During recent tax audits and inspections, many businesses were surprised to receive notices. placed under electronic invoice monitoring., request Explanation of the practice of issuing invoices exceeding safe limits.One of the core reasons that tax authorities are increasingly mentioning is coefficient K.

The worrying point is The K coefficient is not a term clearly defined in the law.but is currently being Tax risk management systems are used as a key warning indicator.,

And this can lead to Inspect, audit, or even halt the use of electronic invoices. if the business cannot provide a reasonable explanation.

Many businesses only discover they are "stuck with the K factor" when:

- Output invoice being monitored more closely,

- Partners have reported seeing risk warnings.

- Or you may receive a letter from the tax authorities requesting an explanation.

This article will help you understand correctly, completely, and deeply.:

- What is the K coefficient?, the nature and how the tax authorities use it,

- How to calculate the coefficient K And why isn't there a "standard threshold" for all businesses?

- K-factor risk What is it and what are the practical consequences for cash flow, bills, and reputation?

- What should businesses do to Prevent risks related to the K-factor right from cost and invoice management.Instead of reacting passively after being scrutinized.

Note: This article is for reference only, as the threshold for the K coefficient will vary depending on factors such as: industry, sector, business scale; specific business characteristics; regulations of each tax authority; and the time period.

Why has the K-factor become a "hot topic" for businesses?

Since 2023, the tax authorities have intensified their efforts. electronic invoice management in the direction of risk managementInstead of manually checking each business as before.

The current tax system doesn't just look at... an invoice, which is analyzed Invoicing behavior throughout the entire purchase-sale-inventory-collection chain..

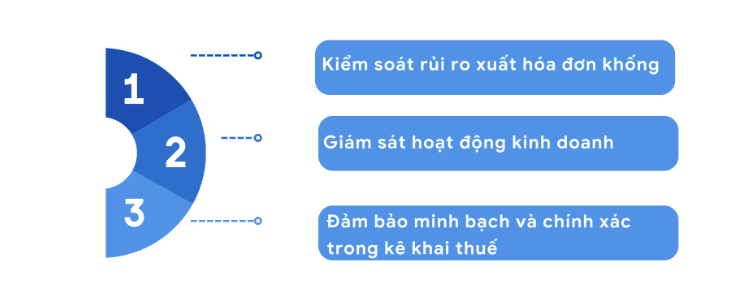

In that context, coefficient K appear as a important monitoring parameters, which helps the tax authorities:

- Compare actual business performance with invoicing behavior.

- Early detection of cases where invoices are issued exceeding the available supply capacity.

- Identify high-risk businesses for monitoring and inspection.

How does the K coefficient directly affect a business?

- Placed under surveillance.Risk information may be displayed to buyers.

- Risk of being asked to provide explanations or being investigated., and even had their use of electronic invoices discontinued.

- This directly impacts cash flow, reputation, and cost control.

Many businesses only discover they have a problem when We have received the official letter from the tax authority. – At that time, the costs of processing, explaining, and the risks involved were all very high.

What is the K coefficient? Concept, nature, and legal basis.

In the context of tax authorities strengthening risk management based on electronic invoice data, the K coefficient is increasingly being used as an important indicator to assess the reasonableness of the relationship between business operations and invoicing behavior. A proper understanding of the nature and legal basis of the K coefficient helps businesses proactively prevent risks, rather than reacting passively once they are placed under surveillance.

What is the concept of the coefficient K (parameter K)?

Coefficient K Is one risk warning index It is developed and used by the tax authorities in their tax risk management system for assessment. The degree of correlation between invoicing behavior and the actual business capacity of the enterprise..

Essentially, the K coefficient is not an accounting or tax indicator directly stipulated in law. It is... data analysis parametersThis is calculated automatically from data sources that the business has declared and generated during its operations.

Specifically, the coefficient K is used for:

- Compare the value of goods and services sold. (as shown through electronic outgoing invoices)

with - The actual supply capacity of the business, as reflected through:

- Inventory value

- The value of goods and services purchased with valid invoices.

Through this comparison, the tax authorities can Discovering cases where businesses issue invoices exceeding their actual capacity.For example:

- Issuing invoices continuously while having little or no input invoices.

