“We consider businesses as partners and have boldly shifted from the “pre-control” mechanism to the “post-control” mechanism. These are huge institutional changes. Instead of managing in an “inverted cone” manner, tightening input but loosening output, we learn from other countries’ experiences and follow the “funnel” model – quoted from Deputy Prime Minister Nguyen Chi Dung’s comments on changes in Resolution 68 on private economic development.

When post-audit replaces pre-audit, businesses have more freedom to enter the market but at the same time have to take more responsibility for transparency and compliance. In this article by Bizzi, let's find out what post-audit replaces pre-audit: What should businesses prepare to be ready?

From pre-control to post-control – big changes in Resolution 68

Resolution 68 (issued in May 2025) on private economic development emphasizes the transition from a “pre-inspection” to a “post-inspection” mechanism, prioritizing the application of civil, economic, and administrative measures instead of criminal ones to correct business violations. The goal is to create conditions for businesses to self-correct, unleash development momentum, and minimize negative impacts on social assets and employment.

Post-audit instead of pre-audit: What should businesses prepare to be ready? Below are the notable points and important impacts of the transition from pre-audit to post-audit in Resolution 68-NQ/TW (issued on May 4, 2025):

- Changing management thinking: The state shifts from control to service, considering businesses as partners.

- Reduce procedural burden: Cut at least 30% of time, costs and business conditions; businesses can access the market more easily.

- Increased autonomy and responsibility: "If the law does not prohibit it, it can be done", reputable businesses can be exempted from physical inspection.

- Support platform requirements: Need for transparent legislation, data digitization, technology application, capacity building and public service ethics.

- Social supervision: Associations, press, and community join together to ensure effective post-auditing and avoid distortion.

What is pre-test and post-test?

Post-audit instead of pre-audit: What do businesses need to prepare to be ready? Before answering this question, let's learn about the concept of Pre-audit - Post-audit:

- “Pre-check”: In the past, inspection and supervision took place before the business started operating or when there were minor violations that hindered development.

- “Post-check”: Resolution 68 shifts to post-audit, which means prioritizing civil, economic, and administrative measures to resolve unclear or remedial issues. Post-audit helps to clear up inputs, control outputs, reduce corruption, and encourage sustainable development of the private economy.

Impact on small and medium enterprises

Post-audit instead of pre-audit: What do businesses need to prepare to be ready? It can be seen that, The shift from pre-control to post-control has positive impacts on small and medium-sized enterprises such as reducing costs, administrative procedures, increasing initiative and responsibility for self-monitoring, encouraging healthy competition, but also requires capacity building. small and medium enterprise management, comply with the law to take responsibility for their activities.

-

Positive impact:

- Reduce costs and procedures: No more waiting for approval before going live, saving time and initial compliance costs.

- Increase initiative and self-responsibility:be empowered to be more proactive in business, and at the same time take full responsibility for the operations and quality of their products/services.

- Promote healthy competition: The conversion facilitates compliant businesses to develop, while fraudulent businesses can be severely punished through post-audit.

- Encourage startups: A more open business environment, with effective post-audit processes, will attract and support start-up businesses to grow.

-

Challenges and requirements:

-

- Enhance internal capacity: It is necessary to proactively improve governance capacity, self-control capacity and internal audit to ensure compliance with legal regulations.

- Building a culture of compliance: Small and medium enterprises need to build a culture of "honesty and compliance" to survive and develop sustainably in a post-audit environment.

- Technology application: Using tools and information technology to effectively manage risks and monitor business operations is essential.

- Conditions for a successful post-audit model:

-

- Risk management system: It is necessary to build and operate an effective risk management system, assess the risk level of each industry and field to focus on inspection.

- Process transparency: Open and transparent testing and evaluation processes to create trust and fairness.

- Perfecting the sanctions: There needs to be a strong and strict system of sanctions to handle violations to protect the interests of the State and consumers and deter violations.

