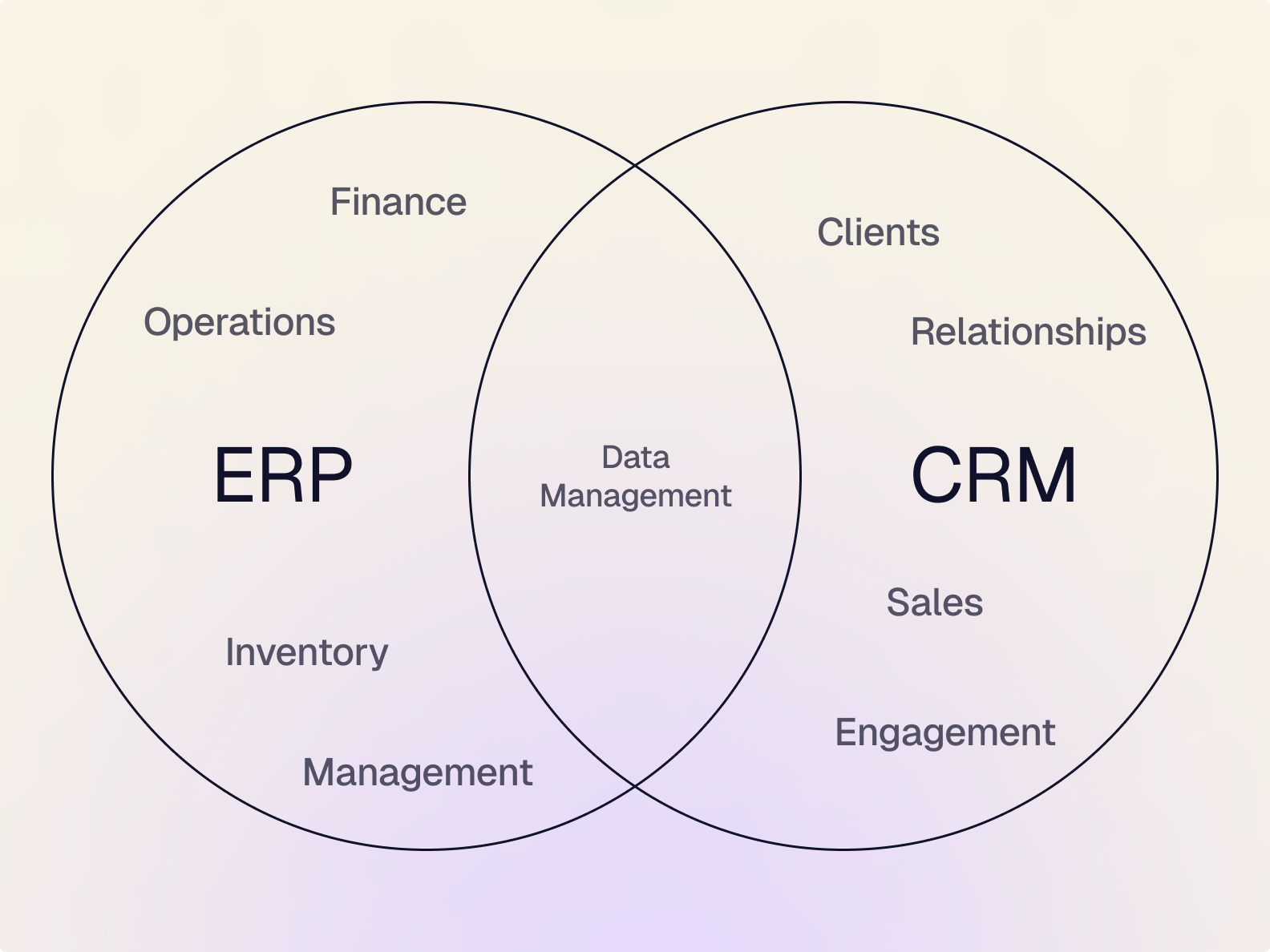

The core difference between ERP and CRM lies in "Actual" and "Forecast".

ERP reflects the past and present, while CRM reflects future expectations. The CFO must manage the gap between these two worlds.

Key formula: Forecast Variance = Forecast – Actual

Without continuously measuring and analyzing variance, businesses will fall into the following situation:

- A beautiful growth plan.

- Revenue recorded was low.

- Cash flow deficit

Many articles only state that "ERP is back-office, CRM is front-office," but the CFO perspective reveals that the real problem lies in the lack of interconnected systems and inaccurate real-time analytics.