- Invoices were issued exceeding inventory capacity.

- Revenue increased dramatically, but not proportionally to the purchase-import-expenses flow.

It is important to emphasize that: The K coefficient is not a basis for concluding that a business has violated regulations., which is risk identification tool, which helps tax authorities determine Which businesses need to be monitored, inspected, or required to provide further explanation?.

The legal basis and system currently using the K coefficient.

Although not directly defined in the Tax Law or accounting guidelines, The K coefficient is formed and operated on the basis of tax risk management.This aligns with the modern management direction of the tax sector.

One of the key documents that clarifies this approach is:

- Official Document 2392/TCT-QLRR of 2023 of the General Department of Taxation on strengthening inspection and monitoring of risks in the use of electronic invoices.

According to the guidelines in this document, the tax authorities will not only check each invoice individually, but also Evaluating the overall data on a company's invoice usage behavior..

The K coefficient is calculated and monitored through the following process: Connecting and comparing data from multiple systems, include:

- Electronic invoicing system (eInvoice): Provides detailed data on the business's incoming and outgoing invoices.

- Electronic Tax System (eTax): Contains information on VAT and corporate income tax declarations, and the operational status of the taxpayer.

- Tax Risk Management System (TMS): It is a place that aggregates and analyzes data and calculates risk indicators (including the K-factor) to rank the risk level of businesses.

In some in-depth testing cases, data from warehouse, bank, customs, contract It can also be used to clarify the cause of a high or abnormal K coefficient.

What is the management objective behind applying the K factor?

The construction and use of the coefficient K reflects a fundamental shift in tax administration thinkingFrom manual inspection to data-driven and risk-based management.

The main objectives include:

- Reducing invoice fraud and combating the issuance of fictitious invoices: Early detection of business models that show signs of "over-invoicing" before significant revenue losses occur.

- Protecting state budget revenue: Prevent the practice of legitimizing revenue and expenses through invoices that do not reflect actual transactions.

- Creating a level playing field for businesses: Businesses that comply with regulations will not face unfair competition from businesses that misuse invoices.

- Developing a standardized risk assessment framework for millions of businesses: Instead of conducting widespread inspections, the tax authorities focus their resources on businesses with high risk indicators, where the K-factor is a key indicator.

In short, The K coefficient is a risk management tool, not a "penalty".However, if businesses do not understand the true nature and do not properly control the purchase-inventory-sales-invoice chain, the K coefficient can completely become... the starting point for more serious tax risks.

Formulas and methods for calculating the K coefficient and understanding its components correctly.

After understanding the nature of the K coefficient as a risk warning indicator, the next important issue for businesses is: How is the K-factor calculated, and why does the same K-factor indicate different levels of risk among businesses?Misunderstanding the formula or its constituent components is a common reason why businesses underestimate their risks. Let's explore how to calculate the K factor.