The role of accounting software & electronic invoices in the post-audit stage

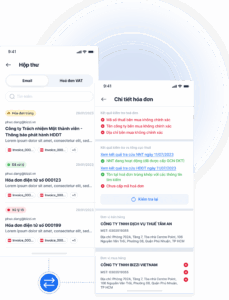

During the post-audit phase, accounting software and Electronic invoice plays an essential role in automating processes, minimizing manual errors, providing transparent and accurate data, thereby helping businesses easily reconcile and trace transactions, closely manage cash resources and quickly respond to inspection requests from authorities.

-

The role of Accounting Software in post-audit:

-

- Data Integration:

Accounting software such as Bizzi Helps synchronize all of a business's financial and transactional data, creating a centralized and easily accessible database. - Support comparison:

It allows for reconciliation of transactions such as cash flow, accounts receivable, and activities related to inventory management, purchasing, and sales, helping to control cash flow effectively. - Timely acknowledgement:

When a transaction occurs, the software will automatically record the entries in the accounting books, ensuring that the information is always updated and accurate. - Quick search:

Using software helps accountants easily search and retrieve information when required, saving time and improving work efficiency.

- Data Integration:

-

The role of electronic invoices in post-audit:

-

- Scientific invoice management:

Electronic invoices help manage input and output invoices scientifically and accurately, minimizing time and effort compared to manual invoice processing. - Automated processing:

E-invoicing software can automatically import data from invoices and store them in an online database, minimizing errors caused by manual data entry. - Transaction transparency:

Provide digital transaction evidence, easy to look up and check, ensuring transparency of transactions. - Compliance with legal regulations:

Using electronic invoices helps businesses comply with legal regulations and easily provide data to tax authorities and other inspection agencies.

- Scientific invoice management:

-

Integrate two solutions:

When combined, accounting software integrated with electronic invoices will help businesses:

-

- Process optimization: 50% reduces workload, optimizes working time and data entry operations.

- Improved performance: Helps accountants spend more time on important tasks, instead of manual processing.

- Increased control: Easily track work processes and results, ensuring data accuracy and transparency.

Bizzi – A powerful assistant for accountants in the digital age

Bizzi is a digital technology platform that provides automated financial and accounting solutions for businesses, acting as an AI assistant to streamline invoice processing, cost management, receivables and payments, thereby improving operational efficiency and optimizing cash flow.

Post-audit instead of pre-audit: What do businesses need to prepare to be ready? In the post-audit phase, businesses need transparency, accuracy and a willingness to provide data when audited. Here, Bizzi can assist in several key areas:

- Automatic collect – compare – store electronic invoices from multiple sources (suppliers, customers).

- Detect Incorrect, duplicate or illegal invoices before payment

- Help businesses reduce risk of post-audit by tax/customs authorities.

Cost Management & Invoice & Document Automation, Transparent Debt

- Automatically record and classify expenses, directly linked to the accounting system.

- Support quick retrieval of transaction history, no time wasted preparing paper documents when being inspected.

- Alerts on unusual debts or payments.

Digital storage system & easy to search

- Store accounting data, invoices, and documents centrally on a digital platform.

- With post-audit, businesses only need to perform a few operations, instead of manually collecting documents.

- Ensure data integrity – no editing outside the system.

Reduce compliance costs & manpower

- Cut up to 80% in invoice processing time compared to manual data entry.

- Reduce human error → reduce the risk of being penalized during post-audit.

- Helps accountants focus on financial analysis instead of just entering data.

Integration & standardization according to Vietnamese law

- Bizzi updates according to the latest regulations on electronic invoices, taxes, and accounting standards.

- Ensure reports and data comply with regulatory inspection requirements.

Conclude

With the above information, we hope you have gained more perspectives and information to answer the question “Post-audit instead of pre-audit: What should businesses prepare to be ready?”. In general, the change from pre-audit to post-audit in Resolution 68 is a big turning point, but also opens up many opportunities for businesses. With the effective support of accounting software like Bizzi, businesses have more advantages and opportunities to “prepare for post-audit” with:

- Transparent data

- Digitalization process

- Fast access

- Reduce errors and compliance costs

Discover more solutions for debt management, transparent costs - protecting businesses in Bizzi's post-audit mechanism here: https://bizzi.vn/