How does Bizzi address this gap? Bizzi acts as a middle control and analysis layer:

- Continuously compare Forecast (CRM) with Actual (ERP) data.

- Early warning when projected revenue fails to translate into invoices or accounts receivable become overdue.

- Help the CFO take action before the accounting period ends, not after bad figures are reported.

Comparing ERP and CRM based on business operational processes.

In the Order-to-Cash process, CRM is often the starting point where sales teams generate leads, opportunities, and forecast revenue. However, all this data is only an expectation. Revenue in CRM is not yet financial revenue, and certainly does not reflect actual cash flow.

ERP only becomes involved when an order is confirmed, an invoice is issued, and accounts receivable (AR) are recorded. From this point on, the CFO has a basis to track DSO, cash flow, and the risk of late payments. This is why CRM cannot replace ERP in actual revenue management, even though both are related to "sales."

Below is the table. How do ERP and CRM differ? Based on actual financial management data, rather than just looking from a sales or accounting perspective.

| Operating procedure | ERP | CRM | Significance for the CFO |

| Order-to-Cash (O2C) | Issue invoices, record AR (Amount Received), and track cash collection. | Sales opportunity management, revenue forecasting. | CRM indicates whether the sale is possible, while ERP indicates whether payment has been received. |

| Procure-to-Pay (P2P) | PO, GR, Invoice, AP, supplier payment | Not participating | ERP controls actual costs; CRM is completely unrelated. |

| Budget management | Recorded after expenditure | Uncontrolled | ERP reflects the consequences, it doesn't prevent overspending. |

| Accounts Payable & Debt Storage | Track AR, age of debt. | Revenue forecast only | CFOs need ERP to manage liquidity. |

| Financial report | Official data source | Not eligible | CRM is not used for auditing or settlement. |

Most articles only differentiate between ERP as back-office and CRM as front-office. This approach is correct but insufficient for CFOs. When comparing how ERP and CRM differ within specific operational processes, it becomes clear: the two systems don't compete, but without an intermediate financial control layer like Bizzi, data will be fragmented and CFOs won't be able to manage overall performance.

Why are ERP and CRM systems alone insufficient for CFOs in performance management?

After comparing how ERP and CRM differ, it becomes clear that the core issue isn't whether ERP or CRM is "weak," but rather that these two systems are designed for two different aspects of a business, while CFOs need a comprehensive picture of financial performance. ERP records actual events – what has happened. CRM manages forecasts – what could happen. The biggest gap lies in budgeting and analysis of discrepancies, where CFOs actually make decisions.

In practice, budgets are often created in Excel, forecasts are in CRM, and actuals are in ERP. When these three data sets are not connected in real time, CFOs can only analyze data after the period, not make adjustments during the period. This makes performance management more of a "post-audit" rather than a "proactive" management approach.

Bizzi acts as an EPM/FP&A layer between ERP and CRM, integrating the three pillars of Budget, Actual, and Forecast into a single model. Actual data is retrieved directly from the ERP, ensuring accuracy and auditability. Forecast data is linked from the CRM, reflecting the latest revenue expectations. Based on this data, CFOs can track Variance = Actual – Budget in real time, instead of waiting until the end of the month or quarter.

More importantly, Bizzi allows CFOs to run financial scenarios (scenario planning) such as lower-than-expected revenue growth, cost overruns, or slow cash flow, without interfering with the core ERP or CRM system. This helps CFOs make faster decisions in volatile situations, instead of relying on IT or manual Excel files.

How does integrating ERP and CRM help optimize cash flow and Date of Sale (DSO)?

One common paradox is that businesses are "selling very well" but are still short of cash. This is because CRM only tells... who can afford to buy, while ERP only provides information. Who is in debt?However, no system proactively monitors the ability to collect payments and the speed of collection in real time. For the CFO, this is a liquidity risk, not a sales problem.

When ERP and CRM systems are not properly integrated, cash flow forecasts are often subjective. The CFO knows upcoming revenue, but doesn't know which revenues will be collected on time and which are at risk of being delayed or lost.

How does Bizzi ARM specifically implement DSO management?

Bizzi ARM retrieves invoice and accounts receivable (AR) data directly from the ERP system, then automates the debt tracking and collection process. The system allows for the creation of different debt reminder scenarios based on debt age, invoice value, or customer group, instead of fragmented manual reminders.