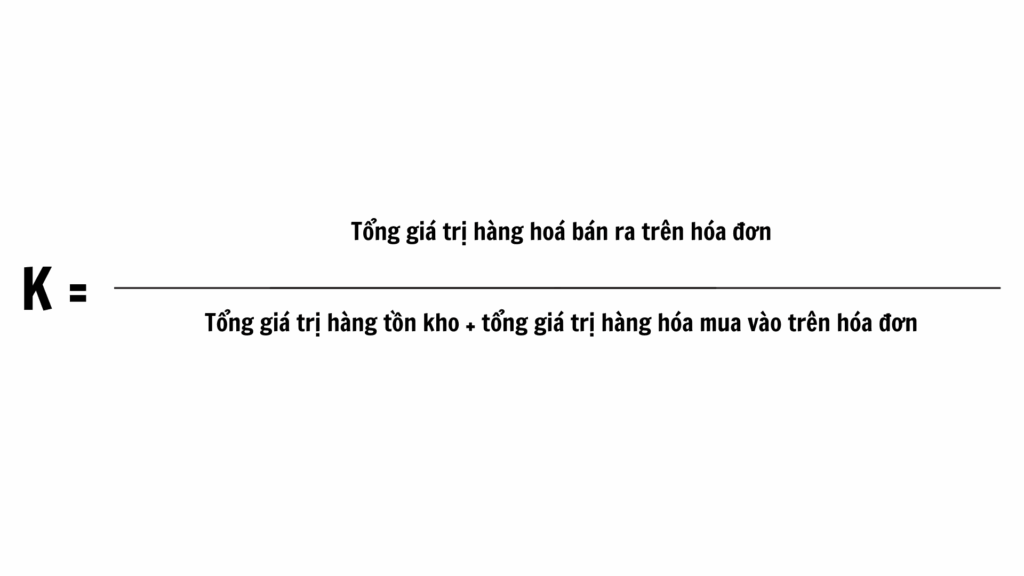

Calculating the coefficient K

The method for calculating the K coefficient, commonly applied in tax risk analysis systems, is as follows:

K = Total value of goods sold on the invoice / (Value of inventory + Value of goods purchased on the invoice)

In there, All prices are calculated excluding VAT. To eliminate the tax factor, focus on the nature of the goods flow and value stream.

This formula allows the tax authorities to answer a very simple but crucial question:

How much is the business selling compared to its actual inventory?

Explain the ingredients in the formula.

Numerator: Total sales revenue invoiced during the period

This is the total value of goods and services that the business has provided. issue electronic output invoices during the calculation period (month, quarter, or analysis period).

The numerator reflects:

- The revenue amount shown on the invoice,

- Invoice issuance intensity,

- The speed at which a business recognizes revenue.

Problems arise when:

- Revenue increased very rapidly.

- But the input factors (purchases, inventory, costs) did not increase proportionally.

Example: Actual supply capacity of the enterprise

The denominator typically consists of two main components:

- Inventory value

It can be calculated as follows:- Beginning inventory,

- Ending inventory,

- Or the average inventory value (depending on the analysis method).

- Value of goods purchased: It is the total value of goods and services purchased. legitimate input invoices during the period.

The sample reflects:

- Business What is there to sell?,

- And How much was purchased to generate that revenue?.

If the denominator is low but the numerator is high, the coefficient K will increase sharply – and this is what it means. risk alert trigger point.

Contact management accountant and cost control specialist.

From a management accounting perspective, the denominator of the K coefficient is Inventory + COGS (Cost of Goods Sold).

This highlights an important fact that many businesses often overlook:

The K factor is not just a tax issue, but a consequence of lax inventory management, purchasing, and cost control.

Some common situations that cause K to be "virtually pushed up":

- The goods have been sold but not yet recorded as received into inventory.

- Purchasing goods from sources that do not provide invoices (individuals, household businesses).

- Cost components that make up the cost of goods sold are not fully reflected on the invoices.

- The data between accounting, inventory, and ERP systems is inconsistent.

In these cases, Businesses may not engage in fraud., but the coefficient K is still high because The data inaccurately reflects actual capabilities..

There is no single "standard K threshold".

A very common mistake is trying to find a "safe number for the k" figure.

Reality, There is no standard K-factor threshold applicable to all businesses..

The coefficient K depends strongly on:

- Occupation: trade, manufacturing, or services,

- Business model: Wholesale, retail, projects, long-term contracts,

- Inventory cycle: Spin fast or slow,

- Profit margin and level of value-added processing.

Commonly used reference examples

- Commercial enterprises: If K is too high (e.g., >2), the business is very likely to be scrutinized because, in principle, revenue should not exceed the total amount of goods purchased and inventory by too much.

- Manufacturing businesses: K may be higher due to value added through multiple stages (labor, depreciation, overhead). However, the business must still demonstrate a reasonable cost structure.

Illustrative example

- Case 1 – Retail Business: Fast inventory turnover, continuous inflow and outflow. In this case, K is approximately 1–2 It is generally considered appropriate to business practices.

- Case 2 – Service Business: With virtually no tangible goods, the primary cost is... labor, depreciation, operating costsAt that time, K is almost always high.However, risk cannot be assessed solely based on inventory. Businesses need to... Explanation of cost structureYou can't just look at inventory figures.

When is a business classified as having a K-factor risk?

Not every case with a high K-factor is considered a risk. Businesses are often placed under supervision when K is high in a way that is "unreasonable" compared to the business model..

Cases of abnormally high cancer rates.

- Business No or very few input invoicesbut issuing output invoices with large values,

- Businesses have unusually high profit margins compared to the industry average,

- Business Issuing invoices frequently while inventory is almost zero or negative..

These signs indicate The buy-stock-sell cycle may not accurately reflect reality..

These business groups are susceptible to high K-factors.

- Service businesses: The main costs are labor and depreciation → fewer material invoices, making it easier to create a low denominator.

- Businesses purchase from individuals and household businesses: Form 01/TNDN must be used → there are no input invoices to reflect purchases.

- Businesses that import a large proportion of goods: Complex documents, prone to errors. discrepancies between customs, accounting, and electronic invoices..

Relating to tax risk and cost management (cross-functional perspective)

A high K coefficient is usually not due to an incorrect invoice, which is due to The entire data chain is not well controlled.: purchase → inventory → stock → sale → cash collection

When this series is broken or the data is skewed, the K coefficient will become composite risk indicator, reflecting:

- Tax risks,

- Risks related to cost management,

- And internal control risks.

This is it the intersection between tax accounting, management accounting, and cost management, and it's not just a story for the tax department alone.

Risks and consequences of exceeding the K coefficient threshold.

The fact that the K coefficient exceeds the threshold is not just a technical indicator in the tax risk management system. In fact, A high K-factor is the "trigger point" for a series of monitoring, inspection, and sanctioning measures.This directly impacts the business operations, cash flow, and reputation of the company.

The company has been placed on the risk monitoring list.

When the K coefficient exceeds the safe threshold as assessed by the tax authorities, the business may be classified as:

"List of taxpayers subject to monitoring for issuing invoices exceeding safe limits"

This is an internal list within the Tax Risk Management System (TMS), used for:

- Track the frequency and value of invoices issued.

- Cross-reference purchase, sales, and inventory data.

- Prioritize inspection resources for businesses showing signs of high risk.

One less-discussed but highly sensitive consequence is:

- The system can send alerts to the buyer., indicating that the business issuing the invoice is at risk.

- This has led customers to worry that their input invoices may be scrutinized or that expenses may be disallowed in the future.

In terms of reputation, the business not yet found guilty of wrongdoing.but has been "marked" within the tax ecosystem.

Risk of being inspected and asked to provide explanations.

After being placed under surveillance, a business will almost certainly face:

- Official letter requesting explanation of coefficient K from the tax authorities,

- We request documentation demonstrating our supply capacity and the nature of the transaction.

The scope of the audit usually doesn't stop at invoices but can extend to:

- Input and output invoices,

- Inventory ledger, inventory card, inventory report,

- Bank statements, cash flow statements,

- Contracts, purchase orders (PO), delivery and acceptance reports (GR),

- The relationship between the parties in the transaction chain.

It is important to note that: Even if the business is not engaging in fraud.However, without a clear explanation of the business logic and cost structure, the risk of being negatively assessed remains very high.

Risk of having electronic invoices discontinued.

In the event that the tax authorities conclude there are indications of:

- Issuing fictitious invoices,

- Buying and selling invoices,

- Or the actual transaction cannot be proven.

Businesses may be subject to drastic measures, including:

- Stop issuing electronic invoice codes.,

- Restrict or prohibit the use of electronic invoices for a certain period of time..

This is considered one of the harshest penalties for operating businesses because:

- Inability to issue an invoice means Revenue cannot be legally recognized.,

- Many commercial contracts will be stalled or face breaches of payment terms.

Administrative penalties and criminal risks

If the conduct is determined to be a violation of invoicing laws, the businesses and individuals involved may face:

- Imposing administrative penalties with large fines. Regarding the act of giving, selling, or using illegal invoices,

- The tax authorities must return the tax benefits obtained illegally.

- In serious cases, criminal liability may be pursued against:

- The crime of illegally printing, issuing, and trading invoices.

- The penalties may include very large fines or imprisonment as stipulated in the Criminal Code.

At this stage, risk is no longer a purely accounting and tax issue, but has become... corporate legal risks.

Impact on cash flow and partner relationships (information gain)

One "chain reaction" consequence, but often underestimated, is impact on cash flow and business relationships.

- When invoicing is restricted or suspended:

- Business Failure to collect payment on time.,

- Cash flow is strained, especially for businesses with long collection cycles.