More importantly, the CFO can track DSO in real timeThis allows CFOs to see upward or downward trends within the period, instead of waiting for the end-of-month report. This helps CFOs adjust credit sales policies, payment terms, or prioritize debt collection in a timely manner to protect cash flow.

What is 3-way matching in ERP and why is it often overlooked?

3-way matching is the process of cross-referencing purchase orders (POs), receipts for goods received or accepted (GRs), and supplier invoices before payment. If not done thoroughly, businesses risk paying invoices with incorrect prices, quantities, or even no actual transactions.

How does Bizzi Bot solve this problem?

Bizzi Bot automatically reads invoices using AI, then reconciles them with purchase orders (PO) and general store (GR) according to established rules. Any discrepancies in price, quantity, or supplier information are flagged for accounting processing before payment. This shifts control from "detecting losses after they occur" to "preventing them before they leave the business," aligning with the CFO's risk management philosophy.

Should businesses implement ERP or CRM first?

Comparing the differences between ERP and CRM systems reveals that there's no single right answer for every business, but there's clear financial logic to it. For SMEs, CRM is often implemented first to generate revenue and expand market share. However, as businesses enter a rapid growth phase, implementing both ERP and CRM simultaneously becomes necessary.

The key point is: without a financial control system like Bizzi's.However, implementing ERP and CRM simultaneously can lead to a "growth but loss" situation. Revenue increases, but costs spiral out of control, accounts receivable balloon, and cash flow fails to keep pace with sales.

FAQ – Frequently Asked Questions about ERP and CRM for CFOs

How do ERP and CRM differ from a CFO's perspective? Below is a summary answering common questions about ERP and CRM.

Can ERP replace CRM?

No. ERP doesn't manage leads, pipelines, or customer behavior. ERP only starts when a transaction has been confirmed and needs to be recorded financially.

Can CRM generate financial reports?

No. CRM data does not comply with revenue recognition standards, lacks an audit trail, and is not eligible for financial reporting or auditing.

Can ERP systems forecast cash flow?

ERP systems reflect cash flows that have already occurred, but they are not designed to forecast or run cash flow scenarios in the future.

Can Bizzi replace ERP or CRM?

No. Bizzi doesn't replace, but rather adds a layer of control, analysis, and automation, enabling ERP and CRM systems to truly serve the CFO's financial decision-making.

Conclude

ERP and CRM are two crucial pillars in modern business operations. Understanding the differences between ERP and CRM through a comparison will help CFOs avoid a common mistake: choosing the wrong system for the wrong objectives.

ERP helps businesses accurately record what has happened – from expenses and accounts payable to actual cash flow. CRM helps forecast what might happen – from revenue and pipelines to customer behavior. However, For a CFO, financial management goes beyond simply recording or forecasting.This lies in the ability to connect, analyze, and control these two data sources within the same operating framework.

The biggest gap between ERP and CRM is the real-time management of performance and cash flow. When Budget, Actual, and Forecast exist separately across different systems, businesses are forced to manage using Excel, relying on IT and making decisions that lag behind actual business conditions. In the context of rising costs, extended collection cycles, and increasingly sophisticated fraud risks, this approach is no longer suitable.

Bizzi was built to fill that gap. Instead of replacing ERP or CRM, Bizzi acts as a replacement. The financial management and performance control layer is located above.This helps CFOs see the entire financial picture within a unified frame of reference. From an FP&A perspective, Bizzi connects Actual data from ERP and Forecast from CRM, bringing Budget back to the center and enabling miscalculation and financial scenario execution without disrupting the core system. From a cash flow perspective, Bizzi helps shift accounts receivable management from passive to active, tracking DSO in real time and improving collection capabilities. With cost and risk control, Bizzi automates easily overlooked processes such as 3-way matching, helping to prevent miscalculations and fraud before money leaves the business.

In reality, many businesses have invested in ERP and CRM but still face the problem of "sufficient reporting but lack of control." The cause lies not in the core technology, but in the absence of a financial management layer capable of connecting data, analyzing it, and taking action. Bizzi addresses this bottleneck, transforming ERP and CRM from mere recording systems into platforms that support strategic financial decision-making.

For CFOs, the question is no longer "should we use ERP or CRM?", but rather... How can these systems actually create financial value, protect cash flow, and support sustainable growth?And that is precisely the role Bizzi was designed to play.

To learn more about Bizzi's solutions and receive one-on-one consultation from experts on a customized solution for your business, register here: https://bizzi.vn/dang-ky-dung-thu/