- From a partner's perspective:

- Customers are concerned about the risk associated with input invoices → possible Suspend cooperation,

- The supplier tightened payment terms or required upfront payment.

- Banks and credit institutions assess businesses as riskier when determining loan limits.

In many cases, The biggest damage doesn't come from fines., which comes from Cash flow disruption and loss of market confidence..

The tax authority's process for controlling invoices based on the K coefficient.

To understand why the K coefficient carries such significant weight, businesses need to grasp the following: the control process that the tax authorities are applying.

Step 1: The system automatically calculates and compares the coefficient K.

The K coefficient is calculated automatically based on aggregated data from:

- Electronic invoice (eInvoice)

- Tax return form,

- Inventory data and related information sources are connected to the tax risk management system (TMS).

This calculation is continuousThis doesn't only happen at the time of the inspection.

Step 2: Issue warnings and create a list of businesses exceeding safety thresholds.

Businesses with a K coefficient exceeding the threshold will:

- Flagged as a risk by the system,

- Place it on the priority watchlist.

At this stage, the business not yet found to be in violation, but it was already within the "monitoring zone".

Step 3: Assess risk levels and develop an inspection plan.

The tax authorities are taking the following action:

- Risk classification by level (low – medium – high),

- Determine the appropriate testing method:

- Inspection at the tax office headquarters.

- On-site inspection,

- Or include it in a comprehensive inspection plan.

Step 4: Implement inspections, audits, and request explanations.

Businesses will receive:

- The official letter requests an explanation of the coefficient K.

- Please provide detailed documents and records.

This is the stage decision, which directly affects:

- Businesses are "relieved of risk".

- They are often subject to further disciplinary action.

Step 5: Summarize results and update risk ratings.

After the test, the results will be:

- Record this in the risk management system.

- Impact ranking the risk of the business in subsequent periods.

This means:The K-factor is not a one-period issue, but a long-term factor impacting a company's tax risk profile.

What should businesses do when they receive a warning about the K factor?

Upon receiving a warning or request for explanation regarding coefficient KThe most important thing businesses need to understand is:

This is not yet a conclusion of violation.but it signals that business figures are being underestimated. insecure in the tax risk management system.

Proper handling at this stage can help businesses:

- Remove the warning,

- Avoid being subjected to an expanded inspection.

- Protect your right to issue invoices and your cash flow.

Conversely, hasty or illogical handling can "amplify" the risk.

1. Identify the internal causes of the high K coefficient.

Before dealing with the tax authorities, businesses It is mandatory to be able to answer the question yourself.:

"Why is my K-factor higher than normal?"

The review should focus on the following key points:

- Review the actual inventory.

- Is there any audio output in the warehouse?

- Is there a discrepancy between the recorded inventory levels (inflow, outflow, and stock) and the actual inventory levels?

- Is the inventory fully updated or is it currently "on hold"?

- Gross profit margin analysis

- Is the gross profit unusually high compared to the industry average?

- Are there any expenses that should have been included in the cost of goods sold but were instead accounted for as other expenses?

- Check the source of purchased goods.

- Were purchases made from sources without invoices (from individuals or household businesses)?

- Have you been using statements instead of invoices for an extended period?

- There's an import transaction, but the customs, accounting, and invoice data don't match?

- Comparing data between systems

- Financial accounting,

- ERP

- Internal management report.

In many cases, the K coefficient is high. not from fraud, which comes from:

- Data is mismatched between systems.

- The recording process is not synchronized.

- Or the cost classification may not reflect its true nature.

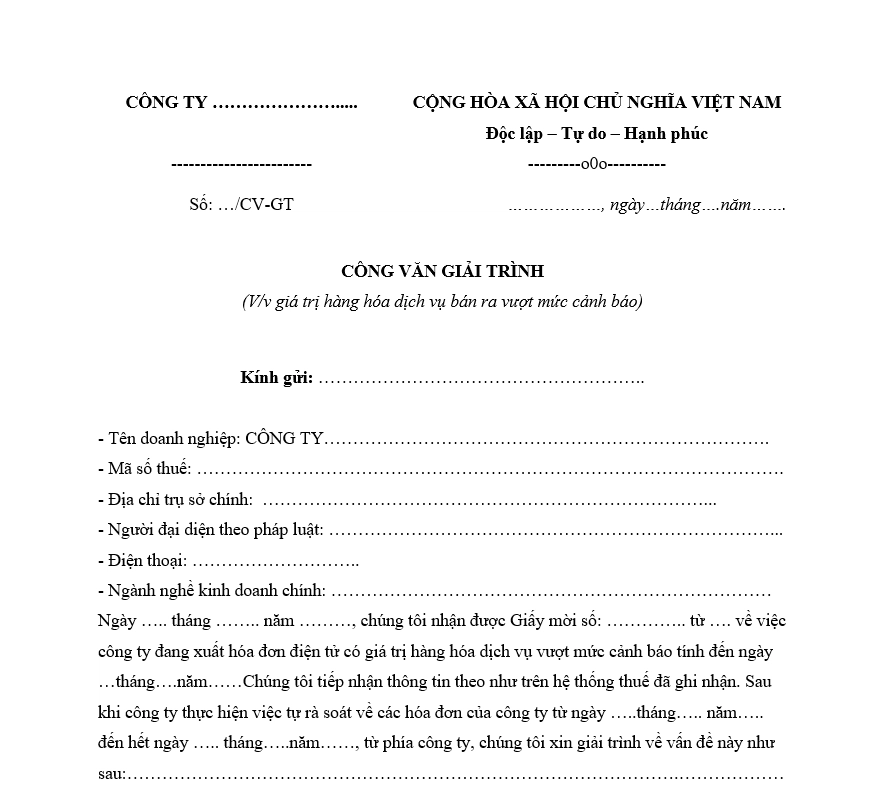

2. Prepare the documentation explaining the K coefficient.

Once the cause has been identified, the business needs to prepare. The explanatory documents are complete, consistent, and have clear business logic..

Explanatory letter

Required documents:

- Explain the nature of the business operation.

- Explain why a high K coefficient is appropriate in this specific context.

- Refer to the accompanying data and documents.

- We pledge to be legally responsible for the accuracy of the information provided.

Documentation for significant transactions

Focus particularly on transactions that are high in value or account for a significant proportion of transactions during the period:

- Economic contract, contract addendum,

- Purchase Order (PO),

- Warehouse receipt / acceptance report (GR),

- Output invoice,

- Payment documents, bank statements,

- Purchases – Sales – Inventory reconciliation statement.

Key principle: Do not submit disjointed documents. The "complete transaction chain" from purchase → inventory → sales → cash collection must be shown.

3. Working with the tax authorities: presenting the key points.

When dealing directly with the tax authorities, the presentation style... Documents are just as important..

Businesses should focus on:

- Specific characteristics of the profession

- Trade, manufacturing, and services have completely different cost structures.

- The same logic for evaluating the K coefficient cannot be applied to all industries.

- Cost structure

- Service businesses: main costs are labor and depreciation → fewer invoices for goods and services.

- Manufacturing businesses: value is added through multiple stages → K can be higher than in trading.

- Objective reasons

- Imports with long documentation cycles,

- Long-term contracts recognize revenue based on progress.

- Seasonal business model

- Revenue increased rapidly due to market expansion, but inventory levels did not reflect this growth.

An effective work session is when The tax authorities understand business logic., not just looking at the K number mechanically.

4. Re-evaluate the internal process system.

After addressing the immediate situation, businesses should view the K-factor warning as a... "Stress test" for internal systems.

The areas requiring review include:

- Inventory accounting and inventory control procedures.

- Procedure for verifying the validity of input and output invoices.

- Expenditure and procurement approval process,

- How to choose and evaluate suppliers.

If these processes are not standardized, The risk of recurrence of risk K in subsequent periods is very high..

Risk mitigation solution based on the K factor (long-term thinking)

Instead of reacting passively after being warned, businesses need to develop strategies. proactive prevention system.

1. Inventory management and sales-receipts flow.

The foundation of the K coefficient lies in the relationship between Buy - Stock - Sell.

Businesses need:

- Do not allow audio output from the archive.

- Ensure that inventory data accurately reflects reality.

- Establish standard procedures: Purchase → Receive → Warehouse → Warehouse → Invoice → Collect payment

In parallel with that is Control costs in the right way.:

- Clearly distinguish between cost of goods sold, administrative expenses, and selling expenses.

- Avoid shifting costs to inappropriate groups, and avoid artificially inflating gross profit margins in a risky way.

2. Quality control of input and output invoices

Invoices are direct input data for the K coefficient.

Businesses should:

- Only accept invoices from valid, operating suppliers.

- Carefully review invoices with large values and unusual occurrences.

- Store and retrieve invoices fully as required (minimum 10 years).

- Ensure quick access to records when explanations are needed.

3. Proactively simulate the K-factor from a financial and accounting perspective (CFO's perspective).

This is something very few businesses do, but it's extremely effective.

From this perspective FP&A / CFO, businesses can:

- Develop a forecasting model:

- Revenue,

- Import goods,

- Inventory.

- Estimate the K-factor for different business scenarios.

- If you see revenue increasing too rapidly compared to your supply or inventory capacity:

- Proactively adjust the plan.

- Re-allocate the invoice date.

- Avoid the sudden "K shock" situation.

In shortThe coefficient K is not a "penalty," but rather... Early warning of risks in financial data management – invoices – inventoryBusinesses that handle the situation correctly will turn the warning into an opportunity to review and upgrade their systems; those that handle it incorrectly will face long-term risks to their tax system, cash flow, and reputation.

How does Bizzi help businesses reduce K-factor risk?

First, one important principle needs to be clarified:

Bizzi does not replace the tax authorities in calculating or determining the K coefficient.

Bizzi's role is to help businesses. Controlling core variables causes the K coefficient to "worse"., include:

- Input and output invoices,

- Procurement and operating costs,

- Accounts payable,

- Inventory data and transaction flow.

When these variables are managed accurate - complete - consistentThe coefficient K will reflect the actual nature of business, instead of becoming a risk indicator due to data bias.

1. Input invoice control – denominator of the K coefficient (Bizzi IPA + 3-way matching)

In the formula for the coefficient K, Denominator (purchases + inventory) This is the biggest weakness of many businesses. Just a missing, incorrect, or "fictitious" input invoice will immediately push the K coefficient up.

Bizzi supports automatic and continuous monitoring of this pattern:

- Automatically download, read, and verify input invoices. Bizzi Bot (RPA + AI) automatically collects electronic invoices from multiple sources, reads the data, and standardizes the information, helping to:

- Avoid missing invoices,

- Reduce manual data entry errors.

- Ensure that purchase data is fully recorded.

- Three-way reconciliation: Invoice – Purchase Order – Retail Price in real time. Bizzi automatically matches:

- Invoice

- Purchase Order (PO),

- Goods Receipt/Acceptance Form (GR).

- This helps ensure:

- The purchase price accurately reflects the actual situation.

- Inventory is not "fictitious".

- The input data is strong enough when the tax authorities check the origin of the goods.

- Verify the supplier's tax identification number and operational status. Bizzi looked it up directly on the tax system:

- Is the provider currently active or has it discontinued/abandoned its service?

- Reduce the risk of receiving invoices from risky suppliers – a common reason why the K-factor is rated poorly.

- Early warning signs of risky input invoices: Instead of waiting until an audit, Bizzi helps accountants detect invoices early:

- Abnormal values,

- Deviation from PO – GR,

- Belongs to the risk category.

- As a result, businesses avoid "Pull K up" due to unsafe transactions..

2. Managing expenses – making expense and purchasing data transparent (Bizzi Expense)

One indirect cause of a high K coefficient is Costs and procurement are not controlled according to established procedures., leading to:

- Buying goods through unofficial channels,

- Legitimizing expenses through risk invoices,

- The purchase data does not accurately reflect reality.

Bizzi Expense helps address this problem at its root:

Establish budgets by department and project.

All expenses are placed within a clear budget framework, which helps to:

- Limit excessive spending.

- Avoid impulsive, unplanned purchases.

Transparent expenditure approval process

Expenditures must go through an approval process:

- Avoid spending outside of the established procedures.

- Reduce the incentive to "run invoices" to legitimize expenses.

Link costs and invoices to specific projects and departments.

When asked to explain the K coefficient, a business can:

- Quickly trace each expenditure.

- Demonstrate the relationship between costs, activities, and revenue.

- Avoid data that is fragmented and difficult to interpret.

3. Electronic output invoice – numerator of the K coefficient (Bizzi B-Invoice)

If the denominator is weak, an inconsistent numerator (revenue) also makes the K coefficient a risk.

Bizzi B-Invoice helps to control the numerator in a standardized way:

Issuing electronic invoices in accordance with regulations: The invoices are generated according to standards, directly connected to the tax system for code issuance, and minimize operational errors.

Invoice lifecycle status management

Follow closely:

- Released,

- Sent,

- Payment has been made.

- Cancel, adjust.

Synchronized with accounting/ERP software

Revenue is recognized consistently between:

- Bill,

- Accountant,

- Management report.

This helps Reduce discrepancies when tax authorities calculate and evaluate the K coefficient..

4. Managing accounts receivable – protecting cash flow when risks arise (Bizzi ARM)

When a business receives a K-factor warning or invoice restrictions, the biggest risk is usually... Cash flow disruption.

Bizzi ARM supports:

- Track customer and supplier accounts payable in real time.

- Automatic debt reminders,

- Helping businesses understand:

- Which amounts have been collected?

- Which amount is outstanding?

- Projected cash flow.

Even if problems arise with K, the business still maintain control over cash flow., to avoid being completely passive.

Frequently Asked Questions: What is the K coefficient?

What is the K coefficient in electronic invoices and taxes?

The K-factor is a risk warning indicator used by tax authorities to compare invoiced revenue with a company's purchasing and inventory capabilities.

Why does a business have a high or excessively high K-factor?

This is often due to missing input invoices, inaccurate inventory figures, unusual profit margins, or data discrepancies between systems.

Does a high K-factor mean fraud?

No. A high K value is simply a risk indicator. Businesses can explain it if they can demonstrate the reasonable nature of their business and cost structure.

How can I tell if my business has received a K-factor warning?

Through notifications from the tax authorities, requests for explanations, or signs of closer scrutiny regarding the use of electronic invoices.

What documents are needed when asked to explain the K coefficient?

The explanatory letter and complete set of documents include: contract, purchase order (PO), general receipt (GR), invoice, payment voucher, and purchase-sales-inventory reconciliation statement.

Is the K coefficient related to the restriction on the use of electronic invoices?

Yes. If a business is assessed as high-risk and fails to provide satisfactory justification, it may be restricted or prohibited from using electronic invoices.

Where should businesses mitigate risk K?

From managing incoming and outgoing invoices, expenses, inventory, and accounts receivable consistently and systematically from the outset.

Conclude

What is the K-factor? The K-factor is not a single "tax figure"., which is a composite indicator reflecting the level Consistency between revenue, purchases, inventory, and cost structure of the business. When the K coefficient exceeds the safe threshold, the problem is not only about invoices being scrutinized, but also indicates... Potential risks are inherent in the entire financial and accounting management process..

The key point businesses need to understand is: There is no standard K coefficient threshold for all cases.The assessment always depends on the industry, business model, inventory cycle, and cost specifics. Therefore, instead of trying to "avoid K," businesses need to focus on it. controlling the nature of data This ratio is made up of: input-output invoices, inventory, expenses, and cash flow.

In the context of tax authorities increasingly adopting technology and risk management systems, The K-factor will continue to be a key monitoring parameter.This is closely linked to the use of electronic invoices, the accountability and compliance level of businesses. Businesses with fragmented data, manual processes, or those overly reliant on post-risk response will face increasing pressure.

Opposite, Businesses proactively standardize the processes of purchasing, importing, inventory, selling, and collecting payments.Combining invoice and expense control from the outset will help the K ratio accurately reflect business realities, reduce the risk of being placed under supervision, and protect cash flow sustainably.

In short, Effective management of the K coefficient is not just about "dealing with taxes.", which is part of modern financial managementWhen data is controlled transparently and consistently, businesses not only reduce tax risks but also build a solid operational foundation for long-term growth.

To receive personalized solutions tailored specifically to your business, register here: https://bizzi.vn/dang-ky-dung-thu/